Transcription

INSTITUTE OF FORENSIC ACCOUNTANTS(IFA)EXAMINATION SYLLABUS

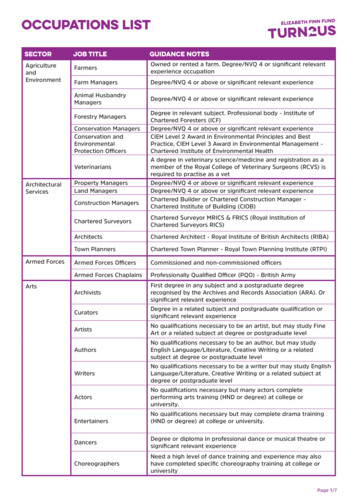

SYUMMARY OF SYLLABUSFOUNDATION LEVEL0.1.Financial Accounting0.2.Auditing0.3.Taxation0.4.Public SpeakingPROFESSIONAL LEVEL-10.5.Business Law0.6.The Law of Evidence0.7.Financial Reporting0.8.Introduction to Forensic AccountingPROFESSIONAL LEVEL-20.9.Legal Elements of Fraud10.Criminology and Ethics11.Forensic Accounting in Fraud Investigation12.Financial Transactions and Fraud SchemesPROFESSIONAL LEVEL-313.Expert Interview Skills in Forensic Accounting14.Litigation Support in Forensic Accountant15.Expert Witnessing in Forensic Accounting16.Expert Forensic Accounting Reporting1

DETAILS SYLLABUSFOUNDATION LEVEL01.FINANCIAL ACCOUNTING1.The Accounting Equation and the Balance Sheet2.The Double Entry System for Assets and Liabilities3.The Assets of Stock4.The Double Entry System for Expenses and Revenues.The Effect of Profit or Loss on Capital5.Balancing off Accounts and the Trial Balance6.Trading and Profit and Loss Accounts: An Introduction7.Balance Sheets8.Trading and Profit and Loss Accounts and Balance Sheets:Further Considerations9.Accounting Concepts and Conventions10.The Division of the Ledger11.The Banking System12.Two Column Cash Books13.Cash Discounts and the Three Column Cash Book14.The Sales Journal15.The Purchases Journal16.The Returns Journals17.Depreciation of Fixed Assets: Nature and Calculations18.Double Entry Records for Depreciation19.Bad Debts, Provisions for Doubtful Debts, Provisions forDiscounts on Debtors20.Capital and Revenue Expenditure21.Other Adjustments for Final Accounts: Accruals,Prepayments etc.2

22.Modern Methods of Processing Data23.Bank Reconciliation Statements24.The Analytical Petty Cash Book and Imp rest System25.The Journal26.Errors Not Affecting Trial Balance Agreement27.Suspense Accounts and Errors28.Control Accounts29.Introduction to Accounting Ratios30.Single Entry and Incomplete Records31.Receipts and Payments Accounts and Income andExpenditure Accounts32.Manufacturing Accounts33.Departmental Accounts34.Partnership Accounts: An Introduction35.Goodwill36.Partnership Accounts Continued: Revelation of Assets37.An Introduction to the Final Accounts of LimitedLiability Companies38.Purchase of Existing Partnership and Sole Trader’sBusinesses39.The Valuation of Stock40.Bills of Exchange41.Joint Ventures42.Consignment Accounts43.Partnership Dissolution44.Branch Accounts45.Further Methods of Providing for Depreciation46.Container Accounts47.Royalty Accounts3

