Transcription

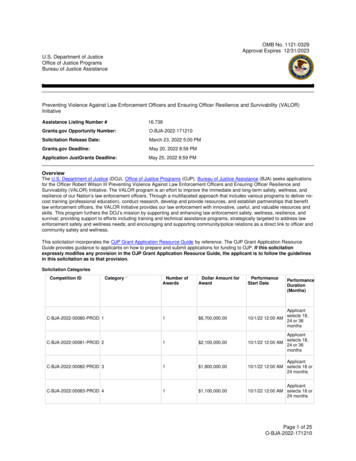

DEPARTMENT OF THEATTORNEY – GENERAL AND JUSTICEGrants Management FrameworkPrinciples and policies for best practicein the administration of grantsJuly 2017www.nt.gov.au/justice

Da Capo Solutions Pty LtdThis work is copyright. Apart from any use as permitted under the Copyright Act 1968, no part may be reproduced for any purpose without the prior written permissionfrom the authoring entity. Ownership and intellectual property residing within this document exists with the authoring entity. The Northern Territory Department ofAttorney-General and Justice retains a license in perpetuity to use this document for its exclusive benefit, but may not distribute or permit unauthorized usage of thesematerials by any third party.Requests and inquiries regarding reproduction and rights should be addressed to:Da Capo Solutions Pty LtdPO Box 41454Casuarina NT 0812

Table of ContentsTABLE OF CONTENTSTABLE OF CONTENTS . ILIST OF ACRONYMS. IINTRODUCTION . 1PART ALEGAL AND DEFINITIONAL FRAMEWORK . 21. DEFINITION AND PURPOSE OF A GRANT . 22. LEGISLATIVE FRAMEWORK . 23. COMMONWEALTH GOVERNMENT POLICY FRAMEWORK . 4PRINCIPLES FOR BEST PRACTICE . 54. ORGANISATION AND CONSISTENCY . 55. COMMUNICATION AND COLLABORATION . 56. PROBITY AND TRANSPARENCY . 67. DEFINED OBJECTIVES . 68. ROBUST RECORD-KEEPING AND ACCOUNTING . 7PART BESTABLISHING A GRANT PROJECT . 89. BUSINESS CASE . 810. ELIGIBILITY . 911. STATEMENT OF REQUIREMENTS . 912. APPROVAL AND PUBLICATION . 10APPLICATIONS FOR FUNDING . 1113. APPLICATION METHODOLOGY . 1114. APPLICATION CONTENTS . 1114.1 ESP DETAILS. 1214.2 AFFILIATED ENTITIES . 1214.3 FINANCIAL INFORMATION . 1214.4 SERVICE LOCATIONS . 1314.5 CAPACITY, NEEDS AND RISKS . 1314.6 OTHER DOCUMENTS . 13Page III

Table of Contents15. APPLICATION APPRAISAL . 1315.1 ROLE ALLOCATION . 1415.2 SELECTION CRITERIA . 1415.3 RISK EVALUATION . 1515.4 FUNDING RECOMMENDATIONS . 1615.5 TERMS AND CONDITIONS . 16ADMINISTRATION OF FUNDING CONTRACTS . 1716. CONTRACT DRAFTING AND EXECUTION . 1716.1 FORM OF CONTRACTS . 1716.2 EXECUTION PROCESS. 1716.3 CONTRACT VARIATIONS . 1717. PAYMENTS . 1817.1 RECURRENT FUNDING . 1817.2 NON-RECURRENT AND ASSET FUNDING. 1817.3 WITHHOLDING PAYMENTS . 1918. MONITORING . 1918.1 MILESTONE ACQUITTAL TASKS . 1918.2 FINANCIAL ACQUITTAL . 2018.3 PERFORMANCE REPORTING . 2019. COMPLETION . 2119.1 CONTRACT EXPIRY . 2119.2 CONTRACT TERMINATION . 2119.3 REPAYMENT OF FUNDING . 21EVALUATION OF PERFORMANCE . 2220. DATA CLASSIFICATION . 2221. PERFORMANCE DATA COLLECTION . 2222. PERFORMANCE DATA ANALYSIS . 2323. ESTIMATING ADDED VALUE. 23FURTHER READING . 24Page IIII

