Transcription

401(k) S OLUTIONSFisher Investments 401(k) Solutions Guideto Cash Balance Plans2 Fisher Investments 401(k) Solutions Guide to Cash Balance Plans

A Cash Balance Plan can be a good retirementsavings vehicle for owners of successful businesseswith steady revenue. While there are certain risks toconsider, participants can expect benefits that other retirementstrategies can’t offer—including significant tax deductionsand accelerated savings.This guide is designed to answer your questions about the risks and benefits of a Cash Balance Planto help you decide if a Cash Balance Plan is right for your firm.Q. What is a Cash Balance Plan?According to the U.S. Department of Labor, thereare two general types of retirement plans: definedbenefit plans and defined contribution plans. A CashBalance Plan is a defined benefit plan that acts insome ways like a defined contribution plan. Becauseit incorporates elements of both, it is sometimescalled a “hybrid” plan.some of the flexibility and portability of a definedcontribution plan.Q. What are the benefits of a Cash Balance Plan?A Cash Balance Plan can help business owners toaccelerate their retirement savings and realizesignificant annual tax deductions, primarilybecause the annual contribution limits for a CashBalance Plan are higher than a 401(k) Profit SharingPlan. For example, the annual maximum contributionfor a 401(k) Profit Sharing Plan is limited to 56,500( 62,500 for age 50 and older) for 2020, whilethe maximum contribution for a Cash BalancePlan can be as high as 336,000. The table belowA defined benefit plan provides a specific benefitat retirement for each eligible employee. Adefined contribution plan specifies the amountof contributions to be made in an employee’sretirement account. A Cash Balance Plan is a hybridof the two in that itguarantees a specificRetirement Plan Contribution Limits for 2020benefit at retirement foreach participant, but401 (k) withCashAgeTotalthe benefit is based onProfit SharingBalanceongoing—and fixed—70 63,500 336,000 399,500annual contributions.65 63,500 271,000 334,500The advantage? The60 63,500 261,000 324,500hybrid format of a Cash55 63,500 203,000 266,500Balance Plan allows forthe larger tax deductions50 63,500 158,000 221,500and accelerated45 57,000 123,000 180,000retirement savings40 57,000 96,000 153,000of a defined benefit35 57,000 75,000 132,000plan, while maintaining*Assumes a 37% tax bracket.3 Fisher Investments 401(k) Solutions Guide to Cash Balance PlansTax Savings* 147,815 123,765 120,065 98,605 81,955 66,600 56,610 48,840

