Transcription

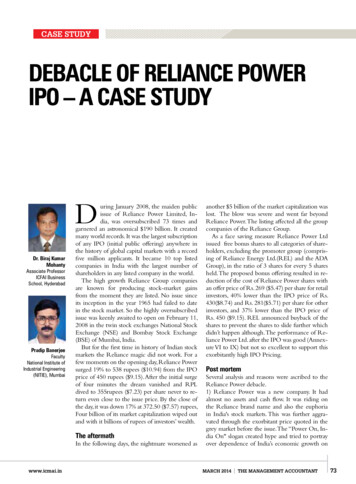

taxationCASE STUDYDebacle of Reliance PowerIPO – A Case StudyDDr. Biraj KumarMohantyAssociate ProfessorICFAI BusinessSchool, HyderabadPradip BanerjeeFacultyNational Institute ofIndustrial Engineering(NITIE), Mumbaiuring January 2008, the maiden publicissue of Reliance Power Limited, India, was oversubscribed 73 times andgarnered an astronomical 190 billion. It createdmany world records. It was the largest subscriptionof any IPO (initial public offering) anywhere inthe history of global capital markets with a recordfive million applicants. It became 10 top listedcompanies in India with the largest number ofshareholders in any listed company in the world.The high growth Reliance Group companiesare known for producing stock-market gainsfrom the moment they are listed. No issue sinceits inception in the year 1965 had failed to datein the stock market. So the highly oversubscribedissue was keenly awaited to open on February 11,2008 in the twin stock exchanges National StockExchange (NSE) and Bombay Stock Exchange(BSE) of Mumbai, India.But for the first time in history of Indian stockmarkets the Reliance magic did not work. For afew moments on the opening day, Reliance Powersurged 19% to 538 rupees ( 10.94) from the IPOprice of 450 rupees ( 9.15). After the initial surgeof four minutes the dream vanished and RPLdived to 355rupees ( 7.23) per share never to return even close to the issue price. By the close ofthe day, it was down 17% at 372.50 ( 7.57) rupees,Four billion of its market capitalization wiped outand with it billions of rupees of investors’ wealth.The aftermathIn the following days, the nightmare worsened aswww.icmai.inanother 5 billion of the market capitalization waslost. The blow was severe and went far beyondReliance Power. The listing affected all the groupcompanies of the Reliance Group.As a face saving measure Reliance Power Ltdissued free bonus shares to all categories of shareholders, excluding the promoter group (comprising of Reliance Energy Ltd.(REL) and the ADAGroup), in the ratio of 3 shares for every 5 sharesheld. The proposed bonus offering resulted in reduction of the cost of Reliance Power shares withan offer price of Rs. 269 ( 5.47) per share for retailinvestors, 40% lower than the IPO price of Rs.430( 8.74) and Rs. 281( 5.71) per share for otherinvestors, and 37% lower than the IPO price ofRs. 450 ( 9.15). REL announced buyback of theshares to prevent the shares to slide further whichdidn’t happen although. The performance of Reliance Power Ltd. after the IPO was good (Annexure VI to IX) but not so excellent to support thisexorbitantly high IPO Pricing.Post mortemSeveral analysis and reasons were ascribed to theReliance Power debacle.1) Reliance Power was a new company. It hadalmost no assets and cash flow. It was riding onthe Reliance brand name and also the euphoriain India's stock markets. This was further aggravated through the exorbitant price quoted in thegrey market before the issue. The “Power On, India On" slogan created hype and tried to portrayover dependence of India’s economic growth onMARCH 2014the management accountant73

