Transcription

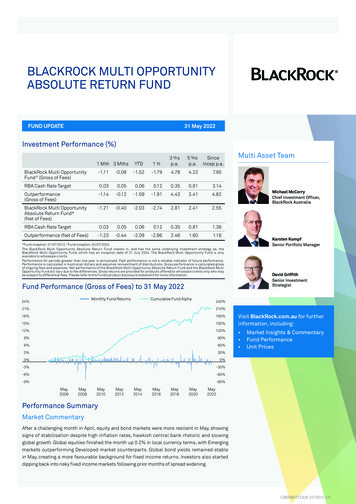

BLACKROCK MULTI OPPORTUNITYABSOLUTE RETURN FUNDFUND UPDATE31 May 2022Investment Performance (%)1 Mth 3 MthsBlackRock Multi OpportunityFund (Gross of Fees)-1.11-0.08YTD1 Yr3 Yrsp.a.5 Yrsp.a.-1.52-1.794.784.22SinceIncep p.a.7.95RBA Cash Rate ross of Fees)-1.14-0.12-1.59-1.914.433.414.82BlackRock Multi OpportunityAbsolute Return Fund*(Net of Fees)-1.21-0.40-2.03-2.742.812.412.55RBA Cash Rate TargetOutperformance (Net of Fees)Multi Asset 862.461.601.18Michael McCorryChief Investment Officer,BlackRock AustraliaKarsten KumpfSenior Portfolio Manager*Fund inception: 31/07/2013. Fund inception: 30/07/2004The BlackRock Multi Opportunity Absolute Return Fund invests in, and has the same underlying investment strategy as, theBlackRock Multi Opportunity Fund, which has an inception date of 31 July 2004. The BlackRock Multi Opportunity Fund is onlyavailable to wholesale clients.Performance for periods greater than one year is annualised. Past performance is not a reliable indicator of future performance.Performance is calculated in Australian dollars and assumes reinvestment of distributions. Gross performance is calculated grossof ongoing fees and expenses. Net performance of the BlackRock Multi Opportunity Absolute Return Fund and the BlackRock MultiOpportunity Fund will vary due to fee differences. Gross returns are provided for products offered to wholesale clients only who maybe subject to differential fees. Please refer to the Fund’s product disclosure statement for more information.David GriffithSenior InvestmentStrategistFund Performance (Gross of Fees) to 31 May 2022Monthly Fund Returns24%Cumulative Fund y2012May2014May2016May2018May2020Visit BlackRock.com.au for furtherinformation, including: Market Insights & CommentaryFund PerformanceUnit PricesMay2022Performance SummaryMarket CommentaryAfter a challenging month in April, equity and bond markets were more resilient in May, showingsigns of stabilisation despite high inflation rates, hawkish central bank rhetoric and slowingglobal growth. Global equities finished the month up 0.2% in local currency terms, with Emergingmarkets outperforming Developed market counterparts. Global bond yields remained stablein May, creating a more favourable background for fixed income returns. Investors also starteddipping back into risky fixed income markets following prior months of spread widening.CBDM0722A/S-2272815-1/5

Perfomance StatementEvent DrivenThe BlackRock Multi Absolute Return Fund had a negative return of-1.1% over the month of May (gross of fees).The Event Driven strategy (BlackRock Global Merger Partners) recordeda negative return in May as the merger spreads widened due to a mix ofinvestor de-risking, idiosyncratic news and regulatory action.Strategy ReviewUnderperformance drivers were broad-based with four of the fivehedge fund components posting a negative contribution for themonth. The Systematic Fixed Income Global Alpha component led theunderperformance, delivering a strong negative return. The other twodetracting components were Systematic Equity Market Neutral andFundamental Equity both of which delivered modest negative returncontributions for the month. Style Premia strategies followed with aslightly negative contribution. The Global Macro component posted amuted performance over the month.Systematic Equity Market-Neutral StrategiesThe Fund’s systematic equity market-neutral component, led by the32 Capital Fund, underperformed over the month. Three out of the foursub-strategies detracted which were slightly offset by small positivecontribution from the Emerging Markets (EM) sub-strategy.Top detractors: The largest detractor was Small Cap which stronglyunderperformed over the month reversing a large part of thecontribution from April. The largest detracting sleeves were Global andUS specific small cap implementations. The Mid Horizon component ofthe fund delivered a small negative contribution to fund performanceover May. At the underlying sleeve level, it was a bifurcated month ofperformance with the US and Cross Border in positive territory butunfortunately offset by weakness in Europe and APAC. Large Cap alsodelivered a small negative performance for the month.Top contributors: The largest contributor was the Emerging Marketssub-strategy which delivered a small positive contribution for themonth. Underperformance across the broader EM universe was offsetby positive contributions from China focus strategies. Within the broaderEM Universe, stock selection was very strong in Taiwan tech and Brazilindustrials.Systematic Fixed Income StrategiesThe systematic fixed income component of the Fund, implementedby