Transcription

WELCOME!Q3 2020 U.S. AUTO SALESFORECAST CALLSeptember 28, 2020

Transforming theway the worldbuys, sells, ownsand uses cars2

TODAY’S AGENDAThe Economy – Jonathan Smoke, Chief EconomistQ3 New-Vehicle Sales Forecast and Inventory – Charlie Chesbrough, Senior EconomistUsed-Vehicle Sales and Values – Zo Rahim, Manager, Economics & Industry InsightsCOVID-19: How Has Behavior Changed? – Vanessa Ton, Sr. Manager, Industry IntelligenceOutlook and Q4 Playlist – Jonathan Smoke, Chief EconomistQ&A3

OUR ECONOMYJonathan SmokeChief Economist

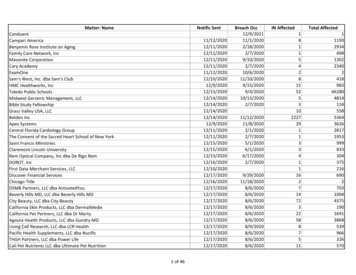

OUR ECONOMY: Signals Reflect Slowing MomentumOverall EconomyEmploymentConditionsBuyer ConfidenceWagesBuyer AbilityGDP Growth-31.2%(Q2 ’20)2.6%(Q3 ’20)U3 UnemploymentRate3.7%(August ’19)8.4%(August ’20)UofM ConsumerSentiment93.2(September ’19)78.9(September ’20)EarningsGrowth3.5%(August ’19)4.7%(August ’20)DisposableIncome Y/Y3.0%(July ’19)9.5%(July ’20)24%(Q3 ’20 F)5

OUR ECONOMY: To V or Not to V, That is (Still) the QuestionAuto FinanceFRBNY 155.5 billion(Q2 ’19) 135.9 billion(Q2 ’20)Interest RatesEffective FedFunds Rate2.13%(August ’19)0.05%(August ’20)Average New AutoLoan Rate6.23%(August ’19)4.64%(August ’20)Average RetailUnleadedGasoline Price 2.58(August ’19) 2.23(August ’20)Borrowing CostsMobility Costs6

Dealer Sentiment IndexHow would you describe the currentU.S. economy?THIRD QUARTER 2020Note: New questionintroduced in Q3 2019Strong55555457484037292321WeakQ2 2017Q3 2017Q4 2017Q1 2018Q2 2018Q3 2018OverallQ4 2018Q1 2019FranchiseQ2 2019Q3 2019Q4 2019Q1 2020Q2 2020Q3 2020IndependentNote: Scale 1 - 100Dealer Sentiment Index Q3 20207

Dealer Sentiment IndexHow would you describe the current market forvehicles in the areas where you operate?THIRD QUARTER 51504847494844425651484656535547464947302017Q2 2017Q3 2017Q4 2017Q1 2018Q2 2018Q3 2018OverallQ4 2018Q1 2019FranchiseQ2 2019Q3 2019Q4 2019Q1 2020IndependentQ2 2020WeakQ3 2020Note: Scale 1 - 100Dealer Sentiment Index Q3 20208

Dealer Sentiment IndexHow would you describe your profits over thepast 3 months?THIRD QUARTER 49444243383538365251424442385146404036251714Q2 2017Q3 2017Q4 2017Q1 2018Q2 2018Q3 2018OverallQ4 2018Q1 2019FranchiseQ2 2019Q3 2019Q4 2019Q1 2020IndependentQ2 2020WeakQ3 2020Note: Scale 1 - 100Dealer Sentiment Index Q3 20209

Dealer Sentiment IndexHow would you describe the currentnew-vehicle inventory levels?THIRD QUARTER 2020Growing68676462615759616059564129DecliningQ2 2017Q3 2017Q4 2017Q1 2018Q2 2018Q3 2018Q4 2018OverallQ1 2019Q2 2019Q3 2019Q4 2019Q1 2020Q2 2020Q3 2020FranchiseNote: Scale 1 - 100Dealer Sentiment Index Q3 202010

Dealer Sentiment IndexHow would you describe the currentused-vehicle inventory levels?THIRD QUARTER 6535446444744585953515351433127282119DecliningQ2 2017Q3 2017Q4 2017Q1 2018Q2 2018Q3 2018OverallQ4 2018Q1 2019FranchiseQ2 2019Q3 2019Q4 2019Q1 2020Q2 2020Q3 2020IndependentNote: Scale 1 - 100Dealer Sentiment Index Q3 202011

