Transcription

Vinita School District No. I-65Craig County, OklahomaAnnual Financial StatementsAndIndependent Auditor’s ReportsJune 30, 2018DAVID CLANIN CPAP.O. BOX 1854, CLAREMORE, OK 74018(918) 519-8336 PHONEDAVID@CLANINCPA.COM

Vinita School District No. I-65Craig County, OklahomaSchool District OfficialsJune 30, 2018Board of EducationPresidentDr. Jandra KorbVice-PresidentJim SheltonClerkSammie PrinceMemberMaryAnne BoydMemberGrant BurgetSuperintendent of SchoolsKelly GrimmettSchool District TreasurerDuwayne KingMinute ClerkAllina JohnsonEncumbrance ClerkMelissa MeeksActivity Fund CustodianKimberly Wagner

Vinita School District No. I-65Craig County, OklahomaTable of ContentsI ndependent Auditor’s Report1-3Reports Required by Government Auditing Standards:Independent Auditor’ s Report on Internal Control Over Financial Reporting and on Complianceand Other Matters Based on an Audit of Financial Statements Performedin Accordance with Government Auditing Standards4-5Independent Auditor’ s Report on Compliance for Each Major Program and InternalControl over Compliance Required by Uniform Guidance6-7Schedule of Findings and Questioned CostsSchedule of Expenditures of Federal AwardsSummary Schedule of Prior Audit FindingsM anagement’s Discussion and AnalysisBasic Financial Statements:Government-Wide Financial StatementsStatement of Net Position-Regulatory BasisStatement of Activities and Changes in Net Position-Regulatory BasisFund Financial StatementsBalance Sheet-Governmental Funds-Regulatory BasisReconciliation of the Governmental Funds Balance Sheet to the Government-WideStatement of Net Position -Regulatory BasisStatement of Revenues, Expenditures and Changes in Fund Balances- Governmental Funds-Regulatory BasisReconciliation of the Governmental Funds Statement of Revenues, Expenditures andChanges in Fund Balances to the Government-Wide Statement of Activities and Changesin Net Position-Regulatory BasisStatement of Changes in Fiduciary Net Position - Fiduciary Funds-Regulatory BasisNotes to the Basic Financial StatementsOther I nformation:Statement of Revenues, Expenditures and Changes in Fund Balances - Budget and Actual Governmental FundsNotes to Budgetary InformationCombining Balance Sheet–Non-Major Governmental Funds–Regulatory BasisCombining Statement of Revenues, Expenditures and Changes in Fund BalancesNon-Major Governmental Funds-Regulatory BasisOther Department of Education Required I nformationAccountant's Professional Liability Insurance 484950

