Transcription

Deep AnalysisVendor VignetteOracle BlockchainFounded 1977 HQ Redwood City, CA 137,000 employees (2018) 39.83B revenue (2018)This report focuses on the enterprise blockchain division within Oracle.Oracle is the enterprise blockchain dark horse. Its stealthy but deeplyfunded and well-sourced entry into the market follows Oracle’s wellestablished pattern: the firm has a history of first dismissing newtechnologies, only to work quietly and then launch into the new marketwith full force. Over the coming few years, Oracle may well set abenchmark for its competitors and will likely gain significant tractionwithin the Oracle customer base.full stack of Oracle software and hardwareThe Companyyet were charged and serviced via a singlelicense and support call. Oracle saw the rapidOracle is one of the world’s largest and mostsuccess of these applications and extendedsuccessful IT vendors, founded in 1977, withits enterprise customer base into the mid-revenues of 39.83 billion in 2018. This reportmarket. The company frst announced itsfocuses on the enterprise blockchain divisionblockchain ambitions in late 2017 and launchedwithin Oracle.its eponymous Oracle Blockchain PlatformThough initially best known for its database(OBP) in mid-2018. To date, there has beenbusiness, Oracle has grown both organicallyonly limited public discussion and visibility ofand by acquisition to embrace the full stackOracle’s work in this space.from core hardware to business applications.Blockchain is arguably a logical extensionOracle’s customer base is global, and typicallyof Oracle’s SaaS applications, and in 2019(though not exclusively) its customers arethe frm announced its frst blockchain-large organizations in both the public andenabled SaaS application. Oracle’s enterpriseprivate sectors. In 2016, Oracle surprised theblockchain work has been, over only a shortmarket by releasing several SaaS applicationstime, extensive. The use of blockchain is clearlyranging from customer experience (CX)a key factor in the company’s future growththrough fnancials to supply chain. Thestrategy.surprise and diferentiating factor in theseSaaS applications was that they ran on aDeep Analysis 2019 info@deep-analysis.netVendor Vignette : Oracle Blockchain1

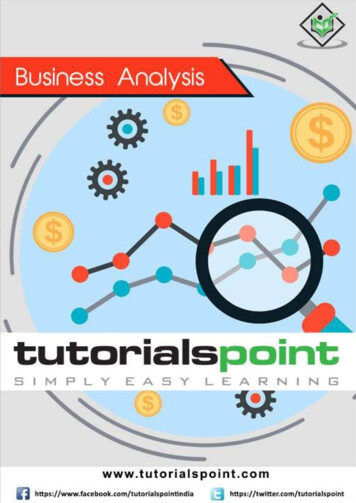

The Technologynow available. Within the next few quarters,Oracle will add pre-built options for coldchain, warranty, and usage tracking. It will alsoThere are two critical elements in Oracle’srelease more accelerators, templates, and pre-enterprise blockchain strategy:packaged components to connect to both itsOracle Blockchain Platform (OBP)own and third-party applications.Oracle SaaS ApplicationsThe bottom line is that Oracle is trying to fipOBP is, as the name suggests, Oracle’s corethe switch from consulting-led enterpriseblockchain platform infrastructure. Basedblockchain to pre-assembled, plug-and-playon Hyperledger Fabric 1.4 (Oracle joined thisenterprise blockchain. To date, too manyopen-source initiative in 2017), the platformprojects have been consulting-led, lengthy,diferentiates itself in providing the frst fullyand costly. Oracle sees blockchain as anmanaged, secure, and permissioned Platforminfrastructure platform component that shouldas a Service (PaaS). It also provides a rangebe easy to access and utilize. This approachof plug-and-play components, APIs, andshould enable developers to quickly build anddeveloper frameworks for easy connectionprovision everything from complex smartto its SaaS applications. However, beyondcontracts to basic records management. Thisthe many standard components it has built,should be applauded, but the platform andwhat particularly caught our attention was anSaaS options have only been available for aoption called OBP EE (Enterprise Edition): ashort period, and end-user feedback is limited.dedicated on-premises enterprise blockchainoption. A second element that caught our eyewas the focus Oracle has placed on analytics,often a weak spot in blockchain deployments.Also interesting was that OBP not only has abuilt-in connection to Oracle Analytics Cloudvia DBaaS or ADW, but the entire transactionhistory is mirrored, and it provides fast andaccurate analysis. That may seem an obviousFigure 1Oracle Blockchain Assessmentthing to do, but as of today, Oracle is one of thefew vendors, if not the only one, to provide thisas standard.Regarding the SaaS applications, Oracle isrolling out its program over the next coupleof years to encompass all its SaaS oferings.CompanyViabilityMarketVisibilityAs of 2019, Oracle has launched integrationswith NetSuite, FlexCube, and Open Banking,with retail, health sciences, and construction/engineering set to launch within the year. Thefagship element to date, though, is OracleCloud SCM (supply chain management) withpre-built blockchain functionality such asMarketGrowthProduct0246810track and trace, lot lineage, and provenanceDeep Analysis 2019 info@deep-analysis.netVendor Vignette : Oracle Blockchain2

