Transcription

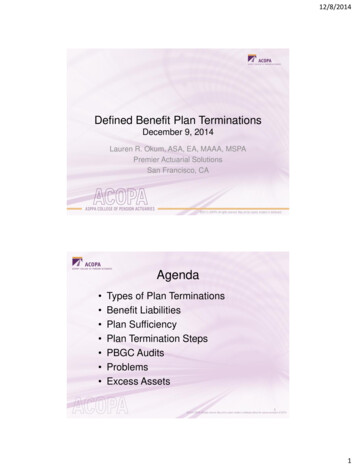

12/8/2014Defined Benefit Plan TerminationsDecember 9, 2014Lauren R. Okum, ASA, EA, MAAA, MSPAPremier Actuarial SolutionsSan Francisco, CAAgenda Types of Plan TerminationsBenefit LiabilitiesPlan SufficiencyPlan Termination StepsPBGC AuditsProblemsExcess Assets11

12/8/2014Voluntary or Involuntary Plan terminations can be voluntary orinvoluntary An involuntary termination is generallyaccomplished by court action initiated by thePBGC– Generally, it will occur when PBGC anticipates thatthe employer's liability to PBGC for unfundedbenefits is expected to increase unreasonably if theplan is not terminated A voluntary termination can be either astandard termination or a distress termination2Standard vs. DistressTermination A standard termination may occur when theterminating plan has assets sufficient to cover allbenefit liabilities– PBGC Reg. 4041.21(a)(4)– i.e. no “unfunded benefit liabilities”– Benefit liabilities are defined in ERISA 4001(a)(16)and PBGC Reg. 4001.2 as “ the benefits ofparticipants and their beneficiaries under the plan(within the meaning of section 401(a)(2) of theCode).” A distress termination is any other voluntarytermination that is not a standard termination– Must meet one of 4 requirements by the PBGC Our focus today is on standard terminations32

12/8/2014Standard Termination ERISA 4041(b) A plan may terminate in astandard termination only if– Plan assets are sufficient to satisfyall plan benefits, and– Plan Administrator followsprescribed steps4Reasons to Terminate IRS Form 5310 provides thefollowing reasons for plantermination:– Change in ownership by merger– Liquidation or dissolution of employer– Change in ownership by sale oftransfer– Adverse business conditions– Adoption of new plan– Other53

12/8/2014Reasons to Terminate IRS indicates other acceptablereasons:– Substantial change in stockownership– Employee dissatisfaction with theplan– Bankruptcy of employer6Reasons to Terminate But we all know other reasons:– Contributions too costly– Fees too costly– Owner(s) ready to retire– Owner(s) hit 415 limit74

12/8/2014Considerations Is the plan sufficient or will theemployer make a commitment tomake it sufficient? (more later) What will replace the plan and howmuch will it cost? Will there be excess assets in theplan after termination? Is there a collective bargainingagreement that would bartermination?8Benefit Liabilities PBGC Reg. 4041.8(a) Benefits are determined under theplan’s provisions in effect on the plan’stermination date Notwithstanding the above, posttermination plan amendments will betaken into account if it doesn’tdecrease the value of plan benefits asof the termination date See Blue Book 2007-9 for furtherguidance95

12/8/2014Benefit Liabilities Benefit liabilities are basically thesum of:– Lump sums to be paid - usinggreater of 417(e) factors or planfactors, as limited by 415 (if any)– Cost of annuities purchased (if any)– Amount transferred to the PBGC formissing participants (if any)10Benefit Liabilities IRC 411(b)(5)(B)(vi); Treas. Reg.1.411(b)(5)-1(e)(2) For cash balance plans that usevariable rates, must use– 5-year average of interest creditingrates; and– 5-year average of annuityconversion interest rates116

