Transcription

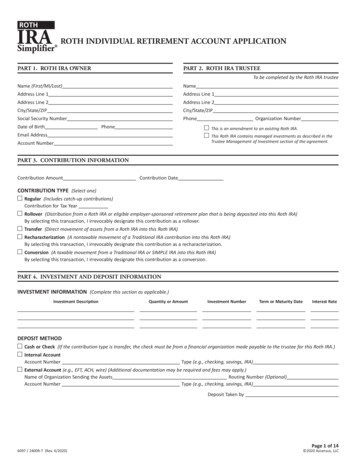

Roth IRA SimplifierROTH INDIVIDUAL RETIREMENT ACCOUNT APPLICATIONPART 1. ROTH IRA OWNERPART 2. ROTH IRA TRUSTEETo be completed by the Roth IRA trusteeName (First/MI/Last)NameAddress Line 1Address Line 1Address Line 2Address Line 2City/State/ZIPCity/State/ZIPSocial Security NumberPhoneDate of BirthPhoneOrganization NumberThis is an amendment to an existing Roth IRA.Email AddressThis Roth IRA contains managed investments as described in theTrustee Management of Investment section of the agreement.Account NumberPART 3. CONTRIBUTION INFORMATIONContribution AmountContribution DateCONTRIBUTION TYPE (Select one)Regular (Includes catch-up contributions)Contribution for Tax YearRollover (Distribution from a Roth IRA or eligible employer-sponsored retirement plan that is being deposited into this Roth IRA)By selecting this transaction, I irrevocably designate this contribution as a rollover.Transfer (Direct movement of assets from a Roth IRA into this Roth IRA)Recharacterization (A nontaxable movement of a Traditional IRA contribution into this Roth IRA)By selecting this transaction, I irrevocably designate this contribution as a recharacterization.Conversion (A taxable movement from a Traditional IRA or SIMPLE IRA into this Roth IRA)By selecting this transaction, I irrevocably designate this contribution as a conversion.PART 4. INVESTMENT AND DEPOSIT INFORMATIONINVESTMENT INFORMATION (Complete this section as applicable.)Investment DescriptionQuantity or AmountInvestment NumberTerm or Maturity DateInterest RateDEPOSIT METHODCash or Check (If the contribution type is transfer, the check must be from a financial organization made payable to the trustee for this Roth IRA.)Internal AccountAccount NumberType (e.g., checking, savings, IRA)External Account (e.g., EFT, ACH, wire) (Additional documentation may be required and fees may apply.)Name of Organization Sending the AssetsRouting Number (Optional)Account NumberType (e.g., checking, savings, IRA)Deposit Taken by6097 / 2400R-T (Rev. 4/2020)Page 1 of 14 2020 Ascensus, LLC

Name of Roth IRA Owner, Account NumberPART 5. BENEFICIARY DESIGNATIONI designate that upon my death, the assets in this account be paid to the beneficiaries named below. The interest of any beneficiary that predeceasesme terminates completely, and the percentage share of any remaining beneficiaries will be increased on a pro rata basis. If no beneficiaries are named,my estate will be my beneficiary.I elect not to designate beneficiaries at this time and understand that I may designate beneficiaries at a later date.PRIMARY BENEFICIARIES (The total percentage designated must equal 100%. If more than one beneficiary is designated and no percentages areindicated, the beneficiaries will be deemed to own equal share percentages in the Roth IRA.)NameNameAddressAddressCity/State/ZIPDate of BirthCity/State/ZIPRelationshipTax ID (SSN/TIN)Date of BirthPercent DesignatedTax ID State/ZIPDate of BirthRelationshipTax ID (SSN/TIN)Date of BirthPercent DesignatedTax ID (SSN/TIN)RelationshipPercent DesignatedRelationshipPercent DesignatedCONTINGENT BENEFICIARIES (The total percentage designated must equal 100%. If more than one beneficiary is designated and no percentages areindicated, the beneficiaries will be deemed to own equal share percentages in the Roth IRA. The balance in the account will be payable to thesebeneficiaries if all primary beneficiaries have predeceased the Roth IRA owner.)NameNameAddressAddressCity/State/ZIPDate of BirthCity/State/ZIPRelationshipTax ID (SSN/TIN)Date of BirthPercent DesignatedTax ID State/ZIPDate of BirthRelationshipTax ID (SSN/TIN)Date of BirthPercent DesignatedTax ID (SSN/TIN)RelationshipPercent DesignatedRelationshipPercent DesignatedCheck here if additional beneficiaries are listed on an attached addendum. Total number of addendums attached to this Roth IRAPART 6. SPOUSAL CONSENTPART 7. SIGNATURESSpousal consent should be considered if either the trust or the residence ofthe Roth IRA owner is located in a community or marital property state.Important: Please read before signing.I understand the eligibility requirements for the type of Roth IRA contribution Iam making, and I state that I do qualify to make the contribution. I have receiveda copy of the Roth IRA Application, 5305-R Trust Account Agreement, theFinancial Disclosure, and the Disclosure Statement. I understand that the termsand conditions that apply to this Roth IRA are contained in this Application andthe Trust Account Agreement. I agree to be bound by those terms andconditions. Within seven days from the date I open this Roth IRA I may revokeit without penalty by mailing or delivering a written notice to the trustee.I assume complete responsibility for determining that I am eligible for a Roth IRA each year I make acontribution, ensuring that all contributions I make are within the limits set forthby the tax laws, and the tax consequences of any contributions (including rollovercontributions and