Transcription

1 Introduction2 BASF Crop ProtectionMarkus HeldtPresident, Crop Protection Division3 BASF Plant Biotechnology

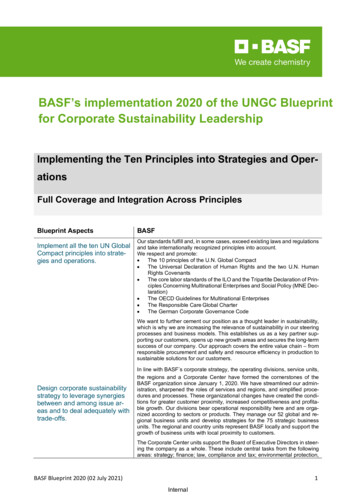

BASF Agricultural SolutionsStrong fundamentals - YTD earnings topped FY 2011Q1-Q32012million Q1-Q32011 %CER %Sales*3,8023,343 14% 9%EBITDA before special items1,114894 25% 14%29.3%26.7%--1,004769 31% 19%26.4%23%--5,5314,941 12% 10%308293 5% 4%EBITDA marginEBIT before special itemsEBIT marginAssets (as of Sep 30)Research and development expenses* Sales drivers Q1-Q3 2012: volumes 7%; prices 2%; currencies 5%BASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments2

Strong growth in all regions3rd Party sales Q1-Q3 2012 by regionin million Key facts Europe:Europe1,596 ( 12%)North America954 ( 9%) 3,802Asia Pacific418 ( 2%)Strong performance in Central& Eastern Europe and UK North America:Strong herbicides sales dueto increasing glyphosateresistance South America, Africa, ME:( 9%)South America,Africa, Middle East834 ( 6%)Season in full swing, offsettingLa Niña impact at beginningof 2012 Asia Pacific:Sales growth mainly driven byIndia and ChinaIn brackets: growth at constant exchange rates in % vs. prior yearBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments3

Strong growth in all indicationsKey facts3rd Party sales Q1-Q3 2012 by indicationin million Fungicides1,624 ( 6%) Fungicides:Herbicides1,395 ( 13%)Strong volume growth drivenby Xemium sales in Europe,and strong Plant Healthadoption in North America Herbicides:Main drivers were Clearfield in Europe, Kixor in NorthAmerica, IMIs in Asia. 3,802( 9%)Insecticides/Other783 ( 7%) Insecticides:Strong demand increase forFipronil especially in Brazil(sugarcane)In brackets: growth at constant exchange rates in % vs. prior yearBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments4

Crop Protection growth story continues, 6 billion sales targeted for mid of decadeFinancial TargetsSales driversin million 6,000 6 billion sales targetexpected to be reached atmid of decade due to: 4,700– strong momentum andadditional value extractionfrom our existing portfolio4,165New &HerbicideGrowthin % 50%– new product launches– emerging market businessmodels gaining further grip46% EBITDA margin target:25% on average20112012E2015EEmerging Markets** Latin America, Eastern Europe, South Africa, Asia (w/o Japan, Australia, New Zealand)** FCC Functional Crop CareBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments5

Global expansion of AgCelence leverages our Plant Health portfoliosales to third partiesSales in million AgCelence Umbrella brand for PlantHealth solutions,global rollout in full swing800 Plant Health effect:600Improved stress tolerance,growth, crop quality F 500 fungicide continues400to be a key contributor toPlant Health business 3rd capacity expansion for200F500 announced inSeptember 20120200820112015ENorth AmericaEurope/EMALatin AmericaAsiaBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments6

Limited impact of US drought on BASFGeneral situation US drought has reduced 2012 yield expectations andfungicide use in corn and soy High crop prices expect to prevail for extended period,driving continued demand for high-yield systemsJune 5th Farmers losses partially mitigated by crop insurance;good liquidity expected for 2013BASF Research 2012, Stark County, IllinoisPlant Health segment Despite drought, 20 million acres treated (corn, soy) Only moderate impact on BASF business expected in Q12013 due to channel inventoriesJune 16th Plant Health will remain a major growth driver for BASFJuly 2ndBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments7

Very successful Xemium launchconfirms blockbuster potentialXemium New fungicide for all marketsegments Strengthens BASF’s globalleadership positionSuccessful launch Global registration proceeds inrecord time. Target: 100 crops, 50 countries Outstanding Q1-Q3 sales Initial peak sales potential: 200 millionXemium registeredNext upcoming registrationsBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments8

