Transcription

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Financial StatementsFor the Year Ended 31 December 2019

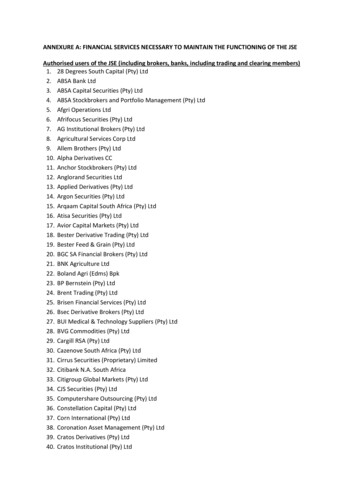

Kaplan Higher Education Pty LimitedABN: 85 124 217 670ContentsFor the Year Ended 31 December 2019PageFinancial StatementsDirectors' ReportAuditor's Independence Declaration under Section 307C of the Corporations Act 2001Statement of Profit or Loss and Other Comprehensive IncomeStatement of Financial PositionStatement of Changes in EquityStatement of Cash FlowsNotes to the Financial StatementsDirectors' DeclarationIndependent Audit Report13456782728

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Directors' Report31 December 2019The directors present their report on the Company for the financial year ended 31 December 2019.DirectorsThe names of each person who has been a director during the year and to the date of this report are:David JonesPatricia VilkinasAndrew GoncziRobert William ReganThe directors have been in office since the start of the financial year to the date of this report unless otherwise stated.Principal activitiesThe principal activities of the Company during the financial year consisted of the provision of higher education services,comprising:a)an online business offering Higher Education qualifications, andb)Murdoch Institute of Technology, a pathways college partnered with the Murdoch University, andc)University of Adelaide College, providing English courses, Degree Transfer and Foundation studies as a pathwayscollege partnered with the University of Adelaide.No significant change in the nature of these activities occurred during the year.Operating resultsThe profit of the Company amounted to 46,717,987 (2018: profit of 10,385,596).Dividends paid or recommendedDividends paid or declared during or since the end of the financial year are as follows:A fully franked dividend of 30,000,000 was declared on 16 December 2019 for payment through issue of a promissory noteto the Company's sole shareholder, Kaplan Australia Pty Limited, for the year ended 31 December 2019.Significant changes in state of affairsThere have been no significant changes in the state of affairs of entities in the Company during the year.Events after the reporting dateThe COVID-19 pandemic and its associated lockdown protocols has impacted the operations and trading performance of theCompany. It is not possible to reliably assess the potential impacts at the present time.Except for the above, no other matters or circumstances have arisen since the end of the financial year which significantlyaffected or could significantly affect the operations of the Company, the results of those operations or the state of affairs ofthe Company in future financial years.1

XGLWRU V ,QGHSHQGHQFH 'HFODUDWLRQ XQGHU 6HFWLRQ & RI WKH &RUSRUDWLRQV FW WR WKH 'LUHFWRUV RI .DSODQ LJKHU (GXFDWLRQ 3W\ /LPLWHG, GHFODUH WKDW WR WKH EHVW RI P\ NQRZOHGJH DQG EHOLHI GXULQJ WKH \HDU HQGHG 'HFHPEHU WKHUH KDYH EHHQ L QR FRQWUDYHQWLRQV RI WKH DXGLWRU LQGHSHQGHQFH UHTXLUHPHQWV DV VHW RXW LQ WKH Corporations Act 2001 LQ UHODWLRQ WR WKH DXGLW DQG LL QR FRQWUDYHQWLRQV RI DQ\ DSSOLFDEOH FRGH RI SURIHVVLRQDO FRQGXFW LQ UHODWLRQ WR WKH DXGLW 3.) 0 57,1 0 77 (:63 571(5 0 6 '1( 16:PKF(NS) Audit & Assurance LimitedPartnershipABN 91 850 861 839Liability limited by a schemeapproved under ProfessionalStandards LegislationSydneyNewcastleLevel 8, 1 O’Connell StreetSydney NSW 2000 AustraliaGPO Box 5446 Sydney NSW 2001755 Hunter StreetNewcastle West NSW 2302 AustraliaPO Box 2368 Dangar NSW 2309pfpf 61 2 8346 6000 61 2 8346 6099 61 2 4962 2688 61 2 4962 3245PKF(NS) Audit & Assurance Limited Partnership is a member firm of the PKF International Limited family of legally independent firms and does notaccept any responsibility or liability for the actions or inactions of any individual member or correspondent firm or firms.For office locations visit www.pkf.com.au

