Transcription

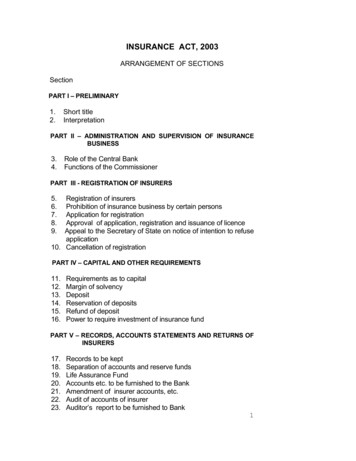

INSURANCE ACT, 2003ARRANGEMENT OF SECTIONSSectionPART I – PRELIMINARY1.2.Short titleInterpretationPART II – ADMINISTRATION AND SUPERVISION OF INSURANCEBUSINESS3.4.Role of the Central BankFunctions of the CommissionerPART III - REGISTRATION OF INSURERS5.6.7.8.9.Registration of insurersProhibition of insurance business by certain personsApplication for registrationApproval of application, registration and issuance of licenceAppeal to the Secretary of State on notice of intention to refuseapplication10. Cancellation of registrationPART IV – CAPITAL AND OTHER REQUIREMENTS11.12.13.14.15.16.Requirements as to capitalMargin of solvencyDepositReservation of depositsRefund of depositPower to require investment of insurance fundPART V – RECORDS, ACCOUNTS STATEMENTS AND RETURNS OFINSURERS17.18.19.20.21.22.23.Records to be keptSeparation of accounts and reserve fundsLife Assurance FundAccounts etc. to be furnished to the BankAmendment of insurer accounts, etc.Audit of accounts of insurerAuditor’s report to be furnished to Bank1

24.25.26.27.28.Minimum basis of calculation of liabilitiesRevaluation of liabilityFurnishing of information to the BankNotification of certain changes and particularsAuthentication of documentsPART VI - AMALGAMATIONS, TRANSFERS AND WINDING-UP29. Sanction of scheme for transfer of life assurance and longterm insurance business30. Provisions supplementary to section 2931. Restriction on change in control32. Scheme of amalgamation or transfer not involving lifeassurance and long term insurance businesses33. Insolvency34. Power to impose requirements for protection of policyholders35. Winding-up by the Court36. Bank’s powers to petition for winding up of insurers37. Commissioner’s power to petition for winding up ofinsurers38. Right of hearing of the Bank39. Voluntary winding up of insurers with life assurance businessand long term business40. Rules relating to winding up41. Control over liquidators42. Appointment of receivers43. Continuation of life assurance business of insurer inliquidation44. Power as to production of books, etc.PART VII – INSURANCE AGENTS, BROKERS AND LOSSADJUSTERSA - INSURANCE AGENTS45.46.47.48.Insurance agents to be registered and period of registrationDuties of insurers and agents inter seInsurance agents to be agents of insurersPenalties for non-compliance by insurance agents andinsurersB - INSURANCE BROKERS49. Insurance brokers to be registered50. Requirement as to professional indemnity cover, staff etc.2

51.52.53.54.5556.57.Suspension of registrationInsurance broker to establish trust accountPayment of premium to insurerRecords, transactions, etcReinsurance brokerageContracts for foreign insurersInsurance broker to submit particulars to the BankC - LOSS ADJUSTERS58.59.60.Loss adjusters to be registeredRecords to be kept by loss adjustersLoss adjusters to submit particulars to the BankD - MISCELLANEOUS61.62.Cancellation of registration of insurance agents, insurancebrokers and loss adjustersRegulation of commission of agents, brokers and lossadjusters.PART VIII – PREMIUMS AND COMMISSIONS63.64.Receipt of premium valid to contract of insuranceRestriction on general increases in premium on motorinsurance business etc.PART IX – FAILING AND FAILED INSURERS, ETC.65.66.67.68.69.Failing insurance institutionControl of failing insurance institutionManagement of failing insurance institutionApplication to the High Court for winding-upMerger of failing insurance institutionPART X – SUPPLEMENTARY AND MISCELLANEOUS ection from civil liabilityDuty to disclose material factsTest of materialityEffect of misstatementSpecial Insurance Supervision FundPrincipal office, principal officer, new offices and relocation ofregistered insurers77. Service of process on insurers3

