Transcription

A&M DentalPPO PlanUpdated June 2019

IntroductionThe Texas A&M University System provides dental benefits to help you and your familymaintain good dental health.The A&M Dental plan emphasizes preventive care — to help avoid those painful and expensive procedures thatcan result from not getting good care on a continuous basis. But recognizing that dental problems can occureven with regular care, the plan also covers most other types of dental treatment.The A&M Dental plan is funded by The Texas A&M University System, and claims are administered by DeltaDental Insurance Company (Delta Dental).This booklet provides a summary of your dental coverage in everyday language. Most of your questions can beanswered by referring to this booklet.This plan is governed by a plan document that includes the information in this booklet plus additionaladministrative details.This booklet is neither a contract of current or future employment nor a guarantee of payment of benefits.The A&M System reserves the right to change or end the benefits described in this booklet at any time for anyreason.Clerical or enrollment errors do not obligate the plan to pay benefits. Errors, when discovered, will be correctedaccording to the provisions of the plan description and published procedures of the A&M System.Privacy InformationCertain personal information must be gathered by the A&M System and Delta Dental to administer your dentalbenefits. Both organizations maintain strict confidentiality of your records, with access limited to those whoneed information to administer the plan or your claims.Both Delta Dental and the A&M System maintain physical, electronic and procedural safeguards to protectpersonal data from unauthorized access and unanticipated threats or hazards.Names, mailing lists and other information is not sold to or shared with outside organizations. Personalinformation is not disclosed except where allowed or required by law or when you give permission forinformation to be released. These disclosures are usually made to affiliates, administrators, consultants, andregulatory or governmental authorities. These groups are subject to the same policies regarding privacy of ourinformation as we are.

ContentsIntroduction . 2Participation . 5Eligible Dependents . 5Enrolling in the Plan . 5Retiree Eligibility . 5Former Employees . 6Your Options. 6Qualifying Life Event . 6Coverage Cost . 8How Dental Coverage Works . 9Annual Deductible . 9Cost Sharing . 9Plan Limits . 9Choice of Dentist . 10Pre-Treatment Estimates . 10Maximum Plan Allowance . 10Covered Dental Expenses . 11Preventive Care . 11Basic Care . 11Major Care . 11Orthodontic Care . 12Dental Expenses Not Covered . 13Filling Claims. 15Overpayments . 15How to Appeal a Claim. 15A&M System Review . 15When Coverage Ends . 18When Coverage is Extended . 18COBRA Coverage Continuation. 19Extended Coverage . 22Administrative and Privacy Information . 23

Plan Name . 23Plan Sponsor . 23Plan Administrator . 23Type of Plan . 23Claims Administrator . 23Plan Funding . 23Plan Year. 23Employee Identification Number . 23Group Number . 23Agent For Service of Legal Process. 24Privacy Information . 24Future of the Plan . 25

ParticipationAll full-time and some part-timeemployees and retirees and their eligibledependents are eligible for A&M Dentalcoverage. Coverage can begin on yourfirst day of work.You and your dependents are eligible to participatein the dental plan if you: are eligible to participate in the TeacherRetirement System of Texas (TRS) orOptional Retirement Program (ORP), andwork at least 50% time for at least 4½months.You and your dependents are also eligible if you area graduate student employee who works at least50% time for at least 4½ months, or if you are apostdoctoral fellow. To be eligible for coverage as aretiree, you must meet the criteria listed in theRetiree Coverage section. Eligibility for this plan issubject to change by the A&M System or the TexasLegislature.Eligible DependentsYou may choose to cover any or all of your eligibledependents. Dependents eligible for coverageinclude: your spouse, and your unmarried dependent children youngerthan 26.Children include: a natural child, an adopted child, a stepchild who has a regular parent/childrelationship with you, a foster child under a legally supervisedfoster care program, a child for whom you are the legal guardianor legal managing conservator and withwhom you have a regular parent/childrelationship, a grandchild claimed on your annual taxreturn, and a dependent for which you have received acourt order to provide coverage.You will be asked to provide dependentdocumentation to verify your relationship to a childwho is not your natural child (for example, courtdocumentation of guardianship).If the child is mentally or physically unable to earna living and is dependent on you for support youmust notify your Human Resources office of thechild’s disability before the child’s 26th birthday.This will allow time for you to obtain and completethe necessary forms for coverage to continue.Periodically, you may be required to provideevidence of the child’s continuing disability andyour support.Enrolling in the PlanCoverage for you and your dependents can takeeffect either on your hire date or on your employercontribution eligibility date (the first of the monthafter your 60th day of employment) if you enrollbefore, on or within seven days after your hire date.If you enroll beyond the seventh day after your hiredate, but during your 45-day enrollment period,your coverage will take effect on your employeecontribution eligibility date.If you do not make any changes during yourenrollment period, you must wait until you have aChange in Status (see page 5) or until the nextAnnual Enrollment period to enroll. Likewise, ifyou gain a new dependent, you must enroll thatdependent within 60-days or wait until the nextAnnual Enrollment period.If you choose to have your dental coverage takeeffect before your employer contribution eligibilitydate, you must pay the full monthly premiumyourself.If you are not a new employee, but you areenrolling in the plan during Annual Enrollment,your coverage will take effect the followingSeptember 1.If you are enrolling in the plan because of aQualifying Life Event, your coverage will takeeffect the first of the month after you enroll.Retiree Eligibility