conversions) and distributions.CURRENT MARITAL STATUSI Am Not Married – I understand that if I become married in thefuture, I should review the requirements for spousal consent.I Am Married – I understand that if I choose to designate a primarybeneficiary other than or in addition to my spouse, my spouse shouldsign below.CONSENT OF SPOUSEI am the spouse of the above-named Roth IRA owner. I acknowledge thatI have received a fair and reasonable disclosure of my spouse’s propertyand financial obligations. Because of the important tax consequences ofgiving up my interest in this Roth IRA, I have been advised to see a taxprofessional.I hereby relinquish any interest that I may have in this Roth IRA andconsent to the beneficiary designation indicated above. I assume fullresponsibility for any adverse consequences that may result.XSignature of SpouseXSignature of Witness6097 / 2400R-T (Rev. 4/2020)Date (mm/dd/yyyy)Date (mm/dd/yyyy)XSignature of Roth IRA OwnerXSignature of WitnessXSignature of TrusteeDate (mm/dd/yyyy)Date (mm/dd/yyyy)Date (mm/dd/yyyy)Page 2 of 14 2020 Ascensus, LLC

ROTH INDIVIDUAL RETIREMENT TRUST ACCOUNT AGREEMENTForm 5305-R under section 408A of the Internal Revenue Code.The grantor named on the application is establishing a Roth individualretirement account (Roth IRA) under section 408A to provide for his or herretirement and for the support of his or her beneficiaries after death.The trustee named on the application has given the grantor the disclosurestatement required by Regulations section 1.408-6.The grantor has assigned the trust account the sum indicated on theapplication.FORM (Rev. April 2017)2. The minimum amount that must be distributed each year underparagraph 1(a) above is the account value at the close of business onDecember 31 of the preceding year divided by the life expectancy (inthe single life table in Regulations section 1.401(a)(9)-9) of thedesignated beneficiary using the attained age of the beneficiary in theyear following the year of the grantor’s death and subtracting onefrom the divisor for each subsequent year.The grantor and the trustee make the following agreement:3. If the grantor’s surviving spouse is the designated beneficiary, suchspouse will then be treated as the grantor.ARTICLE IARTICLE VIExcept in the case of a qualified rollover contribution described in section408A(e) or a recharacterized contribution described in section 408A(d)(6),the trustee will accept only cash contributions up to 5,500 per year for2013 through 2017. For individuals who have reached the age of 50 by theend of the year, the contribution limit is increased to 6,500 per year fortax years 2013 through 2017. For years after 2017, these limits will beincreased to reflect a cost-of-living adjustment, if any.ARTICLE II1. The annual contribution limit described in Article I is gradually reducedto 0 for higher income levels. For a grantor who is single or treated asa single, the annual contribution is phased out between adjusted grossincome (AGI) of 118,000 and 133,000; for a married grantor filingjointly, between AGI of 186,000 and 196,000; and for a marriedgrantor filing separately, between AGI of 0 and 10,000. These phaseout ranges are for 2017. For years after 2017, the phase-out ranges,except for the 0 to 10,000 range, will be increased to reflect a costof-living adjustment, if any. Adjusted gross income is defined in section408A(c)(3).2. In the case of a joint return, the AGI limits in the preceding paragraphapply to the combined AGI of the grantor and his or her spouse.ARTICLE IIIThe grantor’s interest in the balance in the trust account is nonforfeitable.ARTICLE IV1. No part of the trust account funds may be invested in life insurancecontracts, nor may the assets of the trust account be commingled withother property except in a common trust fund or common investmentfund (within the meaning of section 408(a)(5)).2. No part of the trust account funds may be invested in collectibles(within the meaning of section 408(m)) except as otherwise permittedby section 408(m)(3), which provides an exception for certain gold,silver, and platinum coins, coins issued under the laws of any state,and certain bullion.ARTICLE V1. If the grantor dies before his or her entire interest is distributed to himor her and the grantor’s surviving spouse is not the designatedbeneficiary, the remaining interest will be distributed in accordancewith paragraph (a) below or, if elected or there is no designatedbeneficiary, in accordance with paragraph (b) below:(a) The remaining interest will be distributed, starting by the end ofthe calendar year following the year of the grantor’s death, overthe designated beneficiary’s remaining life expectancy asdetermined in the year following the death of the grantor.