Transcription

Draft version for public consultationDraft 2025 TargetSetting ProtocolU.N.-CONVENED NET-ZERO ASSET OWNER ALLIANCEMONITORING REPORTING AND VERIFICATION TRACKIn partnership with: U.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol1

This Document was written by the members of the U.N.-Convened Net-Zero Asset Owner Alliance. Members include:Udo Riese (Allianz), Claudia Bolli (Swiss Re), Sylvain Vanston (AXA), Thomas Liesch (Allianz), PeterSandahl (Nordea), Marcus Bruns (Storebrand), Jean-Francois Coppenolle (Aviva), Helena Charrier (CDC), Thiviya Rajendran (Aviva), Peter Loow (Alecta), Aaron Pinnock (COE), Lise Moret (AXA),Sadaf Stutterheim (Zurich), Ben Carr (Aviva), Silke Jolowicz (Munich Re), Michel Leveillee (CDPQ),Gallus Steiger (Swiss Re), Johanna Koeb (Zurich), Ditte Seidler Hansen (PD), Bertrand Millot(CDPQ), Vincent Damas (CNP), Pauline Lejay (ERAFP), Elisa Vergine (Generali), Emilie Westholm(Folksam), Johannes Jogi (Folksam), Jan Kaeraa-Rasmussen (PD), Anne Faivre (CDC), FlorentRebatel (CDC), Anna Viefhues (AMF), Eric Jean Decker (AXA), Zelda Bentham (Aviva), PascalCoret (CDC), Patrick Peura (Allianz), Sona Stadtelmeyer-Petru (Allianz), Anil Gurturk (Kenfo), AdamMatthews (COE), Stephen Barrier (COE), Jens Norell (AMF), Russ Bowdrey (Aviva), Yun Wai-Song(Scor), Justin Travlos (AXA), Thibaud Escalon (AXA), Thomas Rouland (AXA), James Corah (CCLA),Allison Vanlint (CBUS), Nicole Bradford (CBUS), James Spencer (CBUS), Rosalind McKay (CBUS),Laureen Tessier Haygarth (CDC), Laurent Deborde (CDC), Abou Ali Magued (CNP), Charles-DavidTremblay (CDPQ), Charly Bastard (CDPQ), Francois Humbert (Generali), Francesco Sola (Generali),Jacopo Cardinali (Generali), Johannes Blankenheim (Kenfo), Troels Børrild (MP Pension), AlfredWasserle (Munich Re), Janina Lichnofsky (Munich Re), Lang Maya (Munich Re), Peter-MichaelKracht (Munich Re), Pascal Zbinden (Swiss Re), Jake Barnett (Wespath), Rashed Khan (Wespath),Fred Huang (Wespath), Candice Dial (Rockefeller), Adam Phillips (UNJSPF), Claudia Limardo(Zurich), Danielle Brassel (Zurich), John Scott (Zurich), Sue Reid (Mission2020), David Knewitz(WWF), Hannes Peinl (WWF), Jan Vandermosten (WWF), Matthias Kopp (WWF), Ed Baker (UNPRI),Sagarika Chatterjee (UNPRI), Remco Fischer (UNEP FI), Elke Pfeiffer (UNPRI), and Jesica Andrews(UNEP FI).The Alliance would also like to express its gratitude to the following reviewers/commentators:Iren Levina, Ph.D.Portfolio Alignment Team, COP26Private Finance HubJohan FalkCo-founder and Head of ExponentialRoadmap InitiativeJerome Hilaire, Ph.D.Potsdam Institute for Climate Impact ResearchMagnus Jiborn, Ph.D.Head of Research, GlobalChallenges FoundationJakob ThomäManaging Director, Two DegreesInvesting InitiativeGlen PetersResearch Director, CICERONate AdenSenior Fellow, Science Based TargetsInitiative for Financial InstitutionsAntitrust DisclaimerThe Alliance and its members are committed to comply with all laws and regulations that apply tothem. This includes, amongst others, antitrust laws and regulations and the restrictions on information exchange they impose.2U.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol

Note to readersA growing number of financial institutions, including the world’s largest investment managers,banks, and asset owners, are making commitments to set Paris Agreement-aligned portfoliotargets. Members of the United Nations-Convened Net-Zero Asset Owner Alliance are involved ina number of these initiatives. With this report, the Alliance seeks to contribute to the next phase oftarget setting by global investors. The document provides details on a series of approaches, strategies and frameworks for the process of portfolio-level target setting across asset classes, sectorsand investment management actions. Members of the Alliance have also made commitments toother initiatives including the UN Global Compact Business Ambition for 1.5 C, the Science BasedTargets Initiative for Financial Institutions (SBTIFI), the Paris Aligned Investing Initiative (PAII) of theInstitutional Investors Group on Climate Change (IIGCC) and the Investor Agenda Investor ClimateAction Plans (ICAPs). The Alliance has coordinated with SBTIFI and offers compatible methodological approaches as well as builds on the comprehensive Net-Zero Investment Framework draftprovided by the PAII while offering quantitative insights necessary for 5-year target setting. U.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol3

ContentsAcronyms.5Consultation.6Executive Summary.7Scope and Coverage of the Protocol.741.Introduction: asset owner contributions to global ghg reductions. 102.Theory of Change: our potential management actions .153.Scope Covered by 2020-2025 target setting protocol. 204.Translating net-zero into pathways. 245.T1 – Sub-Portfolio targets. 306.Real Estate.357.T2 - Sector Targets. 398.T3 – Engagement Targets. 489.T4 - Financing Transition Targets.5210.Policy Engagement.5511.Alliance Recruitment Targets. 5812.Reporting on Annual Progress and 5-year Targets. 5913.Referenced Documents. 60U.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting ProtocolContents

AcronymsAFOLU Agriculture, Forestry and Other Land UseNACE Statistical Classification of EconomicActivities in the European CommunityAO Asset ownerNDC Nationally Determined ContributionAOA Asset Owner AllianceNDPE No deforestation, no peat, noexploitation policiesBECCS Bioenergy with carbon capture and storageBICS Bloomberg Industry Classification SystemNOC National Oil CompaniesCDR Carbon Dioxide RemovalOECM One Earth Climate ModelCO2e Carbon Dioxide EquivalentOGCI Oil and Gas Climate InitiativeCOP26 26th United Nations Climate ChangeConference of the PartiesPACTA Paris Agreement CapitalTransition AssessmentCRREM Carbon Risk Real Estate MonitorPAII Paris Aligned Investing InitiativeDFI Development Finance InstitutionPCAF Platform for Carbon Accounting FinancialsEAF Electric Arc FurnacePIK Potsdam Institute for ClimateImpact ResearchEBA European Banking AuthorityEDFI Association of European DevelopmentFinance InstitutionsPRI Principles for Responsible InvestmentRMI Rocky Mountain InstituteEIOPA European Insurance and OccupationalPensions AuthorityRTS Regulatory Technical Standardssbt science-based target (not associatedwith a validation initiative)ESG Environmental, Social andCorporate GovernanceSBTI Science Based Targets InitiativeESMA European Securities and Markets AuthoritySBTIFI Science-Based Targets Initiativefor Financial InstitutionsETC Energy Transition CommissionEV/EVIC Enterprise Value/ EnterpriseValue Including CashSEI Stockholm Environment InstituteSRC Stockholm Resilience CentreFI Financial InstitutionSSA Strategic Asset AllocationGHG Greenhouse GasesTPI Transitions Pathway InitiativeGICS Global Industry Classification SystemULCOS Ultra–Low CO2 SteelmakingIEA International Energy AgencyUNEP United Nations Environment ProgrammeIGCC Investor Group on Climate ChangeUNEP FI United Nations EnvironmentProgramme Finance initiativeIIASA International Institute of AppliedSystems AnalysisUTS University of Technology SydneyIIGCC Institutional Investors Groupon Climate ChangeIPCC International Panel on Climate ChangeISF Institute for Sustainable FuturesWEF World Economic ForumWEF MPP World Economic Forum MissionPossible PlatformWRI World Resources InstituteMRV Monitoring Reporting and VerificationWWF World Wildlife FoundationAcronymsU.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol5

ConsultationThe Alliance 2025 Target Setting Protocol is made available to the public for one month from 13thOctober 2020 to 13th November 2020. During this period members of the general public, academia,government, and business are invited to comment on the Protocol and the contents covered in it.The Alliance will hold one technical webinar on the contents of the Protocol, where the audience willhave the opportunity to ask clarification questions. Please see alliance website for further details.Consultation questions are provided at the end of each chapter. A consultation form is availableat unepfi.org/net-zero-alliance/resources/. Individuals or organizations responding to the consultation are invited to provide their reactions via the consultation form (online or email submission) byNovember 13th 2020. Please email jesica.andrews@un.org with any questions or comment.6U.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting ProtocolConsultation