taxationCASE STUDYavailability of power.2) Indian investor considers IPO as a means of makingquick money.The shares are sold out immediately on opening of the issue.This may be a reason of the Reliance Powerdebacle.3) The IPO was not helped by a souring in global marketmood as the reverberations of the US subprime and credit crisis swept around the world. Between January 4, whenthe IPO was announced, and the listing date of February11, the benchmark Sensex index fell over 4,000 points, oralmost 20%, from historic highs of around 20,686 points to16,630.91 points.4) It was observed that few Mauritius-based foreign institutional investors (FIIs) and a domestic bank offloaded almosttheir entire shareholding in the company within minutes ofthe opening bell.Trading data indicated that as much as 23.77 million shares,10.4% of the total 228 million shares sold through the Reliance Power IPO, changed hands on the twin bourses ofMumbai (Bombay Stock Exchange and National Stock Exchange) within the first four minutes. Sell orders were madeat progressively declining prices. It was pointing towards apre-mediated manipulation in the dealings although an investigation by Securities Exchange Board of India (the regulatory body of Indian Stock Market) cleared the dealingsas genuine.5) Reliance Power's downfall was linked to aggressivepricing of the IPO. Analysts suggested that it was overvalued when compared with peer companies in India.For instance, the IPO price was 450 against the price ofNTPC, (the government power company) at Rs.250/-.RPL was planning a 28000 MW power plant in 2017and did not have a single operational power plant whereasNTPC had 27350 MW of operational power plant in theyear 2007. (Annexure I). Comparison of the financials ofTata Power and NTPC also did not show a very promising picture of RPL. (Annexure II)On the contrary, it was advocated that the retail investorsmay have been swayed by the hype, but that cannot be toldabout the Foreign Institutional Investors (who have got allthe expertise and knowhow of valuation of shares).Background of the IssuePower Sector in IndiaThe Indian power sector has grown significantly since1947 and India today is the third largest producer of power in Asia. The power generating capacity has increasedfrom 1,362 MW in 1947 to over 160,000 MW by mid of2010. Despite significant growth in electricity generationover the years, the shortage of power continues to exist primarily on account of growth in demand for poweroutstripping the growth in generation and capacity addi-74the management accountantMARCH 2014tions in power generation.Historically, India has experienced shortages in energyand peak power requirements. The average energy deficitwas 9.1 percent and the average peak power deficit was 12.8percent between 2003 and 2010. According to projectionsmade in the National Electricity Plan, demand for power isexpected to grow at an average annual rate of 9% during the11th Plan period (2007-12) and at an average annual rateof 7% during the 12th Plan period (2012-17).The gap between demand and supply has not decreased in the last fewyears, leading to persistent power shortages. The prevailingand expected electricity demand and supply imbalance inIndia presents significant opportunities in the power generation sector. (Annexure III).Indian power sector has been regulated for almost a century through ‘The Electricity Act 1910’ and subsequently‘The Electricity (Supply) Act 1948’. By and large it was statecontrolled through the state electric boards and the performance of power sector was dismal during this period. As theIndian Economy started opening up to private sector andforeign players power sector also attracted lot of investment.The year 2003 marked a new beginning of reforms in theElectricity Sector in India with enactment of the ElectricityAct with lot of regulatory changes. The Central Government came out with National Electricity Policy on 6th February 2005. Now 100 percent Foreign Direct Investment(FDI) is allowed in generation, transmission and distributionsegments. Incentives are given to the sector through waiver of duties on capital equipment under the Mega PowerPolicy. These policy initiatives have resulted in building upinvestor confidence in the power sector and have created anideal environment for increased participation by the privatesector.During December 2012,“Cabinet Committee on Investments (CCI)” was formed to enable Greenfield projects toget the required clearances in a timely manner, includingthose related to land acquisition. Eight states have revisedtheir power tariffs and another eight are supposed to reviseduring 2013-14. A framework for Fuel & Power PurchaseCost adjustment (FPPCA) has been approved in many ofthe states during 2011-12. But still power companies arefacing the acute shortage of coal and banks do not extendloan to power companies easily due to its lack of viabilityon many account.Reliance GroupThe Reliance Group, founded by Dhirubhai H. Ambani (1932-2002), is India's largest private sector enterprise,with businesses in the energy and materials value chain.Group's annual revenues are in excess of US 58 billion.The flagship company, Reliance Industries Limited, is aFortune Global 500 company and is the largest privatewww.icmai.in