(b) The remaining interest will be distributed by the end of the calendaryear containing the fifth anniversary of the grantor’s death.6097 / 2400R-T (Rev. 4/2020)1. The grantor agrees to provide the trustee with all information necessaryto prepare any reports required by sections 408(i) and 408A(d)(3)(E),Regulations sections 1.408-5 and 1.408-6, or other guidance publishedby the Internal Revenue Service (IRS).2. The trustee agrees to submit to the IRS and grantor the reportsprescribed by the IRS.ARTICLE VIINotwithstanding any other articles which may be added or incorporated,the provisions of Articles I through IV and this sentence will be controlling.Any additional articles inconsistent with section 408A, the relatedregulations, and other published guidance will be invalid.ARTICLE VIIIThis agreement will be amended as necessary to comply with theprovisions of the Code, the related Regulations, and other publishedguidance. Other amendments may be made with the consent of thepersons whose signatures appear on the application.ARTICLE IX9.01 Definitions – In this part of this agreement (Article IX), the words“you” and “your” mean the grantor. The words “we,” “us,” and“our” mean the trustee. The word “Code” means the InternalRevenue Code, and “regulations” means the Treasury regulations.9.02 Notices and Change of Address – Any required notice regardingthis Roth IRA will be considered effective when we send it to theintended recipient at the last address that we have in our records.Any notice to be given to us will be considered effective when weactually receive it. You, or the intended recipient, must notify us ofany change of address.9.03 Representations and Responsibilities – You represent and warrantto us that any information you have given or will give us withrespect to this agreement is complete and accurate. Further, youagree that any directions you give us or action you take will beproper under this agreement, and that we are entitled to rely uponany such information or directions. If we fail to receive directionsfrom you regarding any transaction, if we receive ambiguousdirections regarding any transaction, or if we, in good faith, believethat any transaction requested is in dispute, we reserve the right totake no action until further clarification acceptable to us is receivedfrom you or the appropriate government or judicial authority. Wewill not be responsible for losses of any kind that may result fromyour directions to us or your actions or failures to act, and youagree to reimburse us for any loss we may incur as a result of suchdirections, actions, or failures to act. We will not be responsible forany penalties, taxes, judgments, or expenses you incur in connectionwith your Roth IRA. We have no duty to determine whether yourcontributions or distributions comply with the Code, regulations,rulings, or this agreement.Page 3 of 14 2020 Ascensus, LLC

We may permit you to appoint, through written notice acceptableto us, an authorized agent to act on your behalf with respect tothis agreement (e.g., attorney-in-fact, executor, administrator,investment manager), but we have no duty to determine thevalidity of such appointment or any instrument appointing suchauthorized agent. We will not be responsible for losses of any kindthat may result from directions, actions, or failures to act by yourauthorized agent, and you agree to reimburse us for any loss wemay incur as a result of such directions, actions, or failures to actby your authorized agent.You will have 60 days after you receive any documents, statements,or other information from us to notify us in writing of any errors orinaccuracies reflected in these documents, statements, or otherinformation. If you do not notify us within 60 days, the documents,statements, or other information will be deemed correct andaccurate, and we will have no further liability or obligation for suchdocuments, statements, other information, or the transactionsdescribed therein.By performing services under this agreement we are acting as youragent. Unless section 9.06(b) of this agreement applies, youacknowledge and agree that nothing in this agreement will beconstrued as conferring fiduciary status upon us. We will not berequired to perform any additional services unless specificallyagreed to under the terms and conditions of this agreement, or asrequired under the Code and the regulations promulgatedthereunder with respect to Roth IRAs. You agree to indemnify andhold us harmless for any and all claims, actions, proceedings,damages, judgments, liabilities, costs, and expenses, includingattorney’s fees arising from or in connection with this agreement.To the extent written instructions or notices are required underthis agreement, we may accept or provide such information in anyother form permitted by the Code or applicable regulationsincluding, but not limited to, electronic communication.9.04 Disclosure of Account Information – We may use agents and/orsubcontractors to assist in administering your Roth IRA. We mayrelease nonpublic personal information regarding your Roth IRA tosuch providers as necessary to provide the products and servicesmade available under this agreement, and to evaluate our businessoperations and analyze potential product, service, or processimprovements.9.05 