Transcription

730 Third AvenueNew York, NY 10017-3206TIAA-CREF Life FundsImportant notice regarding availability of proxy materials for the SpecialMeeting of Shareholders to be held on July 17, 2019. The Proxy Statement forthis meeting is available at: www.proxy-direct.com/tia-30639Notice of Special Meeting — July 17, 2019This notice is being given to the owners of the variable annuity contracts or variablelife insurance policies (collectively, the “variable contracts”) issued by TIAA-CREF LifeInsurance Company (“TIAA-CREF Life”). As an owner of a variable contract issued byTIAA-CREF Life, you are entitled to give voting instructions in connection with theshareholder meetings of the TIAA-CREF Life Funds (the “Trust”), the investmentportfolios (each, a “Fund,” and, collectively, the “Funds”) underlying the variableinvestment accounts of TIAA-CREF Life Separate Account VA-1, TIAA-CREF LifeSeparate Account VLI-1 and TIAA-CREF Life Separate Account VLI-2 established byTIAA-CREF Life (the “Separate Accounts”).The Trust will hold a Special Meeting of Shareholders on July 17, 2019, at1:00 p.m. EDT, at the New York Office of Teachers Insurance and AnnuityAssociation of America (“TIAA”), 730 Third Avenue, New York, NY 10017. Thisproxy statement was mailed to Shareholders of the investment portfolios offeredby the Trust starting on or about June 6, 2019.The purpose of the meeting is:1. To elect ten individuals to serve as Trustees for indefinite terms and until theirsuccessors shall take office; and2. To address any other business that may properly come before the meeting.The Separate Accounts and, for certain of the Funds, the Balanced Fund (a series ofthe Trust) are the only shareholders of the Funds. TIAA-CREF Life is hereby solicitingand agreeing to vote the Separate Accounts’ shares of each Fund at the specialmeeting according to timely instructions received from owners of the variablecontracts who have amounts allocated to the Separate Accounts’ variable investmentaccounts that are invested in Fund shares as of May 30, 2019 (the “Record Date”).As a variable contract owner of record as of the Record Date, you have the right toinstruct TIAA-CREF Life how to vote the Separate Accounts’ shares of the Fundsattributable to your variable contract. To assist you in giving your instructions, we haveenclosed a voting instruction card which you are to use to give voting instructions. Inaddition, the proxy statement is attached to this notice describing certain matters tobe voted on at the special meeting and any adjournments of that meeting.By order of the Board of Trustees,Mona BhallaCorporate Secretary

Please provide voting instructions as soon as possible before the meeting, evenif you plan to attend the meeting. You can provide instructions quickly and easilyby toll-free telephone call, over the Internet or by mail. Just follow the simpleinstructions that appear on your proxy card or voting instruction card.If you plan to attend the meeting, please call 877-535-3910, ext. 22-2440, toobtain an admission pass. In accordance with the Trust’s security procedures,a pass and appropriate picture identification will be required to enter theTrust’s special meeting. Please note that no laptop computers, recordingequipment or cameras will be permitted. All cell phones must be turned offwhen entering the meeting and remain off during the meeting. Please read theinstructions on the admission pass for additional information.June 6, 2019