48.Hire Purchase and Payment by Installments49.Limited Companies: General Background50.The Issue of Shares and Debentures51.Redemption of Redeemable Preference Shares and ofRedeemable Debentures52.Limited Companies Taking Over Other Businesses53.Provisions, Reserves and Liabilities54.Taxation in Accounts55.The Increase and Reduction of the Share Capital ofLimited Companies56.The Final Accounts of Limited Companies57.Flow of Funds Statements and Cash Budgeting58.Investment Accounts59.Contract Accounts60.Consolidated Accounts: Introduction61.Consolidation of Balance Sheets: Basic Mechanics I62.Consolidation of Balance Sheets: Basic Mechanics II63.Inter-Company Dealings: Indebtedness and UnrealisedProfits in Stocks64.Consolidated Accounts: Acquisition of Shares inSubsidiaries at Different Dates65.Inter-Company Dividends66.Consolidated Balance Sheets: Sundry Matters67.Consolidation of the Accounts of Vertical GroupsOf Companies68.Consolidated Profit and Loss Accounts69.Accounting for the Results of Associated Companies70.Discounting Techniques71.Accounting for Inflation4

72.Accounting Ratios: Further Consideration73.Interpretation of Final Accounts0.2.AUDITING1.Theory and Philosophy of auditing2.Stewardship3.Auditing and other Services4.Types of Audit5.Objectives of audit6.Features of an audit7.Timing of the audit8.Generally Accepted Auditing Standards (GAAS)9.Appointment of an auditor10.Removal of auditor11.Resignation of Auditors12.Rights, Duties and Responsibilities of an Auditor13.Books of Accounts14.Commencing an audit15.The Engagement letter16.The Conduct of the audit17.Audit Committees18.Profession Ethics19.The Independence of an auditor, Auditor’s Independence and the Nigerian companiesand Allied matters Decree, 199120.Auditor’s Independence and the Professional Bodies Aid to maintaining Independence21.Audit Planning, Controlling, Quality Control of Audit22.And Analytical Procedure23.Audit Planning5

24.Controlling an audit25.Quality Control26.Types of Reviews27.Analytical Procedures28.Internal Accounting Control System29.Design of Internal Control System30.Elements of Internal Control31.Essential Characteristics of Internal Control32.Types of Internal Control33.Techniques of Ascertainment34.Methods of Recording the System35.Procedures to obtain an understanding of the Client’s36.Internal Control Structure37.Testing the System of Internal Control38.Letter of weakness (Management Letter)39.Internal Audit40.Management Audit41.Internal Check42.Audit Working Papers43.Purpose or Objective of Working Paper44.Types of Working Papers45.Audit Programmes46.Standards Audit Programmes47.Verification and Valuation of Assets and Liabilities48.Verification (Definition)49.Vouching50.Verification of Fixed Assets51.Verification of Current Assets52.Cut-Off Procedures6

53.Verifications of Liabilities54.Balance Sheet Audit55.Programme for a Balance Sheet Audit56.Audit Evidence57.Audit Sampling58.Evaluation of Errors59.Audit of Computer Based Accounting System EDP Systems60.Use of Compute for Audit Purposes Internal Control In EDP Systems61.Advantages and Problems in Computer Based Accounting System62.Typical ICQs in EDP Systems63.Liabilities of Auditors64.Liabilities of Client65.Liabilities of Third Parties66.Criminal Liabilities67.Responsibilities for the Prevention and Detection of error and/irregularities68.Unlawful Acts of Client and their staff-Auditor’s Liabilities69.Legal Decisions on Auditing70.Audit Reports and/or Opinions71.Legal Requirements72.Requirements of the Auditing Standard73.Parts of Audit Report74.Emphasis of Matter75.Qualified Opinion76.Public Sector Audit77.Appointment, Retirement and Removal of Government78.Duties79.Independence80.Nature of Audit of Government Accounts81.Accounting Units7

82.Internal Audit83.Power to Conduct Investigation84.Audit Report and Government Accounting85.Audit Organization within the Government86.Expanded Scope Audit87.Value for Money Audit88.Investigations89.General Principles90.Investigation on behalf of an Individual Firm Proposing to Buy a businessInvestigation on behalf of the promoter of a proposed0.3.TAXATION1.INCOME FROM EMPLOYMENTContract for servicesIncome assessableBenefits in kindPay-As-You-Earn (PAYE)Guaranteed tax-free remuneration2.INCOME FROM TRADE, PROFESSION OR VOCATIONDefinition of incomeIllegal trade operations and isolated transactionsAssets capable of domestic or private useBad debts and provision for bad debtsBasis period for computing assessable incomePost cessation receiptsTax assessment on basis of turnover of a business8

