Transcription

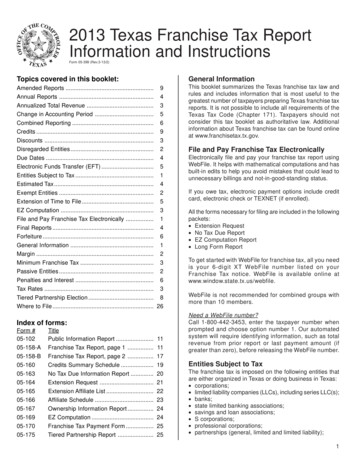

2013 Texas Franchise Tax ReportInformation and InstructionsForm 05-399 (Rev.3-13/2)Topics covered in this booklet:General InformationAmended Reports . 9Annual Reports . 4Annualized Total Revenue . 3Change in Accounting Period . 5Combined Reporting . 6Credits . 9Discounts . 3Disregarded Entities . 2Due Dates . 4Electronic Funds Transfer (EFT) . 5Entities Subject to Tax . 1Estimated Tax . 4Exempt Entities . 2Extension of Time to File . 5EZ Computation . 3File and Pay Franchise Tax Electronically . 1Final Reports . 4Forfeiture . 6General Information . 1Margin . 2Minimum Franchise Tax . 3Passive Entities . 2Penalties and Interest . 6Tax Rates . 3Tiered Partnership Election . 8Where to File . 26This booklet summarizes the Texas franchise tax law andrules and includes information that is most useful to thegreatest number of taxpayers preparing Texas franchise taxreports. It is not possible to include all requirements of theTexas Tax Code (Chapter 171). Taxpayers should notconsider this tax booklet as authoritative law. Additionalinformation about Texas franchise tax can be found onlineat www.franchisetax.tx.gov.Index of forms:Form 16605-16705-16905-17005-175TitlePublic Information Report .Franchise Tax Report, page 1 .Franchise Tax Report, page 2 .Credits Summary Schedule .No Tax Due Information Report .Extension Request .Extension Affiliate List .Affiliate Schedule .Ownership Information Report .EZ Computation .Franchise Tax Payment Form .Tiered Partnership Report .111117192021222324242525File and Pay Franchise Tax ElectronicallyElectronically file and pay your franchise tax report usingWebFile. It helps with mathematical computations and hasbuilt-in edits to help you avoid mistakes that could lead tounnecessary billings and not-in-good-standing status.If you owe tax, electronic payment options include creditcard, electronic check or TEXNET (if enrolled).All the forms necessary for filing are included in the followingpackets: Extension Request No Tax Due Report EZ Computation Report Long Form ReportTo get started with WebFile for franchise tax, all you needis your 6-digit XT WebFile number listed on yourFranchise Tax notice. WebFile is available online atwww.window.state.tx.us/webfile.WebFile is not recommended for combined groups withmore than 10 members.Need a WebFile number?Call 1-800-442-3453, enter the taxpayer number whenprompted and choose option number 1. Our automatedsystem will require identifying information, such as totalrevenue from prior report or last payment amount (ifgreater than zero), before releasing the WebFile number.Entities Subject to TaxThe franchise tax is imposed on the following entities thatare either organized in Texas or doing business in Texas: corporations; limited liability companies (LLCs), including series LLC(s); banks; state limited banking associations; savings and loan associations; S corporations; professional corporations; partnerships (general, limited and limited liability);1

trusts;professional associations;business associations;joint ventures; andother legal entities.The tax is not imposed on: sole proprietorships (except for single member LLCs); general partnerships where direct ownership is composedentirely of natural persons (except for limited liabilitypartnerships); entities exempt under Subchapter B of Chapter 171, TaxCode; certain unincorporated passive entities; certain grantor trusts, estates of natural persons and escrows; real estate mortgage investment conduits and certainqualified real estate investment trusts; a nonprofit self insurance trust created under Chapter 2212,Insurance Code; a trust qualified under Section 401(a), Internal Revenue Code; a trust exempt under Section 501(c)(9), Internal Revenue Code;or unincorporated political committees.See Rule 3.581 for information on nontaxable entities.Exempt EntitiesSome entities may be exempt from the franchise tax. Theexemptions vary depending upon the type of organization.Exemptions are not automatically granted to an entity. Formore information on franchise tax exemptions, go