Transcription

Plantation News - 2018 UpdatePwC IndonesiaPlantation IndustryFocus GroupDecember 2018Overview of palm oilindustry landscape inIndonesiaOnline Single Submission(OSS) – New DigitalPlatform for BusinessLicensesImplementation ofIndonesian Statementof Financial AccountingStandard (“PSAK”) 69“Agriculture” in the oilpalm industryHighlights of the TaxRegulations UpdateData Analytics, the firststep towards better insightOverview of palm oil industry landscape in IndonesiaHafidsyah Mochtar and Yosua SihombingThe palm oil industry is one of the key drivers of Indonesia’s economy. As the world’s largest exporterof Crude Palm Oil (“CPO”), the industry contributed 12% to Indonesia’s total export in 2017. While thepalm oil industry is still dominated by large corporations, the total area of palm oil plantations ownedby smallholders has been increasing in recent years which in turn fuels activities in the rural economy.Moreover, the industry provides jobs for an estimated 17 million workers from the upstream to thedownstream sectors.Indonesia’s palm oil industry is focused on the upstream sector of CPO production. However, thedownstream sector, such as production of biodiesel, has recently gained favor from the government.In 2018, the government expanded the directive to use 20 blended (B20) biodiesels to include not onlypublic transportation but also privately-owned vehicles. In supporting the policy, both producers ofbiodiesel and PT Pertamina have declared their commitment to supply and distribute the products.We have also highlighted the statistics and current trends of Indonesia’s palm oil industry below.Plantation areas and ownersIndonesia’s palm oil plantation geographical areas are highly concentrated on Sumatra Island, where60% of the palm oils plantations are located. The long history of the palm oil plantation industryin Sumatra, which dates back to more than a century ago, has given the island a more advancedinfrastructure as compared to other parts of Indonesia.However, in the past decade, Kalimantan Island has become an alternative for plantations due to itslarge land bank potential. In 2017, some 35% of Indonesia’s total palm oil plantation area is located inKalimantan.Plantation News Page 1 of 12

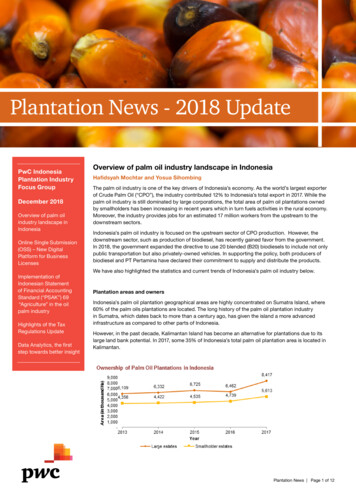

From 2013 to 2017, the total palm oil plantationarea has increased significantly from 10 million hato 14 million ha. In terms of the distribution of keyplayers, the industry is dominated by large estateswhich currently own a combined total of 8.4 millionha in palm oil plantations. Nonetheless, in the lastfive years, palm oil plantation areas owned bysmallholder estates grew by a compound annualgrowth (CAGR) rate of 7% which is only slightlybelow the 8% rate of the large-estate ownedplantations.Low productivity of palm oil industry, among otherthings such as environmental concerns, has ledthe government to impose a moratorium on theissue of new permits. By halting the issue of newplantation area permits and reviewing existingpermits, the government is trying to promptindustry players to increase their productivity.Moreover, to help the smallholder estatesimproving their productivity, the governmenthas set plans for replanting 185 thousand ha ofplantations in 2018 with its Peremajaan SawitRakyat (PSR) program. The government is aimingto increase national palm oil productivity to 8.4 tonof CPO annually per ha.Export marketSource: BPSPalm Oil Production and ProductivityIndonesia’s palm oil production has grownsignificantly in volume from 28 million ton in 2013to 38 million ton in 2017. However, the productivityof palm oil production, defined as the totalproduction per total area of mature plantations,has not increased significantly within the period.In 2017, national productivity numbers rangedfrom approximately 3.5 to 3.6 ton of CPO per ha,with smallholder estates having lower productivityat approximately 2.0 to 3.0 ton of CPO per ha.This level of productivity is considerably lowas compared to the number in the neighboringplantations in Malaysia, which can produce up to10 ton of CPO per ha per year.A major portion of Indonesia’s palm oil productionoutput is currently sold overseas. From the 38million ton of CPO production in 2017, some29 million ton was exported making Indonesiathe world’s number one CPO exporter. In 2017,Indonesia’s export value increased by 28% toUS 20 billion. This was mainly driven by a 20%increase in the volume of CPO exported.The top three countries of destination forIndonesia’s CPO exports are India, China,and Pakistan, together accounting for 44% ofIndonesia’s total export. India and China, beingthe world’s top importers, mainly use palm oil forcooking related purposes. Indonesia’s penetrationto Pakistan’s palm oil market is relatively new. APreferential Trade Agreement between the twocountries, which was implemented in 2012, hashelped Indonesia to increase its market share inPakistan during the last five years, from 20% in2012 to 80% in 2017.Source: BPSSource: BPSPlantation News Page 2 of 12