Change of accounting date3CAPITAL ALLOWANCESQualifying expenditureConditions for claiming capital allowancesAllowances available to a taxpayerBasis period for capital allowances Assets with an element of private useRelevant interest in building, structure or worksManner of making claims for allowancesLeasesAssets acquired on hire-purchaseIndustrial Inspectorate Division4.INDIVIDUAL LOSS RELIEFClaims for loss reliefCommencement provisionsYear of cessation5.INCOME FROM DIVIDENDS, INTEREST, DISCOUNTS, PENSIONS,ANNUITIES, SETLEMENT, TRUST OR ESTATESChargeable dividendsInterest derived from NigeriaComputed income of a trustDeemed income of the settlerDouble taxation reliefPreparation of settlement accounts6.INCOME FROM PROPERTYWho is liable?9

Basis of assessment7.INDIVIDUAL INCOMES COMPUTATIONStatutory incomeReliefs and allowancesClaims for reliefsDue date for payment of tax8.PARTNERSHIP INCOMEComputation of partnership incomeCapital allowancesChanges in partnershipPersonal allowances and deductionsPartnership lossesSole trade preceding partnershipSole trade succeeding partnershipRegistration of partnership agreement9.IMPOSITION OF INCOME TAX ON COMPANIES AND PROFITSCHARGEABLEHistory of companies’ income taxProfits subject to taxDividendsDefinition of Nigerian companyInterest on foreign loansProfits of shipping, air transport, cable undertakings and insurance companies10.ASCERTAINMENT OF PROFITSAllowable and disallowable expenses10

Procedure for computing adjusted profitsTrading assets received in specieConsumption or gift of trading assetValuation of stock in trade11.BASIS OF ASSESSMENT OF PROFITSCommencement of tradeCassation of trade or businessChange of accounting dateSale or transfer of trade or businessCompanies incorporated outside NigeriaAssessment on turnoverAssessment and taxation of banks12.COMPANIES LOSS RELIEFForms of reliefCompanies having more than one source of incomeCompanies in agricultural trade or businessLoss incurred by new business and losses on cessation of trade13.PIONEER INDUSTRIES AND PRODUCTSApplication for pioneer certificateIndigenous controlled companyCancellation of pioneer certificateTax relief periodNet loss of pioneer companyRestriction on dividend and loansAppealsOffences and penalties11

14.ADMINISTRATION OF INDIVIDUAL INCOME TAXMeaning of “relevant tax authority”Administration of the ActFunctions of the BoardAssessmentsObjection and appeals15.ADMINISTRATION OF COMPANIES INCOME TAXFederal Board of Inland RevenuePersons chargeable to taxCompany being would-upReturnsAssessmentsAppealsOffences and penalties16.PETROLEUM PROFITS TAXAscertainment of chargeable profitsDefinition of profitsCapital allowancesChargeable taxPosted priceCollection and paymentOffences and penalties17.CAPITAL TRANSFER TAXValue of gift transferredProperty passing on deathQuick succession relief12

Interaction of capital transfer tax and capital gainsTaxValuation of propertyAdministration and collectionAssessments and paymentAppeal18.CAPITAL GAINS TAXWho is liable?Basis of assessment and rate of taxChargeable assetsExemptions and reliefsPart disposal of assetsCompensation and insurance proceedsReplacement of business assets and roll-over reliefCompulsory acquisition of landPrincipal Private ResidenceDeathShares and securitiesBonus and rights issueCapital lossConnected personsArtificial or fictitious transactionsAdministration returns and appeal19.MISCELLANEOUS TOPICS - 1Determination of residenceTaxation of members of the Armed Forces and Other personsDouble taxation relief13

Taxation aspects of pension funds schemes20.MISCELLANEOUS TOPICS - 2With-holding taxTax clearance certificateTax planningBack duty0.4PUBLIC SPEAKING1.INTRODUCTIONWhy public speaking?You can learn public speakingPublic speaking as empowermentPubic speaking and critical thinkingPublic speaking and ethic2.COMMUNICATION APPREHENSIONWhat’s communication apprehension?What are you afraid of?You’re not aloneSpeech Anxiety as a form of energyOvercoming fears of public speaking3.COMMON TYPES OF SPEECHESInformative speechesPersuasive speechesArgument SpeechesEntertainment Speeches14

4.FUNDAMENTALS OF PERSUASIVE SPEAKINGWhat’s persuasive speaking?Factors of persuasiveSpeaker’s credibilitySource of CredibilitySpeaker’s characterSpeaker’s logicLogical fallaciesSpeaker’s rational appealsTypes of EvidenceSpeaker’s emotional appeals5.SPEECH ORGANIZATION FOR PERSUASIONProblem-solution orderProblem-Cause-Solution orderMonroe’s Motivated SequenceIndirect ProofAnswering ObjectionsUsing humour and satireReframing the issueComparative Advantages orderPrimacy and Recently Effect6.CHALLENGE OF AUDIENCE INVOLVEMENTCauses of audience inattentionTalk about Audience needsMaslow’s Hierarchy of NeedsEstablish common bondCommitment to the topic15

The magic in namesSpeech Opening for audience involvementSpeech closing for Audience involvement7.FORMS OF NONVERBAL BEHAVIOURBody languageGesturesPosturesEye contactNonverbal Language of ColourNonverbal Language of TouchNonverbal Language pf dressingNonverbal Language of Micro ecologyNonverbal Language of Vocal QualifiersVolumeTempoTonePauseNonverbal language of TimeVerbal Crutches8.MODES OF SPEECH DELIVERYImpromptu speakingExtemporaneous speakingMemorized Mode of speakingSpeaking from Manuscript9.COMMON FORMS OF ADDRESSESKeystone Addresses16

Acceptance SpeechesElection Campaign SpeechesInaugural SpeechesCorporate SpeechesEulogiesGraduation SpeechesEntertainment Speeches (Luncheon, After-Dinner and Banquet Speeches)After-Dinner SpeechesBanquet Speeches10.SAMPLE SPEECHES WITH COMMENTARY11.INFORMATIVE SPEECHSuccessful strategies for achieving your career goals (Virgis Colbert)12.PERSUASIVE SPEECHESHow to stop Boring your Audience to Death (Charles Francis)Abolition of the Osu System Bill (Nnamdi Azikiwe)13.CONCLUSION REMARKSBasic Misconceptions about public Speaking17

PROFESSIONAL LEVEL-10.5.BUSINESS LAW1.LAW, ITS ADMINISTRATION AND ENFORCEMENTThe Meaning of LawTypes of LawOrganization of CourtsThe Personnel of the Courts2.CONTRACTNature of a ContractFormation of a ContractPrivity of ContractConditions and WarrantiesExemption ClausesReality of Consent illegalityAssignment of ContractDischargeRemedies for Breach of Contract3.SALE OF GOODSNature of sale of goodsContract of sale of goods distinguished from other contractsConditions and warrantiesCaveat emptorTransfer of propertyTransfer of titlePerformance of the contract18

C. I. F., F. O. B. and Ex-Ship contractsAcceptanceRights of unpaid seller4.AGENCYNature of AgencyCreation of AgencyTermination of Agency5.HIRE PURCHASEThe meaning of ‘Hire Purchase”Credit sale agreementsThe hire purchase Act, 19656.NEGOTIABLE INSTRUMENTS AND NOTESNature of negotiable instruments and notesBills of exchangeDatingAcceptanceChequesPromissory notes7.INSURANCEThe meaning of insuranceContract of insurance – how effectedConditions and warrantiesLiability of principal for Acts of its AgentBasic principles19

Classes of insuranceAssignment of insurance policies8.BUSINESS ORGANIZATIONSPartnershipCompany LawShares and DebenturesRights and duties of directorsMeetings and resolutionsWinding-upForeign companies9.TORTS OF IMPORTANCE TO BUSINESSNature of Torts of importance to businessBasis of Tortuous liabilityParticular TortsProduct liabilityOccupier’s liabilityMaster and servant: Vicarious liabilityDeath as affecting liabilityPassing off10.LABOUR RELATIONSLabour relations: GeneraThe labour codeWorkmen’s compensation ActTrade Unions20