Continued growth in herbicides; salestarget of 1.75 billion for 2015Herbicide RenaissanceBASF launchesEngenia Urgent need for innovation Rethinking of weed control Multiple modes of actionneededBASF’s multi-level approach Strong herbicide pipeline Successful expansion of Kixor Herbicide-tolerant productionsystems:19902000Roundup Ready (RR)launched by Monsantoin 19962010Accelerating marketpenetration of RRsystem in the Americas– Clearfield in global launchIncreasing weedresistance toGlyphosate– Cultivance and Engenia (Dicamba) in approvalBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments9

Acquisition of Becker Underwoodsupports Agricultural solutions strategyBecker Underwood adds valueStrategy Strengthens our traits & seedpartnerships via expandedseed treatment offeringCropprotection Gives access to growth marketof biological Crop Protection Complements offering inInnovationbeyond cropprotectionstrategic crops and countries,i.e. AmericasAgriculturalSolutionsTraits & seedpartnerships Opens door to combinedsolutions of chemical andbiological crop protection Strengthens know-how andtechnology platformBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments10

Becker Underwood further strengthensBASF’s position as solution providerBecker Underwood (Sales 2012E**: 185 million)Timelines Closing of transactionexpected by year end 2012SeedEnhancementLandscapeHorticulture &SpecialtyFoliar PlantHealthLivestockNutrition* Becker Underwood will bepart of Functional Crop Care,support all three pillars Structural integration to becompleted by end of 2013Global Business UnitFunctional Crop Care (FCC)Seed SolutionsInnovationsbeyond CropProtectionBiologicals* To be part of Health & Nutrition ** Fiscal year ended September 30, 2012BASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments11

We will grow Emerging Markets salessignificantlyKey driversEmerging Market salesindexedEastern Europe Latin America: Additional%%300300200200100100resources established, newfinancial tools introducedLatin America Eastern Europe: Headcount0200720112015E0 3 bn.in 2015to double from 2008 - 2013 Asia: Additional investmentsin assets, resources 0720112015E2015E Africa: Crop Protection is amain driver for BASF Group’sgrowth in AfricaAfricaAsia%20110200720112015EBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments12

We are committed to keep investing intoinnovationCommitment to innovationTotal R&D expendituresin million Core of our business model:Innovative solution provider High R&D intensity in Crop410Protection ( 9% of sales)390 Increased R&D investments:– 2007 - 2011: 1.8 billion3583212007– 2012 - 2016: 2.5 billion32920082009201020112012BASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments13

We have a strong innovation pipelineA strong pipeline Total Peak Sales Potential atWeedmanagementDicamba HT 2.8 billion, increased 50%since 2008 In-launch pipeline (2002-2009)at 1.6 billion Young pipeline (2010-2020)Diseasemanagementat 1.2 billion and growing Ongoing R&D and inlicensingactivities in insecticides Functional Crop Care projectsPlantHealthFunctionalCrop CareNitrogenManagementshaping up Pipeline update in Q1 2013WaterManagementBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments14

Capex to be further increased, followingour strategyCapex 2007-2011Capex 2007-2011in billion F500 : capacity expansionVarious*Key Projects 0.8billion(F500, Kixor, Xemium) Formulation: New plants andexpansionsPlanned capex 2012-2016Planned capex 2012-2016in billion Various* F500 : 3rd capacity expansionKey Projects 1.4billion Kixor and Xemium : newproduction plants(F500, Xemium, Dicamba) Xemium : backward integrationDicamba: capacity expansionNew formulation plants (Asia)R&D expansion (India, USA)* Formulation sites, research sites, infrastructureBASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments15

Summary and outlook Positive market fundamentals expected to persist(high crop prices, accelerated technology adaption in emergingmarkets) BASF is strongly positioned as solution provider Continued profitable growth, based upon high demand forinnovative solutions and strong pipeline New sales and earnings records forecasted for 2012 Expected sales of 6 billion in 2015BASF Roundtable Agricultural Solutions, November 12, 201216

BASF Roundtable Agricultural Solutions, November 12, 2012ResultsPortfolio DevelopmentBecker UnderwoodEmerging MarketsInnovation & Investments17

America, IMIs in Asia. . Farmers losses partially mitigated by crop insurance; good liquidity expected for 2013 . Plant Health segment Despite drought, 20 million acres treated (corn, soy) Only moderate impact on BASF business expected in Q1 2013 due to channel inventories