Transcription

Cazenove Capital Model Portfolio ServiceSchroders Investment Conference Edinburgh 2019Steven Rooke, Portfolio Director and Head of DFM Investment StrategyFor professional investors and advisers only. Not for retail clientsMay 2019

Cazenove Capital Model Portfolio Service

AgendaOverview ofCazenoveCapital MPS2InvestmentprocessPortfolioconstruction andperformance reviewRecentrebalances

Overview of Cazenove Capital MPS

A combination of heritage and experience18042019Risk aware anddownside protection4Truly Multi-Assetacross investment vehicles

Two ranges of model portfoliosCore portfolios– Utilise Funds, ETFs and InvestmentTrusts– Truest representation of the house viewmodel on platform– Will use both passive and active funds5Active/passive portfolios– Will use funds only– Will use passive funds where we can toreduce costs– Lower cost– Equity: All passive– Fixed Income: 50/50 active/passive– Alternatives: All active

Current asset allocationsCore modelsHigherCautiousExpected return 5.6%Expected volatility 5.7%15%10%12%6%5%21%9%4% 3%4%28%27%Balanced IncomeExpected return 6.3%Expected volatility 8.2%7%3%64%16%10%20%55%14%21%GrowthExpected return 6.8%Expected volatility 10.8%Equity RiskExpected return 7.6%Expected volatility 15.2%14%17%10%ReturnBalancedExpected return 6.3%Expected volatility 8.2%AggressiveExpected return 7.2%Expected volatility 13.0%32%44%34%26%27%40%LowerVolatilityHigherUK equityFixed IncomeTargeted Absolute ReturnOverseas equitiesPropertyCashThe expected returns are forecasts and not a reliable indicator of future performance. All forecast performance figures are exclusive of commissions, feesand other charges which will have an effect on final performance figures. Data as of 31 March 2019.6

Investment process

Investment teamA depth of resource available to youSchroders global investment researchEconomics and strategyCaspar RockKieron LaunderKeith Wade147Janet MuiInvestment onalsAlex SmittenChris LewisStuart Derrick8Pritosh RanjanPaulo Santos65researchprofessionalsAhmet FeridunCleo FitzsimonsAmericasEuropeAsia PacificUnited ndAustraliaKoreaHong Kong SingaporeIndonesiaJapan

Investment processExternalresearch1Wealth ManagementInvestment Committee4Schroders globalinvestment capability2Research Committee3Asset Class GroupsEconomics, strategyand investment riskInstrumentselection9Equities (UK, Europe, US, Japan, Asia, EM, Global) Fixed Income ETFs Hedge/Multi-Asset Property Private Equity Structured Products Specialist Sustainability MPSInvestmentRiskCommittee

Global themesSecular themesDisruptionDebtDemographicsLong termTechnologyQualitycompoundersSavings and HealthcareRestructuringFiscalEmerging marketsSource: Cazenove Capital.10

Investment viewsOutlook for 2019Key macro themesKey investment views– Growth is slowing – no recession expectedin 2020– Maintaining our equity exposure– Central banks have turned more dovish– Trade tensions and politics cast uncertaintiesEquityNeutralNegativeFixed Income– Maintaining a short duration bias in bonds– Positive on alternatives as diversifying assets– See opportunities in emerging marketsAlternativesPositiveFor illustrative purposes only and should not be viewed as a recommendation to buy or sell.11Cash

Current views – equitiesEquities Valuations have moved above long-term averages but continued growth and central banks’ actions aresupportive.UK Brexit uncertainty continues to weigh on sentiment.European Patchy economic data and the uncertainty around trade tension continues to be a headwind.North America Economic fundamentals are relatively attractive vs. rest of the world and earnings growth expectationshave moderated.Japanese Concern about the impact of the upcoming consumption tax hike.Asia Pacific Slowing Chinese growth and trade tensions remains a headwind but Chinese stimulus should be supportive.Emerging markets Valuations and fundamentals look attractive relative to developed markets.KeyNeutral Up from last quarterPositiveNeutral/negative No changePositive/neutralNegative Down from last quarterSource: Cazenove Capital, May 2019. For illustrative purposes only and should not be viewed as a recommendation to buy or sell.12

