Transcription

SOUTHGATE INDEPENDENT SCHOOL DISTRICTANNUAL FINANCIAL REPORTYear Ended June 30, 2019

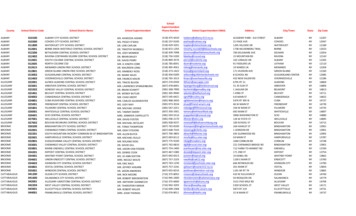

TABLE OF CONTENTSReport of Independent Auditor . 1 - 2Management’s Discussion and Analysis . 3 - 5Basic Financial StatementsGovernment-wide Financial StatementsStatement of Net Position . 6Statement of Activities . 7Fund Financial Statements8Balance Sheet – Governmental Funds . 8Reconciliation of Total Government Fund Balancesto Net Position of Governmental Activities . 9Statement of Revenues, Expenditures, and Changesin Fund Balances – Governmental Funds . 10Reconciliation of the Statement of Revenues, Expenditures, and Changesin Fund Balances of Governmental Funds to the Statement of Activities . 11Statement of Net Position – Proprietary Fund . 12Statement of Revenues, Expenses, and Changesin Net Position – Proprietary Fund . 13Statement of Cash Flows – Proprietary Fund . 14Statement of Fiduciary Net Position – Fiduciary Fund . 15Notes to the Financial Statements . 16 - 40Supplementary InformationStatement of Revenues, Expenditures, and Changesin Fund Balances – Budget and Actual - General Fund. 41Statement of Revenues, Expenditures, and Changin Fund Balances – Budget and Actual – Special Revenue Fund . 42Combining Balance Sheet – Nonmajor Governmental Funds . 43Combining Statement of Revenues, Expenditures, and ChangesIn Fund Balances - Nonmajor Governmental Funds . 44Schedule of District’s Proportionate Share of the Net PensionLiability – County Employees Retirement System . 45Schedule of District’s Proportionate Share of the Net PensionLiability – Kentucky Teachers Retirement System. 46Schedule of District’s Proportionate Share of the Net OPEBLiability – Kentucky Teachers Retirement System. 47Schedule of District’s Proportionate Share of the Net OPEBLiability – County Employees Retirement System . 48Statement of Receipts and Disbursements – School Activity Fund . 49

Independent Auditor’s Report on Internal Control overFinancial Reporting and on Compliance and Other Mattersrequired by Government Auditing Standards . 50 - 51Schedule of Prior Year Audit Findings . 52Management Letter Transmittal. 53Management Letter Comments . 54

REPORT OF INDEPENDENT AUDITORMembers of the Board of EducationSouthgate Independent School District6 William Blatt AvenueSouthgate, KY 41071Report on the Financial StatementsWe have audited the accompanying financial statements of the governmental activities, the business-typeactivities, each major fund, and the aggregate remaining fund information of the Southgate IndependentSchool District (District) as of and for the year ended June 30, 2019, and the related notes to the financialstatements, which collectively comprise the District’s basic financial statements as listed in the table ofcontents.Management’s Responsibility for the Financial StatementsManagement is responsible for the preparation and fair presentation of these financial statements inaccordance with accounting principles generally accepted in the United States of America; this includes thedesign, implementation, and maintenance of internal control relevant to the preparation and fairpresentation of financial statements that are free from material misstatement, whether due to fraud orerror.Auditor’s ResponsibilityOur responsibility is to express opinions on these financial statements based on our audit. We conductedour audit in accordance with auditing standards generally accepted in the United States of America. Thosestandards require that we plan and perform the audit to obtain reasonable assurance about whether thefinancial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in thefinancial statements. The procedures selected depend on the auditor’s judgment, including the assessmentof the risks of material misstatement of the financial statements, whether due to fraud or error. In makingthose risk assessments, the auditor considers internal control relevant to the entity’s preparation and fairpresentation of the financial statements in order to design audit procedures that are appropriate in thecircumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internalcontrol. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness ofaccounting policies used and the reasonableness of significant accounting estimates made by management,as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for ouraudit opinions.OpinionIn our opinion, the financial statements referred to above present fairly, in all material respects, therespective financial position of the governmental activities, the business-type activities, each major fund,and the aggregate remaining fund information of the District, as of June 30, 2019, and the respectivechanges in financial position and, where applicable, cash flows thereof for the year then ended inaccordance with accounting principles generally accepted in the United States of America.Page 1

