Transcription

USAID MOLDOVA FINANCIAL SECTORTRANSPARENCY ACTIVITYQUARTERLY PROGRESS REPORTJANUARY 1, 2020 – MARCH 31, 2020FISCAL YEAR 2020 QUARTER 2This document was prepared by International Development Group LLC and partner ChemonicsInternational, Inc. for review by the United States Agency for International Development.

USAID MOLDOVA FINANCIAL SECTORTRANSPARENCY ACTIVITYQUARTERLY PROGRESS REPORTJANUARY 1, 2020 – MARCH 31, 2020Prepared under USAID Contract Number: 7200AA18D00012 / 72011719F00001Submitted to USAID/MoldovaApril 15, 2020Submitted by:International Development Group LLC (IDG)1100 North Glebe Road, Suite 950Arlington, VA 22201Phone: 1 (571) 336-7980Fax: 1 (571) 336-7998DISCLAIMERThe contents of this report are the sole responsibility of International Development Group LLCand do not necessarily reflect the views of USAID or the United States Government.

TABLE OF CONTENTSProgress Report . 2Principal Activities and Achievements . 2Component 1: Strengthen the capacity of the GOM and National Bank of Moldova to combat financial crime. 2Component 2: Capacity Building and support to the Central Securities Depository of Moldova . 5Component 3: Capacity Building and Support for the National Commission of Financial Markets of Moldova 6Component 4: Assist the Government of Moldova in Improving its Fiscal/Budgetary Transparency . 7Problems And Areas Of Potential Concern . 7Next Quarter Activities . 7FSTA Performance Indicators . 8Success Story . 10

LIST OF OVATWBActivity Monitoring, Evaluation, and Learning PlanAnti-Money Laundering/Combating the Financing of TerrorismCooperating Country NationalCoronavirus Disease 2019Central Securities DepositoryEuropean UnionFinancial Intelligence UnitUSAID Moldova Financial Sector Transparency ActivityFiscal YearGovernment of MoldovaInformation and Communications TechnologyInternational Development Group LLCInformation TechnologyLong-Term Technical AssistanceMoney Laundering/Financing of TerrorismMinistry of FinanceCommittee of Experts on the Evaluation of Anti-Money Laundering Measuresand the Financing of TerrorismNational Bank of MoldovaNational Commission for Financial MarketsPricewaterhouseCoopers LLPReporting EntitiesRequest for InformationRequest for ProposalShort-Term Technical AssistanceUltimate Beneficial OwnersValue-Added TaxWorld Bank

EXECUTIVE SUMMARYThe financial sector in Moldova has been rocked by banking scandals and insurance company insolvencyin recent years, creating the need to resolve questions arising from both substantive structural conditionsand perception problems. While the banking system reform and rehabilitation after the 2014 banking crisishas made significant progress, further efforts need to be made to strengthen the Anti-MoneyLaundering/Combating the Financing of Terrorism (AML/CFT) supervision of financial institutions, addressvulnerabilities in the bank and non-bank sector, tighten regulatory requirements, and increasetransparency. The Government of Moldova (GOM) is motivated to strengthen the AML/CFT regime andimprove transparency. The USAID Moldova Financial Sector Transparency Activity (FSTA) will supportthis commitment to enhance the financial sector.The goal of FSTA is to support economic growth through improving the financial sector transparency,stability and soundness, by further strengthening the capacity of the National Bank of Moldova (NBM), theMoldova Central Securities Depository (CSD) and of the Moldova National Commission for FinancialMarkets (NCFM) to combat financial crimes, automate the monitoring of shareholder transparency andfight systemic money laundering in the banking sector and by enhancing the efficiency and reliability of thesecurities settlement and registry infrastructure in Moldova. Greater transparency and reform in thebanking and financial sector will result in increased public trust in supervision institutions and greatercapacity to expose money laundering and fight corruption. FSTA will have four major components:1. Strengthen the capacity of the Government of Moldova and National Bank of Moldova to combatfinancial crime2. Capacity Building and support for the Central Securities Depository of Moldova3. Capacity Building and support for the National Commission of Financial Markets of Moldova4. Assist the Government of Moldova in improving its Fiscal/Budgetary transparencyThe FSTA contract was signed on September 5, 2019 with an official start date of September 9, 2019. Thisquarterly report covers activities taking place between January 1, 2020 and March 31, 2020 of Fiscal Year(FY) 2020 Quarter 2.During the reporting period, FSTA focused on finalizing the Request for Proposal (RFP) for the AMLsoftware solution procurement for the NBM and started working on Component 3 tasks. Key activitiesundertaken include: On-boarded and fielded short-term experts to support FSTA activities Reviewed responses from the Request for Information (RFI) for the AML software solutionobtained from vendors Refined the technical requirements of the RFP and worked with the working group including NBMstaff members to finalize the RFP Compiled a summary of recommendations based on the MONEYVAL Evaluation Report, whichwill be included in the action plan to be implemented by the NBM and NCFM with FSTA’s support. Carried out a revision of NBM’s AML Supervision Manual, by proposing a new structure. As thefinal version of the manual is being drafted, three papers have been finalized which will accompanythe manual: Customer Due Diligence, Record Keeping, and Compliance Started the pawn shop assessment by conducting an initial review of international practicesregarding the regulation of pawn shops in developed nations as well as countries comparable toMoldova.The following sections present a summary of activities undertaken during the reporting period.1 FSTA Quarterly Progress Report – FY20 Q2