the Fixed Income Global Alpha Fund (FIGA), posted a negativecontribution to the Fund performance in May. Credit and Mortgage& Securitized were the primary detractors, while Macro also postednegative returns for the month. Equity & Capital Structure were the lonecontributors, while Rates Relative Value was flat.Top detractors: Credit strategies were the main detractor in May asUS strategies drove underperformance. US cash bond strategy hadbenefitted from being long the lowest quality cohort of the universe butgave up those gains as the market moved reversed. The strategy washit on both sides throughout the month as long and short positionsdetracted over the period. Privates’ strategy also detracted amid adefensive selloff.Top detractors: An investment in the NortonLifeLock/Avast mergerdetracted from performance, as investors de-risked exposure andconsidered a lower standalone valuation for Avast following theCompany’s quarterly earnings announcement, causing the mergerspread to widen. An investment in the Healthcare Realty Trust (“HR”)/Healthcare Trust of America (“HTA”) merger also hindered performanceas HR received a preliminary proposal during the period, which ifaccepted would have scuttled the existing merger between HR andHTA. An investment in Rogers Communications/Shaw Communicationsfurther detracted from returns, as the Canadian Competition Bureaufiled litigation to block the transaction and the companies agreed not tocomplete the merger until the lawsuit is resolved.Top contributors: The Fund was invested in 5 mergers that closed duringthe month. An investment in the Oracle/Cerner merger contributed toperformance, as the merger spread tightened due to continued progresstowards the receipt of required regulatory approvals. Investments in theTD Bank/First Horizon and Microsoft/Activision Blizzard mergers werealso additive to returns as each of the merger spreads tightened duringthe period.Fundamental Equity Long/ShortThe Fund invests in three fundamental long/short equity strategies – theEmerging Companies Hedge Fund (Cayman), the Emerging CompaniesAbsolute Return Fund (UCITS) and the Global Equity Absolute ReturnFund – each of which recorded a negative return in May.Within the Emerging Companies strategies:Top detractors: 8 of the top 10 detractors were long holdings with themajority being UK listed mid-caps. The largest detractor was Integrafin,a UK wealth management platform for advisers, which disappointedin the month on lack of cost control. The major feature of this businessshould be high levels of recurring (and growing) revenues, and this hasindeed been true. However, the company felt it necessary to take a stepup in operating spend to deliver best in class service and so margins willneed to fall back from the mid 40% range. This should not really changethe fundamental investment case, but it is a disappointment givenprevious statements on cost control, and so the team has reduced theposition. The second largest detractor was RS Group (previously namedElectrocomponents) which had good results with upgrades but hasbeen caught in the sale of all things potentially cyclical. The fund retainsa holding as the team thinks the business plans here are compellingand expect a much bigger business in the next few years even if therewas to be a recession. The third largest detractor was from SigmaRoc, aUK mid cap industrial that has been sold off although profits continueto grow.Top contributors: Equity & Capital Structure strategies were positive inMay. US security selection drove gains with European security selectiondetracting. Performance was strongest in Consumer Discretionary tobegin the month where broad-based signal weakness drove shortsacross many subsectors. Top adders included shorts in cruise linersas well as junkier automotive retailer names amid continued creditconcerns. Risk appetite returns in the second half of the month andfaster US security selection drove gains on the back of reversalinformed insights. From a sector perspective, Energy had the strongestperformance with positive contributions across many other sectors.CBDM0722A/S-2272815-2/5

