Transcription

Hiscox online art trade report 2020PART ONE: THE ONLINE ART TRADE

Cover artwork:Ann Craven, Heart of Gold #1, 2009 11 x 8 1/2 inches, Zerox Print Edition for White Columns, 2009 Edition #10 of 50 plus 10 APsCourtesy of the artist, Southard Reid, London and White Columns, New YorkINTRODUCTION 1KEY FINDINGS 2ONLINE ART SALES 4ONLINE ART SALES GROWTH AND BREAKDOWN 5OUTLOOK FOR THE NEXT 12 MONTHS 7TOP AUCTION HOUSES ADAPT TO COVID-19 8INDUSTRY CONSOLIDATION 10THE FUTURE OF THE ONLINE ART SALES MARKET 12TIMELINE 14FROM EVOLUTION TO REVOLUTION? 16ONLINE ART SALES TRENDS AND FINDINGS 18METHODOLOGY 26COMPANY PROFILES 27

Hiscox online art trade report 2020 IntroductionTHIS YEAR THEONLINE ART TRADEREPORT IS GOINGTO BE PRESENTEDDIFFERENTLY; WEWILL BE PRODUCINGA SHORTER VERSIONFOLLOWED BY FURTHERUPDATES DURING THEYEAR, WHICH WILLALLOW US TO BETTERTRACK DEVELOPMENTSIN THE MARKET ANDSHARPEN OUR FOCUSON SPECIFIC TRENDS.Will coronavirus (COVID-19) bethe catalyst to finally ignite aspluttering online art market?It is the question all art markettwitchers are asking.I could sit here on the fence andfind good reasons to say yes, noor maybe. I am going for a bold yes,hopefully not as the result of cabinfever having been locked away solong. The main reason is that socialdistancing is here to stay for longenough that it will change howwe buy art as well as many otherthings. No longer will we have thejoy and pain of crowded art fairsand gallery openings. Dealers willhave to find new ways to create thebuzz that makes us have to buyNOW, lest we dwell and lose yetanother treasure that we can’t livewithout. I am not sure how, but Iam sure they will.As always I hope you find this reportuseful as we wait with baited breathto see what happens next, in theimmortal words of Captain Jean-LucPicard “Things are only impossibleuntil they are not”.Robert ReadHead of Art and Private ClientsHiscox1

2 Hiscox online art trade report 2020Key findingsONLINE SALES STALL BUT 2020COULD BE A PIVOTAL YEAROnline art and collectible salesstalled in 2019 generating anestimated 4.82 billion – up 4%from 2018. Growth in this markethas steadily declined in recentyears, falling from 12.5% in2017 to 4% in 2019.However, pure online-only auctionsales by Christie’s, Sotheby’s andPhillips generated 370 million inthe first half of 20201, which waswhich was more than five-timeshigher than the same periodin 2019.The COVID-19 crisis forced theart world into an abrupt lockdownand with little warning, onlinebecame the sole promotion andsales channel for much of theindustry. With the majority ofplatforms surveyed expectingthe pandemic to have a positiveimpact on the online market inthe longer term, could this bethe moment the art world finallyembraces digital technology?RAPID GROWTH IN‘OTHER COLLECTIBLES’At 32%, fine art accounted forthe largest share of online art andcollectibles sales – some waybehind watches and jewellery (23%).‘Other collectibles’ such as stampsand memorabilia now accountfor a quarter of online sales, andas traditional auction houses inparticular look to attract youngercollectors, we expect to see agreater focus on this segment.A MARKET ON DIFFERENTGROWTH PATHSPeriod: from 1 January 2020to 28 June 2020.1Online platforms display a broadrange of growth patterns; whileHeritage Auction posted a 0.5%decline in sales in 2019, online-onlyauctions at Sotheby’s grew 55%.We have also seen failures, withPaddle8 filing for bankruptcy inMarch 2020.CHRISTIE’S, SOTHEBY’S ANDHERITAGE PASS 1 BILLIONIN ONLINE SALESSales at these three auction housesincreased from 636 million in 2015to 1.0 billion in 2019 – a 58%increase (equivalent of 12.1%annual compounded growth).The COVID-19 crisis has significantlyaccelerated online sales, withSotheby’s reporting a 131% increasein the number of lots sold online sofar this year (May 2020) and a 74%increase in average price comparedto 2019. Heritage Auction reported a10% increase in online sales for thefirst five months of the year.BIG GALLERIES COULD EMERGEAS KEY ONLINE PLAYERSSome 63% of online platformsexpect existing art market operatorssuch as galleries to emerge as bigonline players when they finally getto grips with digital technology. Overthe last months we have seen manygalleries embracing technologyfrom online private viewing rooms tovirtual reality. However, some of thebig galleries, such as David Zwirnerand Hauser & Wirth have taken theconcept of online gallery platformsto another level, by offering smallergalleries and art fairs the opportunityto exhibit and sell utilising theirtechnology platforms, and basicallyturning these major galleries intothird-party online sales platforms.