ADMINISTRATIONDuring the quarter, the team finalized all mobilization activities including moving and furnishing thepermanent office, opening a bank account, obtaining VAT exemption, and procuring IT equipment for theoffice. While the office is fully operational, due to COVID-19, FSTA staff have shifted to telework andonline conference calls starting mid-March. In additional, several internal procedures in line with IDG,USAID, and GOM have been implemented.Bank AccountThe bank account is open and is fully functional. During the quarter, FSTA was included in the updatedGovernment list of technical assistance projects receiving special fiscal treatment (including VATexemption) which was published in the Moldova Official Gazette. All fiscal registration procedures for theactivity have been completed.Moving into the Office SpaceAfter the furniture was purchased and delivered, the office became fully operational. Internet connectionwas also set up. Other office IT equipment was procured during the quarter, after receiving relevantapprovals from USAID. Due to the COVID-19 related lockdown, local staff are working remotely.Recruitment and Hiring of FSTA StaffThe Country Representative joined the team full-time in January 2020. By the end of the quarter, theFSTA team received official approvals and on-boarded the following positions: ICT Specialist to supportthe procurement of the AML solution at NBM (international STTA), AML Expert (international STTA),the NBFI Expert (international STTA), and Operations and Administrative Assistant (LTTA).Recruitment efforts have also been geared towards finding strong candidates for the following positions:a Regulatory Expert (CCN LTTA) and two international experts (a Retail Market Expert and anInternational/Regulatory Expert) to support Component 2 activities as well as a Finance and OperationsManager (CCN LTTA).PROGRESS REPORTPRINCIPAL ACTIVITIES AND ACHIEVEMENTSCOMPONENT 1: STRENGTHEN THE CAPACITY OF THE GOM AND NATIONAL BANK OF MOLDOVA TOCOMBAT FINANCIAL CRIMEUnder Component 1, FSTA is working to procure and implement an AML IT solution for the NBM. Thefirst phase of this work consists of reviewing existing documents and the previously drafted RFP, updatingthe RFP, and launching the RFP. The second phase consists of selecting the vendor, testing and installingthe new solution. Throughout these two phases, FSTA will work with the NBM staff to ensure presentprocesses are in line with best practices and further train the staff on the new IT solution, processes, andpractices. During this quarter, activities under this component focused on finalizing the RFP and developingrecommendations on how to strengthen the AML environment.Task 1.1: Assess progress made to date by previous effortsDuring this quarter, the team made numerous revisions to the presentation, content, and description ofthe functional and non-functional requirements for the requested system, to be documented in the RFP.The FSTA and the NBM working group including NBM staff members from the IT and AML divisions2 FSTA Quarterly Progress Report – FY20 Q2

