Transcription

GIRO conference October 2011Henry Johnson, Jerome Kirk, Karen Seidel, Matt Gold – Lloyd’sWorkshop C8- Lloyd’s Update 2010 The Actuarial Profession y www.actuaries.org.uk

Agenda Three speakers today (plus me)– Matt Gold– Karen Seidel– Jerome KirkSolvency II update– Central workstream– Scope, Governance and change, ORSA, link to syndicate models – Actuarial function– Syndicate workstreamBAU update– Current issue & Interim results– Year End process 2010 The Actuarial Profession y www.actuaries.org.uk1

Lloyd’s Solvency 2 programme is on track andprogressing within published timescales Syndicate dry run process is on schedule Majority of agents meeting the majority of deadlines Close monitoring of Red and Pink agents continues Key syndicate deliverables are crucial for the Lloyd’s InternalModel (LIM) development First full calibrated run of LIM to calculate a robust SCR Key for our evidencing of the internal model requirements Working towards an end April submission to the FSA FSA has commenced their pre-application reviews of the LIM 2010 The Actuarial Profession y www.actuaries.org.uk2

Our model includes or supports our keysolvency and capital activitiesSyndicatesTechnical ProvisionsStrategy & RiskAppetiteSyndicateInternal ModelsSyndicateBusiness PlanningSBFLloyd’s Strategy& Risk AppetiteSyndicate ReportingSolvency II reportsSyndicateoperationsSyndicate ReturnsSCRReview andApprove SBFsLloyd’sCorporationSyndicate performancemonitoringSet capitalupliftsSet Franchise StandardsDATAParameterisationReview andmonitoring ofsyndicate TPsLloyd’s Internal ModelSyndicate SCR BenchmarkInternal Risk ReportingSyndicate SCR ReviewLIM ReportingAllocate member capitalLloyd’s SocietySCRLloyd’s SocietyEconomic CapitalLIM CCKOther risk & capitalreportsLCMLIRM (inc ESG)Emerging riskmanagementRisk Monitoring & ORSAOp scenarioanalysisCorporationOperational RiskmanagementInternal Audit & Independent Review – assurance on processes and controlsExternal DisclosureSFCRLloyd’s ORSARTSLloyd’s Risk ReportsQuantitativeReportingRisk appetite monitoringand capital planningSRC: Syndicaterisk monitoringFRC: FinancialRisk MonitoringCRC: CorporationRisk MonitoringFeedbackLRC: Risk OversightParameterisation ProcessLloyd’s TPReviewFeedback into RiskStrategy and RiskAppetiteFeedback intoInternal ModeldevelopmentGovernance & AssuranceLloyd’s Risk Governance Framework3

We have set out how the LIM will be governed Franchise BoardFB LIM Sub-GroupERCLIM Operating BoardLIM operationsLIM ManagerLIM Change BoardQualitative Standards ManagementData Standards ManagementCentral Fund(LIM CCK,PARM)SyndicateCapital anagement(LIRM)SyndicateReviewOperationalRiskLIM IT and Systems 2010 The Actuarial Profession y www.actuaries.org.uk4

and how our Change process will operate Change ProcessFSARe-approval (for Major changes)Franchise BoardApprove assessmentSign -off following Major model change, and resolve otherescalated issuesERCLIM Operating BoardLIM ManagerQualitative TeamLIM Change BoardApprove assessmentImplement agreed Minor changesEscalate not-agreed Minor changes and all Major Changesto ERC/FB for sign offAssessment of change Required changeAssess as major / minorReport to LOBMajor/Minor considerations1. Quant impact on SCR/FAL2. Number of componentsaffected3. Complexity of change4. Impact on the 6 testsInitiate the changeRaise the changeReason for changePossible impactsIs it a change?---LIM Component TeamsData Standards ManagementLIM IT and Systems 2010 The Actuarial Profession y www.actuaries.org.uk5

and how the LIM is integrated within ourORSA processORSA ProcessLloyd’s strategy Definition of strategicgoals and objectivesSolvencyassessment Assessing theadequacy of memberand central assetsagainst requirementsCapital setting Setting member andcentral regulatory andeconomic capitalrequirements 2010 The Actuarial Profession y www.actuaries.org.ukRisk appetiteLIMModeltests, inc.use andvalidation Setting risk appetiteand tolerancesRiskmanagement andmonitoring Risk governance Reporting and MI6

