Transcription

Freddie Mac Sustainability Disclosure –Report under the SustainabilityAccounting Standards Board(“SASB”) Standards andManagement CriteriaPublished January 2022

Table of ContentsOverview of Metric Modifications3About Freddie Mac5Environmental, Social andGovernance (ESG) Strategy andRelated Activities5Supporting Borrowers,Lenders, and the Market6Equity in Housing Issues8Natural Disaster andClimate Risk10Inclusion and Diversity atFreddie Mac13Employee Diversity13Supplier Diversity13Promoting Diverse Firms inFinancial Transactions and theCapital Markets13Freddie Mac’sManagement Assertion16Report of IndependentAccountants17

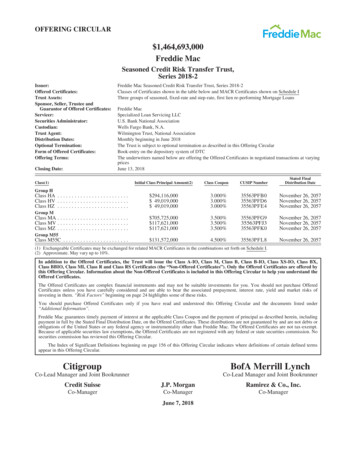

Freddie Mac is issuing this report in accordance with Industry Standards Version 2018-10 issued by the Sustainability AccountingStandards Board (SASB) and additional criteria defined by management for presenting the disclosures. Our disclosures withrespect to those standards are based on the industry within the Financials sector that is most closely aligned with our business:Mortgage Finance. Additionally, within the Financials sector, we have responded to relevant metrics within the Commercial Banksand Investment Banking & Brokerage industries standards. All data is as of and for the year ended December 31, 2020, unlessotherwise noted. PricewaterhouseCoopers LLP (PwC) performed limited assurance on certain metrics denoted with a * symbol thatare included in this report (see PwC’s Report of Independent Accountants on page 17). For additional information on our businessand financial performance, please refer to our corporate financials, including our 2020 Annual Report on Form 10-K andQuarterly Reports on Form 10-Q.OVERVIEW OF METRIC MODIFICATIONSSASB CriteriaManagement-Defined/Specified MetricSASB CodeSASB MetricModified or N/AFreddie Mac Modified MetricFN-MF-270a.1*(1) Number and (2) value of residentialmortgages of the following types:(a) Hybrid or Option Adjustable-rateMortgages (ARM), (b) PrepaymentPenalty, (c) Higher Rate, (d) Total, byFICO scores above or below 660Modified to define "Higher Rate" toconform with the Truth in LendingAct. Consistent with SASB definitions,“residential mortgages” is defined as1-4 family homes.(1) Number and (2) value of residentialmortgages of the following types:(a) Hybrid or Option Adjustable-rateMortgages (ARM), (b) PrepaymentPenalty, (c) Higher Rate, (d) Total, byFICO scores above or below 660,including as a percentage.FN-MF-270a.2*(1) Number and (2) value of (a)residential mortgage modifications,(b) foreclosures, and (c) short sales ordeeds in lieu of foreclosure, by FICOscores above and below 660Modified to address data availability.Consistent with SASB definitions,“residential mortgages” is defined as1-4 family homes.(1) Number and (2) value of(a) residential mortgage modifications,(b) foreclosures, and (c) short sales ordeeds in lieu of foreclosure, by FICOscores greater than or equal to, andbelow, 660FN-MF-270a.3Total amount of monetary losses as aresult of legal proceedings associatedwith communications to customers orremuneration of loan originatorsNot applicable. We omitted this row fromthe SASB table. Freddie Mac does notoriginate mortgage loans.FN-MF-270a.4Description of remuneration structure ofloan originatorsFreddie Mac does not originatemortgage loans.Although we do not originate mortgage loans,we include context regarding requirementsfor our sellers and servicers that may affectremuneration practices for loan originators.FN-MF-270b.1*(1) Number, (2) value, and (3) weightedaverage Loan-to-Value (LTV) ratio ofmortgages issued to (a) minority and(b) all other borrowers, by FICO scoresabove and below 660Modified to increase transparency andmap to Home Mortgage Disclosure Act(HMDA) minority status designations.(1) Number, (2) value, and (3) weightedaverage Loan-to-Value (LTV) ratio ofmortgages purchased by (a) allborrowers, (b)White Non-Latinoborrowers, (c) Latino borrowers, (d)Black borrowers, (e) Asian borrowers,(f) American Indian borrowers, and(g) Pacific Islander borrowers, byFICO scores above and below 660FN-MF-270b.2Total amount of monetary losses as aresult of legal proceedings associatedwith discriminatory mortgage lendingModified to direct readers to annualreport for material legal and regulatoryproceedings. Separately, we providesettlements or judgments exceeding 100,000 as a result of legal proceedingsfor discriminatory mortgage lending.Settlements or judgments exceeding 100,000 as a result of legalproceedings for discriminatorymortgage lending*PwC performed an attest review engagement on this metric. See their report on page 17.FREDDIE MAC3