Q3 NEW-VEHICLE FORECASTAND INVENTORYCharlie ChesbroughSenior Economist

NEW SALES SAAR: September Continues the RecoveryDoes recovery continue or do sales slow as headwinds build?Monthly Light Vehicle Sales SAAR (millions)2020 Monthly 9%-23.4%-20.6%-7.1%-15.5%-16.4%Total Car Share0.2%25.8%7.9%25.6%-37.8% 26.6%-45.9% 23.2%-29.1% 23.0%-27.1% 22.8%-11.5% 23.9%-19.1% 23.2%-21.5% 24.3%2TotalCarLight 8Aug-20180September SAAR Forecast:15.5 million-9.3% Y-O-YVolume -0.3%Source: Cox Automotive, BEA Vehicle Sales13

NEW VEHICLE LIST PRICE: Returned to Trend but Now FallingPost pandemic price surge now moderating – less discounting and less availability likely having impactAverage List Price based on 30 day salesChange In List Price vs 1 week prior, 1 year prior 39,0006.0%5.0% 38,5004.0%3.0% 38,000vs Week Agovs Year Ago2.0% 37,5001.0%0.0% 37,000-1.0%-2.0% 36,500-3.0%Source: vAuto /Cox Automotive VMA 19-12-092019-11-112019-10-14-4.0%2019-09-16 36,00014

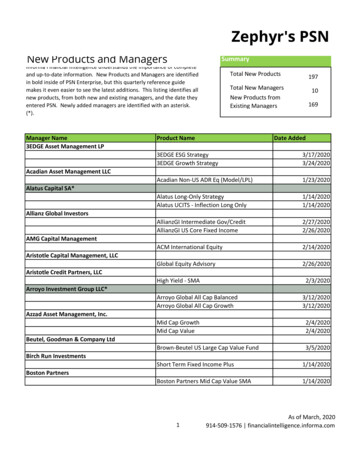

OEM PERFORMANCE: After Q3, YTD Sales Down 19.6%Strong quarter expected from H-K and Volvo as Nissan’s struggles continueOEM19-Sep20-SepChangeQ3 2019Q3 2020ChangeYTD 2019YTD 30,07510.7%77,28972,811-5.8%Hyundai 76675,816-15.5%253,683201,350-20.6%Fiat 90663,619-36.5%Source: Cox Automotive Forecast/KBB Data15

MARKET CHANNELS: Stage of Recovery Phase Varies GreatlyRetail sales holding up relatively well compared to Lease while all Fleet activity remains depressedMonthly Annual Change Jan – Jun 202020%SalesRetail Lease Rental Other FleetYTD Change-13.0% -25.7% fference-40%-60%RetailLease Rental Other Fleet50.9% 24.3% 16.3%58.3% 23.8% 9.9%7.4% -0.5% -6.4%8.5%8.0%-0.5%-80%-100%RetailLeaseRentalOther FleetSource: Cox Automotive/KBB Data16

VanSportsCoCamrLupaxuctrySUFuVrl sssizovePierFuckupll-sizTreucPikckupTrElucecktr -sizeSuCabcomrpaHyctbrCidar/Al tEngCarMinivaConmpactCaFurll-sizeSUMVEnid-stryiz- leeveCalLruxuryCarLuxuSEGMENT YTD SALES: Lower Prices Products UnderperformingPickups doing well while many Car segments lag behindYTD 2020 Change In Sales vs YTD 201910%0%-10%-20%-30%-40%-50%Source: Cox Automotive / Kelley Blue Book Data17

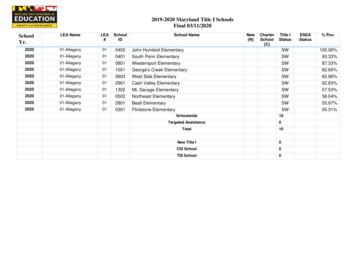

VIRUS IMPACT: State Losses Varied During Peak Crisis PeriodState closures dramatically impacted sales activities on East and West CoastsNation -37%Pennsylvania -65%New York -53%California -47%Texas -23%Arkansas -5%Montana -10%Oklahoma -13%Source: Cox Automotive18

MARKET SHARE CHANGED: Shutdown Impact SignificantState closures dramatically impacted sales activities on East and West CoastsPennsylvania -2.0%New York -1.7%California -1.7%Texas 1.9%Florida 1.3%Source: Cox Automotive19

VIRUS RECOVERY: Early Success Catching Up to Some StatesColors changing for many states but not always in a positive directionNation -15%New Mexico -36%Georgia -24%Utah -23%Texas -19%Maine -3%Montana -3%Nebraska -5%Source: Cox Automotive20

MARKET SHARE CHANGES DURING RECOVERY: Payback TimeRelatively weaker sales pace in late-hit COVID markets allowing others to regain lost ground.Texas -0.4%Georgia -0.4%California -0.4%YOY Market Share GainMay 1 - Aug 31Change0.3%-0.4%Ohio 0.3%New York 0.3%Pennsylvania 0.3%Powered by Bing GeoNames, Microsoft, TomTomSource: Cox Automotive21

BRAND INTEREST RATES: Economic Threat Varies Across BrandsSubaru and Land Rover have large “good credit” customer base – unlike Mitsubishi/Dodge/NissanShare of Sales by Contracted Rate year to date70%Best Credit Share ( 2%)Poor Credit Share ( 10%)60%50%40%30%20%10%FIAKiaTJeCh epevroletBuickRaCh mryAlslefaRo rmeoToyotHy aundaiGMCCaVo di lllks a cwagenFordGenesisAudiMINIMazdaHondaAcurPo aMerrscecde hesBenzLexusBMWLincoIN lnFINITIVolvoJaguaSu rL a b arundRoverMi tsubishiDodgeNissan0%Source: Cox Automotive Market Rate Monitor22

ovHiUbergherPeLurfoxurryHimHyagnhbrceenidC/Adarl teLurnxuatryiveCaEnrergyCaEnLurtryxu- leryveCalLruxurElyCaectr nownmV/LupaCrxuctosryLuSUsoFuxuveV/l cSEGMENT INTEREST RATES: Economic Threat For Some SegmentsSubprime/lower credit buyers face greater headwinds if job losses persist and credit availability wanesShare of Sales by Contracted Rate year to date60%Best Credit Share ( 2%)Poor Credit Share ( 10%)50%40%30%20%10%0%Source: Cox Automotive Market Rate Monitor23

STATUS OF MARKETS: New and Used Recovering at Varied PacesBased on 30-day sales, market bottomed week of April 20th; Used now weakening while New improvesRolling 30 Day Retail SalesAnnual Changeweekly last 12 -50%700,000New Sold Last 30Used 10-142019-09-162019-12-09Used Sold Last 302020-01-06-60%500,000New SalesSource: Cox Automotive VMA Database24

NEW VEHICLE INVENTORY: The Next Recovery HurdleWith plants opening slowly, and sales pace improving, available supply still fallingDays Of Supply weekly, last 12 monthsAvailable Supply weekly, last 12 2,400,000.00402,200,000.0020Source: vAuto /Cox Automotive VMA 025

NEW VEHICLE INVENTORY: Model year Rollover Way BehindShutdown of factories, and offices, has delayed product introductions and strategies – consolidation next?Inventory Share By Model Year weekly, CY2020 vs CY2019Supply Share - Introduction30%Current: MY2021 3.3%Last Year: MY2020 24.8%25%Same week2019Supply Share - Sell downCurrent: MY2019 1.5%Last Year: MY2018 1.0%20%15%Prior 2020-06-082020-06-012020-05-25Next 020-04-27Same week20195%Source: vAuto /Cox Automotive VMA Database26

BRAND INVENTORY: Supply Situation Varies SignificantlyToyota, Subaru low on inventory while Mitsubishi, FIAT highDays’ SupplyModel Year 2019 and 2021 Inventory Share30%120NextMYShareofSupplySource: Cox Automotive VMA hrysler25%Chevrolet10027

LUXURY INVENTORY: Supply Situation Varies SignificantlyBMW, Lexus low on inventory while Buick, Lincoln are high – and no new products yet in marketDays’ SupplyModel Year 2019 and 2021 Inventory Share12012%NextMYShareofSupplySource: Cox Automotive VMA DatabaseNATIONVolvoPorscheMercedes- LincolnLexusLand kBMWAudiAlfa rcedesBenzLincoln0%Lexus0Land 0BMW8%Audi80Alfa Romeo10%Acura10028

PRICE SEGMENT INVENTORY: Below 30K has High SupplySales of vehicles 30- 50K have been relatively strong while low priced products are weakShare of Sales Last 30 Days and Current Supply7535%400% 5060K5% 40 50K45 30 40K10% 20 30K50 15% 80,000 55 60K- 80K20% 50K- 60K60 40K- 50K25% 30K- 40K65 20K- 30K30% 20,0007020KShare of SalesShare of Supply 40% 80K80 6080KDays’ SupplySource: Cox Automotive VMA Database29

USED-VEHICLE SALES AND VALUESZo RahimManager, Economics & Industry Insights

USED SALES: Fall Less Than New And Rebound FasterUSED VEHICLE SALES OUTLOOK (MILLIONS)424038363432COX AUTOMOTIVEFULL-YEAR FORECASTS20192020202140.036.139.3COX AUTOMOTIVERETAIL 819.121.2Source: Cox Automotive31

