Transcription

EXAMINATION REPORTOFGENERAL STAR NATIONAL INSURANCE COMPANYAS OFDECEMBER 31, 2016

TABLE OF CONTENTSSALUTATION . 1SCOPE OF EXAMINATION. 1SUMMARY OF SIGNIFICANT FINDINGS . 3COMPANY HISTORY . 3GENERAL . 3CAPITALIZATION. 3DIVIDENDS . 4MANAGEMENT AND CONTROL . 4DIRECTORS . 4OFFICERS . 5CORPORATE RECORDS . 5INSURANCE HOLDING COMPANY SYSTEM . 6AFFILIATED AGREEMENTS . 8TERRITORY AND PLAN OF OPERATION . 10REINSURANCE. 11FINANCIAL STATEMENTS . 13STATEMENT OF ASSETS . 14STATEMENT OF LIABILITIES, CAPITAL AND SURPLUS . 15STATEMENT OF INCOME . 16RECONCILIATION OF CAPITAL AND SURPLUS . 17ANALYSIS OF CHANGES IN FINANCIAL STATEMENTS RESULTING FROM THEEXAMINATION . 18COMMENTS ON FINANCIAL STATEMENT ITEMS . 18SUBSEQUENT EVENTS . 20COMPLIANCE WITH PRIOR EXAMINATION RECOMMENDATIONS . 20SUMMARY OF RECOMMENDATIONS . 20CONCLUSION . 20ii

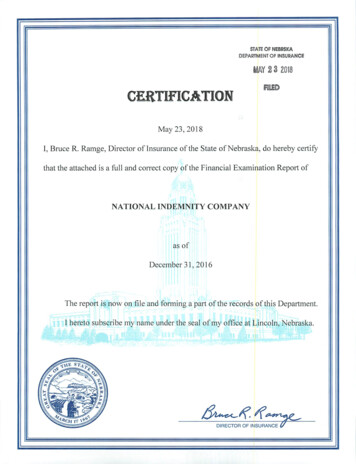

SALUTATIONMay 31, 2018Honorable Trinidad NavarroCommissioner of InsuranceDelaware Department of InsuranceRodney Building841 Silver Lake BoulevardDover, Delaware 19904Commissioner:In compliance with instructions and pursuant to statutory provisions contained in ExamAuthority No. 17.021, dated April 25, 2017, an examination has been made of the affairs,financial condition and management ofGENERAL STAR NATIONAL INSURANCE COMPANYwith its statutory home office located at 120 Long Ridge Road, Stamford, Connecticut 069021843. The report of examination thereon is respectfully submitted.SCOPE OF EXAMINATIONWe have performed our multi-state examination of General Star National InsuranceCompany (the “Company”).The last examination of the Company covered the period ofJanuary 1, 2010 through December 31, 2012. This examination of the Company covers theperiod of January 1, 2013 through December 31, 2016.Our examination was conductedconcurrently with our examination of the Company’s direct parent, General ReinsuranceCorporation (“GRC”), and affiliates General Star Indemnity Company (“GSIC”) and GenesisInsurance Company (“GIC”).We conducted our examination in accordance with the National Association of

General Star National Insurance CompanyInsurance Commissioners (“NAIC”) Financial Condition Examiners Handbook (“Handbook”).The NAIC Handbook requires that we plan and perform the examination to evaluate thefinancial condition, assess corporate governance, identify current and prospective risks of thecompany and evaluate system controls and procedures used to mitigate those risks.Anexamination also includes identifying and evaluating significant risks that could cause aninsurer’s surplus to be materially misstated both currently and prospectively.All accounts and activities of the Company were considered in accordance with the riskfocused examination process.This may include assessing significant estimates made bymanagement and evaluating management’s compliance with Statutory Accounting Principles.The examination does not attest to the fair presentation of the financial statements includedherein. If, during the course of the examination an adjustment is identified, the impact of suchadjustment will be documented separately following the Company’s financial statements.This examination report includes significant findings of fact, pursuant to the GeneralCorporation Laws of the State of Delaware as required by 18 Del. C. § 321, along with generalinformation about the insurer and its financial condition. There may be other items identifiedduring the examination that, due to their nature (e.g., subjective conclusions, proprietaryinformation, etc.), are not included within the examination report but separately communicatedto other regulators and/or the Company.During the course of the examination, consideration was given to work performed by theCompany’s external accounting firm, Deloitte & Touche LLP. Certain auditor work papers havebeen incorporated into the examination work papers.2

