Transcription

NOW OPENANNUAL2021REPORT

A2021A N N UALREPO RTTABLE OF CONTENTSCEO Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1Chair Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2Awards and Recognitions . . . . . . . . . . . . . . . . . . . . 4Treasurer Report . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6Financial Reports . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8Board of Directors . . . . . . . . . . . . . . . . . . . . . . . . . 12LETTERFROM OURCEOAs a member and owner of Veridian Credit Union, your membership helps to improve financialresources and wellness - not only for yourself, but for your fellow members and throughout yourcommunity. The differences we make together are broad and far-reaching. They include advancingwith fast-paced technology that makes our finances easier to manage and serving the underservedin our communities with life-changing financial guidance. This Annual Report is provided to sharehighlights of the good you and your membership helped to create in 2021.The list of our shared achievements is long. Together we saved an estimated 45 million in betterrates and fewer fees. While saving our members money, we also invested more than a milliondollars in donations, sponsorships, scholarships and grants for our communities. Our certificationas a Community Development Financial Institution helped more of our fellow members overcomebarriers to homeownership. We made process improvements based on your feedback, includinginvesting in technology to simplify the process for submitting transaction disputes, adding the abilityto make travel notifications online, streamlining our secure document transfer system and upgradingour lending systems. We also advanced our strategic plan to celebrate diversity, create equity andpromote inclusion. All of this is possible because of your membership, our volunteer board’s selflessservice, and because we have the best and brightest employees who are passionate about makinga difference in the financial lives of our members.Thank you for your membership and for all the ways it benefited your fellow Veridian members andour communities in 2021. As a not-for-profit financial cooperative owned by you, we couldn’t havedone it without you. I’m grateful for your partnership in creating successful financial futures and lookforward to all we can achieve together in 2022.“Thank you for yourmembership and for all theways it benefited your fellowVeridian members and ourcommunities in 2021.“Renee Christoffer, President and CEO1

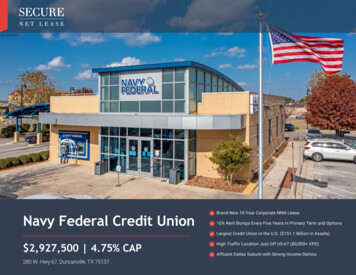

2021AN N UALREPO RTAWORDFROM OUR BOARDCHAIR2021AREASOFFOCUSVeridian’s mission is to partner with our members to create successful financial futures. Here aresome of the areas of focus in our work to achieve that mission in 2021.Having dedicated employees is key to the credit union experience, and the democratic election ofour board is key to the credit union difference. You vote for fellow members to serve as volunteerdirectors and ensure that decisions at the highest level of our credit union are made in members’best interests. As your Board Chair, I know I speak for all our directors when I say that we don’t takethis duty lightly.I’m happy to report that the challenges of 2021 didn’t hinder our mission to create successfulfinancial futures. In fact, they served as a catalyst for us to lean in and truly demonstrate ourcommitment to member service and support. Veridian is one of few financial institutions in Iowaand Nebraska certified by the U.S. Treasury Department as a Community Development FinancialInstitution. In 2021, we used community partnerships and innovative products like IndividualDevelopment Accounts and Financial Inclusion Mortgages to help members overcome barriersto homeownership. This work is important because we know homeownership is one of the mostsignificant tools allowing many to achieve financial stability and maintain long-term financialsuccess. Our partnerships with local Habitat for Humanity organizations provided financial literacyprogramming, corporate donations and lending agreements totaling more than 2 million. And weprovided 1,437 mortgages to members with a household income at or below 80% of the averagemedian income.All the while, Veridian members saved an estimated 45 million on better rates and fees, and weinvested in resources that will give us greater access and convenience in managing our personal andbusiness finances. We added technology to enhance digital access with video calls and real-timepayments while also expanding our branch network. Our Georgetown branch opened in Ankeny inJuly, and we started work on new branches to open in Omaha and Waterloo in 2022.I am extremely proud to be working alongside the Veridian team and am thankful for theirdedication, empathy and compassion for our members. Thank you for your membership and forentrusting our elected directors to oversee this important work.“I am extremely proud to beworking alongside the Veridianteam and am thankful fortheir dedication, empathy andcompassion for our members.HOMEOWNERSHIPHomeownership is one of the most significant tools allowing manyof our members to maintain financial stability and achieve long-termfinancial success. In 2021, we lent more than 8 million in Financial InclusionMortgages to members who experience barriers to homeownership. TheIowa Finance Authority recognized Veridian as a Diamond Lender for Iowahomebuyers. In total, we made 6,433 traditional first mortgage loans,including 1,437 for members at or below 80% of the average median income.A DVA N C I N G T E C H N O LO GYTechnology in financial services is evolving faster than ever, and you rely onVeridian to keep pace. In 2021, we added video calls as an option for youto connect with some of our teams, and we’re working to expand that access nextyear. We’re also in the final stages of an exciting new service that will soon allowyou to make digital payments directly from your accounts faster and easier thanever before.PROCESS IMPROVEMENTSYou provided invaluable feedback that helped us make several proceduralimprovements. With your input, we simplified the process for submittingtransaction disputes, added the ability to make travel notifications withinonline and mobile banking, streamlined our secure document transfer systemand upgraded our lending systems to ensure consistent decisioning.D I V E R S I T Y, E Q U I T Y & I N C L U S I O NWith the help of a strategic plan, we’re working to make our credit union reflectthe diversity in our communities at all levels, from membership to management.We’re hosting round-table discussions with affinity groups and launched amentorship program to help minoritized employees advance their career. Ourcertification as a Community Development Financial Institution is also helping usmake access to credit more equitable in our communities. We know there’s morework to do, and we’re committed to doing it.“Cynthia Buettner, Board Chair23