Current views – bondsBonds Most attractive valuations in US inflation-linked and emerging market bonds. Maintaining a short duration bias.Government bonds US Treasuries are relatively more attractive given a more supportive Federal Reserve.Investment grade Returns are likely to be driven largely by government bond markets. While corporate spreads are close to post 2009averages, we are mindful of increasing company leverage and the lateness of the economic cycle.High-yield Volatility will likely continue and will offer opportunities if spreads move sufficiently in either direction.Inflation-linked US inflation-linked government bonds are attractive compared to conventional ones and will outperform if inflationexpectations rise again. UK linkers are attractive as a Brexit hedge.Emerging markets Emerging market bonds generally offer good value.KeyNeutral Up from last quarterPositiveNeutral/negative No changePositive/neutralNegative Down from last quarterSource: Cazenove Capital, May 2019. For illustrative purposes only and should not be viewed as a recommendation to buy or sell.13

Current views – alternatives and cashAlternatives Attractive diversification characteristics compared to equities and bonds. Remain cautious on UKcommercial property.Absolute Return We like the diversification characteristics of trend followers and long/short strategies.Commercial property (UK) Ongoing concern for the UK commercial property environment, but income characteristics remain attractive.Commodities Gold is attractive as a diversifier, portfolio insurance and an inflation hedge.Cash Cash has defensive and opportunistic qualities in uncertain and volatile markets.KeyNeutral Up from last quarterPositiveNeutral/negative No changePositive/neutralNegative Down from last quarterSource: Cazenove Capital, May 2019. For illustrative purposes only and should not be viewed as a recommendation to buy or sell.14

Portfolio construction and performance review

Asset allocationCazenove Capital MPS balanced modelTrojan Income FundMajedie UK Equity FundArchitas Diversified Real AssetPolar UK Value OpportunitiesGold ETCCash 7%Trojan FundCash10%BlackRock European DynamicUK equities14% 19%UK equitiesVanguard US Equity IndexAlternativesAlternatives28%Winton Absolute Return17%Schroder Asian Alpha Plus FundGlobal equitiesGlobal32%equities24%Henderson UKAbsolute Return FundFixed interestFixedinterest27%22%UK Index-Linked Gilts IndexFidelity Emerging MarketsT.Rowe Global TechnologyLyxor US TIPS ETFWorldwide Healthcare TrustM&G Optimal IncomeSource: Cazenove Capital, as at 30 April 2019.For illustrative purposes only and should not be viewed as a recommendation to buy or sell.16Allianz All China / China A Shares

Asset allocationCazenove Capital MPS balanced active/passive modelVanguard FTSE All ShareArchitas Diversified Real AssetTrojan FundWinton Absolute ReturnCash 7%Cash10%Vanguard FTSE Developed EuropeUK equities14% 19%UK equitiesVanguard US Equity lobal equities32%24%Henderson UKAbsolute Return FundFixedFixed interestinterest27%22%HSBC Pacific IndexVanguard Emerging MarketsUK Index-Linked Gilts IndexL&G Global TechnologySchroder Emerging MarketAbsoluteL&G Global Healthcare and PharmaceuticalsM&G Optimal IncomeSource: Cazenove Capital, as at 30 April 2019.For illustrative purposes only and should not be viewed as a recommendation to buy or sell.17

EquitiesKey fundsChinaJapanGlobal thematic–Allianz All China Equity–Man GLG Japan Core Alpha– T.Rowe Global Technology–Allianz China A Shares–JPMorgan Japan– Worldwide Healthcare InvestmentTrustSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.18

Long term structural trendsTechnology and HealthcareWhy do we like Tech?– Technological advancement is creatingdisruption across all industries– Huge growth opportunities for thosecompanies that can take advantageof this– Notable key themes include– Cloud Computing– Artificial Intelligence– Cyber Security– Connectivity– The UK is under-represented in TechWhy do we like Healthcare?– Healthcare is a defensive, non-cyclicalindustry supported by structuraltailwinds– Structural changes and technologicaldevelopment– Demographics– Increased global spending– Innovation– Valuations remain attractive in the sector– In this highly specialist area, activemanagement is preferableFor illustrative purposes only and should not be viewed as a recommendation to buy or sell.19