If you were retired from or employed in a benefitseligible position with the A&M System on August31, 2003, you are eligible for dental coverage as aretiree when: you are at least age 55 and have at least 5years of service credit, or your age plusyears of service equal at least 80, or youhave at least 30-years of service, andyou have 3-years of service with the A&MSystem, andthe A&M System is your last stateemployer.If you left A&M System employment beforeSeptember 1, 2003, but you met the above criteriaas of August 31, 2003, you qualify for retireebenefit coverage under these criteria.If you are in TRS and you retire after August 31,2003, you must also provide documentation thatyou are receiving or have applied to receive yourTRS annuity payments.If you were hired by the A&M Sys- tem in abenefits-eligible position after August 31, 2003, orif you left A&M System employment before August31, 2003, and did not meet the criteria listed at leftas of August 31, 2003, you are eligible for dentalcoverage as a retiree when: you are at least age 65 and have at least 10years of service credit, or your age plusyears of service equal at least 80 and youhave 10 years of service credit, andyou have 10 years of service with the A&MSystem, andthe A&M System is your last stateemployer.If you are in TRS, you must also providedocumentation that you are receiving or haveapplied to receive your TRS annuity payments.Former EmployeesYou may apply for coverage within 60 days ofmeeting these criteria or within 60 days of leaving aTRS-eligible position with another state employerafter meeting the eligibility criteria. In these cases,you may choose to have your coverage becomeeffective on the first of the month following the datethe Human Resources office receives yourapplication or on your employer contributioneligibility date (the first of the month that falls atleast 60-days after the Human Resources officereceives your application).If you do not enroll on one of these dates, you mayenroll during a later Annual Enrollment period.In that case, you can choose to have your coveragebecome effective on the next September 1 orDecember 1.Your OptionsYou also have a choice of four levels of coverage: employee/retiree only, employee/retiree and spouse, employee/retiree and children, or employee/retiree and family (spouse andchildren).If you enroll your dependents, you must enroll themin the same plan in which you enrolled yourself.Once you enroll in the dental plan, you can onlydrop change or drop coverage during AnnualEnrollment or within 60 days of a Life Event.Qualifying Life EventQualifying Life Events include: employee’s marriage or divorce or death ofemployee’s spouse, birth, adoption or death of a dependentchild, change in employee’s, spouse’s ordependent child’s employment status thataffects benefit eligibility, such as leavewithout pay, child becoming ineligible for cover- age dueto reaching age 26, changes in the employee’s, spouse’s or adependent child’s residence that wouldaffect eligibility for coverage, employee’s receipt of a qualified medicalchild support order or letter from theAttorney General ordering the employee toprovide (or allowing the employee to drop)medical coverage for a child, changes made by a spouse or de- pendentchild during his/her annual enrollmentperiod with another employer,

the employee, spouse or dependent childbecoming eligible or ineligible for Medicareor Medicaid, orsignificant employer- or carrier-initiatedchanges in or cancellation of theemployee’s, spouse’s or dependent child’scoverage.Changes in coverage must be consistent with theLife Event. For example, if you have a baby, youmay add that child to your coverage, but you maynot drop your other children.

