Transcription

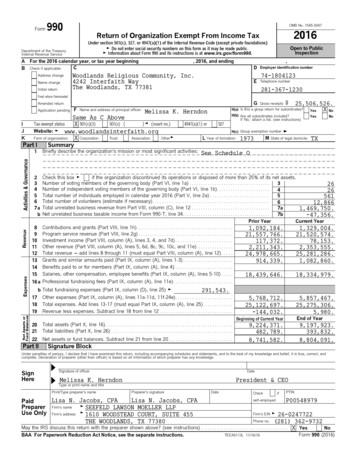

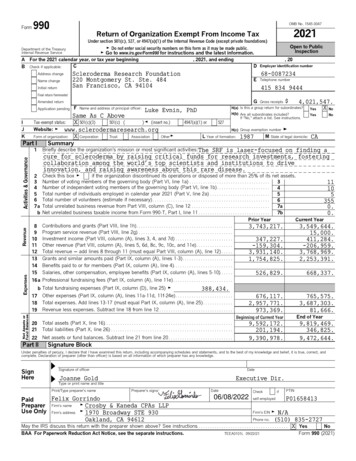

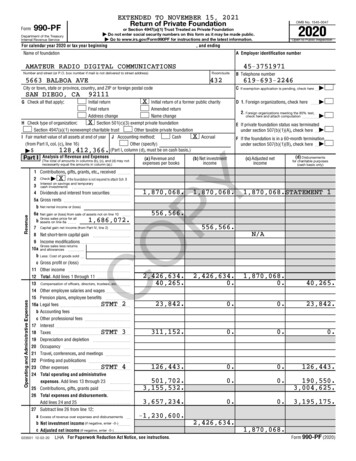

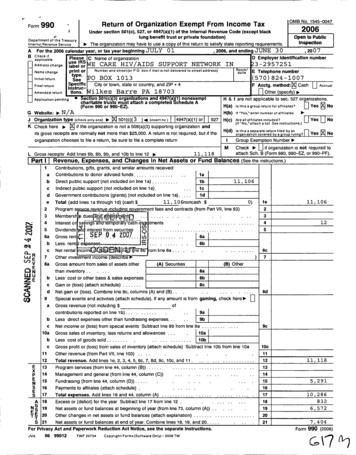

Form0, The organization may have to use a copy of this return to satisfy state reporting requirements.For the 2006 calendar year , or tax year beginning JULYifPlease C Name of organizationB CheckAuse IRSl abel ororp 1Initial returnSeeFinal returnSpecificInstruc tlons .AmendedreturnApplication pending01, 2006 , and ending JUNEE CARE HIV/AIDS SUPPORT NETWORK INSuom/i teO BOX 1013IPAE Telephone number(570)824-1007H & I are not applicable to sec. 527 organizations.H(a) Is this a group return for affiliates?G Website : N/AH(b ) if "Yes,' enter number of affiliatesOrganization type (checkonlyone) KCheck here501(c)(3).4 (insert no)AccrualOther (specify) 18703 Secti on 501 c 3) organ i zat i ons an d 4947(a)( 1 ) nonexemptcharitable trus must attach a completed c edule AJ, 2007F Acctg . method : FT, CashCity or town, state or country, and ZIP 4Barre303-2957251RoNumber and street (or P 0 box if mail is not del i vered to street address )i 1 ke sOpeb to PublicInspectio nD Employer Identification number(Form 990 or 990-EZ).p.2006lung benefit trust or private foundation)Department of the TreasuryInternal Revenue ServiceName changeNo. 1545-0047Under section 501 ( c), 527 , or 4947( a)(1) of the Internal Revenue Code (except black1Address change1 OMBReturn of Organization Exempt From Income Tax-9904947(a)(1) or527H(C)11Yes No Are all affiliates included?(if "No," attach a list See instructions.)YesNoYesNoif the organization is not a 509(a)(3) supporting organization andIts gross receipts are normallyY not more than 25,000. A return is not required, but if theorganization chooses to file a return, be sure to file a complete returnaote return fa g r byH(d) ois gatisu p anani zationorcovered b arulin g ?IGroup Exemption Number MCheck if organization is not required toattach Sch. B (Form 990, 990-EZ, or 990-PF).11, 118L Gross receipts' Add lines 6b, 8b, 9b, and lob to line 12 Part 1Revenue . Expenses . and Chanaes in Net Assets or Fund Balances (See the Instructions.)1abcde 10VLC.LEV23456abc78a12Total revenue . Add lines le, 2, 3, 4, 5, 6c, 7, 8d, 9c, 10c, and 11 .12131415161718192021Program services (from line 44, column ( B)) . . . .Management and general (from line 44, column (C))Fundraising (from line 44, column (D)) .Payments to affiliates (attach schedule)Total expenses . Add lines 16 and 44, column (A) . .Excess or (deficit) for the year Subtract line 17 from line 12. . .Net assets or fund balances at beginning of year (from line 73, column (A)) . .Other changes in net assets or fund balances (attach explanation).Net assets or fund balances at end of year. Combine lines 18, 19, and 20.1314151617181920219aANSTTES.For Privacy Act and Paperwork Reduction Act Notice , see the separate Instructions .JVA2345bc10abc11bcd4ENSEleMembersdues a-hd'6,'F nttD. . . . . .tmentsInterest o sa Insand'temporarycash l.U)DividendsInterest from securities. . .6aGross ren. S E P 0.4 ZOO!. W . .Less. rent I e lNet rental ncomrom line 6a . . .ttr c I neOther investment income escrle)(B) OtherGross amount from sales of assets other(A) Securities8athan inventory . .8bLess, cost or other basis & sales expenses8cGain or (loss) (attach schedule) .Net gain or (loss). Combine line 8c, columns (A) and ( B) . .Special events and activities (attach