Transcription

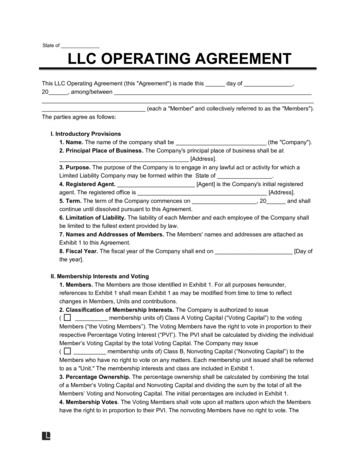

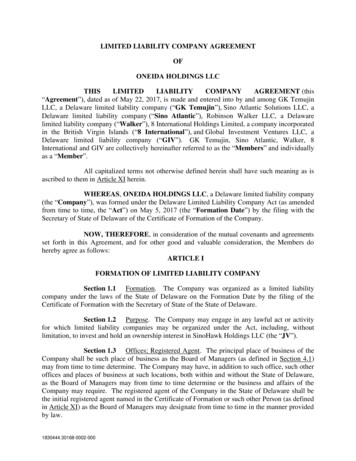

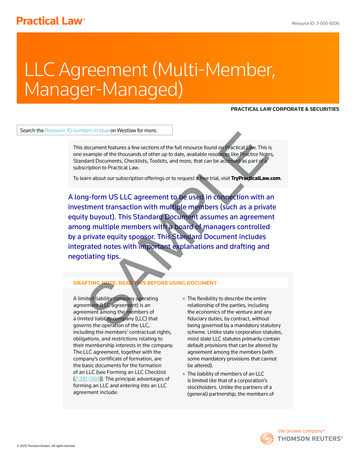

Resource ID: 3-500-9206LLC Agreement (Multi-Member,Manager-Managed)PRACTICAL LAW CORPORATE & SECURITIESSearch the Resource ID numbers in blue on Westlaw for more.EThis document features a few sections of the full resource found on Practical Law. This isone example of the thousands of other up to date, available resources like Practice Notes,Standard Documents, Checklists, Toolkits, and more, that can be accessed as part of asubscription to Practical Law.PLTo learn about our subscription offerings or to request a free trial, visit TryPracticalLaw.com.SAMA long-form US LLC agreement to be used in connection with aninvestment transaction with multiple members (such as a privateequity buyout). This Standard Document assumes an agreementamong multiple members with a board of managers controlledby a private equity sponsor. This Standard Document includesintegrated notes with important explanations and drafting andnegotiating tips.DRAFTING NOTE: READ THIS BEFORE USING DOCUMENTA limited liability company operatingagreement (LLC agreement) is anagreement among the members ofa limited liability company (LLC) thatgoverns the operation of the LLC,including the members’ contractual rights,obligations, and restrictions relating totheir membership interests in the company.The LLC agreement, together with thecompany’s certificate of formation, arethe basic documents for the formationof an LLC (see Forming an LLC Checklist(2-381-1369)). The principal advantages offorming an LLC and entering into an LLCagreement include: 2020 Thomson Reuters. All rights reserved. The flexibility to describe the entirerelationship of the parties, includingthe economics of the venture and anyfiduciary duties, by contract, withoutbeing governed by a mandatory statutoryscheme. Unlike state corporation statutes,most state LLC statutes primarily containdefault provisions that can be altered byagreement among the members (withsome mandatory provisions that cannotbe altered). The liability of members of an LLCis limited like that of a corporation’sstockholders. Unlike the partners of a(general) partnership, the members of

