Transcription

2017-2018FINAL BUDGET ADOPTIONJune 13, 2017Boyertown Area School DistrictBoard of Education

Budget Considerations The 2017-2018 General Fund Budget has been a challenge Construction Projects Ongoing – (BASH, MSW, Elementary HVAC) August 2018 BASH servicing grades 9-12, Junior High Schools becomingmiddle schools servicing grade 6-8, Elementary Schools provided roomfor growth serving K-5 Student and Teacher movement as grades reconfigure Curriculum/Program of Studies Revisions Complete Final Phase of BASH 1:1 Initiative Increasing Mandated Costs – PSERS, Special Education, Charter Tuition Federal and State Budget Difficulties Future Education Funding Concerns – (Title I, Title II, ACCESS) Health Care Expenditures & Governmental Mandates

2017-2018 Budget Development September 2016 - Budget Packages sent to Building and DepartmentAdministrators October 2016 – Building and Department Meetings to discuss budgetassumptions, building needs, and personnel November 2016 review of budget submissions and entry into financial systemas requested November 29 - Initial Board presentation to review budget items includingrevenue projections, Act 1 information, and major mandated expenditures December 2016 – Administrative Personnel projections, review of wage &salary increases, preliminary fringe benefit information January 17 – Board adopts resolution to not exceed Act 1 Index of 3.1% February 7 – Governor Wolf’s Commonwealth Budget Address, BASD Budgetwork session Budget Work Sessions – March 7, April 4, May 2, May 30 May 9 - Final Proposed Budget Adoption – start 30 day review period June 13 - Final Adoption of the 2017-2018 Budget Tonight

Focus on the FutureThe development of the 2017-2018 budget stressed more than aone-year financial plan. With the goal of becoming a highachieving school district, the School Board and Administrationplanned to invest in the Boyertown Area students’ education.Important Items Discussed How will decisions for 17-18 impact the next 5 years? Replacement of One-Time Fund Balances Future Impact of Large Expenditure Items like Health CareCosts, PSERS Pension Contribution Increases, ContinuedIncrease in Special Education Students and Service Building Operations & Maintenance Evaluation – EfficientUtilization of Existing Buildings Need for Additional Revenue versus Program & EducationService reductions. Future Tax Increases to Improve District Performance

2016 Berks County SchoolsReal Estate Tax RateANTIETAMB. HEIGHTSEXETERFLEETWOODWYOMISSINGKUTZTOWNDANIEL 729.9529.7028.5627.70C. WEISERGOV. MIFFLINSCH. VALLEYTWIN VALLEYHAMBURGOLEY 6.7126.3324.9524.2717.93* Reading SD taxpayers voted to exchange HIGHER INCOME tax FOR LOWER PROPERTY tax. CompareReading SD EIT of 1.5% to Boyertown .5%

2016 Montgomery County SchoolsReal Estate Tax OWNLWR MORELANDUPPER DUBLINSPRINGFIELDPERK VALLEYABINGTONUPR .6030.8329.40SOUDERTONMETHACTONHATBORO-HORSLOWER MERIONSPRING FORD28.7828.7427.4927.4026.24BOYERTOWN24.27NORTH PENNUPPER PERKCOLONIALUPPER MERIONWISSAHICKON24.1923.6420.9618.9618.79

Act 1 IndexIndex Calculation for 2017-2018:ECI Index equalstimes: Aid Ratio Allow(.75 .479)xBASD Index (from 24.2724.272.5%Increase.75.751 Mill 2.3 Million times .75 1,725,000The School Board adopted a resolution that the Districtwould not increase the tax rate by more than the Act1 Index

General Fund Budget ProgressFebruary 7 105,347,105Projected RevenueTax Increase of 3.1%Total Projected RevenueProjected Expenditures 111,345,876Projected Deficit (5,998,771)May 9 106,299,617 1,750,000 108,049,617 109,461,229 (1,411,612)June 13 106,347,569 1,750,000 108,097,569 109,439,014 (1,340,445)Use of One-Time FundsPSERS Committed 2,000,000Net Deficit (3,998,771) 1,340,445 01,411,6120Current Budget does include Basic Ed and Special Ed revenue increases asproposed in Governor Wolf’s budget proposal

Budget Deficit Reduction Three Ways to Decrease a Budget Deficit:1. Decrease Expenditures2. Increase Revenue3. Use of Fund Balance

