Transcription

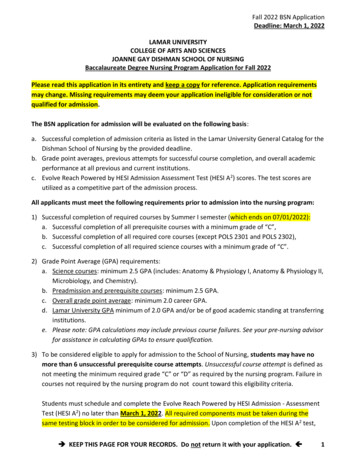

LAMAR INSTITUTE OF TECHNOLOGYA Member of the Texas State University SystemANNUAL FINANCIAL REPORTFISCAL YEAR 2009(September 1, 200S-August 31, 2009)

.MARINSTITUTE OFTECHNOLOGYAV,(e '·e"Je'"; ." F",",,,e/Cp"',,,,O'"November 17,2009Dr. Paul SzuchPresidentLamar Institute of TechnologyBeaumont, TX 77710-0043Dear Dr. Szuch,Submitted herein is the Annual Financial Report of Lamar Instimte of Technology for the fiscal yearended August 31, 2009, in compliance with TEX,GOV'T CODE ANN #2101.011 and in accordancewith the requiremenls established by Ihe Comptroller of Public Accounts.Due to significant changes related to Governmental Accounting Standards Board Statement No. 34,Ba 'ic Financial Slatemenls - and Management 's Di 'cussion and Analysis -for Slate and LocalGovernments, the Comptroller of Public Accounts does not require the accompanying annual financialreport to be in compliance with GAAP.The Annual Financial Report will be audited by the State Auditor as part of the audit of the StatewideAnnual Financial Report; therefore an opinion has not been expressed on the statements and relatedintormation contained in this report.If you have any questions, please contact Jonathan Wolfe at 409 880-7633.JonWolfe,Vice President for Finance and OperationsLamar Institute of TechnologyP.O. Box 10043. Beaumont, TexCl.77710· (409f BBO·7633 fAX (409) 880·2310· 1·800·950·6989A M",nb., ·ofne T.,,,, Store Un""rI' 'Systo",

THE TEXAS STATE UNIVERSITY SYSTEMThQrn3S J. Rusk BUilding200 East 10th Street, Suite 600Austin, Texae 78701·2407Telephone: 512-463·1608ORGANIZATIONAL DATA AS OF AUGUST 31,2009BOARD OF REGENTSOFFICERSRon Staehle)'ChainnanVice ChairmanTrisha S. PollardMEMBERSCity (Texas)Charlie AmatoTerm ExpiresSan AntonioBryan/College StatiOnHoustonHorseshoe BayRon BlatchleyKevin J. LillyRon MitchellDavid MontegneTrisha S. PollardMichael TruncaleGrog WilkinsonDonrta N. aumontBellaireBeaumontDallasArlingtonStudent Regent - San MarcosWilliam DMINISTRATIVE OFFICERSSYSTEM OFFICECharles R. MatthewsChancellorDr. Fernando C. GomezDr. Roland K. SmithVice Chancellor and General CounselVice Chancellor for FinenceDr. Kenneth R. CraycraftVice Chancellor for Academic Affain!LAMAR INSTITUTE OF TECHNOLOGYDr. Paul J. SzuchPresidentDr. Betty ReynardVice President Academic Affail'9Jonathan C. WolfeVice President ror Finance and Operations

UNAUDITEDInstitution NameLamar Institute of TechnologyStudent Enrollment DataFor the Year Ended August 31, 2009NUMBER OF STUDENTS BY SEMESTERSUMMER TERM 2009TYPE OF STUDENTTexas ResidentsOut of SIBle (Classined as Residents)Out or SIBleFALL 2008SPRING n or D,sabledConcurrent Enrollmenl ,,",,J,Fosler Children of the StaleGood Neiehbor0High School Honor ScholarshipsHazelwood ActSenior CitizensCommission for the Blind/DeafFireman Exempt",ThesIs OnlyStudent Service FeesNursingFaculty/StarrTeaching A!;sislBnll;Competetive ScholarshipsMilila'Y PersoooeloLouisiana Adjacent CountyMexico PilotNational Student Exchange ProgramNew Mexico Adjacent CountyTexas Tomorrow Wal erAdopted StudentsMilila'Y DependentPaseTANFH.B,877Distance Learnin Family & Consumer Science Alliance AgreemenlTotals2,8852,671'"Enrollment Data (Fall Semester)SEMESTERSTUDENTSHOURSFiscal Year20092,88531,316."