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Statement of Profit or Loss and Other Comprehensive IncomeFor the Year Ended 31 December 201920192018 799)(2,086,388)(47,083) ,717,98710,385,596--Total comprehensive income for the year46,717,98710,385,596Profit attributable to:Owners of Kaplan Higher Education Pty Ltd46,717,98710,385,596Total comprehensive income attributable to:Owners of Kaplan Higher Education Pty Ltd46,717,98710,385,596Revenue from continuing operationsOther incomeCost of rendering servicesAdministrative expensesMarketing expensesOccupancy expensesAmortisation expenseProfit before income taxIncome tax expenseNote5567Profit for the yearOther comprehensive income for the year, net of taxThe accompanying notes form part of these financial statements.4

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Statement of Financial PositionAs At 31 December 2019NoteASSETSCURRENT ASSETSCash and cash equivalentsTrade and other receivables8920192018 96,427TOTAL LIABILITIES39,278,34849,128,306NET 00,000(5,011,971)58,206,01641,488,029TOTAL CURRENT ASSETSNON-CURRENT ASSETSInvestments in subsidiariesIntangible assetsProperty, plant and equipmentDeferred tax assets12111013TOTAL NON-CURRENT ASSETSTOTAL ASSETSLIABILITIESCURRENT LIABILITIESTrade and other payablesProvisionsDeferred income1415TOTAL CURRENT LIABILITIESNON-CURRENT LIABILITIESProvisions15TOTAL NON-CURRENT LIABILITIESEQUITYIssued capitalRetained earnings/(accumulated losses)1617TOTAL EQUITYThe accompanying notes form part of these financial statements.5

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Statement of Changes in EquityFor the Year Ended 31 December ses) Total Balance at 1 January 2019Profit for the yearDividends ,488,02946,717,987(30,000,000)Balance at 31 December 201946,500,00011,706,01658,206,016Balance at 1 January 2018Change in accounting policyProfit for the 29Balance at 31 December 201818The accompanying notes form part of these financial statements.6

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Statement of Cash FlowsFor the Year Ended 31 December 2019NoteCASH FLOWS FROM OPERATING ACTIVITIES:Receipts from customersPayments to suppliers and employees20192018 ,18613,212,296CASH FLOWS FROM INVESTING ACTIVITIES:Payments for property, plant and equipmentPayments for intangibles(2,224)(565,000)(32,680)-Net cash used in investing activities(567,224)(32,680)CASH FLOWS FROM FINANCING ACTIVITIES:Net payments made to related entities(17,026,926)(8,010,812)Net cash used in financing 875,168,8046,646,38311,430,22311,815,187Net cash provided by operating activities27Net (decrease)/increase in cash and cash equivalents heldCash and cash equivalents at beginning of yearCash and cash equivalents at end of financial year8The accompanying notes form part of these financial statements.7