Hiscox online art trade report 2020 COULD THIS BE THEMOMENT THE ARTWORLD FINALLYEMBRACES DIGITALTECHNOLOGY?4%online sales growth in2019, but COVID-19has been rapidlydriving sales online.63%of online platforms expectmajor galleries to emergeas big online players.48%of online platforms believedisruption from an artmarket ‘outsider’ is verylikely in the next five years.CONSOLIDATION ANDCONVERGENCEA large majority (67%) of platformsthink the online art market will bedominated by a few global playerswithin the next five years. Whilethe ten biggest platforms globallyaccount for approximately 68%of the total online market, someof those surveyed (48%) thinkdisruption from an outsider is areal possibility. The tougher marketconditions imposed by COVID-19could speed potential consolidationup, or even trigger an acquisitionspree among the stronger players,including traditional auction houseskeen on building a strongeronline presence.3

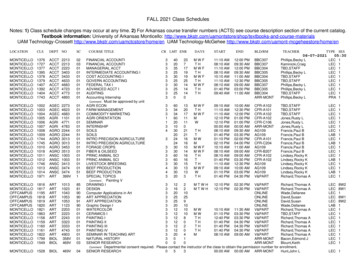

4 Hiscox online art trade report 2020Online art salesSotheby’s saw positive onlinesales growth, particularly in theonline-only segment. Secondly,and more importantly, a stubbornreluctance from much of thecommercial art world to properlyembrace the digital realm and theLast year, online art market salescame in at an estimated 4.82 billion, opportunities it has to offer, hascontributed to the lack of overallup 4% from 4.64 billion in 2018.growth in online sales last year.Since 2015, we have seen marketgrowth rates on a steady decline,With the global art world inwith online sales dropping fromlockdown at the time of writing24.1% in 2015 to 9.8% in 2018.however, and with everything frommuseum exhibitions to art fairs andThe decline in growth comes onauctions either closed, postponedthe back of several factors. Firstly,or cancelled, the art industry hasthe global art market slowdownmigrated online, giving rise to ain sales last year, with a 20% fallwide and innovative range of onlinein the value of auction sales forinitiatives. It’s highly unlikely theSotheby’s, Christie’s and Phillips.art world will revert entirely backData from the Art Basel Art Marketto the old as we emerge from theReport 2020 tells a similar story,crisis. Social distancing has forcedsuggesting global art sales fell 5%a new form of online engagementover the same period. However,which might forever alter the wayas our readers will see in thisthe art market, and its stakeholders,report, despite a decline in overallapproach their digital presence.auction sales, both Christie’s andThe online art and collectiblesmarket showed subdued growth at4% in 2019, but this could quicklychange as the art world is forcedto transact more online.Online art sales ( 420152016201720182019Methodology: this year’s global online estimate is based on publicly available sales figures,as well as sales estimates collected from a survey of the main online art and collectible salesplatforms that are mentioned in the appendix of this report. These online art sales platformsdo not represent the entire population of online art and collectible sales businesses, andtherefore our estimates are likely to be on the conservative side.

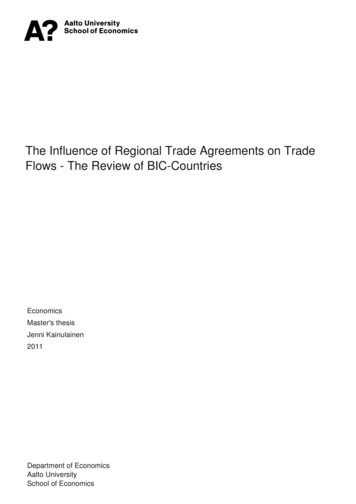

Hiscox online art trade report 2020 5Online art sales growth and breakdownOnline art sales growthyear-on-year (%)Online art sales growth year-on-year (%)24.214.612.59.8?4.02015Breakdown of 2019online art sales bycategory (%)20162017201820192020Breakdown of 2019 online art sales by category (%)81232Fine art23Other collectiblesJewellery and watchesDecorative arts25FurnitureFine art accounted for 32% ofonline art and collectible salesin 2019, with strong growth in‘other collectibles’.At an estimated 32%, fineart accounted for the largestshare of online sales from theplatforms surveyed although‘other collectibles’ (such ascoins, stamps, rare books,maps and memorabilia) nowaccounts for a quarter.Among traditional auctionhouses such as Christie’s,Sotheby’s and Phillips, fine artaccounted for around half of sales(an average of 51% across all threehouses) in 2019. This is significantlymore than other categories,including watches and jewellery(25%), ‘other collectibles’ (15%)decorative arts (8%) and furniture(2%). As a comparison, HeritageAuction, the world’s largest auctionhouse for online sales, derivedmore than 90% of its online salesin 2019 from ‘other collectibles’with only a small portion (3%)from fine art. Moving forwards,as traditional auction houses lookto diversify their client base andattract younger collectors, weexpect to see a greater focus ona wider segment of collectibles.

