Transcription

2014 ANNUAL REPORTwww.debtwave.comPage 1

TABLE OF CONTENTSLetter from the Chairman .Page 3Mission, Vision, and History. Page 4New Initiatives for 2015 and Beyond . Page 5Board of Directors and Board of Advisors . Page 6Event Calendar . Page 7Wave of the Future . Pages 8-9Boost For Our Heroes . Pages 10-11Credit Counseling Statistics and Feedback . Page 12Employee of the Year. Page 13Client Testimonials. Page 14Donors – Client and Individual. Page 15Statement of Financial Activities . Page 162 Page

LETTER FROM THE CHAIRMANDear Friends:2014 was a year of growth and change for DebtWave Credit Counseling, Inc. We were ableto provide resources and services to over 23,500 attendees through our counseling sessions,seminars, workshops, and/ or community outreach events. As more and more people findthemselves in peril due to a variety of circumstances, DebtWave is here to help. Our rebrandingwill position us as a leader in the credit counseling space, and combined with our unparallelededucation programs through the San Diego Financial Literacy Center (SDFLC), DebtWave isready, willing, and able to become the preeminent resource for our community.In 2015, we will continue to support our military through the SDFLC’s Boost For Our Heroesprogram, providing 3,000 each quarter to a military family while also maintaining oureducation calendar of over 200 events annually. Our Debt Management Program yielded a recordnumber of graduates in 2014, with more than 2,400 individuals completing the program andbecoming debt-free. We also witnessed an increase in enrollments from the previous year asnearly 2,000 individuals started on the path to financial freedom in 2014.We look forward to another banner year and thank you for your continued support of ourorganization.Sincerely,Antony MuriguAntony Murigu3 Page

DEBTWAVE CREDIT COUNSELING, INC.MISSION, VISION, AND HISTORYIn 2001, DebtWave was established as a 501(c)3 nonprofit organization with the vision of delivering financialeducation and debt management services. Similar to today, many households were facing budgetary challenges,money mismanagement issues, and an overall lack of financial education. As we enter 2015, the need and requestfor educational workshops and debt management services is still in high demand. By providing top-tier creditcounseling and educating on the best methods to manage and eliminate debt, we empower our clients to becomefinancially fit and self-sufficient.Our mission is to educate the public on the proper use of credit through budget management, to offersound counseling, and to assist clients in reducing and eliminating debt. We deliver services at the higheststandards of professionalism so that your transition to better financial health is both pleasant and personal.It is our passion at DebtWave to provide you with the best education and most appropriate programs to manageyour debt and become financially fit. Because we know how difficult it is to reduce debt, we make it simple byoffering services and programs that are both informative and practical.SAN DIEGO FINANCIAL LITERACY CENTER (SDFLC)Since its inception, DebtWave has been extremely active in the San Diego community with our outreach effortsfocused on youth, military, and low-to-moderate income families. Today, the community outreach program isstronger than ever under its new moniker, San Diego Financial Literacy Center (SDFLC). We are continuallygrowing our outreach and partnerships evidenced by the over 100 community and corporate partners workingwith us to achieve our mission and vision each day.The SDFLC continues to bring real, relevant, and topical personal finance education to our region. All of theSDFLC programs and services are provided free of charge. The core programs continue to focus on youth andlow-income persons, but in 2014, we became heavily involved with the military population as well. The SDLFChelps by enhancing your financial IQ and is working to meet its vision of turning San Diego into “America’sFinest Financially Literate City.”The mission of the San Diego Financial Literacy Center is to educate and empower individuals and families tomake sound financial decisions and develop positive personal finance habits for life.4 Page