0.6.THE LAW OF EVIDENCE1.INTRODUCTION2.RELEVANCY OF FACTS3.ADMISSIONS AND CONFESSIONS4.STATEMENTS BY PERSONS WHO CANNOT BE CALLED AS WITNESSES5.STATEMENTS MADE IN SPECIAL CIRCUMSTANCES6.JUDGMENTS OF COURT OF JUSTICE7.OP[INIONS OF THIRD PERSONS8.EVIDENCE OF CHARACTER9.MEANS OF PROOF10.FACTS WHICH NEED NOT BE PROVED11.PROOF OF PREVIOUYS CONVICTION12.TYPES AND PROFF OF DOCUMENTS13.STATEMENTS ADMISSIBLE UNDER SECTION 9114.DOCUMENTARY EVIDENCE15.BURDEN OF PROOF16.PRESUMPTIONS17.ESTOPPEL18.EFFECT OF WRONGFUL AADMISSION AND REJECTION OF EVEIDENCE19.COMPETENCE AND COMPELLABILITY OF WITNESSES20.OFFICIAL AND PRIVILEGED COMMUNICATIONS21.CORROBORATION22.THE TAKING OF ORAL EVIDENCE AND THE EXAMINATION OF WITNESSES23.THE SERVICE IN ONE STATE OF WITNESS SUMMONS AND OTHERPROCESSES ISSUED IN ANOTHER STATE21

0.7.FINANCIAL REPORTING1. Accounting theory, or accounting can be interesting introduction. An analogy – allabout sausages the focus of the book. Summary Exercises2. The objectives of financial statements and their usefulness to the general user groups.Introduction. The corporate Report. The user groups summary of user needs.Characteristics of useful information. The need for communication. SummaryExercises3. Traditional accounting conventionsIntroduction. The conventions. The revenue recognition problem explored. Theproblem considered. The compromise solution. A coherent frame work. Summary.Exercises4. Economic valuation conceptIntroduction, The basic equation, Income and capital wealth and value, An array ofvalue concepts, Economic value, Capital maintenance, Criterial for appraisingalternative valuation concepts, Fisher and psychic income, psychic income andFrankel’s critique, Hicks and capital maintenance, The calculation of economicincome, Income ex ante and income ex post, summary, Exercises5. Current entry valuesIntroduction, Back to basics, The business itself, Capital maintenance, Replacementcost accounting and depreciation, Current entry values, a preliminary appraisal,Summary, Exercises6. Current exit value and mixed valuesIntroduction, Current exit value accounting, Current exit values, a preliminaryappraisal, Mixed values – ad hoc methods, Mixed values – deprival value, Deprivalvalue (DV) – an appraisal, Current values, Some overall thoughts, Summary, Exercises7. Current purchasing power accountingIntroduction, The measuring unit problem, Current purchasing power, Combination of8. methods, Current purchasing power- what does it really mean? Summary, Exercises22

9. The UK position: past, present and future?Introduction, The background to SSAP16 and current cost accounting, The array of possibilities, UK practice Summary,Exercises10.Some possible extensions to the accounting frameworkIntroduction, The need for additional statement, Possible additional financial reportingstatements, Social accounting, Environmental reporting and the international scene,Desegregation or segmental reporting, More (or less) information? Summary,Exercises11.Towards a general frameworkIntroduction, The elements of accounting, The balance sheet, Profit and loss, Aconceptual framework for the 1990s? the IASC framework, Underlying assumptions,Qualitative characteristics of financial statements, Conclusions, Towards a criticalreview, The crunch questions!, Summary, Exercises12.The international dimensionIntroduction, The International Accounting Standards Committee (IASC), TheEuropean dimension, Influences on accounting in Europe, The EU directives, The UK,European and international dimensions, Conclusions, Summary, Exercises13.Limited Liability companiesIntroduction, Limited liability, The principle established, Conclusions and comments,Sanctity of capital – the ‘interim’ accounting problem, The legal response, Restrictionsaffecting capital, Distributable profits, the case law background, The Companies Act of1985, Distributable profits, Summary, Exercises14.The Companies Act and published accountsIntroduction, The true and fair view, The continental influence, The specified formats,Other Companies Act requirements, Notes to the accounts (schedule 4, part III, 1985Act). Summary, Exercises15.The accounting standards setting processIntroduction, Accounting Standards Committee, Need for reform, Dearing Committee,23