The case for China A sharesThe positives outweigh the negativesIndex inclusion will increase foreign ownershipand flowsBetter access to domestic 'new China' e.g.consumer and healthcareLow correlation to global equity marketsprovides diversificationAttractive valuations vs. history and other equitymarketsThe A shares market has over 3,000 companies and amarket cap of over US 7tn making it the size of allEuro Area stock markets combined Yet foreign ownership is only 2% and representationin MSCI ACWI is not even 0.1% (but growing).This makes underweight China global investorsbiggest unconscious decision.Flighty retail dominated marketSuspension of sharesVolatile market with large drawdownpotentialMacro concerns: trade tensions andslowing growthInefficient market provides opportunities foralphaChinese authorities opening up andinstitutionalising the marketSource: Cazenove Capital, Allianz Global Investors. For illustrative purposes only and should not be viewed as a recommendation to buy or sell.20

Fixed IncomeKey fundsStrategic bond funds–Schroder Strategic Credit–M&G Optimal IncomeInflation linked–Vanguard UK Inflation LinkedGilt Index–Lyxor US TIPS ETF GBP HedgedEmerging market debt– Schroder Emerging MarketAbsolute ReturnSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.21

AlternativesKeys funds and why we outsource to specialistsProperty–TR PropertyTargeted Absolute ReturnDiversifiers–RWC US Absolute Alpha– Gold ETC–Winton Absolute Return– Architas Diversified Real AssetsSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.22

Attribution – Q4 2018Top 5 funds contribution – balanced coreCore – balanced30 September 2018 – 31 December 2018Performance %Contribution %-11.3-5.3Bonds-0.3-0.1Multi-Asset Performance %Contribution %iShares Physical Gold9.70.3Vanguard UK Inflation Linked Gilts2.60.2Schroder EMD Absolute Return1.20.0Polar UK Value Opportunities1.00.0-0.20.0Vanguard UK Short Term Inv Grade– Our alternatives helped manage volatility during aturbulent quarter– Gold was the standout performer as equities heavily sold off– Our government bonds (index linked gilts) acted as ballast– EMD also acted as a useful diversifierPast performance is not a guide to future performance and may not be repeated. The value of investments and theincome from them may go down as well as up and investors may not get back the amount originally invested.Source: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.23

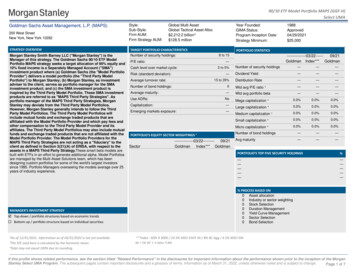

Attribution – year to dateTop 5 funds contribution across core and active/passiveCore – balanced31 December 2018 – 30 April 2019Active/passive balanced31 December 2018 – 30 April 2019Performance %Contribution %14.16.2EquitiesBonds3.40.9Multi-Asset funds5.1Alternatives1.6Total7.6EquitiesPerformance %Contribution %12.75.5Bonds3.00.80.2Multi-Asset e %Contribution %Performance %Contribution %T.Rowe Global Technology26.10.5L&G Global Technology Index21.90.4BlackRock European Dynamic17.60.4Vanguard US Equity Index15.82.2Polar UK Value Opportunities16.70.3Vanguard FTSE UK All Share12.31.8Vanguard US Equity Index15.81.4Vanguard FTSE Developed Europe12.20.5Fidelity Emerging Markets15.20.3Vanguard Emerging Markets10.20.2Past performance is not a guide to future performance and may not be repeated. The value of investments and theincome from them may go down as well as up and investors may not get back the amount originally invested.Source: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.24

Attribution – since inceptionTop 5 funds contribution across core and active/passiveCore – balanced30 June 2016 – 30 April 2019Active/passive balanced30 June 2017 – 30 April 2019Performance %Contribution %Equities36.515.9Bonds10.52.6Multi-Asset funds5.9Alternatives9.5TotalPerformance %Contribution %12.35.8Bonds4.81.30.3Multi-Asset esPerformance %Contribution %L&G Global Technology Index34.90.51.8Vanguard US Equity Index22.43.048.23.5Janus Henderson UK Property10.60.3BlackRock Asian Dragon46.70.5Vanguard Emerging Markets10.40.2JPMorgan US Equity Income44.70.7Vanguard FTSE UK All Share9.01.6Performance %Contribution %Schroder Asia Alpha 65.00.8JPM America Equity60.2Vanguard US Equity IndexPast performance is not a guide to future performance and may not be repeated. The value of investments and theincome from them may go down as well as up and investors may not get back the amount originally invested.Source: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.25