1DAVID CLANIN CPAP.O. BOX 1854, CLAREMORE, OK 74018(918) 519-8336 PHONE (918) 512-4646 FAXDAVID@CLANINCPA.COMINDEPENDENT AUDITOR’S REPORTThe Honorable Board of EducationVinita School District No. I-65Vinita, Craig County, OklahomaReport on the Financial StatementsWe have audited the accompanying financial statements — regulatory basis of the governmental activities, each major fund, andthe aggregate remaining fund information of the aforementioned School District as of and for the year ended June 30, 2018, andthe related notes to the financial statements, which collectively comprise the School District’s basic financial statements as listedin the table of contents.Management’s Responsibility for the Financial StatementsManagement is responsible for the preparation and fair presentation of these financial statements in accordance with financialreporting provisions of the Oklahoma State Department of Education to meet financial reporting requirements of the State ofOklahoma; this includes determining that the regulatory basis of accounting is an acceptable basis for the preparation of thefinancial statements in the circumstances. Management is also responsible for the design, implementation, and maintenance ofinternal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement,whether due to fraud or error.Auditor’s ResponsibilityOur responsibility is to express opinions on these financial statements based on our audit. We conducted our audit in accordancewith auditing standards generally accepted in the United States of America and the standards applicable to financial auditscontained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards requirethat we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free from materialmisstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial statements.The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of thefinancial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal controlrelevant to the entity’s preparation and fair presentation of the financial statements in order to design audit procedures that areappropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internalcontrol. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policiesused and the reasonableness of significant accounting estimates made by management, as well as evaluating the overallpresentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinions.Basis for Adverse Opinion on U.S. Generally Accepted Accounting PrinciplesAs discussed in Note I, the financial statements are prepared by the District, on the basis of the financial reporting provisions ofthe Oklahoma State Department of Education, which is a basis of accounting other than accounting principles generally acceptedin the United States of America, to comply with the requirements of the Oklahoma State Department of Education. The effectson the financial statements of the variances between regulatory basis of accounting described in Note I and accounting principlesgenerally accepted in the United States of America, although not reasonably determined, are presumed to be material.Adverse Opinion on U.S. Generally Accepted Accounting PrinciplesIn our opinion, because the significance of the matter discussed in the “Basis for Adverse Opinion on U.S. Generally AcceptedAccounting Principles” paragraph, the basic financial statements referred to in the first paragraph do not present fairly, inaccordance with accounting principles generally accepted in the United States of America, the financial position of thegovernmental activities, each major fund, and the aggregate remaining fund information of the District, as of June 30, 2018, thechanges in its financial position or, where applicable, its cash flows for the year then ended.Opinion on Regulatory Basis of AccountingIn our opinion, the basic financial statements referred to in the first paragraph present fairly, in all material respects, the respectivefinancial position – regulatory basis of the governmental activities, each major fund and the aggregate remaining fundinformation of the District, as of June 30, 2018, and the respective changes in financial position – regulatory basis for the yearthen ended on the regulator basis of accounting described in Note I.

2Other MattersOther InformationOur audit was conducted for the purpose of forming opinions on the financial statements that collectively comprise the District’sbasic financial statements. The schedule of expenditures of federal awards is presented for purposes of additional analysis asrequired by Title 2 U.S. Code of Federal Regulations (CFR) Part 200, Uniform Guidance Administrative Requirements, CostPrinciples, and Audit Requirements for Federal Awards, and is also not a required part of the basic financial statements.Management’s discussion and analysis, budgetary comparison information and notes, and the combining financial statements,as listed in the table of contents, are presented for purposes of additional analysis as required by the Oklahoma State Departmentof Education and are also not a required part of the basic financial statements.The schedule of expenditures of federal awards and the combining schedules are the responsibility of management and werederived from and relate directly to the underlying accounting and other records used to prepare the basic financial statements.Such information has been subjected to the auditing procedures applied in the audit of the basic financial statements and certainadditional procedures, including comparing and reconciling such information directly to the underlying accounting and otherrecords used to prepare the basic financial statements or to the basic financial statements themselves, and other additionalprocedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, theschedule of expenditures of federal awards and combining schedules are fairly stated in all material respects in relation to thebasic financial statements as a whole.Management’s discussion and analysis and budgetary comparison information and notes, as listed in the table of contents, whichare the responsibility of management, have not been subjected to the auditing procedures applied in the audit of the basic financialstatements, and accordingly, we do not express an opinion or provide any assurance on it.Other Reporting Required by Government Auditing StandardsIn accordance with Government Auditing Standards, we have also issued our report dated January 14, 2018, on our considerationof the School District’s internal control over financial reporting and on our tests of its compliance with certain provisions oflaws, regulations, contracts, and grant agreements and other matters. The purpose of that report is to describe the scope of ourtesting of internal control over financial reporting and compliance and the results of that testing, and not to provide an opinionon internal control over financial reporting or on compliance. That report is an integral part of an audit performed in accordancewith Government Auditing Standards in considering the School District’s internal control over financial reporting andcompliance.David Clanin, CPAClaremore, OklahomaJanuary 14, 2018