Deficit ReductionExpenditures Review

New Secondary PersonnelRecommendationsRegular Ed/Support BASH Administrator BASH Clerical BASH Counselor BASH HPE BASH HPE BASH Custodians (2) BASH Security Monitor BASH CAF Monitor (2) Secondary Orchestra (.5)Special Education BASH ES Teacher (IDEA) BASH .5 Gifted Teacher MSE LS Teacher MS Gifted Teacher

New ElementaryPersonnel Recommended CES Intervention Teacher BES .5 Counselor EES .5 Counselor PFES .5 Counselor GES .5 Dean of Students NHUF .5 Dean of Students GES Playground Aide

New District-widePersonnel Recommended School Psychologist Speech Pathologist PT Staff Accountant

Personnel SummaryFull Time Equivalent PositionsAdditionsRegular Education1 BASH Guidance Counselor1 BASH HPE1 CES Intervention Teacher.5 Secondary OrchestraSpecial Education1 Bash ES Teacher (IDEA).5 BASH Gifted TeacherDeletionsRegular Education.5 BASH Social Studies.5 JHE Planetarium (Contracted)3 WES Grade Teachers1 BES Grade Teacher1 GES Grade Teacher1 NHUF Grade Teacher1 MSE LS Teacher1 School PsychologistSupport.5 Staff Accountant0 Professional FTETotal .5 FTE AdditionGeneral Funded (.5) FTE

Special Education Expense (FederalMandate)

PersonnelWages & BenefitsSalaries & BenefitsFinal Year of BAEA Collective Bargaining Agreement (CBA)No Furloughs – Re-Allocation of Positions through AttritionAll Non-BAEA Employees budged at 2.5% increase in wagesBenefitsPSERS Increase from 30.03% to 32.57%Health Insurance – 0% Increase in PremiumStaff Contribution percent increase .5%Premium Holiday – December 2017Internal Service Fund Balance Reduction

Pension Contribution Expense (State Mandate)

Cost ReductionsJH LibrarianCounselorBASH Chem/BioAdministrationAdministrative ClericalCustodial SupportRecess AidesParaprofessionalBudgets ReductionBus Runs (3)Total 150,000117,000864,000

Deficit ReductionIncrease Revenue

Proposed Revenue IncreasesState RevenueAssume Governor’s Budget will be adopted asproposed with 100 million added to BEFLocal RevenueMaximum tax increase of 3.1% (BASD Act 1 Index)Assessment Increases – Montgomery Co. GrowthStudent Activity Fees increase to 200 per secondarystudent for unlimited participationBASH student Parking Fee increase to 100 per yearBuilding Rental Custodial Hourly Fee from 34 to 44

Use of Fund Balance

Fund Balance Usage 1.34 million in Committed Fund Balance for PSERS included inbudget Projected Balance of PSERS Fund on 6/30/18 is 3.5million Step down plan to utilize remaining balance over 5-6 yearswith proposed .1 mill increase each year slowly replacingthe reliance of one-time funding Capital Projects Fund Transfer of 500,000 for 2017-18eliminated Internal Service Fund Balance Reduction Plan - PremiumHoliday

Other Funding SourcesThe following funding sources will be added to the General Fund budgetfor inclusion in the adoption of the Final Proposed Budget on May 9 andthe Final Budget on June 13:LocalPottstown Health & Wellness 75,000StateReady to Learn Block Grant 928,175FederalTitle I 563,931Title II 93,000IDEA 1,152,225ACCESS 475,000Total 3,307,331Each Funding source has equal revenues and expenditures