Service Fees – We have the right to charge an annual service feeor other designated fees (e.g., a transfer, rollover, or terminationfee) for maintaining your Roth IRA. In addition, we have the rightto be reimbursed for all reasonable expenses, including legalexpenses, we incur in connection with the administration of yourRoth IRA. We may charge you separately for any fees or expenses,or we may deduct the amount of the fees or expenses from theassets in your Roth IRA at our discretion. We reserve the right tocharge any additional fee after giving you 30 days’ notice. Feessuch as subtransfer agent fees or commissions may be paid to usby third parties for assistance in performing certain transactionswith respect to this Roth IRA.Any brokerage commissions attributable to the assets in your RothIRA will be charged to your Roth IRA. You cannot reimburse yourRoth IRA for those commissions.9.06 Investment of Amounts in the Roth IRA –a. Grantor Management of Investment. Unless the Roth IRA or aportion of the Roth IRA is a managed Roth IRA, you haveexclusive responsibility for and control over the investment ofthe assets of your Roth IRA. All transactions will be subject toany and all restrictions or limitations, direct or indirect, that areimposed by our charter, articles of incorporation, or bylaws; any6097 / 2400R-T (Rev. 4/2020)and all applicable federal and state laws and regulations; therules, regulations, customs, and usages of any exchange,market, or clearing house where the transaction is executed;our policies and practices; and this agreement. After your death,your beneficiaries will have the right to direct the investment ofyour Roth IRA assets, subject to the same conditions thatapplied to you during your lifetime under this agreement(including, without limitation, section 9.03 of this article). Wewill have no discretion to direct any investment in your RothIRA. We assume no responsibility for rendering investmentadvice with respect to your Roth IRA, nor will we offer anyopinion or judgment to you on matters concerning the value orsuitability of any investment or proposed investment for yourRoth IRA. In the absence of instructions from you, or if yourinstructions are not in a form acceptable to us, we will have theright to hold any uninvested amounts in cash, and we will haveno responsibility to invest uninvested cash unless and untildirected by you. We will not exercise the voting rights and othershareholder rights with respect to investments in your Roth IRAunless you provide timely written directions acceptable to us.You will select the investment for your Roth IRA assets fromthose investments that we are authorized by our charter,articles of incorporation, or bylaws to offer and do in fact offerfor investment in Roth IRAs (e.g., term share accounts, passbookaccounts, certificates of deposit, money market accounts). Wemay, in our sole discretion, make available to you, additionalinvestment offerings, that will be limited to publicly-tradedsecurities, mutual funds, money market instruments, and otherinvestments that are obtainable by us and that we are capableof holding in the ordinary course of our business.b. Trustee Management of Investment. If any portion of this RothIRA is a managed Roth IRA, as indicated on the application orany other supporting documentation, we will manage theinvestment of the applicable Roth IRA assets. Accordingly, wecan manage, sell, contract to sell, grant, or exercise options topurchase, convey, exchange, transfer, abandon, improve, repair,insure, lease for any term, and otherwise deal with all property,real or personal, in your Roth IRA in such manner, for suchprices and on such terms and conditions as we will decide.We will have the power to do any of the following as we deemnecessary or advisable.1. To invest your Roth IRA assets in a single trust fund, and tocollect the income without distinction between principaland income2. To invest your Roth IRA assets in a common trust fund orcommon investment fund within the meaning of Codesection 408(a)(5)3. To invest your Roth IRA assets into savings instruments thatwe offer4. To invest your Roth IRA assets in any other type ofinvestment permitted by law, including, but not limited to,common or preferred stock, open- or closed-end mutualfunds, bonds, notes, debentures, options, U.S. Treasurybills, commercial paper, or real estate5. To hold any securities or other property under this agreementin our own name, in the name of a nominee, or in bearer form6. To make, execute, acknowledge, and deliver any and alldocuments of transfer and conveyance (includingdocuments for the transfer and conveyance of real estate),and any and all instruments that may be necessary orappropriate to carry out our powersPage 4 of 14 2020 Ascensus, LLC