REPORTS REQUIRED BY GOVERNMENT AUDITING STANDARDS

4DAVID CLANIN CPAP.O. BOX 1854, CLAREMORE, OK 74018(918) 519-8336 PHONE (918) 512-4646 FAXDAVID@CLANINCPA.COMINDEPENDENT AUDITOR’S REPORT ON INTERNAL CONTROL OVER FINANCIAL REPORTING AND ONCOMPLIANCE AND OTHER MATTERS BASED ON AN AUDIT OF FINANCIAL STATEMENTS PERFORMED INACCORDANCE WITH GOVERNMENT AUDITING STANDARDSThe Honorable Board of EducationVinita School District No. I-1Vinita, Ottawa County, OklahomaWe have audited, in accordance with the auditing standards generally accepted in the United States of America and the standardsapplicable to financial audits contained in Government Auditing Standards issued by the Comptroller General of the UnitedStates, the financial statements — regulatory basis of the governmental activities, each major fund, and the aggregate remainingfund information of the aforementioned School District as of and for the year ended June 30, 2018, and the related notes to thefinancial statements, which collectively comprise the School District’s basic financial statements, and have issued our reportthereon dated January 14, 2018, which was adverse with respect to the presentation of the financial statements in conformitywith accounting principles generally accepted in the United States because presentation followed the regulatory basis ofaccounting for Oklahoma school districts and did not conform to the presentation requirements of the Governmental AccountingStandards Board.Internal Control over Financial ReportingIn planning and performing our audit of the financial statements, we considered the School District’s internal control overfinancial reporting (internal control) to determine the audit procedures that are appropriate in the circumstances for the purposeof expressing our opinions on the financial statements, but not for the purpose of expressing an opinion on the effectiveness ofthe School District’s internal control. Accordingly, we do not express an opinion on the effectiveness of the School District’sinternal control.A deficiency in internal control exists when the design or operation of a control does not allow management or employees, inthe normal course of performing their assigned functions, to prevent, or detect and correct, misstatements on a timely basis. Amaterial weakness is a deficiency, or a combination of deficiencies, in internal control, such that there is a reasonable possibilitythat a material misstatement of the entity’s financial statements will not be prevented, or detected and corrected on a timelybasis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control that is less severe than amaterial weakness, yet important enough to merit attention by those charged with governance.Our consideration of internal control was for the limited purpose described in the first paragraph of this section and was notdesigned to identify all deficiencies in internal control that might be material weaknesses or, significant deficiencies. Given theselimitations, during our audit we did not identify any deficiencies in internal control that we consider to be material weaknesses.However, material weaknesses may exist that have not been identified.Compliance and Other MattersAs part of obtaining reasonable assurance about whether the School District’s financial statements are free from materialmisstatement, we performed tests of its compliance with certain provisions of laws, regulations, contracts, and grant agreements,noncompliance with which could have a direct and material effect on the determination of financial statement amounts. However,providing an opinion on compliance with those provisions was not an objective of our audit, and accordingly, we do not expresssuch an opinion. The results of our tests disclosed no instances of noncompliance or other matters that are required to be reportedunder Government Auditing Standards.

5Purpose of this ReportThe purpose of this report is solely to describe the scope of our testing of internal control and compliance and the results ofthat testing, and not to provide an opinion on the effectiveness of the entity’s internal control or on compliance. This report isan integral part of an audit performed in accordance with Government Auditing Standards in considering the entity’s internalcontrol and compliance. Accordingly, this communication is not suitable for any other purpose.David Clanin, CPAJanuary 14, 2019