sector company in India.Backward vertical integration has been the cornerstone ofthe evolution and growth of Reliance. Starting with textilesin the late seventies, Reliance pursued a strategy of backward vertical integration - in polyester, fibre intermediates,plastics, petrochemicals, petroleum refining and oil and gasexploration and production - to be fully integrated alongthe materials and energy value chain. The Group's activitiesspan exploration and production of oil and gas, petroleumrefining and marketing, petrochemicals (polyester, fibre intermediates, plastics and chemicals), textiles, retail, telecom,finance, entertainment and special economic zones.Reliance enjoys global leadership in its businesses, beingthe largest polyester yarn and fibre producer in the worldand among the top five to ten producers in the world inmajor petrochemical products. Reliance Companies arewidely known as cash rich zero debt companies. After thedemise of Dhirubhai Ambani , the business of RelianceGroup was divided among the two sons of the founder.Theelder brother Mukesh holds companies in Petroleum andPoly Yarn whereas Younger brother Anil holds telecom andpower business. (Annexure IV)Both brothers have cashed in on the goodwill of Dhirubhai, who died in 2002 after shaping India's equity cultureby attracting millions of retail investors in a market that wasthen dominated by financial institutions. Through repeatedpublic offerings of Reliance Industries since its IPO in 1977,none of the issues went below their issue price. Dhirubhairevolutionized the country's capital markets by generatingbillions of rupees in wealth for those who put their trust inhis companies.Reliance PowerThe younger brother Anil Dhirubhai Ambani holds thepower business. The company was incorporated in January1995 as Bawana Power Private Limited and many timeschanged its name to be finally known as Reliance PowerLimited.The Reliance Anil Dhirubhai Ambani Group (ADAG)intends Reliance Power to be its primary vehicle for investments in the power generation sector in the future. Othercompanies of the ADAG group like REL, RNRL and Reliance Energy transmission have associative arrangement todraw upon considerable expertise and resources that theypossess in the Indian energy sector. But they do not havenon-compete agreement between them. These companieswill provide Engineering, Procurement and Construction(EPC) services, fuel sourcing and transmission services forsome of RPL projects. RPL also expects to enter into offtake arrangements with its affiliates, including REL and Reliance Energy Trading.RPL has started with an ambitious growth plan. It wantswww.icmai.into develop power plants on various energy sources like Hydro, Coal, and Gas in various locations of the country. Simultaneously work has started at various plant sites. But duringthe time of issue none of the plants were operational. .Securing adequate supplies of fuel is critical to the successof a power project. It intends to secure fuel for the projectsby seeking captive fuel sources, procuring long-term contracts with domestic and foreign suppliers and entering intosupply arrangements with its affiliates, including RNRL.RPL will source the coal needed for its 3,960 MW Sasanproject from three captive mines in the Singrauli coalfields.RPL intends to seek supplies of coal for its supercriticalcoal-fired projects, Shahapur Coal (1,200 MW) and Krishnapatnam (4,000 MW), through RNRL or third parties.In addition, it is planning to seek supplies of natural gas fromRNRL for its gas-fired projects at Shahapur (2,800 MW)and Dadri (7,480 MW), primarily from its rights to KGBasin gas reserves. RPL is also considering opportunitiesfor securing fuel for other power generation projects withthe supplies expected to be available from CBM explorationactivities led by RNRL.RPL intends to sell the power generated by these projectsunder a combination of long-term and short-term PPAs tostate-owned and private distribution companies and industrial consumers.It also aims at achieving optimal project operating efficiency through supercritical technology (beginning withSasan UMPP) to reduce the amount of required coal supplies for the coal-fired projects and combined cycle gas turbine technology to increase output for gas-fired projects.To finance the ambitious power projects RPL has floatedthe mega issue with all the turmoil in the IPO market.(Annexure V)An extract from an analysis by K.R. Balasubramanyam inBusiness Today, dated January 29th 2013 is depicted belowto exhibit the present scenario of Reliance Power Limited.Billionaire entrepreneur Anil Ambani's ambitious venture,Reliance Power Limited, is slowly picking up. But investorsare miles away from recovering even half their investments,let alone make profits.Anil Ambani later issued three bonus shares for everyfive shares that retail investors held, diluting his own stakein the company. He now controls 75 per cent of the Mumbai-headquartered company. The stock was trading at Rs93.40 on the Bombay Stock Exchange (NSE) at 2 pm onTuesday, January 29.The retail investor, who got a small discount in the IPO price, will recover his investment only ifthe stock touches Rs 271. On the performance front, thecompany, led by Jayarama Chalasani, has been doing well.The 3,960 MW Sasan ultra mega power project is expectedto go on-stream in the next few weeks, ahead of schedule.The 1,200 MW Rosa power project in Uttar Pradesh oper-MARCH 2014the management accountant75

