Transcription

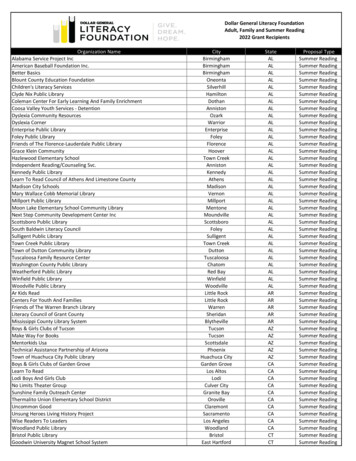

“Summer Spending Reward Program”121Earn up to 470,000 bonus point to redeem 39,000 miles or HK 1,880 spending rebateEnjoy your summer shopping fun by using Bank of Communications Credit Card!Register and spend with Bank of Communications Credit Card, you can enjoy up to 470,000bonus point upon spending designated amount (each eligible transaction must be HK 400).You can exchange 39,000 miles or simply earn the spending rebate for HK 1,880.Registration Hotline: 3977 6211(Registration applicable to Principal Cardholder only, excludes supplementary Card)Promotion PhaseSpending Period (Count by Transaction date)115 July – 14 August 2018215 August – 14 September 2018315 September – 14 October 2018Registration Period (Phase 1)*18 July (9:00am) – 14 August (11:59pm) 2018*Cardholders who have successful registration during Phase 1 registration period will be automaticallyregistered in Phase 2 and 3 and entitled to the rewards from Phase 1 to 3 with eligible spending.Reward 1: “Spend More, Earn More” - Enjoy up to 450,000 bonus pointFrom the phase of successful registration and accumulating eligible local and/ or overseas3spending to below target spending amount in each phase to enjoy below rewards:Target123Target accumulativelocal and/ or overseasspending in each phaseHK 5,000-HK 9,999.99HK 10,000-HK 29,999.99HK 30,000or aboveTotal rewards in 3 phases up toReward1CUP Dual Currency1Credit CardVISA Card20,000 bonus point12,500 bonus point/(Equal to HK 80)HK 50 Spending Rebate45,000 bonus point28,000 bonus point /(Equal to HK 180)HK 112 Spending Rebate150,000 bonus point87,500 bonus point /(Equal to HK 600)HK 350 Spending Rebate450,000 bonus point262,500 bonus point /(Equal to HK 1,800)HK 1,050 SpendingRebate(Quota: 5,000 per each phase)

4Reward 2 Happy Reward Series - Earn up to 20,000 bonus pointCardholder who successfully registers in Phase 1 and accumulates local and/ or overseas3spending with HK 5,000 or above in each phase can earn the below bonus point:Local and/ or overseas spending CUP Dual Currency Credit1in 3 consecutive phasesCard20,000 bonus pointHK 5,000 or above(Equal to HK 80)VISA Card110,000 bonus point /HK 40 SpendingRebateTips for Summer Spending Rewards – Enjoy pp to 470,000 bonus point rewardSpending HK 30,000 in 3 consecutive phases you can enjoy below reward:RewardCUP DualCurrencyCreditCardVISACardReward 1Phrase1Phrase2Phrase3150,000150,000150,000Reward 2Reward 1TotalReward470,00039,000Asia MilesOrHK 1,880Spending RebateRedeem22,500Asia MilesOrHK 1,090Spending Rebate20,00087,50087,50087,500272,500Reward 2Redeem10,000Furthermore, spend at Lane Crawford and New Town Plaza with your Card to enjoy moreshopping privileges! For details of the merchant offer promotions please read the relevantleaflet or visit our website. Act now!Remarks:1. If the Cardholder selected Spending Rebate Program, the cardholder can automatically convertevery 250 bonus points into HK 1 spending rebate. If cardholder selected Bonus Point Program, thecardholder can convert every 25,000 bonus points into HK 100 spending rebate on his own.Spending Rebate Program is only applicable for Platinum Credit Card (excluding Platinum CreditCard Cardholder who choose bonus point program and Co branded Platinum Credit Card) andPacific Credit Card. Bonus point program is valid for CUP Dual Currency Credit Card, PlatinumCredit Card and Co branded Platinum Credit Card (excluding Platinum Credit Card Cardholder whochoose Spending Rebate Program), Go Goal Credit Card, MI Credit Card and Co branded CreditCard.2. For the example of 470,000 bonus points convert to Asia miles: Cardholder spend with CUP DualCurrency credit card with accumulating amount of HK 30,000 in each phase, and fulfills thespending requirement to get “Reward 1” and “Reward 2”, can get 470,000 bonus points. With every6,000 bonus points to redeem 500 Asia miles, the cardholder can redeem for 39,000 miles in total.Cardholder converts his/her bonus point to the Asia miles on his/her own with handling fee.Cardholder can select to redeem for other miles in mileage plan, please refer to our bank websitefor handling fee and other details and subject to relevant terms and conditions.3. “Eligible retail transactions” include a local or overseas spending of HK 400 or above in a singletransaction. Please refer to below terms and conditions.4. The Cardholder successfully registers all 3 phases in Phase 1 and reaches HK 5,000 or above localand / or overseas spending in 3 consecutive phases will be entitled to "Reward 2".

