Transcription

Learning QuestEducationSavings Program A 529 College Savings PlanIn this newsletter you’ll find important informationabout changes coming soon to your account.Effective July 14, 2017, the Learning Quest 529 CollegeSavings Program will implement some exciting changes.These changes include an extended glide path, new namesfor the age-based portfolio options, and new underlyingaccounts for cash allocations and direct investments.These changes will be automatic; you do not need to takeany action. In addition, these changes will not count againstthe two investment exchanges per calendar year allowed bythe Internal Revenue Service.More detailed information about these changes, includingupdated allocations, fees and performance charts will beupdated in The Guide and Participation Agreement availableon July 14, 2017. To request an updated Guide, call us at1-888-903-3863 or visit Schwab.com/LearningQuest.LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 15/5/17 3:01 PM

Summary of ChangesYou’ll see three main changes coming soon to the portfolios:An Expanded Glide PathOur age-based tracks gradually move your investments from equity-focused holdings to more bond-focused holdings. Traditionally,equity holdings offer the potential for greater returns, but also greater risk potential. Alternatively, bonds traditionally offer lower returnpotential, but also lower risk. To make your progression along the age-based track more gradual, we are adding more portfolios withinthe tracks. We are also expanding the glide path from four to seven steps as the beneficiary approaches college age.New Names to Reflect Stock InvestmentsWe’ve simplified the names of the age-based portfolios to reflect their equity allocations. The corresponding static portfolio nameswill also be changing to reflect the new naming convention.Replacement of American Century U.S. Government Money MarketAllocations formerly going to the American Century U.S. Government Money Market underlying fund will now be divided into a newUltra Short Bond Account and a new Cash and Cash Equivalents Account. In addition, investments in the static Money MarketPortfolio will be exchanged into a new Cash and Cash Equivalents Portfolio.Expanded Glide PathThe following table shows the risk tracks and the progression, including the new steps, of the portfolios within each of the age brackets.Age of Beneficiary0-4 years5-7 years8-10 years11-13 years14-15 years16-17 years18-19 years20 yearsAggressive TrackModerate TrackConservative Track90% Equity Portfolio70% Equity Portfolio60% Equity Portfolioâââ80% Equity Portfolio60% Equity Portfolio50% Equity Portfolioâââ70% Equity Portfolio50% Equity Portfolio40% Equity Portfolioâââ60% Equity Portfolio50% Equity Portfolio30% Equity Portfolioâââ50% Equity Portfolio40% Equity Portfolio30% Equity Portfolioâââ40% Equity Portfolio30% Equity Portfolio20% Equity Portfolioâââ30% Equity Portfolio20% Equity Portfolio10% Equity Portfolioâââ20% Equity Portfolio10% Equity PortfolioShort-Term Portfolio2LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 25/5/17 3:01 PM

What These Changes Mean to YouFor age-based tracks, to determine your new portfolio, see the chart below. Specifically, if you are currently invested in any agebased track, your investments will transition to a new portfolio, depending on your current risk track and the beneficiary’s age asof June 30, 2017. This transition may result in a change to your equity, bond and cash allocations.Schwab Learning QuestAge-Based Risk TrackCurrent PortfolioConservativeConservativeVery ConservativeShort-Term*ModerateAge of BeneficiaryNew PortfolioTotal Expense Ratio %0-460% Equity0.77%5-750% Equity0.73%8-1040% Equity0.66%30% Equity0.60%11-1314-1516-1720% Equity0.53%18-1910% Equity0.46%20 Short-Term0.39%0-470% Equity0.81%5-760% Equity0.77%50% Equity0.73%14-1540% Equity0.66%16-1730% Equity0.60%18-1920% Equity0.53%20 10% Equity0.46%0-490% Equity0.88%5-780% Equity0.84%8-1070% Equity0.81%0.77%8-10ModerateConservativeVery ConservativeShort-Term*Very Short-Term Plus*11-1311-1360% Equity14-1550% Equity0.73%16-1740% Equity0.66%18-1930% Equity0.60%20 20% Equity0.53%*Please see updated Guide for additional details.*Important Note: On July 14, 2017 if your account beneficiary is 18 or older and is invested in the age-based Short Term orShort-Term Plus portfolios, your account will be moved to the Static Short-Term or Short-Term Plus portfolio where it will remainunless a request is made to changes the investment direction, as allowed by the IRS.3LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 35/5/17 3:01 PM