LLC Agreement (Multi-Member, Manager-Managed)an LLC are generally not personally liablefor the debts and obligations of the LLC.New York), but for substantive issues likethe permissibility of limiting the fiduciaryduties of managers. It is thereforeimportant to become familiar with therelevant statutory and case law beforedrafting the LLC agreement and, ifnecessary, to engage local counsel. ThisStandard Document is based on Delawarelaw for the following principal reasons: ForUS tax purposes, an LLC may betreated as a partnership, or passthrough entity, which is not taxed at theentity level, but passes the company’sprofits and losses through to themembers. For a discussion of the USfederal income tax rules that apply toUS entities taxed as partnerships, seePractice Note, Taxation of Partnerships(W-000-6885).zzFor a more detailed discussion of theadvantages of LLCs and LLC agreements, seePractice Notes, LLC Agreement Commentary(1-381-0515) and Choice of Entity: Tax Issues(1-382-9949) and Checklist, Choosing anEntity Comparison Chart (7-381-0701).the LLCs for large, complex transactionsare often formed in Delaware;Ezzthe Delaware Limited LiabilityCompany Act has a strong influenceon LLC statutes in other jurisdictions(6 Del C. §§ 18-101 to 18-1109);zzzzDelaware statutory and common lawprovides for the greatest freedom ofcontract.PLASSUMPTIONS USED IN THISDOCUMENTDelaware has the most developed andmost rapidly developing common lawregime governing LLCs; and Scope. This Standard Document setsMThis Standard Document is drafted on thebasis of several important assumptions.Some of these assumptions relate to thedifferences between LLC agreements foroperating companies and LLC agreementsfor holding companies. Others are relevantconsiderations for LLC agreements in anytransaction context.SAGeneral Assumptions and DraftingConsiderations Multiple members. This StandardDocument is an LLC agreement fora company with multiple members.Although the drafting notes frequentlydescribe the different approaches takenby joint ventures and multiple-memberLLCs to various issues, the body of theagreement in this Standard Document isnot meant to be used for a joint venturebetween two parties. For an example ofan LLC agreement written for a two-partyjoint venture, see Standard Document,LLC Agreement (Operating Company)(6-520-9727). Delaware law. This Standard Documentassumes that the company has beenformed in Delaware. This is an importantassumption not only for the use of correctterminology (for example, a “certificateof formation” is filed in Delaware while“articles of organization” are filed in2out most of the terms governing theparties’ ownership interests in thecompany. In some situations, though, theparties may choose to document certainprovisions, such as transfer restrictions,in a separate members’ agreement. Theparties sometimes prefer this approachif certain members are subject to certainbenefits or obligations that others arenot. However, this Standard Documentdoes not include detailed provisionsfor registration rights often granted toinvestors in a private equity deal. ThisStandard Document assumes that theregistration rights are described in aseparate registration rights agreement.For a form registration rights agreement,see Standard Document, RegistrationRights Agreement (Section 4(a)(2) PrivatePlacement Form (8-500-6936)). Specialist counsel. Long-form LLCagreements require significant input fromtax and employee benefits counsel. Theallocations section, in particular, is mostlydriven by tax issues and compliance withvarious Treasury Regulations. The capitalaccounts and distributions sections alsorequire thorough review by tax counsel.In addition, benefits counsel should beconsulted for the drafting of provisionsgoverning the issuance of incentive units 2020 Thomson Reuters. All rights reserved.

