Transcription

REINVENTING AUDIO1March 2021NASDAQ: AUUD

DISCLAIMERThe information in this material is provided for general information purposes only and does not take into account the investment objectives, financial situation and particular needs of any individual or entity.This presentation contains forward looking statements that are based on the beliefs and assumptions of the management team of Clip Interactive, LLC, d/b/a Auddia (“Auddia”), and on information currently available to suchmanagement team. These forward-looking statements are subject to numerous risks and uncertainties, many of which are beyond Auddia’s and its affiliates' control. All statements, other than statements of historical fact,contained in this presentation, including statements regarding future events, further financial performance, business strategy and plans, and objectives of Auddia, for future operations, are forward-looking statements. Thesestatements are only predictions and involve known and unknown risks, uncertainties and other factors, which may cause the actual results, levels of activity, performance or achievements of Auddia and Auddia’s industry to bematerially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. You should not place undue reliance on any forward-looking statement.Auddia undertakes no obligation to update or revise publicly any of the forward-looking statements after the date hereof to conform the statements to actual results or changed expectations.Unless otherwise indicated, information contained in this presentation concerning Auddia’s industry and markets in which it operates, including its general expectations and market opportunity and market size, is based uponinformation from various sources, including independent industry publications in presenting information. Auddia makes no representations as to the accuracy, timeliness, suitability, completeness, or relevance of any informationprepared by any unaffiliated third party and takes no responsibility therefore. The data presented herein were obtained from various third-party sources. While we believe the data to be reliable, no representation is made as to,and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information.Auddia has also made assumptions based upon such data and other similar sources, and on Auddia’s knowledge of and its experience to date in the markets for its product candidates. This information involves a number ofassumptions and limitations and you are cautioned not to give undue weight to such estimates. The industry in which Auddia operates is subject to a high degree of uncertainty and risk due to a variety of factors. These and otherfactors could cause results to differ materially from those expressed in the estimates made by independent parties and by Auddia.This presentation uses Auddia’s trademarks and trade names such as “Auddia” and “Vodacast." This presentation also includes trademarks, trade names and service marks that are the property of other organizations. Solely forconvenience, trademarks and tradenames referred to in this presentation appear without and symbols, but those references, are not intended to indicate that Auddia will not assert to the fullest extent under applicable law,its rights, or that the applicable owner will not assert its rights to these trademarks and trade names. Auddia does not intend to use or display of other companies’ trade names or trademarks to imply a relationship with, orendorsement or sponsorship of Auddia by any other companies.2NASDAQ: AUUD

AUDDIA OVERVIEWAuddia AppCommercial free AM/FM radio streamsRadio stations make 2x revenue from Auddia subscribersNew subscription revenue shared with AuddiaTargets the 270 million radio listeners per monthVodacast AppPodcasts with extra digital content & options to avoid adsPodcasters with access to digital & subscription revenueNew revenue shared with Auddia104 million monthly listeners with 27% CAGR through 2027(1)3(1)Podcast Insights: 2021 Podcast Stats & Facts (New Research From Jan 2021) & Grand View Research: Podcasting Market Size Worth 60.50 Billion By 2027 CAGR: 27.5%NASDAQ: AUUD

Commercial free radio withpersonalized listening4NASDAQ: AUUD

THE PROBLEM WITH RADIO16minutes ofads per hourToo many ads5Broadcastto the manyNo choice in contentNASDAQ: AUUD

THE AUDDIA SOLUTIONAny streaming AM/FM radio stationAI removes and replaces adsAllows high value local content to play(DJ discussions, concerts & festivals, weather)Listening is personalized(skips, on-demand requests, preferred content)6NASDAQ: AUUD

THE COMPETITION(free)Radio(free)Ad FreeContentChoiceLocalContent7NASDAQ: AUUD

“AI FOR AUDIO” PLATFORMADSPatents for applying AI to audio broadcasts & streams to customize listening8NASDAQ: AUUD

