Transcription

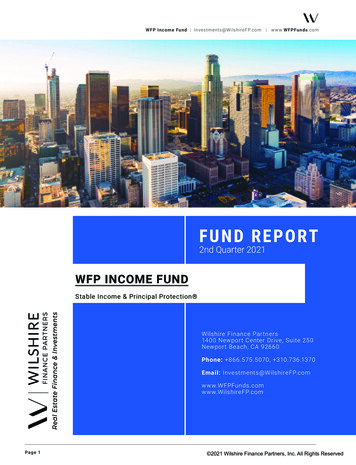

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comF U N D R E POR T2nd Quarter 2021WFP INCOME FUNDStable Income & Principal Protection Wilshire Finance Par tners14 00 Newpor t Center Drive, Suite 250Newpor t Beach, CA 92660Phone: 866.575.5070, 310.736.1370Email: hireFP.comPage 1 2021 Wilshire Finance Partners, Inc. All Rights Reserved

WFP Income Fund Investments@WilshireFP.comWFP INCOME FUNDStable Income & Principal Protection As of June 30, 2021—FUN D D E S CRIP TIO NThe WFP Income Fund, LLC (the Fund) seeksto provide attractive risk-adjusted returns to itsinvestors as compared to other short term fixedincome investments through the Fund’s acquisitionof first trust deeds and mortgages nationwide.Trust deeds create a security interest in real estatefor the repayment of loans. Like mortgages, firsttrust deeds enjoy a priority position over otherencumbrances on the real property collateral andthe Fund’s first trust deeds and mortgages carry alow weighted average loan-to-value ratio. The Fundis designed to generate revenue primarily throughthe interest paid on the mortgage loans/trust deedsin its portfolio by the underlying property owners.The total return for the Fund will primarily bepaid through the dividend.Wilshire FinancePartners, as the Fund Manager, believes the legalcharacteristics of the trust deeds and mortgagesof the Fund, and the value of the real propertycollateral, coupled with the fundamental strategiesthe manager employs will enable the Fund to earnan attractive risk-adjusted return on the investment.Investments in the Fund are being offered pursuantto a Private Placement Memorandum (“PPM”) toaccredited investors in accordance with RegulationD, Rule 506(c). Please consult the PPM for moreinformation on the Fund’s investment process.CUIS PCharles SchwabTD AmeritradeFidelityPershingNo Cusip93099B10294699k534929LP9220 w w w.WFPFunds.comFU ND S U M M ARYMANAGERWilshire Finance Partners, Inc.INCEPTION DATESeptember 23, 2013INVESTMENT THESISStable Income & Principal Protection PORTFOLIO ALLOCATIONShort Term Fixed IncomeINVESTMENT VEHICLEPrivate Pooled Mortgage FundUNDERLYING INVESTMENTSFirst Trust Deeds & MortgagesSTRUCTURELLC, K1 ReportingTOTAL NET ASSETS 54,954,941MINIMUM INVESTMENT 100,000TARGET TOTAL RETURN7% to 8% per annumMANAGEMENT FEE1.50%LIQUIDITY1 Year Lock-UpFU ND R ES U LTSNET ANNUALIZED NONCOMPOUNDED RETURN(YTD)5.37%NET ANNUALIZED NONCOMPOUNDED RETURN(INCEPTION)6.70%NET ANNUALIZEDCOMPOUNDED RETURN(INCEPTION)8.58%WEIGHTED AVERAGE LOANTO-VALUE (WALTV)61.57%WEIGHTED AVERAGEMATURITY (WAM)23 MONTHSNON-PERFORMING LOANS0%REAL ESTATE OWNED (REO)5.88%LOAN LOSS RESERVE(PERCENTAGE OF NONPERFORMING LOANS ANDREAL ESTATE OWNED)146.82%Results as of yearend June 30, 2021. Past performance is not indicativeof future results.FU ND HIG HLIG HTS Experienced Management Team Well Collateralized, Lower LTV, First Lien Position Monthly Dividend No Correlation to Stock or Bond Markets Little-To-No Sensitivity to Interest Rates Diversification Across Borrowers, Asset Types and Geographic Location Transparent Investment ProcessPage 2

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comWFP INCOME FUNDNet Annualized Non-CompoundedReturn Since Inception: 6.70%WFP INCOME FUNDNet Annualized CompoundedReturn Since Inception: 8.58%WFP INCOME FUNDNAV Since InceptionFrom fund inception on September 23, 2013 through June 30, 2021. Past performance is not indicative of future results.Page 3