Grants Management FrameworkLIST OF ACRONYMSABNAustralian Business NumberABRAustralian Business RegisterACNAustralian Company NumberACNCAustralian Charities and Notfor-profits CommissionFMANorthern Territory FinancialManagement Act 1995FOIFreedom of InformationGAUGrants Administration UnitGMFGrants Management FrameworkAFSAudited Financial StatementGSTGoods and Services TaxANAOAustralian National Audit OfficeNFPNot-for-Profit OrganisationASRAssessor/sNTCSATOAustralia Taxation OfficeNorthern Territory CorrectionalServicesCGGCommonwealth GrantGuidelinesNTGNorthern Territory GovernmentPFRPerformance ReportPGOPrincipal Grant OfficerREVReviewerSORStatement of RequirementsSCOANational Standard Chart ofAccounts and Data DictionaryCOAGCouncil of AustralianGovernmentsCTHCommonwealth of AustraliaDELDelegateESPExternal Service ProviderFASFinancial Acquittal StatementFCFunding ContractPage III

Grants Management FrameworkINTRODUCTIONOver the past decade there has been a significant shift in how governments across Australiaprovide benefits to the community, with third parties increasingly being engaged to deliverservices on behalf of the public sector. The nature of these arrangements can broadly becategorised into four relationship types: government funded services which are clientdirected and individualised; collaborative, joint ventures; purchase of service contracting,including competitive and negotiated tendering (the ‘purchaser-provider’ model); and servicedelivery through operational grants. The focus of this document is on the last of these – butbearing in mind that government practice has steadily exhibited a tendency to operationallyconverge purchaser-provider and grants funding paradigms.Traditionally, grants were structured as ‘input focussed’, whereby funding by governmentwas provided with no necessary expectation of a benefit in return. More grants are nowarranged however as ‘output focussed’, such that government funding is provided oncondition of delivery of a service on behalf of government. This shift, accompanied by theaforementioned convergence, means that there is a heightened necessity for grants fundingto be subject to fuller accountability mechanisms; grants programs involve the expenditure ofpublic funds for the principal benefit of public beneficiaries – not primarily grant recipients aswas once the case.This contemporary interpretation of the operational grants model has numerous strengths,and can be an effective form of service delivery if managed well. The purpose of thisdocument is to guide that management process. It endeavours to: Detail best practice in grants management for NTCS, consistent with legislativerequirements and recognised Australian guidelines;Describe processes for appropriate management, accountability and controlarrangements over the design, implementation, payment, ongoing monitoring,acquittal, and evaluation of grants; and ultimatelyProvide guidance to all NTCS staff, to facilitate a shared understanding of the keyprinciples and policies which should underpin end-to-end grants management.This Grants Management Framework (GMF) has been authored as a specialist documentwhich seeks to succinctly articulate principles and policies that are of direct relevance toNTCS, bearing in mind the particulars of its business objectives and capabilities. Accordinglyit is not absolute or exhaustive; a wide range of literature considering all aspects of grantsfunding and administration is available for further, in-depth reference. The GMF is however,intended to be sufficiently comprehensive and detailed to provide its readership with allnecessary guidance to understand, and act in accordance with best practice in grantsmanagement.The remainder of this document is divided into two parts. Part A broadly seeks to provideguidance on the principles underpinning good grants management, describing the legal anddefinitional framework and principles for best practice within which grants should besituated. Part B then builds upon these principles, to provide more succinct and practicalpolicy guidance on establishing a grant project, dealing with applications for funding,administration of Funding Contracts, and evaluation of performance.July 2016Page 1 of 29