General Star National Insurance CompanySUMMARY OF SIGNIFICANT FINDINGSThere were no significant findings or material changes to the Company’s financialstatements as a result of the examination.COMPANY HISTORYGeneralThe Company was originally founded as The Eureka Fire & Marine Insurance Companyon September 10, 1864, under the laws of the State of Ohio. The Company’s name was changedto The Eureka-Security Fire and Marine Insurance Company effective February 14, 1922, and toThe Monarch Insurance Company of Ohio effective July 1, 1956, upon the merger with TheMonarch Fire Insurance Company. On November 14, 1985, the Company was acquired byGRC, a wholly owned subsidiary of General Re Corporation (“General Re”). At the time,General Re was a public company with shares listed on the New York Stock Exchange. TheCompany’s name was changed to General Star National Insurance Company effective May 30,1986. Effective December 21, 1998, General Re, including the Company, was acquired byBerkshire Hathaway Inc. (“Berkshire”). Effective October 1, 2012, the Company changed itsstatutory domicile from Ohio to Delaware.CapitalizationThe Company’s Certificate of Incorporation authorizes the issue of four thousand (4,000)shares of common stock with a 1,000 par value per share. As of December 31, 2016, allauthorized common shares were issued and outstanding totaling 4 million of capital stock. Alloutstanding common shares of the Company are owned by GRC. As of December 31, 2016, theCompany reported gross paid-in and contributed surplus of 60.1 million, which was unchangedover the examination period. The following chart summarizes the Company’s reported capital3

General Star National Insurance Companystock and gross paid-in and contributed surplus from the prior examination date to December 31,2016.Capital Stock 4,000,000 4,000,000December 31, 2012ActivityDecember 31, 2016Gross Paid-in &Contributed Surplus 60,107,585 60,107,585Total Capital Stock,Gross Paid-in &Contributed Surplus 64,107,585 64,107,585DividendsThe Company paid ordinary dividends in the amount of 19.0 million and 18.0 millionfor the calendar years ended 2014 and 2015, respectively. The dividends for each year wereapproved by the Delaware Department of Insurance (“Department”).MANAGEMENT AND CONTROLDirectorsPursuant to the General Corporation Laws of the State of Delaware, the Company’sCertificate of Incorporation and bylaws require the business and affairs of the Company must beexercised by, or under the authority of, its Board of Directors (“Board”). The Company’s bylawsmandate that the Board consist of not less than three members to be elected annually by thestockholders. The bylaws require the Board elect a Chairman of the Board (“Chairman”). TheBoard members duly appointed/elected and serving as of December 31, 2016, were as follows:NameBusiness AffiliationMartin George HacalaChairman, Chief Executive Officer and PresidentGeneral Star National Insurance CompanyGeneral Star Indemnity CompanyGenesis Insurance CompanyAndrew Randall GiffordGeneral CounselGeneral Re Corporation4

General Star National Insurance CompanyEdward Michael NosenzoNorth America Chief Financial OfficerGeneral Reinsurance CorporationOfficersOfficers were appointed in accordance with the Company’s bylaws during the periodunder examination. The bylaws require that the following officers be elected by the Board: aChairman, a President, a Treasurer and a Secretary. The Chairman and the President shall bedirectors, but the other officers need not be directors. The Board may appoint and assign dutiesto one or more Vice Presidents, one of whom may be designated as Executive Vice Presidentand one or more of whom may be designated Senior Vice President. The Board may alsoappoint and assign duties to a Comptroller. The Chief Executive Officer may appoint, assignduties to and terminate other officers at discretion. One person may hold more than one officeexcept the office of Chairman and Secretary or President and Secretary may not be held by thesame person. The primary officers of the Company serving as of December 31, 2016, were asfollows:NameTitleMartin George HacalaChairman, Chief Executive Officer andPresidentSolan Bernhard SchwabSecretaryEdward Michael NosenzoTreasurerCorporate RecordsThe recorded minutes of the stockholder and Board of Directors meetings were reviewedfor the period under examination.The minutes during the examination period adequatelydocumented the approval of the Company’s transactions and events, including the Board ofDirectors approval of investment transactions in accordance with 18 Del. C. § 1304.5

