Transcription

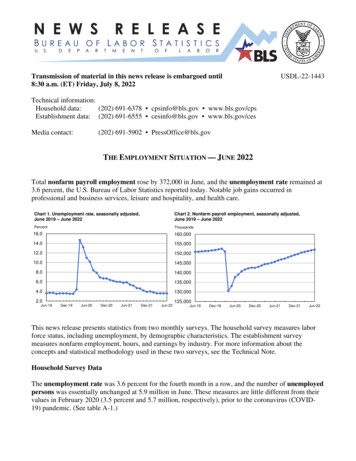

Transmission of material in this news release is embargoed until8:30 a.m. (ET) Friday, July 8, 2022USDL-22-1443Technical information:Household data:(202) 691-6378 cpsinfo@bls.gov www.bls.gov/cpsEstablishment data: (202) 691-6555 cesinfo@bls.gov www.bls.gov/cesMedia contact:(202) 691-5902 PressOffice@bls.govTHE EMPLOYMENT SITUATION — JUNE 2022Total nonfarm payroll employment rose by 372,000 in June, and the unemployment rate remained at3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains occurred inprofessional and business services, leisure and hospitality, and health care.Chart 2. Nonfarm payroll employment, seasonally adjusted,June 2019 – June 2022Chart 1. Unemployment rate, seasonally adjusted,June 2019 – June 19Dec-19Jun-20Dec-20Jun-21Dec-21Jun-22This news release presents statistics from two monthly surveys. The household survey measures laborforce status, including unemployment, by demographic characteristics. The establishment surveymeasures nonfarm employment, hours, and earnings by industry. For more information about theconcepts and statistical methodology used in these two surveys, see the Technical Note.Household Survey DataThe unemployment rate was 3.6 percent for the fourth month in a row, and the number of unemployedpersons was essentially unchanged at 5.9 million in June. These measures are little different from theirvalues in February 2020 (3.5 percent and 5.7 million, respectively), prior to the coronavirus (COVID19) pandemic. (See table A-1.)

Among the major worker groups, the unemployment rate for Asians increased to 3.0 percent in June.The jobless rates for adult men (3.3 percent), adult women (3.3 percent), teenagers (11.0 percent),Whites (3.3 percent), Blacks (5.8 percent), and Hispanics (4.3 percent) showed little or no change overthe month. (See tables A-1, A-2, and A-3.)Among the unemployed, both the number of permanent job losers, at 1.3 million in June, and thenumber of persons on temporary layoff, at 827,000, changed little over the month. These measures arelittle different from their values in February 2020. (See table A-11.)In June, the number of long-term unemployed (those jobless for 27 weeks or more) was essentiallyunchanged at 1.3 million. This measure is 215,000 higher than in February 2020. The long-termunemployed accounted for 22.6 percent of all unemployed persons in June. (See table A-12.)The labor force participation rate, at 62.2 percent, and the employment-population ratio, at 59.9percent, were little changed over the month. Both measures remain below their February 2020 values(63.4 percent and 61.2 percent, respectively). (See table A-1.)The number of persons employed part time for economic reasons declined by 707,000 to 3.6 million inJune and is below its February 2020 level of 4.4 million. These individuals, who would have preferredfull-time employment, were working part time because their hours had been reduced or they were unableto find full-time jobs. (See table A-8.)The number of persons not in the labor force who currently want a job was essentially unchanged at5.7 million in June. This measure is above its February 2020 level of 5.0 million. These individuals werenot counted as unemployed because they were not actively looking for work during the 4 weekspreceding the survey or were unavailable to take a job. (See table A-1.)Among those not in the labor force who wanted a job, the number of persons marginally attached tothe labor force, at 1.5 million, was essentially unchanged in June. These individuals wanted and wereavailable for work and had looked for a job sometime in the prior 12 months but had not looked forwork in the 4 weeks preceding the survey. Discouraged workers, a subset of the marginally attachedwho believed that no jobs were available for them, numbered 364,000 in June, little changed from theprior month. (See Summary table A.)Household Survey Supplemental DataIn June, 7.1 percent of employed persons teleworked because of the coronavirus pandemic, downfrom 7.4 percent in the prior month. These data refer to employed persons who teleworked or worked athome for pay at some point in the 4 weeks preceding the survey specifically because of the pandemic.In June, 2.1 million persons reported that they had been unable to work because their employer closedor lost business due to the pandemic—that is, they did not work at all or worked fewer hours at somepoint in the 4 weeks preceding the survey due to the pandemic. This measure is up from 1.8 million inthe previous month. Among those who reported in June that they were unable to work because ofpandemic-related closures or lost business, 24.8 percent received at least some pay from theiremployer for the hours not worked, little different from the previous month.-2-