taxationCASE STUDYated at 103 percent load factor. At Rs 493 crore in the October-December quarter, EBITDA (earnings before interest,taxes, depreciation and amortisation) rose 252 percent, delivering a profit of Rs 266 crore at the net level. Announcingthe results on January 25, Chalasani said: "The third quarterhas proved to be an excellent one for the company as weturned in outstanding operational and financial numbers."Valuation & Investor DilemmaBehavioral finance advocates that valuation of a share shouldnever be guided by subjective analysis. Although in this casethe indomitable reputation of reliance group, their ability togrow at unparalleled speed, expertise in executing the project are some of the important factors to be considered forthe valuation of IPO, a base price must be found out whichmay be leveraged with the above factors. Analysts suggestvarious base to value the IPO.They are1) Dividend Discounting2) Net worth3) Market price of Competitors4) Market Price of existing group companies.It is imperative for each investor to adopt some or other method to get a base figure of the price and furtherinflate or discount it on his own perception. If in generalefficient market hypothesis rules the market, an en masssuicidal subscription & debacle may not be the roost ofthe day.It was a good performance, but analysts believe the priceat which the stock is trading is fair. The stock, they say, willmove up the price curve only if its liquidity and profits improve dramatically, to reflect in its book value and earningsper share.Industry analysis, Promoter’s reputation in the market,critical factors (power purchase agreement & captive supplyof coal in this case) may be few factors an investor will liketo analyze before investing in an IPO. As it seems, in spite ofall kinds of analysis the investor cannot safeguard his investment as exemplified in this case. Few failures of mega IPOslike this have an adverse impact on the primary market ofthe country.Annexure III: Power requirement vs. supply over the yearsAnnexure ICapacity Reliance Power, NTPC and Tata PowerRPLNTPCTata 002017282007500025000Source: Figures extracted from various internet sourcesAnnexure IIComparison of RPL against Tata Power & NTPCIncomeTotal Income (crores)Total Expenses (Crores)Operating Profit (Crs)Reported Net ProfitShares in issue (lakhs)Earning Per Share (Rs)Equity Dividend (%)Book Value per share (Rs)Market Price of ShareEquity base (31/3/2007) (Rs/Crores)Face Value (15/1/2008)Source: icicidirect.com76the management accountantMARCH 2014800000Power Supply Position7000006000005000004000003000001997-919 898-919 999-020 000-012001-020 202-020 303-042004-052005-062006-020 707-082008-09Year/CompanyRequirement / Supply (MU)900000Time PeriodRequirement (MU)Availability (MU)Shortage (%)Source: CEA, Power Scenario at a Glance, July a 5101010www.icmai.in

