Transcription

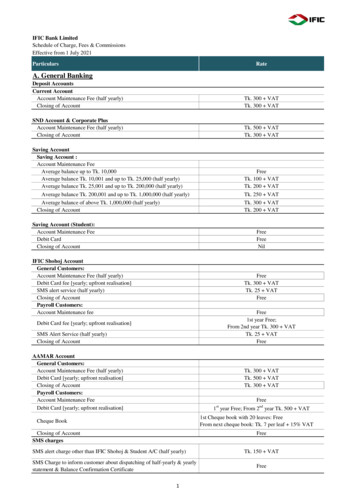

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateA. General BankingDeposit AccountsCurrent AccountAccount Maintenance Fee (half yearly)Closing of AccountTk. 300 VATTk. 300 VATSND Account & Corporate PlusAccount Maintenance Fee (half yearly)Closing of AccountTk. 500 VATTk. 300 VATSaving AccountSaving Account :Account Maintenance FeeAverage balance up to Tk. 10,000Average balance Tk. 10,001 and up to Tk. 25,000 (half yearly)Average balance Tk. 25,001 and up to Tk. 200,000 (half yearly)Average balance Tk. 200,001 and up to Tk. 1,000,000 (half yearly)Average balance of above Tk. 1,000,000 (half yearly)Closing of AccountFreeTk. 100 VATTk. 200 VATTk. 250 VATTk. 300 VATTk. 200 VATSaving Account (Student):Account Maintenance FeeDebit CardClosing of AccountFreeFreeNilIFIC Shohoj AccountGeneral Customers:Account Maintenance Fee (half yearly)Debit Card fee [yearly; upfront realisation]SMS alert service (half yearly)Closing of AccountPayroll Customers:Account Maintenance feeFreeTk. 300 VATTk. 25 VATFreeFree1st year Free;From 2nd year Tk. 300 VATTk. 25 VATFreeDebit Card fee [yearly; upfront realisation]SMS Alert Service (half yearly)Closing of AccountAAMAR AccountGeneral Customers:Account Maintenance Fee (half yearly)Debit Card [yearly; upfront realisation]Closing of AccountPayroll Customers:Account Maintenance FeeDebit Card [yearly; upfront realisation]Tk. 300 VATTk. 500 VATTk. 300 VATFree1st year Free; From 2nd year Tk. 500 VAT1st Cheque book with 20 leaves: FreeFrom next cheque book: Tk. 7 per leaf 15% VATCheque BookClosing of AccountSMS chargesFreeSMS alert charge other than IFIC Shohoj & Student A/C (half yearly)SMS Charge to inform customer about dispatching of half-yearly & yearlystatement & Balance Confirmation Certificate1Tk. 150 VATFree

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateIssuance of Pay Order etc.Up to Tk.1,000Tk. 1,001 to Tk.100,000Above Tk. 100,000Cancellation of PO/SDRDuplicate Issuance of POTk. 20 VATTk. 50 VATTk. 100 VATTk. 50 VATTk. 500 VATLocker & Safe Custody ChargesSmallMediumLargeTk. 5,000 yearly VATTk. 10,000 yearly VATTk. 12,000 yearly VATReplacement of lost keyAt actual plus 15% of rent as handling charges VATSecurity Money (Refundable)SmallMediumLargeTk. 5,000Tk. 10,000Tk. 12,000Mobile Financial Service (MFS)IFIC Account to bKAsh AccountIFIC Card to bkash AccountIFIC Account to Nagad AccountIFIC Card to Nagad AccountFreeFreeFreeFreeSolvency certificateTk. 200 VATDuplicate Issuance of Tax CertificateTk. 1,000 VATHalf-yearly & yearly statement & Balance Confirmation CertificateIssuance of additional statements other than half-yearly & yearly statement& Balance Confirmation CertificateFreeMax. Tk. 100 VATUp to 10 pageTk. 50 VAT11 Pages to 50 PagesTk. 500 VATAbove 50 PagesTK 500 Per page Tk. 5Tk. 100 VATAuthentication/verification of statements/certificatesBeneficiary Owner’s certificateAny other certificateTk. 500 VATCheque Return for Insufficient Fund - Inward/Outward (Each time)Issuance of Cheque BookDestruction of Cheque BookIssuance of copy of Cheque & Voucher (beyond 3 months)Max. Tk. 50 VATAt actual VATTk. 500 VATTk. 1,000 VATStop payment instructionCancelation of Stop payment instructionIssuance of Bangladesh Bank ChequePostage chargeStamp chargeTk. 100 per instruction VATTk. 50 per instruction VATTk. 1,000 per instance VATAt actual (mini Tk. 50) VATAt actualRTGS per transactionTk. 100 (including VAT)Dormant Account Activation ChargeStanding InstructionPremature encashment of DPS & FDR etc.Internet BankingFreeTk. 500 VATFreeFree2

