Transcription

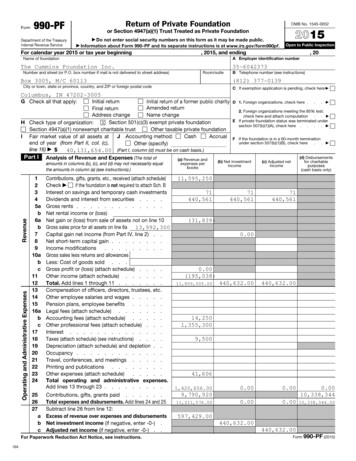

The Cummins Foundation Inc.35-6042373Box 3005, M/C 60113(812) 377-0139Columbus, IN 00440,632.00ISA

Interest 4.00250,0002,010,936347,2001,403,5122,260,936.00 7,429.0038,367,257.0038,367,257.00

See Attached ,1889,996,971.944,40610,001,377.9410,338,344

4,406X4,406 004,406 0011,38211,382 006,9760 006,976 000 00XXXXXXXXXIndianaXXX

XXXwww.cummins.comAaron KalufCummins Inc., 500 Jackson St., Columbus, IN(812) 377-869547202-3005XXXXXXXXXXXX

XXXXXXXXSee Exhibit BNone

NoneN/ANone0.00

0,338,344.00

,154,9355,141,4905,107,5035,960,7768,311,341

000.000.000.000.000.000.000.00NoneNonePaula Blewett, Administrative Assistant, Box 3005, M/C 60028, Columbus, IN 47202-3005 (812) 377-3746See Exhibit CNoneSee Exhibit C

Approved during 2015, paid during 2015Approved prior to 2015, paid in 2015349,9401,775,936See Exhibit D2,125,876.00Approved prior to 2015, not yet paidApproved during 2015, not yet paid175,0001,228,512See Exhibit E1,403,512.00

71440,561(31,839)0.003480.00 408,793.00408,793.00Interest earned on cash awaiting distribution and from temporary cash investmentsDividends & interest earned from investmentsGain / (Loss) on the sale of investments

The Cummins Foundation Inc.35-6042373Schedule 1Part ILine 1 - Contributions, gifts, grants, etc. receivedContributorAmountCummins Inc. 11,595,250Total 11,595,250T:\Returns\2015 Federal Return\Cummins Foundation\2015 Cummins Foundation Schedules and Exhibits

35-6042373The Cummins Foundation, Inc.Line 6 (990-PF) Gain/Loss from Sale of Assets Other Than " ifSale ofSecurityDescriptionXNorthern Trust Long Term Gain - Account 26-98880XNorthern Trust Short Term Loss - Account 17-17862XNorthern Trust Long Term Loss - Account itionMethod14,024,139Expense ofSale and CostGross SalesCost orValuationofDate SoldPriceOther Basis Method Improvements Depreciation12/15/2015 2,500,0002,497,53799/99/99 5,461,5165,458,29799/99/99 (37,520)-

35-6042373The Cummins Foundation, Inc.Line 11 (990-PF) - Other IncomeDescription1 Unrealized Gain/(Loss) on d DisbursementsExpenses InvestmentNetfor Charitableper BooksIncomeIncomePurposes(195,038)

35-6042373The Cummins Foundation, Inc.Line 16b (990-PF) - Accounting FeesName of Organization or PersonProviding Service1 Blue & Co., LLC - Audit Fees2 In-kind Accounting Services34567891014,250RevenueandNetAdjusted DisbursementsExpenses InvestmentNetfor Charitableper BooksIncomeIncomePurposes8,9505,300

35-6042373The Cummins Foundation, Inc.Line 16c (990-PF) - Other FeesName of Organization or PersonProviding Service1 Cummins Inc. - Administrative Fees2 Global Giving - Consultant Fees3456789101,355,300RevenueandNetAdjusted DisbursementsExpenses InvestmentNetfor Charitableper BooksIncomeIncomePurposes1,197,500157,800

35-6042373The Cummins Foundation, Inc.Line 18 (990-PF) - TaxesName of Organization or PersonProviding Service1 Tax on investment income23456789109,500RevenueandNetAdjusted DisbursementsExpenses InvestmentNetfor Charitableper BooksIncomeIncomePurposes9,500

35-6042373The Cummins Foundation, Inc.Line 23 (990-PF) - Other ExpensesDescription1 Administrative Expense234567891041,606RevenueandNetAdjusted DisbursementsExpenses InvestmentNetfor Charitableper BooksIncomeIncomePurposes41,606

35-6042373The Cummins Foundation, Inc.Part II, Line 7 (990-PF) - Other Notes125,000Borrower's Name1 City of Columbus2345678910125,000AllowanceCheck "X"Net Balancefor DoubtfulCheck "X" if if 501(c)3 Original Due Beginning Balance Due Accts End of FMV of Other SecurityBusinessOrg.Amountof YearEnd of YearYearNotesProvidedX250,000125,000125,000

35-6042373The Cummins Foundation, Inc.Part II, Line 13 (990-PF) - Investments - OtherItem or Category1 Mutual Fund2345678910Basis ofValuation36,551,35738,751,228Book Value Beg. Book Value EndOf YearOf Year36,551,35738,751,22838,751,228FMV End ofYear38,751,228

35-6042373The Cummins Foundation, Inc.Part VI, Line 6a (990-PF) - Estimated Tax PaymentsDate1234567Credit from prior year return .First quarter estimated tax payment Second quarter estimated tax payment .Third quarter estimated tax payment .Fourth quarter estimated tax payment .Other payments .Total .-1234567Amount2,3822,0003,0002,0002,00011,382