New Portfolio Names to Reflect Stock InvestmentsTo simplify the naming structure, we’ve updated the names of the portfolios used in the age-based tracks and the corresponding staticportfolios to reflect their equity allocations.You will only see name changes if you are invested in the static portfolios.The pie charts below illustrate the allocations for each portfolio used in the age-based tracks.90% Equity Portfolio80% Equity Portfolio70% Equity Portfolio60% Equity Portfolio50% Equity PortfolioDomestic Stocks 66.5%1Domestic Stocks 58.75%1Domestic Stocks 51.5%1Domestic Stocks 45%1Domestic Stocks 38.5%1International Stocks 23.5%1International Stocks 21.25%1International Stocks 18.5%1International Stocks 15%1International Stocks 11.5%1Bond 10%Bond 20%Bond 30%Bond 40%Bond 48%Cash 0%Cash 0%Cash 0%Cash 0%Cash 2%DomesticInternationalBondCash40% Equity Portfolio30% Equity Portfolio20% Equity Portfolio10% Equity PortfolioShort-Term PortfolioDomestic Stocks 31.5%1Domestic Stocks 24.5%1Domestic Stocks 16.5%1Domestic Stocks 8.25%1Domestic Stocks 0%1International Stocks 8.5%1International Stocks 5.5%1International Stocks 3.5%1International Stocks 1.75%1International Stocks 0%1Bond 51.5%Bond 52.5%Bond 55%Bond 60%Bond 65%Cash 8.5%Cash 17.5%Cash 25%Cash 30%Cash 35%DomesticInternationalBondCashStatic Portfolio Name ChangesCurrent Portfolio NameShort-TermNew Portfolio NameShort-TermShort-Term Plus20% EquityVery Conservative30% EquityConservative50% EquityModerate60% EquityAggressive70% EquityVery Aggressive90% Equity4LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 45/5/17 3:01 PM

Replacement of American Century U.S. Government Money MarketMoney Market AllocationTwo changes relating to the Money Market underlying fund are being made. First, targeted allocations within both the age-basedtracks and the corresponding static portfolios that formerly were invested into the American Century U.S. Government Money Marketunderlying fund will now be invested in a new Ultra Short Bond Account and a new Cash and Cash Equivalents Account, as set forthin the table on page 7.For a complete list of underlying allocations see table on page 7.Second, investments in the static Money Market Portfolio will be exchanged into a new Cash and Cash Equivalents Portfolio.All of these exchanges will be made on July 14, 2017.New Underlying AccountsThe Cash and Cash Equivalents Portfolio will be managed very similarly to the current Money Market Portfolio. Specifically, like theMoney Market Portfolio, the Cash and Cash Equivalents Portfolio will be a very conservative portfolio that seeks to preserveprincipal while earning the highest level of income within that goal. This account will invest in high-quality, short-term debt securitiesissued by banks, corporations and the U.S. Government, as well as state and local governments. Any dividends earned by the Cashand Cash Equivalents Account will be reinvested into the portfolio.The Cash and Cash Equivalents Portfolio will not, however, strive for a stable net asset value (NAV) like a money market is requiredto do. In addition, the underlying fund expense for the Cash and Cash Equivalents Portfolio will be 0.10% compared to 0.23% forthe current Money Market Fund. Please note that if you are invested in the current static Money Market Portfolio, you will see anexchange from the Money Market Portfolio to the Cash and Cash Equivalents Portfolio on your Account Summary after the exchangeis completed on July 17, 2017. The value of your account will not change due to this exchange, although the units and price maychange.The Ultra Short Bond Account will be a conservative portfolio that seeks to earn the highest level of current income while preservingthe value of your investment. This account will invest most of its assets in high-quality, short-term debt securities issued by banks,corporations and the U.S. Government, as well as state and local governments.5LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 55/5/17 3:01 PM

Timeline of Key Dates to RememberAfter the close of business on July 13, 2017, affected investments will automatically transition to the new investment option(s) asdescribed above. Additionally, your contribution allocations will be updated and future contributions will be invested according to thenew allocations. You are able to change the allocation instructions for new contributions at any time with no annual restrictions.While we implement these changes, you will not be able to initiate or request any transactions, including withdrawals or investmentoption changes, nor will you be able to initiate or request other changes to your account between 4:00 pm, Eastern Time ThursdayJuly 13, 2017 and 8:00 am, Eastern Time Monday July 17, 2017 online. However, you will be able to transact by phone up to4:00 pm, Eastern Time Friday July 14, 2017. Theses transactions will be processed on Monday July 17 with net asset value of FridayJuly 14, 2017. Should you wish to adjust your account before or after this period, you may do so as part of your two annualchanges allowed by the IRS.Key DatesActionJuly 13, 2017Transaction and other account-change requests are processed as usual until 4:00 pm Eastern Time. Requestsreceived between 4:00 pm, Eastern Time on July 13, 2017 and 4:00 pm, Eastern Time on July 14, 2017 will beprocessed on July 17, 2017 using portfolio net asset values as of July 14, 2017.July 14, 2017Account assets are transferred from existing portfolios to new portfolios, as outlined in the Glide Path table above.July 14, 2017Recurring contributions (automatic investments) scheduled for July 14, 2017 and transactions or other accountchange requests received by mail after 4:00 pm, Eastern Time on July 13, 2017 are processed under the newallocations using portfolio net asset values as of July 14, 2017.July 17, 2017Schwab.com/LearningQuest will be updated to reflect the changes. A new Guide and Participation Agreementwill be available by visiting Schwab.com/LearningQuest or call Schwab at 1-888-903-3863.July 17, 2017All transactions will show on the quarterly statement, but confirmations will only be sent to shareholders whohad changes to their portfolio allocations. If you only experienced a name change to your portfolio, you will notreceive a confirmation. You may log into your account at Schwab.com/LearningQuest on or after July 17, 2017to review in detail.We’re Here to HelpPlease review your account and ensure it aligns with your college savings goals and risk tolerance. If youhave questions on these changes or would like to discuss options, please call Schwab at 1-888-903-3863.6LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 65/5/17 3:01 PM