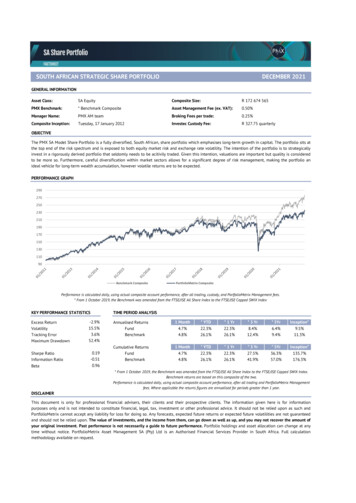

VolatilityCore models and active/passive models – 12 monthsCoreVolatilityMPS Cautious3.17MPS Balanced4.90MPS Growth6.59MPS Aggressive8.20MPS Equity Risk9.15MPS Balanced Income4.29Active/passiveVolatilityMPS Cautious Active/Passive3.36MPS Balanced Active/Passive5.11MPS Growth Active/Passive6.86MPS Aggressive Active/Passive8.54MPS Equity Risk Active/Passive9.52FTSE All Share11.62FTSE All Share11.62MSCI AC World12.88MSCI AC World12.88Volatility is a measure of dispersion of returns for a portfolio. In most cases, the higher the volatility, the riskier the security.Past performance is not a guide to future performance and may not be repeated. The value of investments and theincome from them may go down as well as up and investors may not get back the amount originally invested.Source: Cazenove Capital.26

VolatilityCore models – since inception (30 June 2016)Active/passive models – since inception (30 June 2017)VolatilityVolatilityMPS Cautious3.29MPS Cautious Active/Passive3.20MPS Balanced4.81MPS Balanced Active/Passive4.86MPS Growth6.35MPS Growth Active/Passive6.53MPS Aggressive7.54MPS Equity Risk8.46MPS Aggressive Active/Passive7.92MPS Balanced Income4.54MPS Equity Risk Active/Passi tarting point is to look at passive options– Before looking at whether an active manager has demonstrated ability to generate alphaCore modelsNo. of passives% passivesActive/passive modelsNo. of passives% passivesSource: Cazenove Capital April eMPSEquity siveMPSEquity risk8101010850.34%65.10%75.03%84.33%91.32%

Schroders fundsWhere and why?We are independent on fund selection– Best of breed investment approach– No obligation or pressure to buy Schroder funds– Schroders funds undergo the same strict investment processEquitiesBondsIncome model–Schroder European Alpha Income–Schroder Strategic Credit– Schroder Income–Schroder Asian Alpha Plus–Schroder Emerging MarketAbsolute Return– Schroder Sterling Corporate BondSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.37

ETFs and Investment TrustsWhy we use themAccess to specialist investments and asset classesHealthcareInflation protectedbondsWorldwide Healthcare TrustAccess to aspecialistHealthcaremanagerPropertyGoldLyxor Core US TIPS ETFTR PropertyInvestment TrustiShares PhysicalGold ETCExposure to the USTreasury InflationProtected Securities(TIPS) marketMixture of property equitiesand bricks and mortar, takenadvantage of share pricediscount to NAVDiversifier andportfolio insuranceSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.38

Total costs for MPS – OCFCore portfoliosCautiousBalancedGrowthAggressiveEquity riskBalancedincomeCazenove Capital (0.3% VAT)0.360.360.360.360.360.36Ongoing 081.080.97CautiousBalancedGrowthAggressiveEquity riskCazenove Capital (0.3% VAT)0.360.360.360.360.36Ongoing 51%Active/Passive portfolios%Source: Cazenove Capital, as at March 2019. The value of an investment and the income from it may go down as well as up and investors may not get backthe amount originally invested.39