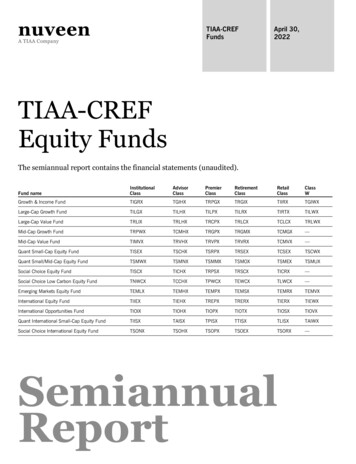

TIAA-CREF Life FundsProxy Statement for Special Meeting to be held on July 17, 2019This proxy statement has been sent on behalf of the TIAA-CREF Life Funds byTIAA-CREF Life Separate Account VA-1, TIAA-CREF Life Separate Account VLI-1 andTIAA-CREF Life Separate Account VLI-2 (the “Separate Accounts”), separateaccounts of TIAA-CREF Life Insurance Company (“TIAA-CREF Life”), to the owners ofthe variable annuity contracts and variable life insurance policies (the “variablecontracts”) issued by TIAA-CREF Life with contract value allocated to accountsinvesting in investment portfolios of the TIAA-CREF Life Funds (each, a “Fund,” andcollectively, the “Funds”).The Board of Trustees (the “Board”) of the Trust has sent you this proxy statementto ask for your voting instructions on certain matters affecting the Trust. Theaccompanying proxy will be voted at the Special Meeting of the Trust’sShareholders being held on July 17, 2019, at 1:00 p.m. EDT, at the New YorkOffice of Teachers Insurance and Annuity Association of America (“TIAA”), 730Third Avenue, New York, NY 10017. This proxy statement was mailed toshareholders starting on or about June 6, 2019.The Trust’s Shareholders are being asked to vote on the following:1. The election of ten individuals to serve as Trustees for indefinite termsand until their successors shall take office; and2. Any other business that may properly come before the meeting or anyadjournments or postponements thereof.At this time, the Board of Trustees does not know of any other matters beingpresented at the meeting or any adjournments or postponements thereof.How do I provide my instructions?You can provide your instructions in any one of four ways:(1) By logging on to the Internet site shown on your proxy card or votinginstruction card and following the on-screen instructions;(2) By marking, signing and mailing the proxy card or voting instruction card inthe envelope provided;(3) By calling the toll-free telephone number shown on your proxy card orvoting instruction card and following the recorded instructions; or(4) By providing your instructions in person at the meeting.If you provide your instructions by Internet or telephone, please do not mail yourproxy card or voting instruction card.Vote onthe InternetVote online at thewebsite listed on yourproxy card or votinginstruction card.Follow the on-screeninstructions.Voteby phoneCall the phonenumber listed on yourproxy card or votinginstruction card.Follow the recordedinstructions available24 hours.Voteby mailVote, sign, and datethe proxy card orvoting instruction cardand return it using thepostage-paidenvelope.Votein personAttend the Meeting ofShareholdersJuly 17, 2019, at1:00 p.m. EDT atTIAA’s New York Office,730 Third Avenue,New York, NY 10017.3

Can I cancel or change my instructions?You can cancel or change your vote at any time up until 5:00 p.m. EDT onJuly 16, 2019. You can do this by simply providing new instructions — byexecuting and returning a later-dated proxy card or voting instruction card,providing instructions through the Internet or by a toll-free telephone call,providing instructions in person at the meeting — or you can cancel your vote bywriting the Trust’s Corporate Secretary at: c/o the TIAA-CREF Life Funds,730 Third Avenue, New York, New York 10017-3206. Cancelled or changedvotes (other than votes cast in person at the meeting) must be received by the5:00 p.m. July 16, 2019 deadline.How does the voting and instruction process work?The Separate Accounts and, for certain Funds, the Balanced Fund (a series ofthe TIAA-CREF Life Funds) (the “Balanced Fund”) are the only shareholders ofthe Funds. The Funds expect that the Separate Accounts will vote their Fundshares at the meeting according to the timely instructions received from theindividual variable contract owners who have allocated account values tosubaccounts investing in the Funds. Accordingly, variable contract owners havingallocated values to a Fund as of May 30, 2019 (the “Record Date”) have beengiven the right to provide voting instructions at the meeting with respect to thatFund. The number of votes for which a variable contract owner may give votinginstructions is based on the number of shares in the Fund attributable to suchvariable contract owner as of the Record Date.The Separate Accounts will vote shares attributable to the variable contracts forwhich no voting instructions are received in the same proportion (for, against,abstain) as the voting instructions received on all outstanding contracts (sometimesreferred to as “echo” voting). If the Funds receive votes or the Separate Accountsreceive voting instructions that do not indicate any intention regarding a proposal,they will be voted in favor of the proposal.Finally, the Balanced Fund also owns a portion of certain Funds’ shares. TheBalanced Fund expects to vote its shares of the Funds in the same proportionas the vote of other shareholders.Because the Separate Accounts and the Balanced Fund intend to vote asindicated above, a small number of contract owners’ voting instructions candetermine the outcome of a proposal.At this time, the Board does not know of any other matters being presentedat the meeting. If other matters are brought before the meeting, the SeparateAccounts will vote the proxies using their own best judgment. All proxies solicitedby the Board that are properly executed and received by the Corporate Secretaryprior to the meeting, and are not cancelled, will be voted at the meeting.4