.95.Service of notices on policy holdersInspection of balance sheet by policy holdersPublications referring to authorised capital, etc. of registeredinsurerAdvertisementFeesExtension of time to comply with provisions of this ActExemption of insurersPublication of summary of returns and preparation of annualreport by the BankPenalty for false statementExamination of insurance institutionsDuty of insurance institutions to produce documents andsupply information for examinationComplaints BureauPenalty for non-compliance with the ActOffences by bodies corporateAction of the Bank to be reviewedPower to make regulations and issue guidelinesApplication of this ActRepeal of the Insurance Act and savings provisions4

INSURANCE BILL 2003A BILL ENTITLEDAN ACT to regulate the business of insurance in TheGambia and to provide for matters connectedtherewith.[]ENACTED by theAssembly.Presidentand theNationalPART I - PRELIMINARYShort title1. This Act may be cited as the Insurance Act, 2003.Interpretation2. In this Act, unless the context otherwise requires"actuary" means a person possessingqualifications as may be prescribed;such"Bank" means the Central Bank of The Gambia;"certified" in relation to a copy or translation of adocument required to be furnished by or on behalf ofan insurer, means certified by the principal officer orprincipal representative, as the case may be, of theinsurer to be a true copy or a correct translation, asthe case may be;“Commissioner”Insurance;Cap. 95:01meanstheCommissionerof"company limited by guarantee" and "companylimited by shares" have the meanings respectivelyassigned to them in the Companies Act;"Court" means a Magistrate Court or High Court ;“external company” means a company incorporatedoutside The Gambia;5

"financial year" in relation to an insurer means (a)each period of twelve months at the endof which the balance of the accounts ofthe insurer is struck, and includes a lesserperiod; or(b)if no balance is struck, a calendar year;"fire insurance" means the business of effecting andcarrying out, otherwise than incidentally to someother class of insurance business, contracts ofinsurance against loss by or incidental to fire or otheroccurrence customarily included among the risksinsured against in fire insurance policies;"friendly society" means an association of personsestablished with no share capital for the purpose ofaiding its members or their dependants, where theassociation does not employ any person whose mainoccupation is the canvassing of other persons tobecome members of the association or the collectionof contributions or subscriptions towards the fund ofthe association from its members;"general insurance business" means insurancebusiness, other than life assurance business andlong term insurance business;"industrial life assurance business" means thebusiness of life assurance where (a)the insurer assumes a contingentobligation dependent on human life;(b) the insurer expressly ortacitlyundertakes to send a person to thepolicy holder or to his or her residenceor place of work to collect the premium;(c) the frequency of payment of premium isnot less than twelve times a year atintervals not exceeding a calendarmonth; and6

(d) the sum assured, or the amount of theannuity per annum does not exceedsuch sum as may be notified in theGazette by the Bank with the approvalof the Secretary of State;"insurance agent" means a person appointed andauthorised by an insurer to solicit applications forinsurance or negotiate for insurance coverage onbehalf of the insurer and to perform such otherfunctions as may be assigned to him or her by theinsurer;"insurance broker" means a person who, as anindependent contractor and for commission or othercompensation and not being an agent of theinsurer, solicits or negotiates insurance business onbehalf of an insured or prospective insured, otherthan itself;"insurance business" means the business ofassuming the obligations of an insurer in any classof insurance business and includes assurance andre-insurance;“insurance institution” means an insurer, a reinsurer,insurance broker or a loss adjuster registered underthis Act;"insurer" means a person carrying on an insurancebusiness otherwise than as an insurance agent orinsurance broker;"life assurance business" includes industrial lifeassurance business and means the business ofeffecting and carrying out contracts of insurance onhuman life, including a contract whereby thepayment of money is assured on death (exceptpolicies for death by accident only) or the happeningof any contingency dependent on human life orwhich is subject to payment of premiums for a termdependent on human life and includes –7