Among those not in the labor force in June, 610,000 persons were prevented from looking for workdue to the pandemic, up from 455,000 in the prior month. (To be counted as unemployed, bydefinition, individuals must be either actively looking for work or on temporary layoff.)These supplemental data come from questions added to the household survey beginning in May 2020 tohelp gauge the effects of the pandemic on the labor market. The data are not seasonally adjusted. Tableswith estimates from the supplemental questions for all months are available online -19-pandemic.htm.Establishment Survey DataTotal nonfarm payroll employment rose by 372,000 in June, in line with the average monthly gainover the prior 3 months ( 383,000). In June, notable job growth occurred in professional and businessservices, leisure and hospitality, and health care. (See table B-1.)Total nonfarm employment is down by 524,000, or 0.3 percent, from its pre-pandemic level in February2020. Private-sector employment has recovered the net job losses due to the pandemic and is 140,000higher than in February 2020, while government employment is 664,000 lower.Employment in professional and business services continued to grow, with an increase of 74,000 inJune. Within the industry, job growth occurred in management of companies and enterprises ( 12,000),computer systems design and related services ( 10,000), office administrative services ( 8,000), andscientific research and development services ( 6,000). Employment in professional and businessservices is 880,000 higher than in February 2020.In June, leisure and hospitality added 67,000 jobs, as growth continued in food services and drinkingplaces ( 41,000). However, employment in leisure and hospitality is down by 1.3 million, or 7.8percent, since February 2020.Employment in health care rose by 57,000 in June, including gains in ambulatory health care services( 28,000), hospitals ( 21,000), and nursing and residential care facilities ( 8,000). Employment inhealth care overall is below its February 2020 level by 176,000, or 1.1 percent.In June, transportation and warehousing added 36,000 jobs. Employment rose in warehousing andstorage ( 18,000) and air transportation ( 8,000). Employment in transportation and warehousing is759,000 above its February 2020 level.Employment in manufacturing increased by 29,000 in June and has returned to its February 2020 level.Information added 25,000 jobs in June, including a gain of 9,000 jobs in publishing industries, exceptInternet. Employment in information is 105,000 higher than in February 2020.In June, employment in social assistance rose by 21,000. Employment continued to trend up in childday care services ( 11,000) and in individual and family services ( 10,000). Employment in socialassistance is down by 87,000, or 2.0 percent, since February 2020.Wholesale trade added 16,000 jobs in June, including 8,000 in nondurable goods. Employment inwholesale trade is down by 18,000, or 0.3 percent, since February 2020.-3-

Mining employment rose by 5,000 in June, with a gain in oil and gas extraction ( 2,000). Miningemployment is 86,000 above a recent low in February 2021.Employment showed little change over the month in other major industries, including construction,retail trade, financial activities, other services, and government.In June, average hourly earnings for all employees on private nonfarm payrolls rose by 10 cents, or0.3 percent, to 32.08. Over the past 12 months, average hourly earnings have increased by 5.1 percent.In June, average hourly earnings of private-sector production and nonsupervisory employees rose by13 cents, or 0.5 percent, to 27.45. (See tables B-3 and B-8.)The average workweek for all employees on private nonfarm payrolls held at 34.5 hours in June. Inmanufacturing, the average workweek for all employees was little changed at 40.3 hours, and overtimefell by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees onprivate nonfarm payrolls remained at 34.0 hours. (See tables B-2 and B-7.)The change in total nonfarm payroll employment for April was revised down by 68,000, from 436,000to 368,000, and the change for May was revised down by 6,000, from 390,000 to 384,000. Withthese revisions, employment in April and May combined is 74,000 lower than previously reported.(Monthly revisions result from additional reports received from businesses and government agenciessince the last published estimates and from the recalculation of seasonal factors.)The Employment Situation for July is scheduled to be released on Friday, August 5, 2022, at 8:30a.m. (ET).2022 Preliminary Benchmark Revision to Establishment Survey Datato be released on August 24, 2022Each year, the establishment survey estimates are benchmarked to comprehensive counts of employmentfrom the Quarterly Census of Employment and Wages (QCEW) for the month of March. These countsare derived from state unemployment insurance (UI) tax records that nearly all employers are required tofile. At 10:00 a.m. (ET) on August 24, 2022, the Bureau of Labor Statistics (BLS) will release thepreliminary estimate of the upcoming annual benchmark revision to the establishment survey data. Thisis the same day that the first-quarter 2022 data from QCEW will be issued. Preliminary benchmarkrevisions for all major industry sectors, as well as total nonfarm and total private employment, will beavailable at www.bls.gov/web/empsit/cesprelbmk.htm.The final benchmark revision will be issued with the publication of the January 2023 EmploymentSituation news release in February 2023.-4-