2021AN N UALREPO RTAWARDS A N D RECOGNITIONSVeridian is consistently ranked among the top 1% of creditunions in the U.S. for returning value to our members.*Best Local Credit UnionDes Moines CityviewBest of Des MoinesBest Credit UnionWaterloo-Cedar Falls CourierBest of the BestBest Customer ServiceWaterloo-Cedar Falls CourierBest of the BestBest Credit UnionDes Moines Business RecordBest of Des MoinesBest Credit Unionsto Work For (10th Nationally)American BankerBest Credit UnionDes Moines RegisterMetro’s BestBest Credit Union (2nd)Omaha MagazineBest of OmahaANN DOLAN AWARDWINNERSThe Ann Dolan Award recognizes one employee from each of our regional markets annually for going aboveand beyond to exceed members’ expectations. This award is named after retired Veridian employeeAnn Dolan, who was consistently recognized for outstanding service to our members.Sheldon StiefelBen AndersonFraud InvestigatorNortheast Iowa RegionLoan Advisor IEast Central Iowa Region“Sheldon flagged a suspicious cashier’s check forreview. It was a valid cashier’s check, and he couldhave easily allowed it to be processed. His instinct toinstead alert us and put the funds on hold saved ourmember from 19,000 in fraud and a lot of grief. Ourthanks to Sheldon and your Fraud Department.”“Ben should be commended for his professionalism,his willingness to go above and beyond and hiscapacity for reaching for solutions that fit thecircumstances. The way he treated me that day hasmade me tell many people that Veridian is the premiercredit union in the area.”Diamond LenderIowa Finance Authority2021 Top Mortgage LendersTop Iowa Workplace (3rd)Des Moines RegisterTop Workplaces*Source: Callahan & AssociatesMembers saved an estimated 45,000,000in 2021 by using products and services atVeridian instead of a for-profit bank.Brandon LeonardDJ CottonLoan Advisor IICentral Iowa RegionBranch ManagerWestern Iowa and Eastern Nebraska Region“Brandon built an impactful relationship with amember who lives with a learning disability and relieson him for trusted advice – both for financial guidanceand for everyday challenges. When the membershared his concern that his bus from Des Moines toWaterloo was cancelled, Brandon drove the memberto Waterloo so he could make it home safely.”“During our round table discussions, the idea of amentorship program was discussed as another way toengage and develop employees. DJ took the initiativeto put together what a program at Veridian couldlook like. He was instrumental in the development ofVeridian’s EPIC Mentorship Program. The leadershipDJ portrayed is commendable.”Veridian is certified as aCommunity DevelopmentFinancial Institution by theU.S. Treasury Department.This certification has helped us lend 27.5 million in Financial Inclusion Mortgagesto members who experience barriers tohomeownership since we first began offeringthem in 2019.45

