Transcription

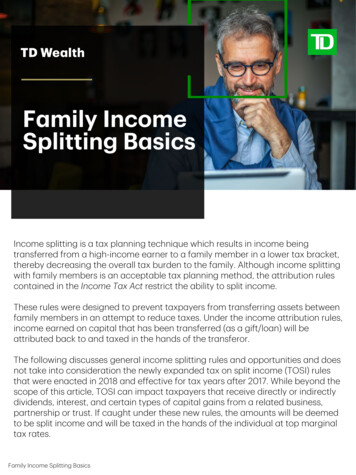

Family IncomeSplitting BasicsIncome splitting is a tax planning technique which results in income beingtransferred from a high-income earner to a family member in a lower tax bracket,thereby decreasing the overall tax burden to the family. Although income splittingwith family members is an acceptable tax planning method, the attribution rulescontained in the Income Tax Act restrict the ability to split income.These rules were designed to prevent taxpayers from transferring assets betweenfamily members in an attempt to reduce taxes. Under the income attribution rules,income earned on capital that has been transferred (as a gift/loan) will beattributed back to and taxed in the hands of the transferor.The following discusses general income splitting rules and opportunities and doesnot take into consideration the newly expanded tax on split income (TOSI) rulesthat were enacted in 2018 and effective for tax years after 2017. While beyond thescope of this article, TOSI can impact taxpayers that receive directly or indirectlydividends, interest, and certain types of capital gains from a related business,partnership or trust. If caught under these new rules, the amounts will be deemedto be split income and will be taxed in the hands of the individual at top marginaltax rates.Family Income Splitting Basics

The table below provides an overview of whether attribution applies wheninvestment income is earned with respect to transfers of gifts and loans to a partneror children:Income earned on Gift/LoanFor example:Fixed incomeinvestmentPerson/StrategyInterestIncome from publiclytraded sharesCapitalDividendsGainsMinor Child under 18GiftNo Interest Loan or Below prescribedrate loanAt or Above Prescribed Rate Loan (see#2 below)Income on Income (see #5 onAttributionAttributionNoNoNoNoNoNoAdult Child 18 and overGiftNo Interest Loan or Below prescribedrate loan (see #3 below)At or Above Prescribed Rate Loan (see#2 below)Income on Income (see #5 below)PartnerGiftNo Interest Loan or Below prescribedrate loanAt or Above Prescribed Rate Loan (see#2 below)Income on Income (see #5 below)Note: The chart above assumes that earned income is from a non-related business.Family Income Splitting Basics

Income SplittingOpportunities1. Contributions to a spousal RRSPAgency’s (CRA) prescribed interestrate at the time the loan is made. AsContributing to a spousal RRSP offers long as a formal loan agreement isfuture tax benefits because it provides executed, and interest payments arean opportunity for Partners topaid within the required timeline,equalize income during retirement.attribution will not apply. All incomeSpousal contributions can be madeand capital gains earned from thisby the higher earning Partner to aloaned money will be taxed in theplan where withdrawals will be taxed hands of the lower-income Partner.in the hands of the lower-incomeThe lower-income Partner will deductPartner. Contributions need to remain the interest paid while the higherin the spousal plan for at least threeincome Partner will report interestyears otherwise attribution rules willincome on the loan; however, thisapply and the amount withdrawn will should be offset by the greater returnbe attributed back to the contributing generated on the money in the handsPartner. However, RRIF (Registeredof the lower income Partner.Retirement Income Fund) withdrawalsare not subject to the attribution rules If the deadline for the interestin the year of contribution or the twopayment is missed, all of that year’sprevious years as long as only theincome and all future years’ incomeminimum amount is withdrawn.will be attributed back to the lendingPlease note that the minimum RRIFindividual. For more details onwithdrawal in the year of conversion is prescribed rate loans, please refer tozero, and no benefit will be derivedour article – Family Income Splitting:from spousal RRSPs if at retirementUsing a Prescribed Rate Loan.both parties are in the same marginalNote that attribution does not applytax bracket.to business income; therefore loans to2. Prescribed rate loana Partner which are used to finance abusiness will not be attributed back toUnder this strategy, the higher earning the Partner that provided the loan.Partner loans money to the lowerAlso note that for tax purposes, theincome Partner at Canada Revenueinterest paid on the loan may beconsidered tax deductible.Family Income Splitting Basics

3. Transfers for fair market valueAttribution rules do not apply whenproperty is transferred in exchangefor consideration equal to theproperty’s fair market value.Consideration may include debt, butinterest must be charged at least atthe CRA’s prescribed interest rate asdiscussed above. This strategy maybe beneficial when the propertytransferred is expected to generatehigh capital gains upon the eventualdisposition, as it will be taxed in thehands of the lower tax bracketindividual.4. Higher income Partner pays forfamily expensesThis strategy requires the higherearning Partner to pay all generalliving expenses (e.g. groceries,mortgage payments / rent, interest oninvestment loans, income taxliabilities) such that, the lower-incomePartner can maintain a largerinvestment base from which to earnfuture income.5. Income on incomeAlthough income is attributed back tothe person who initially transfers orNote: Attribution will apply on interest- lends funds, income earned on the reinvested income is not attributedfree or below prescribed rate loansback to the transferor; rather it ismade to adult children if it can betaxed in the hands of the recipient,determined that one of the mainwho is in a lower tax bracket.reasons for making the loan orConsider maintaining two separateincurring the indebtedness was tobank accounts so that the incomereduce or avoid tax.attributed back to the transferor andthe non-attributed income areaccounted for separately.Family Income Splitting Basics