towww.window.state.tx.us/taxinfo/taxpubs/tx96 1045.html.Note: An entity that qualifies as a passive entity is not consideredan exempt entity.Passive EntitiesPartnerships (general, limited and limited liability) and trusts(other than business trusts) may qualify as a passive entityand not owe any franchise tax for a reporting period if at least90% of the entity’s federal gross income (as reported on theentity’s federal income tax return), for the period upon whichthe tax is based, is from the following sources: dividends, interest, foreign currency exchange gain,periodic and nonperiodic payments with respect to notionalprincipal contracts, option premiums, cash settlements ortermination payments with respect to a financial instrument,and income from a limited liability company; distributive shares of partnership income to the extent thatthose distributive shares of income are greater than zero; net capital gains from the sale of real property, net gainsfrom the sale of commodities traded on a commoditiesexchange and net gains from the sale of securities; and royalties from mineral properties, bonuses from mineralproperties, delay rental income from mineral propertiesand income from other nonoperating mineral interestsincluding nonoperating working interests.Passive income does not include rent or income receivedby a nonoperator from mineral properties under a joint2operating agreement if the nonoperator is a member of anaffiliated group and another member of that group is theoperator under the same joint operating agreement.A passive entity that is registered or is required to beregistered with the Secretary of State (SOS) or theComptroller’s office must file a No Tax Due InformationReport (Form 05-163) annually to affirm that the entityqualifies as a passive entity. A passive entity is not requiredto file an Ownership Information Report (Form 05-167).A partnership or trust that qualifies as a passive entity forthe period upon which the franchise tax report is based,and is not registered and is not required to be registeredwith the SOS or Comptroller's office, will not be required toregister with or file a franchise tax report with theComptroller's office.A passive entity that is not registered with the Comptroller'soffice and that no longer qualifies as a passive entity mustfile a Nexus Questionnaire (Form AP-114) or a BusinessQuestionnaire (Form AP-224) to register with theComptroller's office and begin filing franchise tax reports.Disregarded EntitiesAn entity’s treatment for federal income tax purposes doesnot determine its responsibility for Texas franchise tax.Therefore, partnerships, LLCs and other entities that aredisregarded for federal income tax purposes, are consideredseparate legal entities for franchise tax reporting purposes.The separate entity is responsible for filing its own franchisetax report unless it is a member of a combined group. If theentity is a member of a combined group, the reporting entityfor the group may elect to treat the entity as disregardedand will not unwind its operations from its “parent” entity. Inthis instance, it will be presumed that both the “parent” entityand the disregarded entity have nexus in Texas forapportionment purposes only. Whether or not the entity isdisregarded for franchise tax, it must be listed separatelyon the affiliate schedule. Additionally, if the disregarded entityis organized in Texas or has physical presence in Texas, itwill be required to file the appropriate information report(Form 05-102 or 05-167).MarginUnless a taxable entity qualifies and chooses to file usingthe EZ computation, the tax base is the taxable entity’smargin and is computed in one of the following ways: Total Revenue times 70% Total Revenue minus Cost of Goods Sold (COGS) Total Revenue minus CompensationA taxable entity must make an election to deduct COGS orcompensation by the due date of the franchise tax report,the extended due date or the date the report is filed,whichever is latest. The election to use COGS orcompensation is made by filing the franchise tax report usingone method or the other.