OVERVIEW OF METRIC MODIFICATIONSSASB CriteriaManagement-Defined/Specified MetricSASB CodeSASB MetricModified or N/AFN-MF270b.3Description of policies and proceduresfor ensuring nondiscriminatory mortgageoriginationWe do not originate mortgage loans.Freddie Mac Modified MetricAlthough we do not originate mortgage loans,we include context regarding our policies andprocedures to promote nondiscriminatorymortgage origination practices.FN-MF-450a.1*(1) Number and (2) value of mortgageloans in 100-year flood zonesModified to contextualize data and increasetransparency by including multifamilyinformation. We define “100-year floodzones” as areas designated by the FederalEmergency Management Agency (FEMA) asSpecial Flood Hazard Areas (SFHAs), as ofthe mortgage loan origination date. We alsoinclude mortgages held for sale.(1) Number and (2) value of singlefamily and multifamily mortgage loansin 100-year flood zones, including asa percentage of the populationFN-MF-450a.2(1) Total expected loss and (2) Loss GivenDefault (LGD) attributable to mortgageloan default and delinquency due toweather-related natural catastrophes,by geographic regionModified to address data availability.Description of how weather-relatednatural catastrophes are consideredin determining total expected lossand loss given defaultFN-MF-450a.3Description of how climate changeand other environmental risks areincorporated into mortgage originationand underwritingWe do not originate or underwritemortgage loans.FN-MF-000.A(1) Number and (2) value of mortgagesoriginated by category: (a) residentialand (b) commercialNot applicable. We omitted this row fromthe SASB table. Freddie Mac does notoriginate mortgage loans.FN-MF-000.B*(1) Number and (2) value of mortgagespurchased by category: (a) residentialand (b) commercialModified to increase transparencyby including multifamily mortgagepurchase information.Although we do not originate or underwritemortgage loans, we include contextregarding our requirements for sellers andservicers with respect to homes located inareas with higher environmental risk.(1) Number and (2) value ofmortgages purchased by category:(a) single-family and (b) multifamilyThe portion of the metric relatedto commercial mortgages is notapplicable. We do not purchasecommercial mortgages.FN-IB-330a.1*Percentage of gender and racial/ ethnicgroup representation for (1) executivemanagement, (2) non-executivemanagement, (3) professionals, and (4)all other employeesFN-CB-230a.2Description of approach to identifyingand addressing data security risksFN-CB-550a.2Description of approach to incorporationof results of mandatory and voluntarystress tests into capital adequacyplanning, long-term corporate strategy,and other business activitiesFN-IB-510a.2Description of whistleblower policiesand proceduresFN-IB-510b.4Description of approach to ensuringprofessional integrity, including duty of careModified to map categories to EEO-1job classifications. We omitted "all otheremployees" from the table as there are noFreddie Mac employees in this category;all Freddie Mac employees are includedin the other three categories.Percentage of gender and racial/ethnic group representationfor (1) executive management,(2) non-executive management,and (3) professionals*PwC performed an attest review engagement on this metric. See their report on page 17.FREDDIE MAC4