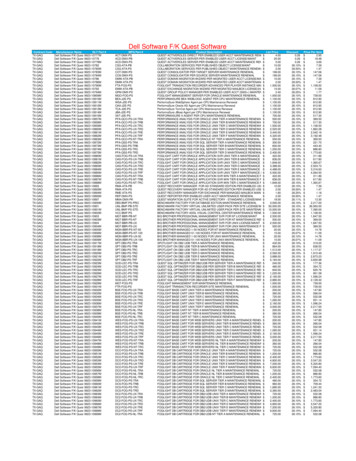

Underlying Portfolio HoldingsUnderlying Holdings of the Age-Based PortfoliosAs of July 14, EquityTerm1Portfolio Portfolio Portfolio Portfolio Portfolio Portfolio Portfolio Portfolio Portfolio PortfolioAmerican Century Growth 00%0.00%American Century Equity Growth 00%0.00%American Century Income & Growth 0.00%American Century Value 00%0.00%American Century Heritage .00%American Century Mid Cap 0.00%Vanguard Small-Cap Index .00%American Century Real Estate .00%Domestic Stock 50%8.25%0.00%Vanguard Total International Stock Index 00%0.00%American Century Global Growth .00%International Stock 1.75%0.00%Baird Core Plus Bond 13.50%15.00%Vanguard Total Bond Market Index 13.50%15.25%Ultra Short Bond 22.50%25.00%American Century Short DurationInflation Protection Bond .00%American Century International Bond .75%Bond 00%60.00%65.00%Cash and Cash Equivalents 0.00%35.00%Cash and Cash Equivalents 100%Also available as a static option.7LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 75/5/17 3:01 PM

Generally, as interest rates rise, the value of the securities held in the fund will decline. The opposite is true when interest rates decline.There is no guarantee that the investment portfolios will achieve their investment objectives. The value of your Learning Quest account willvary, and a gain or loss may occur when you withdraw money from your account.Before investing, carefully consider the plan’s investment objectives, risks, charges and expenses. This information andmore about the plan can be found in the Learning Quest Guide and Participation Agreement, available from Charles Schwab& Co., Inc., at Schwab.com/LearningQuest or 1-888-903-3863, and should be read carefully before investing. If you are nota Kansas taxpayer, consider before investing whether your or the beneficiary’s home state offers a 529 Plan that providesits taxpayers with state tax and other benefits not available through this plan.As with any investment, it is possible to lose money by investing in this plan. The value of your Learning Quest account may fluctuate, andit is possible for the value of your account to be less than the amount you invested.Learning Quest accounts are serviced by Charles Schwab & Co., Inc. The Learning Quest 529 Education Savings Program is managedby American Century Investment Management, Inc.Notice: Accounts established under Learning Quest and their earnings are neither insured nor guaranteed by the state of Kansas, theKansas State Treasurer, American Century Investments or Charles Schwab & Co., Inc. Accounts established under Learning Quest aredomiciled at American Century Investments and not Schwab.This information is for educational purposes only and is not intended as investment or tax advice.Administered by Kansas State Treasurer Jake LaTurnerManaged by American Century Investment Management, Inc.American Century Investment Services, Inc.,Distributor 2017 Charles Schwab & Co., Inc. All rights reserved. Member SIPC.CC0122349 (0715-4063) REG14960-18 (07/15)00145423LQ-FLY-92393 1705LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 85/5/17 3:01 PM

Effective July 14, 2017, the Learning Quest 529 College Savings Program will implement some exciting changes. These changes include an extended glide path, new names for the age-based portfolio options, and new underlying . LQ-FLY-92393-LQ Glide Path Schwab Learning Quest-Final.indd 5 5/5/17 3:01 PM. Timeline of Key Dates to Remember