Questions & Discussion

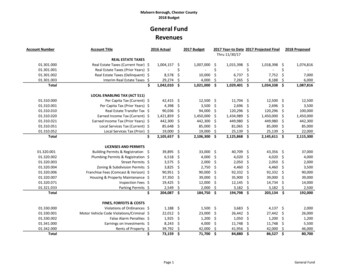

6/13/2017Includes 3.1% Tax IncreaseObjectDescriptionEXPENDITURESSALARY110 Administrative Wages120 Professional Wages130 Extra Duty Wages140 Technical Wages150 Clerical Wages160 Maintenance Wages170 Custodial Wages180 Community Wages190 Para Professional WagesTotal WagesBENEFITS271 Health Insurance272 Dental Insurance213 Life Insurance215 Vision Insurance217 Disability Insurance220 FICA & Medicare230 Retirement240 Tuition Reimbursement250 Unemployment260 Work Comp290 Other BenefitsBOYERTOWN AREA SCHOOL DISTRICTBUDGET SUMMARYGENERAL FUND 016Budget2016-2017Budget2017-2018Budget 90529,864,244TOTAL PROJECTED EXPENDITURESREVENUES6000 LOCAL REVENUE7000 STATE REVENUE8000 FEDERAL REVENUE9000 OTHER ,5811,077,339-TOTAL PROJECTED 3.76%TOTAL SALARY & BENEFITSPROFESSIONAL SERVICESCONTRACTED SERVICESPURCHASED SERVICESSUPPLIES & TEXTBOOKSEQUIPMENTINTEREST & FEESTECHNOLOGY RESERVE TRANSFERCAPITAL PROJECTS TRANSFERDEBT SERVICE, INTERFUND TRANS.TOTAL OTHER EXPENDITURESOPERATIONAL SURPLUS/(DEFICIT)COMMITTED PSERS FUND BALANCEFUND BALANCEDEBT SERVICE TRANSFER INPROJECTED SURPLUS .00%2017-2018Tax at Act 1 Index3.10%3.10%3.10%Proposed Tax3.09%3.09%3.09%Page 50.756/7/2017

BOYERTOWN AREA SCHOOL DISTRICTGENERAL FUND 5 YEAR BUDGET PROJECTION2017-2018 TO 12.25%2017-2018Proposed0.753.1% Tax 606TOTAL SALARY & BENEFITS% Increase 94,346,3753.46%PROFESSIONAL SERVICESCONTRACTED SERVICESPURCHASED SERVICESSUPPLIES & TEXTBOOKSEQUIPMENTINTEREST & FEESTECH RESERVE TRANSFER (Technology Leases)DEBT SERVICE, BUDGET RESERVETOTAL OPERATING EXPENDITURES% Increase (Decrease)Operating nREVENUELOCAL% Tax IncreaseAdditional Tax Revenue2015-2016Actual0.582.49% Tax Inc.6111 Current TaxProperty Tax Relief6112 Interim Tax6120-6141 Per Capita Tax6151 Earned Income6153 Transfer Tax6414-6441 Delinquent TaxOther Tax6510 Interest Earnings6700 Student Activity RevenueOther Local RevenueTOTAL LOCAL REVENUE% Increase (Decrease)STATE7110 Basic Education7271 Special Education7310 Transportation7320 Rental Subsidy7340 Property Tax Relief7810 Social Security7820 RetirementOther State SubsidiesTOTAL STATE REVENUE% Increase (Decrease)OTHER9000 Other RevenueTOTAL GENERAL FUND REVENUE% Increase (Decrease)EXPENDITURESSALARY110 Administrative Wages120 Professional Wages130 Extra Duty Wages140 Technical Wages150 Clerical Wages160 Maintenance Wages170 Custodial Wages180 Community Wages190 Para Professional WagesTotal Wages% Increase (Decrease)BENEFITS271 Health Insurance - SFSF & EdJobs272 Dental Insurance213 Life Insurance215 Vision Insurance217 Disability Insurance220 FICA & Medicare230 Retirement240 Tuition Reimbursement250 Unemployment260 Work Comp290 Other BenefitsTotal BenefitsProposed Tax Increase at 3% 18-19Proposed Tax Increase at 3% 19-20Proposed Tax Increase at 3% 20-21Proposed Tax Increase at 3% 21-22Transfer to Capital ProjectsUse of Committed (PSERS) Fund BalanceUse of Debt Service Fund BalanceUse of General Fund BalanceBUDGET SURPLUS/(DEFICIT)Millage EquivalentTransfers Out Unassigned Fund Balance ChangeUnassigned Fund BalanceCommitted Fund Balance ChangeCommitted Fund BalanceBASD2016-2017Budget0.361.5% Tax ,567Page 0,445)357,3426/7/2017