Top contributors: The top contributors were 5x long and 5x shortpositions. The top contributor was Baltic Classified Group which,although yet to report results, holds a strong market position andmargins over 70%, as such the team believes it should fare well. Thesecond largest contributor was Auction Technology Group – a companywhich had been a detractor in recent months but finally released resultsand an outlook statement which were indeed better than expected, withthe company indicating double digit revenue growth to continue thisyear. The shares therefore rebounded. The third largest contributor wasa long position in WHSmith which has rebounded off recent lows duringthe month. WHSmith is often incorrectly perceived as a pure play UKretailer and therefore suffered the same sell off as retailers in general.However, WHSmith is now mainly an internationally positioned travelretailer, and as such has seen strong trading on a rebound in travelvolumes notably in the USA. There were therefore upgrades followingresults in April and the shares rebounded. Amongst the top contributorswas a short in a UK pub/restaurant group which is a short pure play fordomestic consumption exposed companies that are most at risk from asqueeze on incomes.Within the Global Equity Absolute Return Fund, the volatility seen inApril continued in May and the fund posted negative returns over themonth. From a sector perspective Industrials and Health Care exposuresdetracted from performance while Financials and Energy contributed.The top detractor was a long position in Japan Steel Works, after thewhistle-blower revelations about alleged irregularities/falsifications insome of their nuclear-related products saw its share price fall sharply.Air BnB was the second largest detractor, despite reporting well earlierin the month, with Q1 revenues up 70% year on year and exceededpre-pandemic Q1 2019 revenues by 80%. The share price fall waslargely driven by the broad-based growth sell-off as recessionary fearsraised concerns of consumer discretionary spend. The third detractorwas Roche Holding, after its latest cancer medicine failed in a studyof patients with the most common form of lung cancer which raisedquestions on its future.The top contributor was a short position US fashion retailer afterthe company announced unexpected losses in Q1 driven by higherfreight and product costs. A long position in Comcast was the secondcontributor after strong Q1 results. The company was also rumouredto engage with EA sports on a potential acquisition opportunity whichwas well received by the market. The third contributor for the monthwas Unicredit after the company announced a 10% buyback early in themonth.Global MacroThe Fund’s global macro/managed futures component is implementedby two strategies, the Tactical Opportunities Fund and the AbsoluteMacro Fund.The Tactical Opportunities Fund was relatively flat over the month. Gainsfrom discretionary themes, systematic positions in RV bonds, and equityindustry views were exactly offset by losses in systematic RV equitiesand directional bonds.Top Contributors: The funds’ Discretionary process, which is positionedfor inflation strength pushing back end yields higher, was the topcontributor for the month. A short position in 30-year US and Germanbonds supported performance as the market priced in a hawkish Fed.The fund is also positioned for European Resilience, with longs in theUK, Italy, and Spain against the US and Japan outperforming this monthon waning Ukraine fears and relatively less hawkish policy from the ECB.Within the Systematic process, the team’s signals predicted US growthand inflation peaking versus Canada and Australia’s economies stillbuoyed by commodities, motivating a relative value (RV) long 10yr USversus short 10yr Australia & Canada position, which was additive overthe month.Top Detractors: Within the Discretionary strategy, a short 5yr US bondsdetracted as some dovish comments from Fed policymakers in lateMay led to a brief rally in front-end US bonds. Within the Systematicstrategy, Rate Timing and Interest Rate Swap RV strategies were modestdetractors. Notable losses were generated in the Equity RV strategywhich was positioned for a reprieve of US equity underperformance butwas too early – rotating long US equities in May (after being short formuch of ’22). Longs in Australia and Taiwan against Japan and Koreafurther detracted.The other sub-strategy within the Global Macro component,implemented via the BlackRock Absolute Macro Fund, delivered astrong positive performance over the month. The Macro-Aware SecuritySelection rebounded from the previous month’s weak performance tofinish May as the top contributor to performance with DiscretionaryThematic along proving additive. Global equity Country Selection,Inflation Timing, and DM Rate Country Selection finished flat while FX,Monetary Policy Timing, and Global Rate Country Selection detracted.Top Contributors: Discretionary Thematic performance was additivethrough through the strategy’s short rate positions on the back of boththe U.S. and German curves based on the themes of ‘Global Reflation’and ‘European Resilience’. Performance in the Macro Aware SecuritySelection bucket was driven by a combination of US Industry timing (e.g.Inventories), Tactical insights (exposures to rising inflation and lowergrowth) and Trained exposures.CBDM0722A/S-2272815-3/5