(a) the granting of disability and double ormultiple indemnity accident benefits, if soprovided in the contract of insurance;(b) the granting of annuities payable out of anyfunds applicable solely to the relief andmaintenance of persons engaged or whohave been engaged in any particularprofession, trade or employment or of thedependants of those persons;"life assurance fund" or "life fund" means the fund towhich receipts of an insurer in respect of its lifeassurance business are paid and from whichpayments in respect of that business are made;"long term insurancebusiness of-business"includesthe(a) sinking fund, capital redemption or bondinvestment;(b) indemnifying for loss of income as aresult of disability by accident orsickness;(c) indemnifying for cost of hospitalisation asa result of disability by accident orsickness;(d) insuring the payment on the happening ofthe contingencies of birth, marriage orfailure of issue either single or incombination,but excludes business comprising insurancecontracts which are made for a term not exceedingtwelve months;"loss adjuster" means a person who for money orother valuable consideration acts for or on behalf ofan insurer or person in adjusting claims arising fromall non-life assurance business, excluding motorclaims, but including insurance valuations, risksurveys and claims, provided the person has8

satisfied the conditions set out in this Act forregistration as a loss adjuster;"marine insurance business" means the business ofeffecting and carrying out contracts of insurance(a)on vessels or aircraft, or on themachinery, tackle, furniture or equipmentof vessels or aircraft;(b) on goods, merchandise or property of anydescription whatever on board vessels oraircraft;(c) on the freight of, or any other interest in orrelating to, vessels or aircraft, includingthird party risks;(d) against risks incidentalto theconstruction, repair or docking ofvessels, including third party risks;(e) against transit risks, whether the transit isby sea, inland water, land or air, or by acombinationthereof,includingwarehouse risks or similar risks inaddition to or incidental to the use ofvessels or aircraft and transit risks fromthe commencement of the transit to theultimate destination covered by theinsurance;(f) against other risks of insurance which arecustomarily undertaken in conjunctionwith, or incidental to, the undertaking ofthe business as falls within this definitionby virtue of any of the foregoingparagraphs;"motor insurance business" means the business ofeffecting and carrying out contracts of insuranceagainst loss of, or damage to or arising out of or inconnection with the use of, motor vehicles, includingthird party risks;9

"mutual company" means an insurance companywithout share capital which is owned by andoperated in the interest of its policy holders ormembers only and the affairs of which are directedby the Board of Trustees or Directors elected by themembers;"personal accident insurance" means the businessof effecting and carrying out contracts of insuranceagainst risks of the person insured dying orbecoming disabled or incapacitated as the result ofan accident or disease, not being contracts which bythe terms thereof are not, without renewal, to be ofmore than one year's duration;"policy" means a writing by which a contract ofinsurance is made or agreed to be made;"policy holder" means the person who for the timebeing has the legal title to a policy and includes aperson to whom a policy is for the time beingassigned;"registered" means registered for the purposes ofthis Act;“Secretary of State" means the Secretary of Stateresponsible for Finance;"workmen's compensation insurance business"means the business of effecting and carrying outcontracts of insurance against the liability ofemployers to pay compensation or damages toworkmen in their employment or dependants of theworkmen but does not include any business carriedon as incidental only to some other class ofinsurance business.PART II – ADMINISTRATION AND SUPERVISIONOF INSURANCE BUSINESSRole of theCentral Bank3. (1) In pursuance of section 161 of the Constitutionof The Republic of The Gambia, the Bank shallensure the effective administration, supervision,10

regulation and control of insurance business in TheGambia.(2) There shall be a Commissioner of Insurance whoshall be appointed by the Bank and shall exercise allthe powers and functions of the Commissionerunder this Act.Functions of theCommissioner4. (1) The functions of the Commissioner include –(a) ensuring strict compliance withtheprovisions of this Act and regulationsmade under it and any other enactmentrelating to insurance;(b) with the approval of the Bank, theregistration of insurers, insurance agents,insurance brokers and loss adjusters whotransact insurance businessin TheGambia;(c) the formulation of standards for theconduct of insurance business forcompliance by insurers, insurance agents,insurance brokers and loss adjusters;(d) the inspection of insurers as provided for inthis Act;(e) with the approval of the Bank, theauthorisation of standard conditions toapply to policies of insurance;(f) with the approval of the Bank, thedetermination of rates of insurancepremium in respect of all classes or anyclass of insurance;(g) the supervision of the conduct of insuranceagents, insurance brokers, loss adjustersand agencies which specialize in thehandling of insurance claims;11