Note: Not all entities will qualify to use COGS to compute margin.See instructions for Item 11. Cost of goods sold (COGS) onpage 15 for more information .Tax RatesThe franchise tax rates are: 1.0% (0.01) for most entities 0.5% (0.005) for qualifying wholesalers and retailers 0.575% (0.00575) for those entities with 10 million or lessin annualized total revenue using the EZ computationQualifying retailers and wholesalers are entities that areprimarily engaged in retail and/or wholesale trade. Retailtrade means the activities described in Division G of the1987 Standard Industrial Classification (SIC) manual andapparel rental activities classified as Industry 5999 or 7299of the manual. Wholesale trade means the activitiesdescribed in Division F of the 1987 SIC manual. (The 1987SIC manual is available online at www.osha.gov/pls/imis/sicsearch.html.)An entity is primarily engaged in retail and/or wholesale trade if:1) the total revenue from its activities in retail and wholesaletrade is greater than the total revenue from its activitiesin trades other than the retail and wholesale trades;2) except for eating and drinking places as described inMajor Group 58 of Division G, less than 50% of the totalrevenue from activities in retail and wholesale tradecomes from the sale of products it produces or productsproduced by an entity that is part of an affiliated group towhich the taxable entity also belongs; and3) the taxable entity does not provide retail or wholesale utilities,including telecommunications services, electricity or gas.Note: A product is not considered to be produced if modificationsmade to the acquired product do not increase its sales priceby more than 10%.Annualized Total RevenueTo determine an entity’s eligibility for the 1,030,000 no taxdue threshold and qualification for the EZ computation, anentity must annualize its total revenue if the period upon whichthe report is based is not equal to 12 months.Note: The amount of total revenue used in the tax calculations willNOT change as a result of annualizing revenue. Total revenuewill equal the prescribed amounts for the period upon whichthe tax is based.To annualize total revenue, divide total revenue by thenumber of days in the period upon which the report is based,and multiply the result by 365.Examples:1) A taxable entity’s 2013 franchise tax report is based onthe period 09-15-2012 through 12-31-2012 (108 days),and its total revenue for the period is 400,000. The taxableentity’s annualized total revenue is 1,351,852 ( 400,000divided by 108 days multiplied by 365 days). Based on itsannualized total revenue, the taxable entity would NOTqualify for the 1,030,000 no tax due threshold, but iseligible to file using the EZ computation. The entity willreport 400,000 as total revenue for the period.2) A taxable entity’s 2013 franchise tax report is based onthe period 03-01-2011 through 12-31-2012 (672 days),and its total revenue for the period is 1,375,000. Thetaxable entity’s annualized total revenue is 746,838( 1,375,000 divided by 672 days multiplied by 365 days).Based on its annualized total revenue, the taxable entitywould qualify for the 1,030,000 no tax due threshold,and is eligible to file using the No Tax Due InformationReport (Form 05-163). The entity will report 1,375,000as total revenue for the period.Minimum Franchise TaxThere is no minimum tax requirement under the franchisetax provisions. An entity that calculates an amount of taxdue that is less than 1,000 or that has annualized totalrevenue less than or equal to 1,030,000 is not required topay any tax. (See note for tiered partnership exception.)The entity, however, must submit all required reports tosatisfy its filing requirements.If an entity meets the 1,030,000 no tax due threshold inthe previous paragraph, it may file a No Tax Due InformationReport (Form 05-163).Note: A tiered partnership election is not allowed if the lower tierentity, before passing total revenue to the upper tier entities,has 1,030,000 or less in annualized total revenue or owesless than 1,000 in tax. If the election is made and revenueis passed, both the upper and lower tier entities will oweany amount of tax that is calculated as due even if theamount is less than 1,000 or annualized total revenue afterthe tiered partnership election is 1,030,000 or less.EZ ComputationEntities with 10 million or less in annualized total revenue maychoose to file using the EZ Computation Report (Form 05-169).Combined groups are eligible for the EZ computation. Upperand lower tier entities, when the tiered partnership electionhas been made, will qualify for the EZ computation only if thelower tier entity would have qualified for the EZ computationbefore passing total revenue to the upper tier entities. Entitiesusing the EZ computation forego any credits for that reportyear, including the temporary credit for business losscarryforwards and economic development credits.The franchise tax rate for entities choosing to file usingthe EZ computation is 0.575% (0.00575). No deduction isallowed for COGS or compensation when choosing theEZ computation.DiscountsDiscounts do not apply for the 2010 through 2013 franchisetax reports because the no tax due thresholds of 1 million(for 2010 and 2011) and 1,030,000 (for 2012 and 2013)exceed the total revenue to which the discounts would apply( 900,000).3