finalized the RFP. They addressed a number of issues raised by the FSTA staff, users of the NBM SoftwareSolution 1, and IDG Home Office staff. They compensated for limited input and review process conductedin the earlier RFP draft that preceded the start of FSTA; they revised the evaluation and award process tobe consistent with USAID procurement rules (rather than EU and World Bank procedures, as in theearlier iteration); and they made the RFP more user-friendly and transparent.Task 1.2 Identify the regulatory AML environment affecting the bank and non-bank actorsand the regulatory changes needed for the AML software to be successfulDuring the quarter, the STTA AML Expert undertook a number of important activities under this Task.A series of meetings took place with GOM Agencies involved in the AML/CFT supervision (NBM, NCFM,FIU) to address MONEYVAL recommendations set forth in its 5th Round Mutual Evaluation Report onMoldova. A summary of recommendations was drafted, highlighting the most important actions to beimplemented by our counterparts, such as: NBM must provide specific guidelines and training to reporting entities (RE) in relation to themonitoring process of transactions involving non-profit organizations posing a higher risk. NBM and NCFM should conduct extensive and practical 'risk assessment' trainings and reviewsfor all reporting entities. In conjunction with the FIU, NBM and NCFM should conduct practicaltraining on "transaction monitoring and good quality suspicious transaction reports" for all RE. FIU, NBM, and NCFM must individually review and improve their sanctions regime i.e. the waythat they penalize reporting entities for legal violations. The AML Software Solution will help the NBM to improve its inspection process, particularlyrelated to banks’ shareholders (ultimate beneficial owners – UBO). In this sense, the NBM shouldlook for opportunities to engage with its reporting entities, the FIU and registrar's office to ensurethat UBO data is kept current and accurate. NBM should also engage with other stakeholders toensure that reporting entities do not open or maintain accounts with shell or dormant entities.These, and other relevant suggestions will be included in the action plan to be implemented by the NBMand NCFM to fulfill MONEYVAL recommendations with FSTA’s support, conditional on COR approval.The action plan will be finalized during next quarter.The STTA AML Expert has also started to restructure NBM’s AML Supervision Manual. The existentManual has been drafted and adopted in 2012 but has not been implemented in practice by NBM’sinspectors, due to a number of inapplicable provisions. The STTA AML Expert suggested a new outlinefor the manual, which was discussed and agreed upon with the representatives of NBM’s AML Unit. Inaddition, the AML Expert made several revisions to the examination techniques and practices. Some ofthe content changes included revisions on the customer identification, risk rating of customers, duediligence products; some of changes for the examination techniques included: testing, how to developand present conclusions and additional procedures.The manual is now being restructured to meet the needs of the NBM. Hence, the new structure willinclude three parts: (i) Core examination procedures for AML/CFT compliance, (ii) AML/CFT complianceprogram; and (iii) Developing conclusions and finalizing the examination. The manual will also include asegment addressing other reporting entities supervised by NBM i.e. electronic payment providers andcurrency exchange offices. In the following quarter, a new draft of the manual will be finalized.1Primary users of the NBM Software Solution are the AML Division and the Shareholder Transparency unit (withinBanking Supervision Department). Secondary users will include the IT, Financial Stability, Financial Markets, Reportingand Statistics and Audit departments.3 FSTA Quarterly Progress Report – FY20 Q2

In addition, a number of work papers are being drafted, providing details on particular steps in thesupervisory process. Three papers have been finalized: Customer Due Diligence, Record Keeping, andCompliance. These papers will accompany the manual, enabling the examiners to better document theirfindings during on-site examinations. One paper will be provided for each essential feature of an entity’sAML/CFT program.Task 1.3 Support the introduction and implementation of an AML IT solution at the NBMTask 1.3.1 Carry out a market analysis and estimate the AML IT solution costsDuring the quarter, the ICT Specialist, with guidance from the Program Manager and the NBM workinggroup, reviewed the technical specifications of the RFI responses, assessed the solutions, reviewed thesolutions against the proposed costs, and refined the technical requirements of the RFP. As a result, boththe Functional and Non-functional requirements were adjusted, by reviewing the importance for eachrequirement (“Mandatory”, or “Preferable”). Licensing requirements have been included as part of theNon-functional requirements. Now as part of the Technical Proposal, bidders will have to describe thesuggested licensing model, giving details on why the proposed model is best for the NBM, while alsoproviding the optimal licensing model from the cost perspective. In addition, substantial changes weremade to the attachments the RFP requires the bidder to respond to. These changes were to bring theRFP more in line with USAID procurement requirements and to add greater clarity and transparency tothe RFP.Since the NBM Software Solution is highly customized, we carefully reviewed all requirements includingfunctional, non-functional, implementation and post-implementation. Additional response requirementsas well as cost related attachments were added to the updated RFP. These additions will allow theselection committee to fully review all components of the total cost. Moreover, a negotiation phase willallow for additional efforts to ensure the most reasonable and realistic cost.Negotiations might include a discussion and revision of the technical proposal, the proposed technicalapproach and methodology, work plan, organization, management, and staffing plan. These documents willthen be incorporated in the Contract. IDG and the review committee will also review the detailed costproposal and discuss/negotiate/resolve any areas in which IDG has questions or concerns.Task 1.3.2 Procuring and installing the AML software solution for the NBMAfter the RFP is approved by the NBM Senior Management, the RFP will be published on IDG’s websiteand the RFP launch announcement with the link to the RFP documents will be published on specializedonline platforms and distributed via email. The RFP will be published on the online platforms which werealso used for launching the RFI: Devex, Development Aid, Global Tenders, and DGMarket. The RFP willalso be distributed via email to the vendor list compiled by the FSTA team which includes around 40vendors.Bidders will be allotted a time frame of 45 calendar days to submit their proposals. Bidders will have theopportunity to submit questions related to the RFP by a specific date. Based on the questions received, avirtual bidder’s conference might be scheduled to answer follow-up questions and further discuss NBM’srequirements.Evaluation of proposals, selection of the vendor, negotiation, and implementation will start during thefollowing quarter.4 FSTA Quarterly Progress Report – FY20 Q2