Who may vote; How many votes do I get?The shareholders of each of the Funds (i.e., Growth Equity Fund, Growth &Income Fund, International Equity Fund, Large-Cap Value Fund, Real EstateSecurities Fund, Small-Cap Equity Fund, Social Choice Equity Fund, Stock IndexFund, Bond Fund, Balanced Fund and Money Market Fund), voting together, willbe entitled to elect the Trustees. Each outstanding full share of a Fund isentitled to one vote and each outstanding fractional share is entitled to aproportionate fractional share of one vote. Therefore, the number of votes forwhich you may give voting instructions will depend upon how many shares in therespective Fund are attributable to your variable contract on the Record Date.Fractional votes will be counted.Each person having voting rights on the Record Date may vote at the meeting. Inthe table below are the percentages of the total outstanding shares of each of theFunds held by the Separate Accounts and the Balanced Fund as of May 20, 2019:FundBalanced FundTIAA-CREFLife SeparateAccountVA-1 shares96%TIAA-CREFLife SeparateAccountVLI-1 shares2%TIAA-CREFLife SeparateAccountVLI-2 sharesTIAA-CREFLife BalancedFund shares2%0%Bond Fund80%2%1%17%Growth & Income Fund89%5%2%4%Growth Equity Fund83%6%6%5%International Equity Fund79%9%5%7%Large-Cap Value Fund87%4%1%8%Money Market Fund80%13%7%0%Real Estate Securities Fund93%4%1%2%Small-Cap Equity Fund90%4%4%2%Social Choice Fund95%4%1%0%Stock Index Fund85%10%4%1%The number of each Fund’s shares attributable to you as a contract owner isdetermined by dividing your interest in the applicable variable investmentaccount by the net asset value of the applicable Fund as of the Record Date.How many votes are needed for a quorum or to pass a vote?There will be a quorum for the meeting if 10 percent of the total number ofvotes entitled to be cast vote in person or by proxy. Abstentions are counted indetermining whether a quorum has been reached. Additionally, echo-votedshares are counted as being present at the meeting. Since the SeparateAccounts and the Balanced Fund expect to vote all shares held, as set forthabove, it is anticipated that there will be a quorum at the special meeting.5