Texas State Uni.ersity SystemLamar Institute of TechnologyStatement of Net AssetsAugust 31, 2009TotalASSETSCurrent Assets:Cash and Cash Equi.alentsCash on HandCash in BankCash in Transit/Reimbursement from TreasuryCash in State TreasuryCash Equi.alentsSecurities Lending CollateralShort Term In.estmentsRestricted:Cash and Cash Equi.alentsCash on HandCash in BankCash in Transit/Reimbursement from TreasuryCash in State TreasuryCash Equi alentsShort Term In estmentsLegislati.e AppropriationsIn.estmentsRecei.ables:FederalOther Intergo.ernmentalInterest and Di idendsAccounts Recei ableGiftsInvestment TradesOtherInterfund ReceivablesDue From Other AgenciesConsumable InventoriesMerchandise InventoriesDeferred ChargesLoans and ContractsOther Current AssetsTotal Current Assets2,000.002,623,886.58863,975.51 (schedule 3)1,926,809.9350,302.36(schedule 3)7,615,272636,217,394.1419,299,641.151

Texas State University SystemLamar Institute of TechnologyStatement of Net AssetsAugust 31, 2009TotalNon-current Assets:Restricted:Cash and Cash EquivalentsCash on HandCash in BankCash in TransiUReimbursement from TreasuryCash in State TreasuryCash EquivalentsShort Term InvestmentsReceivablesInvestmentsLoans and ContractsOther AssetsLoans and ContractsInvestmentsInterfund ReceivablesCapital Assets:Non-Depreciable:Land and Land ImprovementsInfrastructureConstruction in ProgressOther Capital AssetsDepreciable:Buildings and Building ImprovementsLess Accumulated DepreciationInfrastructureLess Accumulated DepreciationFacilities and Other ImprovementsLess Accumulated DepreciationFurniture and EquipmentLess Accumulated DepreciationVehicles, Boals, and AircraftLess Accumulated DepreciationOther Capital AssetsLess Accumulated DepreciationOther Non-Current 85.57Total Non-Current Assets29,051,926.72Total Assets2

Texas State Uni. . ersity SystemLamar Institute of TechnologyStatement of Net AssetsAugust 31, 2009TotalLIABILITIESCurrent Liabilities:Payables:AccountsIn. . estment TradesFederalOther Intergo. . ernmentalPayrollOtherInterfund PayableDue to Other AgenciesDeferred Re. . enuesNotes and Loans PayableRe. . enue Bonds PayableGeneral Obligation Bonds PayableClaims and JudgmentsEmployees' Compensable Lea. . eCapital Lease Obligationsliabilities Payable from Restricted AssetsObligations/Re. . erse Purchase AgreementsObligations Under Securities LendingFunds Held for OthersOther Current 44,217,487,470,368.28Total CurrentliabililiesNon-Current liabilities:Interfund PayablesNotes and Loans PayableRe. . enue Bonds PayableGeneral Obligation Bonds PayableClaims and JudgmentsEmployees' Compensable Lea. . eCapital Lease ObligationsOther Non-Current liabilities250,565.72250,565.72Total Non-Current Liabilities7,720,934.00Total LiabilitiesNET ASSETSIn. . ested in Capital Assets, Net of Related DebtRestricted ForEducationDebt Retirement11,441,357.013

Texas State University SystemLamar Institute of TechnologyStatement of Net AssetsAugust31,2009TotalCapital ProjectsEmployee BenefitFunds Held As Permanent ted9,889,63571Total Net Assets21,330,992.724

