Transcription

GET COMFORTABLEOUTSIDE YOUR COMFORT ZONEINSURANCE Digital Transformation Remaking an Industry

Perhaps more than any other financial service, insuranceemphasizes personal relationships. Human emotions like trustand compassion often play a central role, both in winning newcustomers and keeping existing ones. One of the biggest challengesfor insurers today is leveraging technology to build and improvetheir business while maintaining that essential personal touch.To see how insurance executives arestriking this balance, Accenture andOxford Economics surveyed 90 technologyexecutives in the financial services (FS)sector, including a statistically significantsample from the insurance segment. Oursurvey results show nearly all insuranceexecutives envision a digitally transformedFS industry five years from now. As a result,90% of insurers have a coherent, longterm plan for technology innovation thatreaches across their entire company.The survey results show that insurers areharnessing technology not only to improveefficiency but also to enhance customerrelationships and boost growth. For example,40% of insurance respondents expect theirtechnology investments to improve customerloyalty, and nearly that many—37%—expectthem to create new revenue streams.In addition, a third expect their technologyinvestments to help reduce the cost ofcustomer acquisition, and another thirdexpect it to increase their market share.“Digital technologies have changed theway that you can connect and relateto customers,” says Greg Baxter, ChiefDigital Officer of MetLife, Inc. “We needa deep and empathetic understandingof our customers, and that needs to beenabled by world-class capabilities.”Among the survey’s other findings:It is clear that insurance executives seedigital tools transforming their business atthe front end, the back end, and everythingin between. More than six in 10 report thattechnology is already having a significantimpact on their claims and underwritingprocesses. When survey respondents areasked to envision their business in threeyears, those response rates rise markedly,to nearly eight in 10. And more thantwo-thirds expect technology to have asignificant or very significant impact on riskmanagement, distribution, and finance. 90% of insurance respondents say that infive years, consumers will buy most of theirinsurance through online and mobile apps. 80% think more than half of customerinteractions will be substantially handledby virtual assistants. 83% expect that blockchain will bethe predominant ledger system forbusiness-to-business (B2B) financialtransactions within five years.2 INSURANCE

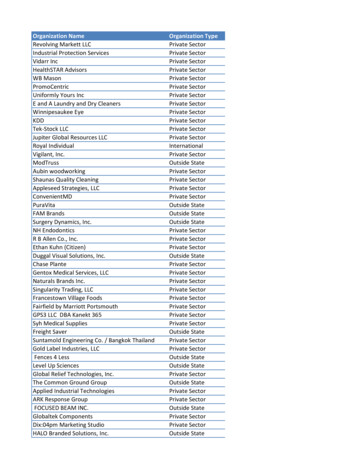

But insurers say integrating IT with longterm corporate strategy and growthplans is challenging. Many worry that thetechnology function works in a silo. Theirfears extend to the FS industry as a whole:Half of insurance executives responding tothe survey think the industry fails to makethe most of technology because financialprofessionals lack understanding of whatdigital tools can do for their business.Nevertheless, insurers are makingsignificant investments in both foundationaland emerging technologies; havemore planned for the future; and arealready seeing results. “The operationalefficiencies you can capture by applyingtechnology to the middle and backoffice are a huge, real-time, measurablebenefit,” says Mr. Baxter at MetLife. 60%More than six in 10 reportthat technology is alreadyhaving a significantimpact on their claims andunderwriting processes.Survey demographics and methodologyIn early 2018, Oxford Economics and Accenture surveyed 90 executives in the financialservices industry responsible for technology purchase decisions at their organization.The survey sample included 30 respondents from insurers; 30 respondents fromretail banking; and 30 respondents from capital markets companies. Unless otherwisenoted, all survey data in this paper reflect responses from insurance respondents.Respondent organizations were roughly evenly distributed across North America,Asia Pacific, and Europe. Respondent titles were evenly distributed among CTOs,CIOs, and EVP/SVP/VPs of IT. In terms of revenues, 37% of insurance respondentsreported 10 billion– 25 billion last year; the rest reported 25.1 billion– 100 billion.Digital Transformation Remaking an Industry 3