If the due date (original or extended) of a report falls on aSaturday, Sunday or legal holiday included on the listpublished before Jan. 1 of each year in the Texas Register,the due date will be the next business day.Combined GroupsFor the period that a combined group exists, the combinedgroup will file only annual reports. For any accounting periodthat an entity is not part of a combined group, the entitymust file a separate report.Annual Reports - due May 15 of each report year.Final ReportsTaxable entities that became subject to the franchise taxon or after Oct. 4, 2009, will owe a first annual report that isdue on May 15 of the year following the year the entitybecame subject to the franchise tax.An entity that ceases doing business in Texas for anyreason (i.e., termination, withdrawal, merger, etc.) isrequired to file a final franchise tax report (Forms 05-158-Aand 05-158-B, 05-163 or 05-169) and pay any additionaltax, if due.Due DatesEstimated TaxTexas law does not require the filing of estimated tax reportsor payments.Annual ReportsReport YearThe year in which the franchise tax report is due. The 2013annual report is due May 15, 2013.Privilege PeriodJan. 1, 2013 through Dec. 31, 2013.For entities that became subject to the tax during the 2012calendar year, the privilege period begins on the entity’sbegin date and ends on Dec. 31, 2013.Accounting PeriodAccounting Year Begin Date:Enter the day after the end date on the previous franchisetax report. For example, if the 2012 annual franchise taxreport had an end date of 12-31-11, then the begin date onthe 2013 annual report should be 01-01-12.For entities that became subject to the tax during the 2012calendar year, enter the date the entity became subject tothe tax.Accounting Year End Date:Enter the last accounting period end date for federal incometax purposes in the year before the year the report isoriginally due.Entities that became subject to the tax during the 2012calendar year and have a federal accounting year end datethat is prior to the date the entity became subject to the tax,will use the day they became subject to the franchise taxas the accounting year end date on the first annual report.This results in a zero report.Example: An entity became subject to the tax on 10-05-12.The entity’s federal accounting year end date is 08-31. Sincethe federal accounting year end date of 08-31-12 is prior tothe date the entity first became subject to the tax, both theaccounting period begin and end date on the 2013 annualreport will be 10-05-12. This results in a zero report. On the2014 annual report, the entity will file with an accountingperiod 10-05-12 through 08-31-13.4Due DateA final report is due 60 days after the entity ceases doingbusiness in Texas.Accounting periodAccounting Year Begin Date:The day after the end date on the previous franchise taxreport.Accounting Year End Date:The date the taxable entity ceases doing business in Texas.For a Texas entity, the end date is the effective date oftermination, merger or conversion into a nontaxable entity.For a non-Texas entity, the end date is the date the entityceases doing business in Texas.Example: A Texas entity filed a 2013 annual franchise taxreport using a 12-31-12 accounting year end date. The entitywants to end its existence on 08-03-13. To obtain a certificateof account status for termination, the entity must file a finalreport and pay tax for the accounting period from 01-01-13through 08-03-13. If the entity is not terminated until 08-1613, the entity must file an amended final report. Theamended final report is due the 60th day after 08-16-13,the date the entity terminated.Taxable entities must satisfy all tax requirements or state inthe appropriate articles which entity will be responsible forsatisfying all franchise tax requirements before they mayterminate legal existence in Texas. All documents required bythe Texas Secretary of State to terminate legal existence inTexas must be received in that office before 5:00 p.m. on Dec.31 to avoid liability for the next annual franchise tax report. IfDec. 31 falls on a weekend, the documents must be receivedby 5:00 p.m. on the last working day of the year. Postmarkdates will not be accepted. You may refer towww.window.state.tx.us/taxinfo/franchise/tax req sos.html formore information on filing requirements. This section does notapply to financial institutions.Non-Texas entities that have not registered with the SOSoffice, but have been doing business in Texas, must satisfyall franchise tax requirements to end their responsibility forfranchise tax. The entity must notify the Comptroller’s officein writing and include the date the entity ceased doingbusiness in Texas.