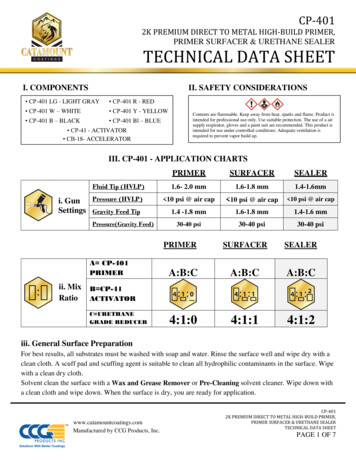

shows the annual maximum Cash Balance Plancontributions—based on age—for 2020. Cashbalance contributions reduce the owner's taxableincome dollar for dollar and also grow taxdeferred.Q. How does a Cash Balance Plan work?With a Cash Balance Plan, each participant’sbenefit grows annually in two ways: a contributioncredit and an interest crediting rate. Participantbenefits are guaranteed by the employer whosolely bears the investment risk.The contribution credit is the amount that theemployer contributes annually on behalf of theowners and the participants. The contribution isdeposited the following year prior to businesstaxes being filed. This amount can either be aflat dollar value or a percentage of income; forexample, 1,000 annually per participant or 2%of a participant’s annual compensation. Thiscontribution can be different for employees andowners so long as the plan passes compliancetesting. The annual funding formula is specific foreach company and is dependent on employeedemographics and employer goals. A cashbalance illustration can model funding formulaoptions for your specific business to help youevaluate whether this is a good strategy.The interest crediting rate (ICR) is the rate at whichthe plan guarantees interest on accumulatedcontributions. This rate is typically tied to an index,such as the 30-year treasury yield.An actuary calculates the required employercontribution each year based on market growth ofplan assets, plan census data and the interest creditingrate. The actuary also makes sure that the plan passesannual compliance testing. These tests make surecontributions made to highly compensated employeesbear a reasonable relationship to contributions madeto non-highly compensated employees.Assets within a Cash Balance Plan are pooledand come only from the employer. Investmentsare directed by the plan trustee, not individualparticipants. Typically, investments within the planseek returns that are consistent with the interestcrediting rate to minimize risk for the employer.Cash Balance Plans are generally used in conjunctionwith a 401(k) Profit Sharing Plan in order to maximizebenefits to the owner and pass compliance testing.Contributing to a 401(k) Profit Sharing Plan providessome funding flexibility to the employer. This canalso help mitigate the employer’s investment riskbecause assets in the 401(k) Profit Sharing Plan arenot subject to the employer-guaranteed interestcrediting rate.For more information about Cash Balance Plans, please call us at 866-607-5156 or visit www.fisher401k.comInvesting in securities involves the risk of loss.Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants.

Who is eligible for a Cash Balance Plan?A Cash Balance Plan can be designed to provide different levels ofbenefit to different employees, as long as annual non-discriminationrequirements are satisfied. For example, in some cases a plan couldprovide 100,000 per year to owners and 2% of compensation to othereligible employees. At the minimum, a Cash Balance Plan must coverthe lesser 40% of employees or 50 employees.Q. Are there risks associated with a CashBalance Plan?Yes. At Fisher Investments, we are committed toproviding unbiased and balanced information onevery aspect of a Cash Balance Plan—the bestway to help you make the right decision for yourbusiness. While the benefits of a Cash Balance Plancan seem attractive to business owners, there arealso significant risks that should be considered. Theyinclude:Value Fluctuation. Investment risk is borne solelyby the employer. The employer guarantees that theassets within the plan will grow by the stated interestcrediting rate (ICR), regardless of actual marketperformance. For example, if the beginning of year(BOY) balance is 100,000 and the interest creditingrate is 4%, the end of the year (EOY) balance shouldbe 104,000. If, due to market performance, theEOY balance is only 50,000, the employer isresponsible to fully fund the 54,000 shortfall inaddition to the planned contribution credit. If thecontribution credit is 100,000, the employer’scontribution requirement is 154,000. The shortfallfunding requirement can be amortized over sevenyears to help smooth out market volatility.Conversely, if, due to market performance,the EOY balance is 124,000, the employer’scontribution requirement would decrease by 20,000. Instead of contributing 100,000,the employer must contribute 20,000 less, or 80,000, which decreases the employer’s taxdeduction for that year.Because market volatility affects the predictabilityof annual ongoing contributions, assets within aCash Balance Plan typically seek returns consistentwith ICR.Risks of Over/Under Performing the ICRInvestment Performancegreater than ICR next year’s contributionand tax deduction decreaseInvestment Performanceless than ICR next year’s contributionand tax deduction increaseICR(shortfall can be spread over 7 years)5 Fisher Investments 401(k) Solutions Guide to Cash Balance Plans

The following simplified case studies illustrate the concept of value fluctuation risk.Scenario #1Scenario #2Beginning of Year (BOY) Balance:. 100,000Beginning of Year (BOY) Balance:. 100,000Annual Contribution Credit:. 100,000Annual Contribution:. 100,000Interest Crediting Rate:. 4%Interest Crediting Rate:. 4%Market Performance:.20%Market Performance:.-20%End of Year (EOY) Balance:. 120,000End of Year (EOY) Balance:. 80,000Net Result for Employer:To fully fund the account, the employer mustcontribute to bring the value up to 204,000.Because of market performance, the employercontribution for this year is reduced from 100,000 to 84,000, which reduces theemployer’s tax deduction by 16,000.Net Result for Employer:To fully fund the account, the employer mustcontribute to bring the value up to 204,000.Because of market performance, the employercontribution for this year is increased from 100,000 to 124,000. The additional 24,000contribution can be amortized over seven years.Investment Performance ExceedsInterest Crediting RateInvestment Performance is Less thanthe Interest Crediting RateThe plan actuary will calculate the employer’s required contribution threshold every year.For more information about Cash Balance Plans, please call us at 866-607-5156 or visit www.fisher401k.comInvesting in securities involves the risk of loss.Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants.

How do we establish a Cash Balance Plan for our business?Fisher Investments will walk you through the following process (top of next page)in order to establish a Cash Balance Plan for your business.Inflexible Funding. Contribution credits are requiredannually and cannot be modified from year to year.Before adopting a Cash Balance Plan, the employershould be sure that it can commit to the ongoingannual funding requirements. If a business is unableto sustain cash flow sufficient to fund the plan overthe long term, a Cash Balance Plan is not a goodoption.Administrative Expense. Because a Cash BalancePlan requires ongoing actuarial work, it is typicallymore costly to administer than a 401(k) ProfitSharing Plan.Q. Is a Cash Balance Plan set in stone?Generally, yes. A Cash Balance Plan should onlybe established if the employer intends for it tobe “permanent.” The employer could possiblyreduce the amount of future contributionsto the Cash Balance Plan as long as certainconditions are met. This can be done by eitheramending the plan document or “freezing”the benefit accruals. A Cash Balance Plan canalso be terminated in some circumstances, butit is a lengthy process and can be costly to theemployer.Administrative Complexity. Generally speaking,a Cash Balance Plan is more complex than a 401(k)Profit Sharing Plan. Because it is a more sophisticatedbenefit, it requires ongoing administrative effort,additional decision-making and associated costs.Q. Where does the money for a Cash BalancePlan come from?All assets within a Cash Balance Plan come fromcompany coffers. Generally, a minimal amountis contributed on behalf of employees, whilethe majority of the assets are contributed for theprincipals. Typically, principals will use the CashBalance contribution to reduce their taxableincome. For example, a 50-year-old doctor whoearns 500,000/year might choose to reduce hissalary to 350,000 and take 150,000 as an annualCash Balance Plan contribution. Because money inthe Cash Balance Plan is tax-deferred, this directlyreduces the doctor’s tax burden.This can get tricky when there are multiple principalsinvolved. Each principal will need to decide howmuch he or she wants to put toward the CashBalance Plan and will need to adjust his or hercompensation accordingly. Some businesses havea practice manager who can facilitate individualmeetings with each principal to determine how mucheach would like to contribute.7 Fisher Investments 401(k) Solutions Guide to Cash Balance Plans