THE GROWTH GOALHappy Employees, Loyal CustomersThere’s no question that technology has helped insurers save money.MetLife, for example, “launched in our P&C business an end-to-enddigital product that has significantly reduced our cost to market at scale,”says Mr. Baxter. However, our survey results show insurers’ goals fordigital innovation go far beyond cost-cutting.Asked about how they expect theirtechnology investments to improvetheir competitiveness, 43% of insurancerespondents say improving employeeretention is among their top threegoals—perhaps not surprising in anindustry segment where high turnoveris a perennial and expensive problem.About the same proportion—40%—expect their technology investments toimprove customer loyalty. By comparison,only half as many respondents citedreducing operational costs as one of thetop three ways they think technologywill boost their competitiveness. Andonly 10% say they’re investing primarilyto compete with insurtech startups.For example, whereas 63% of respondentssay cloud for operational efficiency is makingthe biggest impact on their company today,that percentage plummets to just 30% whenthey think about their business in three years.Then, customer-facing blockchain (53%) andartificial intelligence-based technologies toimprove client-facing processes (47%) getthe most votes for high-impact digital tools.Indeed, insurers see the biggest payoffsfrom digital transformation shifting overthe next few years from efficiency tocustomer-facing applications (see Figure 1). 83% apply consistent metrics to monitorthe value of their technology investments4 INSURANCEInsurers are investing significantly in thesetechnologies, in terms of both moneyand people: 87% have a dedicated in-house teamfor digital innovation 87% take a systematic approach toevaluating emerging technologyThe high response rates show technology’scentral role in long-term strategy. We areseeing insurers back up their technologyinvestments with key performanceindicators (KPIs), talent, and systematicassessments to deliver the greatest value.

Figure 1: Cloud today, blockchain and artificial intelligence (AI) tomorrowPlease select which technologies are having the biggest impact on your companynow and in three years. Insurance respondents.Data analytics50%43%Cloud-based technologies toimprove operational efficiency63%30%Internal blockchainapplications43%50%Customer-facing blockchain37%53%AI-based technologies toimprove operational processes40%37%Cloud-based technologiesto generate business value33%13%AI-based technologies toimprove client-facing processesAgile development27%47%7%27%TodayIn three years“The operational efficiencies you can captureby applying technology to the middle and backoffice are a huge, real-time, measurable benefit.”Greg Baxter, Chief Digital Officer, MetLife, Inc.Digital Transformation Remaking an Industry 5

ARTIFICIAL INTELLIGENCE ANDTHE FUTURE OF INSURANCEAs a relationship business, the insurance sector has a great deal to gain byfiguring out how artificial intelligence and machine learning can enhancecustomer service and make customer interactions more productive. AtMetLife, for instance, AI helps call-center agents in customer conversations.The AI technology recognizes cues in the customer’s voice (tone, pacing,silences) and gives the agent suggestions for, say, adjusting the scriptor calling back at a better time.MetLife is also using AI in underwriting.“We’re using more intelligent ways ofaccepting data sources to determinerisk categories,” Mr. Baxter says. “Thatmassively increases the amount ofstraight-through automated underwritingthat we can do without needing to gothrough an underwriting adjudicator.”Our survey results confirm that insurerssee AI playing a major and evolving role inthe future of their business (see Figure 2).Today, 60% of insurers are investing in AIto improve operational processes, but inthree years—when the technology will havematured considerably—half will be investingin AI to improve client-facing processes.As for blockchain, another next-generationtechnology, more insurers see themselvesinvesting significantly in customer-facingblockchain and internal blockchainapplications in three years than today.Nearly half of respondents (47%) saythey will invest in internal blockchainin the near future, up from 27% today.6 INSURANCEThat’s not to say insurers aren’t makingthe most of core technologies like dataanalytics. Our survey shows a thirdof respondents are already investingsignificantly in analytics. And they arereaping the rewards. When asked whichtechnologies are having the biggestimpact on their company and industrytoday, half name data analytics.Cloud apps are even more popular.But they, too, are seen as being overtaken,in terms of impact and projectedinvestments, by newer, customer-facingtools in three years. Today, two-thirds ofinsurance executives say cloud-basedtechnologies to improve operationalefficiency are having the biggest impacton their industry, and 63% say the sameabout cloud at their own company.But looking ahead three years, thosenumbers plunge to 23% and 30%.