Annexure IVMajor Companies under Anil Ambani Group (ADAG)Name of theCompanyBook Value(31/3/2008) pershareP/E Ratio(31/3/2008)Price / ) 1Annualized ProfitShare Price(31/3/2008) Rs.(31/3/2008) In Rs.MillionReliance e: icicidirect.comAnnexure VIssue DetailsReliance Power LimitedIssue opens15th January 2008Issue Closes18th January 2008Date of Listing11th February 2008Size of Issue68400000 shares with a face value of Rs. 10.Advisors to the IPOKotak Mahindra, ICICI Securities, JM Financial and Enam FinancialPrice BandRs 405-450OversubscriptionFII 82 times, High Net worth Individual 163 times Retail Investors 15times.Amount of Subscription Made190 billion DollarTotal IssuePromoter’s ContributionQIBMutual FundQIB including Mutual FundRetail 0000342000000Source: Extracted from Issue Prospectus & other internet sourcesAnnexure VIIncome Expenditure SummaryIncome & Expenditure Summary (In Rs. Crore)Reliance Power Ltd.Currency: Rs. Crore (Non-Annualised)Total incomeSalesIndustrial salesIncome from non-financial servicesIncome from financial servicesInterest incomeDividendsIncome from treasury operationsPrior period and extra-ordinary incomewww.icmai.inMar-0712 mths2.252.252.25Mar-0812 mths132.87Mar-0912 mths334.72132.83334.69112.7920.04273.7860.91MARCH 2014Mar-1012 mths388.078.55Mar-1112 mths492.4436.38Mar-1212 855.93the management accountant77

taxationCASE STUDYAnnexure VIIncome Expenditure SummaryIncome & Expenditure Summary (In Rs. Crore)Reliance Power Ltd.Mar-07Mar-08Mar-09Mar-10Mar-11Mar-12Total expenses2.0938.285.82114.84217.89225.52Operating nge in stockRaw materials, stores & sparesPurchase of finished goodsPackaging and packing expensesPower, fuel & water chargesCompensation to employees0.263.220.7638.9360.643.18Indirect taxes0.69.70.250.0625.110.05Royalties, technical know-how fees, etcRent & lease rent16.6714.5415.144.26Repairs & maintenance0.020.370.691.631.3Insurance premium paid0.010.150.370.741.5Outsourced professional jobs3.8918.5326.4517.7421.89Non-executive directors' 725.84Communications expenses3.313.3610.913.82Printing & stationery 1238.47Outsourced manufacturing jobsSelling & distribution expensesTravel expenses0.17Miscellaneous expenditure0.01Other operational exp of industrial ent0.011.58Other operational exp of non-fin services entShare of loss in other enterprisesFinancial charges0.827.474.585.7647.6764.24Fee based financial services expenses0.827.474.585.768.157.06Fund based financial services expenses39.5257.18Interest paid33.4244.516.112.67Financial charges on instrumentsProvisions0.01Non-cash 6.060.010.060.1AmortisationWrite-offs27.78Prior period and extra-ordinary expenses5.92Provision for direct tax0.386.27.5715.71Profit after 274.55310.86Source: CMIE Prowess78the management accountantMARCH 2014www.icmai.in

Annexure VIIAsset SummaryAssets Summary (In Rs. Crore)Reliance Power Ltd.Mar-07Mar-08Mar-09Mar-10Mar-11Mar-12Currency: Rs. Crore (Non-Annualised)12 mths12 mths12 mths12 mths12 mths12 mthsGross fixed assets67.2867.4178.1881.1596.53102.21Cumulative 178.7585.2387.990.240.262.52Arrears of depreciationNet fixed assetsIntangible .020.017.997.857.587.3Plant & machinery, computers and electrical 0.040.040.210.271.881.93Capital work-in-progress35.9737.452928.19.4112.22Net pre-operative exp pending 600.06110.26417.24Transport & commn equipment and infrastructureFurniture, social amenities and other fixed assetsNet lease reserve adjustmentInvestmentsInvestment in equity sharesInvestment in preference sharesInvestment in mutual funds10,340.68 8180.18Investment in 7Less: provn for dimin in value of 99.95Investment in debt instrumentsInvestment in approved securitiesInvestment in assisted companiesMemorandumInvestments in group companies41.29Investments in non-group companiesMarket value of quoted investments43.568,412.03Deferred tax assetsCurrent assets3.02361.2114.43101.411,362.99588.06Cash & bank 093.96204.8313,974.3313,852.1614,132.42 17,601.4016,314.82InventoriesReceivablesAssets held for sale and transferLoans & advancesMiscellaneous expenses not written offTotal assetsSource: CMIE Prowesswww.icmai.inMARCH 2014the management accountant79