Executive SummaryThe 2025 Alliance Target Setting Protocol sets out the Alliance’s approach to individual members andcollective target setting and reporting for the period 2020-2025. The Alliance aims to be as transparent and as robust as possible. Thus, this document is being circulated for public comment to solicitinput and commentary prior to final publication.Wherever possible the Alliance recommends members use science-based ranges, targets and methodologies, noting that data and methodological constraints persist. Members are responsible foremploying the recommended science-based criteria outlined herein or explaining why they chose analternative target or methodology from the range of options discussed below.The Alliance is committed to driving real world impact, primarily through engagement with corporates and policymakers as well as contributing capital required to finance the transition. Given thecomplex nature of leveraging ownership and financial strategies to drive real world change, and tracking impacts of these actions, a 4-part structure for target setting is recommended.Scope and Coverage of the ProtocolTargets are set on the asset owner’s own Scope 3 emissions (sometimes referred to as “portfolio emissions” or financed emissions). In addition to setting Scope 3 emissions targets, Alliancemembers are encouraged to set net-zero targets on their own Scope 1 and 2 emissions, as possible. The Alliance further recommends that members set targets on Scope 1 and 2 emissionsfor their underlying holdings and on Scope 3 of underlying holdings for ‘priority sectors’1 whenpossible as detailed in the chapter on sector-level targets. At the portfolio level Alliance membersshould track Scope 3 emissions but are not yet expected to set targets until data becomes morereliable.2Alliance commitments require Alliance members to publish interim targets every 5 years. Thisreporting schedule is in line with Article 4.9 of the Paris Agreement which requires signatories tosubmit updated emissions reductions plans every five years.3 National governments who havesigned up to the Paris Agreement will communicate these updated emissions reduction plans, alsoknown as Nationally Determined Contributions (NDCs), in 2025, 2030, 2035, 2040, 2045 and 2050.The Alliance continues to discuss an additional -5% per annum adjustment for earlier base yearsand includes this proposal for review in section 4.2.1 for the purposes of this consultation. Similarly, Alliance members who join the Alliance and issue targets after 2020 would also reduce by 5%per annum from 2020 for their 2025 target.4 Alliance members will report their emissions reductions targets and associated progress updates in CO2e.5 Members are encouraged to disaggregate GHG emission data wherever possible. It is recommended that Alliance members explain andadjust for large organic and inorganic portfolio changes.12345Identified from those with high Scope 3 emissions or otherwise large emissions contributions as Oil andGas, Utilities, Steel, Aviation, Shipping and heavy and light duty road transport.Comparisons of Scope 3 data reported by similar companies indicate the largest degree of divergence inreported emissions. See Busch, T., Johnson, M., Pioch, T. and Kopp, M. (2018) ‘Consistency of CorporateCarbon Emission Data’ University of Hamburg: https://ec.europa.eu/jrc/sites/jrcsh/files/paper timobusch.pdf.UNFCCC (2015) Paris Agreement: https://unfccc.int/files/meetings/paris nov 2015/application/pdf/paris agreement english .pdfThis is in line with IPCC 1.5 C reductions required for 2015–2020 as well as an equitable annual share ofthe 2020–2025 Alliance reduction target average.Greenhouse gases which contribute to climate change are CO2, CH4, N2O, HFCs, PFCs, SF6, and NF3. Thepredominant gas being Carbon Dioxide (CO2). CO2 equivalent or “CO2e” means the number of metric tonsof CO2 emissions with the same global warming potential as one metric ton of another greenhouse gas.Executive SummaryU.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol7