Coverage CostYou pay the cost of dental coverage. You pay your premiums on a before tax basis.You must pay premiums for dental coverage. If coverage for you or your dependents begins in the middle of amonth, you must pay your share of the premium for the entire month. Through the Pretax Premiums Plan, yourshare of any premium is automatically deducted from your paycheck on a pretax basis. This means you neverpay federal income tax or Social Security tax on the money you pay for your dental coverage.When you pay premiums on a pre-tax basis, your taxable income is reduced. This may mean that your eventualSocial Security benefit could be reduced. However, the reduction is quite small. Your base pay, for purposes ofpay increases and benefits based on pay, is not reduced.

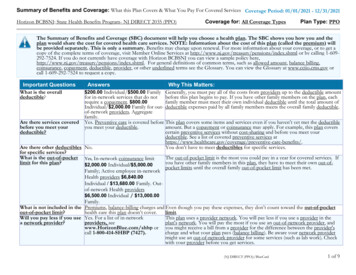

How Dental Coverage WorksThe dental plan covers preventive, basic, major and orthodontic care. The plan pays upto 1,500 a year in benefits, with a 1,500 lifetime maximum on orthodontic care.Your dental plan covers most types of dental care, but at different benefit levels. In general, here’s how the planworks:The plan pays 100% of Delta Dental’s allowed amount for certain preventive care. You must meet a 75deductible each plan year (September 1 – August 31) before the plan pays benefits for basic, major, ororthodontic care.Once you meet your annual deductible, the plan pays 80% of basic and 50% of major and orthodontic care.When you have received 1,500 in benefits for preventive, major services combined in a plan year, the planpays no further benefits for that plan year. Each covered person can receive a lifetime maximum benefit of 1,500 for orthodontic care.Annual DeductibleYou must first meet an annual deductible before you receive dental benefits, except for preventive care. Thismeans you pay the first dental expenses (other than preventive) you have for yourself and your covereddependents each year. If you have dependent coverage, the maximum annual deductible for all family membersis three times the individual deductible. All expenses incurred by any combination of three or more familymembers will go toward meeting the family deductible. Preventive care expenses do not count toward thedeductible, since the allowable amount is paid at 100%.BasicYou pay 20%The plan pays80%*You pay your 75 annual deductibleMajorYou pay 50%The plan pays50%*Once you have received 1,500 in benefits in a plan year, you pay allremaining dental expenses for that plan year.*Of Delta Dental’s allowed amount.OrthodonticYou pay 50%The plan pays50%*Once you have received 1,500in benefits in your lifetime, youpay all remaining orthodonticexpenses.Cost SharingYou and the plan share many costs on a percentage basis. For basic services, after you meet your annualdeductible, you pay 20% and the plan pays 80% of expenses. You and the plan each pay 50% for major andorthodontic care, after you meet your annual deductible.Plan LimitsThe plan pays up to 1,500 per person per plan year for preventive, basic and major services combined. Theplan also pays up to 1,500 in each person’s lifetime for orthodontic care. Any orthodontic benefits previouslyreceived under this plan count toward this lifetime maximum.