12/8/2014Benefit Liabilities Blue Book 2009-10 Q. How do the PPA 2006 changes in theinterest rate and mortality table used incalculating minimum lump sum amountsapply in standard terminations wherelump sums are paid in a yearsubsequent to the year of termination? A. Guidance on this issue was providedin Technical Updates 07-3 and 08-4. Insummary:12Benefit Liabilities Blue Book 2009-10 (continued)– Technical Update 07-3 addresses the situation where theplan's termination date is before the PPA 2006 effectivedate of the changes to IRC 417(e) (i.e., plan yearsbeginning after 2007). In these cases, the PPA 2006changes do not apply. Minimum lump sums aredetermined based on the pre-PPA 2006 statutoryrequirements regardless of when the lump sum is paid.– Technical Update 08-4 addresses the situation where theplan's termination date is on or after the PPA 2006effective date of the changes to IRC 417(e). In thesecases, assuming the plan was amended to reflect thePPA 2006 changes before termination, the interest ratephase-in percentage and mortality assumption are tied tothe annuity starting date, not the year of termination.137

12/8/2014Benefit Liabilities Blue Book 2009-10 (continued)– For example, assume a calendar year plan is amended in2008 to reflect PPA 2006 minimum lump sumassumptions and terminates on July 1, 2009. Alsoassume that the plan has a one-year stability period anda two-month lookback. Therefore, a lump sum paid in2010 is calculated using the following assumptions: Interest - based on the phase-in percentage for the plan yearbeginning in 2010 and the November 2009 rates. Accordingly, a lumpsum paid in 2010 would be determined using a blended rate basedon a 60 percent weighting of the November 2009 segment rates anda 40 percent weighting of the November 2009 30-year Treasury rate. Mortality - based on the RP-2000 unisex mortality table project, inaccordance with IRS rules, for annuity starting dates in 2010.14Benefit Liabilities 1.417(e)-1(d)(1)The present value under IRC 417(e)(3) must be valuedusing the same method as is used under the plan’sactuarial equivalence. It is not clear under PPA, whichchanged the applicable mortality table beginning in2008, whether this regulation still applies– Under the regulation, if the plan does not use preretirement mortality to determine the lump sum, then theIRC 417(e)(3) lump sum would also be valued without theuse of pre-retirement mortality– There has been some comment with regard to thechanges under PPA such that it may be a requirement touse pre-retirement mortality for the IRC 417(e)(3) lumpsum regardless of the plan definition In myexperience, PBGC thinks this is correct158

12/8/2014Benefit Liabilities Gray Book 2006-33 (paraphrased) A defined benefit plan provides lump sumbenefits for employees eligible for earlyretirement, as the larger of:– (i) The present value of the immediate annuityusing the plan’s actuarial equivalence – theapplicable mortality table and 7%; and– (ii) The present value of the participant’sdeferred annuity commencing at normalretirement age using the 417(e)(3) rates. Does this plan meet the minimum lump sumrequirements of ERISA and the InternalRevenue Code?16Benefit Liabilities Gray Book 2006-33 (continued) No. Under regulation 1.417(e)-1(d)(1),the applicable interest rate and mortalitytable must be used to determine theminimum value of any benefit that isvalued. Thus, a third value would needto be considered in this scenario – thepresent value of the early retirementbenefit using the applicable interest rateand applicable mortality table.179

12/8/2014Benefit Liabilities Gray Book 2006-33 (continued) The IRS is correct. The specific casedoes require a third calculation under1.417(e)-1(d)(1) and 1.411(a)-11(a)(2) The key is that the lump sum at ERD isbased upon the annuity commencingimmediately Most plans are not drafted this waydeliberately Moral: Read the document!18Benefit Liabilities Rev. Rul. 85-6 Subsidized early retirement benefit in aterminated plan must be protected, evenif conditions for the subsidy are notsatisfied until some date after the plantermination Recommended ways of providing:– Purchase annuity contracts that wouldprovide the subsidy, if the employee latermeets the conditions; or– Provide the subsidized benefit whether ornot the employee satisfies the conditions1910