Threats and opportunitiesThe lack of legal certainty is still one of the biggest threats to Indonesia’s palm oil industry. Theregulations often change and government inconsistencies often hinder investments in the industry. Forexample, lands that already have cultivation rights (HGU) are often later declared as natural reserves.The Land Law that is currently still under discussion is expected to provide more legal certainty forindustry players and investors.With the government’s directive to use B20 biofuel for all motor vehicles, domestic demand for CPOis expected to increase significantly in the coming years. Consequently, the CPO price is expectedto increase. The global price dynamics of the substitute products will also need to be considered inunderstanding the short term and long term outlook of biodiesel.In the international market, stronger United States Dollar (USD) against the Rupiah is expected tosupport Indonesia’s palm oil industry due to CPO traded in USD. At the same time, however, a strongerUSD against the Indian Rupee is expected to lower demand from the biggest importer country for CPO.Moreover, India also increased its import tax on refined palm oil to 54%, which is expected to furtherlower the demand of imported palm oil in the country.China’s 25% import tariff on US soybeans is expected to increase the price of soybeans in China. This inturn, is expected to increase demand for palm oil as a cheaper substitute for soybean oil products.In 2018, the European Union (EU) reached a compromise on its Renewable Energy Directive whichchanged the defining terminology of one of its blocked products, from “palm oil biofuels” to “high risk /unsustainable biofuels”. This development suggested that to secure long term access to the EU markets,industry players need to adopt more sustainable practices which includes prioritizing improvements inproductivity.Plantation News Page 3 of 12

Online Single Submission (OSS) –New Digital Platform for BusinessLicensesAdi Pratikto and Merry PakpahanIndonesian government has recently launcheda new digital and integrated licensing platformin June 2018 called as the “Online SingleSubmission (OSS)” based on GovernmentRegulation No. 24/2018 (GR 24/2018) concerningthe Electronically Integrated Business LicensingServices.The new OSS system also simplifies variousbusiness licenses, permits and registration andcategorises business licenses into two majorclassifications:1.Business License (Izin Usaha); and2.Commercial License (Izin Komersial).Additionally, the new OSS system also introducesBusiness Identification Number (Nomor IndukBerusaha/NIB) which serves as a single identitynumber for business purposes and also replacingthe current Company Registration Certificate(TDP), Import Identification Number (API) andcustom access document (NIK).Apparently, those commitments are not new sinceit has also been implemented under the previouslicensing system.Nevertheless, with the implementation of this newOSS system, it is expected that various licenses,permit and registrations which are currentlyapplied for and obtain from various ministries,head of agencies, governors, regents and mayorswill gradually be integrated and simplified into anintegrated and electronic licensing platform.Moratorium on the Establishmentof New Palm-Oil Plantation withinForest AreaOn 19 September 2018, the President of theRepublic of Indonesia Instruction No. 8/2018concerning the Moratorium on and Evaluationof the Licensing of Palm-Oil Plantations andProductivity Increases for Palm-Oil Plantations(Inpres 8/2018) which aim is to preserve theenvironment and reduce greenhouse-gasemissions.In summary, Inpres 8/2018 requires variousgovernment official to focus on the following area:Any existing companies will have to register toobtain an NIB by the end of this year 2018.1.Moratorium on the establishment of newpalm-oil plantation within forestry area;There are some licensing authorities remains atthe Investment Coordinating Board (BKPM) but formany business sectors, company now will have togo to OSS for licensing purposes.2.Reconversion of palm-oil plantation;3.Moratorium on new investment application;4.Data verification and evaluation;5.Implementation of the Indonesian SustainablePalm Oil (ISPO) standard;6.Community plantation; and7.Legal enforcement.Particularly to the plantation sector, as a furtherguidance to the implementation of OSS system,the Ministry of Agriculture has issued RegulationNo. 29/Permentan/PP.210/7/2018 on 5 July 2018concerning Licensing Procedures in AgricultureSector. This Ministry of Agriculture regulation,in general, stipulates that issuance of BusinessLicense and/or Commercial License by OSS issubject to fulfilment of certain commitments asdescribed in this regulation.Moratorium on the issuance of new licenses forpalm-oil plantation and the evaluation of existingpalm-oil plantation license is to be implementedover a 3 (three) year period.Depending on the type of Plantation BusinessLicense (Izin Usaha Perkebunan/IUP), a plantationcompany is required to fulfil the commitmentsprior to securing an IUP such as:1.Location Permit;2.Environmental Permit;3.Recommendation from governor/mayorwhere the business is located;4.Land rights;5.Cooperation with local farmers.Plantation News Page 4 of 12