schedule). If any amount is from gaming , check here BoofGross revenue (not including 9acontributions reported on line 1b) . . .9bLess direct expenses other than fundraising expenses.Net income or (loss) from special events Subtract line 9b from line 9a . .Gross sales of inventory, less returns and allowances .10a10bLess cost of goods sold .Gross profit or (loss) from sales of inventory (attach schedule) Subtract line 10b from line 10aOther revenue (from Part VII, line 103 ) . . . .gNEEXContributions, gifts, grants, and similar amounts received:Contributions to donor advised funds . .laDirect public support (not included on line 1a) . , . , .11, 1061b.Indirect public support (not included on line 1a).1c1dGovernment contributions (grants) (not included on line 1a). . , ,11, 10 6noncash 0)Total (add lines 1a through 1d) (cash Programsevenue Incl udlna overnm ent fees and contracts (from Part VII , line 93)0699012TWF 20754Copyright Forms (Software Only) - 2006 TW.11, 106126c78d9c10c1111, 1185,29110,2868326 , 5727 , 4 04Form 99U (2006)q

Paget23-2957251Form 990 (2006) .WE CARE HIV/AIDS SUPPORT lorganizationsmustcompletecolumn(A)(B),P1 Statement ofand (4) or anlzatlons and section 4947(a')(1) nonexempt charitable trusts but optional for others. (See22a22b232425abcFunctional Expensesthe Instruc?ions.)Do not include amounts reported on line6b, 8b, 9b, 10b, or 16 of Part I.Grants paid from donor advised funds (attach sched.)noncash (cash 22aIf this amount includes foreign grants, ck. here Other grants and allocations (attach schedule)noncash (cash 22bIf this amount includes foreign grants, ck here Specific assistance to individuals (attachschedule) . . .2324Benefits paid to or for members (attach schedule) .Compensation of current officers, directors, keyemployees, etc. listed in Part V-A (attach schedule)25aCompensation of former officers, directors, keyemployees, etc listed in Part V-B (attach schedule)25bCompensation and other distributions, not includedabove, to disqualified persons (as defined under28293031323334353637383940section 4958(f)(1)) and persons described in section4958(c)(3)(B) (attach schedule) . .Salaries and wages of employees not included onlines 25a, b, and c .Pension plan contributions not included on lines 25a,b and c . . . . .Employee benefits not included on lines 25a - 27.Payroll taxes . . .Professional fundraising fees. .Accounting fees . .Legal fees. .Supplies. . . . .Telephone.Postage and shipping. .Occupancy. .Equipment rental and maintenance . .Printing and publications . . .Travel . . . .Conferences, conventions, and meetings . .41Interest .42Depreciation, depletion, etc. (attach schedule).262743.(B) Programservices(C) Managementand general(D) 6721, 6191, 6191, 5334142Other expenses not covered above (itemize):a See attachment #143abc43b43cd43de43ef43fg43g44(A) Total3,462Total functional expenses . Add lines 22athrough 43g. (Organizations completingcolumns (B)-(D), carry these totals to lines04013-15). . .0,286. .Joint Costs . Check U If you are following SOP 98-2Are any joint costs from a combined educational campaign and fundraising solicitation reported in (B) Program services?. . 0 Yes, (II) amount allocated to Program services If "Yes," enter ( I) aggregate amount of these point costs , and (Iv) the amount allocated to Fundraising (III) the amount allocated to Management and general JVA0699012TWF 20755Copyright Forms ( Software Only) - 2006 TW,291NoForm 990 (2006)