HOUSEHOLD DATASummary table A. Household data, seasonally adjusted[Numbers in thousands]CategoryJune2021Apr.2022May2022Change from:May 2022June 2022June2022Employment statusCivilian noninstitutional population. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Civilian labor force. .Participation rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Employed. .Employment-population ratio. .Unemployed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Unemployment rate. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Not in labor force. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10Unemployment ratesTotal, 16 years and over. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Adult men (20 years and over). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Adult women (20 years and over). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Teenagers (16 to 19 years). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .White. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Black or African American. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Asian. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Hispanic or Latino ethnicity. 30.0-0.1-0.10.60.1-0.40.60.0Total, 25 years and over. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Less than a high school diploma. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .High school graduates, no college. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Some college or associate degree. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Bachelor’s degree and higher. 5.83.63.12.10.00.6-0.2-0.30.1Reason for unemploymentJob losers and persons who completed temporary jobs. . . . . . . . . . . . . . . . . .Job leavers. .Reentrants. .New entrants. ,6458321,990464-916847-71Duration of unemploymentLess than 5 weeks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5 to 14 weeks. .15 to 26 weeks. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .27 weeks and over. 611,3562,2621,5527531,336196-21592-20Employed persons at work part timePart time for economic reasons. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Slack work or business conditions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Could only find part-time work. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Part time for noneconomic reasons. ons not in the labor forceMarginally attached to the labor force. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Discouraged workers. .1,8226051,6224561,4724151,50436432-51NOTE: Persons whose ethnicity is identified as Hispanic or Latino may be of any race. Detail for the seasonally adjusted data shown in this table willnot necessarily add to totals because of the independent seasonal adjustment of the various series. Updated population controls are introducedannually with the release of January data.

ESTABLISHMENT DATASummary table B. Establishment data, seasonally adjustedJune2021Apr.2022EMPLOYMENT BY SELECTED INDUSTRY(Over-the-month change, in thousands)Total nonfarm. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total private. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Goods-producing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Mining and logging. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Construction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Manufacturing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Durable goods1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Motor vehicles and parts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Nondurable goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Private service-providing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Wholesale trade. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Retail trade. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Transportation and warehousing. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Utilities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Information. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Financial activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Professional and business services1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Temporary help services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Education and health services1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Health care and social assistance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Leisure and hospitality. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Other services. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Government. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11833316.415.435.51.1251745.49677.8672-9(3-month average change, in thousands)Total nonfarm. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total private. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .422367493486383363375362CategoryWOMEN AND PRODUCTION AND NONSUPERVISORY EMPLOYEESAS A PERCENT OF ALL EMPLOYEES2Total nonfarm women employees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total private women employees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Total private production and nonsupervisory employees. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .HOURS AND EARNINGSALL EMPLOYEESTotal privateAverage weekly hours. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Average hourly earnings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Average weekly earnings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Index of aggregate weekly hours (2007 100)3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Over-the-month percent change. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Index of aggregate weekly payrolls (2007 100)4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Over-the-month percent change. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DIFFUSION INDEX(Over 1-month span)5Total private (256 industries). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Manufacturing (74 industries). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .149.848.481.434.8 30.52 1,062.10108.00.1157.60.666.666.949.848.481.534.6 31.86 .534.5 31.98 1.534.5 32.08 1,106.76112.40.3172.40.668.660.8Includes other industries, not shown separately.Data relate to production employees in mining and logging and manufacturing, construction employees in construction, and nonsupervisory employees in theservice-providing industries.3The indexes of aggregate weekly hours are calculated by dividing the current month’s estimates of aggregate hours by the corresponding annual average aggregatehours.4The indexes of aggregate weekly payrolls are calculated by dividing the current month’s estimates of aggregate weekly payrolls by the corresponding annual averageaggregate weekly payrolls.5Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equalbalance between industries with increasing and decreasing employment.p PreliminaryNOTE: Data have been revised to reflect March 2021 benchmark levels and updated seasonal adjustment factors.2

