Transcription

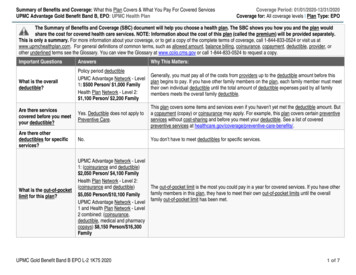

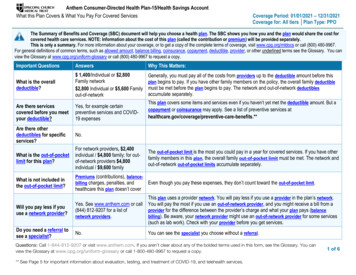

Anthem Consumer-Directed Health Plan-15/Health Savings AccountWhat this Plan Covers & What You Pay For Covered ServicesCoverage Period: 01/01/2021 – 12/31/2021Coverage for: All tiers Plan Type: PPOThe Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the plan would share the cost forcovered health care services. NOTE: Information about the cost of this plan (called the contribution or premium) will be provided separately.This is only a summary. For more information about your coverage, or to get a copy of the complete terms of coverage, visit www.cpg.org/mtdocs or call (800) 480-9967.For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment, deductible, provider, or other underlined terms see the Glossary. You canview the Glossary at www.cpg.org/uniform-glossary or call (800) 480-9967 to request a copy.Important QuestionsAnswersWhy This Matters:What is the overalldeductible? 1,400/Individual or 2,800Family network 2,800 Individual or 5,600 Familyout-of-networkGenerally, you must pay all of the costs from providers up to the deductible amount before thisplan begins to pay. If you have other family members on the policy, the overall family deductiblemust be met before the plan begins to pay. The network and out-of-network deductiblesaccumulate separately.Are there servicescovered before you meetyour deductible?Yes, for example certainpreventive services and COVID19 expensesThis plan covers some items and services even if you haven’t yet met the deductible amount. But acopayment or coinsurance may apply. See a list of preventive services .**Are there otherdeductibles for specificservices?No.What is the out-of-pocketlimit for this plan?For network providers, 2,400individual / 4,800 family; for outof-network providers 4,800individual / 9,600 familyThe out-of-pocket limit is the most you could pay in a year for covered services. If you have otherfamily members in this plan, the overall family out-of-pocket limit must be met. The network andout-of-network out-of-pocket limits accumulate separately.What is not included inthe out-of-pocket limit?Premiums (contributions), balancebilling charges, penalties, andhealthcare this plan doesn’t coverEven though you pay these expenses, they don’t count toward the out-of-pocket limit.Will you pay less if youuse a network provider?Yes. See www.anthem.com or call(844) 812-9207 for a list ofnetwork providers.Do you need a referral tosee a specialist?This plan uses a provider network. You will pay less if you use a provider in the plan’s network.You will pay the most if you use an out-of-network provider, and you might receive a bill from aprovider for the difference between the provider’s charge and what your plan pays (balancebilling). Be aware, your network provider might use an out-of-network provider for some services(such as lab work). Check with your provider before you get services.No.You can see the specialist you choose without a referral.Questions: Call 1-844-812-9207 or visit www.anthem.com. If you aren’t clear about any of the bolded terms used in this form, see the Glossary. You canview the Glossary at www.cpg.org/uniform-glossary or call 1-800-480-9967 to request a copy.** See Page 5 for important information about evaluation, testing, and treatment of COVID-19, and telehealth services.1 of 6

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.CommonMedical EventServices You May NeedPrimary care visit to treat aninjury or illnessSpecialist visitIf you visit a healthcare provider’s officeor clinicIf you have a testIf you have outpatientsurgeryIf you need immediatemedical attentionIf you have a hospitalstayWhat You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)15% coinsurance40% coinsuranceLimitations, Exceptions, & Other ImportantInformation**15% coinsurance40% coinsuranceNo charge.40% coinsurance15% coinsurance40% coinsurance**15% coinsurance40% coinsurance**15% coinsurance40% coinsuranceNone.Physician/surgeon fees15% coinsurance40% coinsuranceEmergency room careEmergency medicaltransportationUrgent careFacility fee (e.g., hospital room)15% coinsurance15% coinsurance**15% coinsurance15% coinsurance**15% coinsurance15% coinsurance15% coinsurance40% coinsurance**Physician/surgeon fees15% coinsurance40% coinsurancePreventive care/screening/immunizationDiagnostic test (x-ray, bloodwork)Imaging (CT/PET scans, MRIs)Facility fee (e.g., ambulatorysurgery center)**You may have to pay for services that aren’tpreventive. Ask your provider if the servicesneeded are preventive. Then check what yourplan will pay for. See a list of preventiveservices at one.Prior authorization is required. *** For more information about limitations and exceptions, see the plan or policy document at www.cpg.org.** See Page 5 for important information about the evaluation, testing, and treatment of COVID-19, and telehealth services.2 of 6