Task 1.4 Provide capacity building support to NBM staffA workshop for NBM, NCFM, and FIU members was planned for late March 2020. The goal of theworkshop was to present the findings of the MONEYVAL review and present and discuss practical stepsthrough which MONEYVAL recommendations can be implemented. The team also intended to discusstraining and outreach programs for reporting entities that could be subsequently provided by FSTA. Theevent, however, has been postponed due to the COVID-19 pandemic.Formal capacity building for the NBM staff will start once the AML Supervision Manual and related papersare finalized. Our experts will conduct training seminars and work with the NBM staff to revise andimprove, as necessary, their work and procedures. Another part of the capacity building activity will derivefrom the action plan for implementing MONEYVAL recommendations that will be drafted during thefollowing quarter.Training of the NBM staff (users of the NBM Software Solution) is a separate phase in the ImplementationRequirements, as established in the RFP. The selected bidder will conduct training sessions to ensure aproper level of knowledge and skills for the NBM Software Solution users, enabling them to efficiently usethe tools available within the solution. The FSTA team will provide support and monitor how the capacitybuilding activities are delivered by the selected vendor. FSTA will also assess any changes to internalprocedures that are needed as a result of the introduction of the AML Software Solution.COMPONENT 2: CAPACITY BUILDING AND SUPPORT TO THE CENTRAL SECURITIES DEPOSITORY OFMOLDOVAThe goal of Component 2 tasks is to strengthen the capacity of the CSD and support the development ofa secondary retail market. During this quarter, activities under this component focused on identifyingpriorities that FSTA will support and recruiting regulatory experts. Tasks 2.2 – 2.4 will start uponidentification of relevant experts, in the third quarter of 2020.Task 2.1: Assess progress made to date by previous effortsTo date, the team has held numerous discussions on CSD priorities. These discussions have helped toidentify and establish two key priorities for FSTA to support. First, FSTA will work to expand thesecondary retail market using existing technology and developing an interface with other marketparticipants (private investors, institutional investors, MoF etc.). Second, FSTA will support CSD to obtainmembership in international depositaries (Euro Clear and ClearStream). The work on these two prioritieswill assist the CSD and the GOM in expanding and entering new financial markets.The Scope of Work for a retail market expert and an International/Regulatory expert were fine-tunedbased on discussions with the CSD. Recruiting efforts have been hindered, as the number of availableexperts with the necessary skillset is very limited. IDG has contracted a recruiting company to help identifycandidates with relevant background alongside CSD’s efforts to identify experts in its network.The retail market expert, once identified, will start to develop a strategy and create a road map for thesteps needed to create a secondary retail market. This will include drafting of a concept note, organizinga task force of market participants to clearly understand the challenges and identify working solutionsboth in terms of IT and regulatory enhancements.The international/regulatory expert, once identified, will help the CSD to gain access to internationalmarkets through joining international depositaries.5 FSTA Quarterly Progress Report – FY20 Q2

COMPONENT 3: CAPACITY BUILDING AND SUPPORT FOR THE NATIONAL COMMISSION OF FINANCIALMARKETS OF MOLDOVAUnder component 3, the program aims to consolidate NCFM’s capacity to regulate and supervise the nonbank finance market more efficiently.Task 3.1 Assess progress made to date by previous effortsA number of donors have provided support to the NCFM over the last few years. NCFM stands to receiveimportant assistance in the insurance sector from the World Bank and an EU Twinning Project that isexpected to start in the fall. This implies the need to rethink FSTA support to the NCFM, hencediscussions will continue to identify the most critical area where the regulator needs assistance. Due toCOVID-19 pandemic, FSTA team is designing activities that could help NCFM respond to the crisis andstrengthen its capacity to monitor and regulate the NBFI sector.Task 3.2 Work with the NCFM to identify and oversee the procurement of a database systemto identify shareholders and shareholders of companies to ensure AML regulations aremaintained by the NCFMPer Moldovan legislation, the NCFM has anti-money laundering and countering the financing of terrorism(AML/CFT) supervisory responsibilities. The new Moldovan AML/CFT Law, adopted in 2017, extendedthe NCFM’s powers in this regard to “collect beneficial ownership data on investment firms’ founders, aswell as customers and their beneficial ownerships.” 2 Based on FSTA team’s assessment, the NCFM hadnot begun collecting this information in all the sectors it currently supervises.Only preliminary discussions were conducted in this area. More discussions and further analysis will beprepared during the next quarter.Task 3.3: Review the regulatory framework for the insurance sector and draft appropriatelegislationNCFM is expected to receive important assistance in the insurance sector form the World Bank and anEU Twinning Project that is expected to start in the fall. The project is ready to provide other assistancein other areas of the insurance sector. Two areas where we can easily provide assistance is in stresstesting and basic actuarial training.Task 3.4: Review the regulatory framework for the NBFI sector and draft appropriatelegislationIn 2018, the NCFM has been given the authority to fully supervise the activity of micro-financeorganizations as well as leasing companies – NBFIs. Pawn shops remain outside the control of financialsector supervisors (NBM or NCFM). Filling this gap in the law would allow for a thorough supervision ofthe entire lending activity, eliminating any potential regulatory arbitrage.The Country Representative coordinated with NCFM to collect all documents NCFM could provide onthe pawn shop industry in Moldova. The documents were shared with the STTA NBFI expert. The NBFIconducted an initial desk review on the pawn shop industry in Moldova and examined international26MONEYVAL, p. 142 FSTA Quarterly Progress Report – FY20 Q2

practices (regulatory environment, reporting requirements, and operations) regarding the regulation andoperations of pawn shops in developed nations as well as countries comparable to Moldova, to identifythe most favorable regulatory model for Moldova. The review looked at regulations in the US, Sweden,The Netherlands, Belgium, Germany, Italy, France, Spain, Russia, Switzerland, Latvia, and Romania. Thereview will be finalized during the next quarter and will be shared with USAID.This review will be complemented by an analysis conducted on the ground once the COVID-19 relatedlockdown is lifted. The analysis will involve discussions with pawn shop representatives and interviewswith GOM entities (MoF and NCFM). Conclusions of this activity and recommendations for improvingthe legal framework will be discussed in a public event once the restrictions on travel and gathering arelifted.Task 3.5: Enhance NCFM’s Risk Based Supervision SystemA number of other projects are currently supporting or have supported the NCFM in the past to developan early warnings system and implement risk-based supervision. Therefore, this task will be undertakenafter additional discussions with the NCFM.COMPONENT 4:TRANSPARENCYASSIST THE GOVERNMENT OF MOLDOVA IN IMPROVING ITS FISCAL/BUDGETARYComponent 4 will begin activities in Year 2.PROBLEMS AND AREAS OF POTENTIAL CONCERNThe COVID-19 pandemic put our counterparts under pressure, as fear of population’s income loss couldpose considerable risk to the balance sheets of supervised entities (banks, micro-finance organizations,leasing and insurance companies), with the potential to trigger a systemic crisis. The NBM had to dedicateimportant human resources to monitor liquidity in the banking system, fine-tuning its monetary policyinstruments and closely follow the foreign exchange market. This raises a concern for the project, as ourcounterparts could be overwhelmed by other priorities, which might delay activities such as the timelyapproval of the RFP.In the summer of 2020, the Parliament will be appointing two new deputy governors to the governingboard of the NBM. The selection process is inscribed in the Law on the NBM. This change might distractthe technical staff and slow down activities. FSTA will continue to build close working relationships at alllevels of NBM to provide FSTA with additional means to move technical aspects of the project in timeswhen there are administrative hurdles to overcome.NEXT QUARTER ACTIVITIESBelow we summarize the major activities planned for each component for the next quarter.Under Component 1, the activities are focused on launching the RFP for the NBM Software Solution andstarting the evaluation process. The STTA AML Expert will finalize the review of the AML policies,procedures, and processes, the MONEYVAL recommendations, and prepare a final draft of the NBM AMLSupervision Manual. Training for NBM staff will be built upon the activities of the STTA AML Expert. FSTAwill develop an action plan for implementation with specific recommendations that FSTA will support.7 FSTA Quarterly Progress Report – FY20 Q2

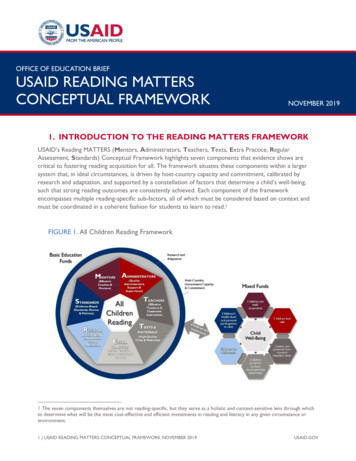

Under Component 2, the priority remains to identify an STTA Retail Market Expert and an STTAInternational/Regulatory Expert to provide support for the CSD. As soon as the experts are identified,experts will start to develop a strategy and create a road map for the steps needed to create a secondaryretail market and help the CSD to gain access to international markets.Component 3 will focus on finalizing the review of pawn shop activities and the regulatory environmentand practices as the first step in reviewing the overall NBFI regulatory environment and framework.Conditional on lifting COVID-19 related restrictions, results of the review will be discussed in a publicevent. Since most of the insurance related activities will be covered by other technical assistance projects,additional discussions will be held with the NCFM to identify the critical areas where USAID assistance isneeded. The project plan will be amended afterwards, conditional on USAID approval.FSTA PERFORMANCE INDICATORSA preliminary MEL Plan was approved by USAID during the past quarter. The MEL Plan will be updatedduring the next quarter together with the work plan. FSTA staff have tracked the following indicatorspresented in the table below.PerformanceY1End of Q 2BaselineProgressIndicatorTargetResultsComponent 1: Strengthen the capacity of the Government of Moldova and National Bank ofMoldova to combat financial crimeDuring this quarter the RFP was1.1 AML ITalmost finalized. The RFP will beSystemNoYNreleased in April 2020 afterprocured andofficial approval from NBM.fully functionalComponent 3: Capacity Building and support for the National Commission of Financial Marketsof Moldova3.1a Number ofinsurance sectorlaws,regulations, and040administrativeprocedures as aresult of USGassistance3.1b Number ofinsurance sectorlaws,regulations, andadministrative040proceduresapproved andimplemented asa result of USGassistance8 FSTA Quarterly Progress Report – FY20 Q2

3.2a Number ofNBFIs laws,regulations, andadministrativeprocedures0drafted andsubmitted topublicconsultation as aresult of USGassistance3.2b Number ofNBFIs laws,regulations, andadministrative0proceduresadopted andimplemented asa result of USGassistanceCross-Component Indicators4.1a Number ofAML regulationsandadministrativeprocedures0drafted andsubmitted topublicconsultation as aresult of USGassistance4.1b Number ofAML regulationsandadministrative0proceduresapproved orimplemented asa result of USGassistance4.2 Number ofpersons that0received USGsponsoredtraining in9 3030The NBFI expert conducted aninitial review of regulations onpawn shop in other countries toidentify the most ideal regulatorymodel for Moldova. An on-siteanalysis has been postponed dueto the lockdown in Moldova.The AML

training on "transaction monitoring and good quality suspicious transaction reports" for all RE. FIU, NBM, and NCFM must individually review and improve their sanctions regime i.e. the way that they penalize reporting entities for legal violations. The AML Software Solution will help the NBM to improve its inspection process, particularly