Grants Management FrameworkLEGAL AND DEFINITIONAL FRAMEWORK1.DEFINITION AND PURPOSE OF A GRANTFor the purposes of NTCS:A grant is defined as an arrangement for the provision of financial assistance to an External ServiceProvider (ESP) to provide a service for public beneficiaries, which is intended to promote the policyobjectives and strategic intent of the agency, and assist the recipient to build capacity and achieveits goals, under such terms and conditions as unilaterally determined by the agency.Financial arrangements which are not grants include the following: The procurement of property or services, including the procurement of property orservices by a third party on behalf of the agency;An act of grace (ex gratia) payment;A payment of compensation relating to defective administration, employmentcompensation, or for a purpose established by legislation;A payment to a person of a benefit or entitlement established by legislation;A tax concession or offset;An investment or loan, whether repayable or not;A gift of public property;A reimbursement of expenses for property or services, whether evidence ofexpenditure is supplied or not; andA payment which is in consequence of another agreement between the agency andanother party.Whist grants are usually distinguishable from these financial arrangements, sometimes thedistinction between a grant and a procurement may not be immediately obvious. In thosecases it is helpful to consider the broader picture, including the purpose for which the fundsare to be provided, the type of activity generated by the funding, the source of funds, andidentity of the beneficiaries. In general if the major focus of the arrangement is on theprovision of property or services to the NTG or a third party organisation, or not primarily forthe benefit of public beneficiaries, it should generally be treated as a procurement andsubject to procurement procedures and regulations. Therefore, a grant arrangement alwaysinvolves three parties: The Provider (NTCS) – who designs, administrates, and oversees the grant;The Recipient (ESP) – who delivers the service as an agent of the provider; andThe Beneficiary (Public) – who receives the benefit of the granting activity.The purpose of a grant must always be linked to the core business and goals of the agency,and maintain a nexus to, and be consistent with, the strategic intent of NTCS. Hence:The purpose of an NTCS grant is to contribute to community safety by reducing re-offendingthrough employment, education and programs.2.LEGISLATIVE FRAMEWORKJuly 2016Page 2 of 29

Grants Management FrameworkThe principal statute governing grants for agencies of the NTG is the Financial ManagementAct 1995 (NT).1 The requirements imposed on NTCS by this legislation are articulated inpractice under section A6.4: Grants and Subsidies, of the Northern Territory Treasurer’sDirections.Selected extracts of significance from the Treasurer’s Directions include the following: A6.4.1 – “Grant and subsidy expenses are distributions of public money made by anAgency to other Agencies, entities or individuals that are directed at achieving Agencyoutputs and outcomes.”A6.4.2 – “Grants may be non-reciprocal or reciprocal in nature.”A6.4.2(ii) – “Grant and subsidy distributions are often used by Agencies as a means ofdelivering services to the community and can take many forms, including theprovision of cash, non-cash assets and services. They can be adopted as a costeffective and efficient way of delivering required services where appropriate publicsector skills or resources are not available and where certain organisations have closercontact with target groups or service users.”A6.4.2(v) – “Grants and subsidies should be distinguished from the purchase ofeveryday goods and services by an Agency. In the majority of cases, the purchase ofgoods and services will be based on standard terms and conditions set by the supplierrather than the Agency. Conversely, grants and subsidy terms, conditions and/oreligibility criteria will invariably be established by the Agency (or Government)providing the grant, rather than the grant recipient.”A6.4.3 – “A non-reciprocal transfer means a transfer in which an Agency providesassets or services or extinguishes liabilities without directly receiving approximatelyequal value in exchange from the other party or parties to the transfer.”A6.4.6 – “A reciprocal transfer means a transfer in which an Agency provided assetsor services or extinguishes liabilities and directly receives approximately equal value inexchange from the other party or parties to the transfer.”A6.4.11 – “Each Agency is to ensure that appropriate management, accountability andcontrol arrangements are in place over the payment, ongoing monitoring, andacquittal of grants and subsidies.”A6.4.11(i) – “In particular, the payment of grant monies should be transparent andcapable of withstanding public scrutiny.”A6.4.11(ii) – “ Agencies should have regard to the relative risk and context withinwhich a grant or subsidy is made”A6.4.11(iii) – “ considerations that may be applicable to grant and subsidydistributions include, but are not limited to:o the identification and selection of recipients should be clear, transparent andcapable of withstanding public scrutiny, with potential recipients selected onmerit against established criteria;o written agreements should be legally sound;1The legal framework governing grants for agencies of the Commonwealth includes the FinancialManagement and Accountability Act 1997, Financial Management and Accountability Regulations 1997,Federal Financial Relations Act 2009, Commonwealth Authorities and Companies Act 1997, and PrivacyAct 1988. Whilst the contents of these Commonwealth Acts and their subsidiary materials areinstructive, they do not directly regulate grants issued by NTG agencies.July 2016Page 3 of 29