Form 990 (2006)WE CARE HIV/AIDSSUPPORT N323-2957251Pert III I Statement of Program Service Accomplishments (See the instructions)Form 990 is available for public inspection and, for some people, serves as the primary or sole source of information about a particular organization.How the public perceives an organization in such cases may be determined by the information presented on its return Therefore, please make surethe return is complete and accurate and fully describes, in Part III, the organization's programs and accomplishments.What is the organization ' s primary exempt purpose?jo See attachment#2All organizations must describe their exempt purpose achievements in a clear and concise manner. State the number of clientsserved , publications issued , etc. Discuss achievements that are not measurable . ( Section 501 (c)(3) and (4) organizations and4947(a)(1) nonexempt charitable trusts must also enter the amount of grants and allocations to others )Program ServiceExpenseseuired for 0c(Rand ( 4) orgs., an(d)(3)4947(a)(1) trusts, buto p tional for others.a(Grants and allocations ) If this amount includes foreign grants , check here(Grants and allocations ) If this amount includes foreign grants, check here. w(Grants and allocations ) If this amount includes foreign grants, check here .bc. jo,d(Grants and allocations ) If this amount includes foreign grants, check heree Other program services ( attach schedule)) If this amount includes foreign grants , check here, .( Grants and allocations . , . . , . .f Total of Program Service Expenses (should equal line 44, column (B), Program services)JVA0699034TWF 20756Copyright Forms ( Software Only) - 2006 TW. , , . , tForm 990 (2006)

Form 990 (2006)WE CARE HIV/AIDS SUPPORT NPert IV Balance Sheets (See the Instructions.)Note :Where required, attached schedules and amounts within the descriptioncolumn should be for end-of-year amounts only.Cash -- non-interest-bearing . .Savings and temporary cash investments .47abAccounts receivable . . .Less: allowance for doubtful accounts48abPledges receivable . .48aLess allowance for doubtful accounts .48b. .Grants receivable . . . . . . .Receivables from current and former officers, directors, trustees, andkey employees (attach schedule) .Receivables from other disqualified persons (as defined under section4958(0(1)) and persons described in section 4958(c)(3)(B) (attach schedule)Other notes and loans receivable (attachschedule)Less: allowance for doubtful accounts .51bInventories for sale or use.Prepaid expenses and deferred charges .Investments -- publicly-traded securities . . CostFMVInvestments -- other securities (attach schedule) CostFMVInvestments -- land, buildings, andequipment basis . . .55aLess- accumulated depreciation (attachschedule)55b. . . .Investments -- other (attach schedule ) .Land, buildings, and equipment basis57aLess accumulated depreciation (attachschedule) .57b. . .Other assets, including program-related investments(describe 5. ,Page 4(A)Beginning of year45464950aETS23-2957251. . .1,3765 , 12 947a47b(B)End of year45462 , 2755 , 12 947cTotal assets ( must eq ual line 74 ) Add lines 45 throu g h 58Accounts payable and accrued expenses . .Grants payable . . .Deferred revenueLoans from officers, directors, trustees, and key employees (attachschedule). . . .Tax-exempt bond liabilities (attach schedule) . . .Mortgages and other notes payable (attach schedule) .Otherliabilities (describe 48c4950a50b51c525354a54b55C5657c586 , 5 05596061627 , 4 046364a64b65)S66Total Ilabllitles . Add lines 60 through 65 . .Organlzatlons that follow SFAS 117, check here and complete lines 67through 69 and lines 73 and 74N FE UT NDAS BS AE LT AS NCO ER SJVA67Unrestricted066.6768Temporarily restricted . .69Permanently restrictedOrganizations that do not follow SFAS 117 , check here and completelines 70 through 7470Capital stock, trust principal, or current funds . . .71Paid-in or capital surplus, or land, building, and equipment fund .72Retained earnings, endowment, accumulated income, or other funds .73Total net assets or fund balances . Add lines 67 through 69 or lines70 through 72. (Column (A) must equal line 19 and column ( B) must. . . . . .equal line 21)74Total Ilabllitles and net assetstfund balances . Add lines 66 and 7368690699034TWF 20757.Copyright Forms ( Software Only) - 2006 TW.6 , 5726,5726 , 57 2707172737407 , 4 047,4047 , 4 04Form 990 (2006)