About Freddie MacFreddie Mac is a government-sponsored enterprise chartered by Congress in 1970. Our public mission is to provideliquidity, stability and affordability to the U.S. housing market. We do this primarily by purchasing residential mortgageloans originated by lenders. In most instances, we package these loans into guaranteed mortgage-related securities,which are sold in the global capital markets, and transfer interest rate and liquidity risks to third-party investors. In addition,we transfer mortgage credit risk exposure to third-party investors through our credit risk transfer programs, which includesecurities- and insurance-based offerings. We also invest in mortgage loans and mortgage-related securities.We support the U.S. housing market and the overall economy by enabling America’s families to access mortgage loanfunding with better terms and by providing consistent liquidity to the multifamily mortgage market. Freddie Mac hasalso helped many distressed borrowers keep their homes or avoid foreclosure and have helped many distressed rentersavoid eviction.Environmental, Social and Governance (ESG) Strategy and Related ActivitiesFreddie Mac is focused on managing the risks and opportunities that arise from ESG issues along with executing ourmission. Freddie Mac has developed a corporate ESG strategy comprised of four pillars: PurposeMission: Deliver solutions to meet the country’s housing needs in good times and bad. Promote greater access toaffordable and sustainable homes and rental properties.PlanetClimate: Promote environmentally sustainable single-family and multifamily housing to help reduce climate-relatedrisks and increase affordability.PeopleDEIA & Talent: Develop our future workforce and build strength in the housing market through diversity, equity,inclusion and accessibility (DEIA).PracticesSustainable Operation: Provide stability to the housing industry through outstanding risk management.See our 2020 Annual Housing Activities Report for information on how Freddie Mac supported affordable single-family andmultifamily housing, served minority and lower-income borrowers, expanded access to credit for first-time homebuyers andunderserved communities, and promoted sustainable homeownership in 2020.Freddie Mac introduced multifamily impact bonds to target specific areas that relate to environmental or social challenges.In 2020, our Multifamily Impact Bond issuance included 1.3 billion in Green Bonds, 877 million in Social Bonds and 971 million in Sustainability Bonds. Our 2020 Multifamily Impact Bonds Report provides more information. Additionally,our single-family business further developed its Green offering and purchased 462 million in GreenCHOICE Mortgages,providing financing to support energy efficiency improvements for approximately 1,685 families.FREDDIE MAC5

Supporting Borrowers, Lenders, and the MarketIn accordance with our Charter, we participate in the secondary mortgage market. We do not originate loans or lendmoney directly to mortgage borrowers. We support the U.S. housing market by executing our Charter Mission to provide liquidity and help maintain creditavailability for new and refinanced single-family mortgages as well as for rental housing. In 2020, we provided 1.2 trillion in liquidity to the mortgage market, which enabled the financing of a total of 4.6 million home purchases,refinancings and rental units. This included funding for nearly 3.8 million single-family homes, 2.7 million of whichwere refinance loans. First-time homebuyers represented 46% of our new single-family home purchase loans. We also provided financing for nearly 803,000 multifamily rental units. 96% of the eligible multifamily rental unitsfinanced were affordable to families earning at or below 120% of area median income.To serve our mission and help borrowers with Freddie Mac-backed mortgages stay in their homes, we offer a variety ofborrower assistance programs, including refinance programs for certain eligible loans and loan workout activities forstruggling borrowers. Our loan workouts include both home retention options and foreclosure alternatives (short sales anddeeds in lieu of foreclosure).Since early 2020, we have offered a variety of mortgage relief options for borrowers affected by the COVID-19 pandemic.Among other measures, we have offered forbearance of up to 18 months to single-family borrowers experiencing financialhardship, either directly or indirectly, related to the COVID-19 pandemic, and a payment deferral option that allows borrowersto defer up to 18 months of payments for eligible homeowners who have the financial capacity to resume making theirmonthly payments but who are unable to afford the additional monthly contributions required by a repayment plan.In 2020, we completed nearly 426,000 single-family workouts, including forbearance agreements and payment deferrals.In addition, over 94% of borrowers who had fallen more than 60 days behind on their Freddie Mac-backed mortgagesduring the pandemic enrolled in our forbearance program. This percentage is even higher across minority populations(96%). We also offer borrowers several options to help them sustain ownership after their forbearance period ends.We have also offered multifamily borrowers mortgage forbearance with the condition that they suspend all evictionsduring the forbearance period for renters unable to pay rent, as well as several supplemental forbearance relief optionsthat servicers may use to assist borrowers who have a forbearance plan in place and continue to be materially affected bythe COVID-19 pandemic. These supplemental relief options provide increased flexibility for affected tenants, includingallowing the repayment of past due rent over time and not in a lump sum.FREDDIE MAC6