LIM Supports our risk and capital frameworkORSA element LIM supports our key activities to ensure a sound capitalLloyd’sunderstanding and allows Lloyd’s to demonstrate capitalstrategyadvantages LIM supports the measurement and monitoring of key riskRisk Appetite appetite metrics to ensure we know where we are inrelation to riskRisk LIM provides further understanding of the key risks weManagement face so we can implement effective risk management tools LIM supports both member level capital setting andCapitalcentral fund capital assessments in a transparent andSettingrobust waySolvency LIM provides a robust measurement of the state of theAssessmentmarket7

Linking the central and syndicate models 2010 The Actuarial Profession y www.actuaries.org.uk8

LIM High Level Model StructureAsset risk and returns from LIRMRisk GroupsSimulate lossesPTFFALProducesyndicate resultsAllocate toMembersRG 1Synd 1RG 2Synd 2RG 3Synd 3CFCalculate hiton CentralFundMember AMember BCentralFundMember XRG nSimulated AttritionallossesSynd 85Member allocationfrom MCATCatastrophe lossesfrom LCM9Presentation name 00 July 20059

LIM CCK - OverviewPhase APhase BPhase CPhase DPhase ESimulate lossesClaimsSyndicate level P&L,BSMember level P&L,BSCapital requirement Attritional risk drivers Dependence between risks Preparation for catastropherisk aggregation withattritional risk Syndicate noise Attritional and event claims atfuture time periods Reinsurance Correlation between attritionaland event claims Calibration to syndicate stats Discounted cash flows Risk margin SII profit and loss accountand balance sheet RI credit risk Op & Group risk Allocation of deficit tomembers Impact of deficit on members’FAL and callable layer SII balance sheet specific tocentral fund assets Op & Group riskTreasuryModelCatModel Asset values Yield curves Bad debt on assets Natural catastropheclaims Other event claimsPhase AAttritional riskPhase BPhase CPhase Dp121Attritional claims Solvency capital requirement Allocation of capitalrequirement to risk types,members, syndicatesn2n1n0 3pCentral fund assetsHit onCentralFundnttNominalcash flows2Deficit by Deficit bysyndicate memberPhase EDiscountedcash enpEvent claimsnpnRisk types MembersEvent risk (catastrophe risk)nTotal claims10MetricsPresentation name 00 July 2005SyndicatesManagementinformation forexample:% chance ofmarketcombined lossratioexceeding110%

LIM CCK Input from LCM 10,000 event scenarios by Synd-YoA-Event– 5 perils– (US WS incl GOM, US EQ, Eur WS, JP WS, JP EQ)– Cross syndicate dependency– In force view supplied by syndicates– Projected forwards and split by Yoa(Proposed Year, Proposed Year -1, Proposed Year -2) Mapping to risk groups Mapping to currencies (USD, .)1111

Phase B – Syndicate Claims1. Calculate mean total net loss, for each synd-yoa-rg-ccy– Net prem * mkt avg Net ULR * payment pattern– Scale to syndicate’s mean total net loss (submitted by synd-yoa)2. Calc mean attr net claim mean total net loss - mean cat loss (fromLCM)3. Simulate attr claims– Mean attr claim * claim volatility * syndicate noise4. Simulate total net claim sim attr claim sim cat claim, using rankmatching5. Calibrate resulting distribution to mean and 99.5% net insurance lossfor each syndicate, by applying a factor to attritional losses1212

The Actuarial Function at Lloyd’s 2010 The Actuarial Profession y www.actuaries.org.uk13

Both Lloyd’s and syndicates will require anActuarial FunctionSyndicate ActuarialFunctionsLloyd’s ActuarialFunction and both must meet Solvency II standards14

Actuarial Function requirements are split intothree areas Technical Provisions– including supporting data Underwriting ReinsuranceAnd will require (annual) formal report to the Board15