LLC Agreement (Multi-Member, Manager-Managed) Tax-related references. When discussingcertain tax-related provisions, thedrafting notes in this Standard Documentsometimes refer to the company as apartnership because multiple-memberLLCs are generally treated as partnershipsfor tax purposes. This is done for the sakeof accuracy when explaining how theInternal Revenue Code (Code or IRC) andthe Internal Revenue Service (IRS) mayview certain provisions in the agreement.As an organizational matter, the companyis of course an LLC, not a partnership.Holding Company versus OperatingCompany Drafting AssumptionsClassification and Ownership ofMembership InterestsTo preserve the sponsor’s control overthe company, a holding-company LLCagreement usually designates variousclasses of membership units, each withdifferent economic and other rights. Bycontrast, many operating-company LLCs(especially two-party joint ventures) donot designate different classes of units,instead defining the rights of the partieson the basis of their respective percentageownership interests in the company (andexplicitly describing any special voting rightsin the agreement).PLThis Standard Document assumes that thecompany has been formed as a holdingcompany to hold a control investment,such as the investment vehicle formedby a private equity sponsor in a buyouttransaction. In a buyout context, the sponsorcontributes cash in return for a controllingequity interest in the holding company,while new or existing management oftencontribute new capital or roll over theirexisting equity in the acquired targetcompany (or both) in return for equity inthe holding company (see Practice Note,Buyouts: Overview (4-381-1368)). Thisassumption has important implications forthis Standard Document and the draftingand negotiating of the LLC agreement, asdescribed below.of the agreement may undergo severalrounds of changes during negotiation.Therefore, this Standard Document aimsto be relatively reasonable to reduce thetime and expense of lengthy negotiationand contains the provisions most oftenincluded in these agreements. The draftingnotes in this document, when applicable,identify issues that both the sponsor andmanagement should consider when draftingor negotiating the LLC agreement.Eand for the drafting of any compensationplan and related award agreementsunder which incentive units are awarded.SAMAs described in detail in Article III, thisStandard Document assumes the followingclassification and ownership of membershipinterests: The company issues three classes of units,consisting of a class each of:zznon-voting preferred units;zzvoting common units; andzzSponsor-Favorable LLC AgreementIn a buyout context, sponsor counselprepares the first draft of the holdingcompany LLC agreement, which favors thesponsor. Accordingly, many provisions ofthis Standard Document are drafted in favorof the sponsor. However, the managementteam of the target company (and the seller,if it will maintain a stake in the portfoliocompany following the buyout) and itscounsel will commonly review and negotiatethe terms of the LLC agreement. (In dealswith minority outside investors, significantinvestors may also be given an opportunityto weigh in on major issues affecting theirinvestment.) As a result, the initial draft 2020 Thomson Reuters. All rights reserved.non-voting incentive units reservedfor issuance to management andemployees of the target company. The sponsor buys both preferred unitsand common units (though it wouldtypically purchase far more preferredthan common units given the liquidationpreference of the preferred units) and willhold a substantial majority of each of thetwo classes. Management members acquire acombination of preferred, common, andincentive units, with individual members:zzco-investing alongside the sponsor bypurchasing preferred and commonunits for cash;3

LLC Agreement (Multi-Member, Manager-Managed)zzacquiring common units by rollingover their existing equity in the targetcompany; and/orzzzzreceiving grants of compensatoryincentive units in consideration fortheir “sweat equity” in managing andgrowing the business.Use of Profits Interestsoptions or derivatives on any of theassets listed above; oran interest in a partnership (or LLCtaxed as a partnership) to the extent ofthe partnership’s (or LLC’s) interests inthe assets listed above.The longer three-year holding periodrequirement thus generally applies to profitsinterests granted to private equity managersand other private equity employees.However, a target company employee whoreceives a profits interests in a holdingcompany LLC may be able to qualify for theregular one-year long-term capital gainholding-period requirement as long asthe employee only provides services to thetarget company (IRC § 1061(c)(1)). (Assuminga typical five-to-seven-year timeline forprivate equity investments, the three-yearholding-period requirement may not havea significant impact for private equitymanagers and employees in any event.)PLSponsors often organize holding companiesas LLCs because, among other reasons,an LLC provides more tax-efficient equityincentives for the company’s managementand other employees. These efficiencies areaccomplished by qualifying the incentiveunits as profits interests. A profits interestis an incentive equity interest that gives therecipient the right to receive a percentage offuture profits (but not existing capital) fromthe LLC. Under current law, profits interestscan be structured so that the grant is taxfree to the recipient and the issuer, providedcertain requirements are met (see Rev. Proc.93-27 and 2001-43).zzcash or cash equivalents;EzzThis Standard Document assumes thatprofits interests are granted to managementwhen the agreement is executed, whichfor a buyout is typically at the closing.Profits interests are typically issued undera written compensatory plan and individualaward agreements. For a summary of therequirements for granting profits interestson a tax-free basis, see Drafting Note, ProfitsInterests (3-422-4189). For more detailedinformation about profits interests, seePractice Note, Profits Interests (9-560-6768).For an example of a profits interest plan, seeStandard Document, Profits Interest Plan.For an example of an award agreement, seeStandard Document, Profits Interest AwardAgreement (8-561-5645).SAMThe recipient of a profits interest is generallyentitled to preferentially taxed, long-termcapital gain treatment (a maximum rateof 20% for higher-income individuals, plusa potential additional 3.8% tax for higherincome individuals on “net investmentincome,” which includes gains) on thelater sale of its interest in the LLC or onthe sale of a capital asset of the LLC, ifthe holding-period requirements are met.Under changes made by 2017 tax-reformlegislation, however, recipients of certainprofits interests in an LLC must satisfy athree-year holding period to qualify for longterm capital gain treatment on a sale ofthe profits interest, or on the LLC’s sale of acapital asset (IRC § 1061). This special threeyear holding period requirement appliesto profits interests received for performingsubstantial services in an applicable tradeor business, which is a business that consistsof both: Raising or returning capital. Either investing in, disposing of, ordeveloping:4zzsecurities;zzcommodities;zzreal estate held for rent or investment;Management StructureAs is common in the private equity context,this Standard Document assumes that thecompany is board-managed, not membermanaged. Although the sponsor is entitledto appoint a majority of the board, minorityinvestors have a say in management if theyhave a right to appoint a board member.Operating-company LLCs can also bemanaged by boards, but joint venturesfrequently designate one member as the 2020 Thomson Reuters. All rights reserved.