Texas State University SystemLamar Institute of TechnologyStatement of Revenues, Expenses, and Changes In Net AssetsFor the Fiscal Year Ended August 31, 2009TotalOPERATING REVENUESSales of Goods and ServicesTuition and Fees (PR-Chgs for Services)11,822,602 81Tuilion and Fees - Pledged (PR-Chgs for Services)Discounts and Allowances-1,321.964.02Hospitals (PR-ChI;lS for Services)Hospitels - Pledged (PR-Chgs for Services)Discounts and AllowancesProfessional Fees (PR-Chgs for Services)Professional Fees - Pledged (PR-Chgs for Services)Discounts and AllowancesAuxiliary Enterprises (PR-Chgs for Services)Auxiliary Enterprises - Pledged (PR-Chgs for Services)166,774.92Discounts and AllowancesOther Sales of Goods and ServicesOther Sales of Goods and Services - PledgedDiscounts and AllowancesPremium Revenue (PR-Chgs for Services)Interest and Investment Income (PR-Chgs for Services)Interest and Investment Income (GR)Net Increase (Decreese) Feir Market Value (PR-OP Grants/Contributions)Net Increase (Decrease) Fair Mar1l.et Value (GR)Federal Revenue-Operating (PR-OP Grants/Contributiorls)Federal Pass-Through Revenue (PR-OP Grants/Contributions)243.46213887,64726State Grant Revenue (PR-OP Grants/Conlributions)State Grant Pass-Through Revenue (PR-OP Grants/Contributions)225,549.00Other Grants and Contracts (PR-OP Granis/Contfibutions)Land Income (PR-Chgs for Services)Contributions to Retirement Systems (PR-Chgs for Services)Other Operating Revenues (PR-Chgs for Services)Other Operating Revenues (GR)12.024,072.10Total Operating RevenuesOPERATING EXPENSESInstructionResearchHospitals and ClinicsPublic 940,422,33Academic SupportSludent Serviceslnstltulionel SupportOperation and Maintenance of PlantScholar'6hip and FellowshipsAuxiliary Enterprise ExpendituresDepreciation and AmortizationTotal Operating Expenses27,314,853.47Operating Income (Loss)-15,290,781.37NONOPERATING REVENUES (EXPENSES):Legislative Revenue (GR)Additional Appropriations (GR)510,870,671 001,696,625.26

Texas State Universily SystemLamar Institute of TechnologyStatement of Revenues, Expenses, and Changes in Net AssetsFor the Fiscal Year Ended August 31. 2009TotalFederal Revenue (PR-OP Grants/Contributions)3,191,404.00Gifts (PR·OP Grants/Contributions)292,465.40Investment Income (Expense) (PR-OP Grants/Contributions)69,009,98Investment Income (Expense) (GR)Loan Premium/Fees Securities Lending (PR-OP Grents/Contributions)Investing Activities ExpensesInterest Expenses and Fiscal ChargesBorrower Rebates and Agent FeesGain (Loss) on Sale of Capital Assets (GR)Netlncreese (Decrease) in F air Value of Investments (PR-OP Grants/Contributions)Net Increase (Decrease) in Fair Value of Investments (GR)Settlement of Claims (PR-Chgs for Services)900,000.00Settlement of Claims (GR)Other Nonoperating Revenues (Expenses) (PR-Chgs for Services)-156,135.71Other Nonoperating Revenues (Expenses) {GR}16,864,039.93Tolal Nonoperating Revenues (Expenses)Income (Loss) before Other Revenues. Expenses,1,573,258,56Gains/Losses and TransfersOTHER REVENUES, EXPENSES, GAINS/LOSSESAND TRANSFERSCapital Contributions1,825,332,00Capital Appropriations (HEAF)Federal Grant - Capital Grant ContributionsContributions to Permanent and Term EndowmentsSpecial ItemsExtraordinary Items1,429,695.57Increase NA Interagency Transfer Capital AssetsDecrease NA Interegency Transfer Capital AssetsTransfer InTransfer Out-278,508.38Legislative Transfer In-544,623.42Legislative Transfer Out-320.00LapsesTotal Other Revenues, Expenses, Gains/Lossesand Transrers2,431,575,77CHANGE IN NET ASSETS4,004,834,33Net Assets, September 1 2008RestatementsNet Assets. September 1, 2008, as Restated17,326,158.39NET ASSETS, August 31 ,200921,330,992,726