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comVALUE OF INCOME STRATEGIES01MO N T HLY C A SH F LOWTrust deeds create a security interest in real estate for the repaymentof loans. Like mortgages, first trust deeds enjoy a priority positionover other encumbrances on the real property collateral. Themonthly mortgage payments on the underlying loans generatemonthly cash flow to investors. Further, the Fund’s first trust deedsand mortgages carry a low weighted average loan-to-value ratiowhich helps to provide downside risk protection.Stable Income & Principal Protection 02Risk Mitigation - Protective Equity15% Drop in Property Value39.26%Protective Equity Cushion**(Borrower Equity)60.74%WAL TV 10,,000,00 0Loan Loss Reserve*40% 8,500,000Mortgage PoolOrder of Loss Allocation25%Borrower EquityLoan Loss Reserve1st Lien60%60%Borrower EquityLoan Loss Reserve1st Lien*Loan loss reserves are set asides established by the fund to cover non-performing loans; including, estimated losses on loans due to defaults and non-payment.** Protective equity cushion exists when the value of the collateral exceeds the value of the fund’s loan (the fund is over secured).Page 4

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comRisk Mitigation - DiversificationALLOCATION BY ASSET CLASSAssisted Living 51.49%Warehouse / Industrial 20.40%Apartment 12.42%Retail 9.39%Office 6.30%GEOGRAPHIC DISPERSIONFL 32.46%TX 24.59%CA 20.15%WA 7.63%MD 3.70%OR 3.41%MI 3.16%CO 2.61%MS 2.29%*As of June 30, 2021. The portfolio allocation and geographic dispersion is subject to change.Page 5

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comTHE FUND ADVANTAGEStable Income Principal Protection Combination of consistent risk adjusted returns and principalprotection through diversification.Attributes of this fund include: Higher Yields Stable Net Asset Value Monthly DistributionsWell Collateralized (Low LTV) First Lien PositionQuantifiable Protective Equity CushionEstablished Loan Loss ReserveNo Correlation to Stock or Bond MarketsLOAN PERFORMANCELittle-To-No Sensitivity to Interest RatesOne Year Hard LockNo LoadSecured by Hard Asset - Real EstateDiversification Across Sponsors, Asset Types,Geographic Location and Other FactorsExperienced Management TeamPerforming 94.12%Real Estate Owned (REO) 5.88%Non-Performing 0%INVESTOR BENEFITSWFP Income Fund results through yearend June 30, 2021.The fund s eeks to provide attractive risk-adjusted returnscompared to other short term fixed income investments.Potential benefits of this fund include: Higher Returns Principal Safeguards Monthly Cash FlowNo Stock or Bond Market RiskNo Exposure to Stock or Bond Market VolatilityGreater Liquidity Compared to Non-Traded REITSShorter Investment HorizonStrong Performance HistoryNo CommissionsEasy, Understandable InvestmentPortfolio DiversifierPage 6Past performance is not indicative of future results.

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comFUND HOLDINGSTotal Pool Amount 43,252,600Net Annualized Non-CompoundedReturn since Inception6.70%Average Loan Size 2,544,270Weighted Average LTV61.57%Original PrincipalBalance"NoteRate"Maturity Date"LienPriority"AggregateAppraised ValueOriginal LTVCityStateType 1,350,0008.90%5/11/20221 3,500,00039%Los AngelesCAWI 3,300,0009.50%12/16/20211 5,325,00062%RichmondWARTL 1,006,9007.75%12/31/20211 1,700,00059%Los AngelesCAWI 1,130,0008.25%12/13/20211 2,350,00048%ArvadaCOOff 2,631,00010.25%7/12/20211 5,500,00048%GeorgetownTXALF 2,400,00010.50%10/18/20211 4,390,00055%OdessaTXWI 1,365,00010.00%7/30/20211 1,890,00072%SaginawMIApt 1,600,0008.50%9/13/20211 2,400,00067%Windsor MillMDOff 3,016,0008.50%11/13/20211 4,100,00074%WacoTXApt 990,0009.10%12/2/20221 1,480,00067%CantonMSApt 3,740,0008.90%2/27/20221 5,700,00066%Pompano BeachFLALF 1,475,0008.50%7/9/20221 2,750,00054%PortlandORWI 759,5008.90%9/21/20211 1,235,00061%InglewoodCARTL 4,931,0009.50%2/1/20221 8,450,00058%OrlandoFLALF 2,590,0008.90%10/5/20211 3,800,00068%StaffordTXWI 5,368,20010.00%10/26/20211 8,650,00062%LargoALF 5,600,0008.75%3/31/20241 8,400,00067%CAALF 4,931,0009.50%2/1/20221 8,450,00058%Fairfield and SacramentoFLOrlandoFLALF 2,590,0008.90%10/5/20211 3,800,00068%StaffordTXWI 5,368,20010.00%10/26/20211 8,650,00062%LargoFLALF 5,600,0008.75%3/31/20241 8,400,00067%CAALFFairfield andSacramentoAs of June 30, 2021. The allocation and geographic dispersion is subject to change. Past performance is not indicative of future results.Page 7