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 2019The financial report covers Kaplan Higher Education Pty Limited as an individual entity. Kaplan Higher Education Pty Limitedis a for-profit proprietary Company, incorporated and domiciled in Australia.The functional and presentational currency of Kaplan Higher Education Pty Limited is Australian dollars.The financial report was authorised for issue by the Directors on 25 May 2020.Comparatives are consistent with prior years, unless otherwise stated.1Basis of PreparationThe financial statements are general purpose financial statements that have been prepared in accordance with theAustralian Accounting Standards - Reduced Disclosure Requirements and the Corporations Act 2001.Historical cost conventionThese financial statements have been prepared under the historical cost convention, as modified by the revaluation ofavailable-for-sale financial assets and liabilities (including derivative instruments) at fair value through profit or loss,certain classes of property, plant and equipment and investment property.2Change in Accounting PolicyLeases - Adoption of AASB 16AASB 16 became mandatory for all entities commencing 1 January 2019, replacing AASB 117 Leases. On adoption ofAASB 16, lease liabilities are recognised in relation to leases which had previously been classified as ‘operating leases’under the principles of AASB 117 Leases. These liabilities are measured at the present value of the remaining leasepayments, discounted using the lessee’s incremental borrowing rate as of 1 January 2019.For leases previously classified as finance leases, the carrying amount of the lease asset and lease liability arerecognised immediately before transition as the carrying amount of the right of use asset and the lease liability at thedate of initial application. The measurement principles of AASB 16 are only applied after that date.Financial statement impact of adoption of AASB 16The company has assessed the impact of this standard through performing a review of contractual relationships inplace and determined that there are no operating leases requiring disclosure. Kaplan Higher Education operates out ofproperty leased by a related party, Kaplan Australia Pty Ltd.3Summary of Significant Accounting Policies(a)Investment in subsidiaryThe investment in the Company's subsidiary is measured at cost less accumulated impairment.(b)Foreign currency transactions and balancesForeign currency transactions are recorded at the spot rate on the date of the transaction.At the end of the reporting period:xForeign currency monetary items are translated using the closing rate;xNon-monetary items that are measured at historical cost are translated using the exchange rate at thedate of the transaction; and8

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(b)Foreign currency transactions and balancesxNon-monetary items that are measured at fair value are translated using the rate at the date when fairvalue was determined.Exchange differences arising on the settlement of monetary items or on translating monetary items at ratesdifferent from those at which they were translated on initial recognition or in prior reporting periods arerecognised through profit or loss, except where they relate to an item of other comprehensive income or whetherthey are deferred in equity as qualifying hedges.(c)Revenue recognitionRevenue is measured at the fair value of the consideration received or receivable. Amounts disclosed asrevenue are net of returns, rebates and amounts collected on behalf of third parties.The Company recognises revenue when the amount of revenue can be reliably measured, it is probable thatfuture economic benefits will flow to the entity and specific criteria have been met for each of the Company'sactivities as described below. The Company bases its estimates on historical results, taking into considerationthe type of customer, the type of transaction and the specifics of each arrangement.The revenue recognition policies for the principal revenue streams of the Company are:(i) Rendering of servicesTuition revenue is recognised over time when the Company satisfies its performance obligation by deliveringtuition services to the student.Other services and commission related revenue are recognised at a point in time when the Company satisfies itsperformance obligations. This usually occurs upon commencement of the course by the student.(ii) Interest incomeRevenue is recognised as interest accrues using the effective interest method. This is a method of calculatingthe amortised cost of a financial asset and allocating the interest income over the relevant period using theeffective interest rate, which is the rate that exactly discounts estimated future cash receipts through theexpected life of the financial asset to the net carrying amount of the financial asset.(iii) Unearned revenueAmounts invoiced and received but not yet earned are recorded as unearned income on the statement offinancial position.(d)Income TaxThe tax expense recognised in the statement of profit or loss and other comprehensive income comprisescurrent income tax expense plus deferred tax expense.Current tax is the amount of income taxes payable (recoverable) in respect of the taxable profit (loss) for theyear and is measured at the amount expected to be paid to (recovered from) the taxation authorities, using thetax rates and laws that have been enacted or substantively enacted by the end of the reporting period. Currenttax liabilities (assets) are measured at the amounts expected to be paid to (recovered from) the relevant taxationauthority.9