LLC Agreement (Multi-Member, Manager-Managed)For an example of an operating agreementfor a member-managed LLC, see StandardDocument, LLC Agreement (OperatingCompany) (6-520-9727).No Capital CallsThis Standard Document assumes that theminority investors do not have veto rightsover specific decisions, which preservesthe sponsor’s control of the company. Toalleviate the minority members’ concernsthat they have no say if the sponsor choosesto sell its ownership interest, the agreementgrants all members tag-along rights(see Drafting Note, Participation).PLThis Standard Document assumes thatmembers are not required to make additionalcapital contributions following their initialinvestment. This is common in the buyoutcontext, where the members expect to maketheir entire required investment at the outsetto finance the buyout. If the company requiresadditional capital, the members expect thecompany to raise it either with debt financingor new equity securities issuances subjectto the LLC agreement’s pre-emptive rights(see Article IX).Special approval rights over majordecisions are common in LLC agreementsfor operating companies and for privateequity minority investments where themembers expect either equal treatmentor specific voting rights. These rights giveminority or non-managing members aveto over major decisions of the board ormanaging member. For more informationabout private equity minority investments,see Practice Note, Minority Investments:Overview (1-422-1158).Emanaging member. This is a commonstructure when a party with operatingexpertise, who acts as the managingmember, brings in an investor to providemuch of the capital for the project or venture(often the majority member). In thosetransactions, the majority member takes amore passive management role, reservingveto rights over major decisions.No Deadlock ProceduresMThis Standard Document does not includeany deadlock procedures. Because holdingcompany LLC agreements do not usuallygrant minority approval rights over majordecisions, they typically do not includedetailed deadlock procedures for resolvingconflicts. In addition, in private equity dealsthe sponsor can usually appoint and removea majority of the board members at will andunder Delaware law, the board members’fiduciary duties can be contracted away (seeDrafting Note, Limitation of Liability). Thismeans that the sponsor can ensure that theboard will act in the sponsor’s best interests.SAIn contrast, LLC agreements for operatingcompanies frequently give the managingmember the right to make capital callson the assumption that the companywill likely need more regular infusions ofcapital to fund its ongoing business. LLCagreements in the fund-formation contextgenerally contemplate a hybrid approach inwhich investors make an aggregate capitalcommitment that can be called in stagesover a period of time.For an example of an operating agreementthat contemplates capital calls andadditional capital contributions, seeStandard Document, LLC Agreement(Operating Company) (6-520-9727).Major DecisionsHolding-company LLC agreements typicallydo not require that major decisions bedecided with supermajority or unanimousapproval because the sponsor expects tocontrol the company through its ownershipof a majority of the voting units and its rightto appoint a majority of the board members. 2020 Thomson Reuters. All rights reserved.For a discussion of deadlock proceduresgenerally, see Practice Note, Joint Ventures:Exits and Terminations (8-501-7299). For anexample of buy-sell deadlock procedures inan LLC agreement, see Standard Document,LLC Agreement (Operating Company):Section 7.07 (6-520-9727).Other assumptions adopted in this StandardDocument are related to specific sections ofthe LLC agreement and are discussed in therelevant drafting notes.COVER PAGE LEGENDMany LLC agreements include a legend onthe cover page of the agreement to notify5