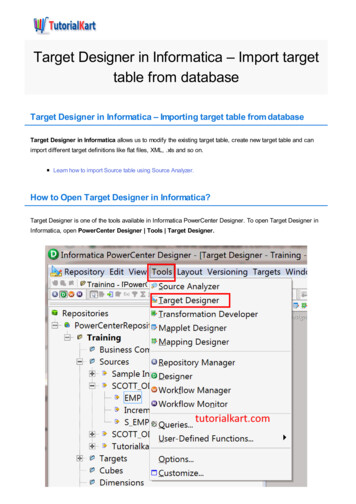

Individual Alliance Member Targets -16 to -29% CO2e reduction by 2025 (per IPCC 1.5 C scenarios) on Public Equity and Corporate Debt, with the same recommended for Real Estate and/or CRREM national pathwaysused Covers Portfolio Emissions Scope 1 & 2, tracking of Scope 3 encouraged Absolute or intensity-based reduction against 2019 base year recommended Phase Two: Sovereign debt to be includedSub-portfolio(later Portfolio) EmissionTargetsSector Targets Intensity-based reductions on AOA priority Sectors (O&G, Utilities, Steel, and Transport –Aviation, Shipping, Heavy and Light Duty Road) Scope 3 to be included wherever possible Sector specific intensity KPIs recommended Sectoral Decarbonization Pathways top-down and bottom-up necessary to set targetsEngagement Targets Financing Transition Targets Engagement with Top 20 (non-aligned) emitters or those AOs to set action targets onresponsible for 65% of emission in portfolio (either Direct, Policy Maker engagementCollective, or via Asset Manager ) Contribute to Sector - Engagement with target sectors Asset Manager - Each member to participate in atleast one engagement with the pre-identified (largest)4 Asset Managers AOA position papers Figure 1:Report on progress on climate-positive investmentsFocus on Renewable Energy in Emerging Markets, Green Buildings, Sustainable Forests,and Hydrogen, among othersContribute to activities enlarging the low carbon investment universe and building solutionsThe 4-part Alliance Target Protocol‘Sub-Portfolio’ Targets.6 Sub-portfolio targets cover asset classes where credible methodologiesand sufficient data coverage exist today. Later, once full coverage is reached these will be termedsimply ‘Portfolio targets’. Where sufficient data exists, Alliance members should set targets acrosstheir corporate equity, corporate debt and real estate portfolios. The Alliance assessed the IPCC’s1.5 C pathways7 and identified an asset class-level emissions reduction target range of -16% to-29% by 2025 (see Chapter 5 for further details). Alliance members may choose the most feasiblepathway for portfolio target setting taking into account the real impact on the economy and potential divestment. Alliance members will set targets on an absolute or intensity-basis (see sub-portfolio target section for details on appropriate metrics).Sector Targets. Sector targets help link portfolio-level reductions to the efficiency requirementsand real-world outcomes. Sector targets also feed into Alliance member engagement and stewardship efforts, providing an indication of expected emissions performance from the sector thatcan be communicated to individual companies and industry associations. Intensity-based,sector-specific targets for high emitting sectors reflect the specifics of each sector, their respective energy transition trade-offs with other sectors in the global economy, and the role they areexpected to play in the transition to a net-zero economy (e.g. sector specific intensities acrosstransport sector segments, a coal phase-out pathway for power utilities). The Alliance will reviewemerging sector-specific pathways for inclusion as reference points in the Protocol, so long asthese are compatible with carbon budgets and assumptions derived from scientific assessments.678The Alliance will not give any recommendations or instructions to their members which precisemeasures need to be taken to achieve the targets as stated in this document nor will the Alliancemembers exchange any information on transaction basis.P1/P2 are two sets of pathways which relate to ‘low’ or ‘no’ overshoot of the 1.5 C target. These includeminimal reliance on carbon dioxide removal technologies. This is considered ‘best available’ science. SeeRogeli, J. et al (2018) ‘Mitigation Pathways Compatible with 1.5 C in the Context of Sustainable Development:’ 19/02/SR15 Chapter2 Low Res.pdfU.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting ProtocolIndividual Alliance Member Targets