SASB — SUSTAINABILITY ACCOUNTING STANDARDS BOARDCode/MetricResponse/ReferenceLending PracticesFN-MF-270a.1, (1) Number and (2) value of(FICOresidential mortgages of the following types: (a) 660)Hybrid or Option Adjustable-rate Mortgages (ARM),(a)HybridorOptionARM16,470(b) Prepayment Penalty, (c) Higher Rate, (d) Total, byFICO scores above or below 660*Higher Rate (Higher Priced)(b) 36,958(d)Prepayment Penalty1,874(c)Total Residential MortgagesNUMBER(FICO(d) 660)LOAN UPB (in millions)Total%(FICO(d) 660)(FICO(d) 660)Total%163,140179,610 1.53%2,03829,54331,581 1.38%151,201188,159 1.60%5,29021,58726,877 1.18%5,9187,792 0.07%2938721,164 0.05%722,798 11,004,294 11,727,092100,238 2,181,998 2,282,237Footnotes- Table represents Single-Family mortgage loans on our consolidated balance sheet.- A single mortgage loan may be represented in multiple categories, e.g., both Hybrid andHigher Rate.a) "Hybrid or Option ARM” means mortgage loans with interest rate resets of less than five years,negative amortization, and/or interest-only payment schedules as determined by us based oninformation provided at purchase. For these purposes, negative amortization loans are consideredOption ARMs. Therefore, the population includes interest-only Option ARMs and ARM loanswith resets of less than five years (For instance, 5/1, 7/1, and 10/1 ARM loans are included in thiscategory, whereas 5/5 ARMs are excluded). We entirely discontinued purchases of loans with thesefeatures in 2010.b) “Higher Rate” has the same meaning as Higher-Priced mortgages under the Truth in Lending Act.Accordingly, the population includes mortgage loans with an annual percentage rate of 150 basispoints or higher than the Average Prime Offer Rate at origination.c) We entirely discontinued purchases of Prepayment Penalty loans in 2014.d) FICO score is as of loan origination.FN-MF-270a.2, (1) Number and (2) value of (a)residential mortgage modifications, (b) foreclosures,and (c) short sales or deeds in lieu of foreclosure, byModification(a)FICO scores above and below 660*Foreclosure(b)Short Sale/Deed in Lieu(c)NUMBER LOAN VALUE (in millions)(FICO(d) 660) (FICO (d) 660)(FICO (d) 660) (FICO (d) 73168Management Note: Due to data limitations, the column headings have been slightly modified from theSASB suggested table; has been changed to , and has been changed to .Footnotes- Table represents Single-Family mortgage loans on our consolidated balance sheet.a) “Modification” includes approved and/or settled home retention workouts, i.e., loan modificationsand payment deferrals.b) “Foreclosure” includes (i) mortgages that were referred to foreclosure; and (ii) mortgages for whichforeclosure sale settled.c) “Short Sale/Deed in Lieu” includes settled liquidation workouts, i.e., short sales and deeds in lieuof foreclosure.d) FICO score is as of loan origination.FN-MF-270a.4, Description of remunerationstructure of loan originatorsUnder Section 305(a) of our Charter, Freddie Mac is not permitted to originate mortgageloans. Accordingly, we do not originate mortgage loans, do not lend money directly tomortgage borrowers, and do not provide compensation to loan originators.We require our sellers and servicers to comply with all applicable federal, state and locallaws and regulations that apply to origination, selling and servicing practices, including,without limitation, compensation provisions in the Truth in Lending Act. For moreinformation on our single-family selling and servicing requirements, see the resourcesavailable on our website. We also require our multifamily sellers to charge a minimumorigination fee based on the size of the loan being delivered to Freddie Mac. For moreinformation on our multifamily selling and servicing requirements, see our MultifamilySeller/Servicer Guide.*PwC performed an attest review engagement on this metric. See their report on page 17.FREDDIE MAC7