Frequently Asked Questions about Employment and Unemployment Estimates1. Why are there two monthly measures of employment?The household survey and establishment survey both produce sample-based estimates ofemployment, and both have strengths and limitations. The establishment survey employment serieshas a smaller margin of error on the measurement of month-to-month change than the householdsurvey because of its much larger sample size. An over-the-month employment change of about100,000 is statistically significant in the establishment survey, while the threshold for a statisticallysignificant change in the household survey is about 500,000. However, the household survey has amore expansive scope than the establishment survey because it includes self-employed workerswhose businesses are unincorporated, unpaid family workers, agricultural workers, and privatehousehold workers, who are excluded by the establishment survey. The household survey alsoprovides estimates of employment for demographic groups. For more information on the differencesbetween the two surveys, please visit www.bls.gov/web/empsit/ces cps trends.htm.2. Are undocumented immigrants counted in the surveys?It is likely that both surveys include at least some undocumented immigrants. However, neither theestablishment nor the household survey is designed to identify the legal status of workers. Therefore,it is not possible to determine how many are counted in either survey. The establishment survey doesnot collect data on the legal status of workers. The household survey does include questions whichidentify the foreign and native born, but it does not include questions about the legal status of theforeign born. Data on the foreign and native born are published each month in table A-7 of TheEmployment Situation news release.3. Why does the establishment survey have revisions?The establishment survey revises published estimates to improve its data series by incorporatingadditional information that was not available at the time of the initial publication of the estimates.The establishment survey revises its initial monthly estimates twice, in the immediately succeeding2 months, to incorporate additional sample receipts from respondents in the survey and recalculatedseasonal adjustment factors. For more information on the monthly revisions, please visitwww.bls.gov/web/empsit/cestn.htm#section7.On an annual basis, the establishment survey incorporates a benchmark revision that re-anchorsestimates to nearly complete employment counts available from unemployment insurance taxrecords. The benchmark helps to control for sampling and modeling errors in the estimates. For moreinformation on the annual benchmark revision, please visit www.bls.gov/web/empsit/cesbmart.htm.4. Does the establishment survey sample include small firms?Yes; about 40 percent of the establishment survey sample is comprised of business establishmentswith fewer than 20 employees. The establishment survey sample is designed to maximize thereliability of the statewide total nonfarm employment estimate; firms from all states, size classes, andindustries are appropriately sampled to achieve that goal.

5. Does the establishment survey account for employment from new businesses?Yes; monthly establishment survey estimates include an adjustment to account for the netemployment change generated by business births and deaths. The adjustment comes from aneconometric model that forecasts the monthly net jobs impact of business births and deaths basedon the actual past values of the net impact that can be observed with a lag from the Quarterly Censusof Employment and Wages. The establishment survey uses modeling rather than sampling for thispurpose because the survey is not immediately able to bring new businesses into the sample. Thereis an unavoidable lag between the birth of a new firm and its appearance on the sampling frame andavailability for selection. BLS adds new businesses to the survey twice a year.6. Is the count of unemployed persons limited to just those people receiving unemploymentinsurance benefits?No; the estimate of unemployment is based on a monthly sample survey of households. All personswho are without jobs and are actively seeking and available to work are included among theunemployed. (People on temporary layoff are included even if they do not actively seek work.) Thereis no requirement or question relating to unemployment insurance benefits in the monthly survey.7. Does the official unemployment rate exclude people who want a job but are not currentlylooking for work?Yes; however, there are separate estimates of persons outside the labor force who want a job,including those who are not currently looking because they believe no jobs are available (discouragedworkers). In addition, alternative measures of labor underutilization (some of which includediscouraged workers and other groups not officially counted as unemployed) are published eachmonth in table A-15 of The Employment Situation news release. For more information about thesealternative measures, please visit 8. How can unusually severe weather affect employment and hours estimates?In the establishment survey, the reference period is the pay period that includes the 12th of themonth. Unusually severe weather is more likely to have an impact on average weekly hours thanon employment. Average weekly hours are estimated for paid time during the pay period, includingpay for holidays, sick leave, or other time off. The impact of severe weather on hours estimatestypically, but not always, results in a reduction in average weekly hours. For example, someemployees may be off work for part of the pay period and not receive pay for the time missed,while some workers, such as those dealing with cleanup or repair, may work extra hours.Typically, it is not possible to precisely quantify the effect of extreme weather on payrollemployment estimates. In order for severe weather conditions to reduce employment estimates,employees have to be off work without pay for the entire pay period. Employeeswho receive pay for any part of the pay period, even 1 hour, are counted in the payrollemployment figures. For more information on how often employees are paid, please do-private-businesses-pay-workers.htm.In the household survey, the reference period is generally the calendar week that includes the 12thof the month. Persons who miss the entire week's work for weather-related events are counted asemployed whether or not they are paid for the time off. The household survey collects data on thenumber of persons who had a job but were not at work due to bad weather. It also provides a measureof the number of persons who usually work full time but had reduced hours due to bad weather.Current and historical data are available on the household survey's most requ

The average workweek for all employees on private nonfarm payrolls held at 34.5 hours in June. In manufacturing, the average workweek for all employees was little changed at 40.3 hours, and overtime fell by 0.1 hour to 3.2 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls remained at 34.0 hours.