7. To employ suitable agents, attorneys, or other persons8. To enter into lawsuits or settle any claims concerning theassets in your Roth IRA, and to be reimbursed for anyexpenses or damages from you or your Roth IRA assets9. To exercise the voting rights and other shareholder rightswith respect to securities in your Roth IRA, provided,however, that we reserve the right to enter into a separateagreement with you governing the exercise of voting andother shareholder rights10. To perform any and all acts that we deem necessary orappropriate for the proper administration of your Roth IRAAll of the foregoing notwithstanding, our powers will be subject toany and all restrictions or limitations, direct or indirect, that areimposed by our charter, articles of incorporation, or bylaws; anyand all applicable federal and state laws and regulations; the rules,regulations, customs, and usages of any exchange, market, orclearing house where the transaction is executed; our policies andpractices; and this agreement.9.07 Beneficiaries – If you die before you receive all of the amounts inyour Roth IRA, payments from your Roth IRA will be made to yourbeneficiaries. We have no obligation to pay to your beneficiariesuntil such time we are notified of your death by receiving a validdeath certificate.You may designate one or more persons or entities as beneficiaryof your Roth IRA. This designation can only be made on a formprovided by or acceptable to us, and it will only be effective whenit is filed with us during your lifetime. Each beneficiary designationyou file with us will cancel all previous designations. The consentof your beneficiaries will not be required for you to revoke abeneficiary designation. If you have designated both primary andcontingent beneficiaries and no primary beneficiary survives you,the contingent beneficiaries will acquire the designated share ofyour Roth IRA. If you do not designate a beneficiary or if all of yourprimary and contingent beneficiaries predecease you, your estatewill be the beneficiary.If your surviving spouse is the designated beneficiary, your spousemay elect to treat your Roth IRA as his or her own Roth IRA, andwould not be subject to the required minimum distribution rules.Your surviving spouse will also be entitled to such additionalbeneficiary payment options as are granted under the Code orapplicable regulations.We may allow, if permitted by state law, an original Roth IRAbeneficiary (the beneficiary who is entitled to receive distributionsfrom an inherited Roth IRA at the time of your death) to namesuccessor beneficiaries for the inherited Roth IRA. This designationcan only be made on a form provided by or acceptable to us, andit will only be effective when it is filed with us during the originalRoth IRA beneficiary’s lifetime. Each beneficiary designation formthat the original Roth IRA beneficiary files with us will cancel allprevious designations. The consent of a successor beneficiary willnot be required for the original Roth IRA beneficiary to revoke asuccessor beneficiary designation. If the original Roth IRAbeneficiary does not designate a successor beneficiary, his or herestate will be the successor beneficiary. In no event will thesuccessor beneficiary be able to extend the distribution periodbeyond that required for the original Roth IRA beneficiary.If we so choose, for any reason (e.g., due to limitations of ourcharter or bylaws), we may require that a beneficiary of a deceasedRoth IRA owner take total distribution of all Roth IRA assets byDecember 31 of the year following the year of death.6097 / 2400R-T (Rev. 4/2020)9.08 Termination of Agreement, Resignation, or Removal of Trustee –Either party may terminate this agreement at any time by givingwritten notice to the other. We can resign as trustee at any timeeffective 30 days after we send written notice of our resignation toyou. Upon receipt of that notice, you must make arrangements totransfer your Roth IRA to another financial organization. If you donot complete a transfer of your Roth IRA within 30 days from thedate we send the notice to you, we have the right to transfer yourRoth IRA assets to a successor Roth IRA trustee or custodian thatwe choose in our sole discretion, or we may pay your Roth IRA toyou in a single sum. We will not be liable for any actions or failuresto act on the part of any successor trustee or custodian, nor forany tax consequences you may incur that result from the transferor distribution of your assets pursuant to this section.If this agreement is terminated, we may charge to your Roth IRA areasonable amount of money that we believe is necessary to coverany associated costs, including but not limited to one or more ofthe following. Any fees, expenses, or taxes chargeable against your Roth IRA Any penalties or surrender charges associated with the earlywithdrawal of any savings instrument or other investment inyour Roth IRAIf we are a nonbank trustee required to comply with Regulationssection 1.408-2(e) and we fail to do so or we are not keeping therecords, making the returns, or sending the statements as arerequired by forms or regulations, the IRS may require us tosubstitute another trustee or custodian.We may establish a policy requiring distribution of the entirebalance of