23-2957251Page 5WE CARE HIV/AIDS SUPPORT NForm 990 heRevenueperAudited:Part IV-A Reconciliation of instructions )abTotal revenue, gains, and other support per audited financial statements .Amounts included on line a but not on Part I, line 12b1. . . .1 Net unrealized gains on investments.b22 Donated services and use of facilities . .b3. . . .3 Recoveries of prior year grants .4 Other (specify)*b4cd12. .Add lines bill through b4 . .Subtract line b from line a .Amounts included on Part I, line 12, but not on line a:d1Investment expenses not included on Part I, line 6b . . .a.,bCOther (specify),d2. . .Add lines d1 and d2 . .Total revenue (Part I, line 12). Add lines c and d .epart IV-Bab. de0Reconciliation of Expenses per Audited Financial Statements With Expenses per ReturnTotal expenses and losses per audited financial statements .Amounts included on line a but not on Part 1, line 17:1 Donated services and use of facilities .2 Prior year adjustments reported on Part I, line 20 . . . . . .3 Losses reported on Part I, line 20 . . .4 Other (specify):.ab1b2b3b4Add lines b1 through b4 . . . . . . . . .Subtract line b from line a.c.Amounts included on Part I, line 17, but not on line a:dd11 Investment expenses not included on Part I, line 6b. .2 Other (specify)d2eAdd lines d1 and d2 .,. .Total expenses (Part I, line 17) Add lines c and d .Part V-Ab. Cde0Current Officers , Directors , Trustees, and Key Employees (List each person who was an officer, director,trustee , or key employee at any time during the year even if they were not compensated.) (See the instructions )( D) Contributions to(E) Expense account(B)(C) Compensation(A) Name and addressemployee benefit plans and other allowances(If not pald , enterTitle and average hours per& deferredweek devoted to position-0-.)com pensation p lansSee attachment #3JVA0699056TWF 20758Copyright Forms ( Software Only) - 2006 TWForm VVU (2006)