General Star National Insurance CompanyInsurance Holding Company SystemThe Company is a member of an insurance holding company system as defined under 18Del. C. §5001 of the Delaware Insurance Code. General Re indirectly owns 100% of theCompany. General Re is a wholly owned subsidiary of Berkshire Hathaway Inc. (“Berkshire”),which is a publicly traded conglomerate controlled by Warren E. Buffett. In addition to GeneralRe, Berkshire owns numerous other domestic and foreign-based insurance entities. Berkshire’sinsurance businesses provide insurance and reinsurance of property and casualty risks worldwideand also reinsure life, accident, and health risks worldwide. The following is an organizationalchart of General Re as of December 31, 2016:6

General Star National Insurance CompanyName of CorporationBerkshire Hathaway Inc.General Re CorporationGeneral Reinsurance CorporationElm Street CorporationGeneral Star Indemnity CompanyGeneral Star National Insurance CompanyGeneral Star Management CompanyGenesis Management and Insurance Services CorporationGenesis Insurance CompanyGRC Realty CorporationGeneral Reinsurance Australia LtdGeneral Re Compania de Reaseguros, S.A.General Reinsurance AGGeneral Reinsurance México S.A.Gen Re Support Services Mumbai Private LimitedGeneral Reinsurance Africa Ltd.General Reinsurance AG Escritóriode Representação no Brasil Ltda.General Reinsurance Life Australia Ltd.Gen Re Beirut s.a.l. offshoreGeneral Re Life CorporationIdealife Insurance CompanyRailsplitter Holdings CorporationNew England Asset Management, Inc.New England Asset Management LimitedUnited States Aviation Underwriters, IncorporatedCanadian Aviation Insurance Managers Ltd.Gen Re Intermediaries CorporationFaraday Holdings LimitedGRF Services LimitedFaraday Underwriting LimitedFaraday Capital LimitedGRD Holdings CorporationGeneral Re Financial Products CorporationGen Re Long Ridge, /Acquired ruguayGermanyMexicoIndiaSouth AfricaBrazilHolding CompanyHolding CompanyReinsurerReal l EstateReinsurerReinsurerReinsurerAgentService 010010010010010010099.99 (3)100 (1)99.99 eIrelandNew YorkCanadaNew neral Business Corp.ReinsurerInsurerHolding CompanyInvestment AdviserInvestment AdviserManagerManagerIntermediaryHolding CompanyGeneral Business Corp.ManagerLloyd's Corporate VehicleHolding CompanyFormer Swap DealerReal Estate100100 1994/1998200119902008(1) Warren E. Buffett owns 295,161 shares of Class A common stock and 79,345 shares of Class B common stock, which is approximately 32.28% of thevoting interest and 17.93% of the economic interest of Berkshire Hathaway Inc.(2) Percentages include any qualifying shares.(3) General Reinsurance AG owns 3,574,417 shares of General Reinsurance AG Escritório de Representação no Brasil Ltda. One share is owned by Luis E.C.Rayes, a Brazilian citizen.(4) General Reinsurance AG owns 99.99% of Gen Re Support Services Mumbai Private Limited. One share is owned by Suzie Foo (on behalf of GRAG).Through its directly and indirectly owned subsidiaries, General Re has global insurance,reinsurance and financial service operations with business activities in over forty-five citiesthroughout the world and provides property/casualty and life/health reinsurance coverageworldwide. General Re's principal reinsurance operations are based in North America andGermany, with other major operations in Asia, Australia, Europe (primarily London) and South7

General Star National Insurance CompanyAmerica.General Re's principal financial service operations are the New England AssetManagement, Inc. (“NEAM”) operations located in the United States (Farmington, Connecticut)and Dublin, Ireland. In January 2002, the Gen Re Financial Products Corporation business wasplaced in long-term runoff, and since that time approximately 99% of underlying contractsoriginated in active years have been terminated.Affiliated Agreements Domestic Management and Cost Sharing Agreementso Effective as of August 1, 2014, the subsidiaries of General Re entered into aMaster Services Agreement wherein the entities provide various services andreporting to each other. The Master Services Agreement superseded the variousindividual service agreements that existed between and among the entities. Feesand expenses are settled based on actual charges and/or allocated in accordancewith methods prescribed in the agreement. Tax Allocation Agreemento Effective for tax years beginning December 31, 2015, the Company entered anAmended and Restated Tax Allocation Agreement with General Re and Berkshireaffiliates. In accordance with the amended agreement, the Company joins with agroup of approximately eight hundred affiliated companies in the filing of aconsolidated federal income tax return by Berkshire.The consolidated taxliability is allocated among affiliates in the ratio that each affiliate’s separatereturn tax liability bears to the sum of the separate return tax liabilities of allaffiliates that are members of the consolidated group.8In addition, a