12/8/2014Benefit Liabilities Treas. Reg. 1.411(d)-4 Q&A-2(a)(2) A participant is treated as receiving hisentire vested benefit, if the payment is atleast actuarially equivalent to his vestednormal retirement age, even if a morevaluable option could be elected The more valuable option must beavailable, regardless of whether themore valuable option is availableimmediately or upon future completion ofeligibility requirements20Benefit Liabilities ASPPA ASAP 14-17 In post-distribution audits ofstandard terminations, the PBGChas required a pre-retirementmortality adjustment for lateretirement benefits, unless:– The plan has no pre-retirementmortality assumption; or– The plan specifically states that preretirement mortality does not apply tothe late retirement benefit calculation2111

12/8/2014Benefit Liabilities 1.415(b)-1(c)(3)(i)“For a benefit paid in a form to which section 417(e)(3)applies, the actuarially equivalent straight life annuitybenefit is the greatest of:– (A) The annual amount of the straight life annuity thathas the same actuarial present value as the particularform of benefit payable [emphasis added], computedusing the interest rate and mortality table, , specified inthe plan for actuarial equivalence;– (B) The annual amount of the straight life annuity thathas the same actuarial present value as the particularform of benefit payable, computed using a 5.5 percentinterest assumption and the applicable mortality table ;or– (C) [Ignored, since doesn’t apply to small plans].”22Benefit Liabilities Example– Owner is retiring at age 65 in 2014– We want to pay him the maximumlump sum possible– Actuarial equivalence is 7% interest,UP-84 mortality– What is his maximum lump sumpayable?2312

12/8/2014Benefit Liabilities Example (continued)What is the actuarial present value of the lump sumusing the assumptions specified in the plan?– Amount calculated using 7% interest, UP-84 mortality; or LS 7%, UP-84 17,500*104.82970 1,834,520 LS 5.5%, 2014 AMT 17,500*139.49229 2,441,115 Maximum lump sum Min( 1,834,520, 2,441,115) 1,834,520– Amount calculated using the greater of 7% interest, UP84 mortality and 5.5% interest, 2014 applicable mortalitytable? LS using 1.25%/4.57%/5.60%, 2014 AMT 17,500*152.254232 2,664,449 Maximum lump sum Min(Max( 1,834,520, 2,664,449), 2,441,115) 2,441,115 Moral: Amend the plan’s definition of actuarialequivalence24Plan Sufficiency Plan sufficiency can be achieveddifferently for PBGC-coveredterminations than terminations ofplans not covered by Title IV ofERISA2513

12/8/2014Plan SufficiencyNon-PBGC Plans Plan sponsormakes additionalcontribution(s) Reduce benefitson a pro-ratabasisPBGC Plans Plan sponsormakes additionalcontribution(s) Majority owner(s)elect to forgobenefitsPlan Sufficiency Plan sponsor makes additional contribution(s)to satisfy all benefit liabilities– Commitment to fund the plan must be made inwriting by the contributing sponsor and/or controlledgroup members– Deduction rules Non-PBGC: Subject to IRC 404 rules PBGC: IRC 404(o)(5) permits Title IV plans tocontribute and deduct the difference between benefitliabilities and assets in the year of plan termination– If the sponsor or any controlled group member is inbankruptcy, the commitment must either be: Approved by the bankruptcy court; or Unconditionally guaranteed by a person not inbankruptcy2714

12/8/2014Plan Sufficiency Reduce benefits on a pro-rata basis– Revenue Ruling 80-229 provides guidance– Not available for plans integrated withSocial Security or that use permitteddisparity– While an argument can be made that theNHCE can have their benefits reduced ona greater basis than HCE as long as IRC§401(a)(4) nondiscrimination rules aresatisfied, I think that is a bad idea28Majority Owner PBGC Reg. 4041.2 Owns, directly or indirectly, 50% or more of:– An unincorporated trade or business;– The capital or profits in a partnership; or– The voting stock or value of all stock of acorporation2915