NEW INITIATIVES FOR 2015 AND BEYONDDebtWave started a rebranding effort beginning in fall of 2014 and introduced our rebranded image in January2015. A revamped website featuring: a new logo, a fresh color scheme, and our new slogan – “Making Your LifeSimple” – provides us with an opportunity to better serve our community and constituents. Our unofficialmascot, a piggy bank, can be found throughout our website, on our logo, and in our videos. Also, as part ofour rebranding efforts, ourcommunity outreach departmenthas become San Diego FinancialLiteracy Center.DebtWave also began development of our online portal, dubbed Payoff Pilot. Setto launch in June 2015, Payoff Pilot will allow individuals to perform a self-guidedcredit counseling session and learn about the many debt management tools andresources available. This software will allow individuals to view their credit reportand score, create a budget, see their potential savings, and analyze a variety of debtrepayment options.The 2015 to 2016 strategic plan of DebtWave is to continue to provide top-tier credit counseling and worldclass personal finance education through the SDFLC. Developing a true philanthropic model in which thecommunity can support our efforts to bring fundamental financial change to our most at-risk populations willbe the benchmark of our outreach program for the foreseeable future. Focusing on our youth, military, andlow-income citizens is imperative to ensure the financial future of our city, state, and nation. As more and moreAmericans and San Diegans must deal with debt on a daily basis, DebtWave and the SDFLC will work tirelesslyto enhance peoples’ financial IQ so that they can become financially fit and debt-free.5 Page

BOARD OF DIRECTORSBOARD OF ADVISORSDEBTWAVE CREDIT COUNSELING, INC.SAN DIEGO FINANCIAL LITERACY CENTERAntony MuriguChairman EmeritusTriple Three, Inc.John CasariettiCFOLibre Technologies, Inc.Michael ButskoVice-President and TreasurerInvestment Officer, Wells Fargo AdvisorsSharon GlasseyPartnerGlassey Smith Consumer AttorneyDouglas TokarikSecretaryChief Operation, Go Motion, Inc.Andy GuzenskiArea Vice PresidentGallagher Levine Insurance CompanyKEY PERSONNELMichelle BlackburnDirector of Human ResourcesMike MarsdenDirector of OperationsBrad PaganoDirector of Community Development andManaging DirectorChase PeckhamDirector of Community OutreachCarlos PerezDirector of Counseling ServicesJeff Johnson, (USMC ret.)OwnerAeon Computing, Inc.Antony MuriguPresidentTriple Three, Inc.Barry White, (USN ret.)DirectorNavy Marine Corps Relief Society Naval BaseSan DiegoRich WhitworthManaging DirectorFirst Allied SecuritiesScott YatesVice President/ Branch ManagerSilvergate Bank6 Page

EVENTS CALENDAR2014SDFLC Relaunch EventFebruary 26, 20142nd Quarter Educational Luncheon andBoost For Our Heroes Award PresentationJune 27, 2014Kaplan College, San Diego, CA20151st Quarter Educational Luncheon andBoost For Our Heroes Award PresentationMarch 27, 20152nd Quarter Educational Luncheon andBoost For Our Heroes Award PresentationJune 26, 20151st Annual Boost For Our Heroes GolfClassicAugust 25, 2014Del Mar Country Club2nd Annual Boost For Our Heroes GolfClassicAugust 24, 2015San Diego Country Club3rd Quarter Educational Luncheon andBoost For Our Heroes Award PresentationSeptember 26, 2014Kaplan College, Vista, CA3rd Quarter Educational Luncheon andBoost For Our Heroes Award PresentationSeptember 25, 2015Manage Your Money WeekOctober 18-25, 20144th Quarter Educational Luncheon andBoost For Our Heroes Award PresentationDecember 19, 2014SDFLC OfficeThe relaunch of the SDFLC on February 26, 2014Manage Your Money WeekOctober 17-24, 20154th Quarter Educational Luncheon andBoost For Our Heroes Award PresentationDecember 18, 2015Live Well and Boost CampaignsMay and November 2015Members of the Marine Corps next to players at our 1st Annual Boost ForOur Heroes Golf Classic7 Page