taxationCASE STUDYAnnexure VIIILiability SummaryLiabilities Summary (In Rs. Crore)Reliance Power Ltd.Currency: Rs. Crore (Non-Annualised)Shareholder's fundsNet worthTotal capitalPaid up equity capitalForfeited equity capitalPaid up preference capitalCapital contribution & funds by govt., othersConvertible warrantsShare application money & suspense accountReserves and fundsFree reservesSpecific reservesRevaluation reservesAccumulated lossesBorrowingsBorrowing from banksBorrowing from financial institutionsBorrowings from central & state govtBorrowings syndicated across banks & institutionsDebentures and bondsForeign currency borrowingsLoans from promoters, directors and shareholdersInter-corporate loansDeferred creditInterest accrued and dueHire purchase loansFixed depositsCommercial papersOther borrowingsDeferred tax liabilityCurrent liabilities & provisionsSundry creditorsAcceptancesDeposits & advances from customers,etcInterest accrued but not dueShare application money - refundableOther current liabilitiesProvisionsTotal liabilitiesMemorandumTangible net worthTotal outside liabilitiesTotal term liabilitiesContingent liabilitiesAuthorised equity capitalIssued equity capitalSource: CMIE Prowess80the management accountantMARCH 2014Mar-0712 mths200.06200.06200.04200.04Mar-0812 mths13,542.6713,542.672,259.952,259.95Mar-0912 mths13,792.8213,792.822,396.802,396.80Mar-1012 mths14,066.0414,066.042,396.802,396.80Mar-1112 mths15,896.5615,896.562,805.132,805.13Mar-1212 2,805.13www.icmai.in

Annexure IXCash Flow SummaryCash Flow (In Rs. Crore)Reliance Power Ltd.Currency: Rs. Crore (Non-Annualised)Net cash flow from operating activitiesNet profit before tax & extra-ordinary incomeAdd: Adjustments for non-cash and non-operating expensesDepreciationAmortisation and w offsUnrealised foreign exchange lossProvision for contingenciesOther provisions like RDD etcInterest PaidLoss on sale of investmentsLoss on sale of assetsOther non-cash and non-operating expensesLess: Adjustments for non-cash and non-oper incomeUnrealised foreign exchange gainProvision or liabilities written backInterest incomeDividend incomeProfit on sale of investmentsProfit or loss on sale of assetsOther non-cash and non-operating incomeOperating cash flow before working capital changesAdd:Cash inflow due toDecrease in trade & other receivablesDecrease in inventoriesIncrease in trade & other payablesIncrease in depositsDecrease in advancesIncrease in other current liabilitiesLess: Cash outflow due toIncrease in trade & other receivablesIncrease in inventoriesDecrease in trade & other payablesDecrease in deposits (banks or fis)Increase in advances (banks or fis)Decrease in other current liabilitiesCash flow generated from operationsCash outflow due to direct taxes paidCash inflow due to direct taxes refundCash outflow due to dividend tax paidCash flow before extraordinary itemsCash outflow due to extraordinary itemsCash inflow due to extraordinary itemsCash outflow due to misc expendNet cash inflow from investing activitiesLess: Cash outflow due to investing activitiesPurchase of fixed assetsIncrease in capital work in progressAcquisition or merger of companies or unitsPurchase of investmentswww.icmai.inMar-07 Mar-0812 mths 12 mths-38.8337.410.54101.440.190.2Mar-0912 mths-524.57256.471.110.2Mar-1012 mths-110.96288.942.990.51Mar-1112 mths-252.43253.6445.331.14Mar-1212 8.8337.41-524.57-110.96-252.43-117.422.77-58.69 -12,267.06 217.09203.01 1,061.87 1,101.63114.38 29,916.44 8,154.17 5,091.92 4,633.32 3,735.4219.339.135.162.27.338.5395.0529,447.96 5,829.54 5,089.72 4,466.89 3,186.89MARCH 2014the management accountant81