The process to establish a Cash Balance Plan:1. FeasibilityStudyFill out the Fisher Investments census template and we will provide you an illustration. The illustrationwill show funding options and how much you could save in taxes each year through implementing aCash Balance Plan.2. ServiceAgreementAfter evaluating the illustration, if you decide to move forward with a Cash Balance Plan, you will signthe Fisher Investments Fiduciary Retirement Agreement and the actuary's Service Agreement.3. PlanDocumentsThe actuary will create Cash Balance Plan documents. The plan will be tailored to fit your firm's unique goalsand also complement your existing 401(k) plan (if applicable).4. PlanInstallationYour Fisher Investments Retirement Counselor will lead you through the plan installation process to ensurea smooth, seamless transition.5. PlanKick OffYour Fisher Investments Retirement Counselor can travel onsite to explain the plan features to youreligible employees and answer any questions.6. OngoingServiceYour Fisher Investments Retirement Counselor will provide check-in calls, annual plan reviews andinvestment education for your plan participants.Q. What are the roles and responsibilitiesassociated with a Cash Balance Plan?Fisher Investments partners with an independentactuary to help your business evaluate your financialneeds, goals and circumstances. Each role in yourCash Balance Plan is described in the chart below:RoleEmployerResponsibility As the plan fiduciary, it isthe employer’s responsibility toselect and monitor service providers Provide and fund the plan Allocate assets among planinvestment optionsFisherInvestments401(k)Solutions As an ERISA 3(38) InvestmentManager, Fisher will select, monitorand update the investment optionsavailable in the plan Support the employer in selectingand monitoring service providers Facilitate communication betweenplan sponsor and service providerPlan ActuaryandRecordkeeper Create plan documents Annual actuarial calculations Annual compliance testing Prepare IRS Form 5500Q. Who is the ideal candidate for a CashBalance Plan?A Cash Balance Plan may be a good fit for yourbusiness if some of the following are true: You or your business partners want to significantlyincrease your rate of retirement savings Your business consistently produces steadyrevenue You or your business partners have personalannual income greater than 275,000 andare seeking an annual tax deduction of 55,000or more Your company has fewer than 15 employeesper one owner You and your business partners are generallyolder than your employees You already fund an employer contribution of5% or more of employee compensation or areinterested in doing so. This could include a ProfitSharing Plan or Safe Harbor 401(k).For more information about Cash Balance Plans, please call us at 866-607-5156 or visit www.fisher401k.comInvesting in securities involves the risk of loss.Intended for use by employers considering or sponsoring retirement plans; not for personal use by plan participants.

GlossaryCash Balance Plan: A type of defined benefit plan thatacts similarly to a defined contribution plan because thebenefit amount is based on annual ongoing employercontributions.Contribution Credit: The annual amount that anemployer must contribute to a Cash Balance Plan onbehalf of the participants. This can be a dollar value or apercentage of the participant’s income.Defined Benefit Plan: This type of plan, also known asa traditional pension plan, promises the participant aspecified monthly benefit at retirement. The employeris responsible for determining how the plan’s assetsare invested and bears all risk if the plan’s assets areinsufficient to cover the promised benefit. Often, thebenefit is based on factors such as salary, age and thenumber of years of employment.Defined Contribution Plan: In a defined contributionplan, the employee and/or the employer contribute tothe employee’s individual account under the plan. Theemployee often decides how his or her account is investedand bears all investment risk. The amount in the accountat distribution includes the contributions and investmentgains or losses, minus any investment and administrativefees. The 401(k) plan is a popular type of a definedcontribution plan.Interest Crediting Rate (ICR): The annual rate at whichthe sponsor of a Cash Balance Plan guaranteesinterest on the accumulated contributions credits.This rate is typically tied to an index such as the30-year treasury rate.Fisher Investments 401(k) SolutionsFor many successful professional practices with steady revenue, Fisher Investments 401(k) Solutions is alogical choice. Specializing in Employer Sponsored Retirement Plans with less than 20 million in assets,we provide extensive client consultation and education, 3(38) investment manager fiduciary services,and a fair and transparent fee structure. To learn more about how Fisher Investments 401(k) Solutionscan benefit your retirement strategy, call us at 866-607-5156.www.fisher401k.com 401(k) S OLUTIONS5525 NW Fisher Creek Drive, Camas WA 98607 2019 Fisher Investments. Investing in securities involves the risk of loss. Intended for use by employersconsideringor sponsoringretirementnotBalancefor personaluse by plan participants.9 FisherInvestments401(k) SolutionsGuideplans;to CashPlansK02164S December 2019

3 Fisher Investments 401(k) Solutions . Guide to Cash Balance Plans. Q. What is a Cash Balance Plan? According to the U.S. Department of Labor, there . are two general types of retirement plans: defined benefit plans and defined contribution plans. A Cash Balance Plan is a defined benefit plan that acts in some ways like a defined .