AUDDIA BASICSLive broadcast Ads Broadcast with ads replaced by songsSong inserted during ad break9Broadcast is now delayedNASDAQ: AUUD

INTELLECTUAL PROPERTYProprietary TechnologyArtificial Intelligence PlatformBroadcast Audio10NASDAQ: AUUD

MARKET OPPORTUNITY133M11 0 subscription 14B subscriptionrevenuerevenueSources: Nielsen Audio, Billboard Business: Are We Reaching Peak Streaming Subscriptions?, SiriusXM 2019 Financial Results, Variety: U.S. Consumers to Spend 26 Billion on Music, VideoSubscriptions This YearNASDAQ: AUUD

CONSUMER INTERESTLikelihood to Purchase(By current radio M133MExtremely7%Very8%Extremely12%Very13%* Company analysis using Harris Insights and Analytics LLC Data, March 2019Extremely Likely34MsubscribersNASDAQ: AUUD

VAN WESTENDORP PRICINGRevenueMaximizingPrice: 1213* Van Westendorp's Price Sensitivity Meter is a standard market technique for determining consumer price preferences.NASDAQ: AUUD

GO TO MARKET STRATEGY - AUDDIARadio gets 10/month for every Auddia subscriberRadio promotes Auddia to their 270M monthly listeners14NASDAQ: AUUD

PRODUCT READINESSSmall-scale, single-market trials, started Q4 2020Expanded trials, Q1 2021Commercial trials begin Q2 2021Commence national launch, Q3 202115NASDAQ: AUUD

Podcasts told with deeper,digital stories16NASDAQ: AUUD

THE OPPORTUNITYPodcasting is explodingCurrent apps provide minimal value to podcastersWe believepodcastinglacksinteractivity&communityads per hour17Sources: Forbes: Podcasting Is Exploding. How Do You Know If It’s Right For Your Brand?NASDAQ: AUUD

THE VODACAST APPDigital content feed correlated to thepodcast audio to tell deeper storiesMultiple payment options to listencommercial free & access bonus contentAccess to all of a podcaster’s brandeddigital content in one placeOn ramp to social feeds to discuss,share, create and discover audio content18NASDAQ: AUUD

COMPETITIONEpisode and Brand FeedsOnly on Flexible MonetizationDistributed Content and MonetizationCommunity and Social NetworkIntegrated Ad Marketplace Many Others19NASDAQ: AUUD

MORE REVENUE FOR PODCASTERS20Digital AdsSubscriptions25%Increase on CPM2X to 3XIncrease over adrevenueOn-demand5XIncrease overad revenueDonationsAd MarketplacePodcasters keep100%Eliminatescommissions toaudio ad salesnetworksNASDAQ: AUUD

GO TO MARKET STRATEGY - VODACAST21We believe if podcasterspromote Vodacast the promotion will drive usersto the Vodacast platform and podcasters willmake more money,reinforcing the desireto promote where we believe podcastlisteners will have a betterexperienceNASDAQ: AUUD

EXPLOSIVE PODCASTING GROWTH100 million monthly listeners in the U.S. todayProjected to grow to 173 million in 2022 9.3B global market in 2019Projected to grow at a 27.5% CAGR to 60B in 202722NASDAQ: AUUD

M&A ACTIVITY IN PODCASTINGAnchor 150MMegaphone 235MGimlet 200MJoe Rogan 100MParcast 56MStitcher & MidrollVoxnestHowStuffWorksWondery23 325MUndisclosed 55M 300MNASDAQ: AUUD

PRODUCT READINESSiOS and Android available in app stores todayPodcaster partnerships, Q1 2021National launch, Q2 202124NASDAQ: AUUD