A Trustee shall be elected to the Board if he or she receives a majority of thevotes cast at a meeting where a quorum is present. Approval of any otherproposals also requires a majority of the votes cast at a meeting where aquorum is present. Abstentions from voting are not treated as votes cast for theelection of Trustees or any other proposal. No votes are cast by brokers.If a quorum is not present at the meeting, or if a quorum is present at themeeting but sufficient votes to approve one or more of the proposed items arenot received, or if other matters arise requiring shareholder attention, thepersons named as proxy agents may propose one or more adjournments of themeeting to permit further solicitation of additional votes.I. Election of TrusteesThe purpose of the meeting is to elect members to the Board. The Trustees willbe elected to serve indefinite terms until his or her successor shall take office.Pursuant to a resolution of the Board, the maximum number of Trustees hasbeen fixed at ten. Under the law, the Board can fill vacancies between meetingsif, in doing so, after an appointment, at least two-thirds of the Trustees thenholding office would have been elected by the shareholders.At this meeting, you are being asked to elect to the Board nine current members(including Prof. Eberly, Mr. Forrester and Mr. Kenny who were previouslyappointed as Trustees by the Board) and one new nominee, Joseph A. Boateng.Information about each of these ten nominees is set forth below. It is intendedthat properly executed and returned proxies will be voted FOR the election of theten nominees unless otherwise indicated in the proxy.Each of the ten nominees was first recommended by the Nominating andGovernance Committee of the Board. This Committee consists of Trustees who arealso themselves nominees and, like all the other members of the Board, are not“interested persons” as such term is defined in the Investment Company Act of1940 (the “1940 Act”). The three current Trustees who were previously appointedby the Board (Prof. Eberly, Mr. Forrester and Mr. Kenny) were each recommendedto the Nominating and Governance Committee by current Trustees after beingidentified by a retained third-party search firm. Mr. Boateng was recommended tothe Nominating and Governance Committee by a retained third-party search firm.Each of the nominees has consented to serve if elected. If any nominee isunavailable to serve when the meeting is held, the proxy agents may cast yourvotes for a substitute chosen by the current Board.Proxies cannot be voted for a greater number of persons than the numberof nominees.The Board, which is composed entirely of Trustees who are not “interestedpersons” (as defined in the 1940 Act) of the Trust or of Teachers Advisors, LLC(“Advisors”), the Trust’s investment adviser, unanimously recommends thatthe shareholders of the Trust vote FOR the election of each of the nominees.6

Management of the TrustBoard of TrusteesThe Trust is governed by its Board, which oversees the Trust’s business andaffairs. The Board delegates the day-to-day management of the Trust to Advisorsand the officers of the Trust (see below).Board of Trustees leadership structure and related mattersThe Board currently is composed of nine Trustees, all of whom are independentor disinterested, which means that they are not “interested persons” of the Trustas defined in Section 2(a)(19) of the 1940 Act (“independent Trustees”). One ofthe independent Trustees, Thomas J. Kenny, serves as the Chairman of theBoard. The Chairman’s responsibilities include: coordinating with management inthe preparation of the agenda for each meeting of the Board; presiding at allmeetings of the Board; and serving as a liaison with other Trustees, the Trust’s’officers and other management personnel, and counsel to the independentTrustees. The Chairman performs such other duties as the Board may from timeto time determine. The principal executive officer of the Trust does not serve onthe Board.The Board meets periodically to review, among other matters, the Funds’activities, contractual arrangements with affiliated and non-affiliated companiesthat provide services to the Fund and the performance of the Funds’ investmentportfolios. The Board holds regularly scheduled in-person meetings and regularlyscheduled meetings by telephone each year and may hold special meetings, asneeded, either in person or by telephone, to address matters arising betweenregularly scheduled meetings. During a portion of each regularly scheduledin-person meeting and, as the Board may determine at its other meetings, theBoard meets without management present.The Board has established a committee structure that includes six standingcommittees and one special committee, each composed solely of independentTrustees and chaired by an independent Trustee, as described below. The Board,with the assistance of its Nominating and Governance Committee, periodicallyevaluates its structure and composition as well as various aspects of itsoperations. The Board believes that its leadership and operating structure, whichincludes its committees and an independent Trustee in the position of Chairmanof the Board and of each committee, provides for independent oversight ofmanagement and is appropriate for the Funds in light of, among other factors,the asset size and nature of the Trust and the Funds, the number of portfoliosoverseen by the Board, the number of other funds overseen by the Trustees astrustees of other investment companies in the TIAA-CREF Fund Complex (asdefined below), the arrangements for the conduct of the Funds’ operations, thenumber of Trustees, and the Board’s responsibilities.The Trust is part of the TIAA-CREF Fund Complex, which is composed of 11Funds within the Trust, 69 funds within the TIAA-CREF Funds (“TCF”), the single7