REPORT OF INDEPENDENT AUDITOR(CONTINUED)Other MattersRequired Supplementary InformationAccounting principles generally accepted in the United States of America require that the management’sdiscussion and analysis on pages 3 to 5, budgetary comparison information on pages 41 to 42, and pensionand OPEB schedules on pages 45 to 48 be presented to supplement the basic financial statements. Suchinformation, although not a part of the basic financial statements, is required by the GovernmentalAccounting Standards Board, who considers it to be an essential part of financial reporting for placing thebasic financial statements in an appropriate operational, economic, or historical context. We have appliedcertain limited procedures to the required supplementary information in accordance with auditingstandards generally accepted in the United States of America, which consisted of inquiries of managementabout the methods of preparing the information and comparing the information for consistency withmanagement’s responses to our inquiries, the basic financial statements, and other knowledge we obtainedduring our audit of the basic financial statements. We do not express and opinion or provide any assuranceon the information because the limited procedures do not provide us with sufficient evidence to express anopinion or provide any assurance.Other InformationOur audit was conducted for the purpose of forming opinions on the financial statements that collectivelycomprise the District’s basic financial statements. The combining and individual nonmajor fund financialstatements are presented for purposes of additional analysis and are not a required part of the basicfinancial statements.The combining and individual nonmajor fund financial statements are the responsibility of management andwere derived from and relate directly to the underlying accounting and other records used to prepare thebasic financial statements. Such information has been subjected to the auditing procedures applied in theaudit of the basic financial statements and certain additional procedures, including comparing andreconciling such information directly to the underlying accounting and other records used to prepare thebasic financial statements or to the basic financial statements themselves, and other additional proceduresin accordance with auditing standards generally accepted in the United States of America.In our opinion, the combining and individual nonmajor fund financial statements are fairly stated in allmaterial respects in relation to the basic financial statements as a whole.Other Reporting Required by Government Auditing StandardsIn accordance with Government Auditing Standards, we have also issued our report dated November 11,2019, on our consideration of the District’s internal control over financial reporting and on our tests of itscompliance with certain provisions of laws, regulations, contracts, and grant agreements and other matters.The purpose of that report is to describe the scope of our testing of internal control over financial reportingand compliance and the results of that testing, and not to provide an opinion on internal control overfinancial reporting or on compliance. That report is an integral part of an audit performed in accordancewith Government Auditing Standards in considering District’s internal control over financial reporting andcompliance.Maddox & Associates CPAs Inc.Fort Thomas, KentuckyNovember 11, 2019Page 2

SOUTHGATE INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISJUNE 30, 2019As management of the Southgate Independent School District (District), we offer readers of the District’sfinancial statements this narrative overview and analysis of the financial activities of the District for the fiscalyear ended June 30, 2019. We encourage readers to consider the information presented here inconjunction with additional information found within the body of the audit.FINANCIAL HIGHLIGHTSKey financial highlights for fiscal year 2019 are as follows: The beginning cash balance for all funds of the District, excluding agency funds, was 1,040,634 andthe ending balance was 1,539,780; an increase of 499,146 for the year.The District’s long-term debt increased by 570,000 due to issuing new bonds of 640,000 andmaking principal payments of 70,000.The General Fund had 2,538,364 in revenues and 2,617,956 in expenditures.OVERVIEW OF FINANCIAL STATEMENTSThis discussion and analysis is intended to serve as an introduction to the District’s basic financialstatements. The District’s basic financial statements are comprised of three components: 1) governmentwide financial statements, 2) fund financial statements, and 3) notes to the financial statements. This reportalso contains other supplementary information in addition to the basic financial statements themselves.Government-Wide Financial StatementsThe government-wide financial statements are designed to provide readers with a broad overview of theDistrict’s finances, in a manner similar to a private-sector business.The statement of net position presents information on all of the District’s assets and liabilities, with thedifference between the two reported as net position. Over time, increases or decreases in net position mayserve as a useful indicator of whether the financial position of the District is improving or deteriorating.The statement of activities presents information showing how the District’s net position changed during themost recent fiscal year. All changes in net position are reported as soon as the underlying event giving riseto the change occurs, regardless of the timing of related cash flows. Thus, revenues and expenses arereported in this statement for some items that will only result in cash flows in future fiscal periods.The government-wide financial statements outline functions of the District that are principally supported byproperty taxes and intergovernmental revenues (governmental activities). The governmental activities ofthe District include instruction, support services, operation and maintenance of plant, and operation of noninstructional services.Fund Financial StatementsA fund is a grouping of related accounts that is used to maintain control over resources that have beensegregated for specific activities or objectives. The District uses fund accounting to ensure and demonstratecompliance with finance-related legal requirements. All of the funds of the District can be divided into threecategories: governmental, proprietary, and fiduciary funds. The only proprietary fund is the food servicefund. Fiduciary funds are trust funds established by benefactors to aid in student education, welfare, andteacher support. All other activities of the District are included in the governmental funds.Page 3