12/8/2014Majority Owner Attribution rules of IRC 414(b) and 414(c) – andtherefore IRC 1563(e) – applyOptions qualify as ownershipNo lookback as in substantial owner definition!Family attribution rules of IRC 1563(e)––––Spouse to spouseParent to minor children (under 21)Minor child to parentsIf ownership 50%, from grandparents, parents,children, and grandchildren– E.g. An underfunded plan with 100% owner son, son’swife, and son’s mother cannot terminate in a standardtermination without fully paying out mom See Blue Book 2011-8 for further guidance30Majority Owner Blue Book 2004-6 Q. A plan is terminating in a standard termination.A husband and wife are both participants in theplan and each owns 40 percent of the contributingsponsor. Is each a majority owner and thus ableto elect alternative treatment of his or her benefitin accordance with 29 CFR 4041.21(b)(2)? A. Yes. Under the constructive ownership rules ofCode sections 414(b), each spouse would be amajority owner and thus able to elect analternative treatment of his or her benefit inaccordance with 29 CFR 4041.21(b)(2). SeeCode section 1563(e)(5) and Treas. Reg. 1414(b)-1.3116

12/8/2014Majority Owner Blue Book 2004-6 (continued)Q. Three persons are each participants in the plan and eachowns one third of the stock of the contributing sponsor andeach has an unrestricted option to buy out the other owners(subject to an ordering rule). Is each of these persons amajority owner and therefore able to elect an alternativetreatment of his or her benefit in accordance with 29 CFR4041.21(b)(2)?A. Yes. If three persons (whether or not related) each ownedone-third of the contributing sponsor, with each owner havingan unrestricted option to buy out the other owners (subject toan ordering rule), each would be a majority owner under theconstructive ownership rules of Code section 414(b) and thusable to elect an alternative treatment of his or her benefit inaccordance with 29 CFR 4041.21(b)(2). See Code section1563(e)(1) and Treas. Reg. 1.414(b)-1.32Majority Owner Blue Book 2007-8Q. PBGC’s standard termination regulations provide that amajority owner may elect to forgo receipt of his or her planbenefits to the extent necessary to enable the plan to satisfyall other plan benefits . Assume that two or moreparticipants are each substantial owners, but not majorityowners, and together have a 50% or greater ownershipinterest. Assume further that they agree among themselvesthat they will each elect such an alternative treatment underthe majority owner rules. May they elect the alternativetreatment?A. To be eligible to elect an alternative treatment under themajority owner rules, a participant must be a majority owner(taking into account the constructive ownership rules). Thereis no aggregation of ownership interests among participants(except to the extent provided under the constructiveownership rules).3317

12/8/2014Majority Owner “Waiver” PBGC Reg. 4041.21(b)(2) One or more “majority owners”may agree to forgo all or a portionof his or her benefit to extentnecessary to satisfy all otherbenefit liabilities34Majority Owner “Waiver” “Waiver” is misnamed call itsomething like “election to forgobenefits” The IRS does not recognize waiversfor purposes of minimum fundingrequirements Thus a “waiver” made for the purposeof reducing benefit liabilities will notreduce minimum required contributionsunder IRC 412 and 4303518

12/8/2014Majority Owner “Waiver” The agreement must be in writing; The agreement must not be inconsistent witha qualified domestic relations order (QDRO); If the benefit is greater than 5,000, thespouse, if any, must consent in writing; and In my opinion, the plan should be amendedprior to the plan termination date to changethe asset allocation method to correspondwith the language of the waiver36Majority Owner “Waiver” Timing– Waiver must be made, and spouse must consent,during period Beginning with date of issuance of notice of intent toterminate (NOIT) and Ending with date of final distribution– Timing can be vital on stock sale of company– Must make sure NOIT is issued, and waiver ismade, prior to date of closing of sale (i.e. must be amajority owner when sale is made no lookbackas in substantial owner definition)– See Blue Book 2004-5 for further guidance3719

12/8/2014Majority Owner “Waiver” If amount of waiver was incorrectand there are plan assetsremaining after paying benefits toall other plan participants, theremaining assets must bedistributed to the majority owner tosatisfy his plan benefits See Blue Book 2005-6 for furtherguidance38Administration During Plan Term PBGC Reg. 4041.22 (and StandardTermination Filing instructions at II.B.) Plan Administrator may not distribute planassets in connection with termination untilPBGC’s review period ends (except asdescribed next) Plan Administrator must continue to carry outnormal plan operations during terminationprocess, including:– Putting participants into pay status– Collecting contributions– Investing plan assets3920

