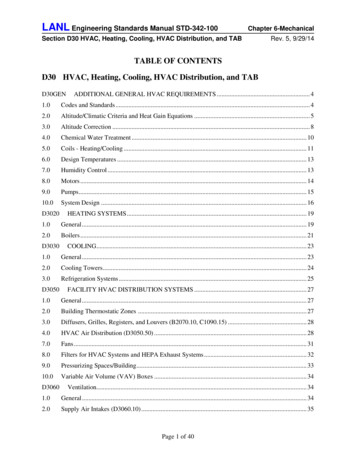

Transcription

1PJC 204.1ReimbursementTexas law recognizes three marital estates: the community property owned by the spouses together and, which is referred to as the community estate; the separate property owned individuallyby one spouse and, which is referred to as a separate estate; and the separate property owned individually by the other spouse, which is also referred to as a separate estate.AFTA claim for reimbursement for funds expended by an estate to pay debts, taxes, interest, orinsurance for the property of another estate is measured by the amount paid. An offset against aclaim for reimbursement for funds expended by an estate to pay debts, taxes, interest, or insurancefor the property of another estate is measured by the value of any related benefit received by thepaying estate, such as the fair value of the use of the property by the paying estate, income receivedby the paying estate from the property, and any reduction in the amount of any income tax obligation of the paying estate by virtue of the paying estate’s claiming tax-deductible items relating tothe property, such as depreciation, interest, taxes, maintenance, and other deductible payments,except that an offset for use and enjoyment of a primary or secondary residence owned wholly orpartly by a separate estate against contributions made by the community estate to the separateestate is not to be a part of such measurement.DRA claim for reimbursement of funds expended by an estate for capital improvements to propertyof another estate is measured by the enhancement in value to the receiving estate resulting fromsuch expenditures. An offset against a claim for reimbursement for capital improvements to property of another estate is measured by the value of any related benefit received by the paying estate,such as the fair value of the use of the property by the paying estate, income received by the payingestate from the property, and any reduction in the amount of any income tax obligation of thepaying estate by virtue of the paying estate’s claiming tax-deductible items relating to the property,such as depreciation, interest, taxes, maintenance, and other deductible payments, except that anoffset for use and enjoyment of a primary or secondary residence owned wholly or partly by aseparate estate against contributions made by the community estate to the separate estate is not tobe a part of such measurement.A claim for reimbursement to the community estate for the spouses’ time, toil, talent, or effortexpended to enhance a spouse’s separate estate is measured by the value of such community time,toil, talent, and effort other than that reasonably necessary to manage and preserve the separateestate. An offset against a claim for reimbursement for the spouses’ time, toil, talent, or effortexpended to enhance a spouse’s separate estate is measured by the compensation paid to the community in the form of salary, bonuses, dividends, and other fringe benefits.A claim for reimbursement arises when the property of one estate is used to benefit the propertyof another estate without the first estate itself receiving an equal benefit in return.Texas law does not recognize a spouse’s claim seeking reimbursement to a marital estate’s claimfor reimbursementestate for the payment of child support, alimony, or spousal maintenance; forliving expenses of a spouse or child of a spouse; for contributions of property of nominal value;for the payment of a liability of a nominal amount; or for a student loan owed by a spouse.A spouse seeking reimbursement has the burden of proving each element of the claim by apreponderance of the evidence. However, a spouse seeking reimbursement to a separate estatemust prove by clear and convincing evidence that the funds or assets expended were separateCopyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