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(d)Income TaxDeferred tax is provided on temporary differences which are determined by comparing the carrying amounts oftax bases of assets and liabilities to the carrying amounts in the consolidated financial statements.Deferred tax is not provided for the following:xThe initial recognition of an asset or liability in a transaction that is not a business combination and at thetime of the transaction, affects neither accounting profit nor taxable profit (tax loss).xTaxable temporary differences arising on the initial recognition of goodwill.xTemporary differences related to investment in subsidiaries, associates and jointly controlled entities tothe extent that the Group is able to control the timing of the reversal of the temporary differences and it isprobable that they will not reverse in the foreseeable future.Deferred tax assets and liabilities are measured at the tax rates that are expected to apply to the period whenthe asset is realised or the liability is settled, based on tax rates (and tax laws) that have been enacted orsubstantively enacted by the end of the reporting period.Deferred tax assets are recognised for all deductible temporary differences and unused tax losses to the extentthat it is probable that taxable profit will be available against which the deductible temporary differences andlosses can be utilised.Current and deferred tax is recognised as income or an expense and included in profit or loss for the periodexcept where the tax arises from a transaction which is recognised in other comprehensive income or equity, inwhich case the tax is recognised in other comprehensive income or equity respectively.Tax consolidationKaplan Australia Holdings Pty Ltd and its wholly owned subsidiaries (which includes Kaplan Higher EducationPty Ltd) elected to implement the tax consolidation legislation and form a tax consolidated group.Each individual entity within the tax consolidated group accounts for its own income tax expense and deferredtax balances following the policy as above. Any current tax balance payable or receivable by the entity based onits own results are accounted for as an intercompany balance to Kaplan Australia Holdings Pty Ltd provided theyare recoverable. Kaplan Australia Holdings Pty Ltd records the consolidated tax payable position of the taxconsolidated group.(e)LeasesFor comparative yearLeases of fixed assets where substantially all the risks and benefits incidental to the ownership of the asset, butnot the legal ownership that are transferred to the Company are classified as finance leases.Finance leases are capitalised by recording an asset and a liability at the lower of the amounts equal to the fairvalue of the leased property or the present value of the minimum lease payments, including any guaranteedresidual values. Lease payments are allocated between the reduction of the lease liability and the lease interestexpense for the period.10

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(f)Financial instrumentsFinancial instruments are recognised initially on the date that the Company becomes party to the contractualprovisions of the instrument.On initial recognition, all financial instruments are measured at fair value plus transaction costs (except forinstruments measured at fair value through profit or loss where transaction costs are expensed as incurred).Financial assetsAll recognised financial assets are subsequently measured in their entirety at either amortised cost or fair value,depending on the classification of the financial assets.ClassificationOn initial recognition, the Company classifies its financial assets into the following categories, those measuredat:xamortised costxfair value through profit or loss - FVTPLFinancial assets are not reclassified subsequent to their initial recognition unless the Company changes itsbusiness model for managing financial assets.Amortised costAssets measured at amortised cost are financial assets where:xthe business model is to hold assets to collect contractual cash flows; andxthe contractual terms give rise on specified dates to cash flows are solely payments of principal andinterest on the principal amount outstanding.The Company's financial assets measured at amortised cost comprise trade and other receivables and cash andcash equivalents in the statement of financial position.Subsequent to initial recognition, these assets are carried at amortised cost using the effective interest ratemethod less provision for impairment.Interest income, foreign exchange gains or losses and impairment are recognised in profit or loss. Gain or losson derecognition is recognised in profit or loss.Financial assets through profit or lossAll financial assets not classified as measured at amortised cost or fair value through other comprehensiveincome as described above are measured at FVTPL.Net gains or losses, including any interest or dividend income are recognised in profit or loss.11

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(f)Financial instrumentsFinancial assetsImpairment of financial assetsImpairment of financial assets is recognised on an expected credit loss (ECL) basis for the following assets:xfinancial assets measured at amortised costWhen determining whether the credit risk of a financial assets has increased significantly since initial recognitionand when estimating ECL, the Company considers reasonable and supportable information that is relevant andavailable without undue cost or effort. This includes both quantitative and qualitative information and analysisbased on the Company's historical experience and informed credit assessment and including forward lookinginformation.The Company uses the presumption that an asset which is more than 30 days past due has seen a significantincrease in credit risk.The Company uses the presumption that a financial asset is in default when:xthe other party is unlikely to pay its credit obligations to the Company in full, without recourse to theCompany to actions such as realising security (if any is held); orxthe financial assets is more than 90 days past due.Credit losses are measured as the present value of the difference between the cash flows due to the Companyin accordance with the contract and the cash flows expected to be received. This is applied using a probabilityweighted approach.Trade receivables and contract assetsImpairment of trade receivables and contract assets have been determined using the simplified approach inAASB 9 which uses an estimation of lifetime expected credit losses. The Company has determined theprobability of non-payment of the receivable and contract asset and multiplied this by the amount of theexpected loss arising from default.The amount of the impairment is recorded in a separate allowance account with the loss being recognised infinance expense. Once the receivable is determined to be uncollectable then the gross carrying amount iswritten off against the associated allowance.Where the Company renegotiates the terms of trade receivables due from certain customers, the new expectedcash flows are discounted at the original effective interest rate and any resulting difference to the carrying valueis recognised in profit or loss.Other financial assets measured at amortised costImpairment of other financial assets measured at amortised cost are determined using the expected credit lossmodel in AASB 9. On initial recognition of the asset, an estimate of the expected credit losses for the next 12months is recognised. Where the asset has experienced significant increase in credit risk then the lifetimelosses are estimated and recognised.12

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(f)Financial instrumentsFinancial liabilitiesThe Company measures all financial liabilities initially at fair value less transaction costs, subsequently financialliabilities are measured at amortised cost using the effective interest rate method.The financial liabilities of the Company comprise trade payables, bank and other loans and finance leaseliabilities.(g)Impairment of assetsAt the end of each reporting period the Company determines whether there is an evidence of an impairmentindicator for non-financial assets.Where an indicator exists and regardless for goodwill, indefinite life intangible assets and intangible assets notyet available for use, the recoverable amount of the asset is estimated.Where assets do not operate independently of other assets, the recoverable amount of the relevantcash-generating unit (CGU) is estimated.The recoverable amount of an asset or CGU is the higher of the fair value less costs of disposal and the value inuse. Value in use is the present value of the future cash flows expected to be derived from an asset orcash-generating unit.Where the recoverable amount is less than the carrying amount, an impairment loss is recognised in profit orloss.Reversal indicators are considered in subsequent periods for all assets which have suffered an impairment loss,except for goodwill.(h)Cash and cash equivalentsCash and cash equivalents comprises cash on hand, demand deposits and short-term investments which arereadily convertible to known amounts of cash and which are subject to an insignificant risk of change in value.(i)Property, plant and equipmentEach class of property, plant and equipment is carried at cost or fair value less, where applicable, anyaccumulated depreciation and impairment.13

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(i)Property, plant and equipmentDepreciationProperty, plant and equipment, excluding freehold land, is depreciated on a straight-line basis over the assetsuseful life to the Company, commencing when the asset is ready for use.Leased assets and leasehold improvements are amortised over the shorter of either the unexpired period of thelease or their estimated useful life.The estimated useful lives used for each class of depreciable asset are shown below:Fixed asset classLeasehold improvementsComputer EquipmentLibraryOffice EquipmentUseful life5 to 8 years2.5 to 3 years3 years4 yearsAt the end of each annual reporting period, the depreciation method, useful life and residual value of each assetis reviewed. Any revisions are accounted for prospectively as a change in estimate.(j)Intangible assetsSoftwareSoftware has a finite life and is carried at cost less any accumulated amortisation and impairment losses. It hasan estimated useful life of between one and four years.AmortisationAmortisation is recognised in profit or loss on a straight-line basis over the estimated useful lives of intangibleassets, other than goodwill, from the date that they are available for use.Amortisation methods, useful lives and residual values are reviewed at each reporting date and adjusted ifappropriate.(k)Trade and other payablesThese amounts represent liabilities for goods and services provided to the Company prior to the end of thefinancial year which are unpaid. The amounts are unsecured and are usually paid within 30 days of recognition.(l)ProvisionsProvisions are recognised when the Company has a legal or constructive obligation, as a result of past events,for which it is probable that an outflow of economic benefits will result and that outflow can be reliably measured.14