WAVE OF THE FUTURECommunity OutreachCoordinator, Felipe AHigh Schorevalo, wool studentsrking withon IntroduLending pction to Creresentatiodit andn on January 22, 2014Craw fordWave of the Future is SDFLC’s financial educationprogram designed to further educate our nextgeneration about the nuances of credit, debt, budgeting,and how to become financially responsible adults. Bypreparing our youth population for their financialfuture via online tools, workbooks, and digitalresources, we are able to help shape the financial habitsthat they will need to be successful. The utilization ofinteractive workshops, games, and the introduction ofreal-life financial scenarios further prepare our youthconstituents to become and stay financially fit.The Wave of the Future program topics include: properuse of credit, introduction to credit and lending,creating a spending plan (budget), understandingcredit reports and scores, how to read and understandfinancial documents, the basics of saving, and a lifeskills module on what to expect after high school.udents atBu siness stcademy ofArfoontitaar y 4, 2014redit presenl on FebruBuilding CHigh SchootonemirClaCurrent partners of the Wave of the Future programinclude: San Diego Unified School District, San DiegoCommunity College District, Clairemont High SchoolAcademy of Business, Southwestern College, PalomarCollege, and more. Our 2014 event calendar washighlighted by working with the Umoja program ofGrossmont College at the scenic Mission Trails RegionalPark Community Center, a program that targetsunderrepresented students in San Diego County.Chase Peckham with Umoja students and instructor, JamesCanady, on May 9, 20148 Page

WAVE OF THE FUTUREMoney Management workshop at Mira Costa College, San ElijoCampus on April 4, 2014End of the workshop class picture at Mira Costa College2014 STATISTICS ABOUT ATTENDEES Number of High School workshops – 36 with total attendees of 1,040Number of Higher Education workshops – 106 with total attendees of 3,364Number of attendees at Smart With Your Money outreach events – 12,44347% are between 14 and 18 years old53% are between 18 and 24 years old50% are male and 50% are female70% of the attendees felt strongly that presentations were useful and informative96% agree that the information provided was easy to understand98% agree that the presenter was knowledgeable about the topics discussed96% agree that the information would help them with future financial decisionsSOME OF OUR EDUCATIONAL PARTNERSFor a list of all partners, visit www.sdflc.org9 Page

BOOST FOR OUR HEROESSOME OF OURMILITARY PARTNERSBoost For Our Heroes is a comprehensive program geared towards active duty,transitioning, and veteran military members that provides them with financialeducation and assistance. Working with community and collaborative partners,such as Navy Marine Corp Relief Society, Fleet and Family Support Centers, andSupport the Enlisted Project (STEP), the SDFLC provides clear, concise, and nonduplicative personal finance education via workshops, seminars, and one-on-oneconsultations.In 2014, the SDFLC conducted forty workshops including: Understanding VAHome Loans, First Time Home Buyers, Financial Management, Debt Management,Understanding Your Credit Report and Score, Conquering Your Credit, andmore. By working directly with our military members and helping them reachself-sufficiency, we are helping to break the cycle of financial mismanagement thatcurrently plagues our military.2014 STATISTICS ABOUT OUR ARMED FORCES MEMBERS Over 1/3 of all military families have difficulties covering expenses.Over half of all enlisted personnel have engaged in credit card debtmismanagement.Transition into civilian life can lead to long periods of underemployment.There is an overall lack of financial education based on environment andexperience.There is a general mismanagement of money – living paycheck to paycheck.There is a stigma faced by admitting that you may need help.For a list of allpartners, visitwww.sdflc.org10 Page

BOOST FOR OUR HEROESBecause of these statistics, the Boost For Our Heroes program also provides a quarterly award of 3,000 to amilitary member or military family. Each quarter, an impartial panel will select one constituent due to financialhardship and develop an integrated financial plan. In 2014, the SDFLC gave 12,000 to four service members(active and veteran).First Quarter Boost For Our Heroes awardee, ENS ThomasBaker, U.S. Navy, on January 26, 2014Second Quarter Boost For Our Heroes awardee, ShaniceJones, U.S. Navy, on June 27, 2014Third Quarter Boost For Our Heroes awardee, StephanieRodriguez, AM2, U.S. Navy, on September 26, 2014Fourth Quarter Boost For Our Heroes awardee, DerrickTorrance, U.S. Marine (Retired), on December 16, 20142014 DATA Worked with 6,441 military personnel via workshops and eventsProvided over 200 individual counseling sessionsSaw an average decrease in debt by almost 10%Almost half of constituents developed or began their savings plan11 Page