Texas State University SystemLamar Institute of TechnologyMatrix or Operating Expenses Reported by FunctionFor the Fiscal Year Ended August 31 ,2009Operallng ExpenseaInstructionResearchHospitala cesInstiluuonalSupponOperalk:ln andMaintenanceof ryEnterpnses'"'Amortizallon' To(al ExpensesCOil of Goods SoldSalanes and WagesPayrnll Related CoslsProfeSSional Feea and .7414,080.6644,023.50202,087.37315,666,60663,117 20343,74765115,861.69 5583,8 .6613,619.6760,434 5981,829,5771,718.3619,527.976,3S l.58Federal Gran! Pass--Through ExpenseState Gram Pass-Thrnugh E.enseTravelMalenals and SupphesCommunications and lIlilrtiesRepair! and MalrrlenanceRentals and LeasesPrinting and .25DepreCIation end Amortizauon' O,422.33Bad Deb! ExpenseImeres!Schor.lrshlps2,950,878,47Claims and JudgmentsOtherDpera ngExpensesTotal Operallng Expenses1,693,901,6611 793 .14446,562,0580013667454263.121 824,726993465416613,065,469,95 Oepreciallon and Amortlzatlon may be allocated 10 lhe vanous functIons or shown entirely in lhe Depreclatlon and Amortlzalion CCllumn1,655,061.563,072,708,041 ,8 ,297.15 000180,129.431,406,875,75l,659,248,S l1,764,850,80114,643 0995,8Bl 314,85347

Texas State University SystemLamar Instltule of TechnologyStatement of Cash FlowsForthe Fiscal Year Ended August 31, 2009TotalCash Flow, trom Operating ActivitiesReceipts trom CustomersProceeds from Tuition and Fees6,997,967,16Proceeds from Research Granls and ContractsProceeds from GiftsProceeds from Loan ProgramsProceeds from AuxiliariesProceeds from Other ymenls 10 Suppliers for Goods and ServicesPayments to Employees for SalariesPayments to Employees lor BenefitsPaymenls for Loans Provided-2,990,878.47Paymenls for Other Expenses-15,583,864.54Net Cash Provided by Operating ActivitiesCash Flows from Noncapital Financing ActivitiesProceeds from Debt IssuanceProceeds from State Appropriations14,357,139.90Proceeds from GiftsProceeds from Endo.mentsProceeds 01 Transfers from Other FundsProceeds from Grant Receipts292,465.40Proceeds from Advances from Other FUrldsProceeds tram Loan ProgramsProceeds from Other Financing Activities900,00000Proceeds tram Conlribuled CapitalPaymerlts of Principal on Debt IssuancePayments at InlereslPayments of O her Costs 01 Debt IssuancePayments for Transfers to other FundsPaymerlts for Grant DisbursementsPayments for Mvances 10 Olher Funds-156,135.71Payments lor Other Uses15,393,469.59Net Cesh Provided by Noncepilal Firlarldng ActiVitiesCash Flows Irom Capital and Related Financing ActiVitiesProceeds Irom the Sale of Capital AssetsProceedslrom DebllssuanceProceeds Irom State Grants arld COrltractsProceedsProceedsProceedsProceedsfrom Federal Grants and Contractstram GiftSfrom Other FlnanclnQ Actlv,hesfrom Capital COl1tributions-60,625001,429,695,57Proceeds from Advances from Olher FundsPayments lor Addiliol1s to Capital AssetsPayments of Principal on Debt·1 ,952,332,66Payments lor Capital LeasePayments of Inlerest on Debllssuance-762,826,80Payments of Other Costs of Debt IssuanceNet Cash Provided by Capitai and Relaled Financing Achvilles-1,346,068,69Cash Flows Irom Investing ActivitiesProceeds from Sales of InvestmenlsProceeds from Inleresllncome69,009,98Proceeds Irom InveslmenllncomeProceeds from Principal Payments on LoansPayments lo Acquire Investments8