Figure 2: An evolving role for artificial intelligencePlease indicate which technologies you are investing in or plan to invest in significantly.Insurance respondents.AI-based technologiesto improve operationalprocesses60%20%Cloud-based technologiesto improve 3%Cloud-based technologiesto generate business value33%47%40%10%Data analytics33%27%AI-based technologiesto improve client-facingprocesses27%Internal blockchainapplications27%50%47%Agile development10%20%We are not investing orplanning to invest in anyof these technologies3%0%Investing todayPlan to invest in three yearsDigital Transformation Remaking an Industry 7

OVERCOMING THE HURDLESWhat roadblocks impede insurers’ journey to digital transformation?More than their peers in retail banking or capital markets, insuranceexecutives worry that IT lives behind a wall where its expertiseis squandered (see Figure 3).For insurers, an equally seriousobstacle is lack of systems integrationor compatibility: 47% of them say lackof collaboration with the IT functionprevents them from getting value fromtheir technology investments, and thesame proportion cite lack of systemsintegration or incompatibility as a hurdle.Yet four in 10 insurance respondents alsoexpect their technology investments toimprove employee retention. This suggeststhat while digital transformation in theindustry may reduce headcount, it canalso help improve employee satisfactionand reduce turnover, which has historicallytended to be high.Fears about headcount reduction representanother obstacle. Nearly all insurers (90%)expect significant headcount shrinkagein their industry segment over the nextfive years due to digital innovation. Andhalf think concerns about headcountreduction stand in the way of digitaltransformation in the FS industry overall.Despite the obstacles, insurers are cleareyed about technology’s importanceto their future competitiveness. Mr.Baxter at MetLife says that while digitaltransformation has gotten off to a slowerstart in insurance than in banking,“customers are every bit as anxiousto get simpler and more convenientsolutions from insurance as they arefrom any other provider. So we see thesame sort of disruption happening.”8 INSURANCE

Figure 3: Struggling with systems incompatibility and an IT siloAt your company, what are the biggest obstacles to achieving desired results fromtechnology investments? Insurance respondents, top-three ranked responses.Lack of systems integrationor compatibility47%Lack of collaborationwith the IT function47%Lack of change managementexpertise43%Regulation and compliancechanges37%Lack of training resourcesor support33%Difficulty of updating technologywithout disrupting daily activities30%Lack of executive support27%Lack of time23%Current organizationalstructure7%Lack of employee support3%Lack of budget3%Digital Transformation Remaking an Industry 9

CONCLUSION ANDACTION POINTSWhat Insurers Can Do TodayInsurance may have come to the fintech revolution a bit late, butthe sector is catching up fast. In part thanks to disruption from newcompetitors, executives recognize the value of strategic investmentsin both foundational technologies like cloud and next-generationtools like blockchain and AI. And over the next couple of years, theyexpect their focus to shift increasingly from driving efficiency toimproving customer service and supporting long-term growth plans.To ensure that their digital transformationefforts are effective, many insurers havealready created dedicated in-house teamsfor technology innovation and measure thevalue of their investments with consistentKPIs. Yet our survey suggests they shoulddo more to integrate technology withstrategy, bringing IT into closer harmonywith all the lines of business. Many insurerscomplain that systems incompatibilitystands in the way of digital innovation,so finding technology platforms thatallow the different parts of their businessto work together efficiently is key.In the digital era—in which personalization,speed to market, and security arekey—pivoting to new technologies andreference architectures including cloud,intelligent automation, distributed ledgertechnology, and enterprise agility is abusiness imperative. Yet transitioningcompletely from existing mainframesand other legacy technology will oftenbe impossible, as these are typicallydeeply embedded in an organization.This is why legacy enhancement andmodernization are so critical on thejourney to competitive advantage.In addition, we see data driving the digitalinsurance business, and insurers shouldmake sure they have data they can trust.They should focus on data veracity, dataarchitecture, and data governance tounderpin their digital transformation.10 INSURANCE