CREDIT COUNSELING STATISTICS AND FEEDBACK The total number of clients that enrolled onto our Debt Management Program (DMP) in 2014 increased12% year over year.The average total credit card debt for enrollees increased more than 7% from 2013.Client’s average payment decreased nearly 15% on the DMP.Client’s average monthly savings from reduced interest rates was 130.Client’s average monthly interest rate decreased more than 50% in 2014 when joining our DMP.The average FICO score for clients that completed their DMP in 2014 was 712, a 6% increase from thosewho completed their DMP in 2013.New Consumer InquiriesClients CounseledClients Enrolled onto DMPTotal Credit Card DebtAverage Payment Prior to DMPAverage Payment on DMPAverage Interest Rate Prior to DMPAverage Interest Rate on DMPAverage Number of Credit CardsAverage FICO Score Prior to DMPAverage FICO Score After DMPDebt Management Program GraduatesAverage AgeAverage Annual Household Income2013201430,8354,1021,727 15,738 488 40818.70%9.00%4.705616702,26445.52 58,53636,1254,1791,948 16,889 487 41618.37%9.11%4.856037122,42044.85 56,664DebtWave continues to receive positive feedback from active Debt Management Program clients through ourannual online survey. Out of the total 446 surveys received in 2014, the overall satisfaction rate was 97.30%.Our certified credit counselors maintain excellence and high standards by completing rigorous training aswell as continuing education modules. We are happy to offer our clients services in both English and Spanishand have found that over 97% of all clients would refer us to a friend for their debt management and financialeducation needs.SOME OF OUR PROGRAM SUPPORTERS12 Page

EMPLOYEE OF THE YEAROne of our greatest assets is our employees. Each year, we choose an employee of theyear that best exemplifies the values that permeate the culture of DebtWave. Hard work,dedication, honesty, perseverance, and a willingness to assist whenever and whereverneeded are just some of the qualities that are exuded by our 2014 winner, DenisseGutierrez. Denisse combines these traits along with a professional demeanor that isrespectful and considerate. She is a conscientious leader who lets her actions speaklouder than her words.Denisse joined the team in June of 2012 and brought with her a tremendous attitude and willingness to learnand grow. Her potential is limitless as she has, in a brief time, excelled in many roles. Starting as a certified creditcounselor where she provided top-tier counseling to her clients via her genuine and articulate nature, she alsoexhibited the one trait that made her one of the best counselors at DebtWave – being an active listener. Promotedto Counseling Manager, Denisse continues to lead our team of experienced counselors on a day-to-day basis,and her leadership skills have helped in the thousands of free counseling sessions offered. Additionally, Denissehas been an integral part of the team to implement our student loan consolidation program as well. Thesediverse roles require Denisse to constantly maintain the utmost professionalism, stay abreast of current trainingmethodologies, and challenge her staff to be their best and perform at the highest levels.We are lucky to have Denisse as part of our management team and are proud of her accomplishments thus far.Congratulations Denisse!13 Page

CLIENT TESTIMONIALSDEBTWAVE CREDIT COUNSELING, INC.“My experience with DebtWave has changed mylife! Everyone there has been kind, thorough, andwonderful! It was so easy for the company to gothrough my debt history and figure out the bestway for me to get out of it!! They have taken yearsof stress off my back and given me a light at theend of the tunnel and a way out. I feel a greatamount of trust with this company!!”– Michelle“DebtWave is a fantastic organization thatmade a difficult process simple. They werevery responsive and handled my accountwith the utmost respect. They make gettingout of debt easy!”– Ryan“DebtWave showed me the light at the endof the tunnel. They consolidated my creditcard debt at an affordable monthly rateand I will have it paid off over a four-yearperiod rather than thirty!”– EricSAN DIEGO FINANCIAL LITERACY CENTER“I had at least five students stay after classtoday telling me how fun your presentationwas and how much they learned! Theyloved it! Thank you.”– Stephanie, Associate Counselor/Professor at MiraCosta College“I want to thank you for taking your time to educate ourcommand personnel with a magnificent presentation.It was great to have an expert of your caliber to educateon Personal Financial Management (PFM). I specificallyadmired your confidence, instructor technique, and theway that you presented the topic in front of us ”– LSC (SW/AW) Rodel, USN from ATG San Diego“I have had the pleasure of working with the San Diego Financial LiteracyCenter for a little over seven months now, and I have been impressed with theorganization’s commitment to helping individuals in financial distress learn tobetter manage their finances. Individuals can benefit greatly from the SDFLC’sprograms, which is why we have partnered with the organization. Now, due to theSDFLC, we are able to do even more for service members and their families ”– Jack, Executive Director at Operation Homefront – California14 Page