16.Accounting Standards Board, ASB statement of aims, Financial Reporting ReviewPanel, Procedure leading to the issue of standards by the ASB, ASB foreword toaccounting standards ED, Urgent Issue Task Force, Summary, Exercises17.Accounting principlesIntroduction, Fundamental accounting concepts, Accounting bases Accountingpolicies, The Companies Act 1985, The ASB attempts to create a ‘statement ofprinciples’ Financial reporting standards for smaller entities, Conclusion, Summary,Exercises18.Fixed assets and goodwillIntroduction, Depreciation, Methods of calculating depreciation, Some less commonalternatives, Some misconceptions underlined, Government grants (SSAP 4),Depreciation and SSAP 12, The Companies Act 1985, Accounting for investmentproperties (SSAP 19), Some issues and problems, Transfers from fixed assets tocurrent assets, FRED 17 ‘Measurement of Tangible Fixed Assets’ Goodwill, Purchasedgoodwill and inherent goodwill, Accounting for goodwill, The Companies Act andgoodwill, FRS 10, ‘Goodwill and Intangible Assets, Initial recognition of positivegoodwill and intangible assets, Consideration of FRS 10, FRS 11 ‘Impairment of fixedAsset and Goodwill’, Summary, Stop press: FRS 15 and SSAP 12, Exercises19.Research and development (SSAP 13)Introduction, The problem, The SSAP’s proposals, Accounting treatment of R&D,Development costs written off, Disclosure requirements, The companies acts, Oil andgas exploration costs, Summary, Exercises20.Substance over formScope of the chapter, FRS 5 ‘Reporting the Substance of Transactions’, Substance of atransaction, Recognition of an item, Quasi-subsidiary, Application notes, Consignmentstock example, Capital instruments, Deep discounted bonds, FRS 4 ‘CapitalInstruments’ Definition of shares, Finance costs, Accounting practice, Allocation offinance costs, The future of substance over form, FRS 13 ‘Derivatives and OtherFinancial Instruments: Disclosure’ Financial instrument disclosure requirements,Summary, Exercises.24

21.Leases and hire purchase contracts (SSAP 21)Introduction, Court Line case, Forms of lease agreements, Further SSAP 21definitions, Accounting for leases in the lessee’s books, Accounting for leases in thelessor’s books, Taxation effect on finance lease accounting for lessors, HP contracts,Disclosure of information, Summary, Exercises22.Stock and long-term contracts (SSAP 9)Introduction, Stock and work progress, Stock cost assumptions, The SSAPrequirements, The companies Act, Long-term contract work in progress, TheCompanies Act 1985 and long-term contracts, Long-term contracts-an illustration,Summary, Exercises23.Taxation (SSAP 5, 8, 15)Introduction, Value added tax, Imputation tax system, Timing of corporation tax,Accounting treatment of irrecoverable ACT, The future of ACT, Deferred, What isdeferred tax? Arguments for deferred tax, arguments against deferred tax, Theaccountants’ response, SSAP 15 (revised) ‘Accounting for Deferred Tax’ Changing taxrates and deferred tax, Deferral v. liability method of provision, Deferred taxcalculation, Crystallization of a liability, Disclosure requirements (SSAP 15 (revised)),Companies Acts and deferred tax, A critical appraisal of the ASC’s approach, Furtherchanges to SSAP 15, The future of deferred tax, Summary, Exercises24.Pension costs (SSAP 24)Introduction, Types of pension schemes, Problems, Matching principle, SSAP 24requirements, The accounting objective explored, Balance sheet effects of matchingpension costs, Scope and disclosure requirements, Deferred taxation, Companies Actrequirements, June 1995 discussion in respect of pension costs, July 1998 discussion inrespect of pension costs, Pension scheme accounts, Review of SORP 1, Summary,Exercises.25.Post-Balance sheet events and provisions and contingencies (SSAP 17, FRS 12)Introduction, Post-balance sheet events (SSAP 17), Adjusting and non-adjustingevents, Redrafting of accounts for post-balance sheet events, Window dressing and25