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateB. Loans and Advancese-Govt. Procurement (e-GP) ServiceRegistration, Renewal, Documentation, Tender SecurityTk. 1,000 VATIssuance of Guarantee and AmendmentIssuance of Bank GuaranteeAmendment of Bank Guarantee for Extension ofValidity/and Increase of ValueAmendment of Bank Guarantee without Extension ofValidity/and Increase of ValueFully covered by Cash marginFully Covered by FDR0.50% per qtr. (Min.Tk.1,000) VAT0.50% per qtr. (Min.Tk.1,000) VATTk. 1,000 per instance VATTk. 1,000 per annum VAT0.25% per quarter (min Tk. 1,000) VAT* Commission to be charged for minimum one quarter. Subsequently, it will be charged proportionately in terms of days.Mortgage/ Charge Creation- Initial, subsequent enhancement/renewalCorporate lending0.15% on loan amount (mini. Tk. 1,000 & Max. Tk. 50,000) VATCMSMEAgriRetailCIB charge and stamp chargeLegal and valuation chargesFreeFreeFreeAt actual on borrowers accountAt actualRetail Loan (IFIC Aamar Rin)Flexi Loan0.50% of loan but Max. Tk. 10,000For existing Aamar Bari Customer: NilTk. 5,000Disbursed loan & existing Aamar Bari customer : NilLoan origination/processing feeDistortion chargeReschedule/restructure feeEarly Settlement (Own source/Takeover)0.25% of loan but Max. Tk. 5,0000.50% on outstanding loan amountAuto Loan0.50% of loan but Max. Tk. 15,000For existing Aamar Bari Customer: NilLoan origination/processing feeReschedule/restructure fee0.25% of loan but Max. Tk. 10,000Tk. 5,000Disbursed loan & existing Aamar Bari customer : Nil0.50% on outstanding loan amountDistortion chargeEarly Settlement (Own source/Takeover)Aamar Account OD (Secured)0.50% of loan but Max. Tk. 10,000For existing Aamar Bari Customer: Nil0.25% of loan but Max. Tk. 5,000Tk. 5,000Disbursed loan & existing Aamar Bari customer : NilNilLoan origination/processing feeRenewal feeDistortion chargeEarly Settlement (Own source/Takeover)Aamar Account OD (Unsecured)Loan origination/processing feeRenewal feeDistortion chargeEarly Settlement (Own source/Takeover)0.50% of loan but Max. Tk. 2,5000.25% of loan but Max. Tk. 1,250NilNilSalary LoanLoan origination/processing feeReschedule/restructure fee0.50% of loan but Max. Tk. 2,5000.25% of loan but Max. Tk. 1,250Distortion chargeNilEarly Settlement (Own source/Takeover)0.50% on outstanding loan amount3

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateEasy LoanLoan origination/processing feeUp to Tk. 5 mln:0.50% of loan or Tk. 2,000, whichever is lowerAbove Tk. 5 mln to Tk. 10 mln: 0.30% of loan or Tk. 3,000, whichever is lowerAbove Tk. 10 mln:0.30% of loan or Tk. 5,000, whichever is lowerRenewal feeUp to Tk. 5 mln:0.25% of loan or Tk. 2,000, whichever is lowerAbove Tk. 5 mln to Tk. 10 mln: 0.25% of loan or Tk. 3,000, whichever is lowerAbove Tk. 10 mln:0.25% of loan or Tk. 5,000, whichever is lowerDistortion chargeNilEarly Settlement (Own source/Takeover)NilAamar BariLoan origination/processing feeTakeover loan: NilFor fresh loan (loan amount) & takeover Home credit (Incremental loan amount):Up to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Reschedule/restructure fee0.25% of loan but Max. Tk. 10,000Distortion chargeTk.10,000Early Settlement (Own source/Takeover)0.50% on outstanding loan amountPremium Overdraft (POD)Up to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000NilN/AUp to Tk. 5,000,000Tk. 5,000Above Tk. 5,000,000Tk. 10,000Loan origination/processing feeEarly Settlement (Own source/Takeover)Distortion chargeRenewal feeOther Retail LoanReschedule/restructure fee (Secured & Unsecured Termnature only )Early Settlement (Own source/Takeover)0.25% of outstanding amount0.50% on outstanding loan amountCottage, Micro, Small & Medium Enterprise (CMSME) LendingsCottage, Micro EnterpriseLoan origination feeUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan takeover chargeCommitment ChargeFreeFreeSmall and Medium Enterprise:Easy Commercial Loan, Retailers Loan, Transport Loan, Commercial House Building Loan, Working Capital Loan, Bidder’s Loan, Muldhan,Lease Finance, Protyasha, Joyeeta, Prantonari, IDBP, Krishi Shilpo, Shilpo Shongjog, SOD/LGLoan Application FeeFreeLoan origination feeUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Commitment ChargeFreeSmall Enterprise: NilMedium Enterprise: 0.50% of outstanding balanceEarly SettlementIFIC Shohoj RinCottage & Micro Enterprises, Marginal Farmers (Livestock & Fisheries), Marginal & Landless Farmers (Crops), Low Income IndividualsDocumentation Charge(CIB, Stamp, Valuation & Legal fee etc.)At actual VATLoan takeover by Bank/NBFICommitment ChargeFreeFree4

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateLarge & Medium Enterprise Financingi. Commercial House Building LoanUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeReschedule/restructure fee0.25% of loan but Max. Tk. 10,000Loan takeover by Bank/NBFIHandling Charge [if sanctioned loan not availed]NilTk. 5,000 VATii. Project Loan/BMREUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeHandling Charge [if sanctioned loan not availed]Tk. 25,000 VATReschedule/restructure feeLoan takeover by Bank/NBFI0.25% of loan but Max. Tk. 10,000Niliii. Working Capital LoanUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeHandling Charge [if sanctioned loan not availed]Tk. 5,000 VATReschedule/restructure feeLoan takeover by Bank/NBFIiv. Syndicate financing0.25% of loan but Max. Tk. 10,000NilCharges and fees shall be realized as per facility agreement or lead Bankarrangement.v. IDBPUp to Tk. 500,000: Charge Tk. 500 per instanceAbove Tk. 500,000: Charge Tk. 1,000 per instanceIDBP Creation ChargeHandling Charge [if sanctioned loan not availed]Tk. 5,000 VATAgriculture FinancingIFIC Suborno GramCrop, Fisheries, Live StockUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeStamp chargeAt actual on Borrower's A/c.Krishi Saronjam RinUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeStamp chargeAt actual on Borrower's A/c.Shech Saronjam RinUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeStamp chargeAt actual on Borrower's A/c.Lease FinanceUp to Tk. 5 mln: 0.50% of loan but Max. Tk. 15,000Above Tk. 5 mln: 0.30% of loan but Max. Tk. 20,000Loan origination feeStamp chargeStamp, CIB, Legal & Valuation FeeForce funded loan creationDemand loan converted to Term loanAt actual on Borrower's A/c.At actual on borrowers A/c1% of funded amount0.25% of converted amount5

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateModification of Terms & ConditionsNOC for change in Board of DirectorsChanging of Mortgaged PropertyChanging of any other TermsUp to Tk. 1,000,000Tk. 1,000,001 to Tk. 10,000,000Above Tk. 10,000,000Redemption of PropertyIn case of own property or taking over and other casesTk. 10,000 VATTk. 20,000 VATTk. 2,500 VATTk. 5,000 VATTk. 10,000 VATSMETk. 200 VATRetailTk. 2,000 VATCorporateTk. 5,000 VATSMETk. 500 VATRetailTk. 4,000 VATCorporateTk. 7,000 VATSMETk. 500 VATRetailTk. 5,000 VATCorporateTk. 8,000 VATSMETk. 700 VATRetailTk. 7,000 VATCorporateTk. 10,000 VATSMETk. 2,000 VATRetailTk. 5,000 VATCorporateTk. 20,000 VATTk. 2,000 VAT; Cost at actualUp to Tk. 500,000Tk. 500,001 to Tk. 5,000,000Tk. 5,000,001 to Tk. 10,000,000Above Tk. 10,000,000Mortgage deferralSecurity verificationSecurity Retention fees after settlement of facilitiesAfter 3 months Tk. 5,000 VATAfter 1 year Tk. 10,000 plus Tk. 10,000 per fraction period or per year VAT6

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateC. Foreign ExchangeLetter of Credit OpeningL/C opening commissions under cash (sight)0.40% for each quarter (Min Tk. 1,000)* VATL/C opening commissions under AID/ Loan/ Credit/ Barter0.50% for each quarter (Min Tk. 1,000)* VATL/C opening Commissions for Back to Back L/C on A/c of export oriented industry0.40% for each quarter (Min Tk. 1,000)*L/C Opening commission under deferred payment0.50% for each quarter (Min Tk. 1,000)* VATUPAS L/C arrangement/processing feeTk. 1,000 VAT per instanceLC with 100% cash margin0.25% for each quarter* VATLC with 100% FDR margin0.40% for each quarter* VATL/C Opening processing fee on case to case basisTk. 300 VAT for each L/CL/C opening commissions where 100% margin is received0.25% for each quarter (Mini Tk. 1,000)* VATCollection of Credit Report by SWIFTSwift charge at actual VAT for each communicationAcceptance commission under Deferred payment L/C's (Including B.B. L/Cs)0.40% for each quarter (Min Tk. 1,000)* VATL/c transmission charges by SWIFTAt actual VAT* Commission on LC issuance /LC acceptance/ Bank guarantee to be charged for minimum one quarter. Subsequently, it will be charged proportionately in terms ofdays.Recovery of Charges/Fees for SWIFT Message (Including VAT)L/C opening (message type 700)L/C amendment (message type 707)Customer transfer (message type 103)Free format message (message type 999)* Charge other than above message types will be realised as per respective SWIFT serviceAmendment of L/CValue increase or extension of timeAny other amendments ChargesTransmission charges for amendment of L/C by SwiftAdd Confirmation ChargeConfirmation arrangement chargeForeign Tk. 2,500 & Local Tk. 750Foreign Tk. 750 & Local Tk. 250Foreign Tk. 500 & Local Tk. 150Foreign Tk. 500 & Local Tk. 200Prescribed rate for LC opening plus transmission chargesTk. 750 and transmission charges VATAt actual VATAt actual by confirming bank0.20% (Flat) VATPayment charge US 60Document Processing Charge US 50 against Foreign L/C VATForeign correspondents charges for all types of L/C'sForeign correspondents charges for amendments of L/C's.On opener's A/c, Minimum Tk. 750 VATDiscrepancy ChargeIn case of Foreign LCIn case of EPZ through FDDLocal LC Discrepancy FeeUp to USD 5,000Above USD 5,001USD 80USD 50USD 30USD 50Correspondence ChargeUp to USD 2,000USD 30Above USD 2,000 to USD 50,000USD 60Above USD 50,000USD 100Up to Tk. 5,000,000Tk. 2,000.00Above Tk. 5,000,000Tk. 5,000.00At actual VATTk. 1,000 VAT (in the case of import capital machinery forproducing export items, VAT will not apply)Tk. 500 VATTk. 1,000 VATImport Payment Charge (through FDD)Import Payment Charge (in local currency)Cancellation of all types of L/Cs : SWIFTLC Commission Cash (min) (in case of 100% cash margin)Processing of Maturity date Extension (min)Processing & verification of IRCImport:IMP/LCA/L/C application formStationery RecoveryImport Transaction CertificateIndemnity for shipping Guarantees in absence of original documents, provided full value ofdocument is deposited by client (Cash LC at sight)Issuance of Shipping Guarantee (Usance)Up to 10,000 10,001 to 200,000Above 200,000Processing of documents for LTRTk. 500 VATTk. 200 VATTk. 500 per certificate VATTk. 1,000 VATTk. 2,000 VATTk. 4,000 VATTk. 6,000 VAT0.15% on invoice value (min. Tk. 1,000 max. Tk. 3000) VATPayment of LCAFImport through LCAFIssuance of Back-to-Back L/C CertificateTk. 1,000 VAT0.15% of Invoice value, Min Tk. 1,000 VATTk. 500 per certificateUp to USD 100,000Above USD 100,001 to USD 1,000,000Above USD 1,000,000Certification of import docs for custom assessment purpose7Tk. 1,000Tk. 2,500Tk. 5,000

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateAttestation of Import documentsEDF refinance processingNOC for Import under Free of Cost (FOC)Advance payment against Local import (Without LC) through FDDTk. 300 VATTk. 1,500 VATTk. 2,000 VATTk. 1,000 VATExport:Advising/Amendment of Export L/C to the beneficiaryL/c issued by Foreign BanksL/c issued by Local BanksTk. 750 VATTk. 750 VATAdvising of Export L/C to the beneficiary (Amendment Advice)L/c issued by Foreign BanksL/c issued by Local BanksAdvising LC/Amendment to the beneficiary of Other BanksTransfer of L/CSTransfer of L/C amendmentBuying house Commission Payment Processing ChargeTransfer CancellationAttestation of LC/SCCollecting Bank's charges abroadProcessing of any Doc. under collection (LC/Contract etc.)Processing of documents under collection denominated in Local CurrencyTk. 750 VATTk. 750 VATTk. 750 VAT and Swift at actualTk. 750 VATTk. 750 VATTk. 2,000 per instance VATTk. 1,000 VATTk. 300 VATAt actualTk. 1,000 VAT0.15% (mini Tk. 500 max Tk. 8,000) VATAdvise and lien of Export Contract for availing pre/post shipmentfinances (BB and others):Up to USD 5,000Tk. 1,000Above USD 5000 to USD 20,000Tk. 3,000Above USD 20,000 to USD 30,000Tk. 4,000Above USD 30,000Tk. 5,000Contract Lien feesContract/Invoices against Advance Payment (TT) received only (NoBB, pre/post shipment facility required) Tk. 750.Mailing of Export documents (Courier/Post)SWIFT charge for claiming reimbursementExport bills related communications with Foreign BanksAdvance Remittance Processing (ARV)Any other charges not mentioned aboveAt actual VATAt actual VATAt actual VATTk. 1,000 VATAt actual VATExport related transactions:Export form certificationTk. 200 each set VATEXP CancellationTk. 500 each set VATCommission on Purchase/discount of export documents drawn against contract1% on purchase valueStationery RecoveryIssuance of Export transaction certificate plus other certificatesTk. 100 VATTk. 500 VATIssuance of PRCFor cash assistanceOther purposeTk. 500 per certificate VATTk. 500 per certificate VATUp to Tk. 1,000,000Tk. 7,000Tk. 1,000,001 to Tk. 2,000,000Tk. 10,000Tk. 2,000,001 to Tk. 5,000,000Tk. 20,000Above Tk. 5,000,001Tk. 25,000Cash assistance documents processing chargesVessel Tracking chargesVessel trackerTranshipment Queries Services (TQS)Local Tracking (FCR/House BL not containing information of Master BL)Tk. 1,000 VATTk. 3,000 VATTk. 100 VATTk. 10,000 Per Case VATTk. 100 VATIssuance of NOC for 2nd/3rd Lien BanksB/L Endorsement Signature VerificationForeign Bank Guarantee:Advising of Guarantees to the beneficiary in original without any engagement on our partTk. 1,000 (Flat) VAT0.50% per quarter or part thereof (min. Tk. 2,000 or USD 50, ifpayable by Foreign correspondents/Beneficiary)* VATAdvising of Guarantee in our own format or on the format supplied by the opening bank with our0.50% per quarter or part thereof (min. Tk. 2,000 or USD 50, iffull engagementpayable by Foreign correspondents/Beneficiary)* VATCounter Guarantee ProcessingUSD 50 per instance*Commission on Bank guarantee to be charged for minimum one quarter. Subsequently, it will be charged proportionately in terms of days.Advising of Guarantees in original by adding our confirmationForeign Remittances (Inward):Payment of any Taka Drafts issued by Exchange house/Foreign Banks in abroad which are drawnon our Bank.FreeEncashment of any Foreign TT in Taka at our CounterFree8

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021ParticularsRateCollectionCollection of clean item (Inward)All other charges including Mail/ SWIFTEncashment from FC account at our counterWithin Bangladesh (flat) Tk. 500 VATAt actualFreeForeign Remittances (Outward):Issuance of Cash (FC)/ Endorsement in Pass-Port/Credit CardIssuance of FC Endorsement certificateTransactions by Nominee/Account holder in F.C. A/cF.C. Demand Draft on Bangladesh BankIssuance of FDD for BO AccountOutward foreign remittance through MT103Ruling Cash selling rate plus Tk. 300 VATTk. 500 VATFreeUp to Tk. 100,000Tk. 100Tk. 100,001 to Tk. 500,000Tk. 200Tk. 500,001 to 1,000,000Tk. 300Above 1,000,000Tk. 500 SWIFT charge at actualRemittance by T.T. (F.C.) through Foreign correspondents (Out going)Tk. 2,000 Per Case VATTk. 2,000 per Renewal VATTk. 200 VATIssuance of Lien confirmation on FC Balance for issuing international Credit CardCancellation of Drafts in FCProcessing of Student File:Opening/Renewal of Student file (Educational remittance)Remittance of Tuition Fee/ Living Expense (per instance)At the time of opening Tk. 6,000 VATTk. 1,000 VATOther Foreign Currency Transaction:Issuance of Foreign currency balance certificate, Foreign currency solvency certificateIssuance of NOC for study & Medical treatment abroadRenewal of NOCCancellation of NOCIssuance of counter FC drafts in favour of local BanksDisposal of remitted fund on A/c of Home RemittanceIssuance of Credit information of local Firm /Companies etc.Tk. 2,000 per certificate VATTk. 500 in each case VATTk. 250 in each case VATTk. 250 in each case VATTk. 500 per instance VAT (to be deducted from the remittedfund)Postage charge at actual VATUSD 50 VATOff-shore Banking (OBU) OperationLocal bill discounting under OBUForeign bill discounting under OBUArrangement Fee on FC Term LendingFC Account maintenance feeUSD 1001% on lendingTk. 