12/8/2014Administration During Plan Term However, during the period beginning with theissuance of the NOIT until PBGC’s reviewperiod ends, the Plan Administrator may not:(except as described next)– Purchase irrevocable commitments (annuitycontracts) to provide any plan benefits– Pay any plan benefits attributable to employercontributions (other than death benefits) in any formother than as an annuity40Administration During Plan Term Exception: Plan Administrator mayprovide benefits attributable toemployer contributions in a form otherthan as an annuity if:– The participant terminated employment oris otherwise permitted to receive thedistribution;– The distribution is consistent with priorpractice; and– The distribution is not likely to jeopardizethe plan’s sufficiency for plan benefits4121

12/8/2014Plan Termination Steps1.2.3.4.5.6.7.8.9.10.11.12.Resolution / Plan Amendment(s)204(h) NoticeNotice of Intent to Terminate (if PBGC-covered)Notice to Interested Parties (if filing for FDL)IRS Determination Letter Request (Forms 5310, 6088, 8717)Notice of Plan BenefitsPBGC Standard Termination Notice (Form 500, Schedule REP-S,Schedule EA-S)Notice of Annuity InformationMissing Participants / Distribution of Plan AssetsNotice of Annuity ContractPBGC Post-Distribution Certification (Form 501, Schedule MP)Final PBGC Premium Filing and IRS Form 5500 / 5500-SF / 5500EZ42Plan Termination StepsStepTimingResolution / Plan Amendment(s)Generally by date of plan termination (DOPT)ERISA 204(h) NoticeAt least 15 days (45 days if large plan) prior to freezeNotice of Intent to TerminateAt least 60 days but no more than 90 days prior to proposed DOPTNotice to Interested PartiesAt least 7 days but no more than 21 days prior to filing Form 5310IRS Form 5310, etc.Prior to filing PBGC Form 500Notice of Plan BenefitsPrior to filing PBGC Form 500PBGC Form 500, etc.No later than 180 days after DOPTNotice of Annuity InformationAt least 45 days prior to distribution of plan assetsDistribution of Plan AssetsGenerally no more than 1 year after termination date (exceptions apply)Notice of Annuity ContractNo later than 30 days are distributions are completedPBGC Form 501, etc.No later than 30 days after final distribution is made (no penalty if 90days after distribution deadline)Final PBGC premium filingRegular filing date for the plan year in which final distribution occursFinal Form 5500 / 5500-SF / 5500-EZNo later than last day of 7th month after final distribution4322

12/8/2014Plan Termination Steps44Resolution and Amendments Resolution for corporations Written Record of Action for soleproprietors and partnerships Only need to update if current plandoesn’t already include4523

12/8/2014Resolution/Amendment Content The date accruals will be suspended;The Date of Plan Termination (DOPT);That participants become fully vested;That no new entrants shall becomeeligible after the DOPT; That no new entrants shall becomeeligible after benefit accruals aresuspended; Any changes to the 417(e) rules;46Resolution/Amendment Content The method of allocating excess assets or adeficiency of assets, or the percentage ofexcess assets which are to be transferred to aQualified Replacement Plan; Any removal of benefits which are notprotected by IRC 411(d)(6) but are consideredto be benefits under IRC 401(a)(2) whichmust be paid before a reversion of assets tothe employer; and Any changes to the plan document to bringthe plan into compliance with law orregulation changes.4724

12/8/2014Timing of Amendments Remember that benefits are determined under the plan’sprovisions in effect on the plan’s termination date, unless theamendment does not decrease the value of benefitsMust be adopted prior to DOPT––– Removal of benefits not protected by 411(d)(6)Change in 417(e) rates for PPA ’06Change in method of allocating excess assetsShould be adopted prior to DOPT–Asset allocation if plan is insufficient –– Pro-rata reduction for non-PBGC plansMajority Owner will be last in line for PBGC plansNot needed for one man plansProviding lump sum distributions if not available (e.g. to retirees)All amendments, if not seeking a FDLMay be adopted after DOPT if necessary to obtain a FDL–Amendments to bring the plan into compliance with laws or regulations48204(h) Notice ERISA 204(h), as amended by EGTRRA,requires that a notice must be provided ifthere is a reduction in future benefit accruals Applies to applicable pension plans that aresubject to funding requirements of IRC 412 Must be provided to all participants,beneficiaries, alternate payees, etc. whosefuture benefit accrual is expected to bereduced by an amendment4925