6DAVID CLANIN CPAP.O. BOX 1854, CLAREMORE, OK 74018(918) 519-8336 PHONE (918) 512-4646 FAXDAVID@CLANINCPA.COMINDEPENDENT AUDITOR’S REPORT ON COMPLIANCE FOR EACH MAJOR PROGRAMAND ON INTERNAL CONTROL OVER COMPLIANCE REQUIRED BY THE UNIFORM GUIDANCEThe Honorable Board of EducationVinita School District No. I-1Vinita, Ottawa County, OklahomaReport on Compliance for Each Major Federal ProgramWe have audited the aforementioned School District’s compliance with the types of compliance requirements described in theOMB Compliance Supplement that could have a direct and material effect on each of the School District’s major federal programsfor the year ended June 30, 2018. The School District’s major federal programs are identified in the summary of auditor’s resultssection of the accompanying schedule of findings and questioned costs.Management’s ResponsibilityManagement is responsible for compliance with federal statutes, regulations, and the terms and conditions of its federal awardsapplicable to its federal programs.Auditor’s ResponsibilityOur responsibility is to express an opinion on compliance for each of the School District’s major federal programs based on ouraudit of the types of compliance requirements referred to above. We conducted our audit of compliance in accordance withauditing standards generally accepted in the United States of America; the standards applicable to financial audits contained inGovernment Auditing Standards, issued by the Comptroller General of the United States; and the audit requirements of Title 2U.S. Code of Federal Regulations Part 200, Uniform Administrative Requirements, Cost Principles, and Audit Requirements forFederal Awards (Uniform Guidance). Those standards and the Uniform Guidance require that we plan and perform the audit toobtain reasonable assurance about whether noncompliance with the types of compliance requirements referred to above thatcould have a direct and material effect on a major federal program occurred. An audit includes examining, on a test basis,evidence about the School District’s compliance with those requirements and performing such other procedures as we considerednecessary in the circumstances.We believe that our audit provides a reasonable basis for our opinion on compliance for each major federal program. However,our audit does not provide a legal determination of the School District’s compliance.Opinion on Each Major Federal ProgramIn our opinion, the School District complied, in all material respects, with the types of compliance requirements referred toabove that could have a direct and material effect on each of its major federal programs for the year ended June 30, 2018.Report on Internal Control over ComplianceManagement of the School District is responsible for establishing and maintaining effective internal control over compliancewith the types of compliance requirements referred to above. In planning and performing our audit of compliance, we consideredthe School District’s internal control over compliance with the types of requirements that could have a direct and material effecton each major federal program to determine the auditing procedures that are appropriate in the circumstances for the purpose ofexpressing an opinion on compliance for each major federal program and to test and report on internal control over compliancein accordance with the Uniform Guidance, but not for the purpose of expressing an opinion on the effectiveness of internalcontrol over compliance. Accordingly, we do not express an opinion on the effectiveness of the School District’s internal controlover compliance.A deficiency in internal control over compliance exists when the design or operation of a control over compliance does not allowmanagement or employees, in the normal course of performing their assigned functions, to prevent, or detect and correct,noncompliance with a type of compliance requirement of a federal program on a timely basis. A material weakness in internalcontrol over compliance is a deficiency, or combination of deficiencies, in internal control over compliance, such that there is areasonable possibility that material noncompliance with a type of compliance requirement of a federal program will not beprevented, or detected and corrected, on a timely basis. A significant deficiency in internal control over compliance is adeficiency, or a combination of deficiencies, in internal control over compliance with a type of compliance requirement of afederal program that is less severe than a material weakness in internal control over compliance, yet important enough to meritattention by those charged with governance.

7Our consideration of internal control over compliance was for the limited purpose described in the first paragraph of this sectionand was not designed to identify all deficiencies in internal control over compliance that might be material weaknesses orsignificant deficiencies. We did not identify any deficiencies in internal control over compliance that we consider to be materialweaknesses. However, material weaknesses may exist that have not been identified.The purpose of this report on internal control over compliance is solely to describe the scope of our testing of internal controlover compliance and the results of that testing based on the requirements of the Uniform Guidance. Accordingly, this report isnot suitable for any other purpose.David Clanin, CPAClaremore, OklahomaJanuary 14, 2018