Top Detractors: Underperformance in the Monetary Policy Timingstrategy bucket was centered within developed markets, with lossesevenly split between directional and cross-sectional risk. In thedirectional arm of the strategy, we remain overall short duration,continuing to see strong underlying inflationary pressures andsupportive technicals for this position. Front-end performance duringthe month was mixed with the US finishing lower, whilst Europe finishedhigher. The fund had the majority of its short positioning in the US, whichdetracted. Global Rates Country Selection bucket lost money on its USand Mexican shorts as the US led a rates rally during a brief period ofgrowth concerns, but made money on its short Polish exposure givenhigher inflationary pressures. Received HKD exposure rallied with USrates, while shorts in SGD rates paid off as previous outperformance –led by expectations of lower FX-implied rates as the Monetary Authorityof Singapore adjusted its exchange rate policy – reversed. Other longexposures – like Korea, Euro and Sweden – were negative detractors ashigher inflation prints and, consequently, central banks’ shift to a morehawkish stance. FX strategy detracted from performance in May fromits long USD positioning with GBP, SEK, JPY, and EUR on the other sideas the USD strength reverted.Yearly Alpha, Gross of Fees (%)20%10%0%-10%-20%2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022Performance AttributionYearly alpha for the BlackRock Multi Opportunity FundSystematic Active EquityFixed IncomeMacro / Managed futuresFundamental EquityStyle Premia-1%1%0%1 Month2%3%3 YearsAttribution for the BlackRock Multi Opportunity FundSub-Strategy Risk Allocation15%Equity AlphaFixed Income %AustraliaGlnEqobaluSm ityGlobalallCMapGl id HoboraizolLPananAs rgeCaiaPaLparnAsgeiaCaPa MipdnAs HoriziaSm onEM allLa CaprgeCEMSm apallCapAgenEMcyMor FXtgAsagseestCa Allocpiattal S ionCrtruedctitLoung re/ShoEM rtM RatacesroRaMteRaidstes R HorizelonativeValuSeecuEmritiseredgiVonglaEm Com Eve tilitynterpaDrginingiveesGl Com (Ca nobymal pananieEq)sui(UtyAb CITss.)ReturnDefensiMom veentumValueTaCactica rrylOAbppsosluteMacro-5%CBDM0722A/S-2272815-4/5

About the FundInvestment ObjectiveThe Fund aims to achieve a return of 8% p.a. before fees, above theReserve Bank of Australia’s Cash Rate Target over rolling three-yearperiods. The Fund will aim to achieve its investment objective bytargeting a total expected risk of between 4%-6% p.a. over the samerolling three-year period.Fund StrategyThe Fund aims to outperform the Benchmark by providing investorswith a source of risk controlled absolute returns that are, over time,expected to have low correlations with the returns of major assetclasses.The Fund gains exposure to a diversified range of absolute returnstrategies that may include, but are not limited to:Equity Market Absolute Return strategies that seek to exploitinefficiencies in individual stock prices by gaining exposure to longand short positions in local and global equity markets.Event Driven strategies that seek to capture the structural andpersistent risk premia in merger arbitrage through a robust andrepeatable investment process focused on companies that areinvolved in publicly announced definitive mergers, takeovers, tenderoffers, leveraged buyouts, and other corporate combinations.Fixed Income Absolute Return strategies that seek to exploitopportunities across global fixed income markets by taking longand short positions in a broad range of fixed income securitiesincluding, but not limited to: sovereign bonds; corporate credit;mortgages; and other securities.Global Macro/Managed Futures strategies that seek to exploitinefficiencies across global markets by gaining exposure to longand short positions across a broad array of global assets including,but not limited to: equities; bonds; currencies; commodities; andother assets. These strategies may utilise both fundamental and/or trend following insights to construct portfolios.Market Neutral Style Premia strategies that seek to capturepositive returns from a range of style factor strategies acrossglobal asset classes while maintaining low correlation to broadmarket factors.The selection of an investment for the Fund is the result ofcomprehensive due diligence to ensure that it is in line with fiduciaryduties and in compliance with related party policies. The Fund may bea seed, lead or only investor in a BlackRock strategy. Acting as the seedinvestor may create a commercial opportunity for the BlackRock