SOUTHGATE INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISJUNE 30, 2019Notes to the Financial StatementsThe notes provide additional information that is essential to a full understanding of the data provided in thegovernment-wide and fund financial statements.GOVERNMENT-WIDE FINANCIAL ANALYSISNet position may serve over time as a useful indicator of a government’s financial position. In the case ofthe District, assets exceeded liabilities by 594,562 at year end.The largest portion of the District’s net position reflects its investment in capital assets (e.g., land, buildingsand improvements, and equipment less any related debt used to acquire those assets. The District usesthese capital assets to provide services to its students; consequently, these assets are not available forfuture spending. Although the District’s investment in capital assets is reported net of related debt, it shouldbe noted that the resources needed to repay this debt must be provided from other sources, since thecapital assets themselves cannot be used to liquidate these liabilities.Net position for the period ending June 30, 2019:June 30, 2019Current assetsNon-current assets Total assets1,654,0801,820,854June 30, 2018 207,1882,792,767177,6952,189,348Total liabilities2,999,9552,367,043Deferred 93,835(216,599)Deferred outflowsCurrent liabilitiesNon-current liabilitiesNet invesment in capital assetsRestrictedUnrestrictedTotal net position 594,562 711,051COMMENTS ON GENERAL FUND BUDGET COMPARISONSThe District’s total general fund revenue was 2,538,364 compared to budgeted revenue of 2,092,651. Thefavorable variance is mainly due to property taxes and state aid.General Fund actual expenditures were 2,617,956 compared to budgeted expenditures of 3,071,732. Thefavorable variance is mainly due building improvements and the budgeted contingency.Page 4

SOUTHGATE INDEPENDENT SCHOOL DISTRICTMANAGEMENT’S DISCUSSION AND ANALYSISJUNE 30, 2019The following table presents a summary of revenue and expense of total governmental funds for the yearended June 30, 2019:June 30, 2019Revenues and other sources:Local revenueState/federal revenueInvestmentsTotal revenuesExpenditures:InstructionStudent supportInstruction staffDistrict administrativeSchool administrativeBusiness supportPlant operations and maintenanceFood service operationDebt serviceTotal expendituresJune 30, 2018 1,328,3611,894,17527,463 1,288,4021,630,89417,371 3,249,999 2,936,667 2,129,058152,024134,278323,074219,37641,232293,306 ,804114,325 2,855,677112,575 3,404,923General Fund ExpendituresThe District expended approximately 62% of total expenditures for instruction. The remaining 38% wasexpended mainly for support services and plant operation and maintenance.Budgetary ImplicationsIn Kentucky, the public school fiscal year is July 1 – June 30; other programs, i.e. some federal programsoperate on a different fiscal calendar, but are reflected in the District overall budget. By law, the budgetmust have a minimum 2% contingency. The District adopted a budget with a contingency of 271,001 (9%).The beginning general fund cash balance for the next fiscal year is 962,830.Contacting the District’s Financial ManagementQuestions about this report should be directed to the Superintendent at (859) 441-0743 or by mail at6 William Blatt Avenue, Southgate, Kentucky 41071.Page 5

Southgate Independent School DistrictStatement of Net PositionJune 30, 2019GovernmentalActivitiesAssets:Cash and cash equivalentsReceivablesInventories for consumptionCapital assets, netBond issue costs 19,2571,767,33734,260Total assetsTotal 63,474,934Deferred OutflowsRelated to pensions - CERSRelated to OPEB - CERSRelated to OPEB - 000Total deferred 432,655126,112669,000Liabilities:Accounts payableAccrued salaries and benefitsAccrued interest payableUnearned revenueNet pension liability - CERSNet OPEB liability - CERSNet OPEB liability - KTRSLong-term liabilities:Due within one yearDue in more than one year70,0001,565,000Total 000109,005Deferred inflowsRelated to pensions - CERSRelated to OPEB - CERSRelated to OPEB - KTRSTotal deferred inflowsNet position:Net investment in capital assetsRestrictedUnrestrictedTotal net position54,08215,7649,001272,337642,494(297,424) 617,407The accompanying notes are an integral part of these financial statements.Page 619,257(42,102) (22,845)291,594642,494(339,526) 594,562