-Exhibit BPage 1 of 2The Cummins Foundation Inc.35-6042373A Statement Attached to and Made Part ofReturn of Private Foundation Exempt fromIncome Tax for Year Ended 12-31-15Form 990-PF, Page 6, Part VIII, Item I – Compensation ofOfficers, Directors, Trustees, Foundation ManagersName & AddressTom LinebargerCummins Inc.Box 3005 – M/C 60913Columbus, IN 47202-3005Mark Levett (Ret. 11/30/2015)Cummins Inc.Box 3005 – M/C 60913Columbus, IN 47202-3005TitleChairmanCEOTime DevotedTo BusinessNominalCompensationNone33% of timeNoneTony SatterthwaiteCummins Inc.3850 Victoria Street, NorthM/C – OC300Shoreview, MN 55126DirectorNominalNoneLisa YoderCummins Inc.3850 Victoria Street, NorthM/C – OC300Shoreview, MN 55126DirectorNominalNoneJulie Del GenioCummins Inc.301 Jackson StreetM/C 91671Columbus, IN 47202-3005SecretaryNominalNone

Exhibit BPage 2 of 2Name & AddressWill MillerThe Wallace Foundation5 Penn PlazaNew York, NY 10001TitleDirectorTime DevotedTo BusinessNominalCompensationNoneMarya RoseCummins Inc.One American SquareSuite 1800M/C C0014Indianapolis, IN 46282DirectorNominalNonePat WardCummins Inc.Box 3005 – M/C 60911Columbus, IN 47202-3005DirectorNominalNoneAnant TalaulicarCummins Inc.Box 3005 – M/C C0045Columbus, IN 47202-3005DirectorNominalNoneRich FreelandCummins Inc.Box 3005 – M/C 60913Columbus, IN 47202-3005DirectorNominalNoneAaron KalufCummins Inc.301 Jackson StreetM/C 91671Columbus, IN 47202-3005TreasurerNominalNoneMary Chandler (Eff. 12/17/15)Cummins Inc.One American SquareSuite 1800 – M/C C0014Indianapolis, IN 46282CEONominalNone

Exhibit CThe Cummins Foundation Inc.35-6042373A Statement Attached to and Made Part ofReturn of Private Foundation Exempt formIncome Tax for Year Ended 12-31-15Page 10, Part XV, Line 2 (b) and (d)- Information regarding contribution, grant,gift, loan, scholarships, etc. programs.The Foundation’s budget year is from January 1 through December 31. TheFoundation directors meet four times a year to consider new programs andapprove grants. The staff has authority to make grants under 250,000 andlarger grants requiring immediate action may be approved by the ExecutiveCommittee between meetings.Inquiries and proposals may be submitted in writing at anytime during the year.A preliminary proposal should include a brief description of the problem beingaddressed, outcomes anticipated, the operating budget and additional financialrequirements necessary.The Foundation primarily makes grants in the communities where the Companyhas business interests. Cummins believes a Company is only as healthy as thecommunities where we do business. The present global priority areas include:the environment, education and social justice. The Foundation looks for projectswhere Cummins employees are engaged in making a meaningful and significantcommunity contribution and where possible specific and measurable outcomeshave been defined to guide the work.The Foundation does not support political causes or candidates, or sectarianreligious activities. No grants are made to individuals.

The Cummins Foundation, Inc.35-6042373Exhibit DGrants SummaryUnpaidCommitmentsPer ReturnAs Of sMadeIn 2015Dr9,790,920CommitmentsPaidIn 2015Cr(10,338,344)UnpaidCommitmentsPer ReturnAs Of 12-31-15Rounding0*Note: India 2014 Environmental Challenge funds totaling 60,000 were declined by the recipientT:\Returns\2015 Federal Return\Cummins Foundation\2015 Cummins Foundation Schedules and Exhibits1,403,512

The Cummins Foundation Inc.35-6042373Exhibit E2014 Grant Summary - Unpaid CommitmentsBalance as of 12/31/2015The Cummins Foundation - 2014 Grant Summary - Unpaid Commitments12/31/2015BalanceUnited Way of Greater Cincinnati 60,000 Grant 10,000Association ROI 30,000 Grant 10,000Heritage Fund of Bartholomew County 90,000 Grant 30,000Trustees of Indiana University 150,000 Grant 75,000Heritage Fund of Bartholomew County 100,000 Grant 50,000United Way of Central West Virginia 25,000 Grant 12,500Earth University 1,000,000 Grant 750,000Growing Place Indy 61,000 Grant 30,000United Way of Eastern New Mexico 99,000 Grant 85,000Face without Places (FWP) - UpSpring 195,000 Grant 195,000Indianapolis Parks Foundation Inc. 28,808 Grant 27,068Keep Indianapolis Beautiful Inc. 25,400 Grant 13,000Batley Girls High School (through GlobalGiving) 42,600 Grant 24,300United Way of Winnipeg 2,332 GrantUnited Way of Thunder Bay 60 GrantLloydminster & District United Way 162 GrantUnited Way of Calgary and Area 90 Grant 2,332 60 162 90

Hoosier Trails Council - Boy Scouts of American 34,000 Grant 24,000World Education and Development Fund 65,000 Grant 65,000Total 1,403,512

The Cummins Foundation, Inc. 35-6042373 Line 6 (990-PF) Gain/Loss from Sale of Assets Other Than Inventory 14,024,13913,992,300 (31,839) Inde x Check "X" if Sale of Security Description Date Acquired Acquisition Method Date Sold Gross Sales Price Cost or Other Basis Valuation Method Expense of Sale and Cost of Improvements Depreciation Net Gain .