500 VATMiscellaneousForwarding application regarding import registration certificate, indentors registration certificate,encashment certificate for freight forwarders, authorised money changer license or for specialpermission etc. from Bangladesh Bank or any other agency and any other certificateTk. 2,500 per certificate VATProcessing of Approval Letters to Bangladesh Bank/Govt. Authority:e.g. Foreign commission if exceeds 5%, Proposal for deferred payment LC above 360 days,Maturity extension of deferred payment LC, Maturity extension of EDF LC, Time extension forsubmission B/E etc.Tk. 2,500 VATUp to 50 PageTk. 500Above 50 PageTk. 1000At actual plus Tk. 500 VAT500 VAT500 VATAttestation of documentsCollection of Credit Report through Rating AgencyProcessing of EGP uploadAuthorization letter to collect LC/document/FDD from other Bank**VAT is not applicable in case of export oriented industry9

IFIC Bank LimitedSchedule of Charge, Fees & CommissionsEffective from 1 July 2021RateParticularsD. Card OperationDebit CardAnnual Card FeeProprietorship/Business Debit CardSaving A/CRFCDSupplementary Aamar CardCard Replacement FeePin Replacement FeeAnnual Passport Endorsement Fee (Aamar Card Only)ATM Transaction Fees (At Any ATM in Bangladesh)ATM Transaction Fees (ATMs outside Bangladesh)Card Closing ChargeCCTV Footage Other Banks (if Available)BDT 1000 VATBDT 500 VATUSD 10 VATBDT 500 VATBDT 500 VATBDT 300 VATFreeFreeUSD 5 VATBDT 500 VATAt actualCredit CardAnnual Card Fee per yearClassicGoldSupplementary Card Fee per yearClassicGoldFC Activation/ Maintenance Fee (Annually)ClassicGoldCard Replacement Fee per instanceClassicGoldPin Replacement Fee per instanceClassicGoldLate Payment FeeApplicable when the minimum payment due is not paid withinthe due date mentioned in the statementLocalInternational (Dual)BDT 1,500 VATBDT 2,500 VATBDT 2,000 VATBDT 4,000 VAT2 Card Free, for each additional card BDT 500 VAT2 Card Free, for each additional card BDT 1,000 VAT-USD 5 VAT, IFIC Staff: FreeUSD 10 VAT, IFIC Staff: FreeBDT 500 VATBDT 500 VATBDT 500 VATBDT 500 VATBDT 300 VATBDT 300 VATBDT 300 VATBDT 300 VAT1% Min BDT 500 whichever is higher VATfor USD payment 1% or USD 5,whichever is higher VAT1% of due or BDT 500,whichever is higher VATOver limit feeBDT 500 VATBDT 500 VATSMS Fee (Half yearly)BDT 150 VATBDT 150 VATCash Advance Fee per instancesAT IFIC’s ATM2% on advance, min Tk. 200 VATAt Q-Cash Consortium ATM3% on advance, min Tk. 200 VATAt other ATM2% of Cash Advance Min BDT 100 VAT, IFIC Staff: FreeAt Branches POS3% Min USD 5 VATAt ATM outside BangladeshDuplicate Statement FeeFor each month (Previous) onlyBDT 50 VATIFIC Staff FreeCheque Return FeeBDT 200 VATOutstation Cheque Collection FeeBDT 100 VATCertificate Issuance FeeBDT 200 VATBDT 100 VATIFIC Staff FreeBDT 200 VAT,USD 10 VATBDT 100 VAT,USD 10 VATBDT 200 VATAt actualCCTV Footage (if Available)BDT 500 (Max) VAT orUSD 10 (Max) VATClosing Charge**Fees for any other service in the Schedule of Charge is Tk. 500 VAT.10

IFIC Bank Limited Rate Credit Card 2 Card Free, for each additional card BDT 500 VAT 2 Card Free, for each additional card BDT 1,000 VAT Debit Card Annual Passport Endorsement Fee (Aamar Card Only) 2% on advance, min Tk. 200 VAT 3% on advance, min Tk. 200 VAT 2% of Cash Advance Min BDT 100 VAT, IFIC Staff: Free 3% Min USD 5 VAT At actual