General Star National Insurance Companycomplementary method is used which results in reimbursement by profitableaffiliates to loss affiliates for tax benefits generated by loss affiliates. Cash Management Agreementso Effective as of January 1, 1989, and amended February 1, 2007, October 1, 2008and July 1, 2009, the Company entered a Joint Asset Agreement with several ofits affiliates. In accordance with the agreement, a pool fund was establishedwhereby each participant contributes cash in excess of general working capital inorder to improve the investment returns on the contributed funds.Eachparticipant jointly owns a percentage of the assets in the pool and the investmentincome derived from the pool. Reinvestments of the pool are made in proportionto each participant’s contributed assets, and each participant jointly shares thesame proportion in the profits or losses, if any, of the pool fund. The agreementappoints GRC as the manager of the pool fund, and any participant may cancel itsparticipation and liquidate or withdraw its contributions on notice to the manager.o Effective as of March 1, 1993, and amended February 1, 2007, October 1, 2008and July 1, 2009, the Company and several affiliates entered a Master LoanAgreement. In accordance with the agreement, an intercompany short-term loanprogram was established to reduce each participant’s level of short-terminvestments yet allow the participants to retain sufficient liquidity to pay currentobligations by borrowing funds as needed. GRC acts as the manager of the shortterm loan facility.It is authorized to make loans by affiliates to affiliatesrequesting such a loan. Material loans require the lending affiliate's specificapproval. Loans are repayable on demand but are anticipated to be outstanding9

General Star National Insurance Companyfor six months or less. Borrowing affiliates may repay the loans at any timewithout penalty. Investment Management Agreemento Effective as of January 1, 2009, and amended October 1, 2012, the Company andits affiliate, New England Asset Management, Inc. ("NEAM"), entered into anInvestment Management Agreement. In accordance with the agreement, NEAMperforms certain investment management services for the Company in return foran annual fee as specified in the agreement. Other – From time to time, the Company participates in various affiliated agreements andtransactions with entities owned or controlled by Berkshire. The principal agreements inplace during the examination period include affiliated reinsurance agreements wherebythe Company cedes insurance risk to Berkshire entities and affiliated investmentcontracts whereby the Company invests in lending agreements and/or securities issued byBerkshire entities.TERRITORY AND PLAN OF OPERATIONThe Company’s direct parent, GRC, is the principal subsidiary of General Re and directlyor indirectly owns the majority of General Re’s domestic and international insurance operatingentities.General Re operates in four principal business segments: North Americanproperty/casualty insurance and reinsurance, international property/casualty reinsurance, globallife/health reinsurance and financial services. GRC’s standalone operations constitute the NorthAmerican property/casualty reinsurance segment. The Company and its affiliates, GSIC andGIC, as standalone operations constitute the North American property/casualty insurancesegment of General Re.10

General Star National Insurance CompanyThe Company is licensed to write property and casualty insurance in all fifty states, theDistrict of Columbia and Puerto Rico. The Company provides commercial casualty insurance ona primary and excess basis, primarily for small and midsized commercial entities. Business iswritten through wholesale brokers and appointed agents. The Company’s business is producedthrough two operating divisions. The Brokerage Division writes business in several states andwithin the New York Free Trade Zone. The Delegated Division includes an entertainmentoriented book of business produced by a single producer and errors and omissions liabilityprograms for professionals produced by various Program Administrators. The Company retainsclaims authority for the program business, but delegates marketing, underwriting, pricing andpolicy issuance to Program Administrators.The Company receives administrative services from affiliates General Star ManagementCompany (“GSM”) and Genesis Management and Insurance Services Corporation (“GMIS”).GSM and GMIS are licensed insurance agencies that provide services to the Company inaccordance with an affiliated Master Services Agreement. Services provided may include:business services, business development, claims administration, underwriting services andenterprise risk management. The Company and its affiliates have branch offices in Atlanta,Georgia; Chicago, Illinois; Los Angeles, California; and New York, New York.REINSURANCEThe Company utilizes reinsurance agreements to reduce its exposure to large losses. TheCompany’s ceded reinsurance program is primarily concentrated with two Berkshire affiliates asfurther described as follows. Effective January 1, 2005, the Company (and affiliates: GRC,GSIC and GIC) entered into a loss portfolio transfer reinsurance contract (the “loss portfolio”)and a quota share reinsurance contract (the “quota share”) with two other Berkshire affiliates,11