CORPORATE DONORS 5,000 - 9,999 2,500 - 4,999 1,000 - 2,499 250 - 999Beck SteelEverbankOn BudgetStudent Loan AssistanceCenterThe Patio RestaurantGroupREIGSilvergate BankStudent Loan ServicesBIOCOM PurchasingGroupChugachFedCom TechnologiesLower My BillsNetSuitePacific DebtPrimary FundingCorporationSure AscentVeterans UnitedCox FoundationGlassey SmithGo MotionINDIVIDUAL DONORS 7,500 5,000 - 7,499 2,500 - 4,999 1,500 - 2,499 500 - 1,499 100 - 499 10 - 99Randy RiveraAnonymousGary and Lisa LevineWessal KhaderMichael ButskoAntony MuriguDoug TokarikWilliam LynchBradley and Sara PaganoJason SeversonDavid AlemianBrian BlackburnMichelle BlackburnRandy BlackburnSarah DavisAndrew GuzenskiJohn HardyMichael MallotMike MarsdenChase and Keri PeckhamJeffrey SmithsonScott YatesSean YatesJames WhiteFelipe ArevaloDamon AyersChad BakerEric CaballeroJennifer CalhounJohn CasariettiGeorge Davis and NoelWheelerMark GregoryDenisse GutierrezMike HymesHolly and John KennedyShannon MatwiyoffTed ParkmanCarlos PerezRichard WhitworthStephen Woodcock15 Page

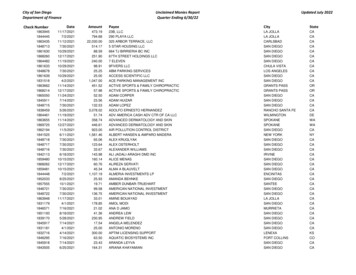

STATEMENT OF FINANCIAL ACTIVITIESASSETS20142013 379,943 332,775Current Assets Cash– Unrestricted Client Trust Funds– Restricted Accrued Income Prepaid ExpensesTotal Current Assets 94,251 55,982 20,411 14,346 508,951 31,097 42,762 462,616Fixed AssetsOther Assets 51,922 50,914 77,658 54,270Total Assets 611,787 594,544LIABILITIES AND NETASSETS20142013Current Liabilities Accounts Payable Accrued Expenses Client CreditorPayablesTotal CurrentLiabilitiesNet Assets UnrestrictedTotal Liabilities andNet Assets 17,360 33,386 94,251 47,111 93,672 55,982 144,997 196,765 466,790 611,787 397,779 594,544UNRESTRICTED NETASSETSRevenue, Gains, andOther Support Service FeeRevenue First Pay Revenue Fairshare Grant Income Other IncomeTotal Revenue, Gainsand Other Support Less Service FeeRefundsTotal Revenue, Gains,and Other Support(Net)Expenses Client Services Program/Education/Marketing Expenses Management andGeneral Fundraisingand VolunteerRecruitmentTotal ExpensesIncrease inUnrestricted NetAssets20142013 1,794,659 1,840,953 102,038 88,973 729,745 900,389 699,687 647,762 40 930 3,296,469 3,478,980 0- 12,207 3,296,469 3,466,773 84,355 130,218 86,978 80,052 2,920,966 3,611,913 91,919 21,346 3,227,458 3,800,289 69,011- 333,51616 Page

9325 Sky Park Court Ste 260 San Diego CA 92123http://www.sdflc.org/Tax ID Number: 91-215-650417 Page

Kaplan College, San Diego, CA 1st Annual Boost For Our Heroes Golf Classic August 25, 2014 Del Mar Country Club 3rd Quarter Educational Luncheon and Boost For Our Heroes Award Presentation September 26, 2014 Kaplan College, Vista, CA Manage Your Money Week October 18-25, 2014 4th Quarter Educational Luncheon and Boost For Our Heroes Award .