portfolio within the TIAA Separate Account VA-1 (“VA-1”), and eight Accountswithin the College Retirement Equities Fund (“CREF”). All of the persons thatserve on the Board also serve on, and the same person serves as the Chairmanof, the respective Boards of Trustees of TCF and CREF and the ManagementCommittee of VA-1.Qualifications of TrusteesThe Board believes that each of the nominees is qualified to serve as a Trusteeof the Trust based on a review of the experience, qualifications, attributes orskills of each nominee. The Board bases this view on its consideration of avariety of criteria, no single one of which is controlling. Generally, the Boardlooks for: character; integrity; ability to review critically, evaluate, question anddiscuss information provided and exercise effective business judgment inprotecting shareholder interests; willingness and ability to commit the timenecessary to perform the duties of a Trustee; and significance of eachnominee’s background, experience, qualifications, attributes or skills in thecontext of overall diversity of the Board’s composition. Each nominee’s ability toperform his or her duties effectively is evidenced by his or her experience in oneor more of the following fields: management, consulting and/or boardexperience in the investment management industry; academic positions inrelevant fields; management, consulting and/or board experience with publiccompanies in other fields, non-profit entities or other organizations; educationalbackground and professional training; and experience as a Trustee of the Trustand other funds in the TIAA-CREF Fund Complex. With respect to diversity, theBoard generally considers the manner in which each nominee’s professionalexperience, education, expertise in relevant matters, general leadershipexperience and life experiences are complementary and, as a whole, contributeto the ability of the Board to perform its duties.Information indicating certain of the specific experience and relevant qualifications,attributes and skills of each nominee relevant to the Board’s belief that thenominee should serve in this capacity is provided in the “Disinterested Trusteesand Nominees” table set forth below. This table includes, for each Trustee,positions held with the Trust, length of office and time served, and principaloccupations in the last five years. The table also includes the number of portfoliosin the TIAA-CREF Fund Complex overseen by each Trustee and certain directorshipsheld by each of them.Risk oversightDay-to-day management of the various risks relating to the administration andoperation of the Trust and the Funds is the responsibility of management, whichincludes professional risk management staff. The Board oversees this riskmanagement function consistent with and as part of its oversight responsibility.The Board performs this risk management oversight directly and, as to certainmatters, through its standing committees (which are described below) and, attimes, through its use of ad hoc committees. The following provides an overview ofthe principal, but not all, aspects of the Board’s oversight of risk management for8

the Trust and the Funds. The Board recognizes that it is not possible to identifyall of the risks that may affect the Trust and the Funds or to develop proceduresor controls that eliminate the Trust’s and the Funds’ exposure to all ofthese risks.In general, a Fund’s risks include, among others, market risk, credit risk,liquidity risk, valuation risk, operational risk, reputational risk, regulatorycompliance risk and cyber security risk. The Board has adopted, and periodicallyreviews, policies and procedures designed to address certain (but not all) ofthese and other risks to the Trust and the Funds. In addition, under the generaloversight of the Board, Advisors, the investment manager and administrator foreach Fund, and other service providers to the Funds have adopted a variety ofpolicies, procedures and controls designed to address particular risks to theFunds. Different processes, procedures and controls are employed with respectto different types of risks.The Board also oversees risk management for the Trust and the Funds throughreceipt and review by the Board and/or its committees of regular and specialreports, presentations and other information from officers of the Trust and otherpersons, including from the Chief Risk Officer or senior risk managementpersonnel for Advisors and its affiliates. Senior officers of the Trust, seniorofficers of Advisors and its affiliates and the Funds’ Chief Compliance Officer(“CCO”) regularly report to the Board and/or one or more of the Board’sstanding committees on a range of matters, including those relating to riskmanagement. The Board also regularly receives reports, presentations and otherinformation from Advisors with respect to the investments and securities tradingof the Funds. At least annually, the Board receives a report from the Funds’ CCOregarding the effectiveness of the Funds’ compliance program. Also, on anannual basis, the Board receives reports, presentations and other informationfrom TIAA in connection with the Board’s consideration of the renewal of theTrust’s investment management agreements with Advisors. In addition, on anannual basis, Advisors, in its capacity as administrator of the Funds’ liquidityrisk management program pursuant to applicable Securities and ExchangeCommission (“SEC”) regulations, provides the Board with a written report thataddresses the operation, adequacy and effectiveness of the program.Officers of the Trust and officers of TIAA also report regularly to the Audit andCompliance Committee on the Trust’s internal controls over financial reportingand accounting and financial reporting policies and practices. The Funds’ CCOreports regularly to the Audit and Compliance Committee on compliancematters, and TIAA’s Chief Auditor reports regularly to the Audit and ComplianceCommittee regarding internal audit matters. In addition, the Audit andCompliance Committee receives regular reports from the Trust’s independentregistered public accounting firm on internal controls and financialreporting matters.The Operations Committee receives regular and special reports, presentationsand other information from the Trust’s officers and Fund management personnel9