To strike the balance between adoptingnew technologies and maintaining thepersonal relationships that are criticalto a successful insurance business, werecommend the following action points: Insurance companies are stronglyadvised to make the seamlessintegration of old and new systemsa priority as they migrate to moreinnovative and powerful technologies. Before undertaking any majorinvestments in new technologies ormaking any major changes, insurancecompanies should take a close look attheir workforce. Do they have the righttalent base to seize full value from thetechnology portfolio? Can they attractand retain people who will use newtechnologies to gain a competitive edge? Insurers should leverage data fromthe Internet of Things (IoT) and othersources to support their intelligentautomation journey. Most operating models common in theinsurance industry won’t be effectivein the digital age. Insurers should assesstheir business model, identifying wherechanges are called for to respond tothe evolving competitive landscape.These actions can help insurancecompanies capture the benefitsand opportunities of new intelligentplatforms and technologies. Insurancecompanies should also continue tocollaborate with one another and tobuild out their ecosystems of alliances,partners, and vendors as they moveforward on their digital journey. Insurers should conduct a thorough reviewof their applications to help determinewhich alliances, partners, and vendorsshould be integrated into their ecosystem,actively identifying savings opportunitiesand operational efficiencies.The AuthorsAndrew Poppletonandrew.poppleton@accenture.comSenior Managing Director, Accenture Financial Services Technology AdvisoryJim Struntzjames.p.struntz.jr@accenture.comManaging Director, Accenture Financial Services, North America Technology Consulting leadCarmina Leescarmina.lees@accenture.comManaging Director, Accenture Financial Services Technology AdvisoryDigital Transformation Remaking an Industry 11

OXFORD ECONOMICSABOUT ACCENTUREGlobal headquartersOxford Economics Ltd, Abbey House,121 St Aldates, Oxford, OX1 1HB, UKTel: 44 (0)1865 268900Accenture is a leading global professional servicescompany, providing a broad range of services andsolutions in strategy, consulting, digital, technologyand operations. Combining unmatched experienceand specialized skills across more than 40 industriesand all business functions—underpinned by theworld’s largest delivery network—Accenture worksat the intersection of business and technology tohelp clients improve their performance and createsustainable value for their stakeholders. With 469,000people serving clients in more than 120 countries,Accenture drives innovation to improve the way theworld works and lives. Visit us at www.accenture.com.LondonBroadwall House, 21 Broadwall,London, SE1 9PL, UKTel: 44 (0)203 910 8000New York5 Hanover Square, 8th Floor,New York, NY 10004, USATel: 1 (646) 786 1879Singapore6 Battery Road, #38-05, Singapore 049909Tel: 65 6850 0110Email: mailbox@oxfordeconomics.comWebsite: www.oxfordeconomics.comSTAY CONNECTEDAccenture Financial ServicesTechnology technology-advisoryConnect With Uswww.linkedin.com/showcase/16197660/Follow Ustwitter.com/TechAdvisoryFSDISCLAIMERThis document is intended for general informationalpurposes only and does not take into accountthe reader’s specific circumstances, and may notreflect the most current developments. Accenturedisclaims, to the fullest extent permitted byapplicable law, any and all liability for the accuracyand completeness of the information in thisdocument and for any acts or omissions made basedon such information. Accenture does not providelegal, regulatory, audit, or tax advice. Readers areresponsible for obtaining such advice from theirown legal counsel or other licensed professionals.Copyright 2019 Accenture.All rights reserved.Accenture and its logo are trademarks of Accenture.182019

expect significant headcount shrinkage in their industry segment over the next five years due to digital innovation. And half think concerns about headcount reduction stand in the way of digital transformation in the FS industry overall. Yet four in 10 insurance respondents also expect their technology investments to improve employee retention.