taxationCASE STUDYAnnexure IXCash Flow SummaryCash Flow (In Rs. Crore)Reliance Power Ltd.Mar-07Mar-09Mar-10Mar-11Mar-12Currency: Rs. Crore (Non-Annualised)12 mths 12 mths12 mths12 mths12 mths12 mths459.352,319.47Loans to subsi or group companiesMar-08Loans to other companies540Profit or (loss) on redemption of sharesOther income159.1DisbursementsAdd: Cash inflow due to investing activities55.6917,649.38 8,371.26 5,294.93 5,695.19 4,837.05Sale of fixed assets0.06Decrease in capital work in progress0.240.06209.140.060.24Merger or hiving off of companies or units0.03Sale of Investments55.4517,536.55 8,097.47 4,062.92 4,484.06 2,523.08Redemption of sharesLoans from subs or group companies1,019.92817.292,022.41Loans from other companiesInterest received0.010.010.0145.35120.43Dividend received112.79273.78212.02139.1182.12Other income88.89disbursementsNet cash inflow or (outflow) from financing activitiesLess: Cash outflow due to financing activities97.6312,290.040Issue .332,009.8872.1440.241.6949.3395.99nterest paidDividend paidRepayment of borrowings1,913.89Repayment of long term liabilitiesRepayment of short term liabilitiesCash (outflow) due to redemption or buyback of capital6.57Cash inflow or (outflow) due to other cash receipts or payables from financingactivitiesAdd: Cash inflow from financing activities97.6312,362.180.98Proceeds from share issue97.6312,362.180.980215223.96215223.96Cash SubsidyProceeds from borrowingsProceeds from long term borrowingsProceeds from short term borrowingsOther cash receipts or payables from financing activitiesNet increase or (decrease) in cash & cash equivalents0.14360.39-346.7483.79975.11-778.92Cash & bank - opening balance0.580.72361.1614.422.57977.68Cash & bank - closing balance0.72361.1114.4298.21977.68198.76Net increase or (decrease) in cash & cash .92Source: CMIE Prowess82the management accountantMARCH 2014www.icmai.in

Annexure XCapital Expenditure ProjectsCapital Expenditure Projects (In Rs. t PowerExpansion ProjectProject nameSamalkot EastGodavari AndhraPradesh10,000.00Steam Turbine960MwUnderImplementationKakinada FSRULNG ImportTerminal ProjectKakinada EastGodavari AndhraPradesh5,400.00Kakinada FSRULNG ImportTerminal5MTPAAnnouncedJaisalmer SolarPower Solar Power160MwAnnouncedSource: CMIE ProwessDiscussion about the case study1.The book building process of Initial Public Offer (IPO)The very first sale of stock to the general public is called anIPO. The issuer may be a new company or an old company. The issuer and the investment banker jointly decide theprice band of the new issue and once the price band is determ

investors, 40% lower than the IPO price of Rs. 430( 8.74) and Rs. 281( 5.71) per share for other investors, and 37% lower than the IPO price of Rs. 450 ( 9.15). REL announced buyback of the shares to prevent the shares to slide further which didn't happen although. The performance of Re-liance Power Ltd. after the IPO was good (Annex-