Equity in Housing IssuesEquity in housing is a critical issue, and one Freddie Mac takes seriously. We seek to provide leadership throughinnovation and collaboration to enhance liquidity, stability and affordability. We also seek to help the housing industrybetter serve the needs of homebuyers and renters, particularly in the context of the current affordability challenges,including those stemming from fundamental problems relating to the housing supply. We intend to do so by identifyingand implementing new ways to expand fair and responsible access to credit, including through our single-family andmultifamily housing goals and implementing our Duty to Serve plan. We are also focused on removing other barriersminority borrowers face in accessing housing. For example, in addition to the aforementioned progress the company hasmade in expanding homeownership since 1970, we are committed to helping underserved communities attain affordableand sustainable housing through areas such as access to credit, financial education and identifying causes of housingdisparities in minority communities. Access to Credit. Many Black and minority borrowers are less likely to meet the traditional credit standards necessary toqualify for a mortgage. As a result, Freddie Mac is working on innovations in credit standards to help increase minorityhomeownership by actively evaluating alternative credit score models and technology and machine learning tools thatcan expand homeownership opportunities responsibly. Financial Education. Financial education is essential to making homeownership available to more families. Ourcommunity engagement team holds over 400 education and outreach events each year to inform lenders, bankinginstitutions, real estate professionals and other industry stakeholders on how to best help underserved communitiesovercome barriers to homeownership. We also are helping consumers learn about the importance of building,maintaining and using credit through CreditSmart. We celebrated 20 years of this program by launching a new,comprehensive curriculum. Causes of Appraisal Disparities in Minority Communities. Freddie Mac research reflects ongoing house priceappraisal gaps, where homes in diverse communities are more likely to be valued lower than the contract price. As aresult, we are working with the appraisal community and other stakeholders as a core partner of the Appraiser DiversityInitiative, which provides resources and support to attract diverse new entrants into the residential appraisal field,overcoming barriers to entry and providing support to position aspiring appraisers for professional success.Our work to promote equity in housing complements and enhances the work we have been doing to help create andpreserve affordable housing and provide relief for borrowers, renters and lenders affected by the COVID-19 pandemic.FREDDIE MAC8