Implementation of Indonesian Statementof Financial Accounting Standards(“PSAK”) 69, “Agriculture” in the palm oilindustryAndy Santoso and Steven AnggoroWhat are the key features of PSAK 69?PSAK 69 “Agriculture” which is effective for the financial yearbeginning on or after 1 January 2018, is equivalent to theInternational Accounting Standard (“IAS”) 41 as amended by“Agriculture: Bearer Plants (Amendments to IAS 16 and IAS41)” in 2014. PSAK 69 is to be applied retrospectively.This standard is applied to account for (a) biological assets,except for bearer plants; (b) agricultural produce at the pointof harvest; and (c) government grants, when they relate toagricultural activity.Agricultural activity covers a diverse range of activities i.e.raising livestock, forestry, annual or perennial cropping,plantations with certain common features as follows:(a)Capability to change. Living animals and plants arecapable of biological transformation;(b) Management of change. Management facilitatesbiological transformation by enhancing, or at leaststabilising, conditions necessary for the process to takeplace i.e. nutrient levels, temperature, light; and(c)Measurement of change. Biological transformation givesrise to the change in quality i.e. ripeness, oil content, orchange in quantity i.e. weight, fibre length; or harvestis measured and monitored as a routine managementfunction.An entity shall recognise a biological asset or agriculturalproduce when, and only when:a)The entity controls the asset as a result of past events;b)It is probable that future economic benefits associatedwith the asset will flow to the entity; andc)The fair value or cost of the asset can be measuredreliably.An entity shall also measure a biological asset or agriculturalproduce at Fair Value Less Costs To Sell (“FVLCTS”) at initialrecognition and each reporting date. The changes in theFVLCTS are directly recognised in profit or loss.What are the impacts to palm oil industry players?This standard is applied to account for the Fresh FruitBunch (“FFB”) as the agricultural produce growing onpalm trees. There are three (3) key impacts of this standardimplementation as follows:Timing of recognition of the agricultural produceBased on general palm oil industry knowledge, the blossomon FFB takes around 5-6 months to grow into ripe fruit (“theFFB bearing cycle”). An entity needs to assess at which pointduring the bearing cycle that the entity is eligible to recognisePlantation News Page 5 of 12

the FFB growing on palm trees based on the threeconditions to be fullfilled as specified above.Such assessment could include consideration ofmatters such as agronomical research, censusdata. Management is also required to exercisejudgement in deciding on the assessment. Thejudgement could be based on results of censusdata in determining the likelihood that unripebiological assets at certain stage during thebearing cycle, will grow into ripe fruit and ready tobe harvested. For example: should the blossomon FFB be qualified for recognition as agriculturalproduce?Where to go from here?-Perform a gap assessments from the pointsof view of accounting, business process andinformation system;Measurement of FVLCTS of the agriculturalproduce-Assess the capability of its existing systemwhether the system is able to timelycapture and process relevant businessand operational information to produceinformation that meet the disclosurerequirements above as well as externalreporting timeline;-Set up a plan to communicate the impact ofthis standard implementation (if significant) tostakeholders;-Assess the impact of the standard tothe internal setting of management’s keyperformance indicators;-Assess the impact to the determination ofincome tax.As the FFB will be harvested at the end of thebearing cycle, applying a cash flow valuationmodel may be considered appropriate. Eventhough the FFB bearing cycle is around 5-6months which will lessen the complexity of thevaluation (i.e. discounting could be consideredunnecessary given the short period of timeinvolved), challenges could arise in determiningthe underlying key assumptions (e.g. Crude PalmOil (“CPO”) price, FFB productivity, harvestingcost, maintenance cost) which form the basis ofthe directly attributable cash inflows and outflowsfor the valuation.The FVLCTS of harvested FFB shall be thedeemed cost of inventories on the date whenPSAK 14, “Inventories” is applied.Depending on the readiness of entities,complying with the requirements above generallynecessitates quite a lot of preparation and time.Collection of data, analysis of impacts (accountingand non-accounting aspects), and exercise ofjudgements are typically significant processesthat require significant efforts. It is thereforerecommended that entities consider the following:Disclosure requirementsThere are quite comprehensive disclosurerequirements that entities need to addresswhich come from not only PSAK 69 but alsoPSAK 68 “Fair value measurement” and PSAK 1“Presentation of financial statements”. Certain keydisclosure matters are as follows:-Significant accounting policies;-Critical accounting estimates;-Reconciliation of the FFB FVLCTS whichincludes changes in the FVLCTS, additionsbrought by the biological transformation,deductions due to harvesting;-Cash flow valuation model and its underlyingkey assumptions in measuring the FFBFVLCTS;-Hierarchy of the fair value.Plantation News Page 6 of 12