Texas State University SystemLamar Institute of TechnologyStatement of Cash FlowsFor the Fiscal 'l'ear Ended August 31, 2009TotalNel Cash Provided by Investing AclivlUes69,009.98Net Increase (Decrease) in Cash aOO Cash Equivalents-1,467,473,86Cash and Cash Equivalents, September 1, 2008Changes in Accounting PrinCipalChanges in Reporting EntityRestatements to Beginning Cash and Cash EqUivalents5,245,376.80Cash and Cash Equivalents, September 1, 2008 - Restated5,245,376.80Cash and Cash Equivalents, August 31, 20093,777,902.94Reconciliation of Operating Income toNet Cash Provided by Operating ActivitiesOperating Income (Loss)-15,290,781.37Adjustments to Reconcile Operating Income (Loss)10 Net Cash Provided by Operating AclivitiesAmortization and Depreciation940,422,33Bad Debt ExpenseOperaling Income (Loss) and Cash Flow Categories:Classification DifferencesChanges in Assets and Liabilities,(Increase) Decrease In Receivables-2,406,522,65(Increase) Decrease in Due from Other Funds(Increase) Decrease In Inventories(Increase) Decrease in Prepaid Expenses(Increase) Decrease In Notes Receivable-423,656,97(Increase) Decrease In Loans & Contracts(Increase) Decrease in other Assets(Increase) Decrease in Stale Appropriations652,764.4819,64000Increase (Decrease) in PayablesIncrease (Decrease) in DepoSitsIncrease (Decrease)Increase (Decrease)Increase (Decrease)Increase (Decrease)Increase (Dacreasa)inIninininDue 10 Other FundsDeferred IncomeCompensated Absence LiabilityBenefits Payableother Liabilities846,5970977,672.55-293,08317Tolal Mjustments-15,583.884.54Net Cash ProVided by Operating ActiVitiesNon Cash TransactionsDonation of Capital AsselsNet Change In Fair Value of InveslmenlsBorrowing Under Capllal Lease PurchaseOther9

LAMAR INSTITUTE OF TECHNOLOGYNOTES TO THE FINANCIAL STATEMENTSAugust 31, 2009INOTE 1: Summary of Significant Accounting PoliciesEntityLamar Institute of Technology is considered an Institution of Higher Education of theState of Texas, and its financial records comply with state statutes and regulations. Thisincludes compliance with the Texas Comptroller of Public Accounts' ReportingRequirementsfor Annual Financial Reports oiState Agencies and Universities.Due to the statewide requirements embedded in Governmental Accounting StandardsBoard Statement No. 34, Basic Financial Statements - and Management's Discussion andAnalysis - for Stale and Local Government, the Comptroller of Public Accounts does notrequire the accompanying annual financial report (0 comply with all the requirements inthis statement. The financial report will be considered for audit by the State Auditor aspart of the audit of the State of Texas Comprehensive Annual Financial Report; thcrefore,an opinion has not been expressed on the financial statements and relatcd infonnationcontained in this report.Fund StructureThe accompanying financial statements arc presented on the basis of funds. A fund isconsidered a separate accounting entity. The fund designation for institutions of highereducation is a Business Type Activity within the Proprietary Fund Type.Proprietary FundsBusiness Type ActivityBusiness type funds arc used for activities that are financed through thc chargingof fees and sales for goods or services to the ultimate user. Institutions of highereducation are required to report their financial activities as busincss type; because,the predominance of their funding comes through charges to students, sales ofgoods and services, and grant revenues.Component UnitsThe fund types of the individual discrete componcnt units are available from thecomponent units' separately issued financial statements. Additional infonnationabout component unit.c; can be found in Note 18.10

UnauditedBasis of AccountingThe basis of aceounting determines when revenues and expenditures or expenses arerecognized in the accounts reported in the financial statements. The accounting andfinancial reporting treatment applied to a fund is determined by its measurementfocus.Business activIty type funds (proprietary funds) are accounted for using the fullaccrual basis of accounting. Under the accrual basis of accouming, revenues arerecognized when earned and expenses arc recognized at the time liabilities arcincurred. Proprietary funds distinguish operating from non-operating items. Operatingrevenues and expenses result from providing services or producing and deliveringgoods in eonneetion with the proprietary funds principal ongoing operations.Operating expenses for the proprietary funds include the cost of sales and services,administrative expenses, and depreciation on eapital assets.Budget and Budgetary AccountingThe budget is prepared biennially and represents appropnatlOns authorized by theLegislature and approved by the Governor (the General Appropriations Act).Unencumbered appropriations are generally subject to lapse 60 days after the end ofthe fiscal year for which they were appropriated.Assets. Liabilities. and Fund BalanceslNet AssetsASSETSCash and Cash EquivalentsShort-term highly liquid investments with an original maturity of three months orless are considered cash equivalents.Securities Lending CollateralInvestments are stated at fair value in all funds except pension trust funds inaccordanec with GASB Statement 31, Accounting and Financial Reporting/orCertain Investments and/or External Investment Pools. For pension trust funds,investments are required to be reported at fair value using the accrual basis ofaccounting in accordance with GASB Statement 25, Financial Reporting/orDefined Benefit Pension Plans and Note Disclosures/or Defined ContributionPlans.Securities lent are reported as assets on the balance sheet. The costs of securitieslending transactions arc reported as expenditures or expenses in the OperatingStatement. These costs arc reported at gross.11