SASB — SUSTAINABILITY ACCOUNTING STANDARDS BOARDCode/MetricResponse/ReferenceDiscriminatory LendingFN-MF-270b.1, (1) Number, (2) value, and (3)weighted average Loan-to-Value (LTV) ratio ofmortgages issued to (a) minority and (b) all otherborrowers, by FICO scores above and below 660*AGGREGATE AND WHITE NON-LATINOAggregate(c)(FICO(a) 660)Number722,798 120,516,214,631Value(b)White Non-LatinoNumber11,004,294 2,490,752,900,00077.0%Weighted Average LTV(b)Value(b)(FICO(a) 660)73.1%(FICO(a) 660)(FICO(a) 660)411,289 66,726,525,8887,312,803 1,579,837,500,00076.5%Weighted Average LTV(b)73.2%MINORITY BORROWERLatinoNumberValue(b)(FICO(a) 660)BlackNumberValue(b)AsianValue(b)American IndianNumberValue(b) Weighted Average LTV(b)Pacific IslanderNumberValue(b)Weighted Average LTV(b) 88,931,752,45579.8%(FICO(a) 660)(FICO(a) 660)99,633 952,875217,202,665,88577.9%76.0%(FICO(a) 660)(FICO(a) 660)26,999 6,285,044,596Weighted Average LTV(b)433,13182.3% 16,984,773,454Weighted Average LTV(b)Number77,786 12,283,382,386Weighted Average LTV(b)(FICO(a) 660)831,433 246,574,405,25074.6%69.9%(FICO(a) 660)(FICO(a) 660)6,8541,141,220,851 65,68614,262,185,34376.7%75.1%(FICO(a) 660)(FICO(a) 660)4,424904,895,33777.6% 47,34512,156,288,76673.7%Management note:We have modified this metric to increase transparency and map to Home Mortgage Disclosure ActMinority Status Designations.Footnotes:- Table represents Single-Family mortgage loans on our consolidated balance sheet.- For all protected class groups, in cases where there are more than two borrowers, only the first twoborrowers are considered. A loan is considered Latino if either borrower is Latino. Similarly, a loan isconsidered Black, Asian, American Indian or Pacific Islander if either borrower lists one of those raceson the loan application. As such, the individual race/ethnicity categories do not form a partition so thatthe same loan can be counted in two different protected class groups. However, a loan is consideredWhite non-Latino only when the borrower(s) list both race as White and ethnicity as non-Latino. A loancannot be considered White non-Latino and another race/ethnicity category at the same time.a) FICO refers to the FICO score used for loan application decisioning.b) Value (UPB) and LTV refers to information at origination.c) Records without borrower race or ethnicity information are only included in the “Aggregate” row.*PwC performed an attest review engagement on this metric. See their report on page 17.FREDDIE MAC9

SASB — SUSTAINABILITY ACCOUNTING STANDARDS BOARDCode/MetricResponse/ReferenceFN-MF-270b.2, Total amount of monetary lossesas a result of legal proceedings associated withdiscriminatory mortgage lendingFreddie Mac discloses material legal and regulatory proceedings in its Annual Report.Please see our 2020 Annual Report. Separately, Freddie Mac has not identified anysettlements or judgments exceeding 100,000 as a result of legal proceedings fordiscriminatory mortgage lending.FN-MF-270b.3, Description of policies andprocedures for ensuring nondiscriminatorymortgage originationUnder Section 305(a) of our Charter, Freddie Mac is not permitted to originate mortgageloans. Accordingly, we do not originate mortgage loans or lend money directly tomortgage borrowers.Although Freddie Mac does not originate loans, we require all Seller/Servicerswith whom we do business to abide by the law and practice the principles of equalopportunity and non-discrimination in all business activities. Our Single-Family Seller/Servicer Guides require that seller/servicers must not discriminate on the basis of race,color, religion, sex, age, marital status, disability, veteran status, genetic information(including family medical history), pregnancy, parental status, familial status, nationalorigin, ethnicity, sexual orientation, gender identity or other characteristics protectedby law. Our Single-Family Seller/Servicer Guides also require seller/servicers tocomply with all applicable federal, state and local laws and regulations, including nondiscrimination and fair lending laws, and to employ business practices that promotefair lending. For more information on our selling and servicing requirements, see ourSingle-Family Seller/Servicer Guides. In addition, Freddie Mac has fair lendingstaff and management professionals in all three lines of defense (i.e., our business,risk management and internal audit divisions) as well as the legal division. Theseprofessionals conduct quantitative and qualitative reviews concerning our creditpolicies, Seller/Servicer Guide requirements, underwriting and valuation, and otherwisesupport Freddie Mac’s commitment to fair lending and compliance with its fair lendingpolicy and all federal antidiscrimination laws and regulations. Additionally, see ourMultifamily Seller/Servicer Guide.Natural Disaster and Climate RiskThrough our natural disaster risk management practices, Freddie Mac has minimized economic losses to the company bymanaging the associated risk while supporting borrowers affected by natural disasters. Historically, our economic lossesfrom natural disasters, such as floods, hurricanes and earthquakes, have not been significant.We do this by conducting periodic quality control reviews of compliance with flood insurance coverage requirementsin the applicable areas. These reviews reveal a very low percentage of noncompliance, allow us to determine theeffectiveness of Seller/Servicer controls and assist with identifying any flood map changes.To assess and manage our natural disaster risk related to flooding, we require our Sellers to obtain a FEMA Flood ZoneDetermination to identify any homes or multifamily properties located in Special Flood Hazard Area (SFHA) for which thefederal mandatory flood insurance purchase requirements would apply. If applicable, they are required to ensure thatflood insurance coverage exists for these homes or properties at the time the loans are sold to Freddie Mac. We requireflood insurance coverage to be maintained on these homes or properties throughout the life of the loan and in amountsneeded to comply with federal government and Freddie Mac requirements.Freddie Mac continues to require flood insurance for homes located in a SFHA, even if the community does not participate inthe National Flood Insurance Program (a “nonparticipating community”). In addition, our Single-Family division reviewsflood models from other third-party sources to help us assess potential or emerging flood risk exposure. Our Multifamilydivision also uses property surveys, virtual maps and environmental and property condition reports to identify properties thatare potentially at higher risk for natural disasters related to flooding. This helps focus more attention on the review of relevantrisk, property conditions and the insurance coverage we require our borrowers to maintain.FREDDIE MAC10