Group.For example, a seed investment in a BlackRock Strategy may allow theBlackRock Group to establish a track record for a fund or product that itis then able to sell to other clients.We continuously explore BlackRock for the addition of new investmentstrategies with the view of including these where they meet theFund’s strict investment criteria. The Fund’s investment strategy isimplemented in three stages :1.Strategy Selection: continuous search for (and due diligence on)the latest and most innovative research and investment ideas,leveraging BlackRock’s extensive pool of investment specialists.2. Capital Allocation: capital is allocated to construct a diversifiedportfolio of absolute-return strategies taking into account theexpected return, risk and cost of accessing each absolute returncategory, as well as the available capacity of each category.3. Core Security/Market Selection: security/market selection occurswithin each absolute-return category at the underlying strategy level.The Fund should be considered by investors who Seek a fund that uses total-return strategies across major assetclasses and world markets with the objective of enhancing portfolioreturns while diversifying risk.Seek a fund that has a low correlation to equity returns, interestrate moves and other active return sources.Have a long term investment horizon.Fund DetailsBlackRock Multi Opportunity Absolute Return FundAPIRBuy/Sell SpreadManagement FeePerformance FeeStrategy AUMHurdle RateLiquidityBLK0001AU0.45%/0.45%1.25% p.a.20% 1146 milRBA Cash RateMonthlyPrivate placements (% of NAV)1.0%Minimum Initial Investment 50KNotificationLock-up PeriodDomicileCustodian12 business daysNoneAustralian Unit TrustJ.P. Morgan Chase BankIMPORTANT INFORMATION: Issued by BlackRock Investment Management (Australia) Limited ABN 13 006 165 975, AFSL 230 523 (BIMAL). This materialis not a financial product recommendation or an offer or solicitation with respect to the purchase or sale of any financial product in any jurisdiction. Thematerial provides general information only and does not take into account your individual objectives, financial situation, needs or circumstances. Beforemaking any investment decision, you should assess whether the material is appropriate for you and obtain financial advice tailored to you having regardto your individual objectives, financial situation, needs and circumstances. BIMAL is the responsible entity and issuer of units in the Australian domiciledmanaged investment schemes referred to in this material. Any potential investor should consider the latest product disclosure statement, prospectus orother offer document (Offer Documents) before deciding whether to acquire, or continue to hold, an investment in any BlackRock fund. Offer Documentscan be obtained by contacting the BIMAL Client Services Centre on 1300 366 100. In some instances Offer Documents are also available on the BIMALwebsite at www.blackrock.com.au. BIMAL, its officers, employees and agents believe that the information in this material and the sources on which itis based (which may be sourced from third parties) are correct as at the date of publication. While every care has been taken in the preparation of thismaterial, no warranty of accuracy or reliability is given and no responsibility for the information is accepted by BIMAL, its officers, employees or agents.Any investment is subject to investment risk, including delays on the payment of withdrawal proceeds and the loss of income or the principal invested.While any forecasts, estimates and opinions in this material are made on a reasonable basis, actual future results and operations may differ materiallyfrom the forecasts, estimates and opinions set out in this material. No guarantee as to the repayment of capital or the performance of any product orrate of return referred to in this material is made by BIMAL or any entity in the BlackRock group of companies. No part of this material may be reproducedor distributed in any manner without the prior written permission of BIMAL. 2022 BlackRock, Inc. All Rights reserved. BLACKROCK, BLACKROCKSOLUTIONS, iSHARES and the stylised i logo are registered and unregistered trademarks of BlackRock, Inc. or its subsidiaries in the United States andelsewhere. All other trademarks are those of their respective owners.CBDM0722A/S-2272815-5/5

The BlackRock Multi Opportunity Absolute Return Fund had a positive return of 0.4% over the month of April (gross of fees). Strategy Review Performance drivers were broad-based with four of the five hedge fund components posting a positive contribution for the month. The Systematic Fixed Income Alpha component led the performance,