Transcription

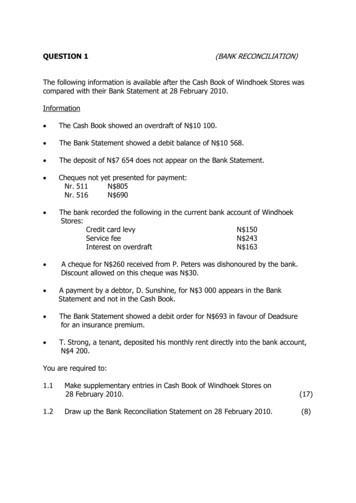

QUESTION 1(BANK RECONCILIATION)The following information is available after the Cash Book of Windhoek Stores wascompared with their Bank Statement at 28 February 2010.Information The Cash Book showed an overdraft of N 10 100. The Bank Statement showed a debit balance of N 10 568. The deposit of N 7 654 does not appear on the Bank Statement. Cheques not yet presented for payment:Nr. 511N 805Nr. 516N 690 The bank recorded the following in the current bank account of WindhoekStores:Credit card levyN 150Service feeN 243Interest on overdraftN 163 A cheque for N 260 received from P. Peters was dishonoured by the bank.Discount allowed on this cheque was N 30. A payment by a debtor, D. Sunshine, for N 3 000 appears in the BankStatement and not in the Cash Book. The Bank Statement showed a debit order for N 693 in favour of Deadsurefor an insurance premium. T. Strong, a tenant, deposited his monthly rent directly into the bank account,N 4 200.You are required to:1.11.2Make supplementary entries in Cash Book of Windhoek Stores on28 February 2010.(17)Draw up the Bank Reconciliation Statement on 28 February 2010.(8)

MEMORANDUM: QUESTION 1CASH BOOK OF WINDHOEK STORES – FEBRUARY 2010CB2DOC DAY DETAILSBANKDOC DAY DETAILSB/S 28D. SUNSHINE3 00028BALANCE B/DB/SRENT INCOME4 200B/SBANK CHARGES (150 243)B/SBALANCE4 409B/SINTEREST ON C/DOVERDRAFTB/SINSURANCEB/SP. PETER (R/D)11 609MARCH 2009 CB31BALANCEBANK10 100 393 163 693 26011 609 4 409BANK RECONCILIATION STATEMENT AS AT 28 FEBRUARY 2010.CREDIT BALANCE ACCORDING TO CASH BOOKLESS: UNPRESENTED CHEQUES:NO 511516805 690 1 4952914 7 654ADD: OUTSTANDING DEPOSITDEBIT BALANCE ACCORDING TO BANK STATEMENT4409 10568

QUESTION 2(TRIAL BALANCE)The following balances were taken from the books of John’s General Stores on31 December 2010.N 12 000105 4006 00013 0009 60070 0001 80068 5003 5008 800?Stock (1 January 2010)SalesBank (dr)DebtorsRent IncomeEquipmentReturns : Prepare a Trial Balance for John’s General Stores as at31 December 2010.(12)MEMORANDUM: QUESTION 2Trial Balance of John’s General Stores as at 31folBALANCE SHEET MINAL ACCOUNTSSALESRENT INCOMERETURNS OUTWARDSPURCHASESINSURANCENo totals or Capital calculation – 0. (List) Sections left out – 2.December 2010DebitCreditN NS 47 400 12 000 6 000 13 000 70 000 8 800 105 400 9 600 1 800 68 500 3 500173 000173 000

(WAGES JOURNAL)QUESTION 3Required: Use the following information and draw up the Wages Journal of USATraders for the week ending 21 March 2010. Close off the WagesJournal and post it to the given accounts in the General Ledger.A normal working week is 40 hours.Employees HoursworkedS KnowallP Nobody5248RatenormaltimeN 40N 30Rateovertime1½timesnormaltime ratePAYE15 % ofGrosswageDeductionsPensionSocialSecurity9% ofN 21NormalN 14wage(31)

MEMORANDUM: QUESTION 3Wages Journal of USA Traders for the week ending 21 March 2010DetailsNormal HoursRateSocialTotalNet WagesSecurityDeductionsAmountS Knowall4040 1 600 12 60 720 2 320 144 348 21 513 1 807P Nobody4030 1 200 8 45 360 1 560 108 234 14 356 1 2041 0803 880252582358693 011GL7GL6 2 800GL5

General Ledger of USA TradersDrCreditors for WagesGL5Cr2010MAR21WAGESPension FundWJ 3 011GL62010MARWages2010MAR21GROSSWAGESWJ 3 88021WAGESWJGL7 252

(ACCOUNTING EQUATION)QUESTION 4Analyse the given transactions on the answer sheet. Show an increase with a ( ), adecrease with a (-) and no effect with (0). Give the amount concerned in each case.TRANSACTIONS:1.2.3.4.Goods sold on credit to A. Anna, N 600.A Anna returned damaged goods, N 250, issued credit note.Purchased stock on credit, N 7 000 from ABC Traders.The owner, B. Bennie, provide a vehicle as part of his capital contribution,N 280 000.5. Tax deducted from employees in the Wages Journal for the month wasN 2 500. Sent a cheque to the Receiver of Revenue(PAYE) for the amountdeducted.6. Purchased stationery, N 300, paid from Petty Cash.7. Interest on fixed deposit received and deposited into the bank account,N 400.(28)MEMORANDUM: QUESTION 4EFFECT ONO’EL 6000 1ACCOUNT DEBITEDA ANNAACCOUNT CREDITEDSALES A 6002RETURNS INWARDSA ANNA -250-2500 3PURCHASESABC TRADERS 0 -7 000 7 0004VEHICLESCAPITAL 280 000 280 000 0 5RECEIVER OF REVENUE6 (PAYE)BANK -5000-500STATIONERYPETTY CASH -300-3000 400 4000 INTEREST ON FIXED7BANKDEPOSIT

QUESTION 5(RATIO’S)The following amounts were taken from the books of Tsumeb Stores on 30 July 2010.SalesCost of SalesOther IncomeExpensesFixed AssetsInvestmentsCurrent Assets (including stock)Current LiabilitiesStockLong-term LiabilitiesOpening CapitalN 250 000175 0005 00030 000150 00015 00030 9009 0008 00060 000126 900Calculate to two decimal places:5.1Mark-up[3]5.2Margin[2]5.3Solvency[6]

5.4Quick ratio[4]5.5ROCE[4]MEMORANDUM: QUESTION 55.1Mark-up[3]GP% of Cost of Sales 75 000175 000x 100% 42,86% 5.2Margin[2]GP% of Sales 75 000250 000x 100% 30% 5.3SolvencySolvency Total Assets : Total Liabilities (150 000 15 000 30 900) : (60 000 9 000) 195 900 : 69 000 2.84 : 1 [6]

5.4Quick ratio[4](Current assets – stock) : Current liabilities (30 900 – 8000) : 9000 22 900 : 9 000 5.52.54 : 1 ROCE[4]𝑁𝑒𝑡 �� 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑥 100% 50 000 39.40% 126 900 𝑥 100%

QUESTION 1 (BANK RECONCILIATION) The following information is available after the Cash Book of Windhoek Stores was compared with their Bank Statement at 28 File Size: 638KBPage Count: 10