The Alliance will start with the highest emitting sectors for both Sector specific and EngagementTargets. Alliance members will start by setting sectoral targets for:i.ii.iii.iv.Oil & Gas;Utilities;Transport - civil aviation, shipping and road transport; andSteel.Engagement targets. Engagement targets track our activities and progress with individual corporates. The engagement targets provide a common and productive lever for Alliance members todrive change at the company and sector-level in the real economy. These targets are a necessarycomponent of the target setting exercise for each Alliance member. To define their 2025 Engagement Target(s), individual Alliance members should identify either the top 20 emitters or thoseresponsible for 65% of their portfolio emissions which do not already have Paris-Aligned business transition commitments and set either Direct, Collective, or Asset Manager action targetsto engage the identified group of high emitting companies. The Alliance encourages members todefine asset class and/or sector-level emissions targets in conjunction with engagement targets,given that engagement activities are expected to play a prominent role in achieving sub-portfolioand sector targets. Members will define their own engagement targets by selecting joint and/orindividual and/or outcome-based KPI in this/these area(s) from the common KPI framework (asdescribed in the Engagement Targets Chapter). Each member should decide whether to report onmultiple engagement KPIs, while setting targets on a more limited number of KPIs.Financing transition targets. “Financing Transition” targets are broad, long-term targets whichcontribute to the net-zero economy. This category of targets provides ample long-term contributionto the creation of a net-zero economy, not simply the decarbonization of the current economy or aspecific sector. Setting financing transition targets therefore require a less quantitative approachthan other targets. Reference to financing transition targets encourages Alliance members to usethe resources and capabilities available to them to grow the supply side of net-zero solutions. Inparticular, Alliance members should explore opportunities to support the growth of investmentinto Green Buildings, Renewable Energy in Emerging Markets, Sustainable Forestry andAgriculture, Hydrogen Fuel development, among other growing market segments linked to thenet-zero transition. In general, public reporting on financing transition targets will be conductedat the Alliance level via shared communications. Members are also encouraged to report individually to the public on their progress against these targets. The Alliance will focus on enlargingthe scale, pace, and geographic reach of net-zero compatible technologies. Alliance memberscontribute to financing transition targets by conducting roundtables, investing in the supply sideof low carbon solutions and establishing working relationships with Development Finance Institutions (DFIs) or other partners to enlarge geographical coverage of investable solutions.Policy engagement targets. Policy engagement targets support all of the above efforts andaddresses factors beyond the control of Alliance members. The Alliance’s policy work has 3 focusareas:i. embedding net-zero by 2050 in the post-COVID19 economic recovery framework, NationallyDetermined Contributions (NDCs) and national emission reduction plans;ii. sector policies to promote an accelerated energy transition; andiii. promotion of mandatory climate reporting and business transition plans at investee companies.Alliance recruitment target. The Alliance recruitment target aims to achieve a minimum of 200Alliance members or USD25 trillion in assets under management across the group in the mid-term.The Alliance will publish an annual qualitative progress report, and a more detailed report on quantitative achievements every 5 years.Contribute to activities enlarging the low carbon investment universe and building solutionsU.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol9

1. Introduction: assetowner contributions toglobal ghg reductions1.1.The Alliance Commitment: What we want to achieveThe members of the Alliance have made the following commitment:“The members of the Alliance commit to transitioning their investment portfolios to net-zeroGHG emissions by 2050 consistent with a maximum temperature rise of 1.5 C abovepre-industrial temperatures, taking into account the best available scientific knowledgeincluding the findings of the IPCC, and regularly reporting on progress, including establishingintermediate targets every five years in line with Paris Agreement Article 4.9.In order to enable members to meet their fiduciary duty to manage risks and achieve targetreturns, this Commitment must be embedded in a holistic ESG approach, incorporating but notlimited to, climate change, and must emphasise GHG emissions reduction outcomes in the realeconomy.Members will seek to reach this Commitment, especially through advocating for, and engagingon, corporate and industry action, as well as public policies, for a low-carbon transition ofeconomic sectors in line with science and under consideration of associated social impacts.This Commitment is made in the expectation that governments will follow through on their owncommitments to ensure the objectives of the Paris Agreement are met.”Monitoring, Reporting and Verification. In order to deliver on this commitment, the members ofthe Alliance must develop, issue and report against their decarbonisation targets every 5 years.The Monitoring, Reporting and Verification (MRV) track drives this effort. Members of the MRVtrack have reviewed large amounts of known, available scientific guidance, commissioned scientific guidance, and available methodologies8 against their own portfolios. The 2025 Target SettingProtocol is the result of this process and is published on behalf of the Alliance. It sets out the Alliance’s approach to target setting and reporting on progress towards real world emissions reductions in line with established science.810SBTIFI, PCAF, IIGCC PAII, CRREM, 2dii, were each explored.U.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting ProtocolIntroduction: asset owner contributions to global ghg reductions