12/8/2014204(h) Notice Final regulations clarify:– ERISA 204(h) notice is not neededfor plan amendments that substitutethe 417(e)(3) segment rates for30‐year Treasury rates– Other notices may suffice forcomplying with the 204(h)requirements50204(h) Notice– Examples of other notices may suffice forcomplying with the 204(h) requirements ERISA 101(j) notices that apply when IRC 436restrictions on accruals, shutdown benefits andaccelerated benefit payments Notices required for multiemployer plans inreorganization, insolvency, or reducing planbenefits Notices required for retroactive amendmentsunder IRC 412(d)(2) [former 412(c)(8)]5126

12/8/2014204(h) Notice Timing Plans with fewer than 100participants have a 15-day noticeperiod Larger plans have a 45-day noticeperiod (exceptions on next slide) Multiemployer plans have a 15day notice period52204(h) Notice Timing Exceptions for larger plans:– The 15-day rule also would apply to a planamendment adopted in connection with a corporateacquisition or disposition– A plan amendment in connection with a merger,transfer, or consolidation of assets or liabilities thatsignificantly reduces an early retirement benefit orretirement-type subsidy but does not significantlyreduce the rate of future benefit accrual has until 30days after the effective date of the amendment5327

12/8/2014204(h) Notice Content Must “provide sufficient informationto enable a participant to understandthe effect of the amendment” Content must permit the applicableindividual to determine theapproximate magnitude of thereduction available to the individual,which can be satisfied throughillustrative examples54204(h) Notice Content If participants have a choicebetween an old and a new benefitformula (like in a cash balanceconversion), participants must begiven sufficient information tochoose between the two Individualized benefit statementsmay be used in lieu of illustrativeexamples if they include the sameinformation5528

12/8/2014Notice of Intent to Terminate Applies to PBGC-covered plans Issued to “affected parties” as of theproposed termination date– PBGC Reg. 4001.2– Includes participants, beneficiaries,alternate payees, and unions– Does not include the PBGC Provided 60-90 days prior toproposed termination date56NOIT Delivery Standard Termination Filing instructions atII.A.1. Delivery by any method reasonably exceptedto ensure receipt––––Hand deliveryFirst class mailElectronic delivery by electronic mediaCommercial delivery service to affected party’s lastknown address (deemed issued on date of deliveryor evidence of postmark) Posting is not a permissible method5729

12/8/2014NOIT Content Model Notice in PBGC’s StandardTermination Filing instructions Identifying information– Name of plan and plan number– Name and EIN of each contributingsponsor– Name, address, and phone number ofperson to be contacted with questions58NOIT Content Intent to terminate plan– A statement that the PA intends toterminate the plan in a standardtermination as of a specified date and willnotify affected parties if date changed or iftermination does not occu Sufficiency requirement– A statement that to terminate in a standardtermination plan assets must be sufficientto provide all benefits under the plan5930

12/8/2014NOIT Content Cessation of accruals– As statement that: Benefit accruals will cease as of termination date, butwill continue if plan does not terminate An amendment has been adopted ceasing benefitaccruals as of proposed term date (or earlierspecified date) whether or not terminated; or Benefit accruals had ceased, in accordance withERISA 204(h), as of date before NOIT issued– May require different NOITs for different participants– This satisfies the 204(h) notice requirement60NOIT Content Annuity information– Either include contents of Notice of AnnuityInformation; or– Statement indicating that: Annuity contracts may be purchased from aninsurer that is yet to be identified; and Affected parties will receive a supplementalnotice identifying the insurer at least 45 daysprior to distribution6131