23-2957251Form 990 (2006)WE CARE HIV/AIDS SUPPORT NPart V-A Current Officers , Directors , Trustees , and Key Em p loy ees (continued )75a Enter the total number of officers, directors, and trustees permitted to vote on organization business at boardmeetings .bcd.Do any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated employeeslisted in Schedule A, Part I, or highest compensated professional and other independent contractors listed in ScheduleA, Part II-A or II-B, receive compensation from any other organizations, whether tax exempt or taxable, that are related.to the organization? See the instructions for the defenition of "related organization." . . If "Yes," attach a statement that includes the information described in the instructions. . . .Does the organization have a written conflict of interest policy? . . . . .Part 4178ab7980ab81abJVA75bX75cX75dXFormer Officers , Directors , Trustees , and Key Employees That Received Compensation or OtherBenefits (If any former officer, director, trustee, or key employee received compensation or other benefits (described below)during the year, list that person below and enter the amount of compensation or other benefits in the appropriate column Seethe instructions.)(B) Loans andAdvances(A) Name and address77. Are any officers, directors, trustees, or key employees listed in Form 990, Part V-A, or highest compensated employeeslisted in Schedule A, Part I, or highest compensated professional and other independent contractors listed in ScheduleA, Part II-A or II-B, related to each other through family or business relationships? If "Yes," attach a statement thatidentifies the individuals and explains the relationship(s) . . .Part V-B76.Page 6Yes No(C) Compensation(if not paid,enter -0-)(D) Contributions toemployee benefit plans& deferredcomp ensation p lans(E) Expenseaccount and otherallowancesYesOther Information ( Seethe instructions.Did the organization make a change in its activities or methods of conducting activities? If "Yes," attach a detailed.statement of each change .Were any changes made in the organizing or governing documents but not reported to the IRS? . .If "Yes," attach a conformed copy of the changes.Did the organization have unrelated business gross income of 1,000 or more during the year covered by this return? .If "Yes," has it filed a tax return on Form 990 -T for this year? . . . . . . . .Was there a liquidation, dissolution, termination, or substantial contraction during the year? If "Yes," attach a statementIs the organization related (other than by association with a statewide or nationwide organization) through common. .membership, governing bodies, trustees, officers, etc., to any other exempt or nonexempt organization?.No7677XX78a78b79XXX80aX81bXIf "Yes," enter the name of the organization exempt orand check whether it isEnter direct and indirect political expenditures. (See line 81 instructions) .81aDid the organization file Form 1120 -POL for this year?. ,. . . . . . . . .0699056TWF 20759Copyright Forms ( Software Only) - 2006 TWnonexemptN/AForm 99U (2006)

Form 990 (2006)WE CARE HIV/AIDSPart VIInthpr Infnrmatinn f,nntirn, bSUPPORT NPage 7Yes No23-2957251Did the- organization receive donated services or the use of materials , equipment , or facilities at no charge or atsubstantially less than fair rental value? .If "Yes," you may indicate the value of these items here . Do not include this amount as revenue in Part I or as anexpense in Part II.N/A. ,1 82b( See instructions in Part Ill .) .Did the organization comply with the public inspection requirements for returns and exemption applications ? . .Did the organization comply with the disclosure requirements relating to quid pro quo contributions?. . .Did the organization solicit any contributions or gifts that were not tax deductible ? . .If "Yes," did the organization include with every solicitation an express statement that such contributions or gifts were82a83anot tax deductible ?. . .501(c)(4), (5), or ( 6) organizations a Were substantially all dues nondeductible by members ? .Did the organization make only in - house lobbying expenditures of 2,000 or less ? . .If "Yes" was answered to either 85a or 85b , do not complete 85c through 85h below unless the organization receiveda waiver for proxy tax owed for the prior year.N/A85cDues , assessments , and similar amounts from members . .85dN/ASection 162 ( e) lobbying and political expenditures . , . . . .85eN/AAggregate nondeductible amount of section 6033 (e)(1)(A) dues notices . .85fN/ATaxable amount of lobbying and political expenditures ( line 85d less 85e).Does the organization elect to pay the section 6033 (e) tax on the amount on line 85f? . .If section 6033 (e)(1)(A) dues notices were sent , does the organization agree to add the amount on line 85f to itsreasonable estimate of dues allocable to nondeductible lobbying and political expenditures for the following tax year?86aN/A501(c)( 7) orgs Enter : a Initiation fees and capital contributions included on line 12 , . .86bN AGross receipts , included on line 12 , for public use of club facilities . .87aN /A. .501(c)( 12) orgs . Enter a Gross income from members or shareholders.Gross income from other sources . ( Do not net amounts due or paid to other sources against87bN/Aamounts due or received from them ).At any time during the year, did the organization own a 50% or greater interest in a taxable corporation or partnership,or an entity disregarded as separate from the organization under Regulations sections 301 7701-2 and 301.7701-3?84b.If "Yes," complete Part IX. . . . . .At any time during the year, did the organization , directly or indirectly , own a controlled entity within the meaning of section. .512(b)(13)? If "Yes," complete Part XI . . . .501(c )(3) organizations Enter . Amount of tax imposed on the organization during the year under:N/AN/A , section 4955 section 4911 N/A ;section 4912 501(c )(3) and 501 (c)(4) orgs. Did the organization engage in any section 4958 excess benefit transaction during the yearor did it become aware of an excess benefit transaction from a prior year? If " Yes," attach a statement explaining each88atransaction . . .Enter : Amount of tax imposed on the organization managers or disqualified persons duringN/Athe year under sections 4912 , 4955 , and 4958 . . . . N/AEnter Amount of tax on line 89c , above , reimbursed by the organization . .All organizations At any time during the tax year, was the organization a party to a prohibited tax shelter transaction?. .All organizations Did the organization acquire a direct or indirect interest in any applicable insurance contract? .For supporting organizations and sponsoring organizations maintaining donor advised funds . Did the supportingorganization , or a fund maintained by a sponsoring organization , have excess business holdings at any time during the89byear?. . . . . . . .List the states with which a copy of this return is filed 90bNumber of employees employed in the pay period that includes March 12, 2006 ( See instructions) .Telephone no The books are in care of See attachment #4ZIP 4 Located at 89gAt any time during the calendar year, did the organization have an interest in or a signature or other authority over afinancial account in a foreign country (such as a bank account, securities account, or other financial account)?If "Yes," enter the name of the foreign country 85h88b89e891N/AN/AYesNo91bSee the instructions for exceptions and filing requirements for Form TD F 90-22 .1, Report of Foreign Bank andFinancial AccountsJVA0699078TWF 20760ACopyright Forms ( Software Only)- 2006 TWForm 990 (2006)