regarding valuation and other operational matters. In addition to regular reports,presentations and other information received from Advisors and other TIAApersonnel, the Operations Committee receives reports, presentations and otherinformation regarding certain other service providers to the Trust, either directlyor through the Trust’s officers, including the CCO and TIAA personnel, on aperiodic or regular basis.The Investment Committee regularly receives reports, presentations and otherinformation from Advisors with respect to the investments, securities trading,portfolio liquidity and other portfolio management aspects of the Funds.The Corporate Governance and Social Responsibility Committee regularlyreceives reports, presentations, and other information from Advisors regardingthe voting of proxies of the Funds’ portfolio companies.The Nominating and Governance Committee routinely monitors various aspectsof the Board’s structure and oversight activities, including reviewing matterssuch as the workload of the committees of the Board, the balance ofresponsibilities delegated among the committees of the Board and the relevantskill sets of the Board members. On an annual basis, the Nominating andGovernance Committee reviews the independent status of each Trustee underthe 1940 Act and the independent status of counsel to the independentTrustees.Current Trustees, Nominees and Executive Officers of the TrustThe following table includes certain information about the Trust’s’ currentTrustees, nominees and executive officers, including positions currently heldwith the Trust, length of office and time served, and principal occupations in thelast five years and other relevant experience and qualifications. The table alsoincludes the number of portfolios in the TIAA-CREF Fund Complex overseen byeach nominee and certain directorships held by each of them. The first tableincludes information about the Trust’s’ disinterested Trustees and nomineesand the second table includes information about the Trust’s officers.10

Disinterested Trustees and NomineesName, addressand year of birth(“YOB”)Term ofPosition(s) office andheld with length ofthe Trust time servedForrest Berkleyc/o CorporateTrusteeSecretary730 Third AvenueNew York, NY10017-3206YOB: 1954Indefiniteterm.Trusteesince 2006.Principal occupation(s)during past 5 years andother relevant experienceand qualificationsRetired Partner (since2006), Partner (1990–2005) and Head of GlobalProduct Management(2003–2005), GMO(formerly, Grantham,Mayo, Van Otterloo & Co.)(investmentmanagement), andmember of assetallocation portfoliomanagement team, GMO(2003–2005).Number ofportfoliosin fundcomplexoverseen Other directorshipsby Trustee held by Trustee89Director, Save theChildren Foundation,Inc; InvestmentCommittee member,Maine CommunityFoundation and theElmina B. SewallFoundation.8Board member, YearUp Puget Sound;Investment AdvisoryCommittee Chair,Seattle City Employees’Retirement System;Investment Committeemember, TheSeattle Foundation.Mr. Berkley has particularexperience in investmentmanagement, globaloperations and finance,as well as experience withnon-profit organizationsand foundations.Joseph A. Boatengc/o CorporateSecretary730 Third AvenueNew York, NY10017-3206YOB: 1963Nominee N/AandConsultantto theBoard ofTrusteessince 2018.Chief Investment Officer,Casey Family Programs(since 2007). Director ofU.S. Pension Plans atJohnson & Johnson(2002–2006); Manager,Financial ServicesConsultant, KPMGConsulting (2000–2002);several positions, XeroxCorporation(1988–2000).Mr. Boateng has particularexperience in investmentmanagement, pensionplan management,and finance.11