2property. “Clear and convincing evidence” is that measure or degree of proof that produces a firmbelief or conviction that the allegations sought to be established are true. The amount of the claimis measured as of the time of trial.A spouse seeking an offset against a claim for reimbursement has the burden of proving eachelement of the offsetting claim by a preponderance of the evidence. The amount of the offset ismeasured as of the time of trial.QUESTION 1State in dollarsDid Estate A confer a benefit on Estate B?Estate A conferred a benefit on Estate B if—[Insert applicable instruction(s).]1. the property of Estate A was used to pay a debt, liability, or expense that in equity andgood conscience should have been paid from the property of Estate B; orAFT2. the property of Estate A was used to make capital improvements on the real propertyof Estate B, and the improvements resulted in an enhancement in the value of EstateB’s real property; or3. one or both spouses used community property, time, toil, talent, or effort to enhancethe value of Estate B’s property.Answer “Yes” or “No.”Answer:Question 2.Answer Question 2 if you answered “Yes” to Question 1. Otherwise, do not answerRQUESTION 2the amount of the reimbursement claim, if any, proved in favor of—the community estate againstSPOUSE A’s separate estateAnswer:2.SPOUSE A’s separate estateagainst SPOUSE B’s separateestateAnswer:D1.If you inserted a sum of money in answer to Question 1, answer the corresponding part of Question2.What is the value of the benefit Estate A conferred on Estate B, measured at the time of trial?[Insert applicable instruction(s).]1. If the benefit conferred on Estate B resulted from the use of Estate A’s property to paya debt, liability, or expense that in equity and good conscience should have been paidfrom the property of Estate B, then the value of the benefit conferred is measured bythe amount of the debt, liability, or expense Estate A paid.2. If the benefit conferred on the property of Estate B resulted from the use of Estate A’sproperty to make capital improvements on the real property of Estate B, then the valueof the benefit conferred is measured by the enhancement in the value of Estate B’s realproperty that resulted from the capital improvements.Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

33. If the benefit conferred on Estate B resulted from the use of community property, time,toil, talent, or effort, then the value of the benefit conferred is measured by the time,toil, talent, or effort other than that reasonably necessary to manage and preserve EstateB’s property.Answer in dollars and cents.Answer:Answer Question 3 if you answered Question 2. Otherwise, do not answer Question3.QUESTION 3Did SPOUSE B prove that Estate A received an offsetting benefit from Estate B?[Insert applicable instruction(s).]AFTSPOUSE A’s claim for reimbursement for benefits conferred by Estate A on Estate B can beoffset by the value of any related benefit that SPOUSE B proves that Estate A received from EstateB, such as— the value of the use and enjoyment of the property by Estate A; income received by Estate A from the property of Estate B; and any reduction in the amount of any income tax obligation of Estate A by virtue of EstateA’s claiming tax-deductible items relating to the property of Estate B, such as depreciation, interest, taxes, maintenance, and other deductible payments.RHowever, a spouse may not claim an offset for the use and enjoyment of a primary or secondaryresidence owned wholly or partly by a separate estate against expenditures made by the communityestate to the separate estate.An offset against a claim for reimbursement for the spouse’s time, toil, talent, or effort expendedto enhance a spouse’s separate estate is measured by the compensation paid to the community suchas salary, bonuses, dividends, and other fringe benefits.DAnswer “Yes” or “No.”Answer:Question 4.Answer Question 4 if you answered “Yes” to Question 3. Otherwise, do not answerQUESTION 4What is the value of the offsetting benefit measured at the time of trial?Answer Otherwise, do not answer Question 2.QUESTION 2State in dollars the amount of the offset against such reimbursement claim, if any, proved infavor of—1.SPOUSE A’s separate estateAnswer:2.SPOUSE B’s separate estateAnswer:Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