CommonMedical EventIf you need mentalhealth, behavioralhealth, or substanceabuse services.If you are pregnantIf you need helprecovering or haveother special healthneedsIf your child needsdental or eye careWhat You Will PayNetwork ProviderOut-of-Network Provider(You will pay the least)(You will pay the most)Limitations, Exceptions, & Other ImportantInformationOutpatient services15% coinsurance40% coinsuranceInpatient services15% coinsurance40% coinsurancePrior authorization required for inpatientservices.Colleague Group30% coinsurance30% coinsuranceThe plan will reimburse 70% up to a maximumreimbursable fee of 40. The member isresponsible for all costs above that amount.Office visitsChildbirth/delivery professionalservicesChildbirth/delivery facilityservices15% coinsurance40% coinsuranceNone.15% coinsurance40% coinsuranceWell-newborn care is covered. Newborn mustbe enrolled in the Plan within 30 days of birth.Home health care15% coinsurance40% coinsuranceRehabilitation services15% coinsurance40% coinsuranceHabilitation services15% coinsurance40% coinsuranceSkilled nursing care15% coinsurance40% coinsuranceDurable medical equipmentHospice servicesChildren’s eye examChildren’s glassesChildren’s dental check-up15% coinsuranceNo charge.Not covered.Not covered.Not covered.40% coinsurance40% coinsuranceNot covered.Not covered.Not covered.Services You May NeedLimited to 210 visits per plan year. Priorauthorization is required.Benefits include hearing/speech, physical, andoccupational therapy. Limited to 60 visits perplan year, combined facility and office, pereach of the three therapies.Limited to 60 days per plan year, combinedwith acute rehabilitation. Prior authorization isrequired.None.Vision benefits are available through EyeMedVision Care.* For more information about limitations and exceptions, see the plan or policy document at www.cpg.org.** See Page 5 for important information about the evaluation, testing, and treatment of COVID-19, and telehealth services.3 of 6

CommonMedical EventIf you need drugs totreat your illness orcondition. Moreinformation aboutprescription drugcoverage is available atwww.express-scripts.comServices You May NeedWhat You Will PayRetailHome DeliveryGeneric drugs15% (after deductible)Preferred brand drugs25% (after deductible)Non-preferred brand drugs50% (after deductible)Specialty drugsYour cost is based on whether the specialty drug is apreferred brand or non-preferred brand drug.Limitations, Exceptions, & Other ImportantInformationYou may get up to a 30-day supply when usinga retail pharmacy, and up to a 90-day supplywhen using home delivery. Your prescriptiondeductible and out-of-pocket limit is combinedwith your medical deductible and out-of-pocketlimit.Excluded Services & Other Covered Services:Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded services.) Cosmetic surgery Dental care (Adult) Long-term care Routine eye care (Adult) Routine foot care Weight loss programsOther Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.) Acupuncture Bariatric surgery Chiropractic careNon-emergency care when traveling outside the Hearing aids Infertility treatmentU.S. 1 Private-duty nursingCoverage for non-emergency care when traveling outside the U.S. applies only to services available through Anthem Blue Cross and Blue Shield. Non-emergencycare outside the U.S. is not available through Express Scripts.1* For more information about limitations and exceptions, see the plan or policy document at www.cpg.org.** See Page 5 for important information about the evaluation, testing, and treatment of COVID-19, and telehealth services.4 of 6