Grants Management Frameworkooooo applicable grant terms and conditions should be clearly specified andcommunicated with grant recipients, including any non-compliance and/orrepayment requirements;clear acquittal processes should be established that are commensurate withthe nature, risk and amount of funding provided; payments should be approved by an appropriately delegated officer;grants should be followed up in a timely manner where terms and/orconditions are breached to a material extent and partial or full repayment of agrant is required; periodic review of the overall efficiency and effectiveness of grant andsubsidy funding as a means of achieving Agency objectives should beundertaken.”A second NT statute of direct relevance to grants for agencies of the NTG is the InformationAct 2002 (NT).2 Under this Act, in relation to grants: Personal information should be managed by the agency in accordance with theInformation Privacy Principles3 and not be disclosed to any other third party withoutthe consent of the ESP, unless required by law or authorised by the Act;Personal information should only be accessed by authorised agency staff for purposesdirectly related to assessing applications and managing grants; andESPs must refrain from engaging in direct marketing and impose the same privacyobligations to partners and subcontractors it engages to deliver services.More generally, agency staff should bear in mind that grants procedures should be consistentwith the dictates of Australian administrative law, and in particular priorities of natural justice,anti-discrimination, and freedom of information.A final statute directly concerning grants for agencies of the NTG is the A New tax System(Goods and Services Tax) Act 1999 (Cth), in relation to GST obligations. Although it isincumbent on ESPs to apprise the ABR and NTCS of their GST status, the agency must still beaware of GST implications for grants payments for both the agency and recipient, and act inaccordance with Territory policies specified in NT Treasury Tax Circulars.3.COMMONWEALTH GOVERNMENT POLICY FRAMEWORKThe Commonwealth Grant Guidelines (CGGs), issued by the Federal Finance Minister underregulation 7A of the Financial Management and Accountability Regulations 1997, establish thepolicy framework for grants administration by Commonwealth Government agencies subjectto the Financial Management and Accountability Act 1997 (Cth). These highly detailedguidelines may be instructive to NTCS in general, but do not bind it in any way. Notablyhowever, the CGGs articulate seven broad principles for grants administration: robustplanning and design; collaboration and partnership; proportionality; an outcomes orientation;achieving value with public money; governance and accountability; and probity andtransparency. These judicious principles are recognised and incorporated henceforth in thisGMF as and where they are relevant to the specific grants work of NTCS.2This Act draws much of its substance from the Commonwealth Privacy Act 1988.These principles effectively mirror the Commonwealth’s National Privacy Principles established underthe Privacy Act 1988 (Cth).3July 2016Page 4 of 29

Grants Management FrameworkPRINCIPLES FOR BEST PRACTICEThe high level principles applicable for best practice in the administration of grants areoutlined below. These principles are essentially relevant to all NTG agencies, with processesand concepts described being suitable irrespective of the substantive operational objective ofa grant. Hence they are not only principles, but also standards for best practice.4.ORGANISATION AND CONSISTENCYTo maintain integrity and accountability, mitigate concerns about equitable treatment ofESPs, and ensure constancy in business practice, it is imperative that NTCS conduct its grantswork in an organised and consistent manner within, and across its divisions. In practice, thismeans following uniform, systematic workflow processes to help ensure that both agencystaff and ESPs are aware of their obligations, and can have confidence in the outcomes oftheir work. From a business standpoint, maintaining consistent work protocols also assistswhen staff changes occur and there can otherwise be a loss of institutional memory regardingcorrect processes.Consistency is also essential with regards to terminology. Clearly defining grants activities asdistinct from other agency work and financial arrangements helps to alleviate confusion; forexample, procurement terminology such as ‘request for tender’ and ‘expressions of interest’should not generally be used in grants documentation. Accordingly, both the process bywhich grants are established, administered and evaluated, and definitions and terminologyassociated with these activities should be clearly documented and accessible to agency staff.5.COMMUNICATION AND COLLABORATIONAn effective grants program requires clear communication between all stakeholders; that is,both with ESPs but also within NTCS itself. Staff should seek to consult, cooperate, andcollaborate with potential grant applicants, industry and community sectors, othergovernment agencies, and relevant employees within their organisation to help reducefragmentation, unnecessary overlaps and duplication of funding. Agency policy objectivesare most likely to be achieved through collaborative efforts which facilitate positive workingrelationships, information sharing, and a shared understanding of expectations and intendedoutcomes.With regard to ESPs, it is imperative that NTCS maintains meaningful dialogue, providingreasoning and guidance wherever possible. Hence in relation to applications and acquittaltasks, it is important not only to provide timely notification of success, failure, compliance,and non-compliance, but also details for why a submission has been adjudicated as such. Itshould not be assumed that all an ESP requires is money – the agency can contributevaluable, specialist advice and experience which will help ESPs to build capacity andultimately deliver better results.Bear in mind though that agency staff should be careful to not overstep their bounds. Adviceand assistance communicated should always be provided at arms-length, by qualifiedpersons, and not transgress the separation of duties between the provider and recipient;NTCS should seek to assist ESPs to apply for grants, deliver services and acquit theiractivities wherever possible, but never directly complete their work for them.July 2016Page 5 of 29