Freddie Mac’s loss exposure from natural disasters is further limited by: Insurance coverage that borrowers are required to maintain throughout the life of the mortgage loan, includingcatastrophic risk coverage. Seller/Servicers are required to review borrower insurance compliance annually aspolicies renew, and we require servicers to directly place required coverage should borrowers fail to obtain andmaintain compliant insurance. The geographic diversity of Freddie Mac’s mortgage portfolio. Borrower equity in the properties’ underlying mortgage loans across the portfolio. Relief options for borrowers affected by natural disasters. Multifamily’s credit risk transfer model via K-Deal and other securitizations. Community support provided by FEMA and local and federal governments affected by natural disasters.As climate change poses broader risks than natural disasters, in 2020 Freddie Mac established a Climate Advisory Group,and we are developing a comprehensive framework to identify, measure, manage, mitigate and report on the risks thatclimate change poses to our business and mission, as well as the housing market and mortgage industry.SASB — SUSTAINABILITY ACCOUNTING STANDARDS BOARDCode/MetricResponse/ReferenceEnvironmental RiskSingle-Family(1) 361,000 loans and (2) 69 billion, based on UPB of loans in our Single-Familymortgage portfolio, which represented 3.02% of our total 2,282 billionSingle-Family mortgage portfolio.FN-MF-450a.1, (1) Number and (2) value ofmortgage loans in 100-year flood zones*Multifamily(1) 120 loans and (2) 2.41 billion, based on UPB of unsecuritized mortgage loans,securitized mortgage loans held by consolidated trusts and other mortgage-relatedguarantees in our Multifamily mortgage portfolio, as this represented where Multifamilyhad exposure to first loss on properties located in these 100-year flood zones. Thisrepresented 4.3% of that population of 56.5 billion.Management Note:We define “100-year flood zones” as areas designated by FEMA as SFHAs, as of the loanorigination date. We also include mortgages held for sale.FN-MF-450a.2, (1) Total expected loss and (2) LossGiven Default (LGD) attributable to mortgage loandefault and delinquency due to weather-relatednatural catastrophes, by geographic regionBecause weather-related natural catastrophes are one of many factors that could leadto mortgage loan default and/or delinquency, Freddie Mac has not gener

About Freddie Mac Freddie Mac is a government-sponsored enterprise chartered by Congress in 1970. Our public mission is to provide liquidity, stability and affordability to the U.S. housing market. We do this primarily by purchasing residential mortgage loans originated by lenders.