6/7/2017BOYERTOWN AREA SCHOOL DISTRICTGENERAL FUND REVENUE PROJECTIONS2017-20186/13/2017 3.1% Tax Increase 8614109ACCOUNT NAMEProperty Tax ReliefCURR RE TAX BALLYCURR RE TAX BECHTELSVILLECURR RE TAX BOYERTOWNCURR RE TAX COLEBROOKDALECURR RE TAX DOUG/BKSCURR RE TAX EARLCURR RE TAX WASHINGTONCURR RE TAX DOUG/MTGCURR RE TAX NEW HANOVERCURR RE TAX U FREDERICKTOTAL REAL ESTATE TAX LEVYINT RE TAX BALLYINT RE TAX BECHTELSVILLEINT RE TAX BOYERTOWNINT RE TAX COLEBRKINT RE TAX DOUG BKSINT RE TAX EARLINT RE TAX WASHINT RE TAX DOUG MONTINT RE TAX NEW HANINT RE TAX U FREDPUB UTILITY TAXIN LIEU OF TAXCURR PC TAX 679 BALLCURR PC TAX 679 BECHCURR PC TAX 679 BOYCURR PC TAX 679 COLECURR PC TAX 679 DOUGBKCURR PC TAX 679 EARLCURR PC TAX 679 WASHCURR PC TAX 679 DOUGMONCURR PC TAX 679 NHANCURR PC TAX 679 UFREDCURR PC TAX 511 BALLYCURR PC TAX 511 BECHCURR PC TAX 511 BOYCURR PC TAX 511 COLECURR PC TAX 511 DBCURR PC TAX 511 EARLCURR PC TAX 511 WASHCURR PC TAX 511 DGMNTCURR PC TAX 511 ,46931,34334,040Page 1 of ,000 .00%0.00%0.00%0.00%0.00%

6/7/2017BOYERTOWN AREA SCHOOL DISTRICTGENERAL FUND REVENUE PROJECTIONS2017-20186/13/2017 3.1% Tax Increase 0692000ACCOUNT NAMECURR PC TAX 511 UFREDOCC PRIV TAXEARNED INCOME TAXRE TRANS TAX BERKSRE TRANS TAX MONTGTOTAL OTHER TAX REVENUEDEL RE TAX BALLYDEL RE TAX BECHDEL RE TAX BOYERDEL RE TAX COLEDEL RE TAX DOUBKSDEL RE TAX EARLDEL RE TAX WASHDEL RET DOUG MONTDEL RE TAX NHANDEL RE TAX UFREDDEL RE TAX BASDDEL RE TAX COLLECTED ATTORNEYDEL PC TAX 679 BALLYDEL PC 679 BECHDEL PC TAX 679 BOYDEL PC TAX 679 COLEDEL PC TAX 679 DBDEL PC TAX 679 EARLDEL PC TAX 679 WASHDEL PCT 679 DOUGMONTDEL PC TAX 679 NHANDEL PC TAX 679 UFREDDEL PC TAX 511 BALLYDEL PC TAX 511 BECHDEL PC TAX 511 BOYDEL PC TAX 511 COLEDEL PC TAX 511 DBDEL PC TAX 511 EARLDEL PC TAX 511 WASHDEL PCT 511 DOUG MONDEL PC TAX 511 NHANDEL PC TAX 511 UFREDTOTAL DEL TAX REVENUE COLLECTEDEARN FROM INVESTMTSSTUDENT ACTIVITIES REVENUERENT SCH OTH 5,379138,836140,430137,6762,872Page 2 of 70,000180,0005,000 0.00%-11.63%51.00%92.86%12.50%66.67%

6/7/2017BOYERTOWN AREA SCHOOL DISTRICTGENERAL FUND REVENUE PROJECTIONS2017-20186/13/2017 3.1% Tax Increase 0731000731001732000733000734000781000782000ACCOUNT NAMETUITIONTUITION SUMMER SCHOOLSUMMER CAMPSRCPTS OTH LEA SRVSRVCS OTH GOVT UNITSERVICES PROVIDED OTHER LEAPLANETERIUM REVENUENJROTC GRANTMISC REVENUESUMMER MUSIC PROGRAMTAX CERT FEESTAX COLL ADMIN FEETOTAL OTHER LOCAL REVENUETOTAL LOCAL REVENUEBASIC INST SUBSIDYSEC 1305-06 COMMONSP ED SCH AGE PUPILSTRANSPORTATION SUBSIDYNON-PUBLIC TRANSPORTATIONRENTAL SUBSIDYHLTH SRV (MED/DENT/NURSE)TAX RELIEF FUND ACT 1REV SOC SEC PAYMTSREV RETIREMENT PAYMTTOTAL STATE REVENUE934000 DEBT SERV FUND TRANS934050 OPERATING TRANSFER FROM FOOD SERVICE940000 SALE RE & SER EQUIPTOTAL OTHER REVENUETOTAL AL2016-2017BUDGET2017-2018PROJECTED 58105,819,738108,098,569Page 3 of 32,278,8312.15%

achieving school district, the School Board and Administration . LOWER MERION 27.40 SPRING FORD 26.24 BOYERTOWN 24.27 NORTH PENN 24.19 UPPER PERK 23.64 . .5 BASH Gifted Teacher 1 MSE LS Teacher 1 School Psychologist Support.5 Staff Accountant Deletions Regular Education