Combined GroupsIf every member of a combined group ceases doingbusiness in Texas, a final report will need to be filed andpaid before a taxable entity will receive clearance from theComptroller for termination, cancellation, withdrawal ormerger. In all other cases, a combined group will not file afinal report.for the period 01-01-12 through 06-27-12. The entity didnot change its accounting year end and filed a second shortperiod federal return for the period 06-28-12 through12-31-12. For franchise tax reporting purposes, the entitywould include the period 01-01-12 through 12-31-12 on its2013 annual report and would combine the relevantinformation from the two federal reports.Except as provided below, if the entity that ceases doingbusiness in Texas is part of a combined group, the datathat should be reported on the final report will be includedin the combined group’s report for the correspondingaccounting period. The entity should use Form 05-359,Request for Certificate of Account Status to identify thereporting entity of the combined group.Extension of Time to FileAn entity that joins a combined group and then ceases doingbusiness in Texas in the accounting year that would becovered by a final report is required to file a final report forthe data from the accounting year begin date through thedate before it joined the combined group. The periodbeginning with the date the entity joined the combined groupthrough the date the entity ceased doing business in Texaswill be reported on the combined group’s annual report forthe corresponding period.A member of a combined group that leaves the combinedgroup and then ceases doing business in Texas during theaccounting year that would be covered by a final report isrequired to file a final report for the data from the date theentity left the combined group through the date that the entityceased doing business in Texas.Change in Accounting PeriodTexas law does not provide for the filing of short period franchisetax reports. A change in a federal accounting period or theloss of a federal filing election does not change the beginand end dates of an accounting period for franchise taxreporting purposes. The keys to the period upon which thetax is based are the begin and end dates. The begin datewill be the day after the end date on the prior franchise taxreport, and the end date will be the last federal taxaccounting period end date in the year prior to the year inwhich the report is originally due. Therefore, a change in afederal accounting period may result in an accounting periodon the franchise tax report of more or less than 12 months.Example 1: A fiscal year entity changes its accounting yearend from 09-30-12 to a calendar year end of 12-31-12.Because of the change in the federal accounting period,the entity is required to file a short period federal returncovering the period 10-01-12 through 12-31-12. Forfranchise tax reporting purposes, the entity would file its2013 report based on the period beginning 10-01-11 through12-31-12, combining the relevant information from the twofederal income tax reports.Example 2: A calendar year entity lost its S election underthe Internal Revenue Code on June 27, 2012. As a result,the entity was required to file a short period federal S returnPlease see extension requirements for combined reports andelectronic funds transfer (EFT) payors in the respectivesections of these instructions.If an entity cannot file its annual report, including the firstannual report, by the original due date, it may request anextension of time to file the report. If granted, the extensionfor a non-EFT payor will be through Nov. 15, 2013. Theextension payment must be at least 90% of the tax thatwill be due with the report or 100% of the tax reported asdue on the prior franchise tax report (provided the priorreport was filed on or before May 14, 2013). Theextension request must be made on Form 05-164 andmust be postmarked on or before May 15, 2013. If a timelyfiled extension request does not meet the paymentrequirements, then penalty and interest will apply to anypart of the 90% not paid by May 15, 2013, and to any partof the 10% not paid by Nov. 15, 2013.A taxable entity that became subject to the franchise taxduring the 2012 calendar year may not use the 100%extension option.An entity that was included as an affiliate on a 2012combined group report may not use the 100% extensionoption if filing as a separate entity in 2013.Note: A combined group must file the Extension Request (Form05-164) and an Affiliate List (Form 05-165) to have a validextension for all members of the group.Electronic Funds Transfer (EFT)Taxable entities that paid 10,000 or more in franchise taxduring the preceding state fiscal year are required toelectronically transmit franchise tax payments to theComptroller’s office for the subsequent year. Additionalinformation about EFT requirements are outlined in Rule3.9 concerning electronic filing and electronic fund transfers.The extended due date for mandatory EFT payors is differentfrom that of other franchise taxpayers. An EFT payor mayextend the filing date from May 15, 2013, to Aug. 15, 2013 bytimely making an extension payment electronically usingTEXNET (tax type code 13080 Franchise Tax Extension) orWebFile. Mandatory EFT payors must remit at least 90% ofthe tax that will be due with the report, or 100% of the taxreported as due on the prior franchise tax report provided theprior year’s report was filed on or before May 14, 2013.An EFT payor may request a second extension to Nov.15, 2013, to file the report by paying electronically before5