Holdings – core portfoliosAs at 30 April 2019Asset ClassSecurityMPS CautiousMPS BalancedMPS GrowthMPS AggressiveMPS Equity RiskEquities - UKEquities - UKMajedie UK Equity3.07%4.49%6.40%6.27%5.95%Investec UK Special Situations0.00%0.00%0.00%4.00%5.46%Equities - UKTrojan Income2.41%3.71%5.25%6.15%6.45%Equities - UKMerian UK Alpha3.39%4.43%5.97%6.23%5.89%Equities - UKPolar Capital UK Value 0.67%26.80%28.36%2.23%Equities - UK TotalEquities - Europe ex UKSchroder European Alpha Income1.53%1.50%1.72%1.70%Equities - Europe ex UKBlackrock European 4%7.90%5.15%Equities - Europe ex UK TotalEquities - USJP Morgan US Equity Income0.00%1.71%2.73%3.69%Equities - USJP Morgan America Fund2.24%3.97%5.56%7.21%8.19%Equities - USVanguard US Equity Index5.56%8.80%12.88%16.12%17.77%Equities - US Total7.80%14.48%21.18%27.02%31.11%Equities - JapanVanguard Japan Stock Index1.60%0.00%0.00%0.00%0.00%Equities - JapanMan GLG Japan Core Alpha0.00%1.49%2.05%1.78%2.06%Equities - JapanJP Morgan 5.35%3.52%Equities - Japan TotalEquities - Asia ex JapanBlackRock Asian Dragon0.00%1.72%2.59%2.78%Equities - Asia ex JapanSchroder Asia 6.00%Equities - Asia ex Japan TotalEquities - Emerging MarketsFidelity Emerging Markets0.72%2.20%2.14%2.19%2.86%Equities - Emerging MarketsRWC Global Emerging Markets0.00%0.00%1.42%2.50%2.60%Equities - Emerging MarketsAllianz All China Equity0.00%1.08%0.00%0.00%0.00%Equities - Emerging MarketsAllianz China A %7.95%3.48%Equities - Emerging Markets TotalEquities - GlobalT.Rowe Global Technology Equity0.00%2.40%3.07%3.51%Equities - GlobalWorldwide Healthcare 5.51%24.69%46.69%65.73%82.53%92.19%Equities - Global TotalEquities TotalSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.40

Holdings – core portfolios (cont’d)As at 30 April 2019Asset ClassSecurityMPS CautiousMPS BalancedMPS GrowthMPS AggressiveMPS Equity RiskBonds – UKBonds – UKM&G Optimal Income5.56%2.61%1.25%1.05%0.00%Schroder Strategic Credit4.05%3.21%1.19%0.00%0.00%Bonds – UKVanguard UK Short-Term Inv Grade Bond Index9.72%6.62%4.06%1.44%0.00%Bonds – UKVanguard UK Inflation-Linked Gilt 56%0.00%Bonds – UK TotalBonds – USLyxor US TIPS ETF GBP hedgedBonds – US TotalBonds – Emerging MarketsSchroder Emerging Market Absolute ReturnBonds – Emerging Markets TotalBonds 0.00%39.51%26.61%15.81%4.88%0.00%Alternatives – Hedge FundsRWC US Absolute Alpha1.91%1.93%1.85%1.34%1.09%Alternatives – Hedge FundsJanus Henderson UK Absolute Return3.05%2.33%1.93%1.72%1.11%Alternatives – Hedge FundsWinton Absolute %3.35%Alternatives – Hedge Funds TotalAlternatives – GoldiShares Physical Gold ETCAlternatives – Gold TotalAlternatives – OtherArchitas Diversified Real AssetsAlternatives – Other TotalAlternatives – Multi AssetTrojan FundAlternatives – Multi Asset TotalAlternatives TotalCash – GBPCash .00%100.00%100.00%100.00%Source: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.41

Holdings – balanced incomeAs at 30 April 2019Asset ClassSecurityMPS Balanced IncomeAsset ClassSecurityEquities - UKEquities - UKTrojan Income5.53%Bonds – UKM&G Optimal Income0.00%JO Hambro UK Equity Income4.72%Equities - UKSchroder Income4.61%Bonds – UKSchroder Strategic Credit2.47%Equities - UKGAM UK Equity IncomeBonds – UKVanguard UK Short-Term Inv Grade Bond Index5.30%Bonds – UKVanguard UK Inflation-Linked Gilt Index3.92%Bonds – UKSchroder Sterling Corporate BondEquities - UK TotalEquities - Europe ex UK5.05%19.91%Schroder European Alpha IncomeEquities - Europe ex UK Total3.19%3.19%Equities - USJP Morgan US Equity Income3.47%Equities - USVanguard US Equity Index8.20%Equities - US TotalEquities - Japan11.67%Vanguard Japan Stock IndexEquities - Japan TotalEquities - Asia ex JapanHSBC Pacific IndexEquities - Asia ex Japan TotalEquities - Emerging MarketsPolar Emerging Markets IncomeEquities - Emerging Markets TotalEquities - Global2.74%2.74%Bonds – UK TotalLyxor US TIPS ETF GBP hedgedBonds – USAXA US Short Duration High YieldBonds – US TotalEquities - Global TotalEquities TotalPIMCO Global LIBOR PlusBonds – Global TotalSchroder Emerging Market Absolute ReturnBonds – Emerging MarketsAshmore EM Total Return1.92%Bonds – Emerging Markets TotalAlternatives – Property (UK)4.29%Alternatives – Property (UK) Total46.79%Alternatives – OtherUK Commercial Property1.86%3.05%33.42%3.01%3.01%Architas Diversified Real AssetsAlternatives – Other Total6.84%6.84%Alternatives Total9.85%Cash Total9.95%Cash – GBP9.95%TotalSource: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.424.00%4.91%Bonds Total4.29%4.93%4.00%Bonds – Emerging Markets1.92%Fidelity Global Dividend2.93%7.86%3.06%3.06%4.96%16.65%Bonds – USBonds – GlobalMPS Balanced Income100.00%