AUDDIA LEADERSHIPFounder/Executive Chair - Jeff ThramannSerial entrepreneur with multiple successful exits. Inventor with more than 50 U.S. and internationalpatents. Graduate of US Military Academy and Cornell University Medical College.CEO - Michael LawlessVeteran of multiple software startups, leading R&D and operations. Emphasis on technologydevelopment for consumer products. Graduate of US Air Force Academy and University of Dayton.CTO - Peter ShoebridgeTechnologist with 35 years of software and Internet product development across multiple industrysectors. Founder and CEO of Blue Yonder Gaming. Educated in London, EnglandCFO - Rick LiebmanExperienced technology company CFO with a background in investment banking and corporatefinance. He is a graduate of Brown University and has an M.B.A. from Columbia Business School.25NASDAQ: AUUD

INDEPENDENT BOARD OF DIRECTORSFounder/Executive Chair - Jeff ThramannChief Executive Officer - Michael LawlessNew Independent DirectorsSteve Deitsch – CFO Paragon28, BioScrip, Coalfire, ZimmerTim Hanlon – Founder/CEO Vertere Group, Velociter, VivaKi VenturesTom Birch – CEO Lakes Media LLC, Birch/Scarborough, Founder Birch Radio26NASDAQ: AUUD

RECENT IPO SUMMARYTickerNasdaq, AUUD/AUUDWIPO Unit* Price (2/17/2021) 4.125Share Price (3/15/2021) 3.15Warrant Price (3/15/2021) 0.73Post-IPO Shares Outstanding, fully diluted11,291,829IPO Warrants3,991,818Gross Proceeds 16.5M* IPO of 3,991,818 units, consisting of one share of common stockand one Series A warrant to purchase one share of common stock.The units were immediately and automatically separated uponissuance and are trading separately. Warrants are trading onNasdaq under ticker "AUUDW“ and will be exercisable immediatelyat an exercise price of 4.5375 per share and will expire five yearsfrom the date of issuance.27Large Equity HoldersJeff Thramann1,681,652 sharesFounder, Executive Chairman14.9% of outstanding sharesRick MinicozziInvestor15.5%1,750,450NASDAQ: AUUD

KEY TAKEAWYSIndustry First’s AM/FM radio with added personalized content and no commercialsPodcasts with interactive digital feed that supports deeper storiesand delivers digital revenue to podcastersHighly differentiated listening experience with strong IPAddresses large and rapidly growing audiences with strongpurchase intent and attractive margins that scaleRevenue startup H2 2021 / meaningful ramp 202228NASDAQ: AUUD

THANK YOUAuddiaJeff Thramann, Founder and Chairmanjthramann@auddia.comInvestor RelationsKirin Smith, Presidentksmith@pcgadvisory.comPh: 646.823.8656Michael Lawless, CEOmlawless@auddia.com29Ph: 303.219.9771www.auddia.comNASDAQ: AUUD

THE POWER OF LOCAL CONTENTShare of Ear Share of Time Spent Listening toAudio Sources in the US30*Edison Research, Share of Ear Q3 2018NASDAQ: AUUD

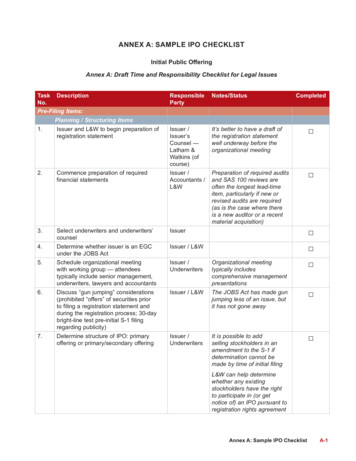

27 RECENT IPO SUMMARY Ticker Nasdaq, AUUD/AUUDW IPO Unit* Price (2/17/2021) 4.125 Share Price (3/15/2021) 3.15 Warrant Price (3/15/2021) 0.73 Post-IPO Shares Outstanding, fully diluted 11,291,829 IPO Warrants 3,991,818 Gross Proceeds 16.5M * IPO of 3,991,818 units, consisting of one share of common stock