UnauditedRestrieted AssetsRestrieted assets include momes or other resources restricted by legal orcontractual requirements. These assels include proceeds of enterprise fundgeneral obligation and revenue bonds and revenues set aside for statutory orcontractual requirements. Assets held in reserve for guaranteed student loandefaults are also included.Inventories and Prepaid ItemsInventories include both merchandise inventories on hand for sale andconsumable inventories. Inventories are valued at cost, generally utilizing thelast-in, first-out method. The eonsumption method of accounting is used toaccount for inventories and prepaid items that appear in the proprietary fundtypes. The east of these items is expensed when the items are consumed.Capital AssetsAssets with an initial, individual cost of more than 5,000 and an estimated usefullife in exeess of one year should be capitalized. These assets are capitalizcd ateast or, if not purchased, at appraised fair value as of the datc of acquisition.Depreciation is rcported on all "exhaustible" assets. "Inexhaustible" assets such asworks of art and historical treasures are not depreciated. Road and highwayinfrastructure is reported on the modified basis. Assets are depreciated over theestimated useful life of the asset using the straight -line method.All capital assets acquired hy proprietary funds or trust funds are reported at costor estimated historical I,;ost if actual historical is not available. Donated assets arereported at fair value on the acquisition date. Depreciation is charged tooperations over the estimated useful life of each asset using the straight-linemethod.Other Receivables - Current and NoncurrentThe disaggregation of other receivables as reported in the finaneial statements isshown in Note 24, "Disaggregation of Reeeivables and Payables Balances."Other receivables include year-end accruals not ineluded in any other receivablecategory. This account ean appear in govenunental and proprietary fund types.12

UnauditedLIABILITIESAccounts PayableAccounts Payable represents the liability for the value of assets or servicesreceived at the ba[ancl;: sheet date for which payment is pending.Other Parables - Current and NoncurrentOther payables are the accrual at year -end of expenditure transactions notincluded in any of the other payable deseriptions. The disaggregation of otherpayables as reported in the financial statements is shown in Note 24,"Disaggregation of Reeeivables and Payables Balanees."Employees' Compensable Leave BalancesEmployees' Compensable Leave Balances represent the liability that becomes"due" upon the occurrence of relevant events such as resignations,retirements, and uses of leave balances by covered employees. Liabilities arereported separately as either current or noncurrent in the statement of netassets. These obligations are normally paid from the same funding sourcefrom which each employee's salary or wage compensation was paid.Capital Lease ObligationsCapital lease obligations represent the liability for future lease payments undercapital lease contracts contingent upon the appropriation of funding by theLegislature. Liabilities are reported separately as either current or noncurrentin the statement of net assets.Bonds Pavable-General Obligation BondsGeneral obligation bonds are accounted for in the long-term liabilitiesadjustment column for governmental activities and in proprietary funds forbusiness-type activities. These payables are reported as long-term liabilities(current for amounts due within one year) and long-term liabilities (noncurrentfor amounts due thereafter in the statement of net assets/balance). Thc bondsare reported at par, net of unamortized premiums, discounts, issuance costsand gains/(losses) on bond refunding activities.For governmental activities, bond proeeeds are accounted for (when received)as an "other financing source" in the governmental fund reeeiving theproceeds. Payment of prineipal and interest is an expenditure recorded in thedebt service fund. All bond transactions and balanees for business-typeactivities are reported in proprietary funds.Bonds Payable-Revenue BondsRevenue bonds arc generally accounted for in the proprietary funds. Thebonds payable arc reported at par less unamortized discount or plusunamortized premium. Interest expense is reported on the accrual basis, with13