Southgate Independent School DistrictStatement of ActivitiesYear Ended June 30, 2019Functions/ProgramsGovernmental activities:InstructionSupport services:StudentInstruction staffDistrict administrativeSchool administrativeBusiness supportPlant operation and maintenanceInterest on long-term debtTotal governmental activitiesBusiness-type activities:Food serviceTotal business-type activitiesTotal DistrictExpensesChargesfor Services 2,196,986Program RevenuesOperatingCapitalGrants andGrants s (1,470,154) 219,376)(41,232)(205,348)(40,825)726,832Net (Expense) Revenue and Changes in Net 264135,855 3,530,111 2,264 862,6870(2,621,771)0 1)General Revenues:Property taxesMotor vehicle taxesUtilities taxState aidInvestment earningsOther revenuesFunds transferTotal general revenues(2,621,771)(43,389)00TotalChange in net position(93,644)(48,349)(141,993)Net position - beginning of year as restated711,05125,504736,555Net position - end of yearThe accompanying notes are an integral part of these financial statements. Page 7617,407 (22,845) 594,562

Southgate Independent School DistrictBalance SheetGovernmental FundsJune 30, 2019Assets:Cash and cash equivalents (deficit)Receivables:TaxesIntergovernmental - federalInterfund receivableTotal assetsLiabilities:Accounts payableAccrued salaries and benefitsTotal liabilitiesDeferred inflows of resources:Deferred revenueTotal deferred inflows of resourcesFund balances:RestrictedAssigned for sick leaveUnassignedTotal fund balancesTotal liabilities, deferred inflows ofresources, and fund therGovernmentalFunds 940,565 (62,074) 558,11384,400TotalGovernmentalFunds 1,521,0040112,5070112,507 940,565 50,433 558,113 1,07412,12113,195 5,4109,11714,527 19065,600065,600 84,400 190 01,488(29,694)558,09484,4001,540,17084,400 1,633,511 50,433The accompanying notes are an integral part of these financial statements.Page 86,50321,23827,74165,60025,882901,488927,370 1,633,511 558,113

Southgate Independent School DistrictReconciliation of Total Governmental Fund Balancesto Net Position of Governmental ActivitiesJune 30, 2019Total governmental fund balances 1,540,170Amounts reported for governmental activities in the statementof net position are different because:Capital assets used in governmental activities are not financialresources and therefore are not reported in the funds1,767,337Deferred bond costs are not available to pay for current period expendituresand therefore are deferred in the funds34,260Certain liabilities are not due and payable from current resourcesand therefore are not reported in the fundsLong-term liabilitiesAccrued interest payableNet position of governmental activities(1,635,000)(40,825) The accompanying notes are an integral part of these financial statements.Page 9617,407

Southgate Independent School DistrictStatement of Revenues, Expenditures, and Changes in Fund BalancesGovernmental FundsYear Ended June 30, 2019GeneralFundRevenues:From local sources:Taxes:PropertyMotor vehicleUtilitiesEarnings on investmentsOther local revenueIntergovernmental - StateIntergovernmental - State on behalfIntergovernmental - Indirect federal ,763Total revenuesExpenditures:InstructionSupport services:StudentInstruction staffDistrict administrativeSchool administrativeBusiness supportPlant operation and maintenanceDebt servicePrincipalInterestExcess of revenues over (under) expendituresOther financing sources (uses):Transfers inTransfers outOrginal issue discountBond proceeds8,862171,477409,4001,510,304618,75464Net change in fund balancesFund balances - beginning of year 5,1431,098,29884,400 1,540,1701,004,463 ,704)640,000Total other financing sources (uses)Fund balances - end of year64589,7392,617,956OtherConstruction GovernmentalFundFunds Total expendituresSpecialRevenue927,370Page 100 (29,694) 558,094

Southgate Independent School DistrictReconciliation of the Statement of Revenues, Expenditures, andChanges in Fund Balances of Governmental Funds to theStatement of ActivitiesYear Ended June 30, 2019Net change in fund balances - total governmental funds 441,872Amounts reported for governmental activities in the statement ofGovernmental funds report capital outlays as expenditures; however in thestatement of activities the cost of those assets is allocated over their estimateduseful lives and reported as depreciation expense.Capital asset additionsConstruction in progressDepreciation expense3,77672,918(68,172)8,522Governmental funds report pension contributions as expenditures; however, inthe statement of activities the cost of penion and OPEB benefits earned isreported as an expense.Pension and OPEB expenseBond proceeds are reported as financing sources in the government funds;however they are reported as increases in long-term liabilities and do not affectthe statement of activities. Similary, the repayment of principal is anexpenditure in the government funds but reduces the liability in the statementof net position.Principal paidInterest payableBond proceedsBond issue costsBond issue 0,506)Change in net position of governmental activitiesThe accompanying notes are an integral part of these financial statements.Page 11 (93,644)