12/8/2014NOIT Content Benefit information– A statement that each affected party entitled tobenefits will receive a written notification regardinghis or her plan benefits (Notice of Plan Benefits) Summary Plan Description– A statement as to how an affected party can get thelatest updated Summary Plan Description Continuation of monthly benefits (for personsin pay status)– A statement that their periodic benefits will not beaffected by the plan's termination; or– An explanation of how their periodic benefits will beaffected under the provisions of the plan62NOIT Content Extinguishment of guarantee– A statement that after plan assetshave been distributed in fullsatisfaction of all plan benefits withrespect to a participant or abeneficiary, the PBGC no longerguarantees that participant's orbeneficiary's benefits6332

12/8/2014Notice to Interested Parties Informs participants of their rightsregarding the plan termination Only required if requesting a FDL Not required for one man plans Provided 7-21 days prior to filingForm 5310 Sample notice in Announcement2013-1564Determination Letter Request Filed prior to filing PBGC Form 500 Not required but can be helpful What does a FDL do?– It is “the opinion of the Service as to thequalification of the particular plan involving theprovisions of §§401 .”– It does not apply to taxability issues under §404– It covers document issues, not operational issues– See Revenue Procedure 2013-6, Section 21 (“WhatEffect Will An Employee Plan Determination LetterHave?”)6533

12/8/2014Determination Letter Request Pros– Provides protection from risk ofdisqualification– More protection from problems if the Planwere later to be chosen for examination– More protection both for the client and forthe service provider– No reliance on Opinion Letter or AdvisoryLetter for plan termination– Extends the time for final distribution ofbenefits for PBGC-covered plans (Is this agood thing?)66Determination Letter Request Cons– Does not establish validity of termination– Does not establish that benefit distributions werecorrect– Issues discovered by the reviewing agent are nolonger allowed to be cleaned up without penalty– More likely to be chosen for an audit “to see if thedistributions were made as proposed by thetaxpayer”– IRS User Fee ( 2,000 for single employer plansand 3,000 - 15,000 for multiple employer plans(dependent on number of employees maintain theplan)6734

12/8/2014Notice of Plan Benefits Send to each “affected party”– Not required to send to a participantwhose benefits are paid out prior toNOPB due date see Blue Book2007-6 Provided prior to filing PBGCForm 500 Delivered in same manner asNotice of Intent to Terminate68NOPB Content Identifying information– Name of plan and plan number– Name and EIN of each contributing sponsor– Name, address, and phone number of personto be contacted with questions Proposed termination date given in NOIT(and any extended proposed terminationdate) If benefit amount in notice is estimate, astatement stating so and that benefits paidmay be greater than or less than estimate6935

12/8/2014NOPB Content For persons not in pay status for more than ayear as of proposed termination date– Personal data needed to calculate person’sbenefits, e.g., DOB, DOH, credited service, salaryhistory (if applicable)– Statement requesting that affected party promptlycorrect any information he/she believes not correct– If any necessary data not available, the bestavailable data, along with statement informingaffected party of data not available and affordinghim or her opportunity to provide70NOPB Content For persons in pay status as of proposedtermination date– Amount and form of participant’s or beneficiary’sbenefits payable as of proposed termination date– Amount and form of benefits, if any, payable uponparticipant’s death and name of beneficiary– Amount and date of any increase or decrease inbenefit that has occurred or is scheduled to occurafter proposed termination date with explanation,and reference to pertinent plan provision7136

12/8/2014NOPB Content For persons with valid elections (or deminimis benefits) as of proposed DOPT– Amount and form of participant’s or beneficiary’sbenefits payable as of indicated projected date– Amount and form of benefits, if any, payable uponparticipant’s death and name of beneficiary– Amount and date of any increase or decrease inbenefit that has occurred or is sche

Amount calculated using 7% interest, UP-84 mortality; or LS 7%, UP-84 17,500*104.82970 1,834,520 LS 5.5%, 2014 AMT 17,500*139.49229 2,441,115 Maximum lump sum Min( 1,834,520, 2,441,115) 1,834,520 Amount calculated using the greater of 7% interest, UP- 84 mortality and 5.5% interest, 2014 applicable mortality table?