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comSAMPLE TRANSACTIONSAssisted Living FacilityAssisted Living FacilityLoan Amount: 2,631,000 48% LTV 10.25% Rate 36 Month TermLoan Amount: 5,368,000 62% LTV 10% Rate 12 Month TermTexasWarehouse / IndustrialTexasLoan Amount: 2,590,000 68% LTV 8.90% Rate 12 Month Term*Examples only. This may not be a complete list or description of current Fund investments.Page 8FloridaWarehouseOregonLoan Amount: 1,475,000 54% LTV 8.5% Rate 24 Month Term

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comFUND MANAGERDon Pelgrim is an owner, director and the CEO of Wilshire FinancePartners, and the manager of the WFP Income Fund, WFP IncomeREIT, and WFP Opportunity Fund. He is also an attorney and hasbeen a chief-level executive officer in the banking and financialservices industry.As an attorney, Mr. Pelgrim practiced corporate, real estate andreal estate finance law at Brobeck, Phleger & Harrison, LLP andRutan & Tucker, LLP. During his banking career, Mr. Pelgrim servedas an Executive Vice President and Chief Administrative Officer atregional community banks.Don PelgrimHe received his Juris Doctorate from Loyola Law School of LosAngeles and his Bachelors of Business Administration fromHofstra University. He is an active member of the CaliforniaBar and has maintained his California Real Estate License since1986. He has received regulatory “non-disapproval” to serve as achief-level banking executive from the Office of the Comptroller ofthe Currency (OCC), the Board of Governors of the Federal Reserve(FRB), the Federal Deposit Insurance Corporation (FDIC) and theOffice of Thrift Supervision (OTS).Chief Executive OfficerCUIS PCharles SchwabTD AmeritradeFidelityPershingNo Cusip93099B10294699K534929LP9220FundAdminis t rationFUND MANAGERSERVICER / ADMINISTRATORAUDITORLEGALWilshire Finance Partners, IncFCI Lender ServicesArmanino, LLPTroutman Sanders, LLPPage 9

WFP Income Fund Investments@WilshireFP.com w w w.WFPFunds.comDISCLOSURESFor more information on Wilshire Finance Partners or the WFP Income Fund please call(866) 575-5070 or visit www.WilshireFP.com.The WFP Income Fund is approved for both retirement and non-retirement accounts on thefollowing alternative investment platforms: Charles Schwab; (SSID Number available through an Advisor) Fidelity Investments (National Financial Services or NFS); CUSIP Number 94699K534 Pershing as WFP INCOME FUND LLC; CUSIP Number 929LP9220 TD Ameritrade as WFP INCOME FUND LLC NSA; CUSIP Number 93099B102 Wells Fargo Advisors; No CUSIP number requiredThe WFP Income Fund is also open to investors, wealth managers and individual investmentadvisors directly through Wilshire Finance PartnersAbout Wilshire Finance Partners and our investment alternatives.Wilshire Finance Partners, Inc. (“Wilshire”) specializes in real estate finance and investments andis the manager of the WFP Income Fund, LLC (“WFP Income Fund”) and the WFP OpportunityFund, LLC (“WFP Opportunity Fund” and collectively with the WFP Income Fund, the “Funds”).The WFP Income Fund invests in a diversified pool of residential, multifamily, and commercialreal estate related short-term bridge loans secured by first trust deeds and mortgages. The WFPOpportunity Fund invests in a diversified pool of residential, multifamily, and commercial real estaterelated short-term bridge loans, participating loans, real estate joint ventures, and direct real estateinvestments. Wilshire commenced operations in January 2008 and launched the WFP Income Fundand the WFP Opportunity Fund in September 2013.The WFP Income Fund is approved for both retirement and non-retirement accounts on thefollowing alternative investment platforms: Charles Schwab; (SSID Number available through an Advisor) Fidelity Investments (National Financial Services or NFS); CUSIP Number 94699K534 Pershing as WFP INCOME FUND LLC; CUSIP Number 929LP9220 TD Ameritrade as WFP INCOME FUND LLC NSA; CUSIP Number 93099B102 Wells Fargo Advisors; No CUSIP number requiredSafe Harbor StatementThis communication is not an offer to sell or the solicitation of offers to purchase thesecurities of either of the Funds, individual loan or trust deed investments, or otherwise(individually and collectively, the “Securities”). The purpose of this communicationis to provide an overview of the respective Securities and their private placement.Persons interested in learning about the Securities and their private placementwill be provided with the respective Private Placement Memorandum (inclusiveof exhibits thereto and any supplements, the “Memorandum”), which provides adescription of the Securities, the terms of their private placement, a discussion ofrisk factors, a copy of the limited liability company operating agreement for thefund (as applicable), a subscription agreement and other information related tothe Securities.This communication contains certain forward-looking statements regarding theSecurities and the investment objectives and strategies of each of the Funds.The forward-looking statements are based on current expectations that involvenumerous risks and uncertainties which are difficult or impossible to predictaccurately and many of which are beyond the control of Wilshire, as the managerof the Funds. Although Wilshire believes that the assumptions underlying theforward-looking statements are reasonable, any of the assumptions could proveinaccurate and, therefore, there can be no assurance that the forward-lookingstatements will prove to be accurate. In light of the significant uncertainties inherentin the forward-looking statements, the inclusion of such information should notbe regarded as a representation by Wilshire, any placement agent, or any otherperson, that the objectives and strategies of the respective Securities or the Fundswill be achieved.Investments in the Securities may only be made solely by accredited investors(which for natural persons, are investors who meet certain minimum annualincome or net worth threshold), who are provided with the Memorandum and whocomplete, execute and deliver the subscription documents included therein. Eachof the Securities is being offered in reliance on an exemption from the registrationrequirements of the Securities Act of 1933, as amended (the Securities Act) andare not required to comply with specific disclosure requirements that apply toregistration under the Securities Act. The Securities Exchange Commission has notpassed upon the merits of or given its approval to the Securities, the terms ofthe offering, or the accuracy or completeness of any offering materials. Each ofthe Securities is subject to legal restrictions on transfer and resale and investorsshould not assume they will be able to resell the Securities. Past performance is notindicative of future results. Investing in any of the Securities, including the Funds,involves substantial risk, including loss of investment, and is not suitable for allinvestors.Contact:The WFP Opportunity Fund is approved for both retirement and non-retirement accounts on thefollowing alternative investment platform:Wilshire Finance Partners, Inc.Donald H. Pelgrim, Jr. Charles Schwab; (SSID Number available through an Advisor)(866) 575-5070 Fidelity Investments (National Financial Services or NFS); CUSIP Number 94699B948dpelgrim@wilshirefp.com TD Ameritrade as WFP OPPORTUNITY FUND NSA; CUSIP Number 93099C100Source: Wilshire Finance Partners, Inc.In addition, each of the WFP Income Fund and WFP Opportunity Fund are approved for selfdirected retirement accounts and various other platforms without the need for the CUSIP number,including, Community National Bank, Equity Trust Company (Sterling Trust), Millennium TrustCompany, Pacific Premier Trust Company, Provident Trust Company, Strata Trust Company andShareholder Services Group.Each of the WFP Income Fund and WFP Opportunity Fund is open to investors, wealth managersand individual investment advisors under the above referenced platforms using standardsubscription and transfer procedures.Investors and advisors may also invest directly through Wilshire. Individual investors not using athird-party advisor may be required to meet additional requirements of the platform providers.For more information contact us at:Wilshire Finance Par tners, Inc.Direc t link:w w w.W FPFunds.com14 0 0 Newpor t Center Drive, Suite 25 0Newpor t Beach, CA 9 26 6 0Page 10Call: 8 6 6.5 75.5 070E mail: Inves tme nts@Wilshire FP.comw w w.WilshireFP.com

WFP INCOME FUNDStable Income & Principal Protection Wilshire Finance Par tners14 0 0 Newpor t Center Drive, Suite 25 0Newpor t Beach, CA 9 26 6 0Phone: 8 6 6.5 75.5 070, 310.736.1370E mail: Investments@WilshireFP.comw w w.W FPFunds.comw w w.WilshireFP.com 20 21 Wilshire Finance Par tners, Inc. All Rights Reser ved.

WFP INCOME FUND Stable Income & Principal Protection Wilshire Finance Partners 1400 Newport Center Drive, Suite 250 Newport Beach, CA 92660 Phone: 866.575.5070, 310.736.1370 Email: Investments@WilshireFP.com www.WFPFunds.com