Transcription

TIAA-CREF Lifetime Income SurveyExecutive SummaryFebruary 3, 20151

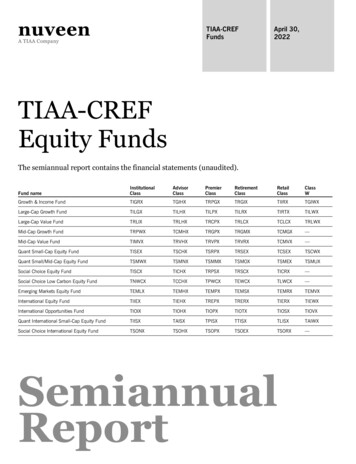

TIAA-CREF Survey:Americans Want MonthlyRetirement Income But Don’tKnow How to Get ItThe following pages outline Americans’ attitudes about lifetimeincome and provide additional information about TIAA-CREF’sexpanded portfolio of advice and financial education resources.Despite being concerned about theirfinancial future, few Americans aretaking steps to secure lifetime incomeAccording to a new TIAA-CREF survey, 84percent of Americans say having a guarantee ofmonthly income for the rest of their life isimportant to them. Nearly half (48 percent, upfrom 34 percent in 2014) say that havingguaranteed income to cover living costs shouldbe the primary goal for their retirement plan.That increase highlights Americans’ growingfocus on having a regular paycheck during theirpost-career years.But, for as important as Americans say it is tohave guaranteed monthly income in retirement,only 14 percent have actually purchased anannuity, which is the only way to ensure incomethat retirees can’t outlive. Furthermore, manyAmericans (44 percent) are unsure if theircurrent retirement plan even offers them theoption of receiving a monthly paycheck inretirement.If you could set one primary goal for yourretirement plan, what would it 1%8%4%0%ProvideEnsure that your Allow you to save Allow you to earnguaranteed money savings will be a specific amount a competitive rateevery month tosafeof moneyof returncover living costsin retirementDon't know2

Many Americansneed help setting andachieving retirementgoalsThe 2015 Lifetime Income surveyshowed that Americans are likely tounderestimate how much of theirincome they will need to replace inretirement. Although expertsrecommend planning to replace 70percent to 90 percent of pre-retirementincome, only one-third of Americansthink they will need to replace morethan 75 percent of pre-retirementincome.That disconnect may explain thealarming increase, from 21 percent in2014 to 29 percent in 2015, in thenumber of Americans who are savingnothing at all for retirement.What percentage of your current annualincome do you think you will need in orderto live comfortably in ess than25%25%-50%50%-75%75%-100%More than100%Don't know3

EHave you done an analysis of how yoursavings will translate into monthly incomein retirement?*70%62%60%Employers have an opportunity to helpemployees better understand how togenerate a steady stream of income inretirement, by offering access tofinancial advice. Without such advice,many Americans may be missing outon options in their retirement plans thatcould help them meet their financialgoals.50%40%30%20%18%16%14%14%Financial advice canboost confidence inlifetime incomeoptions12%10%10%10%6%0%Only 31 percent of Americans havesought advice on how to translate theirretirement savings into lifetime income.Similarly, just 38 percent haveanalyzed how their savings willtranslate into monthly income inretirement. In many cases, Americansconducted this analysis without thehelp of a financial professional.Financial advice and education canhelp individuals meet their need forretirement income that they can’toutlive.*Note: Respondents could choose more than one option.4