2021AN N UALREPO RTAWORD F R O MOUR BOARDTREASURERAUDITCREDITThis committee helps ensure that Veridian’sfinancial condition is accurately representedand its assets are protected.This committee monitors lending policies andapproves new loan products and services,ensuring Veridian is always responding to thechanging needs of our growing membership.Committee ChairStephanie AtkinCommittee ChairAubrey WardWe also put our assets to work for you. Callahan & Associates, a Washington, D.C.-based firm thatreports nationally on credit union performance, continues to rank Veridian in the top 1% of creditunions in the U.S. for returning value to members. In 2021, our members saved an estimated 45million in better rates and fewer fees when compared to the same products and services at a for-profitbank. We also invested in technology and campaigns to find opportunities to save members more.For example, in a single outreach campaign, we saved 1,064 members more than 1 million in totalinterest by refinancing their auto loans at a lower rate.Committee MembersPam AyresGaylen D. WitzelCommittee MembersGinger ShirleyBill BoeversJustine PeeblesBob Kressig Annual review of specific board policies.We know that good financial guidance can be life-changing, and our mission calls us to be a partnerin creating successful financial futures. In addition to the more than 1 million we invested indonations, scholarships, sponsorships and grants, we partnered with organizations across our fieldof membership to provide financial literacy curriculum, help remove barriers to homeownership andmake access to credit more equitable in our communities. Annual review of independentaudit and exam reports.One of our core values as a credit union is to maintain unquestionable financial security. It’s crucial inachieving our mission to create successful financial futures. As our Treasurer, my duty is to ensure ourcredit union lives up to that promise while investing in resources for our members and communities.In 2021, I’m pleased to report we did exactly that.Growth is vital to maintaining financial security. And in 2021, Veridian’s deposits and assets grew by14.67% and 14.28%, respectively. Our capital ratio, an indicator of our financial strength, reached10.95%. The National Credit Union Administration considers credit unions with a capital ratio of 7%or greater to be well capitalized and in a strong position to serve members, including duringeconomic downturns.As a member-owned cooperative, our partnership with each of you allows us to offer great rates andlower fees, while strengthening the communities we serve. Thank you for the opportunity to join youin these efforts in 2021.“Callahan & Associates, aWashington, D.C.-based firm thatreports nationally on credit unionperformance, continues to rankVeridian in the top 1% of creditunions in the U.S. for returningvalue to members.“6COMMITTEE REPORTSCreston L. Van Wey, TreasurerAudit Committee Responsibilities:Credit Committee Responsibilities: Annual review of specific board policies. Review and approval of loanadvisor lending limits. Review of suspicious activity reporting. Review and approval of annualinternal audit plan. Approve new lending productsand services. Review of internal audit reports. Approve loans outside approvalauthority of loan advisors.Veridian invested more than 1 million in donations,sponsorships, scholarshipsand grants for ourcommunities in 2021.7

2021AN N UALREPO RTFINANCIALConsolidated Statements of IncomeSTATEMENTSYears Ended December 31, 2021 & 202020212020185,691,609181,561,066Interest on investment securities4,599,9141,915,142Interest on certificates of deposit and other 4Members’ shares31,996,07345,252,026Borrowed ,41226,432,12257,02039,759Interest incomeInterest and fees on loansConsolidated Statements of Financial ConditionYears Ended December 31, 2021 & 2020Total interest income20212020AssetsCash and cash equivalentsCertificates of ebt securities available for sale255,705,476176,254,271Equity ns held for saleLoans receivable, netAccrued interest receivableLand and land improvements20,169,72520,169,725Buildings and improvements65,331,71962,052,971Furniture and 247,069,17942,387,00173,960,00273,657,621National Credit Union Share Insurance Fund (NCUSIF) deposit41,237,83335,657,085Other assets58,651,34338,235,143Total assets 5,860,379,237 5,127,999,280Less accumulated depreciationNet property and 5,549Unappropriated99,835,78148,662,025Accumulated other comprehensive (loss)(9,703,288)(8,201,352)631,917,154516,456,222 5,860,379,237 5,127,999,280Members’ sharesAccrued interest payableBorrowed fundsAccrued expenses and other liabilitiesTotal liabilitiesMembers’ equityAppropriatedTotal members’ equityTotal liabilities and members’ equityTotal interest expenseNet interest incomeProvision for loan lossesNet interest income after provision for loan lossesNoninterest incomeService chargesProperty and equipmentTotal property and equipmentInterest expenseInsurance commissionsCredit card interchange feesGains from the sale of loansRealized gains on sales of equity securities, netUnrealized (losses) gains on equity securities, netGain (loss) on sale of property and equipmentOther service charges and feesTotal noninterest ,25196,195,50672,601,794Noninterest expensesSalaries and employee 6,230Furniture and fixtures6,451,5646,476,385Advertising and promotion3,781,3823,883,989Supplies and postage1,993,5722,210,490Data 3,152,829128,054,678 116,962,868 68,241,402OtherTotal noninterest expensesNet incomeConsolidated Statements of Comprehensive IncomeYears Ended December 31, 2021 & 2020Net income2021 116,962,8682020 68,241,402Other comprehensive income (loss):Unrealized (losses) gains on debt securities available for sale:Unrealized holding (losses) gains arising during the year(3,766,879)212,068Post-retirement benefit 4) 115,460,932 66,447,838Other comprehensive (loss)Comprehensive income83,997,186(1,992,779)9