8Vinita School District No. I-65Schedule of Findings and Questioned CostsFor the Fiscal Year Ended June 30, 2018SUMMARY OF AUDITOR’S RESULTS1.The auditor’s report expresses an adverse opinion on the basic financial statements-regulatory basis inconformity with generally accepted accounting principles and an unqualified opinion on the governmentalactivities, each major fund and the aggregate remaining fund information in conformity with a regulatorybasis of accounting prescribed by the Oklahoma Department of Education.2. No deficiencies relating to the audit of the financial statements is reported in the Schedule of Findings andQuestioned Costs.3. No instances of noncompliance material to the financial statements of Vinita School District weredisclosed during the audit.4. No significant deficiencies relating to the audit of the major federal award programs during the audit arereported in the Independent Auditor’s Report on Compliance with Requirement that could have a directmaterial effect on each major Program and Internal Control over Compliance with OMB UniformGuidance.5. The auditor’s report on compliance for the major federal award programs for Vinita School Districtexpresses an unqualified opinion on all major federal programs.6. Audit findings that are required to be reported in accordance with Section 200.510(a) of the UniformGuidance are reported in this schedule.7. The programs tested as major programs included:CFDA Number10.55510.55384.010Name of Federal ProgramUSDA LunchUSDA BreakfastTitle I, Part A – Improving Basic Programs8. The threshold used for distinguishing between Type A and B programs was 750,000.9. Vinita School District is not a low-risk auditee.FINDINGS – FINANCIAL STATEMENT AUDIT1. NoneFINDINGS AND QUESTIONED COSTS – MAJOR FEDERAL AWARD PROGRAMS AUDIT1. None

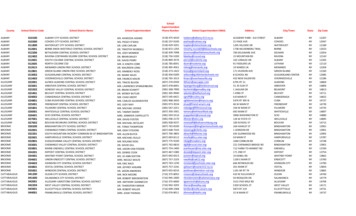

9Vinita School District No. I-65Schedule of Expenditure of Federal AwardsFor the Fiscal Year Ended June 30, 2018Federal Grantor/Pass-Through Grantor/ Program umberPass-ThroughEntityI dentifyingNumberU.S. Department of EducationDirect Programs:Title VII, Part A - Indian Education84.060561S060A171108Passed Through State Department of Education:Title I, Part A - Improving Basic ProgramsTitle I, Part D, Neglected and DelinquentIDEA-B DiscretionaryIDEA-BIDEA-B PreschoolTitle II, Part A - Teacher and Principal Training and Recruiting FundTitle VI, Subpart 2 - 532613621641541587S010A170036S010A170036Passed Through Oklahoma Department of Vocational Education:Rehabilitative Services84.126456ApprovedAmount 0036925,725.54U.S. Department of AgriculturePassed Through State Department of Education:National School Breakfast ProgramNational School Lunch ProgramSummer Food Service ProgramFresh Fruit and /AN/APassed Through Department of Health & Human ServicesCommodities - Note 410.550385N/A15.13056324,280.00 41,555.67950,005.54 FederalExpendituresReceipts 122,693.12 al U.S. Department of AgricultureTOTAL FEDERAL ASSI STANCE 1628,895.69Total U.S. Department of EducationOther Federal AssistanceJohnson O'Malley ProgramBalance atJuly 1, 2017Receivables /(Payables)Balance atJune 30, 2018255,437.31 1,347,940.25 1,400,189.88 48,346.55- 307,686.94Continued on next page

10Vinita School District No. I-65Schedule of Expenditure of Federal AwardsFor the Fiscal Year Ended June 30, 2018(continued)Note 1. Basis of PresentationThis accompanying schedule of expenditures of federal awards (the “Schedule”) includes the federal award activityof the District under programs of the federal government for the year ended June 30, 2018. The information in thisSchedule is presented in accordance with the requirements of Title 2 U. S. Code of Federal Regulations Part 200,Uniform Administrative Requirements, Cost Principles, and Audit Requirements for Federal Awards (UniformGuidance). Because the Schedule presents only a selected portion of operations of the District, it is not intended toand does not present the financial position, changes in net assets, or cash flows of the District.Note 2. Summary of Significant Accounting PoliciesExpenditures reported on the Schedule are reported on the regulatory basis of accounting. Such expendituresrecognized following the cost principles contained in the Uniform Guidance, wherein certain types of expendituresare not allowable or are limited to reimbursement.Note 3. Indirect Cost RateThe District has elected not to use the 10-percent de minimis indirect cost rate allowed under the Uniform Guidance.The District elects to use the rate of 2.82% to charge indirect costs to federal programs.Note 4. Food DistributionNon-monetary assistance is reported in the schedule at the fair market value of the commodities received anddisbursed.