4in dollars and cents.Answer:COMMENTWhen to use. The foregoing instruction and questions may be used to submit the claim for reimbursement of one estate against another and for offsetting benefits received by the paying estate. Only the portions of the instruction that are relevantSource. Certain claims for reimbursement are listed in Tex. Fam.Code § 3.402(a). Use of the term “includes” in that section indicates that types of claims other than thoselisted in that section may be cognizable as claims for reimbursement (Tex. Gov’t Code § 311.005(13)). TheCommittee has concluded that section 3.402(a) does not prohibit the more expansive interpretation set forthin the foregoing instruction, which includes claims established under case law discussed below.In Penick in the particular case should be given.AFTSource. v. Penick, 783 S.W.2d 194, 197–98 (Tex. 1988), the Supreme Court of Texas set forth itsposition on offsetting benefits to claims for reimbursement and emphasized the equitable nature of reimbursement. The courtReimbursement is an equitable doctrine applied to prevent unjust enrichment whenone marital estate receives benefits from another marital estate that in equity and good conscience it shouldrepay. Penick v. Penick, 783 S.W.2d 194, 197–98 (Tex. 1988); Anderson v. Gilliland, 684 S.W.2d 673, 675(Tex. 1985); Vallone v. Vallone, 644 S.W.2d 455, 459 (Tex. 1982); see also Thomas v. Southwestern Settlement & Development Co., 123 S.W.2d 290, 296 (Tex. 1939) (partition case); Dakan v. Dakan, 83 S.W.2d620, 627 (Tex. 1935) (probate case); see also Hanrick v. Gurley, 54 S.W. 347, 354 (Tex. 1899) (probatecase).RA spouse seeking reimbursement must prove at least three things: (1) that one marital estate conferred abenefit upon another marital estate; (2) the value of the benefit conferred; and (3) that unjust enrichmentwill occur if the court does not require the benefitted estate to reimburse the conferring estate. See Penick,783 S.W.2d at 197–98; Anderson, 684 S.W.2d at 675; Vallone, 644 S.W.2d at 459. The determination ofwhether unjust enrichment will occur if one estate is not made to reimburse another estate is a question oflaw for the court to decide when making its just and right division of the spouses’ community estate. SeeTex. Fam. Code § 7.007.DThe court ultimately decides whether reimbursement will be permitted after considering all facts andcircumstances and applying equitable principles. Tex. Fam. Code §§ 3.402(b), 7.007; Penick, 783 S.W.2dat 197–98 . In Penick, the Texas Supreme Court stated that it was “difficult to announce a single formulawhich will balance the equities between each marital estate in every situation and for every kind of propertyand contribution.” The supreme court concluded that a court should use the same discretion in evaluating aclaim for reimbursement as in making a “just and right” division of the community property. Penick, 783S.W.3d at 197–98. The court must resolve a claim for reimbursement by using equitable principles, including the principle that claims for reimbursement may be offset against each other if the court determines itto be appropriate. Tex. Fam. Code § 3.402(b).Certain claims for reimbursement are listed in Tex. Fam. Code § 3.402(a). Use of the term “includes” inthat section indicates that types of claims other than those listed in that section may be cognizable as claimsfor reimbursement. See Tex. Gov’t Code § 311.005(13). Additionally, Tex. Fam. Code § 3.402(b) requiresthe court to use “equitable principles” in resolving claims for reimbursement. The Committee believes thatsections 3.402(a) and 3.402(b) do not prohibit the more expansive interpretation set forth in the aboveinstructions, which includes claims and offsets established under case law discussed below. See Tex. Gov’tCode § 311.005(13); Bigelow v. Stephens, 286 S.W.3d 619, 622 (Tex. App.—Beaumont 2009, no pet.). Theinstructions should be revised to include the more specific claims set forth in Tex. Fam. Code § 3.402(a)when appropriate.Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