Highlights of Updated TaxRegulationsYunita Wahadaniah and Stevanus WishnuTax Audit StrategyThe Directorate General of Taxation (“DGT”)issued Circular Letter No. SE-15/PJ/2018 (“SE-15”)dated 13 August 2018 regarding Tax Audit Policy.SE-15 is was issued in order to develop a moreefficient tax audit process. SE-15 came into effecton 13 August 2018.SE-15 sets out requirements regarding thepreparation of a compliance map and prioritylist of potential tax audit targets. Taxpayers whoare included as potential tax audit targets aretaxpayers who have high indications of a tax gap,resulting from non-compliance and disobedience.SE-15 also sets out the selection criteria with aconsideration of the amount of potential tax value,the ability to pay tax (collectability), and othercriteria at DGT’s discretion.Tax Facilities – Tax Holiday and SpecialEconomic ZonesTo attract investment in certain industries andareas in Indonesia, the Government provided TaxHoliday and tax facilities for Special EconomicZones (Kawasan Ekonomi Ekslusif/KEK). Furtherdetail of the tax facilities is as follows. Tax HolidayAs part of the Economic Policy Package XVI,the Minister of Finance (“MoF”) has issued anupdate Tax Holiday Policy through regulationNo. 150/PMK.010/2018 (“MoF-150”) dated27 November 2018. MoF-150 revokes thecurrently-issued MoF regulation No. 35/PMK.010/2018 (“MoF-35”).agricultural, plantation, or forestry-basedprocessing that produce pulp. MoF-150 alsoallows certain taxpayers who are assignedfor the implementation of National StrategicProjects (Proyek Strategis Nasional/PSN) toapply for the Tax Holiday. Business sectorsoutside this list may continue to be eligible toapply through a separate channel to the MoF.The Tax Holiday application will be processedthrough Online Single Submission (“OSS”)system to the MoF via Directorate General ofTaxation (“DGT”). It can be submitted up tofive years after the date of MoF-150, i.e. until26 November 2023.The Tax Holiday is open for new capitalinvestments plan in Indonesia from IDR10o billion up to more than IDR 30 trillion(the previous regulation requires minimuminvestment of IDR 500 billion). The MoF-150does not require this new investment in theform of a new taxpayer (i.e. a company) nor toplace an investment commitment in the formof a bank deposit.The other requirements to be fulfilled is asfollows:1.Debt to equity ratio – The taxpayer isrequired to satisfy the debt to equity ratioof 4:1 as stipulated in MoF regulation no.169/PMK.010/2015.2.The taxpayer has never had its TaxHoliday application granted or rejectedby the MoF. Taxpayers who have enjoyeda tax allowance facility cannot enjoy thisTax Holiday, and vice versa.3.The taxpayer is incorporated inIndonesia (no limitation on the date ofestablishment).The Tax Holiday is also available for theplantations sector, specifically integratedorganic basic chemicals from agriculture,plantation, or forestry products, andPlantation News Page 7 of 12