Form 990 (2006)WE CARE HIV/AIDS SUPPORT NPart VIOther Information (continued)23-2957251Page 8Yes No91cXc At any time during the calendar year, did the organization maintain an office outside of the United States? . , . .If "Yes," enter the name of the foreign country flo.92 Section 4947(a)(1) nonexempt charitable trusts iling Form 990 in lieu of Form 1041 -- Check here . . . . N/.A LI. , . p. 1 92N/Aand enter the amount of tax-exempt interest received or accrued during the tax year.[ Part VIIIAnalysis of Income-ProducinActivities (See the instructions )Excluded by section 512, 513, or 514(D)(C)ExclAmountcodeUnrelated business income(B)AmountNote : Enter gross amounts unlessotherwise indicated93 Program service revenue(A)Businesscode(E)Related or exemptfunction incomeabcdef Medicare/Medicaid paymentsg Fees & contracts from government agencies94 Membership dues and assessments .1295Interest on savings and temporary cash investments96Dividends and interest from securities .97Net rental income or (loss) from real estate'a debt-financed property.b not debt-financed property . .98Net rental income or (loss) from personal property99Other investment income .Gain or ( loss) from sales of assets other than inventory100101Net income or (loss) from special events .102Gross profit or (loss) from sales of inventory103Other revenue: abcde11104 Subtotal ( add columns ( B), (D), and (E))105 Total ( add line 104 , columns ( B), (D), and (E)) .Note : Line 105 plus line le , Part I, should equal the amount on line 12, Part I121001.12Part VIII Relationshi p of Activities to the Accom p lishm ent of Exem pt Pur poses ( See the instructions )Line No . Explain how each activity for which income is reported in column (E) of Part VII contributed importantly to the accomplishment of theVorganization's exempt purposes (other than by providing funds for such purposes).PartInformation Regardin g Taxable Subsidi aries and Disre g arded Entities See the instructions )(A)Name, address, and EIN of corporation,p artnershi p, or disreg arded entl(B)Percentage ofownershi p Int(C)Nature of activities%1 A(a) Did organization, during the year, receive any funds, directly or(b) Did the organization, during the year, pay premiums, directly orNote, If "Yes" to (bl file Form 8870 and Form 4720 (see InstructlolCopyright Forms (Software Only) -(D)Total Income(E)End-of-yearassets