Grants Management Framework6.PROBITY AND TRANSPARENCYEstablishing and maintaining probity – ethical behaviour – involves applying and complyingwith the values of NTCS: integrity, respect, courage, professional excellence, commitmentand accountability. Transparency is a related, but independent concept, which relates to theagency’s willingness to be open, and prepared to be subject to scrutiny about its processesand decisions. Probity and transparency in grants administration are principally achieved byensuring that decisions are impartial, documented, publicly defensible, and lawful, and thatprocesses incorporate appropriate safeguards against fraud, unlawful activity, and otherinappropriate conduct.Public reporting is a key method by which both principles are given effect; effective, reliable,and timely disclosure of information helps to provide both the public and parliament withconfidence in the quality and worth of a grants program. Accordingly, details of approvedgrants, identifying the recipient, amount, and basic contract details should be published onthe NTCS website as well as its annual report, unless prohibited by a specific policy orlegislative reason. Details of rejected applications may also be published and can specifyreasons for non-approval. In both instances, the agency should consider what information, ifany, should be treated in confidence under the Information Act 2002 (NT). Nevertheless, thedefault position should be that NTCS must report as much information as legally possibleregarding its grants activity, in a manner which allows for reasonable access and scrutiny bythe public.Maintaining probity and transparency in grants administration also requires carefulconsideration of actual or perceived conflicts of interest. These arise where a person makesa decision or exercises a power in a manner which may be, or may be perceived to be,influenced by material personal interests (whether financial or non-financial) or materialpersonal associations; any personal bias, obligation, interest or loyalty that reasonably affectsdecision-making on anything but the merits may constitute a conflict. Consequently, in orderto prevent any inferences of impropriety, NTCS staff should always declare if they have apotential conflict of interest, and abstain from any decision-making where a conflict isidentified.7.DEFINED OBJECTIVESGrant projects should be designed to ensure that their objectives are clear and specific, andreadily communicate what is to be achieved, assessed, measured, and evaluated. In order todo this, it is necessary to delineate the inputs, outputs, and outcomes relevant to a grantingactivity. These terms can be broadly understood as follows: Inputs are those things consumed to make the grant activity possible (e.g. time, cash,non-cash resources, in-kind support, direct and indirect administration costs);Outputs are quantifiable measures which are able to numerically express the extent towhich a grant seeks to, or actually achieves operational targets (e.g. the number ofclients to be serviced, the number of completed activities); andOutcomes are unquantifiable measures which are able to qualitatively express thedesired, or actually realised extent to which a grant meets the strategic andoperational objectives of the agency (e.g. the impact of the grant on the public, thequality of the services provided, the change in a client’s capacity, attitude or outlook).July 2016Page 6 of 29

Grants Management FrameworkThus grant projects should be designed and implemented so that both NTCS and ESP focuson achieving outcomes and outputs for beneficiaries, whilst seeking to most efficiently andeffectively utilise their respective inputs. Bear in mind that awarding a grant or consuminginputs does not, in and of itself, secure the delivery of desired outputs and outcomes. Thus,it is essential to describe the inputs, outputs, and outcomes relevant to a granting activityfrom the outset, to facilitate ongoing, effective and efficient evaluation of the services andactivities funded by a grant.8.ROBUST RECORD-KEEPING AND ACCOUNTINGMinisters, chief executives, agency staff and ESPs all have their respective roles to play inachieving specific government objectives and should be held accountable for the ways inwhich they fulfil their roles. This accountability is enabled in no small part by robust recordkeeping and adherence to recognised accounting protocols.First and foremost, documentation and relevant files should be maintained with the samerigour applied to financial records and transactions; this includes written communicationsbetween the parties, file notes, financial acquittal statements, performance reports, andmilestone docume

Grants Management Framework July 2016 Page 3 of 29 The principal statute governing grants for agencies of the NTG is the Financial Management Act 1995 (NT).1 The requirements imposed on NTCS by this legislation are articulated in practice under section A6.4: Grants and Subsidies, of the Northern Territory Treasurer's Directions.