COVID-19 Evaluation, Testing, and Treatment, and Telehealth Services: The Medical Trust will waive all copays, deductibles, and coinsurance for its membersfor healthcare services relating to the evaluation and testing for COVID-19. In addition, the Medical Trust will waive all copays, deductibles, and in-networkcoinsurance for its active members for healthcare services relating to the treatment of COVID-19. The Medical Trust will also waive all copays, deductibles, andcoinsurance for all telehealth services received through vendor platforms. The Medical Trust will also allow claims for virtual visits with network and out-of-networkproviders who do not use a telehealth platform offered by Anthem. Standard deductibles, copays, and coinsurance will apply.Your Rights to Continue Coverage: The Plan’s Extension of Benefits program is similar, but not identical, to the healthcare continuation coverage provided underFederal law (known as COBRA) for non-church plans. Because the Plan is a church plan as described under Section 3(33) of ERISA, the Plan is exempt fromCOBRA requirements 2. Nonetheless, subscribers and/or their enrolled dependents will have the opportunity to continue benefits for a limited time in certain instanceswhen coverage through the health plan would otherwise cease. Individuals who elect to continue coverage must pay for the coverage. Call (800) 480-9967 for moreinformation.Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is called agrievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan documents alsoprovide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights, this notice, or assistance,contact Anthem Blue Cross and Blue Shield or Express Scripts as appropriate.Does this plan provide Minimum Essential Coverage? YesMinimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare, Medicaid,CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the premium tax credit.Does this plan meet the Minimum Value Standards? YesIf your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.Language Access Services:[Spanish (Español): Para obtener asistencia en Español, llame al (800) 480-9967.[Tagalog (Tagalog): Kung kailangan ninyo ang tulong sa Tagalog tumawag sa (800) 480-9967.[Chinese (中文): � (800) 480-9967.[Navajo (Dine): Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' (800) 480-9967.2Under Section 4980B(d) of the Code and Treasury Regulation Section 54.4980 B-2, Q. and A. No. 4.* For more information about limitations and exceptions, see the plan or policy document at www.cpg.org.** See Page 5 for important information about the evaluation, testing, and treatment of COVID-19, and telehealth services.5 of 6

About these Coverage Examples:This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will bedifferent depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost sharingamounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare the portion ofcosts you might pay under different health plans. Please note these coverage examples are based on self-only coverage.Peg is Having a Baby(9 months of in-network pre-natal care and ahospital delivery) The plan’s overall deductible Specialist [cost sharing] Hospital (facility) [cost sharing] Other [cost sharing] 1,40015%15%15%This EXAMPLE event includes services like:Specialist office visits (prenatal care)Childbirth/Delivery Professional ServicesChildbirth/Delivery Facility ServicesDiagnostic tests (ultrasounds and blood work)Specialist visit (anesthesia)Total Example CostIn this example, Peg would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Peg would pay is 12,739 1,400 0 1,895 60 2,400Managing Joe’s type 2 DiabetesMia’s Simple Fracture(a year of routine in-network care of a wellcontrolled condition) The plan’s overall deductible Specialist [cost sharing] Hospital (facility) [cost sharing] Other [cost sharing] 1,400(in-network emergency room visit and followup care)15%15%15%This EXAMPLE event includes services like:Primary care physician office visits (includingdisease education)Diagnostic tests (blood work)Prescription drugsDurable medical equipment (glucose meter)Total Example CostIn this example, Joe would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Joe would pay is 7,400 1,400 0 1,436 55 2,400 The plan’s overall deductible Specialist [cost sharing] Hospital (facility) [cost sharing] Other [cost sharing] 1,40015%15%15%This EXAMPLE event includes services like:Emergency room care (including medicalsupplies)Diagnostic test (x-ray)Durable medical equipment (crutches)Rehabilitation services (physical therapy)Total Example CostIn this example, Mia would pay:Cost SharingDeductiblesCopaymentsCoinsuranceWhat isn’t coveredLimits or exclusionsThe total Mia would pay isThe plan would be responsible for the other costs of these EXAMPLE covered services. 1,925 1,400 0 289 0 1,6896 of 6

Limited to 210 visits per plan year. Prior authorization is required. Rehabilitation services 15% coinsurance 40% coinsurance Benefits include hearing/speech, physical, and occupational therapy. Limited to 60 visits per plan year, combined facility and office, per each of the three therapies. Habilitation services 15% coinsurance 40% coinsurance