Terms and conditions –Bank of Communications Credit Card “Summer Spending Reward Program”:1. Bank of Communications Credit Card “Summer Spending Reward Program” (“TheProgram”) is applicable to the Cardholders (“The Cardholders”) of both Principal CreditCard(s) issued by Bank of Communications Co., Ltd. ("the Bank") in Hong Kong and suchother credit cards designated by the Bank from time to time (“Eligible Credit Card”). It isnot applicable to Supplementary card, the Pacific Internet card and gift card.2. The Cardholders who successfully register and obtain the registration quota by calling3977 6211 will be entitled to the Promotion. The Cardholder who registers in Phase 1 isentitled to the registration for Phases 1, 2 & 3, and eligible registrations for Phases 1 to 3will be awarded. Cardholder who successfully registers in the Phase 2 is automaticallyentitled in the Phase 3 also. Only the promotion period of 2 to 3 will be rewarded; if thecard is successfully registered in the Phase 3, only the eligible spending of Phase 3 can beawarded. The registration quota of “Phrase 1, 2 & 3” of each phase is 5,000.Registration Period & Spending Period:Promotion Registration PeriodPhase118 July (9:00am) to14 August 2018 (11:59pm)215 August (9:00am) to14 September 2018 (11:59pm)315 September (9:00am) to15 October 2018 (11:59pm)Spending Period15 July – 14 August 201815 August – 14 September 201815 September – 14 October 20183. To complete the registration, the Cardholders are required to input the principal card’s4.5.6.7.8.9.credit card number and contact number in daytime and confirm the information and agreethe terms and conditions. A reference number will be assigned to the successful register.Each eligible credit card number is eligible for one registration quota only. If more than oneregistration is made with the same eligible credit card number, the first registrationconfirmed by the Bank will be adopted."Eligible spending transactions" include: (1) Local retail transaction, (2) Foreign retailtransaction (non HKD Transaction), (3) Online retail transaction and (4) Purchases madeby post/fax/phone during the transaction period in each phase. Each eligible transactionmust be 400 or above (or equivalent value in foreign currency).“Eligible Transactions” exclude local/overseas cash advance, top up amount of Octopusautomatic add value service, electronic wallet transaction including but not limited toWeChat Pay, PayMe and Alipay, monthly payment for instalment plans, monthlyinstalment to merchants, MPF/SVC contribution, balance transfer amount, all online billpayments, purchase of casino chips, tax payment, purchase of traveller's cheques,insurance fee, payment of all credit card charges (annual fees, finance charges, etc.),handling fees for other redemption promotions and the transactions in Mainland China byusing CUP Dual Currency Credit Card including transactions of Mainland property, vehicle,air ticket, fuel, wholesale, supermarket spending, hospital fee, education fee and anycredit card transactions designated by the Bank from time to time.For the “Eligible Transaction” made by Cardholder’s CUP Dual Currency Credit Card inMainland China, every RMB 1 spending will be calculated as HK 1 in this promotion.“Eligible Transaction” of a Supplementary Card will be combined with the Principal CreditCard account, but the Supplementary Card is not entitled to the reward of this program. Ifthe cardholder has more than one principle card, the spending from other principle cardcannot be transferrable or combined to count as accumulating spending amount to get thereward in this program.All spending transaction dates are counted by the transaction date of the Bank’s record.Eligible Transaction must be posted before the spending rebate credited into designated