ExampleLee gives 10,000 to his partner, who in turn earns 1,000 in interest in the firstyear. In the first year, the 1,000 in interest income is attributed back to Lee. Inthe second year, the Partner invests the 1,000, which in turn generates afurther 100 in interest. This secondary interest of 100 is not attributed backto Lee, and will be taxed in the Partner’s hands. See the table below for anillustration. Note that a second account should be opened in order toadequately separate the attributed and non-attributed income.Bank Account #1(End of year) BalanceIncomeAttributed to LeeYear 1 10,000 1,000Year 2 10,000 1,000Year 3 10,000 1,0006. Transfer capital property to minorchildrenBecause attribution rules do not applyto capital gains with respect to minorchildren, you can transfer assets tothem which you expect to grow invalue. Although dividend income willbe attributed back to you, any capitalgain resulting from the sale of thoseassets will not be attributed back.Parents often set up in-trust accountswith their minor children asbeneficiaries. These accounts aredesigned to principally provide capitalgains (e.g. by investing in equitymutual funds) so that the eventualcapital gains taxes upon sale will bepaid by the children.Family Income Splitting BasicsBank Account #2Balance Income taxed in handsof Partner 1,000 2,100 100 210If you are a parent contemplating theuse of this strategy, ensure that the intrust account is properly set upotherwise you may contraveneSection 75(2) of the Income Tax Act.This rule provides that, if the accountterms stipulate that the property canrevert back to the parent, or can onlybe disposed of with the consent of, orin accordance with, the direction ofthe parent, capital gains as well asincome may be attributed back to theparent. This means that to beeffective and avoid capital gainsattribution, the parent must beprepared for the prospect of the childbeing legally entitled to the accountupon reaching age 18. In essence, inorder to avoid capital gains splitting,these accounts should be regarded

as a gift to the minor child where the parent is exercising dominion over theaccount only as agent for the child during their minority. The other alternative toeffect capital gains splitting would be to document the arrangement as an actualTrust where the account belongs to the Trust and the Trust would need to filereturns and may have other reporting obligations.Here are a few general anti-avoidance rules which further limit income-splittingopportunities:RuleExampleIf a Partner or minor child receives aloan based only on a guarantee of theother Partner, this loan will be treatedas if that Partner had loaned the fundsdirectly, and attribution will thereforeapply. If an individual transfers property orloans money to a third party, who inturn transfers or loans that property tothe Partner or minor child of theoriginal transferor, the amount will betreated as if the Partner had loaned ortransferred the funds directly, andattribution will therefore apply. If a person indirectly transfers propertyto a trust for the benefit of the Partneror minor child, it will be treated as ifthat transfer was made directly, andattribution will therefore apply. Family Income Splitting Basics Bobby receives a loan at the bankbased solely on the fact that herPartner Jesse has fully guaranteedthe loan.In this case it will be deemed asthough Jesse has directly loanedthe funds to Bobby, and attributionwill apply.Blair Smith loans money to LeslieJones, who in turn loans thatmoney to Blair’s Partner Pat.In this case it will be deemed asthough Blair Smith has directlyloaned the funds to Pat Smith, andattribution will apply.Mr. Smith transfers money to a trustspecifically for the benefit of hisminor child.In this case it will be deemed asthough Mr. Smith has directlyloaned the funds to his child, andattribution will apply.

ConsiderationsDue to the complex nature of the attribution rules briefly discussed in this article,consider speaking to your TD advisor and tax specialist prior to implementingany of these tax-planning strategies.The information contained herein has been provided by TD Wealth and is for information purposes only. The informationhas been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investmentadvice. Particular investment, tax, or trading strategies should be evaluated relative to each individual's objectives and risktolerance. TD Wealth represents the products and services offered by TD Waterhouse Canada Inc., TD Waterhouse PrivateInvestment Counsel Inc., TD Wealth Private Banking (offered by The Toronto-Dominion Bank) and TD Wealth Private Trust(offered by The Canada Trust Company). All trademarks are the property of their respective owners. The TD logo and othertrade-marks are the property of The Toronto-Dominion Bank or its subsidiaries.03/2020Family Income Splitting Basics

Family Income Splitting Basics. The table below provides an overview of whether attribution applies when investment income is earned with respect to transfers of gifts and loans to a partner or children: Income earned on Gift/Loan. For example: Fixed income investment. Income from publicly traded shares; Person/Strategy . Interest: