Transcription

SUNDARAM TRUSTEECOMPANY LIMITED14ANNUAL REPORT2017-18

SUNDARAM TRUSTEE COMPANY LIMITEDBoard of DirectorsM S SundararajanChairmanS VijiR VenkatramanSoundara Kumar (Ms.)Audit CommitteeR VenkatramanChairmanSoundara Kumar (Ms.)BankerIDBI Bank LtdAuditorsM/s. Sundaram & Srinivasan, ChennaiChartered AccountantsRegistered Office21, Patullos RoadChennai 600 002Corporate OfficeSundaram Towers,I & II Floor, 46, Whites Road,Royapettah, Chennai 600 014Tel: 91 44 4060 9900 / 2856 9900,Fax: 91 44 2858 3156CIN: U65999TN2003PLC052058Website: www.sundarammutual.comANNUAL REPORT 2017-183

SUNDARAM TRUSTEE COMPANY LIMITEDContentsDirectors’ Report5Auditors’ Report18Balance Sheet22Profit and Loss Statement23Notes24Cash Flow Statement32ANNUAL REPORT 2017-184

SUNDARAM TRUSTEE COMPANY LIMITEDDIRECTORS’ REPORTTo the MembersYour Directors have pleasure in presenting the 14th Annual Report with the audited financial statementof accounts for the year ended March 31, 2018. The summarized financial results of the Company aregiven hereunder:( In lakhs)ParticularsTotal RevenueTotal ExpensesProfit Before TaxProvision for TaxProfit After TaxYear endedMarch 31, 2018150.2139.51110.7030.5280.18Year endedMarch 31, 2017122.5239.9482.5824.7457.84Company PerformanceDuring the year under review, your Company earned a gross income of 150.21 lakhs by way oftrusteeship fees and other income as against 122.52 lakhs reported in the previous year 2016-17.The expenditure for the year under review was 39.51 lakhs in the current financial year compared to 39.94 lakhs in 2016-17. Your company reported a profit after tax of 80.18 lakhs for the year endedMarch 31, 2018 as against 57.84 lakhs in the previous year. A sum of 111.46 lakhs is availablefor appropriation for the financial year 2017-18. Your Directors are happy to recommend a higherdividend of 1000% on the paid up capital of the company as against 800% declared during 2016-17.The dividend amounting to 50 lakhs together with dividend tax of 10.28 lakhs absorbs a sum of 60.28 lakhs.During the year, your Company consented to act as Trustees of Sundaram Category IIAlternative Investment Trust. The Trust had launched a scheme - Sundaram AlternativeOpportunities Series – High Yield Secured Debt Fund which secured a capital commitment of 223.65 cr.Mutual Fund IndustryDuring the year, overall assets under management of the Indian mutual fund industry have grown from 17.55 Trillion to 21.36 Trillion, registering a growth of 22%. The equity assets have grown from 6.73 Trillion to 9.95 Trillion as at 31 March 2018, registering a growth of 48%.Sundaram Mutual FundThe average assets of mutual funds under management grew to 34,164 cr. for the financial yearended 31 March 2018 from 26,896 cr., in the previous financial year. This represents an increase of27% over the previous year. Your Directors are happy to note that during the course of the year, thecombined assets under management exceeded 40,000 cr.Fund PerformanceDuring the year under review, Sundaram Mutual Fund launched 16 close-ended schemes mobilizing 1,374 cr. Most of the schemes registered good performance during the year beating the benchmarkand in line with our philosophy, several schemes distributed sizeable dividends.ANNUAL REPORT 2017-185

SUNDARAM TRUSTEE COMPANY LIMITEDIn October 2017, Sundaram Asset Management Company Limited (Sundaram AMC) was awardedAsia’s Top 100 Money Managers by Institutional Investor Magazine and in January 2018, SundaramAMC was awarded one of the Best BFSI Brands 2018 by Economic Times.Your Directors are happy to inform you that the AUM of Sundaram Select Midcap touched 6,000cr., mark on 2 November 2017. On a fifteen year annualized return, Sundaram Select Midcapreturned 29.9% and on a ten year annualized return, Sundaram Select Midcap returned 17.3% as on31 March 2018. Sundaram Rural India has grown tremendously and secured CPR No. 1 ranking fromCRISIL.Your schemes were recognised by rating agencies and the press. Some of the accolades were:Scheme NameCRISILMorningStarCategoryValue ResearchSundaram Equity Multiplier FundEquity4 StarsSundaram Select Midcap Fund Direct PlanEquity4 StarsSundaram Rural India FundEquityRank 1Sundaram Select FocusEquityRank 2Sundaram Infrastructure AdvantageFundEquityRank 2Sundaram Flexible Fund - FlexibleIncome Plan - Direct PlanDebt4 StarsSundaram Money FundDebt4 StarsSundaram Monthly Income Plan Aggressive PlanDebt4 Stars4 StarsSundaram Select Debt Short TermAsset PlanDebt4 Stars4 StarsSundaram Ultra Short Term FundDebt4 Stars4 StarsSundaram Flexible Fund – FlexibleIncome PlanDebtRank 2Sundaram Monthly Income PlanDebtRank 24 Stars4 Stars4 StarsRank 25 StarsSundaram Income Plus - Direct Plan Growth OptionUltrashortBond5 StarsSundaram Banking & PSU Debt Fund- Bonus OptionShort-TermBond4 StarsSundaram Bond Saver - Direct Plan Growth OptionIntermediateBond4 StarsSundaram Gilt Fund - Direct Plan Growth OptionIntermediateGovernmentBond4 StarsSundaram Regular savings- DirectPlan - Growth OptionConservativeAllocation4 StarsANNUAL REPORT 2017-186

SUNDARAM TRUSTEE COMPANY LIMITEDRisk ManagementThe Company’s operations mainly relate to providing trusteeship services to Sundaram Mutual FundSchemes. The risk management areas relating to the mutual funds operations have been extensivelycovered by the Enterprise Risk Management Framework of the Investment Manager, Sundaram AMC,which is designed to assist in the identification and assessment of risks in order that they can bemanaged in an efficient manner and that informed decisions can be taken to manage threats andexploit opportunities.The reports of the internal auditor and independent auditor of the schemes relating to the financials andthe operations of the Company and schemes were reviewed by the Audit Committee which overseesRisk Controls in the system.Internal Control System and AdequacyThe Company has an adequate system of internal controls consistent with its nature and size of theoperations to ensure that all assets are safeguarded and protected against loss from unauthorized useor disposition and that the transactions are authorized, recorded and reported correctly. The Companycarries out extensive and regular internal control programs, policy reviews, guidelines and proceduresto ensure that the internal control systems are adequate enough to protect the Company against anyloss or misuse of the company’s assets.Capital Market OutlookIn FY ’18 Nifty 50 rose 10.55% from 9237 to 10212. The Nifty 50 hit a high of 11,130 on 29 Januarybefore retracting following the introduction of tax on equity investments in the Union Budget. Theyear featured two major reformatory steps – announcement by the Government of a 2.1Trillionrecapitalization plan to boost the Balance Sheets of Public Sector Banks that were struggling with highNPAs and introduction of the GST framework. The Union Budget for FY19 which was presented on30 January showed a great amount of fiscal restraint especially coming as it did in a pre-election year.The budget narrative continues to focus on agriculture and rural India. India also witnessed a positivesovereign rating upgrade from Moody’s of one notch above the current rating. It is important to notehere that this rating upgrade comes after a period of 13 years.The consensus view of equity markets for FY ‘19 is one of consolidation. Given that this is a preelection year with chatter that general elections can be advanced towards the end of the year theequity markets will most likely wait out the outcome of the elections before making its next move. Themarkets will also closely watch the fiscal deficit numbers though the Government has indicated thatthere will be no slippage on this front.On the Fixed income front, the benchmark 10 year G-Sec moved from 6.68% to 7.3% on the backof higher inflation and increase in prices of crude oil. The yields further increased in the 1Q ofFY ’19 to cross the 8% mark before falling back to around 7.8% levels currently. Hence, return fromfixed income investments for FY’18 and for the 1Q of FY ’19 has been disappointing. However, theoutlook for interest rates and by extension Fixed Income investments is slightly positive if only becausethe fixed income markets seem to have fully discounted inflation expectations and the probability ofyields moving down is thoughts to be higher than their moving up. How well the Government is ableto manage inflation expectations will prove crucial for the economy and for the markets. Despite theabove, we don’t expect the RBI to raise rates till at least October this year and are not expecting furtherrate hikes for FY ’19 given the fragility of economic growth.ANNUAL REPORT 2017-187

SUNDARAM TRUSTEE COMPANY LIMITEDIn conclusion, while growth appears to be recovering in pockets, both the sustainability and the breadthof this growth remain to be seen. High crude prices, rising global yields, sustained high inflation,possibility of a full blown mutually destructive trade war, rupee depreciation, shortfall in GST.RegulationSEBI has driven a change in fund rationalisation that reduces the fund overlap across the industry.SEBI driven fund rationalisation also gives scope to introduce new categories of funds. SundaramAMC will continue to focus on introducing new products, keeping in mind the long term interestof the investors. With the continued support of the equity markets, good performance of the fundsand adopting appropriate product and distribution strategy, your directors hope to continue the goodperformance in the coming years.During the year, SEBI had also issued circulars on the following aspects: As a part of Green Initiative, SEBI has decided to dispense with the requirement of publicationof daily NAV, sale / repurchase prices in newspapers and of sending (i) physical copies of schemeannual reports or abridged summary to all the investors whose email addresses are not availableand (ii) statement of scheme portfolios to unit holders on half-yearly basis. Benchmarking of scheme’s performance to Total Return Index in the place of price returnindex effective from February 2018;SEBI has also decided to reduce the expense ratio in the following manner: Additional TER of upto 30 basis points would be allowed for inflows from beyond top 30 citiesinstead of beyond top 15 cities effective from April 2018; AMCs shall not be eligible to charge additional expenses of upto 0.20% of daily net assetsin respect of mutual fund schemes including close ended schemes wherein exit load is notlevied / not applicable; Reduction in the additional expenses of upto 0.20% of the daily net assets of MF Schemes inlieu of the exit load to 0.05%.The above measures will adversely impact the fund mobilisation and profitability of Sundaram AMCin the long run.Board of DirectorsThe Board of Directors of the company is vested with general power of superintendence, direction andmanagement of the affairs of the Mutual Fund. Sundaram AMC acts as the Investment Manager of theSchemes of the Mutual Fund. The Board of Directors monitor and review the functions of the AssetManagement Company in order to ensure that it fulfils the tasks assigned to it under the investmentmanagement agreement and complies with SEBI Regulations and other laws in force. During the yearunder review, six Board Meetings were held.DirectorshipMr. R Venkatraman (DIN:07119686) retires at the ensuing General Meeting and being eligible, offershimself for re-appointment. Necessary resolution is submitted for your approval.ANNUAL REPORT 2017-188

SUNDARAM TRUSTEE COMPANY LIMITEDAudit CommitteeThe Audit Committee of the Board is constituted as per the SEBI Regulations. Mr R Venkatraman andMs Soundara Kumar are the members of the committee. During the year, five meetings of the committeewere held. The committee reviews the internal audit plans, financial statements, adequacy of internalcontrol systems. The committee reviews the reports, the observations of the internal / external auditorsand the responses of the management on the reports.The Company is not required to constitute Nomination and Remuneration Committee, CSR committeeas per the provisions of the Companies Act, 2013.Disclosure as per Secretarial Standard on meetings of the Board of Directors (SS-1)The number and dates of Meetings of the Board and Committees held during the financial year indicatingthe number of Meetings attended by each Director is furnished vide Annexure I. Your Company hascomplied with applicable Secretarial Standards issued by Institute of Company Secretaries of India.Public DepositsYour company has not accepted any deposits from the public.Particulars of Employee RemunerationThe Company has no employee on its payroll. Accordingly, the provisions of Section 197(12) of theCompanies Act, 2013 requiring disclosure of remuneration of employees is not applicable.The Company is not required to appoint a Whole Time Key Managerial Personnel in accordance withthe provisions of the Companies Act, 2013.Disclosure under the Prevention of Sexual Harassment of Women at Workplace Act, 2013The Company has no employee in its payroll and hence the Act is not applicable.Information under Section 134 (3) (m) of the Companies Act, 2013Your Company has no activity relating to conservation of energy or technology absorption. TheCompany had no foreign exchange earnings or outgo during the year 2017-18 and in 2016-17.Particulars of loans, guarantee and investments pursuant to Section 186 of the Companies Act,2013The Company has not given any loan or guarantee to any person or body corporate nor invested insecurities of any other body corporate during the year 2017-18.Particulars of Related Party Transactions pursuant to Section 134 (3) (h) of the Companies Act,2013During the year, the Company did not enter into any material transaction with related parties, underSection 188 of the Companies Act, 2013. All transactions entered into by the Company with the relatedparties were in the ordinary course of business and on an arm’s length basis. Form AOC-2, as requiredunder Section 134 (3) (h) of the Act, read with Rule 8 (2) of the Companies (Accounts) Rules 2014, isattached as part of this report vide Annexure II.ANNUAL REPORT 2017-189

SUNDARAM TRUSTEE COMPANY LIMITEDDirectors’ responsibility statement pursuant to Section 134 (3) (c) of Companies Act, 2013Your directors confirm that :1.In the preparation of the annual accounts, the applicable accounting standards had beenfollowed along with proper explanation relating to material departures;2.The directors had selected such accounting policies and applied them consistently and madejudgments and estimates that are reasonable and prudent so as to give a true and fair view ofthe state of affairs of the company at the end of the financial year and of the profit of thecompany for that period;3.The directors had taken proper and sufficient care for the maintenance of adequate accountingrecords in accordance with the provisions of the Companies Act, 2013 for safeguarding theassets of the company and for preventing and detecting fraud and other irregularities;4.The directors had prepared the annual accounts on a going concern basis;5.The directors had devised proper systems to ensure compliance with the provisions of allapplicable laws and that such systems were adequate and operating effectively.Extract of Annual ReturnThe extract of the annual return pursuant to Rule 12 (1) of the Companies (Management andAdministration) Rules, 2014 is attached as Annexure III.AuditorsM/s. Sundaram & Srinivasan, Chartered Accountants, Chennai, Statutory Auditors of your Company willhold office until the conclusion of the ensuing Annual General Meeting. Your directors recommend there-appointment of M/s. Sundaram & Srinivasan, Chartered Accountants, Chennai, as Statutory Auditorsof the Company in accordance with the provisions of Sections 139, 141 and other applicable provisionsof the Companies Act, 2013 to hold office from the conclusion of 14th Annual General Meetinguntil the conclusion of 19th Annual General Meeting, subject to the approval of the shareholders atthe 14th Annual General Meeting and ratification at every Annual General Meeting thereafter. TheCompany has received a certificate from them pursuant to Section 139 confirming their eligibility underSection 141 of the Companies Act, 2013 and rules issued thereunder.AcknowledgementYour Directors wish to place on record their deep appreciation of the professional support and guidancereceived from Sundaram Finance Limited, Sundaram AMC, Securities and Exchange Board of Indiaand Association of Mutual Funds in India.Your Directors also acknowledge the support and co-operation extended by investors, bankers,Registrars, the Custodian and other service providers and look forward to their continued support.Your Directors place on record their appreciation of the dedication and commitment displayed by theemployees of the AMC.For and On behalf of the Board of DirectorsPlace: ChennaiDate: 27.04.2018ANNUAL REPORT 2017-18M S SundararajanChairman10

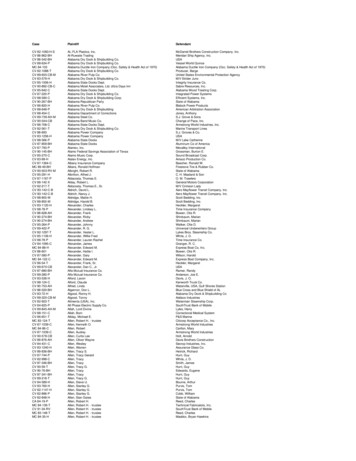

SUNDARAM TRUSTEE COMPANY LIMITEDAnnexure - IDisclosure as per Secretarial Standard on meetings of the Board of Directors (SS-1)During the year under review, 6 meetings of the Board of Directors were held. The details of directors’attendance at Board Meetings are as follows:Sl.No.Name of the DirectorDINNo. of Meetingsattended1M S Sundara Rajan0016977542S Viji0013904363R Venkatraman0711968664Soundara Kumar (Mrs.)019745156Meeting .201719.02.2018During the year under review, 5 meetings of the Audit Committee were held. Attendance of themembers at Committee meetings are as follows:S. No.Name of the MemberNo. of MeetingsAttended1R Venkatraman52Soundara Kumar (Mrs.)5Meeting .2018For and On behalf of the Board of DirectorsPlace: ChennaiDate: 27.04.2018M S SundararajanChairmanAnnexure - IIForm No. AOC-2(Pursuant to clause (h) of sub-section (3) of Section 134 of the Act and Rule 8 (2) of theCompanies (Accounts) Rules, 2014)Form for disclosure of particulars of contracts/arrangements entered into by the company withrelated parties referred to in sub-section (1) of section 188 of the Companies Act, 2013 includingcertain arms length transactions under third proviso thereto1.Details of contracts or arrangements or transactions not at arm’s length basisAll transactions entered into by the Company during the year with related parties were on anarm’s length basis.2.Details of material contracts or arrangement or transactions at arm’s length basisThe transactions entered into by the Company during the year with related parties on an arm’slength basis were not material in nature.For and On behalf of the Board of DirectorsPlace: ChennaiDate: 27.04.2018ANNUAL REPORT 2017-18M S SundararajanChairman11

SUNDARAM TRUSTEE COMPANY LIMITEDAnnexure - IIIFORM NO MGT-9Extract of Annual Return as on the financial year ended on 31st March 2018[Puruant to Section 92(3) of the Companies Act, 2013 and Rule 12(1) of the Companies(Management and Administration Rules, 2014]IREGISTRATION AND OTHER DETAILSi)CINU65999TN2003PLC052058ii)Registration Date2-Dec-03iii)Name of the CompanySundaram Trustee Company Limitediv)Category / Sub-category of the companyPublic Company / Company having share capitalv)Address of the Registered office and contact details 21 Patullos Road, Chennai 600 002.vi)Tel: 91 44 4060 9900 / 2856 9900Whether listed companyNovii) Name, address and contact details of Registrarand Transfer agent, if anyNot applicableII PRINCIPAL BUSINESS ACTIVITIES OF THE COMPANYAll the business activities contributing 10% or more of the total turnover of the company shall be statedSl.NoName & description of mainproducts / servicesNIC Code of the product /services% to total turnover of thecompany1Trusteeship Services65999100%III. PARTICULARS OF HOLDING, SUBSIDIARY AND ASSOCIATE COMPANIESSl.NoName and address of thecompany1Sundaram Finance Ltd.21, Patullos Road,Chennai 600002ANNUAL REPORT 2017-18CIN/GLNHolding/Subsidiary/Associate% of ldingCompany100%Sec. 2 (46)12

SUNDARAM TRUSTEE COMPANY LIMITEDIV SHARE HOLDING PATTERN (Equity Share Capital Breakup as percentage of Total Equity)(I) Category-wise Share HoldingNo of Shares held at thebeginning of the yearCategory of ShareholdersNo of shares held at the end of theyearDematPhysicalTotal% ofTotalShares-----b) Central Govt----c)State Govt(s)----d) Bodies Corp.-50,00050,000100%e)Banks / FI----f)Any Other----Sub Total A(1)-50,00050,000100%NRIs - Individuals----b) Other Individuals---c)--d) Banks / FI-e)Any Other%ChangeDuringthe yearTotal% ----------Sub Total A(2)---------Total Shareholding ofpromoter (A) A(1) A(2)-50,00050,000100%50,00050,000100%Nil1) Institutions---------a)---------b) Banks / FI---------c)---------d) State Govt---------e)Venture Capital Funds---------f)Insurance Companies---------g)FIIs---------h) Foreign Venture CapitalFunds---------i)Others(Specify)---------Sub Total B(1)---------Demat PhysicalA. Promoter1) Indiana)Individual / HUF2) Foreigna)Bodies Corp.B. Public ShareholdingMutual FundsCentral GovtANNUAL REPORT 2017-1813

SUNDARAM TRUSTEE COMPANY LIMITEDNo of Shares held at thebeginning of the yearCategory of ShareholdersNo of shares held at theend of the yearDematPhysicalTotal% ofTotalSharesDemat PhysicalTotal% ofTotalShares%ChangeDuringthe year2) Non-Institutionsa)Bodies Corp.---------i)Indian---------ii) Overseas---------Individual shareholdersholding nominal sharecapital upto 1 Lakh---------ii) Individual shareholdersholding nominal share capital in excess of 1 Lakh---------c)Others Specify---------Sub Total B(2)---------Total Public Shareholding(B) B(1) 00100%Nilb) Individualsi)C. Shares held by custodianfor GDRs & ADRsGrand Total (A) (B) (C)ii) Shareholding of PromotorsShareholding at thebeginning of the yearShareholder's NameNo ofsharesSundaram Finance Limited50,000ANNUAL REPORT 2017-18% of% of sharestotalpledged /shares of encumberedtheto totalcompanyshares100%NilShareholding at theend of the yearNo ofShares% of totalshares of thecompany% of sharespledged /encumberedto total shares50,000100%Nil% change inshare holdingduring theyearNil14

SUNDARAM TRUSTEE COMPANY LIMITEDiii) Change in Promoter’s Shareholding (Please specify, if there is no change)Shareholder's NameShareholding at thebeginning of the year% of total sharesNo of Sharesof the companyCummulative shareholdingduring the year% of total sharesNo of Sharesof the companySundaram Finance LimitedAt the beginning of the year50,000100%Date wise increase / decrease50,000100%50,000100%No ChangeAt the End of the yeariv) Shareholding pattern of top ten shareholders (Other than Directors, Promoters and Holders of GDRs and ADRs)Shareholder's NameShareholding at thebeginning of the yearNo of SharesCummulative shareholdingduring the year% of total sharesof the companyAt the beginning of the yearNo of Shares% of total sharesof the companyNilDate wise increase / decreaseAt the End of the yearv) Shareholding pattern of Directors and Key Managerial PersonnelName of Director and KMPMr S Viji, DirectorAt the beginning of the yearDate wise increase / decreaseAt the End of the yearANNUAL REPORT 2017-18Shareholding at thebeginning of the yearCummulative shareholdingduring the yearNo of Shares% of total sharesof the companyNo of Shares% of total shares of thecompany1Negligible1Negligible1NegligibleNil15

SUNDARAM TRUSTEE COMPANY LIMITEDV) INDEBTEDNESSIndebtedness of the Company including interest outstanding / accrued but not due for paymentSecured ndebtednessIndebtedness at the beginning of the financialyeari) Principal Amountii) Interest due but not paidIII) Interest accrued but not dueTotal (i) (ii) (iii)Change in Indebtedness during the financialyearNilAdditionReductionNet ChangeIndebtedness at the end of the financial yeari) Principal Amountii) Interest due but not paidIII) Interest accrued but not dueTotal (i) (ii) (iii)VI REMUNERATION OF DIRECTORS AND KEY MANAGERIAL PERSONNELA. Remuneration to Managing Director, Whole-time directors and/or ManagerSl.No1Particulars of RemunerationName of MD/WTD/ManagerTotal Amount ( )Gross Salarya) Salary as per provisions contained in Section 17(1) of theIncome tax Act, 1961b) Value of Perquisites u/s 17(2) of the Income Tax Act, 1961c) Profits in Lieu of salary under Section 17(3) of the Income taxAct, 19612Stock Option3Sweat Equity4CommissionNil- as % of Profits- others, specify5Others, Please specifyTotal (A)Ceiling as per the Act (10% of Net Profits)ANNUAL REPORT 2017-18NA16

SUNDARAM TRUSTEE COMPANY LIMITEDB. Remuneration to Other DirectorsParticulars of RemunerationCommissionOthers,Please SpecifyTotalAmount( )----1,00,0003,50,000----Mr. R. Venkatraman2,75,0003,50,000-6,25,000Ms. Soundara Kumar2,75,0003,50,000-6,25,000Name of DirectorsFee for attending board/committee meetingsIndependent Directors :Other Non-Executive Directors:Mr. M.S. SundararajanMr. S. Viji4,50,000-Total (B)17,00,000Total Managerial Remuneration (A) (B) excluding Sitting Fee10,50,000Overall Ceiling as per the Act (11% of Net Profits)13,14,156C. Remuneration to Key Managerial Personnel other than MD/Manager/WTDKey Managerial PersonnelSl.NoParticulars of RemunerationCEO1Gross Salary(a)Salary as per provisions contained in Section 17(1) of theIncome Tax Act, 1961(b)Value of Perquisites u/s Section17(2) of the Income Tax Act, 1961(c)Profits in Lieu of salary under Section 17(3) of the Income tax Act,19612Stock Option3Sweat Equity4CommissionCompanySecretary*CFOTotalNil- as % of Profits- Others, Please Specify5Others, Please specifyTotal (A)Ceiling as per the ActNA* Mr Ashwani Kumar Dalal, Company Secretary has been nominated by Sundaram Asset Management Company Limitedand no remuneration is borne by this Company.VII PENALTIES / PUNISHMENT / COMPOUNDING OF OFFENCESThere were no penalties / punishment / compounding of offences against the Company, Directors and other Officersin Default during the year ended 31st March 2018.For and On behalf of the Board of DirectorsPlace: ChennaiDate: 27.04.2018ANNUAL REPORT 2017-18M S SundararajanChairman17

SUNDARAM TRUSTEE COMPANY LIMITEDINDEPENDENT AUDITOR’S REPORTTO THE MEMBERS OF SUNDARAM TRUSTEE COMPANY LIMITEDReport on Financial StatementsWe have audited the accompanying financial statements of Sundaram Trustee Company Limited (“the Company”), whichcomprise the Balance Sheet as at March 31, 2018, the Statement of Profit and Loss, the Cash Flow Statement for the yearthen ended and a summary of the significant accounting policies and other explanatory information.Management’s Responsibility for the Financial StatementsThe Company’s Board of Directors is responsible for the matters stated in Section 134(5) of the Companies Act, 2013 (“theAct”) with respect to the preparation of these financial statements that give a true and fair view of the financial position,financial performance and cash flows of the Company in accordance with the accounting principles generally acceptedin India, including the Accounting Standards specified under Section 133 of the Act, read with Rule 7 of the Companies(Accounts) Rules, 2014. This responsibility also includes maintenance of adequate accounting records in accordancewith the provisions of the Act for safeguarding of the assets of the Company and for preventing and detecting frauds andother irregularities; selection and application of appropriate accounting policies; making judgments and estimates that arereasonable and prudent; and design, implementation and maintenance of adequate internal financial controls, that wereoperating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the preparation andpresentation of the financial statements that give a true and fair view and are free from material misstatement, whether dueto fraud or error.Auditor’s ResponsibilityOur responsibility is to express an opinion on these financial statements based on our audit.We have taken into account the provisions of the Act, the accounting and auditing standards and matters which arerequired to be included in the audit report under the provisions of the Act and the Rules made thereunder.We conducted our audit in accordance with the Standards on Auditing specified under Section 143(10) of the Act. ThoseStandards require that we comply with ethical requirements and plan and perform the audit to obtain reasonable assuranceabout whether the financial statements are free from material misstatement.An audit involves performing procedures to obtain audit evidence about the amounts and the disclosures in the financialstatements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of materialmisstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the auditorconsiders internal financial control relevant to the Company’s preparation of the financial statements that give a true andfair view in order to design audit procedures that are appropriate in the circumstances. An audit also includes evaluating theappropriateness of the accounting policies used and the reasonableness of the accounting estimates made by Company’sDirectors, as well as evaluating the overall presentation of the financial statements.We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinionon the financial statements.OpinionIn our opinion and to the best of our information and according to the explanations given to us, the financial statementsgive

Mutual Fund Industry During the year, overall assets under management of the Indian mutual fund industry have grown from . Sundaram Rural India has grown tremendously and secured CPR No. 1 ranking from CRISIL. Your schemes were recognised by rating agencies and the press. Some of the accolades were: Scheme Name Category Value Research CRISIL .