Transcription

How management accountantscan grow their influence to drivebusiness performance

White paperINTRODUCTIONM02any managementaccountants are not yetbeing engaged to exercisetheir potential to improvedecision-making and performancemanagement. They continue to behampered by operational activities, legacysystems and a lack of appetite to embracenew technologies.Oracle, in partnership with theChartered Institute of ManagementAccountants, sourced the views of morethan 250 finance professionalsthrough a survey entitled ‘How canmanagement accountants improvebusiness performance?’.Respondents, more than 40% ofwhom were from large organisationswith a turnover of more than 750m perannum, revealed a strong desire for financeto grow its influence across the business,to drive performance and to help informdecision-making.The survey revealed, however, thatmany feel they are bogged down withday-to-day tasks that could be automatedor streamlined with the aid of technology;lack systems that can provide themwith the data and information to informdecisions; and are hindered by a lackof desire to invest in new technologies,such as the cloud.Nigel Youell, senior director, officeof finance at Oracle, says: “We recognisethat financial professionals are in the eyeof a storm of change, with no ready-to-useroad map. Today they are often expectedto deliver more strategic input and becomeactive participants in organisationalforward-planning. Senior financial officersare increasingly asked to integrate oroversee other operational functions,drive change initiatives and innovateprocess – yet they also retain a mass ofresponsibilities based on their traditionalaccounting and compliance mandate.In this scenario simply having moreinformation isn’t enough – they need realinsight, in order to develop more informedcontrol and drive effective change.”Peter Simons, technical specialist,research and development at CIMA,adds: “More than two-thirds of therespondents to the survey classedthemselves as being in senior managementor senior professional roles – so that tellsus that these issues are genuinely affectingthe top of organisations.“It is clear that the people at the top oforganisations are telling us that there isa need for management accountantsto have more influence; for finance to bemore efficient, with better informationand greater influence; and for finance tobe better business partners.“Technology is an enabler for that– whether it is making processes moreefficient to free up time to focus onother areas, or providing the tools toequip finance professionals with theinformation they need.”DRIVING PERFORMANCEThe demands of accounting operations,external reporting and informationsystems are hampering managementaccountants’ ability to drive and manageperformance across their organisations –despite believing they can add real value.Respondents to the Oracle survey‘How can management accountantsimprove business performance?’, carriedout in partnership with CIMA, revealedthey would prefer to be spending around50% more time than they currently aredriving performance management intheir organisations. They also revealedthat they are spending more timethan they would like on accountingoperations, information systems andexternal reporting.Considering your own role and the activities that accountants might perform in a business, pleaseindicate the actual percentage of your time that you spend in the following activities and thepercentage of your time that you would ideally spend to be of more value to the business.Time spent 25on activities(%) isiefennacefcunt ionOtheraivctit ies

White paper‘More than twothirds of therespondentsto the surveyclassedthemselves asbeing in seniormanagementor seniorprofessional roles– so that tells usthat these issuesare genuinelyaffecting the topof organisations’Simons says the fact that managementaccountants are being bogged down withoperational activities – eroding their abilityto drive performance – could have seriousimplications for businesses.“Management accountants are ata real advantage because their workacross divisions gives them the bestoverview of the business,” he says. “Theyalso know the direction the CFO wantsto go in – so these things combined makethem ideally placed to drive performance.“If they are being prevented fromplaying this crucial role, that couldcertainly be detrimental to the business.”Simons suggests that financeprofessionals can increase theirinvolvement in driving performancethrough their ability to set, implementand measure effective key performanceindicators (KPIs). “They can get behindthe numbers to really understandwhat drives performance – to ensurebusinesses manage the right things andset the right goals.“Finance’s ability to providetransparency around performance metricsand to ensure everybody is working in thebest interests of the shareholders, ratherthan their own immediate objectives,shouldn’t be underestimated.”The survey also identified the main‘obstacles’ that management accountantsfeel obstruct their potential to play a widerrole in supporting their business.Around 45% of respondents saidthey do not have enough opportunity todevelop business understanding, whilethe same number said that the lack of amandate from senior management orthe board was an obstacle. Just over 32%of respondents said that the inability toaccess relevant customer or operationaldata stopped them from playing a widerrole in the business, while 27% cited a lackof credibility in commercial matters amongbusiness managers.Simons says it’s not unusual forbusiness partnering to falter in the face ofother distractions.“Every successful story about businesspartnering begins with an insight,” hesays. “One of the reasons why businesspartnering may be stalling in organisationsis that it’s not easy to come up with insights.“The key is for finance to come up withthose – to drive the appetite for businesspartnering,” he adds. “There are a numberof ways they can do that. The best way isto initiate conversations with others in thebusiness. Management accountants arerespected for their expertise in accountingmatters. This gives them a seat at thetable. They also have an analyticaltoolkit, so they have financial insights tocontribute and bring a bit of professionalobjectivity. When managementaccountants show colleagues what thefigures seem to be suggesting and havethe courage to ask basic questions, theycan develop insights about root causes orpotential solutions in a collaborative way.The next step is to communicate thoseinsights in a way that is understandableto the rest of the business so that action istaken. As a finance professional, you mayrecognise when decisions are motivatedby short-termism or self-interest. Youshouldn’t be shy of putting forwardcommercial arguments so that theshareholders’ money is invested wherethe returns are best over the long term.”Simons adds that the key toachieving these things and to obtainingthe freedom to focus on performancemanagement lies very much withtechnology.“Technology is the enabler here,” hesays. “We need to release the capacityand that means using technology to takeon, or improve, the efficiency of some ofthe things that management accountantstell us are absorbing their time.”03