Actuarial Function (1)- Technical Provisions Requirements are:– coordinate the calculation of technical provisions;– ensure the appropriateness of the methodologies and underlying modelsused as well as the assumptions made in the calculation of technicalprovisions;– assess the sufficiency and quality of the data used in the calculation oftechnical provisions;– compare best estimates against experience;– inform the administrative, management or supervisory body of thereliability and adequacy of the calculation of technical provisions;– oversee the calculation of technical provisions in the cases set out inArticle 82; Lloyd’s have been testing the requirements over the summer 16

and have seen that the impact is significant 100%95%90%% change in reserves85%80%75%70%65%60%55%50%Current basisnet reservesas at year-end2010Inclusion ofRemoval of100% UPR incepted futurepremiumsrequirementand marginsfor prudenceInclusion ofuninceptedcontractsChange ofAllowance forexpense basis binary eventsDiscountingcreditInclusion ofrisk margin*Solvency II nettechnicalprovisions asat year-end2010Source of change in reservesSource: y/e 2010 SRD and May 2010 TP submissionsNote: excludes some syndicates so that a like for like comparison can be madeNote: Solvency II TPs include estimated risk margin of 10%17

and need to look closely at the overall impacton the balance sheetMarket TotalAnalysis of Technical Provisions and Impacton Balance Sheet ( m)CurrentBasisNet Technical Provisions35,422Net Premium Debtors *(2,612)Deferred Acquisition Costs(2,348)Net technical provisions less premiumdebtors and DAC30,462Solvency II Change fromBasisCurrent %)27,885(2,577)(238)(8%)Note: table above shows liabilities with a positive sign and assets with a negative sign* Net premium debtors are calculated as insurance and intermediary recoverables less reinsurance accounts payable “Real” impact is much lower allowing for asset movements– direct impact on Solvency position– Need to ensure consistency with any Internal Model18

What does this mean for the future of SAOs? Can potentially see the future of SAOs going one ofthree ways:– an SAO based on the TP’s for solvency purposes– no opinion to be given– an opinion on a financial reporting basis and map thisacross to solvency figures Not decided and there are many considerations /interested parties. For example:– auditors– actuaries / profession– Lloyd’s / FSA– international regulators19

Actuarial Function (2)- Underwriting Doc 29/09 outlines: The actuarial function’s opinion on underwriting policy mustinclude the following issues, at a minimum:“Sufficiency of premiums to cover future losses.”“Considerations regarding inflation, legal risk, changes in mix, anti-selectionand adequacy of bonus-malus systems implemented in specific lines ofbusiness” Lloyd’s Minimum underwriting standard state:“Managing agents are expected to have appropriate pricing methodologieswhich are transparent and consistent for each class of business. This is toensure that the syndicates they manage generate sufficient premiums in theaggregate to achieve the planned levels of profitability in the business planapproved by Lloyd's.”20

Actuarial Function (3)- Reinsurance Doc 29/09 outlines: The actuarial function’s opinion on underwriting policy mustinclude the following issues, at a minimum:“The adequacy of significant reinsurance arrangements.Expected cover under stress scenarios in relation to underwriting policy.The adequacy of the calculation of technical provisions arising from reinsurance.” Lloyd’s Minimum underwriting standard state: The managing agent shouldregularly review its reinsurance arrangements to ensure that:“All significant risks related to the arrangements, and the residual risks borne by the firm,have been identified.Appropriate risk mitigation techniques have been applied to manage and control those risks.There is full and regular analysis of the effect of the reinsurance plan on its exposure toinsurance risk, its underwriting strategy and business plan, and its ability to meetregulatory obligations.Specific consideration has been given to the risks associated with the use of sharedreinsurance arrangements.”21

Syndicate review update 2010 The Actuarial Profession y www.actuaries.org.uk22

Overall, the syndicate dry run has seen goodprogress over the summer Additional guidance published by Lloyd’s– Final Application Pack, Validation Report and ORSA Approx 150 model walkthrough sessions held to date– joint meetings with FSA in many cases Further evidence templates submitted by agents Quantitative submissions on technical provisions, QIS5 andSCRs And still significant work until the end of the year .23

24

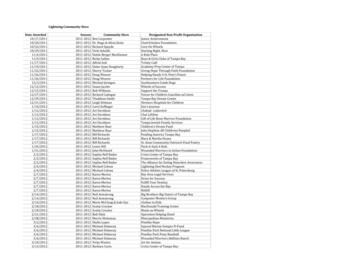

the level of the Standard Formula acts as areminder of the importance of model approvalSCR vs ICA Comparison- SF Rerun vs. 2011 ICA (215%)- QIS5 SCR vs. 2010 ICA (244%)- QIS4 SCR vs. 2008 ICA (157%)SCR- Current (100%)ICANote: excludes some syndicates for illustration purposes25