orting &Verification (MRV)EngagementMonitoring,Reporting &Verification (MRV)CommunicationMonitoring,Reporting &Verification (MRV)RecruitingDevelop a protocolfor Alliance target setting and reportingSuccessfulengagement of keysectors, companiesand asset managersto develop transitionpathwaysStrengthenconnections andsupporting dialogueson key policies for atransition to net-zeroby 2050Support all tracks bypromoting activitiesof the Alliance andaligning messagingwith stakeholderengagementExplore waysto financetransformationand invest in newtechnologies neededto a net-zero by 2050worldOrchestratedoutreach to furtherAsset Owners tosignificantly growthe AllianceFigure 2:1.2.The 6 Alliance work tracksApproach to 2025 Target SettingThe Alliance is committed to supporting the real economy in its transition to a net-zero worldwhile being guided by science. A range of scientific, academic, and technical experts are engagedin and contribute to the Alliance’s work. This report was produced by the technical leads within theAlliance membership with input from our global networks.The Alliance’s work provides science-based recommendations for portfolio alignment withnet-zero targets. Alliance members should set targets based on recommendations outlined inthe Protocol and should explain any necessary deviations. Despite the firm root in science, scaling down global climate, energy, or economic models to the level of a portfolio or economic sectoris riddled with challenges. Therefore, while a science-based recommendation may be an appropriate guidepost for the average asset owner, the composition, structure, and investment opportunities of a given asset owner vary significantly.1.3.Objective of this ProtocolThe publication of the Protocol sets out to address two objectives:1. Maximise the impact of communication with external audiences. The Alliance aims to be reliably transparent and proactive in explaining our role, views and how we are addressing keyissues and limitations of portfolio decarbonisation beyond our control. Our open approach tocommunication also means that we seek to learn from and build on external feedback receivedthrough public consultation.2. Develop a shared internal ‘playbook’. The Alliance playbook will help to guide and supportAlliance members to develop and articulate a common position on how our Alliance-wideapproach can be best implemented.1.4.Transparent, and Unique Targets best suitedto Encourage Real World ReductionsEach Alliance member is unique and may identify unique levers that exist within their institutions foraccelerating decarbonisation in the real world. They also possess differences in investment scope,strategies, internal governance structures, current exposure to certain high-emitting sectors etc.This Protocol was constructed to allow Alliance members to employ the combination of approachesthat best supports their unique decarbonisation and engagement strategies. In this way the Alliancemembers aim to have “transparent, and unique” targets, which suit individual institutions, but whichcan also be aggregated and against which progress can be tracked.1.5.How we operate (Alliance Governance)The Alliance is convened by the United Nations Environment Programme Finance Initiative (UNEP FI)and the UN-backed Principles for Responsible Investment (PRI). It is supported and advised byMission 2020 and WWF. To join the Alliance, asset owner CEOs make a public commitment to aligntheir portfolios and engage in the Alliance. A Steering Group made up of the 7 founding asset ownerIntroduction: asset owner contributions to global ghg reductionsU.N.-Convened Net-Zero Asset Owner AllianceDraft 2025 Target Setting Protocol11

members of the Alliance guides the strategic direction of the organisation. The Steering Groupmeets quarterly and, with secretariat members UNEP FI and PRI,9 have voting rights to determinethe group’s strategic direction. It is chaired by one C-suite member. Strategic content reviewed bythe Steering Group is submitted by the ‘tracks’ which are Working Groups comprised of staff fromall Alliance members. Any Alliance staff member, regardless of their steering group status, can takeup a leadership or content development role on one or several of the ‘tracks’ or working groupsincluding the chair role, as well as propose additional work areas. The content developed by thesecolleagues is then submitted to the Steering Group for review, discussion and approval.The Monitoring, Reporting and Verification (MRV) track is co-chaired by three (3) Alliance memberrepresentatives, with sub-track working groups providing support on various aspects of content. Overall, over 25 asset owner organisations and over 100 members of their staff, several external experts,and parallel initiatives have contributed to the design of the guidance contained in this document.The Alliance Steering Group approved the 2025 Target Setting Protocol for public consultation inOctober 2020. Approval by the Alliance Steering Group means that the methods, argumentation andstandpoints are commonly accepted by the Alliance and that the published document representsviews that the Alliance is ready to engage with as an organisation. Adjustments and edits will bemade following external expert and public input received during the consultation period. The Alliancewill then launch the final 2025 Protocol, followed by the publication of individual targets by members.Members are expected to issue individual targets according to the Protocol within 12 months of joining the Alliance, unless a reporting period is less than 3 months away. The maximum time w

2 U.N.-Convened Net-Zero Asset Owner Alliance Draft 2025 Target Setting Protocol This Document was written by the members of the U.N.-Convened Net-Zero Asset Owner Alli-ance. Members include: