Transcription

MSc in Financial Mathematics – 2020MSc (Coursework)/PG Diploma in Financial Mathematics – 2020The MSc/PG Diploma in Financial Mathematics aims to provide a professionaldevelopment package for professionals in the discipline of Finance, Insurance, Banks,Financial Analysis, Financial Consultancy and Financial Simulation sectors. The awardof the degree will provide its recipients with a valuable professional qualification.Considering new trends in the field of quantitative finance, starting from year 2020 batch,the program provides two pathways, namely, Financial Engineering (FE) Financial Analysis (FA)Financial Analysis is focused more towards qualitative aspects, and FinancialEngineering is focused on deeper quantitative aspects. Both pathways require coreconcepts and tools of financial mathematics in the areas of finance, applied mathematics,statistics and computer science. They form the common set of courses delivered insemester I. The split into the two pathways is introduced in semester II based on studentdemand. In semester III, a related industry project is introduced to strengthen theacquired knowledge in the industry setting.Programme Intended Learning OutcomesThe end of the two years (SLQF Level 9) MSc in Financial Mathematics Degreeholders should be able to: ILO I: demonstrate knowledge and proficiency in the terminologies, theories,concepts, practices and skills specific to the field of finance, financial instruments,financial markets and financial product development. ILO II: display critical awareness of current local/globalfinancialissues/environments ILO III: observe and interpret financial markets to uncover potentialopportunities and construct financial portfolios. ILO IV: apply best practices in financial product development / analysis to makeplans, organize projects, monitor outcomes and provide financial leadership. ILO V: apply the Standards of Practice and Codes of Conduct of FinancialPractitioners to address ethical challenges within the business environment anddemonstrate intellectual maturity in a global setting. ILO VI: practice professionalism and uphold ethical standards andimprove/update skills required for employment and life-long learning. ILO VII: effectively communicate & disseminate knowledge, information andideas to specialist and a wider society ILO VIII: perform independently as well as interdependently ILO IX: demonstrate self-direction and originality in tackling and solvingproblems and be able to plan and implement tasks at professional levels1

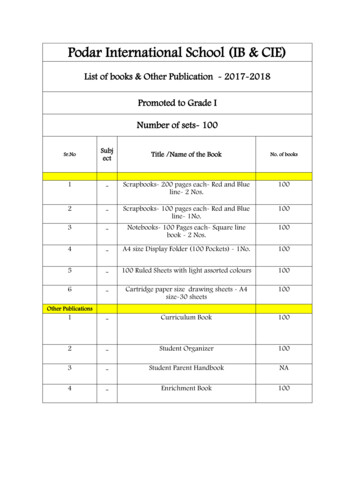

MSc in Financial Mathematics – 2020PART I: PG DiplomaCourse CodeSemester IMFM 5041MFM 5042MFM 5043MFM 5044MFM 5045Semester IIMFM 5046MFM 5047MFM 5048MFM 5049MFM 5050MFM 5051MFM 5052MFM 5053MFM 5054Course TitleDetailsNotionalhoursFAFE30L, 30P, 3CApplied FinanceOptimizationMethodsfor 30L, 30P, 3CFinance30L, 30P, 3CFinancial Products & PricingComputing for Finance60P, 2CCase Study on Financial90P, 3CMarkets150150XXXX150100150XXXXXXCorporate FinanceFinancial Risk ManagementEconomics for FinanceFinancial Reporting andAnalysisQuantitative Methods in FinanceInvestment AnalysisQuantitative Risk AnalysisFinancial EconometricsComputationalModelsinFinancial EngineeringTOTAL NOTIONAL HOURS(PG Diploma) – SLQF Level 8TOTALCREDITS(PGDiploma) - SLQF Level 8100100100100XX150150150X30L, 2C30L, 2C30L, 2C30L, 2C30L, 30P,30L, 30P,30L, 30P,30L, 30P,60P, 2C3C3C3C3CXXXXXX1501001250125025C25CPART II: MSc CourseworkCourseCourse TitleDetailsCodeSemester IIIMFM 5055 Quantitative Finance Project150P, 5CMFM 5056 Financial Analysis Project150P, 5CTOTAL NOTIONAL HOURS(MSc) - SLQF Level 9TOTAL CREDITS (MScCoursework) - SLQF Level 92Notionalhours500500FAFEXX1750175030C30C

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5041 Applied Finance3NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours303090150This course explores the theoretical aspects of finance and valuation ofmoney and provides applicationsBy the end of the course, students should be able to identify and apply basics valuation methods and compute timevalue value the different cash flows apply techniques to price the financial instrument use techniques to compare different cash flowsThe effective rate of interest, the real rate of interest, the force ofinterest, nominal rates of interest, the rate of discount, the principle ofequivalence, level cash series, Recursive relations, accumulations,deferred and conventional level cash series, more general level cashseries, valuing simple projects, financial instrument and theirbehavioral properties, fund analysis, Money weighted rate and Timeweighted rate, Excel financial functions and their applications.End of semester examinationContinuous Assessment60%40 %1. Ross, SA, Westerfield, RW, Jordan, BD, (2002), Fundamentalsof Corporate Finance, 8th edition, McGraw-Hill PublishingCompany.2. Kellison, SG, (2008), The Theory on Interest, 6th Edition,Richard D. Irwin Inc.3. Marek Capinski and Tomasz Zastawniak (2003), Mathematicsfor Finance, An introduction to Financial Engineering,Springer-Verlag London Limited.3

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5042 Optimization Methods for Finance3NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours303090150Optimization models and methods play an increasingly important rolein financial decisions. This course introduces the approach ofmodeling financial decisions as optimization problems and thendeveloping appropriate optimization methodologies to solve theseproblems.By the end of the course, students should be able to model financial optimization problems interpret models as mathematical programs ology and software use analysis to gain insight and make decisionsLinear Optimization: Linear Programming, Linear programmingproblem, duality, optimality conditions, short review on simplexmethod. LP models: Asset/liability cash-flow matching, short-termfinancing, dedication, sensitivity analysis for LP, case studies onconstructing a dedicated portfolio. LP models: Asset pricing andarbitrage, derivative securities and fundamental theorem of assetpricing, arbitrage detection using LP. Nonlinear Optimization:Nonlinear Programming, univariate optimization, unconstrainedoptimization and constrained optimization, quadratic programming forportfolio optimization.End of semester examinationContinuous Assessment60%40 %1. Gerard Cornuejols, Reha Tutuncu (2007), OptimizationMethods in Finance, Cambridge University Press.2. Taha HA (2017), Operations Research, 10th Editions, PearsonPrentice Hall.3. Winston WL, Venkataramanan V (2003), Introduction toMathematical Programming, 4th Edition, Brooks/Cole,Cengage Learning.4

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5043 Financial Products & Pricing3NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours303090150This course explores financial products of the modern financial marketand the mathematical techniques for product price calculation.By the end of the course, students should be able to identify financial products and value them apply techniques to value the products design financial products for risk marketIntroduction to derivatives, complete market, Market risk and creditrisks in the use of derivatives. American and European options, Typesof Trades, Hedgers, Speculators and arbitragers, Hedging withderivatives, Factors affecting option prices, Strategies with options,Boundaries with options, One-step Binomial Models, Risk Neutralvaluation,Two-Step Binomial trees, Black Scholes model,Distribution of returns, volatility, risk neutral pricing, Black-ScholesMerton differential equation. Estimating volatility using historicaldata, implied volatility, Exotic and path dependent optionsForward and Future Contracts, Futures and forward pricing, Hedgingwith futures, Options on stock indices, currencies and futures,evaluation of future options using a binomial tree, Options on stockindices, currencies and futuresEnd of semester examinationContinuous Assessment60%40 %1. Hull John, (2008), Options, futures and other derivatives,International 7th Edn, Pearson Prentice Hall.2. Ross S. (2003), Introduction to Mathematical Finance,Cambridge University Press.3. Marek Capinski, Tomasz Zastawniak (2011), Mathematics forFinance: An Introduction to Financial Engineering, Springer5

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5044 Computing for Finance2NoneLectures (H)Practical(H)Independent Learning(H)Notional HoursNone6040100This course explores the practical application of electronicspreadsheets in the aspect of financial mathematics.By the end of the course, students should be able to identify financial products and value them apply techniques to value the products design financial products for risk marketIntroduction to formulas for understanding of basic spreadsheetsbuild-in functions, Functions for financial calculations and decisions.Do sensitivity analysis with data tables in spreadsheet applications,Summarizing and visualizing data using build-in functions and pivottables, understanding correlations and summary relationships, tomultiple regression tools in spreadsheets, Using Monte Carlosimulation in spreadsheet, Automating the tasks and Macroprogramming.End of semester examinationContinuous Assessment50%50 %1. Wayne L. Winston (2016), Excel 2016 Data Analysis andBusiness Modeling, Microsoft Press.2. Bill Jelen and Tracy Syrstad (2010), VBA and Macros –Microsoft Excel 2010, Que Publishing.6

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5045 Case Study on Financial Market3MFM 5041, MFM 5042, MFM 5043Lectures (H)Practical(H)Independent Learning(H)Notional HoursNone9060150To provide the hands on experiences in the field of Financial MarketBy the end of the course, students should be able to apply quantitative methods to real data analysis scenarios and judge the current patterns prioritize conditions and methods to apply different real cases imitationsIndividual candidates will be assigned to a Case Study on FinancialMarket. Each student will be required to gain thorough knowledge ona given topic related to the financial market through a set of fieldvisits/workshops under the guidance of an industrial expertise panel.After the given period of time, candidates are expected to conduct theseminar based on their case studies.Final PresentationVivaContinuous Assessment / Reports25%25%50 %1. Chiradeep Chatterjee (2008), Case Studies on FinancialMarkets, The Institute of Chartered Financial Analysts ofIndia.2. Tarika Sikarwar (2017), A Handbook of Case Studies inFinance, Cambridge Scholars Publishing3. Robert F. Bruner, Kenneth Eades, Michael Schill (2009), CaseStudies in Finance, McGraw-Hill Higher Education.7

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5046 Corporate Finance2MFM 5041, MFM 5043Lectures (H)Practical(H)Independent Learning(H)Notional Hours30None70100This course explores the theoretical aspects of finance and valuation ofmoney and provides applicationsBy the end of the course, students should be able to compute the cost of capital and analyze practical applications value the taxation of the company apply techniques to price the projectsIntroduction of Corporate finance and financial manager, the goal ofthe financial management, Stock valuation, Capital budgeting, Capitalstructure, cost of capital, dividend policy, personal and corporationtaxation, Project analysis and evaluation, Return risk and the securitymarket line, short/long term financing, Measures and assessment offinancial performance.End of semester examinationContinuous Assessment60%40 %1. Ross, SA, Westerfield, RW, Jordan, BD, (2002), Fundamentalsof Corporate Finance, 8th edition, McGraw-Hill PublishingCompany.2. Kellison, SG, (2008), The Theory on Interest, 6th Edition,Richard D. Irwin Inc.3. Marek Capinski and Tomasz Zastawniak (2003), Mathematicsfor Finance, An introduction to Financial Engineering,Springer-Verlag London Limited.8

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5047 Financial Risk Management2MFM 5041, MFM 5043Lectures (H)Practical(H)Independent Learning(H)Notional Hours30None70100This course explores financial risk management techniques and theirapplications into financial markets and instrumentsBy the end of the course, students should be able to identify and compute financial risk apply suitable risk measures quantify financial risk and make decisionsIntroduction to Risk, Fixed income risk, duration and convexity,Markowitz risk- return approach for asset allocation of a portfolios,Efficient frontier, Risk Measures: Value at Risk (VaR), ConditionalValue at Risk (CVaR): Parametric, Historical simulation, Portfolioanalysis and measurements of risk. Equity portfolio risk managementvia option strategies.End of semester examinationContinuous Assessment60%40 %1. Philippe Jorion (2009), Financial Risk Manager Hand book(GARP (Global Association of Risk Professionals)), JohnWiley & Sons.2. Steven Allen (2003), Financial Risk Management: APractitioner's Guide to Managing Market and Credit Risk, JohnWiley & Sons, Ins9

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5048 Economics for Finance2NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours30None70100To provide the advanced knowledge in Economic models, methodsthose are essential for economic analysis and economic problemsolvingBy the end of the course, students should be able to explain the function of market and prices as allocatedmechanisms apply the concept of equilibrium to both microeconomics andmacroeconomics discuss the application of marginal analysis assess the role of the factor market in determining theallocation of resources identify and compare the limits of economic analysis.The basic theory of individual choice, Contingent commodities ,Insurance and Expected utility, The firm and its goal, Production andcosts, perfect competition when firms have identical cost and nonidentical costs, the basic monopoly model and regulatory responses tomonopoly, price discrimination, Oligopoly models: cournot model,stackelberg and Bertrand, Demand and supply for factors andequilibrium in the factor market, Monopsony and monopoly in thefactor market, Inter temporal consumption and production, Investmentdecision and Present value, Pareto efficiency and market failure,Adverse selection, moral hazard , signaling and screening,Externalities, Public goodsMacroeconomics: IS-LM Model, Unemployment, AD- AS, Inflation,Phillips curve, Economic growth, Solow model, Exogenous endendogenous growth theories, open economy, mundel-flemming model,Theories of consumption, investment, Money demand and Moneysupply, Monetary and Fiscal PolicyEnd of semester examinationContinuous Assessment60%40 %1. Katz, ML, Rosen, HS (2005), Microeconomics, McGraw-HillEducation2. Mankiw, NG (2010), Macroeconomics, Worth Publishers, NY.10

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5049 Financial Reporting and Analysis2NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours30None70100This course explores the theoretical underpinnings and practicalapplication of financial statement analysis.By the end of the course, students should be able to discuss the importance of financial statement analysis to usergroups identify the basic components of each of the financialstatements identify and apply the appropriate techniques of financialstatement analysis interpret the results obtained during basic analysis stageFinancial statements and the components, Accounting principles,Importance and limitations of financial statement analysis, Uses anduser groups, Sources of information, Tools and techniques of financialstatement analysis, Financial statement irregularitiesEnd of semester examinationContinuous Assessment60%40 %1. Temte, A., Temte, A. (2003). Financial Statement Analysis.Chicago: Dearborn Trade, A Kaplan Professional Company.2. Fridson, M., Alvarez, F. (2011). Financial statement analysis: apractitioner’s guide, fourth edition (4th ed.). Hoboken, N.J:John Wiley & Sons.11

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5050 Quantitative Methods in Finance3NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours303090150This course provides the probability and statistical methods to modelfinance and to draw quantitative financial discussions.By the end of the course, students should be able to discuss basic probability theory define random variables and solve univariate and multivariateprobability problems apply the concepts of expectation, variance, covariance andcorrelation to solve problems use methods in statistical inference to solve financial problemsBasic statistics and probability theory, random variables, univariateand multivariate probability distributions-continuous and discrete,expectation-conditional and unconditional, variance, covariance,variance-covariance matrices, correlation, random matrices, samplingand estimation, confidence intervals, F-test, t-Test, Chi-Squared Test,Hypothesis testing and ANOVA, MATLAB and Excel functions tosolve probabilistic problems in financeEnd of semester examinationContinuous Assessment60%40 %1. Sheldon M. Rose (2014), Introduction to Probability andStatistics for Engineers and Scientists, Fifth Edition, Elsevier.2. Alan J. Izenman (2008), Modern Multivariate StatisticalTechniques, Springer.3. Jay L. Devore and Kenneth N. Berk (2012), ModernMathematical Statistics with Applications, Springer.12

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5051 Investment Analysis3MFM 5041, MFM 5043Lectures (H)Practical(H)Independent Learning(H)Notional Hours303090150This course provides basic concepts of financial decision markingtechniquesBy the end of the course, students should be able to compute and analyze the impact of interest rate variation. compute the bond price and analyze variability apply the valuation methods to identify feasibility of the givenprojectIntroduction to financial analysis, pricing a bond and sensitivity of it,zero coupon bonds and their features, par yield, spot rates, forwardrates, term structure of the interest rate, yield rate, duration andconvexity of the bond, fund analysis, valuing real cash flows, valuingrandom cash flows, Excel computation and solvers.End of semester examinationContinuous Assessment60%40 %1. R Stephen G. Kellison (2009), The Theory of Interest, 3rdEdition, McGraw-Hill Irwin.2. Perry H. Beaumont (2004), Financial Engineering Principles:A Unified Theory for Financial Product Analysis andValuation, John Wiley & Sons, Inc.3. Marek Capinski &Tomasz Zastawniak (2003), Mathematicsfor Finance: An Introduction to Financial Engineering,Springer.13

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5052 Quantitative Risk Analysis3MFM 5041, MFM 5043Lectures (H)Practical(H)Independent Learning(H)Notional Hours303090150This course provides basic concepts of financial decision makingtechniquesBy the end of the course, students should be able to compute financial risk value suitable risk measures model and quantify financial risk quantify credit risk model operational riskIntroduction to risk, financial risk, credit risk and operational risk,Risk measures, Risk return tradeoff. Risk modelling andquantification. Fixed income, equity and option market risk analysisand strategies, Yield curve and forward curve modelling, duration andconvexity, Value at Risk: Parametric approach, historical simulationand monte-carlo simulation. Credit Risk Modelling: Altman’s modeland Application of credit Matrix approach. Operational Risk: Basel II(Basel-II) framework.End of semester examinationContinuous Assessment60%40 %1. Donald R. Van Deventer, Kenji Imai, Mark Mesler (2014),Advanced Financial Risk Management, John Wiley & Sons,Ins.2. Philippe Jorion (2009), Financial Risk Manager Handbook(GARP (Global Association of Risk Professionals)), JohnWiley & Sons.3. Steven Allen (2003), Financial Risk Management: APractitioner's Guide to Managing Market and Credit Risk, JohnWiley & Sons, Ins.14

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsRationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsMFM 5053 Financial Econometrics3NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours303090150This course provides basic concepts of financial decision makingtechniquesBy the end of the course, students should be able to estimate linear relationships among financial variables andderive conclusions based on estimated models model and forecast univariate and multivariate financial timeseries model and forecast financial volatilityStatistical Properties of Financial Returns, Regression analysis andApplications in Finance, Maximum Likelihood Estimation, UnivariateTime Series and Applications to Finance, Vector AutoregressiveModels and Cointegration, Modelling Volatility – ConditionalHeteroscedastic Models, Modelling Volatility and Correlations –Multivariate GARCH Models.End of semester examinationContinuous Assessment60%40 %1. Brooks, C (2019), Introductory Econometrics for Finance, 4thEdition, Cambridge University Press.2. Alexander, C. (2001). Market Models: A Guide to FinancialData Analysis. John, Wiley & Sons.15

MSc in Financial Mathematics – 2020Course Code / TitleMFM 5054EngineeringCredit ValuePrerequisitesDetails2MFM 5044RationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading MaterialsLectures (H)ComputationalPractical(H)ModelsIndependent Learning(H)inFinancialNotional HoursNone6040100This course provides theoretical and practical knowledge, on buildingand using, computational models based on soft programmingtechniquesBy the end of the course, students should be able to compare hard computing methods with soft computingmethods and choose the appropriate method for solving a givenproblem describe theoretical aspect of Artificial Neural Networks(ANN) their advantages and limitations implement a simple Feed Forward Network in Excel andMATLAB or similar software and use ANN to solve realworld classification and prediction problems describe how Genetic Algorithms (GA) functions andimplement a GA program to solve optimization problems use Monte-Carlo simulations to solve appropriate problemsIntroduction to MATLAB (ML) programming, Introduction toArtificial Neural Networks (ANN), Single Layer Networks, MultilayerNetworks, Different learning rules, Advantages and limitations ofANN. Preprocessing and post processing of data, Using ANN to solvereal world problems, Introduction to Genetic Algorithms (GA) withadvantages, disadvantages and limitations, Encoding data to genes,Cross overs, mutations and other generation creation techniques,Different selection methods, Solving TSP and knapsack problems,Using ML to implement GA to solve problems, Different hybridmechanism, Implement a GA ANN hybrid, Advantages of a hybrid,Introduction to Monte Carlo simulations (MC), its applications, UsingML to implement a MC to model real world problemsEnd of semester examinationContinuous Assessment50%50 %1. Kevin L. Priddy, Paul E. Keller (2005), Artificial NeuralNetworks: An Introduction, ,SPIE Publications.2. Zbigniew Michalewicz (2009), Genetic Algorithms DataStructures Evolution Programs, Springer-Verlag BerlinHeidelberg3. Randy L. Haupt, Sue Ellen Haupt (2004), Practical GeneticAlgorithms, Wiley-Interscience16

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsMFM 5055 Quantitative Finance Project5NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours20RationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading utilizegainedtheoretical/practical knowledge and experiences to solve realquantitative finance problems in real environment settingsBy the end of the course, students should be able to design models to quantify future behavior modify existing models appropriately develop simulation models to demonstrate financial behavior collaborate with existing models/methods write reports to demonstrate models and their features develop effective presentationsIndividual candidates will be assigned guided study on quantitativefinance topics. Each student will be required to study/develop/modifymodel/s and simulation technique/s on a given topic related toquantitative finance under the guidance of a supervisor and orindustrial mentor appointed by the department.After the given six months period of time, candidates are expected toconduct the four seminars (proposal / literature / methodology / basicresults) in each six weeks’ time based on their studies. The end of theperiod students are supposed to submit reports according to givenguidelines and make final presentation.Final PresentationVivaReportContinuous20%20%30 %Assessment (Fourpresentations)30%1. Scott P. Mason, Robert C. Merton, Andre F. Perold, PeterTufano (2005),Cases in Financial Engineering: AppliedStudies of Financial Innovation, Prentice Hall.2. Gianluca Fusai, Andrea Roncoroni (2008), ImplementingModels in Quantitative Finance: Methods and Cases (SpringerFinance), Springer-Verlag Berlin Heidelberg3. Wolfgang Härdle, Cathy Yi-Hsuan Chen, Ludger Overbeck(2017), Applied Quantitative Finance, Springer-Verlag BerlinHeidelberg17

MSc in Financial Mathematics – 2020Course Code / TitleCredit ValuePrerequisitesDetailsMFM 5056 Financial Analysis Project5NoneLectures (H)Practical(H)Independent Learning(H)Notional Hours20RationaleIntended LearningOutcomesCourse ContentMethod/s ofEvaluation:References/Reading utilizegainedtheoretical/practical knowledge and experiences to analysis financialsituations in real settingsBy the end of the course, students should be able to design the analysis tools to quantify current behavior modify existing analyzing tools appropriately develop simulation models to demonstrate financial behavior collaborate with existing financial tools write reports to demonstrate analysis tools and their features develop effective presentationsIndividual candidates will be assigned guided study on financialanalysis topics. Each student will be required to study/develop/modifyanalysis tools and simulation technique/s on a given topic related tofinancial analysis under the guidance of a supervisor and or industrialmentor appointed by the department.After the given six months period of time, candidates are expected toconduct the four seminars (proposal / literature / methodology / basicresults) in each six weeks’ time based on their studies. The end of theperiod students are supposed to submit reports according to givenguidelines and make final presentation.Final PresentationVivaReportContinuous20%20%30 %Assessment (Fourpresentations)30%1. Harold Bierman Jr (Cornell) (2017), Case Studies forCorporate Finance, World Scientific.2. K. MidgleyR. G. Burns (2015),Case Studies in BusinessFinance and Financial Analysis, Springer18

MSc in Financial Mathematics – 2020Table1: Course vs Programme ILOs MapCourseCodeILOIILOIIILOIIIILOIVILOVILOVIILOVI MMMMMHHMFM 5041MFM 5042MFM 5043MFM 5044MFM 5045MFM 5046MFM 5047MFM 5048MFM 5049MFM 5050MFM 5051MFM 5052MFM 5053MFM 5054MFM 5055MFM 5056Table 2: Courses vs Level Descriptors Learning Outcomes (SLQF)(1, 2,.12 denote Learning Outcomes given in SLQF- see Table3)CourseCode123456789101112MFM 5041MFM 5042MFM 5043MFM 5044MFM 5045MFM 5046MFM 5047MFM 5048MFM 5049MFM 5050MFM 5051MFM 5052MFM 5053MFM 5054MFM 5055MFM MMHMMMMMMMMHHHLLLLHLLLLLLLLHHHLLLLHLLLLLLLLHHH19

MSc in Financial Mathematics – 2020HMLHighly correlatedModerately correlatedCorrelatedTable 3: Categories of Learning Outcomes (SLQF)No123456789101112Categories of Learning OutcomesSubject / Theoretical KnowledgePractical Knowledge and ApplicationCommunicationTeamwork and Leadership

MSc in Financial Mathematics - 2020 6 Course Code / Title MFM 5044 Computing for Finance Credit Value 2 Prerequisites None Details Lectures (H) Practical (H) Independent Learning (H) Notional Hours None 60 40 100 Rationale This course explores the practical application of electronic spreadsheets in the aspect of financial mathematics.