Choice of DentistYou can choose a Delta Dental PPOSM Dentist(PPO Dentist), a Delta Dental Premier Dentist(Premier Dentist) or a non-Delta Dental Dentist: Choosing a PPO Dentist gives you thegreatest reduction in your out-of-pocket costbecause these dentists have contracted withDelta Dental to charge less than what mostdentists in your area charge. Choosing a Premier Dentist allows you toreceive dental care at a cost that is usuallylower than a non- Delta Dental Dentist’scharges but more than a PPO Dentist’scharges. Premier Dentists charge either theirregular fees, the Premier contracted fee orthe maximum plan allowance (see below),whichever is less. If you choose a non-Delta Dental Dentist,Delta Dental will pay the dentist’s charge orthe maximum plan allowance (see below),whichever is less. You must pay anyremaining charges.In addition, a PPO Dentist or Premier Dentist willfile claims for you. You pay only the deductible andyour coinsurance. Delta Dental will pay the dentistdirectly for the remaining cost up to the maximumbenefit (see Plan Limits, previous page).Dental providers can be located throughhttp://www.deltadentalins.com, the A&M Systemdedicated site, http://deltadentalins.com/tamus, oryour Human Resources office.Dentists are regularly added to or deleted from thepanel, so a new dentist may not be listed, and youshould always verify with Delta Dental that a listeddentist is still in the network.Pre-Treatment EstimatesIf your dentist recommends treatment that will costmore than 300, you should submit a treatment planto Delta Dental in advance. Delta Dental will figureyour benefit under this plan before you receivetreatment. This will allow you and your dentist toknow before you agree to treatment exactly howmuch the plan will pay and how much you will haveto pay.Many dental problems can be treated in more thanone way. The plan will pay benefits based on thegenerally accepted treatment that provides adequatecare at the lowest cost. For example, veneermaterials may be used for front teeth or bicuspids.The plan will pay benefits based on the leastexpensive adequate veneer material.If the treatment your dentist proposes is not the leastexpensive acceptable treatment, a pretreatmentestimate will let you know that in advance. You canthen discuss with your dentist the alternativetreatments and make your decision based on yourbenefits allowed by the plan.Pre-treatment estimates are valid for 60 days fromthe date of the pre-treatment estimate, until youbecome ineligible for dental coverage or until theplan ends, whichever occurs first.Maximum Plan AllowanceThe Maximum Plan Allowance (MPA) is thehighest amount Delta Dental will reimburse for acovered procedure. Delta Dental sets MPAs eachyear based on actual claims submitted by providersin the same geographic area with similarprofessional standing. The MPA may vary by thetype of dentist.

Covered DentalExpensesBasic CareThis section lists the expenses covered by the plan.Some limitations may apply to specific services asnoted in this list. Expenses that are not covered arelisted beginning on page 12.If you cannot find a service or supply in eithersection, call Delta Dental’s Customer Servicedepartment at 1 (800) 521-2651 to find out if theexpense is covered.For in-network services, the plan pays 80% after thedeductible for: extractions, restorative fillings, including amalgam,acrylic, or composite fillings, posterior composite, colored fillings(excluding metal fillings) oral surgery, general and local anesthetic for covered oralsurgery procedures, administration of nitrous oxide for use assedation and/or analgesic for children up toage 14, treatment of periodontal and other diseasesof the gums and tissues supporting the teeth(except periodontal cleanings, which arecovered as preventive care if proof of priorroot planning and scaling or osseous surgeryis provided), endodontic treatment, including root canals,if the tooth is opened while the patient iscovered by the plan, injection of antibiotic drugs, re-cementing of crowns, inlays andbridgework (certain limitations may apply) realignment of dentures, up to once everytwo plan years, and emergency palliative (pain) treatment.Preventive CareMajor CareFor in-network services, the plan pays 100%, withno deductible, for: oral exams, up to three each plan year, prophylaxis (cleaning), includingperiodontal prophylaxis, up to three eachplan year, topical application of fluoride for childrenyounger than 15, up to twice each plan year, full-mouth x-rays, including pano graphonce every three years, bitewing x-rays, up to twice each plan year, space maintainers for children younger than14, an sealants, limited to once per tooth within 24months; up to age 16 for first and secondmolars.For in-network services, the plan pays 50% after thedeductible for: implants (prosthetic appliances placed intoor on the bone of the maxilla or mandible(upper or lower jaw) to retain or supportdental prosthesis). inlays, onlays, gold fillings or crowns, initial installation of fixed bridge-work,including inlays and crowns, or replacementof existing bridge- work or the addition ofteeth on existing bridgework, and initial installation of partial or fullremovable dentures, the replacement of anexisting partial or full removable denture orthe addition of teeth to a partial removabledenture. However, initial installation andreplacements or additions to existingdentures or bridge- work will be coveredonly if the work cannot be repaired and wereThe dental plan covers regular checkupsand routine care such as fillings, x-rays,cleanings and extractions. Othertreatments also are covered, includingorthodontic care.Your dental plan covers most medically necessary,reasonable and customary charges for servicesprovided by: licensed dentists, doctors operating within the scope of theirlicenses, and licensed dental hygienists operating withinthe scope of their licenses and under thesupervision and direction of dentists ordoctors.