White paperPRACTICAL STEPS TO EFFECTIVE PERFORMANCE MANAGEMENTEffective performance management helps toovercome uncertainty and volatility, increasingstakeholder expectations, growing IT complexityand inefficiencies in organisational processes. Itmust serve the entire organisation’s needs, notjust those of the financial leadership. Understand the fundamentals: performancemanagement links actions to the strategies theyshould support, monitors results against goalsand applies analytics to boost understanding ofwhat’s actually happening.04 Ask the right questions to set the rightgoals: where is there a need for greaterperformance visibility? What is the urgencyand timing framework around key informationgaps? Which individuals, teams or functionsare involved in creating or resolving suchgaps? Are the information and insight wealready have being used to improve keyprocesses? Do we develop strategic plans andobjectives informed by solid analysis of pastperformance? Recognise the changes: acceleration of business,explosion of data to analyse and utilise, ademand by stakeholders and regulators alike forgreater transparency and the enormous appetitefor technology enablement in a changing,increasingly millennial, workforce. Establish a small number of meaningfulmetrics to measure effectiveness: what highlevel performance measures are required,and how do they relate to the business modeland its goals? How can we compare theseagainst past performance? Can we identifysome predictive, as well as reactive, measures? Spot the opportunities: the shift to social,cloud and mobile, plus penetration of consumertechnologies, can enable you to act faster toimprove performance management, while bigdata technologies are transforming the potentialof data to inform and drive decisions. Take action – but keep it small: create atemplate performance improvement planfocused on a priority area, with a small groupof key stakeholders who will implement it andthen monitor success before refining and rollingout principles to engage the wider organisation.MITIGATING RISKFor many respondents, risks suchas regulatory change, complianceissues and data and cyber securitycontinue to be top concerns.Most businesses surveyed saidthat data security was a majorconcern to their business, despitethe recent advances around cloudtechnologies and data securitysystems. More than a third of ourrespondents revealed that they areworried about cyber attacks.Simons says data security concernspersist for many because they are reluctantto move to a cloud-based system – and thatmany firms need to overhaul decisionmaking around risk in general.“I think that in the context of movingdata into the cloud, the risk is overstated.When there have been security breaches,they have received some very sensationalheadlines and coverage – but the reality isthat a cloud storage specialist should befar better placed to hold my data than I am,or indeed than a business will be.“I believe that data security and cybersecurity are sometimes used as an excusenot to invest in a system or a solution,”he adds. “There is a need for businessesto improve decision-making around riskmanagement. That’s about being rational,thinking widely about how you assessyour threats and opportunities – and whatyour risks are.“The first step is to try to identify yourrisks. The second step is to assess them insome way. Traditionally, the typical waythat has been done has been throughtrying to calculate the probability ofsomething happening and the scale of theimpact – and then insuring the things thatare likely to happen and are likely to hitthe business hard. That has always helpedyou understand your appetite for risk.Businesses need to get better at putting avalue on that so it is a quantitative risk.“Financial people are naturally abit conservative and risk-averse, whichprobably comes from the fact their datais so precious and that historically theyhave owned a lot of the really valuableIP. If they can take a more objective viewof risk and data security, and hand someof those things over to third parties and/or technology – then they will have moreopportunity to focus on the areas wherethey can add real value to the business.”Simons adds that the key to makinginformed decisions around these issuesalso lies with good accounting principles.“At CIMA, we have been workingto create the Global ManagementAccounting Principles, which are allabout doing the right things and gatheringrelevant information to ensure you cometo the best decisions,” he says. “Only bydoing that, by checking there is benefit tothe shareholders in a culture where thingscan be considered carefully and whereit’s considered appropriate to take actionsbased on those things, can businessesmake informed decisions.”

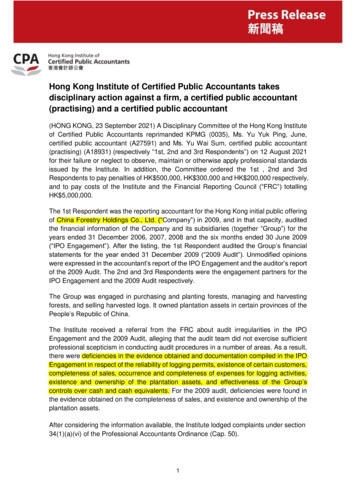

White paperWhich of the following topical issues are of concern to your business? (Multiple selectionsof issues apply here, with ranking in accordance to issues chosen the most by respondents.)Data security54.2Further cuts in government spending50.5Cyber attacks30.7Competitors from cheaper economies28.8An ageing population28.3Economic crises in export markets26.9Interest rates might rise (e.g. to 5% in 2020)25.5Shortage of skilled school-leavers or graduates23.6Climate change17.9Finite energy supplies or natural resources17.5The UK leaving the EU15.6Terrorism10.4Restrictions on immigration8.00HOW TECHNOLOGY CAN HELPMITIGATE RISK AND IMPROVEPRODUCTIVITYEffectively managing and mitigating risk isonly possible with solid, systematic processesthat make risk visible and provide the insight,time and tools with which to make decisions.Technology now plays an enormous role inthis for every company.Today big data is changing how risk canbe managed and it offers finance professionalsa huge opportunity, not only to activelyimprove performance management andproductivity, but also to sharpen forecastingand planning. Finance could deliver datainsights to the business that help itdifferentiate from the competition and1The survey also revealed manyemployers view a shortage of skilledschool-leavers and graduates as aproblem – with nearly a quarter citing theissue as a concern to their business.Simons says this could potentiallyhave an impact on productivity forbusinesses – leading them to further turnto technology that drives efficiency intheir operations.Other concerns for businessesincluded the impact of economic crises inexport markets and the threat they poseto overseas activities – cited as a concernby 26.9% of respondents. The threat ofrises in interest rates was cited by 25.5%.102030405060 (%)drive growth. Based on a global CGMAsurvey it was discovered that over 90%agreed that finance has a critical role to playin helping their organisation benefit fromdata1. With their data-orientation andquantitative skills, finance professionalshave an opportunity to become moreengaged in quantifying and qualifying newdata sources and their value. Whether it iscollecting social analytics and sentimentanalysis to forecast revenue, using sensorsto manage buildings, capital equipment,lower maintenance costs, improvequality or streamline processes basedon new data insights, the possibilitiesare endless.Technology also delivers the agility ofwhich companies once could only dream.Today’s organisations must “plan at thespeed of business”, which means a constantneed to reforecast and replan. Insteadof traditional annual planning cycles,they need driver-based rolling forecasts;financial professionals will increasinglyneed relevant operational metrics at theirfingertips to quickly calculate and allocatefinancial values. Usage is growing inorganisations of tools that enable this kindof speed of operation and high productivity.They are just part of the landscape oftechnology change that looks set totransform finance office /DownloadableDocuments/From insight to impact-unlocking the opportunities in big data.pdf05

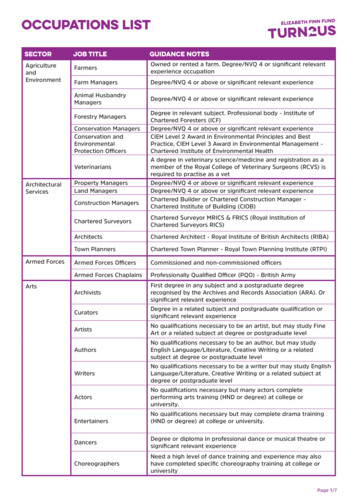

White paperWhich, if any, of the following obstacles limit management accountants’ potential to play a wider role insupporting your business? Please select all that apply.Too busy with the accounting cycle, etc.69.9Inefficiency of legacy systems and workarounds63.2Not enough opportunity to develop business understanding44.9Lack of a mandate from senior management or the board44.9Not able to access relevant customer or operational data0632.4Lack of credibility in commercial matters among business managers27.2Accountants’ preference for traditional accounting roles22.8More challenging demands as experts in accounting-related matters16.9Lacking in the analytical skills to be able to contribute insights15.4Other3.70OVERCOMING LEGACYThe desire among financial professionalsto have greater influence over thedirection of their organisations is beingfurther hampered by efforts to overcomeor work around legacy systems.A staggering 63.2% of respondentsto the survey said that the inefficiencyof legacy systems and workarounds arelimiting their potential to play a widerrole in supporting their business.More than 40% of respondents arefrom large organisations – those with10203040more than 750m annual turnover – andSimons says that legacy systems are abigger challenge for them.“This is certainly one of those areaswhere the size of your organisation makesa difference,” he says. “If you’re a smallto mid-sized business, or even a bankbranch dealing with customers’ accounts,it’s a relatively straightforward activity tooverhaul your systems. If you’re a majororganisation with global operations, orthe size of the NHS, for example, pullingsystems together will require many506070 (%)different people’s buy-in, more time andmore effort.“Overall, there is a danger, however,of false economies,” he adds. “Thesurvey makes it quite clear that thereis a focus on saving costs now to investin the future – and finance has a role toplay by saying that, while money is tight,investing now will help us save moremoney in the future and achieve ourgoals more quickly.”Simons adds that technologicaldevelopments, such as cloud

White paperBENEFITS OF CLOUD TECHNOLOGY/OVERCOMING LEGACY SYSTEMSCloud computing has been with us foryears and is still growing. IDC Researchpredicts spending on public cloud to surpass 127bn by 2018. In a recent Oracle survey2of enterprise performance management, itemerged that companies are lookingbeyond cutting costs and driving efficiency.Instead, respondents commented howcloud allows them to focus on their corebusiness and growth – to “stop runninginfrastructure and focus on what makesus money”. In a similar way, perceptionaround the potential for mobile is movingon from the simple convenience of“anytime, anywhere” working and accessto information, towards its potential todrive growth.For businesses still seeking to gainthe first benefits from cloud this may seemfrustrating, because their first order ofbusiness is to manage the transition to cloudin the first place. They want the benefits oftechnologies, have reduced the risks – andtherefore the barriers – around change.“Cloud technologies can be a greatopportunity to reduce your investmentcosts and the risks are diminishedbecause you are buying proventechnology,” he says.“At CIMA, we used to host an annualinnovation awards. Every year, somebusinesses would put forward howthey had managed to introduce cleverworkarounds so that the ERP system theyhad would work ‘better’ for them. I couldcloud. In the data centre they can expectlower costs, as well as lower environmentalimpact. The business can gain IT agility, couldreduce its time to market or unlockinnovation. Business application costs canplummet, while employees are enormouslyempowered to work more collaborativelyand remotely.Moving to cloud can seem dauntingas businesses must overcome challengessuch as how to move legacy data to cloud,integrate multiple SaaS apps with differentstandards, ensure timely movement of databetween cloud and on-premise systems andensure data quality and ease of managementat the same time.However, these are exactly the challengesthat the Oracle Complete Cloud can resolve.Its advanced data integration andmanagement technologies are designed towork seamlessly with all its other offerings,including those tuned for the needs of financesuch as Enterprise Performance ReportingCloud, Accounting Hub Reporting Cloud andFinancials Cloud.never understand that. Why would youbuy a system from technology experts,which has been designed in a specificway, and then look for ways to changethat or work around it? Businesses mustget much better at adapting to thesystems they are buying, rather than theother way around.“Many businesses are put off by thatchallenge when it comes to cloud,” Simonsadds. “But they should embrace it and useit to lead them into being a more efficientand more streamlined -2015-2441101.pdf07

White paper08ABOUT ORACLEThe Oracle Corporation designs, developsand delivers database and middlewaresoftware, application software, cloudinfrastructure, hardware systemsand related services worldwide. Bysimplifying the IT environment, Oracleenables 400,000 customers across morethan 145 countries to innovate fasterand create added value for their owncustomers. Oracle’s integrated systemsare architected, tested and optimisedto work together to reduce complexity,cost and risk – and to deliver extremeperformance. It supplies the top brands inevery industry sector through dedicatedvertical organisations that provideunmatched industry-specific expertiseand best-of-breed technologies, andbusiness solutions that help enterprisessolve their most complex problems. OnlyOracle offers the most complete andintegrated financial management solutionsfor finance operations; governance,risk and compliance; and performancemanagement, to help companies driveefficiencies, manage risk and drivesustainable growth.www.oracle.com/uk/erpABOUT CGMATwo of the world’s most prestigiousaccounting bodies, AICPA and CIMA,have formed a joint venture to establishthe Chartered Global ManagementAccountant (CGMA ) designation toelevate and build recognition of theprofession of management accounting.This international designation recognisesthe most talented and committedmanagement accountants with thediscipline and skill to drive strongbusiness performance. CGMA designationholders are either CPAs with qualifyingmanagement accounting experienceor associate or fellow members of theChartered Institute of ManagementAccountants.www.cgma.org

role in the business, while 27% cited a lack of credibility in commercial matters among business managers. Simons says it's not unusual for business partnering to falter in the face of other distractions. "Every successful story about business partnering begins with an insight," he says. "One of the reasons why business