Transcription

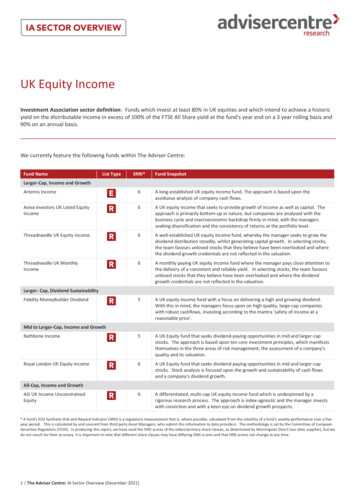

UK Equity IncomeInvestment Association sector definition: Funds which invest at least 80% in UK equities and which intend to achieve a historicyield on the distributable income in excess of 100% of the FTSE All Share yield at the fund's year end on a 3 year rolling basis and90% on an annual basis.We currently feature the following funds within The Adviser Centre:Fund NameList TypeSRRI*Fund SnapshotLarger-Cap, Income and GrowthArtemis Income6A long-established UK equity income fund. The approach is based upon theassiduous analysis of company cash flows.Aviva Investors UK Listed EquityIncome6A UK equity income that seeks to provide growth of income as well as capital. Theapproach is primarily bottom-up in nature, but companies are analysed with thebusiness cycle and macroeconomic backdrop firmly in mind, with the managersseeking diversification and the consistency of returns at the portfolio level.Threadneedle UK Equity Income6A well-established UK equity income fund, whereby the manager seeks to grow thedividend distribution steadily, whilst generating capital growth. In selecting stocks,the team favours unloved stocks that they believe have been overlooked and wherethe dividend growth credentials are not reflected in the valuation.Threadneedle UK MonthlyIncome6A monthly paying UK equity income fund where the manager pays close attention tothe delivery of a consistent and reliable yield. In selecting stocks, the team favoursunloved stocks that they believe have been overlooked and where the dividendgrowth credentials are not reflected in the valuation.5A UK equity income fund with a focus on delivering a high and growing dividend.With this in mind, the managers focus upon on high quality, large-cap companieswith robust cashflows, investing according to the mantra 'safety of income at areasonable price'.Rathbone Income5A UK Equity fund that seeks dividend-paying opportunities in mid and larger-capstocks. The approach is based upon ten core investment principles, which manifeststhemselves in the three areas of risk management, the assessment of a company'squality and its valuation.Royal London UK Equity Income6A UK Equity fund that seeks dividend-paying opportunities in mid and larger-capstocks. Stock analysis is focused upon the growth and sustainability of cash flowsand a company's dividend growth.6A differentiated, multi-cap UK equity income fund which is underpinned by arigorous research process. The approach is index-agnostic and the manager investswith conviction and with a keen eye on dividend growth prospects.Larger- Cap, Dividend SustainabilityFidelity MoneyBuilder DividendMid to Larger-Cap, Income and GrowthAll-Cap, Income and GrowthASI UK Income UnconstrainedEquity* A fund’s KIID Synthetic Risk and Reward Indicator (SRRI) is a regulatory measurement that is, where possible, calculated from the volatility of a fund’s weekly performance over a fiveyear period. This is calculated by and sourced from third party Asset Managers, who submit this information to data providers. The methodology is set by the Committee of EuropeanSecurities Regulators (CESR). In producing this report, we have used the SRRI scores of the oldest/primary share classes, as determined by Morningstar Direct (our data supplier), but wedo not vouch for their accuracy. It is important to note that different share classes may have differing SRRI scores and that SRRI scores can change at any time.1 The Adviser Centre: IA Sector Overview (December 2021)

2 The Adviser Centre: IA Sector Overview (December 2021)Sector CategoriesWe feature 8 funds from the IA UK Equity Income sector in The Adviser Centre. They are grouped into several categories, thecharacteristics of which are explained below. We use these groupings to compare funds that share some attributes, whilstacknowledging that even within categories, nuances in approaches can result in a variety of outcomes, according to marketconditions. Please note that some funds have migrated away from this sector to the UK All Companies sector (see Sector Newssection below).Larger-Cap, Income and GrowthKey characteristics are as follows: This is the mainstay category of the UK Equity Income sector. These funds can be considered traditional UK equity funds,given the importance of dividends within the UK equity market. Managers are concerned with the current dividend of the fund, as well as dividend and capital growth prospects. Managers acknowledge that a higher yield should not come at the expense of a dwindling capital base. There is usuallyflexibility around the income discipline, in that managers are prepared to include companies that yield less than the index, oreven those that have no current yield, on the expectation that they will increase dividends in the future. Therefore, portfoliocalibration is important, as the remainder of the portfolio needs to provide sufficient income to secure a high enoughaggregate yield to satisfy IA and client requirements.Larger-Cap, Dividend SustainabilityKey characteristics are as follows: Managers in this category have a keen focus upon the sustainability of dividends. This is a more conservative approach compared to other funds in the peer group. It tends to result in more defensive risk andreturn characteristics over time, given the preference for stable companies with strong cashflows that offer safety of income. Over the long term, a more defensive risk/return profile is expected, although performance can be under pressure whenthere are fears of rising bond yields.Mid to Larger-Cap, Income and GrowthKey characteristics are as follows: Managers are concerned with the current dividend of the fund, as well as dividend and capital growth prospects. Managers acknowledge that a higher yield should not come at the expense of a dwindling capital base. There is usually flexibility around the income discipline, in that managers are prepared to include companies that yield lessthan the index, or even those that have no current yield, on the expectation that they will increase dividends in the future.Therefore, portfolio calibration is important, as the remainder of the portfolio needs to provide sufficient income to secure ahigh enough aggregate yield to satisfy IA and client requirements With a willingness to invest in mid-cap as well as large-cap stocks, these funds display a degree of correlation with theperformance of the mid-cap index and outcomes can differ from the more mainstream funds in the sector.

3 The Adviser Centre: IA Sector Overview (December 2021)All-Cap, Income and GrowthKey characteristics are as follows: Managers are concerned with the current dividend of the fund, as well as dividend and capital growth prospects. Managers acknowledge that a higher yield should not come at the expense of a dwindling capital base. There is usually flexibility around the income discipline, in that managers are prepared to include companies that yield lessthan the index, or even those that have no current yield, on the expectation that they will increase dividends in the future.Therefore, portfolio calibration is important, as the remainder of the portfolio needs to provide sufficient income to secure ahigh enough aggregate yield to satisfy IA and client requirements. With a willingness to invest across the market-cap range, relative performance can be more variable when compared to moremainstream funds in the peer group and the long-run volatility is likely to be higher.Sector PerspectivesThe IA UK Equity Income sector features approximately 85 funds, with at least one year of performance data, at the time ofwriting.The popularity and appeal of UK equity income funds is enduring, and for good reason. The UK equity market has a strongincome-paying heritage, with around 60% of returns of the market attributable to reinvested dividends over the past 25 years.With this in mind, an income-biased fund stands a good chance of having an innate head start.A few years ago, a lack of diversity in the composition of equity income funds was cited as a concern because of the highproportion of the market’s dividend income that is delivered by relatively few large-cap companies. This engendered somechanges to the characteristics of the sector as fund managers responded to this concern.Today, the sector is certainly more diversified in terms of approaches and stock exposures. Key changes are: The greater use of mid and small-cap stocks by equity income fund managers. The drift away from an arguably unduereliance on mega-cap stocks means that the sector now has a stronger correlation with the FTSE 250 index. The greater use of overseas stocks. Some managers choose to use the 20% flexibility permitted by the sector guidelines toinvest in higher yielding stocks outside the UK.These developments have brought about greater diversification and opportunity, in terms of both dividend and capital growth.As well as opportunities, of course, there are different kinds of risk to consider.On the subject of overseas exposure, UK equity income managers tend to opt for blue-chip companies that have attractivecurrent dividends and dividend growth prospects. Given the international nature of most blue chips, we do not see this as amajor diversion from the traditional stomping ground of UK equity income funds. It is also worth being aware of the basecurrency of the overseas holdings and how this element of currency risk is tackled (hedged back to sterling, or not).Extensive exposure to mid and small-cap companies by fund managers does represent an important departure from tradition. Inthe past, smaller companies did not have a strong dividend-paying culture when considered in aggregate and were mainly thepreserve of fund managers seeking capital growth. However, higher quality mid and small-cap companies can have many of theattributes that attract income managers, notably dividend growth. Indeed, some income funds have strong biases to, or areentirely invested in, mid and small-cap companies. Alongside the opportunity that this brings, investors should be prepared forthe additional risks that exposure to smaller companies represents, including the risk to dividend streams and the potential forelevated capital volatility and liquidity issues.It is worth pausing for thought about the consequences of ESG strategies for UK equity income investors. Some of the importantdividend-paying sectors in the market are oil & gas, mining, tobacco and pharmaceuticals and the reduction or absence of theseexposures in portfolios would impact negatively upon the available yield.Please see note in Sector News regarding COVID-19.