LLC Agreement (Multi-Member, Manager-Managed)transferees of any restrictions on the unitsthat are contained in the LLC agreement(see Drafting Note, Legends). An example ofthis legend used in this context is as follows:EBRACKETED ITEMSBracketed items in ALL CAPS shouldbe completed with the relevant facts.Bracketed items in sentence case areeither optional provisions or includealternative language choices to beselected, added, or deleted at thediscretion of the drafting party.PL”THE UNITS REFERRED TOIN THIS AMENDED ANDRESTATED LIMITED LIABILITYCOMPANY AGREEMENT ARESUBJECT TO THE PROVISIONSOF SUCH AGREEMENT. NOTRANSFER, SALE, ASSIGNMENT,PLEDGE, HYPOTHECATION OROTHER DISPOSITION OF THEUNITS REFERRED TO IN THISAMENDED AND RESTATEDLIMITED LIABILITY COMPANYAGREEMENT MAY BE MADEEXCEPT IN ACCORDANCE WITHTHE PROVISIONS OF SUCHAGREEMENT.”REGISTERED UNDER THESECURITIES ACT OF 1933,AS AMENDED, OR UNDERANY OTHER APPLICABLESECURITIES LAWS AND MAYNOT BE TRANSFERRED,SOLD, ASSIGNED, PLEDGED,HYPOTHECATED OR OTHERWISEDISPOSED EXCEPT (A)PURSUANT TO A REGISTRATIONSTATEMENT EFFECTIVE UNDERSUCH ACT AND LAWS, OR (B)PURSUANT TO AN EXEMPTIONFROM REGISTRATIONTHEREUNDER.”M”THE UNITS REFERRED TO INTHIS AMENDED AND RESTATEDLIMITED LIABILITY COMPANYAGREEMENT HAVE NOT BEENSASection 3.01 Units Generally. The Membership Interests of the Members shall be representedby issued and outstanding Units, which may be divided into one or more types, classes, orseries. Each type, class or series of Units shall have the privileges, preference, duties, liabilities,obligations, and rights, including voting rights, if any, set forth in this Agreement with respect tosuch type, class, or series. The Board shall maintain a schedule of all Members, their respectivemailing addresses, and the amount and series of Units held by them (the “Members Schedule”),and shall update the Members Schedule upon the issuance or Transfer of any Units to any newor existing Member. A copy of the Members Schedule as of the execution of this Agreement isattached hereto as Schedule A.DRAFTING NOTE: UNITS GENERALLYSection 3.01 authorizes the companyto establish various designations ofunits. A similar authority is expresslycontemplated by the Delaware Act, whichallows a company’s LLC agreement todesignate different classes or series ofmembership interests with different rightsand obligations (6 Del. C. § 18-215(a)).However, the authorization to designateand issue units is a concept borrowed fromthe corporate context. The Delaware Actdoes not speak of issuing units to members,6only admitting persons as members of thecompany.The ensuing sections of Article III go on tospecify the preferred, common, and incentiveclasses of units. The particular terminologyused to identify the different types of unitsin the agreement is not as important asaccurately defining the different rightsand obligations of each class of unit. Forexample, this Standard Document, likemany LLC agreements, uses the terms 2020 Thomson Reuters. All rights reserved.