26.SSAP 17, Accounting for provisions, contingent liabilities and contingent assets, TheCompanies Act and contingencies, Redrafting of accounts involving contingenciesunder SSAP 18, The provisions problem, FRS 12 objectives and definitions,Accounting treatment for provisions, contingent liabilities and contingent assets,Measurement of a provision under FRS 12, Summary, Exercises.27.Group accounts and associated companies (SSAP 1 and FRSs 2, 6, 7, 8)Introduction, Need for group accounts, Goodwill (premium) on acquisition, Definitionof Subsidiary, FRS 2 ‘Accounting for Subsidiary Undertakings’, Mixed groups, Preacquisition profits and acquisition accounting, Acquisition accounting later than dateacquisition, Inter-company trading and the elimination of unrealized profits, Thereconciliation of inter-company balances, The regulations governing the presentationof group accounts, Consistency within the group, Exemptions from consolidation,Accounting treatment of excluded subsidiaries, Changes in composition of a group,Accounting for the results of associates and Joint ventures (FRS 9), Example 1 – Thenormal presentation, Merger accounting, Comparison of Companies Act and SSAP 23,SSAP 23 problems, Revision to SSAP 23, Companies Act and FRS 6, Differencesbetween acquisition accounting and merger accounting, FRS 6 disclosure requirements,FRS 7 ‘Fair Values in Acquisition Accounting’ Related party transactions, FRS 8‘Related Party Disclosures’ Related parties, Information to be disclosed, Summary,Exercises.28.Foreign currency transaction (SSAP 20)Introduction, Currency conversion, Currency translation, SSAP 20 requirements forindividual companies’ foreign currency transactions, Translation methods,Consolidated financial statements, Disclosure requirements, The Companies Act 1985,Summary, Exercises.29.Reporting financial performance (SSAP 3, 25 and FRS 3)Introduction, Basic earnings per share, The tax problem, The number of sharesproblem, Changes in equity above capital during the year, Diluted earnings per share,Disclosure requirements of FRS 14, All inclusive and current operating performance26

30.concepts, ASB solution, FRS 3, ‘Reporting Financial Performance’, Prior yearadjustments, Changes in accounting policies, Fundamental errors, Statement of totalrecognition gains and losses (SORG), Historical cost profits and losses, Profit or losson the disposal of an asset, Segmental reporting, Corporate Report and segmentalreporting, SSAP 25, ‘Segmental Reporting’, Summary, Exercises.31.Cash flow statements (FRS 1)Introduction, Cash flow reporting, Funds flow or cash flow? Advantages of cash flowstatements, Practical examples, Summary, Exercises.32.Interpretation of financial statementsIntroduction, Accounting information and users, Benchmarking, Technique of ratioanalysis, Financial status, Investment potential, Additional information, Multivariateanalysis, Summary, Exercises.33.Financial statement analysisIntroduction, Effects of different accounting policies, Real-life vignette, Summary,Exercises, Final thoughts.0.8.INTRODUCTION TO FORENSIC ACCOUNTING1. Forensic Accounting definition and backward2. Investigative Forensic Accounting3. The Forensic Accountant as Expert Witness4. Differences between Forensic Accounting and Fraud Examination5. Financial Crime Summaries6. Qualities of a Good Forensic Accountant7. When and why to call a Forensic Accounting Investigation8. Understanding white Collar Crimes9. Money Laundering10.Computer Crimes27