5The instruction on debts, taxes, interest, and insurance the three marital estates is based on Tex. Fam.Code § 3.401(4).The definition of reimbursement is based on Vallone, 644 S.W.2d at 459, and Penick, 783 S.W.2d at197–98.AFTThe instructions on the payment of a debt, liability, or expense are derived from Tex. Fam. Code§ 3.402(a); Penick, 783 S.W.2d 194,at 196; and Colden v. Alexander, 171 S.W.2d 328, 334 (Tex. 1943). Aclaim for reimbursement for funds expended by an estate to pay debts, taxes, interest, or insurance for theproperty ofproperty expended by one estate to pay a debt, liability, or expense that in equity and goodconscience should have been paid by another estate includes payment of unsecured liabilities, reduction ofprincipal debt secured by a lien on property including a refinance, interest paid on a debt, taxes, and insurance costs that conferred a benefit on the property of another estate. See Tex. Fam. Code § 3.402(a). Aclaim for reimbursement for property expended by one estate to pay a debt, liability, or expense that inequity and good conscience should have been paid by another estate is measured by the amount paid. Anoffset against such a claim for reimbursement is measured by the value of any related benefit received bythe paying estate, such as the fair value of the use of the property by the paying estate except under certaincircumstances (see comment below entitled “Offset for use and enjoyment of residence”), income receivedby the paying estate from the property, and any reduction in the amount of any income tax obligation of thepayingof debt, liability, or expense the conferring estate by virtue of the paying estate’s claiming tax-deductible items relating to the property, such as depreciation, interest, taxes, maintenance, and other deductible payments. See Penick, 783 S.W.2d at 197–98.paid. See Penick, 783 S.W.2d at 195–96 (citing Dakan,83 S.W.2d. at 628; Colden, 171 S.W.2d at 334); Hanrick v. Gurley, 171 S.W.2d 347, 354 (Tex. 1899).The Texas Family Code provides that a claim for reimbursement includes payment by one marital estateof the unsecured liabilities of another marital estate (Tex. Fam. Code § 3.402(a)(1)) and the reduction bythe community property estate of an unsecured debt incurred by the separate estate of one of the spouses(Tex. Fam. Code § 3.402(a)(9)). If such a claim involves the payment of debt or liabilities that are notrelated to property, the following instruction should be included:DRA claim for reimbursement for funds expended by an estate to pay unsecured debt orliabilities of another estate is measured by the amount paid. An offset against a claim forreimbursement for funds expended by an estate to pay unsecured debt or liabilities ofanother estate is measured by the value of any related benefit received by the payingestate.Certain claims regarding debt are not described by any subsection of Tex. Fam. Code § 3.402(a). (Forexample, the community takes a loan secured by a second lien on a house owned by the spouses as community property, using the proceeds to pay children’s college expenses; the loan is later repaid with fundsinherited by one spouse.). Similarly, subsections (a)(3) through (a)(7) of Code section 3.402 are cast interms of the reduction of the principal amount of debt. Because use of the term “includes” in section3.402(a) indicates that other types of claims may also be cognizable as claims for reimbursement (Tex.Gov’t Code § 311.005(13)), the Committee has concluded that section 3.402(a) does not prohibit recognition of such claims.The instruction on capital improvements to property is based on Tex. Fam. Code § 3.402(a)(8), (d), andAnderson v. Gilliland, 684 S.W.2d 673 (Tex. 1985). A claim for reimbursement of funds expended byanone estate for capital improvements tothat conferred a benefit on property of another estate, other thanby incurring debt, is measured by the enhancement in value toof property of the receivingbenefitted estateresulting from such expenditures. Anderson, 684 S.W.2d 673. An offset against such a claim for reimbursement is measured by the value of any related benefit received by the paying estate, such as the fair value ofthe use of the property by the paying estate except under certain circumstances (see comment below entitled“Offset for use and enjoyment of residence”), income received by the paying estate from the property, andany reduction in the amount of any income tax obligation of the paying estate by virtue of the paying estate’sCopyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