10.11.12.13.14.15.16.17.18.19.credit card account. Other unposted transactions (including but not limit to disputetransactions, reversal transactions or delay posted by merchants) are not applicable forthis program, and such transactions are non-eligible spending transaction.The offered reward cannot be further sold or transferred to others, exchanged for cash orexchanged to other products or offers.To be eligible to the rewards of this program, the eligible Credit Card Account must bevalid and in good financial standing. Any fraud and abuse, false trading and otherunauthorized, cancelled, refunded or unposted transactions is not applicable for thisprogram. The Bank will verify the credit card transaction record to confirm credit cardaccounts' eligibility for the program and the entitlement of the reward. The Cardholders arerequired to keep the relevant original sales receipts and Credit Card sales slips forinspection upon request by the Bank. In case of disputes, the Cardholders are required tosubmit the relevant original sale receipt(s) and Credit Card sales slip(s) for furtherinvestigation by the Bank. All relevant documents submitted to the Bank will not bereturned. In case of discrepancy between the Bank's computer record and detailsrecorded on the credit card sales slip, the Bank's computer record shall prevail.If the Cardholders have cancelled any related transactions which had been included incalculating for the Promotion after promotional period, the Bank reserves the right to debitthe amount equivalent to the value of the reward from the eligible Credit Card Accountwithout prior notices.If cardholder selects Spending Rebate Program, the cardholder can convert every 250bonus point into HK 1 spending rebate. If cardholder selects Bonus Point Program, thecardholder can convert every 25,000 bonus points into HK 100 spending rebate.Spending Rebate Program is only applicable for Platinum Credit Card (excluding PlatinumCredit Card Cardholder who choose bonus point program and Co brand Platinum CreditCard) and Pacific Credit Card. Bonus point program is applicable for CUP Dual CurrencyCredit Card, Platinum Credit Card and Co brand Platinum Credit Card whose rewardprogram is bonus point(excluding Platinum Credit Card Cardholder who choose spendingrebate program), Go Goal Credit Card, MI Credit Card and Co brand Credit Card.Cardholder converts his/her bonus point to the Asia miles on his/her own with handling fee.Cardholder can select to redeem for other miles in mileage plan, please refer to our bankwebsite for more details. The relevant terms & conditions apply.All spending rebate can only be used for retail spending and both cash rebate and bonuspoint cannot be refunded, transferred or exchanged for cash, cash advance.The Bank reserves the right to vary the terms and conditions, to change or terminate thePrograms at any time without prior notice. The Bank accepts no liability for any mattersrelating to changes or termination of the Program.In case of any disputes, the Bank's decisions shall be final and conclusive.No person other than the Customer and the Bank will have any rights under the Contracts(Rights of Third Parties) Ordinance (Cap. 623, the Laws of Hong Kong) to enforce or toenjoy the benefit of any term under these Terms and Conditions.If there is any inconsistency or conflict between the English and Chinese versions of theseterms and conditions, the Chinese version shall prevail.“Reward 1” Spend More, Earn More – Terms and Conditions:20. Upon successfully registration, Cardholders who accumulates below target spendingamount in each phase will be entitled to below Reward (“Reward”). Each eligible creditcard account (based on the Credit Card number) is entitled to the Reward once only ineach phase:TargetTargeted accumulativeeligible spending ineach phaseRewardCUP Dual CurrencyCredit CardVISA Card

123HK 5,000 –HK 9,999.99HK 10,000 –HK 29,999.99HK 30,000 or aboveTotal rewards in 3 phases20,000 bonus point45,000 bonus point150,000 bonus point450,000 bonus point12,500 bonus points/HK 50 Spending Rebate28,000 bonus points/HK 112 Spending Rebate87,500 bonus points/HK 350 Spending Rebate262,500 bonus points/HK 1,050 SpendingRebate21. Each principal card account (under the same credit card number) is eligible to get therebate for once only. The spending rebate or bonus point of phase 1 will be credited toprincipal card account in January 2019; the spending rebate or bonus point of phase 2 willbe credited to principal card account in February 2019; the spending rebate or bonus pointof phase 3 will be credited to principal card account in March 2019.“Reward 2” Happy Reward Series – Terms and Conditions22. The Cardholder successfully registers all 3 phases in Phase 1 and reaches HK 5,000 orabove eligible local and/ or overseas spending in 3 consecutive phases, CUP DualCurrency Card can enjoy 20,000 bonus point; VISA Card can enjoy 10,000 bonus point orHK 40 spending rebate. Each eligible credit card account (based on the credit cardnumber) is entitled to “Reward 2” once only.23. Bonus Point/ Spending Rebate reward will be credited to the Eligible Credit Card Accountby the Bank in March 2019.To borrow or not to borrow? Borrow only if you can repay!

Enjoy your summer shopping fun by using Bank of Communications Credit Card! Register and spend with Bank of Communications Credit Card, you can enjoy up to 470,000 bonus point upon spending designated amount (each eligible transaction must be HK 400). You can exchange 39,000 miles or simply earn the spending rebate for HK 1,880.