installed at least five years beforereplacement.If your dental coverage ends while you are in themiddle of treatment for major services, coveragemay be extended for that service. If you are notentitled to benefits under any other dental plan andinstallation of a dental appliance, crown, bridge orgold resto- ration is performed within 30-days of theend of your coverage, benefits for the installationwill be paid if: an impression for the appliance was takenbefore coverage ended, or the tooth was prepared for the crown, bridgeor gold restoration before coverage ended.Orthodontic CareThe plan will pay 50% after the deductible fortreatment, materials and supplies related toorthodontic treatment. The plan will pay 50% ofyour down payment, which may not exceed onethird of the total cost or 700, whichever is less, fororthodontic treatment. The remaining cost will bedivided by the number of months of expectedservice (generally 24-months). You will bereimbursed 50% of this monthly cost each month.Orthodontic benefits are limited to 1,500 percovered person per lifetime.If you or a covered dependent begins orthodontictreatment before becoming covered under this plan,this plan may pay for part of the treatment. The planwill pay no benefits for the placement of theappliance if that step pre-dated plan coverage.However, the plan will pay for the ongoingtreatment that occurs after coverage begins. In thiscase, Delta Dental will make monthly payments onthe first payment due date after your coveragebecomes effective.If coverage ends before your treatment is finished,Delta Dental will make its last orthodontic paymenton the first payment due date after your coverageends or on the last payment due date before the planterminates, whichever occurs first.If an interceptive appliance, such as an expander, isplaced before the orthodontic work begins, benefitsfor the related charges would be considered part ofthe 1,500 maximum orthodontic benefit.

Dental ExpensesNot CoveredCharges for cosmetic work, charges thatare not medically necessary, chargesabove the maximum plan allowance andcertain other items are not covered bythe dental plan.While most dental expenses are covered by thisplan, some dental expenses are not covered. Most ofthese are listed below. Others that are specific to acertain service are listed in the section “CoveredDental Expenses.”If you cannot find a specific expense listed in thissection or in the list of covered expenses beginningon page 10, call Delta Dental’s Customer Servicedepartment at 1 (800) 521-2651.Expenses that are not covered include, but are notlimited to: for any treatment, including materials andsupplies, not begun and completed while thepatient is covered by the plan, except asexplained on page 11, for repair and/or replacement of lost,missing or stolen prosthetic or orthodonticappliances, for prescription drugs, although these maybe covered by your health plan, for any treatment, material or sup- plies thatare for orthodontic treatment except asexplained on page 11. Recementations within six months by thesame dentist/dental office, Recementations in excess of onerecementation by the same dentist/ dentaloffice. for dentures, crowns, inlays, onlays, bridgework or other treatment, material or suppliesprovided to alter vertical dimension or alterocclusion, for failure to keep a scheduled appointmentwith a dentist, for services restoring tooth structure lostfrom wear, erosion, or abrasion, forrebuilding or maintaining chewing surfacesdue to teeth out of alignment or occlusion, or for stabilizing the teeth includingequilibration and periodontal splinting.for sealants except as explained on page 10,or other materials to prevent decay otherthan fluorides,for accidental injury or illness related to anyemployment or for which the patient isentitled to or has received benefits or asettlement from any workers’ compensationor occupational disease law,due to war or any act of war, whetherdeclared or undeclared,for telephone consultations, records or xrays necessary for Delta Dental to make abenefit determination, that would not havebeen made if you did not have coverage,that you are not legally obligated to pay,except charges from a tax-supportedinstitution of the State of Texas for care ofmental illness or retardation and charges forservices or materials provided under theTexas Medical Assistance Act of 1967,for services or supplies furnished by anagency of the U.S. or a foreign government,unless excluding the charges is illegal,for services while you are not under thedirect care of a dentist

But recognizing that dental problems can occur even with regular care, the plan also covers most other types of dental treatment. The A&M Dental plan is funded by The Texas A&M University System, and claims are administered by Delta Dental Insurance Company (Delta Dental). This booklet provides a summary of your dental coverage in everyday .