6claiming tax-deductible items relating to the property, such as depreciation, interest, taxes, maintenance,and other deductible payments. See Penick, 783 S.W.2d at 197–98.675.The instruction on the spouses’ time, toil, talent, or effort is based on Jensen v. Jensen, 665 S.W.2d 107,109 (Tex. 1984). The words salary, bonuses, dividends,), and other fringe benefits should be replaced withterms appropriate to the particular case.in part on Tex. Fam. Code § 3.402(a)(2). The submission does notcontain all the elements stated intrack verbatim Tex. Fam. Code § 3.402(a)(2), which provides that a claimfor reimbursement includes “inadequate compensation for the time, toil, talent, and effort of a spouse by abusiness entity under the control and direction of that spouse.” Because use of the term “includes” in section3.402(a) indicates that other types of claims may also be cognizable as claims for reimbursement (Tex.Gov’t Code § 311.005(13)), the Committee has concludedbelieves that the instruction is inclusive of allJensen claims and does not preclude the use of the exact language in section 3.402(a)(2) does not alter therequirements for a Jensen claim as set forth in the foregoing submissionwhen appropriate.The instruction on the three marital estates is based on Tex. Fam. Code § 3.401(4).AFTThe instruction on offset is based on Penick, 783 S.W.2d at 197–98. An offset against a claim for reimbursement is measured by the value of any related benefit received by the paying estate, such as the valueof the use of the property by the paying estate except under certain circumstances (see comment belowentitled “Offset for use and enjoyment of residence”); income received by the paying estate from the property; and any reduction in the amount of any income tax obligation of the paying estate by virtue of thepaying estate’s claiming tax-deductible items relating to the property, such as depreciation, interest, taxes,maintenance, and other deductible payments. Penick, 783 S.W.2d at 197–98.The instruction on offset to a claim seeking reimbursement for a spouse’s time, toil, talent and effort isbased on Jensen, 665 S.W.2d at 110. The words salary, bonuses, dividends, and other fringe benefits shouldbe replaced with terms appropriate to the particular case.RThe phrases “one spouse” and “the other spouse” are used in place of the phrases “the husband” and “thewife” that appear in Tex. Fam. Code § 3.401(4)(B), (4)(C); the substitution is based on the ruling of theUnited States Supreme Court of the United States in Obergefell v. Hodges, 135 576 U.S. Ct. 2584644(2015).The instruction on claims that may not be recognized is based on Tex. Fam. Code § 3.409.DThe instruction on burden of proof by clear and convincing evidence for reimbursement to a separateestate is based on Tex. Fam. Code § 3.003. The definition of “clear and convincing evidence” is based onTex. Fam. Code § 101.007.The instruction on burden of proof on an offset to a reimbursement claim is based on Tex. Fam. Code§ 3.402(e), which provides that the party seeking an offset has the burden of proof with regard to the offset.When to use. The foregoing instruction and questions may be used to submit the claim for reimbursement of one estate against another. Only the portions of the instruction that are relevant in the particularcase should be given.If no separate-property reimbursement is asserted. If no claim for reimbursement to a separateestate is asserted, the second and third sentences of the sixthfourth paragraph, relating to the clear-andconvincing-evidence standard, should be omitted.If no offset is asserted. If no offset to a claim for reimbursement is asserted, the seventhfifth paragraphshould be omitted.Characterization of property. Any instructions and questions necessary for establishing the characterization of relevant property should be given to the jury before thesethe above instructions and the questions concerning reimbursement are given. See PJC 202.1–202.15 regarding characterization of property.If characterization of property is in dispute, see PJC 204.3 (reimbursement—separate trials (comment)).Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

7Rewording questions for specific claims. The itemized listing given as an example in the questionsabove term Estate A should be reworded as appropriate replaced with the marital estate to submit theparticular claims that are in issue in the case. which a spouse is seeking reimbursement. The list can beworded to resolve claims of reimbursement in any of the following situations:SPOUSE A term Estate B should be replaced with the marital estate from which a spouse isseeking reimbursement to the community estate from SPOUSE B’s separate estate.1.2.SPOUSE B is seeking reimbursement to the community estate from SPOUSE A’s separate es-3.SPOUSE A is seeking reimbursement to his or her separate estate from the community estate.4.SPOUSE B is seeking reimbursement to his or her separate estate from the community estate.5.estate.SPOUSE A is seeking reimbursement to his or her separate estate from SPOUSE B’s separate6.estate.SPOUSE B is seeking reimbursement to his or her separate estate from SPOUSE A’s separatetate.AFTIn Question 1, only the estate or estates seeking reimbursement. The words debt, liability, or expenseshould be listed in the answer portionreplaced with words appropriate for the particular case. The phrases“the property of Estate A” and the “property of Estate B” should be replaced with words appropriate for theparticular case.In the conditioning instruction preceding Question 1 should be submitted only if there is a dispute overwhether the first estate conferred a benefit on the second estate.Question 2, omit the words the corresponding part of if 3 should be submitted only one estateif there isa dispute over whether Estate A received an offsetting benefit from Estate B.RQuestions 3 and 4 should be submitted only if Estate B seeks an offset against the reimbursement claimasserted by Estate A.DOffset for use and enjoyment of residence. Question 2 should not be submitted as toin a claim foroffset for use and enjoyment of a primary or secondary residence owned wholly or partly by a separateestate against contributions made by the community estate to the separate estate. Tex. Fam. Code§ 3.402(c).Marital dissolution cases filed or deaths occurring before September 1, 2009. Many claims forreimbursement in cases for dissolution of a marriage filed before September 1, 2009, or arising from thedeath of a spouse before that date, may be subject to statutory provisions differing from those reflected inthe instructions in PJC 204.1. Consult earlier editions of this book for appropriate instructions and questionsfor such suits.Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