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20193Summary of Significant Accounting Policies(l)ProvisionsProvisions are measured at the present value of management's best estimate of the outflow required to settlethe obligation at the end of the reporting period. The discount rate used is a pre-tax rate that reflects currentmarket assessments of the time value of money and the risks specific to the liability. The increase in theprovision due to the unwinding of the discount is taken to finance costs in the statement of profit or loss andother comprehensive income.(m)Employee benefitsShort-term obligationsLiabilities for wages and salaries, including non-monetary benefits, annual leave and accumulating sick leaveexpected to be settled within 12 months after the end of the period in which the employees render the relatedservice are recognised in respect of employee's services up to the end of the reporting period and are measuredat the amounts expected to be paid when the liabilities are settled. The liability for annual leave andaccumulating sick leave is recognised in the provision for employee benefits. All other short-term employeebenefit obligations are presented as a payable.Other long-term employee benefit obligationsThe liability for long service leave and annual leave which is not expected to be settled within 12 months afterthe end of the period in which the employees render the related service is recognised in the provision foremployee benefits and measured as the present value of expected future payments to be made in respect ofservices provided by employees up to the end of the reporting period using the projected unit credit method.Consideration is given to expected future wage and salary levels, experience of employee departures andperiods of service. Expected future payments are discounted using market yields at the end of the reportingperiod on national government bonds with terms to maturity and currency that match, as closely as possible, theestimated future cash outflows.(n)Contributed equityOrdinary shares are classified as equity. Incremental costs directly attributable to the issue of ordinary sharesand share options which vest immediately are recognised as a deduction from equity, net of any tax effects.(o)Goods and services tax (GST)Revenue, expenses and assets are recognised net of the amount of goods and services tax (GST), exceptwhere the amount of GST incurred is not recoverable from the Australian Taxation Office (ATO).Receivables and payable are stated inclusive of GST.Cash flows in the statement of cash flows are included on a gross basis and the GST component of cash flowsarising from investing and financing activities which is recoverable from, or payable to, the taxation authority isclassified as operating cash flows.15

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20194Critical Accounting Estimates and JudgmentsThe directors make estimates and judgements during the preparation of these financial statements regardingassumptions about current and future events affecting transactions and balances.These estimates and judgements are based on the best information available at the time of preparing the financialstatements, however as additional information is known then the actual results may differ from the estimates.The significant estimates and judgements made have been described below.Impairment of intangiblesThe Company determines whether intangibles are impaired at least on an annual basis. This requires an estimation ofthe recoverable amount of the cash-generating units, using a value in use discounted cash flow methodology, to whichthe intangibles with indefinite useful lives are allocated.16

Kaplan Higher Education Pty LimitedABN: 85 124 217 670Notes to the Financial StatementsFor the Year Ended 31 December 20195Revenue from contract with customers20192018 Revenue from continuing operationsSales revenue - Rendering of services(a)57,353,09746,670,013Other incomeDividend income(b)30,000,000-(a)Disaggregation of revenue from contracts with customersRevenue from contracts with customers has been disaggregated into revenue recognised over time and at apoint in time and the following table shows this breakdown:Timing of revenue recognition- Over time- At a point in 3,09746,670,013Dividend incomeA fully franked dividend of 30,000,000 was received on the 16 December 2019 from the Company's subsidiary,Kaplan Business School Pty Ltd. The dividend was paid through issuance of a promissory note and redu

Kaplan Higher Education Pty Limited ABN: 85 124 217 670 Contents For the Year Ended 31 December 2019 Page Financial Statements Directors' Report 1 Auditor's Independence Declaration under Section 307C of the Corporations Act 2001 3 Statement of Profit or Loss and Other Comprehensive Income 4 Statement of Financial Position 5 Statement of Changes in Equity 6