Transcription

The CPA Exam andRequirementsAdapted and modified from material originally created by David Reinus.

An extra 1,024,870 with a CPA license.

Education Exam ExperienceEvery state is unique

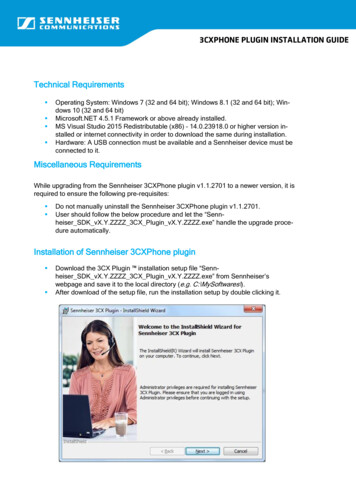

Step 5Step 4Step 3Step 2Step 1Schedule the exam sectionsReceive Notice to Schedule (NTS)Select sections and pay fees (within 90 days of receiving Payment Coupon)Submit application (Set up CBA Client Account at https://www.cba.ca.gov/cbt public/join form)Send college transcripts to the California Board of Accountancy (CBA)Access “Expedited Transcript Request for CPA Exam” athttps://www.csun.edu/acctis/students

EducationalRequirementsBaccalaureateDegreeUnit RequirementsTo Sit for CPA ExamTo be LicensedYesYes24 accounting units24 business units120 total units30 accounting units38 business units10 ethics units (3 in accounting)150 total units

CPAAccounting UnitsBUS Related UnitsEthics UnitsRequirements303810CSUN35Over 4010

CPA Ethics Requirement RS 361PHIL 305 or BLAW 368*ACCT 460ACCT 511* Or any other BLAW course.3 units3 units1 unit3 units10 units

1st QtrWindow2nd QtrWindow3rd QtrWindow4th OSED** The first 10 days of the closed months are available.

“Test Drive” 30Actual check-inID confirmationDocumentation checkingImage capture of finger printAssignment of a lockerSeated at a computerSample test (at a computer for 15 minutes)Become familiar with parking, location,and commute time to the center.

Financial Accounting and Reporting (FAR)Auditing and Attestation (AUD)Regulation (REG)Business Environment and Concepts (BEC)

Financial Accounting and Reporting (FAR)ACCT 350 – Intermediate Financial Accounting IACCT 351 – Intermediate Financial Accounting IIACCT 352 – Intermediate Financial Accounting IIIACCT 450 – Advanced Financial AccountingACCT 475 – Governmental and Nonprofit AccountingAuditing and Attestation (AUD)ACCT 460 – Auditing Principles and AnalyticsACCT 465 – Advanced Auditing

Business Environment and Concepts (BEC)ACCT 380 – Cost AccountingIS 312 – Systems and Technologies for ManagersFIN 303 – Financial ManagementECON 160 Principles of MicroeconomicsECON 161 Principles of MacroeconomicsRegulation (REG)ACCT 440 – Income Tax IACCT 441 – Income Tax IIBLAW 280 – Business Law IBLAW 308 – Business Law II

For details about each topic and task for the CPA exam, seethe blueprints atCopy and paste each link. The links cannot be accessed by clicking.FAR cpa-exam-blueprint-far-section-july-2019.pdfAUD cpa-exam-blueprint-aud-section-july-2019.pdfREG cpa-exam-blueprint-reg-section-july-2019.pdfBEC cpa-exam-blueprint-bec-section-july-2019.pdf

Auditing & Attestation Financial Accounting & Reporting Business Environment & Concepts Regulation 224.99224.99224.99224.99 899.96 Application Fee ( 50 re-application)100.00 Total 999.96

NTS is good for 9 months.Candidates may sit for one or more sections at anytime and in any order. Section(s) not passed cannot be taken within thesame (3-month) window. Must pass all four sections within a rolling 18-monthperiod.

Rolling 18-Month Period1x1XZap! 1x12x2xXZap! 2x13x4x18 MonthsRequired3x3x3x1184x4x182x1x18

Exam PartTimeFinancial (FAR)4 hoursAudit (AUD)4 hoursRegulation (REG)4 hoursBusiness (BEC)4 hoursTotal 16 hours

50%TESTLET 1: MULTIPLE CHOICETESTLET 2: MULTIPLE CHOICETESTLET 3: TASK-BASED SIMULATION50%TESTLET 4: TASK-BASED SIMULATIONTESTLET 5: TASK-BASED SIMULATION Two multiple-choice question(MCQ) testlets contain 66questions. Three testlets containing 8task-based simulations (TBS);research question anddocument review simulationincluded.

50%TESTLET 1: MULTIPLE CHOICETESTLET 2: MULTIPLE CHOICETESTLET 3: TASK-BASED SIMULATION50%TESTLET 4: TASK-BASED SIMULATIONTESTLET 5: TASK-BASED SIMULATION Two multiple-choice question(MCQ) testlets contain 72questions. Three testlets containing 8task-based simulations (TBS);research question anddocument review simulationincluded.

50%TESTLET 1: MULTIPLE CHOICETESTLET 2: MULTIPLE CHOICETESTLET 3: TASK-BASED SIMULATION50%TESTLET 4: TASK-BASED SIMULATIONTESTLET 5: TASK-BASED SIMULATION Two multiple-choice question(MCQ) testlets contain 76questions. Three testlets containing 8task-based simulations (TBS);research question anddocument review simulationincluded.

50%35%15%TESTLET 1: MULTIPLE CHOICETESTLET 2: MULTIPLE CHOICETESTLET 3: TASK-BASED SIMULATIONTESTLET 4: TASK-BASED SIMULATIONTESTLET 5: WRITTEN COMMUNICATION Two multiple-choice question(MCQ) testlets contain 62questions. Two testlets containing 4task-based simulations (TBS). One testlet containing 3 writtencommunications.

0p ionallBreak1110p ionallBreakCl ock IRuns10p ionallBreakCl oc IRuns1

Accounting Experience 1 year in a CPA firm (public accounting) or 1 year in a non-CPA firm (private accounting or government) inthe accounting function and under the direct supervisionof a CPA. Auditing Experience (Optional) 500 hours Only required if authority to sign audit reports is desired.

56.34%53.16%47.24%48.45%49.43%

A passing score is 75 Psychometrics &Psychometricians The MCQ testlets have two levels ofdifficulty – medium and difficult.The questions are weighted on the levelof difficulty.The difficult questions receive morepoints in reaching 75.

Testlet 1MediumWeakPerformanceTestlet 2Medium

Testlet 1MediumTestlet 2Difficult

Strongly Recommended The California Board of Accountancy UniformCPA Examination mbook.pdf

50 multiple choice questions90% score required300-page self-study course3 attemptsOne year to pass 150 ( 125 if member of CalCPA)Membership in CalCPA is free for students and forone year while taking the CPA exam.

CPA Review Course? Study time is used more efficiently.Strategies for taking the exam are learned.Practice doing task-based simulations.Keeps you disciplined and organized.Most efficient way to review what you’ve already learned.Increases probability of passing.Obtain immediate feedback from practice exams.Obtain practice navigating the computer screen and simulations.

For a tutorial and practice examfor each section of the CPA exam,go idates/tutorialandsampletest.html

The CPA Exam and . Requirements. Adapted and modified from material originally created by David Reinus.