6 Hiscox online art trade report 2020Online art sales growth and breakdown (cont.). AS TRADITIONALAUCTION HOUSESLOOK TO DIVERSIFYTHEIR CLIENT BASEAND ATTRACT YOUNGERCOLLECTORS, WEEXPECT TO SEE AGREATER FOCUS ONA WIDER SEGMENTOF COLLECTIBLES.Among the art and collectiblesplatforms and auction aggregators(such as Invaluable, LiveAuctioneerand the saleroom), as well asonline auction platforms (suchas Catawiki), fine art sales onlyaccounted for an average of 19.5%of total online sales, with jewelleryand watches accounting for 25%and ‘other collectibles’ for 30%.Among the 41 online platformssurveyed, 31 say fine art is theirmost popular sales category, with13 (42%) attributing more than 90%of sales to this. The majority (58%)of the 31 however, had annualrevenues of less than 5 million lastyear, suggesting that online fineart sales are more fragmented andspread out across a larger numberof smaller online platforms.

Hiscox online art trade report 2020 Outlook for the next 12 monthsCOVID-19 AND OUTLOOK80%of online art salesplatforms expect onlinesales to increase in thenext 12 months.COVID-19 crisis(March)*Despite the immediate shock thatthe virus caused in the traditionalspace, the majority of platforms arealready reporting increased trafficand sales, as online remains theonly viable sales channel.The majority of online platformsbelieve that while the COVID-19crisis will have a negative impacton the overall industry, it will bea positive influence and salesdriver for the online market inBut will it last, or will we return tothe coming 12 months.‘business as usual’ as soon as thepandemic concludes? The majorityThe large majority (80%) of online (65%) of online sales platformsart and collectibles platformssay they believe the current crisismaintain a positive outlook for the will result in a permanent andonline art market in the comingtransformative shift, with online12 months. This is higher thanbecoming a natural part of any artour initial survey, conducted assales business (galleries, dealers,the World Health Organizationauctions and advisors). Several(WHO) declared COVID-19platforms however, issue a note ofa pandemic in March, whichcaution, stating that although onlineshowed that 74% had asales are likely to benefit from thepositive 12-month outlook.current crisis, this will not be feltequally, as the likely prospect ofa prolonged economic downturn4%could hurt online platforms with22%higher overheads. If this comestrue, we might find ourselves at thebeginning of a broader re-shufflein the online art market, driven byconsolidation and failures as wellas new innovations.74%PositiveCOVID-19 Survey conducted in March(as COVID-19 is declareda pandemic) and thentwo months later in May.*Positive7

8 Hiscox online art trade report 2020Top auction houses adapt to COVID-19SOTHEBY’S HAS SEENA 131% INCREASE INTHE NUMBER OF LOTSSOLD ONLINE SO FARTHIS YEAR AND A 74%INCREASE IN AVERAGEPRICE COMPAREDTO 2019.AUCTION HOUSES EMBARKON DIGITAL TRANSFORMATIONCHASING ONLINE GROWTHlots sold online so far this year, anda 74% increase in average pricescompared to 2019.Christie’s, Sotheby’s and Heritagepassed 1 billion in online salesin 2019. Since 2015 we havemonitored the online activity ofthese three auction houses andsales have increased 58% – from 636 million in 2015 to 1.0 billionin 2019 (equivalent of 12.1% annualcompounded growth). That said,the three auction houses showdistinctly different growth patterns.The online sales spanned allcategories of fine art and luxuryobjects, and include innovative newformats, such weekly online watchauctions, presented in a rollingsale format with a new selection ofwatches being unveiled every sevendays. Sotheby’s recent decision toopen a new digital marketplace forblue-chip galleries, called ‘Sotheby’sGallery Network’, signals new digitalambitions for the auction house.SOTHEBY’SCHRISTIE’SOn the back of Patrick Drahi’sacquisition of Sotheby’s in June2019, the auction house hascontinued to restructure in anattempt to meet client demandsand expectations of what a 21stcentury auction house shouldbe. The business has now beenorganised into two global divisions;‘fine arts and luxury’ and ‘art andobjects’. Although live auctionsare likely to remain the corebusiness, Sotheby’s is eyeingCURATED LIVE ANDopportunities to develop new salesONLINE HYBRID SALES, channels including marketplaces,WHICH BLUR CATEGORY e-commerce and even retail.BOUNDARIES, COULDThe impact of this strategy canBRING IN CLIENTSalready be seen in the growth ofIN A NEW ANDonline-only curated sales; in 2016UNPRECEDENTED WAY.(the year of launch), just 17 onlinesales were conducted generati

Ann Craven, Heart of Gold #1, 2009 11 x 8 1/2 inches, Zerox Print Edition for White Columns, 2009 Edition #10 of 50 plus 10 APs Courtesy of the artist, Southard Reid, London and