The facilityBelow is the available tax facilities under the MoF-150.Capital Investment PlanProvisionIDR 100 billion - IDR 500billion (New) IDR 500 billion50%100%Corporate IncomeTax (CIT) reductionrate5 – 20 years depending on the investment value:Concession periodTransition5 years25% CIT reduction for thenext 2 yearsNo.Investment(in IDR)Period(in years)1500 billion up to 1 trillion521 trillion up to 5 trillion735 trillion up to 15 trillion10415 trillion up to 30 trillion155 30 trillion2050% CIT reduction for the next 2 yearsPost-approval provisionsIf during a field audit to assess the start of commercial production, the DGT determines that the capitalinvestment plan has not been fully realized, the DGT can adjust the CIT reduction rate or concessionperiod based on the actual investment realization. This provision is also applicable for taxpayers grantedwith a Tax Holiday based on MoF-35.Taxpayer’s approval can be revoked under certain conditions.Based on the field audit, the DGT will issue a letter to confirm the start of commercial production.If any of the above situations occur, the Tax Holiday value that has been utilized by the taxpayers shouldbe repaid along with the penalties.Unlike the MoF-35, the MoF-150 silent on whether taxpayers whose approval is revoked due torealization of investment plan being below the threshold, eligible for tax allowance facility (e.g.Investment in KEK), etc. Special Economic ZoneThe other investment facility is the Special Economic Zone (Kawasan Ekonomi Ekslusif/“KEK”) limited tothe KEKs appointed by the government. The tax facility is regulated under Government Regulation No.96/2015 (“GR-96”).Currently, there are eight areas designated as KEKs:1.Sei Mangkei2.Tanjung Api – Api3.Tanjung Lesung4.Mandalika5.Maloy Batuta Trans Kalimantan6.Palu7.Bitung8.MorotaiThe locations are spread across Indonesia, and each KEK has different resources to be developed,ranging from plantations and logistics, to tourism activities.There are 3 three locations which have significant plantation activities, i.e. Sei Mangkei, Tanjung Api –Api and Maloy Batuta Trans Kalimantan. Those areas are included in the KEK’s tax facilities with the aimof further development of downstream plantations industries.The tax facilities under KEK cover Corporate Income Tax (“CIT”), Value Added Tax (“VAT”), LuxuryGoods Sales Tax, import duty and excise facilities.Plantation News Page 8 of 12

The tax facilitiesBelow is the range of tax facilities under KEK:1.CIT reduction and/or income tax allowancei.ii.CIT reduction – A CIT reduction facility may be granted to new taxpayers with new capitalinvested in the production chain of the main KEK activities as described below:Investment Plan(IDR in billion)Reduction Period(in years) IDR 1,00010 - 25IDR 500 up to IDR 1,0005 - 15 IDR 5005 - 15CIT Reduction20% - 100%at MoF discretionIncome tax allowance – Taxpayers that have been rejected for CIT reduction facility andtaxpayers carrying out other activities in a KEK may apply for income tax allowance thatprovides the following: Reduction in net taxable income of up to 30% of the amount invested in the form of fixedassets (including land), prorated at 5% for six years of commercial production, subject tocertain requirements. Accelerated fiscal depreciation or amortisation. Reduction in withholding tax rate on dividends paid to non-residents to 10% (or theapplicable rate based on Tax Treaty). Extension of tax-loss carry forward for more than five years but not more than ten years(subject to certain requirements).Taxpayers in a KEK can only apply for CIT reduction and income tax allowance facilitiesunder GR-96. Application for income tax facilities should be submitted to the MoF via theAdministrator of the relevant KEK.2.VAT / LST and import taxOn top of the income tax facilities, taxpayers in a KEK are also entitled to the following tax facilities: Non-collection of VAT and LST on the importation or domestic purchase of certain goods. Non-collection of VAT and LST on the delivery of certain goods between taxpayers in a KEK. Non-collection of Article 22 Income Tax on imports. Postponement of import duty on capital goods and equipment, and goods and material forprocessing. Import duty is exempted on the import of capital goods to develop in a KEK. Goods delivery from a KEK will be subject to the following tax and customs treatmentdepending on the destination:DestinationTax and Customs TreatmentPlaces outside of the Customs Area (export)Follow the prevailing regulations on exportPlaces within a Customs Area that havespecial concessionsFollow the relevant facilities available in thedestinationOther places within the CustomsArea(Tempat Lain Dalam Daerah Pabean/TLDDP),where the recipient is not granted any taxand customs facilities on imports.Import duty, excise, and import taxes (VAT/LST and Article 22 Income Tax) whichwere previously not-collected/exempted/postponed must be paid.Other facilitiesThe taxpayers in a KEK may enjoy investment facilities in other areas namely: movement of goods,manpower, immigration, land procurement and licensing.Plantation News Page 9 of 12

Data Analytics, the first step towards better insightLeny SuwardiPlantation is one of the large scale industry that collects many data start from size of land bank, locationprofile, tree density, fertiliser usage, operating expense spending, and others. Given the critical humanand environmental risks posed by palm oil, we need to better understand the macro and micro levelstructure and governance of the palm oil industry. Productivity, efficiency, governance and compliancebecoming more important and metrics can be applied by using a specific analytic and visualisation tool.One of the area that analytic can be applied is procurement. Combining data of various purchasesbeing made centrally and/or in estate, allows us to take more benefit by looking at the organisation’sproductivity, efficiency and compliance aspects.Some key benefits of using analytic tool in the procurement area:1.Verify your compliance and governance process. The purchase to pay analyser tool, for example,will allow your company to know if your procurement policies have been effectively applied forcentralised general procurement, and estate procurement. The tools will trace each and every ofyour procurement and payment details, that allows you to understand how and when each of thetransaction is being executed, at an allowable business hours and by which authorised users.2.Increase your operational efficiency. Companies will able to see the most purchased and preferredsuppliers along versus the one-time-vendor, which can help the companies to opt for a moreeffective pricing strategy or to centralise/decentralise the purchasing of specific items. This willdrive the overall and improve relationship with your main suppliers and increase your procurementproductivity.3.New insight to the management. This will improve confidence in decision making through hard factssupported by data. Management will be able to view data in visualisations that may help to identifypatterns of unusual activity and potentially higher risk areas.Some sample test and insights that can be build based on the data driven are:Account PayablePayroll Duplicate invoices Payments to vendors notin vendor masterEmployees paid but noton master Payments more than 30days after terminationPayments to employeeswith unusual ages Payments to one timevendors Payments to vendorsmatching employeedetails Overtime patternsReceivablesWorking Capital Unusual invoice values Customers on exclusionlistsAverage payment daysby supplier/debtor Invoices to customersnot in master filePayments termscompliance to contract Duplicate invoices andreceiptsErosion in paymentsagainst historicalAreas that we can help to transform your analytic journey Audit analyticsTransform traditional audit testing fromsmall samples to 100% of transactionsusing dynamic business intelligencesolutions with full data discovery.Data visualisation and reportingDevelop leading edge businessintelligence capabilities and solutionsto facilitate better managementreporting, dashboards andvisualisation of multiple, disparatedatasets in one place.Fraud analyticsPerform more powerful and advancedsuspicious and fraudulent transactionanalytics by bringing together multipleprocesses, including procurement,vendor and payroll data, for crossfunctional testing.Process and control verificationUse process intelligence tools tofully animate the flow of transactionsthrough complex processes end-toend to visualisation conformance andoptimisation areas.Risk attribute samplingIdentifying anomalies and pattern intransactions to ensure effort is focusedon those more non-standard andriskier items in full populations.Data quality and profingVisualise the completeness, accuracyand integrity of full datasets, includingvendor and employee master files, toquickly uncover data quality issues forremediation.Plantation News Page 10 of 12

Plantation News Page 11 of 12

ContactsPlease feel free to contact our Plantation Industry Specialists.Plantation Leader, TaxAli Widodoali.widodo@id.pwc.comAssurance ServicesBuntoro Riantobuntoro.rianto@id.pwc.comAndry D. Atmadjaandry.d.atmadja@id.pwc.comYusup Lemanahyusup.lemanah@id.pwc.comAndy Santosoandy.santoso@id.pwc.comLeny Suwardileny.suwardi@id.pwc.comTax ServicesAntonius SanyojayaYunita daniah@id.pwc.comAdvisory ServicesMirza DiranTriono .pwc.comHafidsyah Mochtarhafidsyah.mochtar@id.pwc.comInvestment ServicesLaksmi DjuwitaAdi wc.comLegal ServicesMelli Darsamelli.darsa@id.pwc.comwww.pwc.com/idPwC Indonesia@PwC IndonesiaDISCLAIMER: This content is for general information purposes only, and should not be used as asubstitute for consultation with professional advisors. 2018 PwC. All rights reserved. PwC refers to the PwC network and/orone or more of its member firms, each of which is a separate legal entity.Please see http://www.pwc.com/structure for further details.

Plantation areas and owners Indonesia's palm oil plantation geographical areas are highly concentrated on Sumatra Island, where 60% of the palm oils plantations are located. The long history of the palm oil plantation industry in Sumatra, which dates back to more than a century ago, has given the island a more advanced