Southgate Independent School DistrictStatement of Net PositionProprietary FundJune 30, 2019FoodServiceFundAssets:Current assets:Cash and cash equivalentsInventories for consumptionCapital assets, net Total assets18,7761,79319,25739,826Deferred outflowsRelated to pensions - CERSRelated to OPEB - CERS14,8724,326Total deferred outflowsTotal assets and deferred outflowsLiabilities:Accounts payableNet pension liability - CERSNet OPEB liability - CERS Total rred inflowsRelated to pensions - CERSRelated to OPEB - CERS5,3683,633Total deferred inflows9,001Total liabilities and deferred inflows81,869Net position:Net investment in capital assetsUnrestricted19,257(42,102)Total net position(22,845)Total liabilities, deferred inflows, and net positionThe accompanying notes are an integral part of these financial statements.Page 12 59,024

Southgate Independent School DistrictStatement of Revenues, Expenses, and Changes in Net PositionProprietary FundYear Ended June 30, 2019FoodServiceFundOperating revenuesLunchroom sales 2,264Total operating revenues2,264Operating expensesSalaries and wagesEmployee benefitsMaterials and suppliesDepreciationOther operating expenses38,05190,12447,3024,4541,577Total operating expenses181,508Operating loss(179,244)Nonoperating revenuesFederal grantsIntergovernmental - State on behalfTransfers out116,48419,371(4,960)Total nonoperating revenues130,895Change in net position(48,349)Net position - beginning of year as restatedNet position - end of year25,504 The accompanying notes are an integral part of these financial statements.Page 13(22,845)

Southgate Independent School DistrictStatement of Cash FlowsProprietary FundYear Ended June 30, 2019FoodServiceFundCash flows from operating activities:Cash received from:Lunchroom salesCash paid for:EmployeesSuppliers for goods and servicesOther activities 2,264(49,157)(63,652)(1,574)Net cash used for operating activities(112,119)Cash flows from noncapital financing activities:Government grants135,855Net cash provided by noncapital financing activities135,855Cash flows from capital and related financing activitiesTransfers out(4,960)Net cash flows used for capital and related financing activities(4,960)Net decrease in cash and cash equivalents18,776Cash and cash equivalents, beginning of year0Cash and cash equivalents, end of year Reconciliation of operating loss to net cash used for operating activities:Operating loss (179,244)Adjustments to reconcile operating loss to net cash used for operatingactivities:DepreciationChange in pension and OPEB liabilities and deferred inflows and outflowsChange in accounts payableNet cash used for operating activities18,7764,45459,6493,022 (112,119)Non-cash items:On-behalf payments The accompanying notes are an integral part of these financial statements.Page 1419,371

Southgate Independent School DistrictStatement of Fiduciary Net PositionJune 30, 2019AgencyFundsAssets:Cash and cash equivalentsTotal assetsLiabilities:Due to student groupsTotal liabilities 7,455 7,455 7,455 7,455The accompanying notes are an integral part of these financial statements.Page 15

SOUTHGATE INDEPENDENT SCHOOL DISTRICTNOTES TO THE FINANCIAL STATEMENTSJUNE 30, 2019NOTE 1 – ACCOUNTING POLICIESA. The Reporting EntityThe Southgate Independent Board of Education (Board), a five-member group, is the level of governmentwhich has oversight responsibilities over all activities related to public elementary and secondaryeducation within the jurisdiction of Southgate Independent Board of Education (District). The Districtreceives funding from local, state and federal government sources and must comply with thecommitment requirements of these funding source entities. However, the District is not included in anyother governmental reporting entity as defined by Section 2100 of the GASB Codification ofGovernmental Accounting and Financial Reporting Standards. Board members are elected by the publicand have decision making authority, the power to designate management, the responsibility to developpolicies which may influence operations, and primary accountability for fiscal matters.The District, for financial purposes, includes all of the funds and account groups relevant to the operationof the Board. The financial statements presented herein do not include funds of groups or organizations,which although associated with the school system, have not originated with the Board; such as BandBoosters, Parent-Teacher Associations, and others. The financial statements of the District includ

SOUTHGATE INDEPENDENT SCHOOL DISTRICT MANAGEMENT'S DISCUSSION AND ANALYSIS JUNE 30, 2019 As management of the Southgate Independent School District (District), we offer readers of the District's financial statements this narrative overview and analysis of the financial activities of the District for the fiscal year ended June 30, 2019.