2021AN N UALREPO RTFINANCIALSTATEMENTSNet change inAccrued interest receivableOther assetsAccrued interest payableAccrued expenses and other liabilitiesNet cash provided by operating activitiesConsolidated Statements of Changes in Members’ EquityProceeds from maturities of certificates of depositPurchase of certificates of umulated hase of debt securities available for saleProceeds from maturities of debt securities available for saleTotalPurchase of equity securitiesProceeds from sales of equity securitiesBalance, December 31, 8,241,40268,241,402––Net increase in loans receivableOther comprehensive ,56150,430,731(50,430,731)––Purchases of property and equipment300,261,640475,995,549 48,662,025(8,201,352) 1,501,936)–(1,501,936)– 192,889,791 348,894,870 541,784,661 99,835,781(9,703,288) 631,917,15490,959,466(24,983,686)(351,504,396)Net 0–Comprehensive ensive income(15,912,005)(173,458,056)Proceeds from sale of Federal Home Loan Bank stock450,008,384Balance, December 31, 202127,563,00010,829,269(6,407,788)Transfers, net77,984,014(2,803,400)30,851,354Net income147,992,163(935,800)425,564,818Other comprehensive , December 31, 2020(2,245)16,473,037Purchase of Federal Home Loan Bank stock156,125,739Transfers, net(808,501)(4,005,201)Cash flows from investing activitiesYears Ended December 31, 2021 & 2020Legal reservefor loan losses(595,950)(20,547,599)Proceeds from sale of property and 8)642,041,544(75,738,713)713,539,860Net cash provided by financing activities602,713,177703,306,929Increase in cash and cash equivalents232,891,883329,170,891Cash and cash equivalents at beginning of year444,365,178115,194,287Cash and cash equivalents at end of 8,2174,236,895Net increase in National Credit Union Share Insurance Fund depositNet cash used in investing activitiesCash flows from financing activitiesProceeds from borrowed fundsPayments to borrowed fundsNet increase in members’ sharesSupplemental disclosures of cash flow information, cash payments forInterest paid to membersInterest paid on borrowed fundsConsolidated Statements of Cash FlowsSupplemental schedule of noncash investment and financing activitiesYears Ended December 31, 2021 & 202020212020Unrealized (losses) gains on securities available for sale, netCash flows from operating activitiesNet income 116,962,868 68,241,402Adjustments to reconcile net income to net cash provided by operating activities:DepreciationProvision for loan lossesPost-retirement benefit obligation1,465,038Transfers from loans to foreclosed real 21,025,423,789Originations of loans held for sale(Gains) from the sale of ealized (gains) on sales of equity securities, net(3,997,186)(221,757)Unrealized losses (gains) on equity securities, ,730,535Net amortization of premiums on available-for-sale investment securities105,270,486Proceeds from sale of loans soldGain on sale of property and equipmentChange in accumulated other comprehensive (loss):11

2021AN N UAL12REPO OMMITTEESAudit (Chair)Strategic PlanningAudit (Secretary)NominatingStrategic PlanningCreditNominating (Chair)Executive (Chair)Strategic MMITTEESCOMMITTEESCOMMITTEECOMMITTEESBoard GovernanceExecutive (Secretary)CreditPolitical InvolvementStrategic PlanningExecutive (2nd Vice Chair)Strategic Planning on L.Van O Board MemberNominatingBoard GovernanceCredit (Secretary)Board GovernanceExecutive (Treasurer)AubreyWardNickWatersGaylen D.WitzelCOMMITTEESCOMMITTEESCOMMITTEESCredit (Chair)CUSO Board MemberNominatingBoard Governance (Chair)Executive (1st Vice Chair)AuditBoard GovernanceNominating13

This credit union is federally insured by the National Credit Union Administration.

Iowa Finance Authority recognized Veridian as a Diamond Lender for Iowa homebuyers. In total, we made 6,433 traditional first mortgage loans, including 1,437 for members at or below 80% of the average median income. ADVANCING TECHNOLOGY Technology in financial services is evolving faster than ever, and you rely on Veridian to keep pace.