Americans aren’t familiar withannuitiesThe survey revealed that 46 percent of Americans areworried about running out of money in retirement. Yetthe majority (65 percent) are not familiar with annuities,which are the only sure way besides Social Security or apension to guarantee a steady stream of income inretirement. This is particularly true of Americans ages18-34: Only 26 percent are familiar with annuities,compared to 48 percent of Americans ages 55-64.What is your impression of What’s more, only 28 percent of Americans overallhave a favorable impression of annuities, and only 29percent have purchased an annuity or plan to do so inthe future.These results highlight the opportunity for manyAmericans to learn about the benefits annuities canoffer. The results also reveal the critical need foreducation and financial advice to help Americans whoare clear about what they want from their retirementplan, but unclear about how to achieve it.The findings come from TIAA-CREF’s 2015 LifetimeIncome Survey, which was conducted by anindependent research firm and polled a random sampleof 1,000 adults nationwide to assess their attitudes,preferences and behaviors about lifetime income andreceiving financial advice. The survey was notconducted among TIAA-CREF participants, and thesurvey questions and responses did not reference orconcern any TIAA-CREF product, service or clientexperience.FavorableUnfavorableNeutralDon't knowHave you purchased an annuity or do youplan to in the future?70%61%60%50%40%30%20%10%14%9%6%9%0%Yes, I have No, but I plan No, but I plan No, I do notalreadyto at someto when Iplan topurchased anpointretirepurchase anannuityannuityDon't know5

Improving access to advice TIAA-CREF “Financial Essentials” FinancialEducation Program: This series of in-personworkshops and webinars addresses a variety oftopics from investing, saving and budgeting toplanning and living in retirement. Workshops tacklethe real issues individuals face, like planning forhealthcare costs in retirement and learning how toeffectively use online tools to help manage theirfinances. In-Person Advice Services: TIAA-CREF offersaccess to financial consultants via phone and atmore than 100 offices across the country.In response to individuals’ diverse needs andpreferences for receiving information, TIAA-CREF hasexpanded its portfolio of advice and financial educationresources to give clients more options for receivinghelp. Enhanced Online Advice and Guidance Center:TIAA-CREF’s Advice and Guidance Center hasexpanded to feature articles and resources basedon commonly searched financial topics, includingretirement, and a variety of other important lifeevents. The enhanced site also delivers TIAA-CREFclients individualized content to ensure theinformation they receive is relevant to them.For Women: To give women the tools they need tohelp them become financially secure andsuccessful, TIAA-CREF continues to expand itsWoman to Woman Financial Empowerment Series,which includes workshops that are developed bywomen, for women. Each workshop is interactive,allowing attendees to learn from the financialconsultant, as well as the other women in the room.Explore furtherFor more information on the survey and TIAA-CREF’sadvice and planning resources, visit tiaa-cref.org. Formore information on TIAA-CREF’s advice andguidance offerings, visit our Advice and GuidanceCenter.The TIAA-CREF 2015 Lifetime Income survey w as conducted by KRC Research by phone among a national random sample of 1,000 adults, ages18 years and older, from Jan. 7-13, 2015, using landline and cell phone interview s. The margin of error for the entire sample is plus or minus 3.1percentage points.6

The material is for informational purposes only and should not be regarded as a recommendation or an offer to buy or sell any product or service towhich this information may relate. Certain products and services may not be available to all entities or persons. Past performance does not guaranteefuture results.Guarantees are based on the claims-paying ability of the issuer. Payments from variable annuity accounts are not guaranteed and will rise or fallbased on investment performance.Annuity contracts contain exclusions, limitations, reductions of benefits and may contain terms for keeping them in force. Your financial advisor canprovide you with costs and complete details.Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured b y any federalgovernment agency, are not a condition to any banking service or activity, and may lose value.TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC, Members FINRA andSIPC, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America (TIAA)and College Retirement Equities Fund (CREF), New York, NY. Each is solely responsible for its own financial condition and contractual obligations. 2015 Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA-CREF), 730 Third Avenue, New York, NY10017C217316

TIAA-CREF Individual & Institutional Services, LLC, Teachers Personal Investors Services, Inc., and Nuveen Securities, LLC, Memb ers FINRA and SIPC, distribute securities products. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Associ ation of America (TIAA) and College Retirement Equities Fund (CREF), New York, NY.