MID-SEPTEMBER MANHEIM INDEX: Sees A 1151101051009590Jan-95January 1995 9Source: Cox Automotive32

WHOLESALE PRICES: Continue DecliningMY 2017 Retail and Wholesale Price Indices (wk1 100)2019 Retail Index2020 Retail Index2019 Wholesale Index2020 Wholesale Index120%115%Wholesale YTD: 12.5%Retail YTD: 9.3%110%105%100%95%90%85%80%123456789 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51Source: Cox Automotive33

USED INVENTORY: Improved, but Drawing Down QuicklyAvailable Supply weekly, last 12 monthsChange In Supply vs 1 week prior, 1 year 00-10.0%-15.0%2,200,000-20.0%Source: Cox 0,00034

CPO SALES: 20Aug-20Source: Cox Automotive Analysis of Motor Intelligence35

COVID-19: HOW HAS BEHAVIOR CHANGED?Vanessa TonSenior Manager, Industry Intelligence

#1 THE PANDEMIC ACCELERATED THEADOPTION OF DIGITAL RETAILING

ONLINE SHOPPING: Booming In All Industries, Including Auto47%61%of COVID-19 buyers didFreemore steps online than intheNightspast74%increase in shopperssubmitting deals onlinesince Jan. 202060%of shoppers want to domore purchase stepsonline*75%80%of franchise dealers expectto see more consumers buyvehicles online in the futurefranchise dealers have adigital retailing solutionin place* Compared to the last time they purchased a vehicle at a franchised dealershipSource: Cox Automotive38

#2 THE SHIFT TO DIGITAL RETAILINGREQUIRES DIFFERENT STAFFING

SHIFT: Digital Retailing Redefined the Needed Skillsets47%(May 15-18)57%(Sept. 14-18)Percent of dealers placing greater emphasison hiring digital / tech-savvy skillsets62%of dealers changedtheir communicationstrategy with leads33%of dealers made staffchanges to better alignto new modelSource: Cox Automotive40

#3 THE PANDEMIC CREATED NEWWAYS OF DOING BUSINESS

TOUCHLESS SERVICES: More Desirable, More Revenue60%61%of dealers offer ServiceFreePickup and Delivery(SPUD)NightsServices90% of vehicle owners aresatisfied with theirSPUD experience19%of owners who had theirvehicle serviced sinceCOVID used SPUD47%48%of vehicle owners who haveused SPUD had moreservices completedof owners are likely topay 20 forSPUD servicesSource: Cox Automotive42

2020: THE END IS NEARJonathan SmokeChief Economist

12.0M3.2MNEW SALESNEW RETAIL SALESNEW LEASEVOLUME36.1M19.1M2.6M13.9M2020FORECASTSUSED SALESUSED RETAIL SALESCPO SALES27%1.9M 8.3%LEASEPENETRATIONFLEET SALESMANHEIM USEDVEHICLE VALUEINDEX44

LOOKING AHEAD: Our Fourth Quarter PlaylistF2020 (Radio Edit)by Avenue BeatUpside Downby JVKEI DON’T KNOW ABOUTEVERYONE ELSE, BUTI’M KINDA DONE. CANWE JUST GET TO 2021?“UP, DOWN, UP, DOWN,TURN MY STOMACHUPSIDE DOWN ” THENEXT FEW MONTHSARE UNCERTAIN.Overwhelmedby Royal & theSerpentOK Not to Be OKby Marshmello andDemi LevatoWITH NO NEW HELPIN SIGHT, THEUNEMPLOYED WILLBE OVERWHELMED.IN THE SPRING ANDSUMMER, DEALERS DIDOK, WHEN THE WORLDWAS NOT OK.45

QUESTIONS?

THANK YOU!Contact Information:Dara HailesManager, Public RelationsCox Automotivedara.hailes@coxautoinc.comMark SchirmerDirector, Public RelationsCox Automotivemark.schirmer@coxautoinc.comFor additional content from Cox Automotive, visit theNewsroom at http://www.coxautoinc.com/newsroom andsign up for From the Newsroom, our biweekly newsletter:coxautoinc.com/signup

Source: Cox Automotive analysis of IHS -Markit vehicle registrations data 15.2 0 2 4 6 8 10 12 14 16 18 Aug-2018 Oct-2018 Dec-2018 Feb-2019 Apr-2019 Jun-2019 Aug-2019 Oct-2019 Dec-2019 Feb-2020 Apr-2020 Jun-2020 Aug-2020 Total Car Light Truck Monthly Light Vehicle Sales SAAR (millions) 2020 Monthly Volume NEW SALES SAAR: September Continues the .