8PJC 207.5Enforceability of Agreement to Convert SeparateProperty to Community PropertyPJC 207.5AEnforceability of Agreement to Convert SeparateProperty to Community Property—DefinitionAt any time, spouses may agree that all or part of the separate property ownedby either or both of them is converted to community property. Such an agreement must—be in writing, and2.be signed by both spouses, and3.identify the property being converted, andAFT1.4. specify that the property is being converted to the spouses’ community property.PJC 207.5BEnforceability of Agreement to Convert SeparateProperty to Community Property—VoluntarinessDRAn agreement to convert separate property to community property is unenforceable if the spouse against whom enforcement is sought proves that he orshe did not execute the agreement voluntarily.PJC 207.5CEnforceability of Agreement to Convert SeparateProperty to Community Property—DisclosureAn agreement to convert separate property to community property is unenforceable if the spouse against whom enforcement is sought proves that he orshe did not receive a fair and reasonable disclosure of the legal effect of converting the property to community property.Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

9PJC 207.5DEnforceability of Agreement to Convert SeparateProperty to Community Property—QuestionQUESTION 1Is the agreement to convert separate property to community property unenforceable?Answer “Yes” or “No.”Answer:AFTCOMMENTSource. The instruction in PJC 207.5A is based on Tex. Fam. Code §§ 4.202–.203. The instruction in PJC 207.5B is based on Tex. Fam. Code § 4.205(a)(1). Theinstruction in PJC 207.5C is based on Tex. Fam. Code § 4.205(a)(2).When to use. The foregoing submission should be used if the enforceability of anagreement to convert separate property to community property is in dispute. PJC207.5B should be used only if lack of voluntariness is in issue. Similarly, PJC 207.5Cshould be used only if lack of disclosure is in issue.DRSee PJC 207.1 (enforceability of property agreements—separate trials) for the Committee’s suggestion that the trial court consider a separate trial for enforceability issues.If the characterization of property is in issue in the same trial, the instructions in PJC202.1 (separate and community property) and PJC 202.10 (agreement to convert separate property to community property) should also be submitted. (In such a case, thefirst paragraph of PJC 202.10, which is identical to PJC 207.5A, should be omitted.)No instruction on presumption. No instruction should be given on the presumption, contained in Tex. Fam. Code § 4.205(b), that an agreement containing certainwording is rebuttably presumed to provide a fair and reasonable disclosure of the legaleffect of converting separate property to community property. The sole purpose of apresumption is to fix the burden of producing evidence. Sanders v. Davila, 593 S.W.2d127 (Tex. App.—Amarillo 1979, writ ref’d n.r.e.); McGuire v. Brown, 580 S.W.2d 425(Tex. App.—Austin 1979, writ ref’d n.r.e.). An instruction on the presumption mayalso constitute an impermissible comment on the weight of the evidence. Glover v.Henry, 749 S.W.2d 502 (Tex. App.—Eastland 1988, no writ).Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

10DRAFTOnly for Texas contracts. The foregoing submission is written for use only foragreements to convert separate property to community property that are clearly governed by Texas law. Agreements executed in another state may involve difficult issuesof conflict of laws that are beyond the scope of this book.Copyright State Bar of Texas, with all rights reserved. Permission to use these materials by or under the discretion of licensed attorneys in the practice of law is hereby granted.No other use is permitted that will infringe the copyright without the express written consent of the State Bar of Texas.

11PJC 215.6Rights of Parent Appointed Conservator“Conservator,” when that term is used alone, includes a sole managing conservator, a jointmanaging conservator, and a p

PJC 204.1 Reimbursement . Texas law recognizes three marital estates: the community property owned by the spouses to-gether and, which is referred to as the community estate; the separate property owned individually by one spouse and, which is referred to as a separate estate; and the separate property owned indi-