Unauditedamortization of diseount or premium. Payables are reported separately aseither current or noncurrent in the statement of net assets.FUND BALANCEINET ASSETSThe difference between fund assets and liabilities is "Net Assets" on thegovernment-wide, proprietary and fiduciary fund statements, and the "FundBalance" is the differenee between fund assets and liabilities on the governmentalfund statements.Resenration of Fund BalanceFund Balances for governmental funds are classified as either reserved orunreserved in the fund financial statements. Reservations are legally restricted toa specific future use or not available for expenditures.Resenred for EncumbrancesThis represents commitments of the value of contracts av.'arded or assets orderedprior to year·end but not received as of that date. Encumbrances are not includedwith expenditures or liabilities. They represent current resources designated forspecific expenditures in subsequent operating periods.Resenre for Consumable InveuloriesThis represents the amount of supplies, postage and prepaid assets to be used inthe next fiscal year.UnresenredlUndesignaledThis represents the unappropriated balance atyear cnd.Invested in Capital Assets, Net of Related DebtInvested in capital assets, net of related debt consists of capital assets, net ofaccumulated depreciation and reduced by outstanding balances for bond, notes,and other deht that are attributed to the acquisition, construction, or improvementof those assets.Restrided Net AssetsRestricted net assets result when constraints placed on net asset use are eitherexternally imposed by creditors, grantors, contributors, and the like, or imposedby law through constitutional provisions or enabling legislation.Unrestrided Net AssetsUnrestricted net assets consist of net assets, which do not meet the definition ofthe two preceding categories. Unrestricted net assets often have constraints onresources, which are imposed by management, but can be removed or modified.14

UnauditedINTERFUND ACTIVITY AND TRANSACTIONSLamar Institute of Technology has the following types of transactions bctweenfunds:(I) Transfers:Legally required transfers that are reported when incurred as'Transfers In" by the recipient fund and as "Transfers Out" by the disbursingfund.(2) Reimbursements: Reimbursements are repayments from funds responsiblefor expenditurcs or expenses to funds that made the actual payment.Reimbursements of expenditures made by one fund for another that are recordedas expenditures in the reimbursing fund and as a rcduction of cxpenditurcs in thereimbursed fund. Reimbursements are not displayed in the financial statements.(3) Interfund receivables and payables: Interfund loans are reported asinterfund receivables and payables. If repayment is due during the current year orsoon thereafter it is classified as "Current." Balances for repayment due in two(or more) years are classified as "noncurrent."(4) Inlerfund Sales and Purcbases: Charges or collcctions for services renderedby one fund to another that are recorded as rcvenucs of the recipient fund andexpenditures or expenses of the disbursing fund. The composition of LamarInstitute of Technology's Inkrfund activities and balances are presented in Note[2.15

UnauditedI NOTE 2: Capital AssetsRevenue Reeeived from the sale of surplus property has been transferred tounappropriated general revenue in accordance with HB7, Sec. 20.A summary of changes in Capitnl Assets for the year ended August J 1. 2009 is presentedbelow:Balance09101108PRIMARY GOVERNMENTCompletedTranSfersAdjuslm nlsCIPInd\Decrease)Addili,: Non·Depreciable AssetsLand and 1,290.22637, 13.551,198,703.7710,551,097.685,676,260 aseholdsConstruction in ProgressOther AssetsTotal Non-DepreciableAssetsDepreciable AssetsBUildings and BuildingImprovementsInfrastruclureFaclli es & OlherImprovementsFurniture andEquipmentVehicle, BDats & AlrtrallOther Capital AsselsTDlal Dep",ciabl . A selsLe" Acwmulall'd Depre,BUildings and ImprD emlInfraslTucwr.Facllitle & Olher Impro Fum,lu'e and EqulpmenlVehicles, HDals & Aircra!Olher Capital AssetsTDI(l1 Accumulated Oeprec,Dep'edilble Asset:;, NelBUSiness 22.053,2'90115,447, 5E.586,284,875.72540,55918(' 33)(388,853 15)(3ElEl 853 11,441,357,01

UnauditedINOTE 3: Deposits, Investments, & Repurchase AgreementsLamar Institute of Technology is authorized to invest in obligations and instruments asdefined in the Public Funds Investment Act (Sec. 2256. 001 Texas Government Code).Endowment Funds may be invested in accordance with the Uniform Manage

Lamar Institute of Technology . Beaumont, TX 77710-0043 . Dear Dr. Szuch, Submitted herein is the Annual Financial Report of Lamar Instimte of Technology for the fiscal year . ended August 31, 2009, in compliance with TEX,GOV'T CODE ANN #2101.011 and in accordance . with the requiremenls established by Ihe Comptroller of Public Accounts.