General Star National Insurance CompanyNational Indemnity Company and Columbia Insurance Company. Both agreements cover themajority of the North American property/casualty business. The loss portfolio provides for a50% reinsurance cover on existing net losses as of December 31, 2004, subject to an overallaggregate limit of 11,155 million. The quota share provides 50% reinsurance cover on netlosses occurring after January 1, 2005.The following is a summary of the Company’s gross written premium, ceded premiumand net written premium for the year ended December 31, 2016:Direct premium writtenPremiumWritten andCeded 20,681,029% of WrittenPremium100.0%Ceded to affiliatesCeded to non-affiliatesTotal ceded10,332,300104,725 10,437,02550.0%0.5%50.5%Net written premium 10,244,00449.5%As of December 31, 2016, the Company’s ceded reinsurance in-force consists primarilyof affiliated reinsurance as demonstrated by the following summary of reported credits forreinsurance:(In Thousands)AffiliatedReinsurers 1,95713,28371,4794,994 91,713Paid losses and loss adjustment expensesKnown case loss and loss adjustment expensesIncurred but not reportedUnearned premiums and Contingent commissionsTotal Reinsurance Recoverables12UnaffiliatedReinsurers 135321663 633Total as of12/31/2016 1,95813,63671,6955,057 92,346

General Star National Insurance CompanyFINANCIAL STATEMENTSThe following financial statements are based on the statutory financial statements filed bythe Company with the Department and present the financial condition of the Company for theperiod ending December 31, 2016: Statement of AssetsStatement of Liabilities, Capital and SurplusStatement of IncomeReconciliation of Capital and Surplus13

General Star National Insurance CompanyStatement of AssetsAs of December 31, 2016BondsPreferred stocksCommon stocksCash - Schedule E - Part 1Cash equivalent - Schedule E - Part 2Short-term investments - Schedule DAInvestment income due and accruedUncollected premiums and agents' balancesDeferred premiums, agents' balances and installmentsbooked but deferred and not yet dueAmounts recoverable from reinsurersAggregate write-ins for other than invested assetsTotal assetsLedger Assets 649,539562,9121,873,702Assets NotAdmitted 22,245Net AdmittedAssets 18232,7941,957,685355,571 14234,141,369 39,663 234,101,706Notes1211

General Star National Insurance CompanyStatement of Liabilities, Capital and SurplusAs of December 31, 2016LossesLoss adjustment expensesCommissions payable, contingent commissions and other similar chargesCurrent federal and foreign income taxesNet deferred tax liabilityUnearned premiumsCeded reinsurance premiums payableAmounts withheld or retained by company for account of othersRemittances and items not allocatedPayable to parent, subsidiaries and affiliatesPayable for securitiesAggregate write-ins for liabilities ,07314,8386,374774,4841,57679,785Total liabilities 55,985,002Common capital stockGross paid in and contributed surplusUnassigned funds (surplus) 4,000,00060,107,585114,009,119Total capital and surplus 178,116,704Total liabilities, capital and surplus 234,101,70615Notes33

General Star National Insurance CompanyStatement of IncomeFor the Year Ended December 31, 2016UNDERWRITING INCOMEPremiums earned 10,138,971Losses incurredLoss adjustment expenses incurredOther underwriting expenses incurredTotal underwriting deductions Net underwriting gain (loss)INVESTMENT INCOMENet investment incomeNet realized capital gains (losses)Total net investment gain (loss) 1,480,4481,234,5214,662,4527,377,421 2,761,550 2,752,430(78)2,752,352 OTHER INCOMENet gain (loss) from agents' or premium balances charged offAggregate write-ins for miscellaneous incomeTotal other income (3,496)4,148652Net gain from operations before federal income tax 5,514,554 Federal and foreign income taxes incurred (benefit)Net income (loss)1,189,254 164,325,300