Aug. 15, 2013, the balance of the amount of tax due thatwill be reported as due on Nov. 15, 2013, using TEXNET(tax type code 13080 Franchise Tax Extension), WebFileor by submitting a paper Extension Request (Form 05164) if the entity has paid all of the tax due with its firstextension.Combined ReportingIf an online extension payment is made, the taxable entityshould NOT submit a paper Extension Request (Form 05-164).An affiliated group is a group of entities (with or without nexusin Texas) in which a controlling interest (more than 50%) isowned by a common owner, either corporate or noncorporate,or by one or more of the member entities.Combined GroupsIf any one member of a combined group receives noticethat it is required to electronically transfer franchise taxpayments, then the combined group is required toelectronically transfer payments. The payment must beremitted as discussed on the previous page; however, thecombined group must also submit an Extension Affiliate List(Form 05-165) to the Comptroller ’s office for the firstextension request.Penalties and InterestLate Filing PenaltiesTaxpayers will be assessed a 50 penalty when a report isfiled late. The penalty will be assessed regardless of whetherthe taxpayer subsequently files the report or any tax is duefor the period covered by the late-filed report. This 50penalty is due in addition to any other penalties assessedfor the reporting period.A penalty of 5% of the tax due shall be imposed on an entitythat fails to pay the tax when due. If the entity fails to paythe tax within 30 days after the due date, an additional 5%penalty shall be imposed.Delinquent taxes accrue interest beginning 60 days afterthe date the tax is due. The interest rate to be charged isthe prime rate plus 1%, as published in The Wall StreetJournal on the first day of each calendar year that is not aSaturday, Sunday or legal holiday.Late EFT payments are subject to the same penalties notedabove. Also, failure to follow the EFT requirements couldresult in an additional 5% penalty being assessed.ForfeitureIf an entity does not file its franchise tax report and requiredinformation report and/or does not pay tax, penalty or interestdue within 45 days of the due date, its powers, rights andits right to transact business may be forfeited. Entities thatfail to file or pay within 120 days of the forfeiture of the rightto transact business are subject to having their registrationforfeited.Upon the forfeiture of the right to transact business, theofficers and directors of the entity become personally liablefor each debt of the entity that is created or incurred in thisstate after the due date of the report and/or tax and beforethe privileges are restored. Texas Tax Code Section171.255.6Taxable entities that are part of an affiliated group engagedin a unitary business shall file a combined group report inlieu of individual reports. The combined group is a singletaxable entity for purposes of calculating franchise tax dueand completing the required tax reports.An affiliated group can include: pass-through entities, including partnerships; limited liability companies taxed as partnerships underfederal law; S corporations; and disregarded entities under federal law.A combined group cannot include: taxable entities that conduct business outside the UnitedStates if 80% or more of the taxable entity’s property andpayroll are assigned to locations outside the UnitedStates; insurance companies that pay the Texas gross premiumtax; an entity exempt under Chapter 171, Subchapter B; or passive entities; however, the pro rata share of net incomefrom a passive entity shall be included in the total revenueto the extent it was not included in the margin of anothertaxable entity. (See the section on Passive Entities foradditional information.)A unitary business is defined as a single economic enterprise that is made up of separate parts of a single entityor of a commonly controlled group of entities that aresufficiently interdependent, integrated and interrelatedthrough their activities so as to provide a synergy andmutual benefit that produces a sharing or exchange ofvalue among them and a significant flow of value to theseparate parts. All affiliated entities are presumed to beengaged in a unitary business.See franchise tax Rule 3.590 for more detailed informationon combined reporting.Repo

a nonprofit self insurance trust created under Chapter 2212, Insurance Code; a trust qualified under Section 401(a), Internal Revenue Code; a trust exempt under Section 501(c)(9), Internal Revenue Code; or unincorporated political committees. See Rule 3.581 for information on nontaxable entities. Exempt Entities