LLC Agreement (Multi-Member, Manager-Managed)“preferred” and “common” units, eventhough those terms do not appear in theDelaware Act. The terms are also borrowedfrom the corporate context because theyevoke the common associations thatinvestors have with the terms preferred stock(no voting rights, fixed minimum return,priority on distributions) and common stock(voting rights, unlimited equity upside,distributions after the preferred stock). Theseunits can be categorized as Class A, Class B,and Class C units or with any other namingdevice that is helpful.to limits on authorization in certificatesof incorporation. Although this limit onauthorization is not contemplated by theDelaware Act for LLCs, a Delaware courtwill honor the limit if the company attemptsto issue more units than it is authorized tounder the LLC agreement. The companymust amend the LLC agreement to raisethe authorized number of units. (SeeZimmerman v. Crothall et al., 62 A.3d 676,692-97 (Del. Ch. 2013).)AUTHORIZED NUMBER OF UNITSThe Delaware Act requires the company tomaintain a current record of the name andlast known business, residence or mailingaddress of each member and manager(6 Del. C. § 18-305(h)). Any member of thecompany can request this record (6 Del. C.§ 18-305(a)(3)).EPLSection 3.02 and Section 3.03 do not limitthe number of preferred and common unitsthat the company may issue. Some LLCagreements limit the number of units thatthe company is authorized to issue, similarMEMBERS SCHEDULEMSection 7.02 Priority of Distributions. After making all Distributions required for a given FiscalYear under Section 7.04 and subject to the priority of Distributions pursuant to Section 13.03(c),if applicable, all Distributions determined to be made by the Board pursuant to Section 7.01 shallbe made in the following manner: (a) first, to the Members pro rata in proportion to their holdings of Preferred Units, untilDistributions under this Section 7.02(a) equal the Preferred Unpaid Yield in respect of all thePreferred Units owned by the Members as of the time of such Distribution;SA (b) second, to the Members pro rata in proportion to their holdings of Preferred Units, untilDistributions under this Section 7.02(b) equal the aggregate amount of Capital Contributionsattributable to the Members in respect of their acquisitions of Preferred Units; (c) third, to the Members pro rata in proportion to their holdings of Common Units, untilDistributions under this Section 7.02(c) equal the aggregate amount of Capital Contributionsattributable to the Members in respect of their acquisitions of Common Units; and (d) fourth, any remaining amounts to the Members holding Common Units and Incentive Units(subject to Section 7.03) pro rata in proportion to their aggregate holdings of Common Unitsand Incentive Units treated as one class of Units.DRAFTING NOTE: PRIORITY OF DISTRIBUTIONSSection 7.02 sets out the economicconsequences of the members’ investmentor the business deal by describing thepriority for distributions of cash andproperty out of the company (known asthe distribution waterfall) on a sale of 2020 Thomson Reuters. All rights reserved.the company or the underlying operatingcompany or out of normal operatingearnings.The distribution waterfall in this StandardDocument is common to most sophisticated7