(h) the formulation of proposals for thepromotion of sound and efficient insurancemarket in The Gambia; and(i) such other functions as are assigned to theCommissioner by this Act or by regulationsmade under it.(2) The Commissioner may, with the approval of theBank, make rules requiring insurance institutions toestablish (a)standards for corporate governance ofinsurers, including standards that prescribe the roles and responsibilities oftheir boards of directors, and distinguishbetween standards to be met by locallyincorporated insurance institutions andbranch operations of insurance institutionsincorporated in other jurisdictions;(b)internal control to ensure compliance withlegal and prudential requirements;(c)standards affecting the assets of insurersthe require diversification by type, basisfor valuation of assets, requirement forsafekeeping, appropriate matching ofassets and liabilities, and liquidity;(d)limits, disclosure requirements andmonitoring obligations with respect to theuse of derivatives and off-balance sheetitems;(e)standards relating to the use ofreinsurance, including the obligation toassess the financial condition ofreinsurers;(f)formal procedures to recognize potentialsuspicious transactions, including moneylaundering activities, and to require that12

they be reported in accordance with anyexisting money laundering legislation.PART III - REGISTRATION OF INSURERSRegistration ofinsurers.5. (1) Subject to the provisions of this Part of thisAct, no person shall commence or carry on anyclass of insurance business in The Gambia unlessthe person is registered under this Act to transactthat class of insurance business.(2) A person who contravenes the provisions ofsubsection (1) commits an offence and is liable onconviction to a fine of not less than fifty thousanddalasis or imprisonment for a term not exceedingfive years, or to both the fine and imprisonment.Prohibitionof insurancebusiness bycertain personsCap 95:016. No person, other than(a) a company incorporated under theCompanies Act;(b)Cap. 50:02a society registered under the Co-operative Societies Act;(c) a corporation established under any lawfor the time being in force in TheGambia;(d) a body corporate incorporated under thelaws of any country outside The Gambianot being of the nature of a privatecompany or subsidiary of a privatecompany; or(e) a mutual insurance company registeredfor any class of insurance business inThe Gambia,shall be registered for any class of insurancebusiness in The Gambia.Applicationforregistration7. An application for registration under this Act shallbe made to the Commissioner and shall beaccompanied by the following documents 13

(a) the proposed Memorandum and Articlesof Association of the prospectiveinsurance company;(b) in the case of a co-operative society or amutual insurer, a copy of its proposedby-laws or other rights of membership;(c)the name and permanent residence ofevery person who intends to subscribefor any shares that the proposedcompany intends to issue and thesubscribers to the Memorandum andArticles of Association;(d) in the case of a co-operative society or amutual insurer the names of all themembers who intend to apply forregistration;(e) the address of the place of businesswhere the applicant proposes to locateand any other proposed branches;(f)full particulars of the business theapplicant proposes to carry on;(g) the amount of the applicant’s proposedcapital and the assurances and evidenceof the capital;Cap 95:01(h) if an external company, evidence that itis duly registered under the CompaniesAct;(i)evidence of the applicant’s capability tocomply with section 14;(j)a copy of each policy of insurance whichthe applicant proposes to issue; and(k)such additional informationCommissioner may prescribe.asthe14

Approval ofapplication,registration andissuance oflicence8. (1) If the Commissioner is satisfied that (a) the class of insurance business inrespect of which the application is madeis or will be conducted in accordancewith sound insurance principles;(b) the applicant is not a person whoseregistration is prohibited under section 6;(c) therelevant capital requirements forinsurers specified in Part IV and inregulations made under this Act havebeen complied with;(d) the margin of solvency of the insurer isadequate having regard to anyregulations made in relation theretounder section 12;(e) the management and administration ofthe applicant assures the safety andprotection of the interests of policyholders and the public;(f) the proposal forms and the terms andconditions of the policies are in orderand acceptable;(g) where the applicant is an externalcompany and it is duly registered underthe Companies Act of The Gambia,it shall deliver to the Registrar of Companies theapproved Memorandum and Articles of Associationor the approved by-laws or rules in the case of a Cooperative Society or a mutual insurer.(2) Notwithstanding anything in the Companies Actor any other enactment, the Registrar of Companiesor any other person shall not incorporate or registera company or an association -15

(a) under a name that includes the word“insurance” or any of its derivatives inany language; or(b)has as its objects or one of its objectsas the carrying on of insurancebusiness,unless the application is received from and isapproved by the Commissioner.(3) A company or an association shall, on er with certified copies of theMemorandum and Articles of Association asregistered.(4) On receiving the Memorandum and Articles ofAssociation pursuant to subsection (3), theCommissioner shall, with the approval of the Bank,grant the application for registration as an insurerand issue a licence to the applicant.(5) A notice of the issue of a licence shall bepublished in the Gazette.(6) An insurer shall notify thewriting, within thirty days of anyMemorandum of AssociationAssociation or other instrumentincorporated.Appeal to theSecretary of Stateon refusal ofapplicationCommissioner inamendment of itsand Articles ofunder which it is9. (1) A person aggrieved by a decision the Bank torefuse to grant an application for registration as aninsurer may, within sixty days after the date of thenotification of the refusal to grant the application,lodge a notice of appeal to the Secretary of Stateand send a copy the Commissioner.(2) A notice of appeal shall be in writing, setting outthe grounds on which it is made.16