General Star National Insurance CompanyReconciliation of Capital and Surplusfor the Period from the Prior ExaminationDecember 31, 2012 to December 31, 2016Balance at December 31, 20122013 Net income2013 Changes in unassigned funds - other2013 Dividends to stockholdersBalance at December 31, 20132014 Net income2014 Changes in unassigned funds - other2014 Dividends to stockholdersBalance at December 31, 20142015 Net income2015 Changes in unassigned funds - other2015 Dividends to stockholdersBalance at December 31, 20152016 Net income2016 Changes in unassigned funds - other2016 Dividends to stockholdersBalance at December 31, 2016(1)(1)(1)(1)CommonCapitalStock 4,000,000 4,000,000 4,000,000 4,000,000 4,000,000Gross Paid-in &ContributedSurplus 60,107,585 60,107,585 60,107,585 60,107,585 60,107,585Unassigned FundsSurplus 117,082,39313,238,9303,616,773 133,938,0962,341,6182,901,262(19,000,000) 120,180,9761,461,075(1,330,557)(18,000,000) 102,311,4944,325,3007,372,325 114,009,119 8,116,704(1): Changes in unassigned funds - other for each year include: change in net unrealized capital gain/loss, change innet deferred income tax and changes in non-admitted assets.17

General Star National Insurance CompanyANALYSIS OF CHANGES IN FINANCIAL STATEMENTS RESULTING FROM THEEXAMINATIONThere were no adjustments to the Company’s financial statements as a result of theexamination.COMMENTS ON FINANCIAL STATEMENT ITEMSNote 1:Schedule D – Part 1 - BondsSchedule DA – Part 1 – Short-term InvestmentsSchedule E – Part 2 – Cash equivalents 16,598,936135,649,53913,663,481As of December 31, 2016, total bonds were comprised of the following based on NAICAnnual Statement classification:Book ValueSchedule DA - Short-term Investments:United States - Treasury BillsOtherSub-total Schedule DASchedule E - Part 2 - Cash Equivalents:General Re - Affiliated Cash Pool* Schedule D - Bonds:U.S. Government Bonds - Issuer ObligationsIndustrial and Miscellaneous - Issuer ObligationsU.S. Special Revenue & Assessment - Issuer ObligationsResidential Mortgage Backed SecuritiesU.S. Territory - Issuer ObligationsSub-total Schedule D - BondsTotal Bonds*: Conists primarily of United States Treasury Bills18% of Total BondBook Value 134,921,426728,113135,649,53981.3%0.44%81.8% 13,663,4818.2% 2.9%3.0%3.8%0.1%0.2%10.0% 165,911,956100%

General Star National Insurance CompanyOf the Company’s total bond holdings, all were categorized as Class 1 with respect toNAIC credit quality standards. As of December 31, 2016, bond maturities were structured with91.4%, 5.5%, and 3.1% maturing in less than one year, one to five years and five to ten years,respectively. Of the total bond holdings, all were publicly traded securities.Note 2:Schedule D – Part 2 – Section 2 – Common Stock 51,950,376As of December 31, 2016, the Company reported total unaffiliated common stockinvestments on Schedule D – Part 2 – Section 2 with book/fair market values in the amount of 52.0 million and actual cost of 23.2 million. The following as a summary of the Company’scommon stock holdings as of December 31, 2016.Book/Fair 83 51,950,376Wells Fargo & CompanyBank of America Corp - WarrantGoldman Sachs Group Inc.Apple, IncGeneral Electric CoTotal Common Stocks Note: 3LossesLoss Adjustment ExpenseActual Cost5,976,5022,800,0008,589,3254,950,864862,917 23,179,608 28,998,1678,805,995INS Consultants, Inc. (“Consulting Actuary”) assisted in review of the inherent risks,management oversight and other mitigating controls over the Company’s actuar

General Star National Insurance Company 6 Insurance Holding Company System The Company is a member of an insurance holding company system as defined under 18 Del. C. §5001 of the Delaware Insurance Code. General Re indirectly owns 100% of the Company. General Re is a wholly owned subsidiary of Berkshire Hathaway Inc. ("Berkshire"),