11Vinita School District No. I-65Craig County, OklahomaSummary Schedule of Prior Audit FindingsFor the Fiscal Year Ended June 30, 2018PRIOR AUDIT FINDINGSNone.

12Vinita School District No. I-65Craig County, OklahomaManagement’s Discussion and AnalysisJune 30, 2018As management of the Vinita School District No. I-65 (District), we offer readers of the District’s financialstatements this narrative overview and analysis of the financial activities of the District for the fiscal year ended June30, 2018. The intent of this discussion and analysis is to look at the District’s financial performance as a whole;readers should also review the basic financial statements and the notes to the basic financial statements to enhancetheir understanding of the District’s financial performance.FINANCIAL HIGHLIGHTS The total net position of the District increased by 976,482 or 7.3% over the fiscal year. General revenues accounted for 11,001,395 or 88% of total governmental activities revenue. Programspecific revenues accounted for 1,450,220 or 12% of total governmental activities revenue. The District had 11,475,133 in expenses related to governmental activities: 1,450,220 of these expenseswas offset by program specific charges for services, grants or contributions. The remaining expenses of thegovernmental activities were offset by property tax levies, state and county sources, and other miscellaneoussources. Governmental activities capital assets decreased by a net of 475,483, primarily due to the purchase of aautoclave offset by current year depreciation.Overview of the Financial StatementsThis discussion and analysis is intended to serve as an introduction to the District’s basic financial statements. TheDistrict’s financial statements are comprised of three components: 1) government-wide financial statements, 2)fund financial statements, and 3) notes to the financial statements. This report also contains other supplementaryinformation.Government–wide financial statements - The government-wide financial statements are designed to providereaders with a broad overview of the District’s finances, in a manner similar to a private-sector business.The Statement of Net Position presents information on all of the District’s assets and liabilities with a differencebetween the two reported as net position. Over time, increase or decreases in net position may serve as a usefulindicator of whether the financial position of the District is improving or deteriorating.The Statement of Activities presents information showing how the District’s net position changed during the mostrecent year. All changes in net position are reported as soon as the underlining event given rise to the change occurs,regardless of the timing of the related cash flows. Thus, revenues and expenses are reported in this statements forsome items that will only result in cash flows in future fiscal periods.(e.g., reserves paid in the following year).The government-wide financial statements distinguish functions of the District that are principally supported by taxesand intergovernmental revenues from other functions that are intended to recover all or a significant portion of theircosts through user fees and charges. The government-wide financial statements can be found on pages 19-20 of thisreportUNAUDITED

13Vinita School District No. I-65Craig County, OklahomaManagement’s Discussion and AnalysisJune 30, 2018Fund financial statements – A fund is a grouping of related accounts that is used to maintain control over resourcesthat have been segregated for specific activities or objectives. The District, like other state and local governments,uses fund accounting to ensure and demonstrate compliance with finance-related legal requirements. All of the fundsof the District can be divided into two categories –governmental funds andfiduciary funds.Governmental Funds- Governmental funds are used to account for essentially the same functions reported asgovernmental activities in the government-wide financial statements. However, unlike the government-widefinancial statements, governmental find financial statements focus on current sources and uses of spendableresources, as well as on balan

Craig County, Oklahoma . Annual Financial Statements . And . Independent Auditor's Reports . June 30, 2018 . DAVID CLANIN CPA . P.O. B. OX . 1854, C. LAREMORE, OK 74018 . accounting for Oklahoma school districts and did not conform to the presentation requirements of the Governmental Accounting Standards Board.