Name, addressand year of birth(“YOB”)Term ofPosition(s) office andheld with length ofthe Trust time servedJanice C. Eberlyc/o CorporateTrusteeSecretary730 Third AvenueNew York, NY10017-3206YOB: 1962Indefiniteterm. Trusteesince 2018.Principal occupation(s)during past 5 years andother relevant experienceand qualificationsJames R. andHelen D. Russell Professorof Finance at the KelloggSchool of Management atNorthwestern University(2002–2011 and since2013), and Chair of theFinance Department(2005–2007). AssistantSecretary for EconomicPolicy, United StatesDepartment of theTreasury (2011–2013).Number ofportfoliosin fundcomplexoverseen Other directorshipsby Trustee held by Trustee89Member of the Boardof the Office ofFinance, Federal HomeLoan Banks; Director,Avant, LLC.89Independent Director,The Lazard Funds, Inc.,Lazard RetirementSeries, Inc., LazardGlobal Total Return andIncome Fund, Inc., andLazard WorldDividend & IncomeFund, Inc.Professor Eberly hasparticular experience ineducation, finance andpublic economic policy.Nancy A. Ecklc/o CorporateTrusteeSecretary730 Third AvenueNew York, NY10017-3206YOB: 1962Indefiniteterm.Trusteesince 2007.Vice President (1990–2006), American BeaconAdvisors, Inc. and ofcertain funds advised byAmerican BeaconAdvisors, Inc.Ms. Eckl has particularexperience in investmentmanagement, mutualfunds, pension planmanagement, finance,accounting andoperations. Ms. Eckl islicensed as a certifiedpublic accountant in theState of Texas.12

Name, addressand year of birth(“YOB”)Term ofPosition(s) office andheld with length ofthe Trust time servedMichael A. Forresterc/o CorporateTrusteeSecretary730 Third AvenueNew York, NY10017-3206YOB: 1967Indefiniteterm.Trusteesince 2007.Principal occupation(s)during past 5 years andother relevant experienceand qualificationsChief Executive Officer(since 2014), and ChiefOperating Officer, CopperRock Capital Partners, LLC(2007–2014). ChiefOperating Officer, DDJCapital Management(2003–2006).Number ofportfoliosin fundcomplexoverseen Other directorshipsby Trustee held by Trustee89Director, Copper RockCapital Partners, LLC(investment adviser);Trustee, DexterSouthfield School.89Director,Commonwealth(non-profit organization).Mr. Forrester hasparticular experience ininvestment management,institutional marketingand product development,operations management,alternative investmentsand experience withnon-profit organizations.Howell E. Jacksonc/o CorporateTrusteeSecretary730 Third AvenueNew York, NY10017-3206YOB: 1954Indefiniteterm.Trusteesince 2005.James S. Reid, Jr.Professor of Law (since2004), Senior Adviser tothe President and Provost(2010–2012), ActingDean (2009), Vice Deanfor Budget (2003–2006),and on the faculty (since1989) of HarvardLaw School.Professor Jackson hasparticular experience inlaw, including the federalsecurities laws, consumerprotection, finance,pensions and SocialSecurity, andorganizationalmanagementand education.13

Name, addressand year of birth(“YOB”)

life insurance policies (collectively, the "variable contracts") issued by TIAA-CREF Life Insurance Company ("TIAA-CREF Life"). As an owner of a variable contract issued by TIAA-CREF Life, you are entitled to give voting instructions in connection with the shareholder meetings of the TIAA-CREF Life Funds (the "Trust"), the investment