(3) A notice of appeal may be withdrawn by theperson aggrieved before the appeal is dealt with bythe Secretary of State.(4) The Secretary of State shall, on receipt of anotice of appeal, consider the appeal and thegrounds thereof and any other facts orconsiderations placed before him or her by theperson aggrieved or by the Bank and shall decidewhether to uphold or disallow the appeal.(5) The Secretary of State shall, unless the appeal iswithdrawn, give notice in writing to the applicant forregistration of his or her decision on the appeal.(6) If the appeal is upheld, the Commissioner shallregister the applicant and issuea licence,accordingly .Cancellationof registration.10. (1) If, in the case of a registered insurer, theBank is satisfied that(a) the insurer is not conducting its insurancebusiness in accordance with soundinsurance principles;(b) the insurer fails to comply with therequirements of this Act or regulations,rules or orders made under it;(c) the insurer has ceased to carry oninsurance business in The Gambia; or(d) a judgment obtained in a Court in TheGambia against the insurer under apolicy of insurance issued by it remainsunsatisfied for thirty days after the dateof judgment unless an appeal againstthe judgment is pending,the Bank shall give notice in writing to the insurer ofits intention to cancel the registration of the insurer,and the provisions of section 9, with suchappropriate modifications, shall apply to the notice ofintention to cancel the registration as if it was a17

refusal to grant an application for registration.(2) The Commissioner may cancel the registrationof a registered insurer if the insurer requests inwriting that the registration be cancelled.(3) A request under subsection (2) for the cancellation of the registration of an insurer shall bepublished in the Gazette.(4) Every cancellation of the registration of an insurershall take effect on the date on which notice of thecancellation is published in the Gazette.(5) When a registration is cancelled, the insurer shallnot, after the cancellation has taken effect, enter intoany new contracts of insurance, but all rights andliabilities in respect of contracts of insurance enteredinto by it before the cancellation takes effect shallcontinue as if the cancellation had not taken place.PARTIVREQUIREMENTSRequirements asto capitalCAPITALANDOTHER11. (1) No person shall be registered, or remainregistered as an insurer under this Act. unless theperson has and maintains in The Gambia at all timeswhile that person carries on that business, in thecase of(a) a company limited by shares, a paid-upcapital;(b) a company limited by guarantee, acontribution by the subscribers to theMemorandum of Association andArticles of Association to the generalfund of the company; or(c) a mutual company, a surplus of assetsover liabilities,of not less than such amount as may be prescribedby regulations.18

(2) No person shall carry on life assurance businessand long term insurance business together with anyother class of insurance business unless that personmaintains in The Gambia at all times while thatperson carries on these businesses together, anamount not less than twice the amount of thatrequired in relation to that person under subsection(1).Margin ofsolvency12.(1) The Secretary of State may make regulationsprescribing margins of solvency for an insurercarrying on insurance business in The Gambia, orcarrying on insurance business in and outside TheGambia.(2) Without prejudice to subsection (1), the marginsof solvency may be prescribed in respect of (a)life assurance business;(b) any insurance business, including lifeassurance business; and(c) insurance business, other than lifeassurance business.(3) Regulations made under this section mayprescribe the method of calculating the assets of aninsurer for the purposes of this section.(4) If the margins of solvency of an insurer fall belowthe levels prescribed under subsection (1), theCommissioner may impose on the insurer suchrestrictions, including prohibiting the insurer fromissuing new or renewing existing policies, andlimiting the kind of policies the insurer may issue.Deposit13. Every registered insurer shall deposit in trust withthe Bank, the securities of not less than suchamount in value as may be prescribed and shallkeep the securities so deposited for so long as theinsurer carries on business in The Gambia.19