Holdings – active/passive modelsAs at 30 April 2019Asset ClassSecurityEquities - UKVanguard FTSE All Share IndexEquities - UK TotalEquities - Europe ex UKVanguard FTSE Developed Europe ex UK IndexEquities - Europe ex UK TotalEquities - USVanguard US Equity IndexEquities - US TotalEquities - JapanVanguard Japan Stock IndexEquities - Japan TotalEquities - Asia ex JapanHSBC Pacific IndexEquities - Asia ex Japan TotalEquities - Emerging MarketsVanguard Em MktsStk Indx-I -GBP-IncEquities - Emerging Markets TotalMPS CautiousMPS BalancedMPS GrowthMPS AggressiveMPS Equity 4%2.08%3.32%5.10%6.13%3.24%Equities - GlobalL&G Global Technology Index0.00%2.11%2.93%3.28%Equities - GlobalL&G Global Healthcare & Pharmaceuticals 5.35%Equities - Global Total24.78%46.09%64.98%81.91%91.32%Bonds - UKEquities TotalM&G Optimal Income6.26%2.60%1.24%1.14%0.00%Bonds - UKSchroder Strategic Credit6.58%3.71%1.42%0.00%0.00%Bonds - UKVanguard UK Short-Term Inv Grade Bond Index12.86%9.67%4.96%1.43%0.00%Bonds - UKVanguard UK Inflation-Linked Gilt .56%0.00%Bonds - UK TotalBonds - Emerging MarketsSchroder Emerging Market Absolute ReturnBonds - Emerging Markets TotalBonds 0.00%39.73%26.65%14.04%4.88%0.00%Alternatives - Hedge FundsRWC US Absolute Alpha2.85%2.66%1.84%1.30%1.03%Alternatives - Hedge FundsJanus Henderson UK Absolute Return3.03%2.80%1.92%1.83%1.10%Alternatives - Hedge FundsWinton Absolute %3.02%Alternatives - Hedge Funds TotalAlternatives - OtherArchitas Diversified Real AssetsAlternatives - Other TotalAlternatives - Multi AssetTrojan FundAlternatives - Multi Asset TotalAlternatives TotalCash - GBPCash 00.00%100.00%100.00%100.00%Source: Cazenove Capital. Securities mentioned are for illustrative purposes only and not a recommendation to buy or sell.43

Holdings – sustainable modelsAs at 30 April 2019Asset ClassSecurityEquities - UKKames Ethical EquityEquities - UKSLI UK EthicalEquities - UKEquities - UKMPS Ethical BalancedMPS Ethical GrowthMPS Ethical AggressiveMPS Ethical Equity .51%Trojan Ethical Income3.18%4.14%5.09%6.00%7.90%Schroder Responsible Value UK Equity4.19%6.14%8.05%7.90%10.73%Equities - UK TotalMPS Ethical Cautious13.03%19.16%24.05%26.74%35.55%Equities - GlobalFP Wheb Sustainable3.29%6.95%9.17%11.65%12.62%Equities - GlobalStewart Worldwide Sustainable3.08%6.53%8.88%11.62%12.44%Equities - GlobalImpax Environmental Markets3.35%7.09%9.65%12.63%13.52%Equit

Two ranges of model portfolios 5 Core portfolios Active/passive portfolios -Utilise Funds, ETFs and Investment Trusts -Truest representation of the house view model on platform -Will use both passive and active funds -Will use funds only -Will use passive funds where we can to reduce costs -Lower cost -Equity: All passive