LLC Agreement (Multi-Member, Manager-Managed)In many other buyout waterfalls, thecommon unitholders have no priorityover the incentive units to receive a returnof invested capital. In those cases, thewaterfall provides for the common units toimmediately share any proceeds with theincentive unitholders after the preferredunitholders have received their liquidationpreference. For this type of a waterfall,simply remove Section 7.02(c).Finally, as drafted here, once the commonunitholders receive a return of their capitalcontributions, they share in any remainingproceeds with the incentive units (subjectto the vesting and profits interest hurdlelimitations for the incentive units describedin Section 7.03). Whether in this structureor in the waterfall described above in whichthe common units share all proceeds withthe incentive unitholders, the sponsorgives itself an opportunity to participatein the company’s growth potential byapportioning some of its investment towardthe acquisition of common units. Thetrade-off for the sponsor is that it foregoesa first-priority return on that portion of itsinvestment that otherwise would have beeninvested in preferred units.MPLThe layering of waterfall distributions in thisStandard Document is a common approachfor private equity buyouts with investmentholding companies. The sponsor in a buyoutis typically the principal source of theequity financing for the transaction, whilemanagement receives profits interests (seePractice Note, Buyouts: Overview: EquityFinancing (4-381-1368) and Drafting Note,Profits Interests). The sponsor in a buyout(and in other private equity investments)typically structures the equity financing toguarantee a return of invested capital, oftentogether with a minimum return, beforeany distributions are made to other equityholders (such as founders, management,and previous investors).common units do not typically earn any yieldon the invested capital. This is a sponsorfriendly structure as it ensures that thesponsor gets back its entire investment (forboth its preferred and common units) plus ahurdle before the incentive units receive anydistributions.Emulti-member LLC agreements. Each tierof the waterfall receives its full distributionbefore the next tier receives any proceeds.The layering of waterfall tiers and theapportionment of distributions amongthem are matters of negotiation andcome in a wide variety of options, thoughcertain approaches prevail among certaintypes of companies. Even these standardapproaches, however, can have multiplevariations, the choice of which can havean important impact on the distribution ofproceeds on a sale or other liquidation of thecompany.SAThe sponsor commonly accomplishesthis by making the bulk of its equityinvestment (75% to 90% of the dollaramount) in preferred equity and usingthe remainder to acquire common equity.The preferred equity has a liquidationpreference as reflected in the waterfallused in this Standard Document, receivinga priority return of the invested capitalas well as a preferred yield (or hurdle) onthe preferred investment (similar to thedividend that accrues on preferred stock in aC-corporation (see Practice Note, PreferredStock: Overview (2-504-1419))). As a result,the sponsor’s new equity investment issubject to the least risk of nonpayment.Common units are next in priority for thewaterfall in this provision. Common unitshave a right to receive a return of investedcapital before the management incentiveunitholders participate in any distributions.Unlike the preferred units, however, the8In some waterfall provisions, prior tothe final pro rata split of distributionsbetween the common units and theincentive units, the incentive units receivecatch-up distributions until the aggregatedistributions to the incentive units relativeto the aggregate distributions to all units(including the incentive units) equalsthe same ratio of outstanding incentiveunits to outstanding common units (seeDrafting Note, Non-Participating PreferredStructure). In a successful deal, this type ofnon-participating waterfall results in thesponsor and management receiving theeconomics implied by their respective equityownership percentages, as discussed ingreater detail in Drafting Note, AlternativeWaterfalls below. 2020 Thomson Reuters. All rights reserved.

LLC Agreement (Multi-Member, Manager-Managed)ALTERNATIVE WATERFALLSThe distribution waterfall in this StandardDocument allows a sponsor or other investorin a private equity transaction to achieve thetwo primary goals of receiving: A liquidation preference for a priorityreturn of at least the bulk of its capitalinvestment (with a possible preferredyield). A pro rata share of any remaining residualvalue following the priority payments onthe preferred units through the ownershipof common equity.If using this kind of equity structure, modifythe waterfall in Section 7.02(a) throughSection 7.02(d) as follows:SAMPLSponsors using LLC investment-holdingcompany structures can also achievethese dual goals through an alternativedistribution waterfall that assumes thesponsor owns a single class of preferredunits with characteristics of both preferredunits and common units, rather thanowning a combination of preferred units andcommon units. The advantage of this singlepreferred class structure is that the sponsorreceives a liquidation preference (plus apreferred return, if desired) on its entireequity investment, while preserving its prorata share of the company’s future growth.yield) before the holders of incentive unitsreceive any distribution proceeds. Afterthe liquidation preference distribution,the incentive units have a catch-up toreceive distributions until the aggregatedistributions to the incentive units relativeto the aggregate distributions to all units(including the incentive units) equals thesame ratio as the aggregate ownershipsplit between the sponsor and the holde

A limited liability company operating agreement (LLC agreement) is an agreement among the members of a limited liability company (LLC) that governs the operation of the LLC, including the members' contractual rights, obligations, and restrictions relating to their membership interests in the company. The LLC agreement, together with the