Half Year results 2010 The Actuarial Profession y www.actuaries.org.uk26

We have reported a loss in the first half which isheavily impacted by June 2010June 2011% chgDec 201013,49013,534022,5928,2858,546317,111Net incurred claims(5,403)(6,697)24(10,029)Net operating expenses1(2,775)(2,987)8(5,939)Underwriting result107(1,138)-1,143Investment return 2597548(8)1,258Other income / expenses3(76)(107)(42)(206)Profit before tax628(697)-2,195Combined ratio98.7%113.3% mGross written premiumsNet earned premiums93.3%Source: Lloyd’s pro forma basis, 1) Technical account 2) Return on syndicates’ assets, members’ funds at Lloyd’s and centralassets 3) Non-technical account27

unprecedented half year catastrophe claims 4,500Lloyd’s Major claims: Net Ultimate Claims ( 122 242m - H1 Average570199419951996 199719981999 20002001 2002 2003 2004 2005 2006 2007 2008 200920102011Indexed to June 2011Source: Lloyd’s pro forma basis28

which may not necessarily develop to historicpatterns .Chilean EQ Development icane benchmark911MonthChile13151719Earthquake benchmarkSource: Lloyd’s QMR & Xchanging data29

elsewhere have seen little movement in otherelements of the combined ratioCombined ratios140%130%2011H1 110%32.4%(5.5%)Major lossesPrior year 0%Accident yearCalendar dent yearMajor lossesPrior year reservemovementsCalendar yearSource: Lloyd’s pro forma basis30

Investments in the first half were “modest”INVESTMENT RETURN m9008007006005004003002001000-100IR:H1 07H1 08H1 09H1 10H1 112.4%0.9%1.6%1.3%1.1%PTFFALCentral assetsNote: PTF – Syndicate Premium Trust Funds; FAL - Members’ Funds at Lloyd’sSource: Lloyd’s pro forma financial statements, 30 June 2011 2010 The Actuarial Profession y www.actuaries.org.uk31

But solvency coverage and central assets arenow at record levelsBalance Sheet ( m)Solvency ( 7,35719,12119,1212,5002,000Members' funds at Lloyd's(FAL)1,500Central assets (excludingcallable layer)15,00014,46115,26410,000Members' balance (surplus)Solvency surplus1,0005,00050000Dec 2007Dec 2008Dec 2009Dec 2010Jun 2011Source: Society of Lloyd’s financial statements32

Current Issues and Year End timetable 2010 The Actuarial Profession y www.actuaries.org.uk33

Looking forward to year-end The catastrophe losses will impact the year-end No new reserving “hot topics” have emerged . but last year’s do remain– UK Motor– Italian Hospitals– Casualty and the cycle Monitoring and understanding reserving remains vital– at the same time as transitioning to the new regime34

Year-end - submission dates - reminderSubmissionUS Trust Fund SAOs13 February 2012Worldwide SAOs23 February 2012SAO Reports Deadline30 March 2012 or earlierPlease submit two copies of the SAO report– one of which must be a hard copy, electronic copies areencouraged– reports to Jerome Kirk, Market Reserving & Capital, G5,Lloyd’s, One Lime Street, EC3M 7HA,– submit electronic copies via email to SAOReports@lloyds.com35

Wrap up and Questions Central and syndicate level Solvency II projects are progressingwell– And are closely intertwined: BOTH must succeed– Many requirements of the Actuarial Function should alreadyexist Half Year results reflected the risks taken at Lloyd’s Current issues and year end timetable: no major changes 2010 The Actuarial Profession y www.actuaries.org.uk36

Henry Johnson, Jerome Kirk, Karen Seidel, Matt Gold - Lloyd's Workshop C8 - Lloyd's Update. Agenda Three speakers today (plus me) - Matt Gold - Karen Seidel - Jerome Kirk Solvency II update - Central workstream - Scope, Governance and change, ORSA, link to syndicate models . Lloyd's Minimum underwriting standard .