4 The Adviser Centre: IA Sector Overview (December 2021)Sector NewsIA sector definitionIn March 2017, the IA altered the sector definition. Following consultation with consumers, financial advisers and productproviders, the decision was taken to lower the sector’s yield hurdle from 110% to 100% of the index yield, measured over athree-year rolling period. Although the yield target was lowered, failure to achieve 90% of the index yield in a one-year periodwill still result in the fund being removed from the sector.Fund migrationsMontanaro UK Income, featured in our service, is now in the IA UK All Companies sector having previously resided in the IA UKEquity Income sector. It was moved out of the UK Equity Income sector when it failed the previous 110% yield hurdle. This wasone of several funds that changed sector around the same time.COVID-19In April 2020, the IA issued new guidance for equity income sectors. This was necessary because of the impact of measures tocontrol COVID-19. Many companies had to review their dividend policies, with some being suspended or postponed. This meantthat some funds were unable to meet the requirements for the sector. The revised guidelines were designed to prevent anyshort-term disruption to these sectors and enable a focus upon long-term outcomes for savers.It is estimated that the average UK equity income fund had to cut its dividend by 30% during 2020 (source: Trustnet). Thiscompares to a drop in headline pay-outs from UK companies of 44% (source: Link Group). Since then, dividend rates haverecovered much of the lost ground.Sector Performance PointersTitleSector Performance PointersMarket/index themesThe main UK indices have relatively high concentration in the top-weighted stocks. The FTSE 100 index hasapproximately 40% in the top 10 and the FTSE All-Share over 30%. While managers take different approachesto investing in the largest companies, sensible diversification means that there is often reticence about tying uptoo much capital in a concentrated number of stocks.Given the proportion of international earners in the FTSE 100, the value of sterling has a significant bearingupon its performance when compared to the mid and small cap indices.The advancement of ESG themes is a challenge for the UK market, given the presence of large-cap oil & gas,mining and tobacco stocks in particular. We are seeing some reticence from fund managers towardscompanies and sectors that are regarded as more controversial, because of regulatory pressure, client feedbackor simply concern about the long-term structural/financial picture. An associated problem is that of dividendincome, which has been such an important component of the total return from UK equities over time; thesesectors happen to include some of the dividend stalwarts.Please see above for comments relating to the impact of COVID-19 in dividends. During 2020, the UK sufferedmore than a 40% drop in the level of dividend distributions. The drop was less severe for the funds that wefeature in this sector as managers adjusted their portfolios in the face of a changed backdrop and/or achieved abetter outcome thanks to companies that were able to reinstatement their dividends.

5 The Adviser Centre: IA Sector Overview (December 2021)TitleSector Performance PointersMarket capThe FTSE All-Share index, the most common benchmark for funds in the sector, has the following market-capsplit at the time of writing: large cap: 64%, mid cap: 23%, small cap: 13%. Income funds are more likely to havehigh allocations to large-cap stocks although overweight exposures to mid-cap stocks are more common thanthey used to be. There are also some all-cap funds in the sector, whose risk/return profiles are more likely tobe idiosyncratic in nature.Passive fundsPassive funds are uncommon in the equity income arena. There is one passive fund in this sector, which tracksthe FTSE U.K. Equity Income Index. This index consists of the shares of companies listed on the LSE mainmarket that are expected to pay dividends that generally are higher than average.Style themesAs a general comment, equity income sectors typically display stronger value characteristics than other equitysectors. While the growth versus value dynamic has been important within the non-income focused equitysectors, it has had a less dominant influence upon the outcomes from the equity income sectors, although it isnot absent altogether.In anticipating the likely customer journey, the important consideration for UK equity income funds is theapproach to delivering income, in other words, the bias towards dividend sustainability and/or dividendgrowth. Stylistic preferences are a secondary consideration, although the sector does feature some funds withovert style skews.From a market perspective, growth styles have been in charge over one, three and five years. Companies seenas structural growth beneficiaries have been favoured as global economic growth and inflation levels have beenmuted. Conversely, companies that are more sensitive to the economic cycle were shunned, and,notwithstanding short-lived style rotations, they were consigned to the unloved value camp. Business modeldisruption, notably due to technology innovation and the expanding use of the internet, robotics and AI, hasalso resulted in companies falling into the “value trap” category. The referendum vote to leave the EU in 2016also added to concerns about domestically orientated companies.There was a change of pace at the end of 2020 as optimism about COVID-19 vaccines prompted a re-evaluationof stocks that had been particularly badly hit in the previous months. This was to the benefit of value funds,helping them to claw back some of the cumulative performance gap. Newsflow has been choppy over thecourse of 2021 and equity sectors and styles have been responding to the opposing narratives of economicrecovery/inflation versus COVID-19 scares/peaking economic growth rates.This change of backdrop has not necessarily been of great help to income funds. Many were caught in the trapof being neither high growth, nor deep value and therefore, tended not to capture the imagination. Indeed, in2020, a negative year for the market, it was somewhat unusual to see the UK Equity Income sectorunderperform the UK All Companies sector. Such an outcome reflects the unique set of circumstances.Other notable trendsThe sector features funds that use covered call-writing strategies to enhance the income distribution. Theseapproaches can be suitable for investors who are seeking to boost their income, but they can also curtail capitalgrowth.Key BenchmarksMost funds in the sector use the FTSE All-Share index as their reference benchmark.The requirement and discipline of providing a yield means that fund managers are often prepared to deviate meaningfully fromthe index in the interests of meeting their funds’ income objectives.KIID SRRI Score* and VolatilityThe table below displays the seven SRRI risk classes, their respective volatility intervals and the proportion of UK Equity Incomefunds that reside within each risk class:

6 The Adviser Centre: IA Sector Overview (December 2021)SRRI Risk ClassVolatility Intervals% of Funds PerRisk ClassEqual or aboveLess %25%78%725%and over0%The volatility characteristics of different asset classes have persistence over the very long term (as measured in decades), butover shorter-term time periods, standard deviation outcomes can vary meaningfully. This means that there is always thepotential for a fund’s risk score to shift to a different SRRI category, particularly where the risk outcome is close to one of theprescribed standard deviation boundaries. In other words, changes to risk scores may be purely a function of underlying marketconditions and not the result of a change in investment approach.The effect of the post-Global Financial Crisis era of falling interest rates and monetary stimulus was to dampen the medium-termvolatility profiles of most risk assets. As a result, SRRI scores tended to decline in line with the five-year standard deviations offund returns. In 2020, the environment changed as the COVID-19 crisis shocked all asset classes and triggered sharp falls in pricesduring the first quarter. This was followed by a rapid rebound in the months that followed. The past year of higher volatility isseeing some SRRI scores shifting upwards again as new data is feeding into the five-year standard deviation calculations.* A fund’s KIID Synthetic Risk and Reward Indicator (SRRI) is a regulatory measurement that is, where possible, calculated from the volatility of a fund’s weekly performance over a fiveyear period. This is calculated by and sourced from third party Asset Managers, who submit this information to data providers. The methodology is set by the Committee of EuropeanSecurities Regulators (CESR). In producing this report, we have used the SRRI scores of the oldest/primary share classes, as determined by Morningstar Direct (our data supplier), but wedo not vouch for their accuracy. It is important to note that different share classes may have differing SRRI scores and that SRRI scores can change at any time.theadvisercentre.co.ukThis document is for financial professional use only. The Adviser Centre is a trading name of Embark Investments Limited. Embark Investments Limited is a companyincorporated in England Company Number 03383730 and is regulated by the FCA, registration number 628981. The information in this document, including informationfrom asset managers and third party sources, is deemed to be correct at the time of publication but The Adviser Centre takes no responsibility for its accuracy. Thisdocument has been written for illustrative purposes and as such is neither a solicitation nor a recommendation with respect to the purchase or sale of any securities.Opinions are always stated honestly and with careful consideration but they can change at any time. Full fund documentation provided by the asset manager should bereviewed as part of any decision-making process. Any investment’s value and any income from it may fall as well as rise, as a result of market and currency fluctuations.Investors may not get back the amount originally invested.

6 A UK Equity fund that seeks dividend-paying opportunities in mid and larger-cap stocks. Stock analysis is focused upon the growth and sustainability of cash flows and a company's dividend growth. All-Cap, Income and Growth ASI UK Income Unconstrained Equity 6 A differentiated, multi-cap UK equity income fund which is underpinned by a