Our OpinionAdvice to BuyersOracle is the enterprise blockchain dark horse.It stands to reason that existing OracleIts stealthy but deeply funded and well-sourcedSaaS customers should frst consider OBP’sentry into the market follows Oracle’s well-options, as they are, or will be, pre-integratedestablished pattern: the frm has a history ofcapabilities. For non-Oracle SaaS customers,frst dismissing new technologies, only to workOracle should at least be on the shortlistquietly and then launch into the new marketfor consideration, if solely for the work theywith full force. That being said, with Oracle’shave undertaken to build and to pre-packagedeep roots in the supply chain, fnancialmany elements of blockchain. Similarly, thoseservices, and government sectors, blockchainconsidering a digital transformation exercisealways made more sense for it to embracethat will involve the replacement of existingthan for some of its competitors. The full-business applications may want to look atstack nature of Oracle’s SaaS oferings makeswhat Oracle has to ofer. Finally, it is worththem ideal candidates to bundle blockchainnoting that Oracle to date has focused muchfunctionality. In other words, though thereof its blockchain eforts on consortiums.will always be disruption when leveragingFor example, it leads the Retail Blockchainblockchain, Oracle’s approach makes it one ofConsortium (RBC), and is also heavilythe simplest and least disruptive approachesinvolved in the Global Shipping Businessto adoption. The other side of this coin is thatNetwork (GSBN). Oracle has a specifcallysuch an easy integration may mean that thedesigned blockchain option for existing or newtruly disruptive and transformative nature ofconsortiums that want to work collectively.blockchain is potentially limited, impedingthe reimagining and reinventing of traditionalbusiness process activities. Either way, thesignifcant but early progress of Oracle here isimpressive. Over the coming few years, Oraclemay well set a benchmark for its competitorsand will likely gain signifcant traction withinthe Oracle customer base. Figure 1 shows ourassessment of Oracle Blockchain acrossfour categories.Deep Analysis 2019 info@deep-analysis.netVendor Vignette : Oracle Blockchain3

SOAR AnalysisStrengthsAspirationsExisting global customer base looking forReplace IBM as the de facto choice forblockchain optionsconsortiumsPre-building blockchain functionality forOpen up a clear lead on SAPplug-and-play integrationEmbed and bundle blockchain as coreOn-premises and consortium options availablefunctionalityOpportunitiesResultsQuickly lock out competitors150 active blockchain customersExtend blockchain across its entireApproximately 500 frms running active trialsSaaS/PaaS portfolioSignifcant DB/analytics capabilities versusExpand and create blockchain analytic servicesthe competitionDeep Analysis 2019 info@deep-analysis.netVendor Vignette : Oracle Blockchain4

Deep AnalysisAbout Deep AnalysisDeep Analysis is an advisory frm that helps organizationsunderstand and address the challenges of innovative anddisruptive technologies in the enterprise software marketplace.Its work is built on decades of experience in advising andconsulting to global technology frms large and small, from IBM,Oracle, and HP to countless start-ups.Led by Alan Pelz-Sharpe, the frm focuses on InformationManagement and the business application of Cloud, ArtifcialAbout the AuthorAlan Pelz-Sharpe is the founder ofDeep Analysis. He has over 25 yearsof experience in the IT industry,Intelligence, and Blockchain. Deep Analysis recently publishedworking with a wide variety ofthe book "Practical Artifcial Intelligence: An Enterpriseend-user organizations like FedEx,Playbook," co-authored by Alan and Kashyap Kompella,outlining strategies for organizations to avoid pitfalls andsuccessfully deploy AI.Deep Analysis works with technology vendors to improve theirThe Mayo Clinic, and Allstate, andvendors ranging from Oracle and IBMto startups around the world. Alan wasformerly a Partner at The Real StoryGroup, Consulting Director at IndianServices frm Wipro, Research Directorunderstanding and provide actionable guidance on current andat 451, and VP for North Americafuture market opportunities.at industry analyst frm Ovum. He isYet, unlike traditional analyst frms, Deep Analysis takes a buyer-including the Wall Street Journal andcentric approach to its research and understands real-worldThe Guardian, and has appearedbuyer and market needs versus the “echo chamber” of thetechnology industry.regularly quoted in the press,on the BBC, CNBC, and ABC as anexpert guest.Contact us:info@deep-analysis.net 1 978 877 7915Deep Analysis 2019 info@deep-analysis.netVendor Vignette : Oracle Blockchain5

plug-and-play integration On-premises and consortium options available Opportunities Quickly lock out competitors Extend blockchain across its entire SaaS/PaaS portfolio Expand and create blockchain analytic services Aspirations Replace IBM as the de facto choice for consortiums Open up a clear lead on SAP Embed and bundle blockchain as core