Reservation ofdeposits14. (1) A deposit made under section 13 shall bedeemed to be part of the assets of the insurer butshall not be –(a) susceptible to any assignment or charge;(b) available for the discharging of any liabilitiesof the insurer other than liabilities arising outof policies of insurance issued by the insurerso long as any of the liabilities remainundischarged; or(c) liable for attachment in execution of anydecree except a decree obtained under anypolicy issued by the insurer in respect of adebt due on a policy which debt could not berealised in any other way.(2) A deposit made in respect of life assurancebusiness shall not be liable for the discharge of anyliability of the insurer other than liabilities arising outof policies of life assurance issued by the insurer.Refundof deposit15. Where an insurer has ceased to carry on in TheGambia a class of insurance business in respect ofwhich a deposit has been made under section 13and its liabilities in The Gambia in respect ofbusiness of that class have been satisfied orotherwise provided for, the Bank may, on theapplication of the insurer, return to the insurer somuch of the deposit as does not relate to the class ofinsurance business, if any, which the insurercontinues to carry on.Power torequireinvestmentof insurancefund16. (1) The Secretary of State may make regulationsrequiring that all registered insurers or a registeredinsurer of a particular class or description specifiedin the regulations, shall invest a percentage of theinsurance funds of the insurers or insurer, as thecase may be, accruing in respect of their or itsbusiness in The Gambia in The GambianGovernment securities and other securities in TheGambia, as may be prescribed in the regulations.20

(2) Regulations made under subsection (1) mayprescribe different percentages of the insurancefunds as aforesaid to be so invested according to theclass of insurance business or description of aninsurer.PART V – RECORDS, ACCOUNTS, STATEMENTS AND RETURNS OF INSURERSRecordsto be kept17. A registered insurer shall keep in The Gambiasuch records of its business transacted in or outsideThe Gambia as may be prescribed.Separation ofaccounts andreserve funds18. (1) Where a registered insurer carries on morethan one class of insurance business, it shall keep aseparate revenue account for each of the following (a) life assurance business;(b) each class and sub-class of long terminsurance business;(c) fire insurance business;(d) marine insurance business;(e) motor insurance business;(f) employers liability and workmen'scompensation insurance business.(2) There shall also be kept one revenue account inrespect of all other classes of insurance businessother than those referred to in subsection (1).Life AssuranceFund19. (1) Where an insurer carries on life assurancebusiness together with any other class of insurancebusiness, the insurer shall keep a separateaccount of all receipts in respect of the lifeassurance business which shall be carried to andform a separate Life Assurance Fund, the assetsof which shall be kept free from all encumbrancesand distinct and separate from all other assets ofthe insurer.21

(2) The Life Assurance Fund shall be investedseparately from the investment of any other fund ofthe insurer.(3) The Life Assurance Fund shall (a) be absolutely the security of the life policyholders as though it belonged to aninsurer carrying on no other businessthan life assurance business;(b)not be liable for any contracts of theinsurer for which it would not have beenliable had the business of the insurerbeen only that of life assurance; and(c) not be applied directly or indirectly for anypurpose other than that of life assurancebusiness.Accounts, etc.to be furnishedto the Bank20. An insurer shall, in respect of the insurancebusiness carried on by it in The Gambia, prepare inthe form prescribed, at the end of each financial yearwith reference to that year, and furnish to the Bankwithin three months after the end of the year towhich they relate, respectively (a) a certificate as to the solvency of theinsurer, signed, in the case of a lifeinsurer, by an actuary;(b) a balance sheet duly audited, showingthe financial position of the insurancebusiness;(c) a profit and loss account;(d) a certified copy of the revenue account inrespect of each class of insurancebusiness carried on by the insurer in thatyear;22

(e) a statement of the life assurancebusiness, if any, carried on by theinsurer in The Gambia in that year;(f)copiesof board and managementreports on the affairs of the insurer forthe financial year as submitted to thepolicy holders or shareholders of theinsurer duly signed and certified; and(g) such other documents and informationrelating to the relevant accounts andbalance sheet as the Bank mayrequire.Amendmentof insureraccountsetc21. (1) If, in the opinion of the Bank, a documentfurnished by an insurer under section 20 is incorrector is not prepared in accordance with the provisionsof this Act, it may, by notice in writing, call on theinsurer to amend the document or to fu

45. Insurance agents to be registered and period of registration 46. Duties of insurers and agents inter se 47. Insurance agents to be agents of insurers 48. Penalties for non-compliance by insurance agents and insurers B - INSURANCE BROKERS 49. Insurance brokers to be registered 50. Requirement as to professional indemnity cover, staff etc.