your Roth IRA to you in cash or property if the balanceof your Roth IRA drops below the minimum balance requiredunder the applicable investment or policy established.9.09 Successor Trustee – If our organization changes its name,reorganizes, merges with another organization (or comes under thecontrol of any federal or state agency), or if our entire organization(or any portion that includes your Roth IRA) is bought by anotherorganization, that organization (or agency) will automaticallybecome the trustee or custodian of your Roth IRA, but only if it isthe type of organization authorized to serve as a Roth IRA trusteeor custodian.9.10 Amendments – We have the right to amend this agreement at anytime. Any amendment we make to comply with the Code andrelated regulations does not require your consent. You will bedeemed to have consented to any other amendment unless,within 30 days from the date we send the amendment, you notifyus in writing that you do not consent.9.11 Withdrawals or Transfers – All requests for withdrawal or transferwill be in writing on a form provided by or acceptable to us. Themethod of distribution must be specified in writing or in any othermethod acceptable to us. The tax identification number of therecipient must be provided to us before we are obligated to makea distribution. Withdrawals will be subject to all applicable tax andother laws and regulations, including but not limited to possibleearly distribution penalty taxes, surrender charges, and withholdingrequirements.You are not required to take a distribution from your Roth IRAduring your lifetime. At your death, however, your beneficiariesmust begin taking distributions in accordance with Article V andsection 9.07 of this article. We will make no distributions to youfrom your Roth IRA until you provide us with a written request fora distribution on a form provided by or acceptable to us.Page 5 of 14 2020 Ascensus, LLC

9.12 Transfers From Other Plans – We can receive amounts transferredto this Roth IRA from the trustee or custodian of another Roth IRAas permitted by the Code. In addition, we can accept rollovers ofeligible rollover distributions from employer-sponsored retirementplans as permitted by the Code. We reserve the right not to acceptany transfer.9.13 Liquidation of Assets – We have the right to liquidate assets in yourRoth IRA if necessary to make distributions or to pay fees, expenses,taxes, penalties, or surrender charges properly chargeable againstyour Roth IRA. If you fail to direct us as to which assets to liquidate,we will decide, in our complete and sole discretion, and you agreeto not hold us liable for any adverse consequences that result fromour decision.9.14 Restrictions on the Fund – Neither you nor any beneficiary maysell, transfer, or pledge any interest in your Roth IRA in any mannerwhatsoever, except as provided by law or this agreement.The assets in your Roth IRA will not be responsible for the debts,contracts, or torts of any person entitled to distributions underthis agreement.9.15 What Law Applies – This agreement is subject to all applicablefederal and state laws and regulations. If it is necessary to applyany state law to interpret and administer this agreement, the lawof our domicile will govern.If any part of this agreement is held to be illegal or invalid, theremaining parts will not be affected. Neither your nor our failureto enforce at any time or for any period of time any of theprovisions of this agreement will be construed as a waiver of suchprovisions, or your right or our right thereafter to enforce eachand every such provision.GENERAL INSTRUCTIONSSection references are to the Internal Revenue Code unless otherwise noted.PURPOSE OF FORMForm 5305-R is a model trust account agreement that meets therequirements of section 408A. However, only Articles I through VIII havebeen reviewed by the IRS. A Roth individual retirement account (Roth IRA)is established after the form is fully executed by both the individual(grantor) and the trustee. This account must be created in the UnitedStates for the exclusive benefit of the grantor and his or her beneficiaries.Do not file Form 5305-R with the IRS. Instead, keep it with your records.Unlike contributions to Traditional individual retirement arrangements,contributions to a Roth IRA are not deductible from the grantor’s grossincome; and distributions after five years that are made when the grantoris 59½ years of age or older or on account of death, disability, or thepurchase of a home by a first-time homebuyer (limited to 10,000), arenot includible in gross income. For more information on Roth IRAs,including the required disclosures the trustee must give

PART 1. ROTH IRA OWNER Name (First/MI/Last) Address Line 1 Address Line 2 City/State/ZIP Social Security Number Date of Birth Phone Email Address Account Number PART 2. ROTH IRA TRUSTEE To be completed by the Roth IRA trustee. Name. Address Line 1 Address Line 2 City/State/ZIP Phone Organization Number. This is an amendment to an existing Roth IRA.