PROFESSIONAL LEVEL-20.9.LEGAL ELEMENTS OF FRAUDTHE LAW RELATED FRAUD1.Definition of Fraud2.Principal Types of FraudMisrepresentation of Material FactsConcealment of Material FactsBriberyIllegal GratuityCommercial BriberyExtortionConflict of InterestTheft of Money and PropertyEmbezzlementLarcenyTheft of Trade SecretsRemediesBreach of Fiduciary DutyDuty of LoyaltyDuty of Care3.Federal Legislation Related to FraudThe Sarbanes-Oxley Act (Public Law 107-204)Public Company Accounting Oversight BoardCertification Obligations for CEOs and CFOsNew Standards for Audit Committee IndependenceNew Standards for Auditor IndependenceEnhanced Financial Disclosure Requirements28

Protections for Corporate Whistleblowers under Sarbanes-OxleyEnhanced Penalties for White-Collar CrimeMail Fraud and Wire FraudMail FraudWire Fraud“Honest Services” fraudInterstate transportation of stolen propertyRacketeer influenced and corrupt organizations (RICO)Prohibited activitiesCriminal penaltiesCivil remediesFalse claims and statementsStatements or entries generallyPossession of false papers to defraud United StatesDemands against the United StatesBank entries, reports and transactionsLoan and credit applications generallyCrop insuranceConspiracyFalse, fictitious, or fraudulent claimsMajor fraud against the United StatesCivil false claims ActProgram fraud civil remediesCivil monetary penalty law4.Insurance Fraud Prevention Act5.Federal Corruption StatutesBribery of public officials and witnessesAnti-kickback Act of 198629

The foreign corrupt practices ActTheft or bribery concerning programs receiving federal funds6.Federal Securities LawSarbanes-Oxley7.Tax evasion, false returns, and failure to file8.Bankruptcy fraud9.Statutes relating to financial InstitutionsBank frauInjunctions against fraudFraud by bank personnel and receiversFinancial Institutions reform, recovery and enforcement ActFinancial Institution Anti-fraud enforcement Act 1990Continuing financial crime enterprise statuteParticipation in the affairs of a financial Institution by a convicted FelonFraudulent use of credit cardsThe electronic funds transfer Act10.Laws relating to Health Care Fraud11.Identity TheftFraud and related activity in connection with identification documents andinformationThe Anti-Phishing Act of 2004Aggravated identity theft12.Telemarketing Fraud13.Computers and Access DevicesFraud and related activity in connection with access devices30

Fraud in connection with computersProsecuting computers related frauds14.Internet Crime15.Identifying and protecting Trade Secrets16.Money LaunderingLaundering of money instrumentsEngaging in monetary transactions in property derived from specified unlawfulactivity17.Conspiracy and Aiding and AbettingConspiracyAiding and abetting18.Obstruction of JusticeDestruction, alteration, or falsification of records in Federal Investigationsand BankruptcyDestruction of corporate Audit RecordsObstruction of Federal AuditObstructing Examination of financial institution19.Perjury20.INDIVIDUAL RIGHTS DURING EXAMINATIONEmployee’s Duty cooperateEmployee’s rights during InvestigationContractual rightsWhistleblowersEmployee’s constitutional rights31

21.INTERVIEWSEmployee’s right against self-incriminationNature of the rightMiranda warningsPublic of corporate attorneyEmployee’s right to counselApplicabilityEmployee’s right to due processState constitutionsFederal statutesNational labor relations ActNondiscrimination statutesFair labor standards22.COMMON LAW PROTECTION IN CONNECTION WITH INTERVIEWSInvasion of privacy: Intrusion into seclusionInvasion of privacy: Public disc

0.1. Financial Accounting 0.2. Auditing 0.3. Taxation 0.4. Public Speaking PROFESSIONAL LEVEL-1 0.5. Business Law 0.6. The Law of Evidence 0.7. Financial Reporting 0.8. Introduction to Forensic Accounting PROFESSIONAL LEVEL-2 0.9. Legal Elements of Fraud 10. Criminology and Ethics 11. Forensic Accounting in Fraud Investigation 12.