Form 990(2006)Part XlPage 9Information Regarding Transfers To and From Controlled Entities .Complete only if the organizationis a controlling organization as defined in section 512(b)(13)Yes106No' Did the reporting organization make any transfers to a controlled entity as defined in section 512(b)(13) of the Code?If "Yes," complete the schedule below for each controlled entity.N/A(A)Name , address, of eachcontrolled entity(B)Employer IdentificationNumber(C)Description oftransfer(D)Amount of transferabcTotalsYes107NoDid the reporting organization receive any transfers from a controlled entity as defined in section 512(b)(13) of the Code?If "Yes," complete the schedule below for each controlled entity.N/A(C)(B)(A)Description ofName , address, of eachEmployer Identification(D)Amount of transfertransfercontrolled entityNumberabcTotalsYes108PleaseSignHere ' Signature of officerANDREW BULEZAType or print ne and titlec'vPRESIDENTP- 27Preparer's Firm's name (or yoursR JACOB ZA RAPAN INCuse Onlyif self-employed),' 104 NEW ALEXANDER STaddress, and ZIP 4Wilkes Barre PA 18702069909TWF 20762Copyright Forms ( Software Only) - 2006TW1DateDatePreparer's IL J(11signature/PaidJVANoDid the organization have a binding written contract in effect on August 17, 2006, covering the interest, rents, royalties,and annuities described in question 107 above?N/AUnder penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to thebest of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than officer) is based on all information of whic 1 parer has any knowledI Check if self-0 7employedF]Preer's SSN or PTIN (See Gen. Inst X)/ /6 - I-y7r5'? /EINPhoneno.X570-825-4388Form 990 (2006)

SCHEDULE A(Form 990 or 990-EZ)Organization Exempt Under Section 501(c)(3)OMB No . 1545-0047(Except Private Foundation) and Section 501(e), 501(f), 501(k),501(n), or 4947(a)(1) Nonexempt Charitable TrustSupplementary Information - (See separate Instructions.)Department of the TreasuryInternal Revenue Service2006 MUST be completed by the above organizations and attached to their Form 990 or 990-EZEmployer Identification numberName of the organization123-2957251WE CARE HIV/AIDS SUPPORT NETWORK IN.Part ICompensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees(See the instructions list each one. If there are none. enter "None.")(a) Name and address of each employee paid morethan 50 , 000(b) Title and average hoursc) Compensationper week devoted to position (( d) Contributions toempl. benefit plans &deferred compensation(e) Expenseaccount andother allowancesNONETotal number of other employees paid over 50,000 0Part II- A Compensation of the Five Highest Paid Independent Contractors for Professional Services(See the Instructions. List each one (whether individuals or firms). If there are none, enter "None.")(b) Type of service(a) Name and address of each independent contractor paid more than 50,000(c) CompensationNONETotal number of others receiving over 50,000 forprofessional services , . , . 0Part 5-8 Compensation of the Five Highest Paid Independent Contractors for Other Services(List each contractor who performed services other than professional services, whether individuals orfirms. If there are none, enter "None " See instructions )(a) Name and address of each independent contractor paid more than 50,0001(b) Type of serviceI (c) CompensationTotal number of other contractors receiving over 50,000 for other services . 0For Paperwork Reduction Act Notice , see the Instructions for Form 990 and Form 990 - EZ.JVA06990A12TWF 20742Copyright Forms ( Software Only) - 2006 TWSchedule A (Form 990 or 990 - EZ) 2006

Schedule A (Form 990 or 990-EZ) 2006 WEPart IIICAREHIV/AIDSSUPPORTNPage 223-2957251YesStatements About Activities (See the instructions .)During the year, has the organization attempted to influence national, state, or local legislation, including anyattempt to influence public opinion on a legislative matter or referendum? If "Yes," enter the total expenses paid(Must equal amounts on line 38,. or incurred in connection with the lobbying activities.Part VI-A, or line I of Part VI- B)1No1Organizations that made an election under section 501(h) by filing Form 5768 must complete Part VI-A. Otherorganizations checking "Yes" must complete Part VI-B AND attach a s

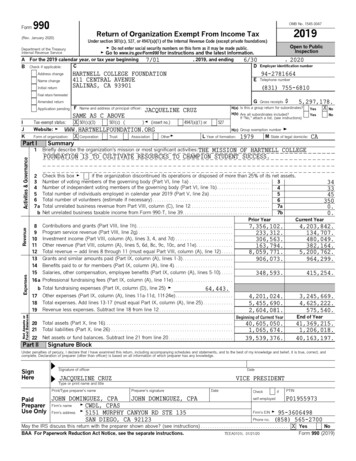

Form 990 - Return of Organization Exempt From Income Tax 1 OMBNo. 1545-0047 1 Undersection 501(c), 527, or 4947(a)(1) of the Internal RevenueCode(exceptblack 2006 lungbenefit trust orprivate foundation) Opebto Public