Transcription

ESSENTIAL TOOLS FORMANAGEMENT ACCOUNTANTSThe tools and techniques to supportsustainable business success

Two of the world’s most prestigious accounting bodies,AICPA and CIMA, have formed a joint venture to establishthe Chartered Global Management Accountant (CGMA )designation to elevate and build recognition of the professionof management accounting. This international designationrecognises the most talented and committed managementaccountants with the discipline and skill to drive strongbusiness performance. CGMA designation holders areeither CPAs with qualifying management accountingexperience or associate or fellow members of theChartered Institute of Management Accountants.4ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

contentsIntroduction 3Governance and risk managementThe CIMA Strategic Scorecard 8Enterprise Risk Management (ERM) 16Risk Heat Maps 22CGMA Ethical Management Reflection Checklist 28Strategic planning and execution Strategic Planning Tools – including mission and visionstatements, goals and objectives, SWOT and PEST 32The Balanced Scorecard – including operational dashboards 38Strategy Mapping 44Porter’s Five Forces of Competitive Position Analysis 50Performance management and measurementKPIs – financial and non-financial 54Benchmarking 60The Performance Prism 641

Planning and forecastingRolling Plans and Forecasts 70Activity-Based Budgeting (ABB) 74Scenario and Contingency PlanningCash Flow Modelling 78 84Product and service deliveryActivity-Based Costing (ABC)Lean 90 94 Quality Management Tools – including TQM,Six Sigma, Cost of Quality and EFQM 98Value recognitionValue Chain Analysis 104Customer Relationship Management (CRM) 108AppendixBibliography and sources 114Acknowledgements 1152ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

INTRODUCTIONWhat is a management accounting tool?A management accounting tool is a framework, model, technique orprocess that enables management accountants to: improve performance;facilitate decision-making; support strategic goals and objectives; andotherwise add value.Why you should read this book“Within the area of management accounting there is almost an infinitenumber of tools, methods, techniques and approaches floating around.”This is no understatement. At the time of writing there were over12.9 million results from a Google search on ‘management accountingtools’. There is a huge array of practices and tools available, all promisingto help define and manage the organisation’s strategy, resources, customersand costs; and improve overall performance. In this context, managerscan often struggle to evaluate and identify the most suitable tools tosupport their organisation and to implement and manage them effectively.This book helps management accountants and business managers toidentify the right tools from a crowded field and to obtain the full valuefrom such tools. It does this by: supporting business in evaluating the value of the top managementaccounting tools helping management accountants and the organisation to select theappropriate tools providing guidance and best practice on how to implement the toolseffectively.3

What you will find in this bookThis book contains the need-to-know information about the essentialmanagement accounting tools, old and new. This includes: What is the tool and what value can it bring management accountantsand their organisation? What are the crucial considerations for implementing and usingthe tool? What actions do you need to consider, and avoid, to maximise itspotential? What best practice looks like – including real examples and casestudies from organisations that have implemented the tool. Resources, including further reading and material on each tool,if you want to delve deeper.4ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

ManagementaccountingcategoryToolThe CIMA Strategic Scorecard Governanceand riskmanagementEnterprise Risk Management (ERM)Risk Heat MapsCGMA Ethical Management Reflection ChecklistStrategic Planning Tools – including mission andvision statements, goals and objectives, SWOT, PESTStrategicplanning andexecutionThe Balanced Scorecard – including operationaldashboardsStrategy MappingPorter’s Five Forces of Competitive Position AnalysisPerformancemanagement andmeasurementKPIs – financial and non-financialBenchmarkingThe Performance PrismRolling Plans and ForecastsPlanning andforecastingActivity-Based Budgeting (ABB)Scenario and Contingency PlanningCash Flow ModellingActivity-Based Costing (ABC)Product andservice deliveryValuerecognitionLeanQuality Management Tools – including TQM,Six Sigma, Cost of Quality and EFQMValue Chain AnalysisCustomer Relationship Management (CRM)5

Using this bookSize, sector, culture and leadership in each organisation are different, asis their appetite for change. So there is no one-size-fits-all approach tosuccessfully implementing and realising value from such tools and practices.This book provides a high-level summary of the benefits and value thatessential management accounting tools can bring to the majority oforganisations, regardless of size or sector. It provides objective analysisand reviews of the tools’ effectiveness as well as considerations and tipson how best to implement and use them.As mentioned, there is an overwhelming amount of information availableon these tools. This book provides an overview and a starting point – it isnot a detailed ‘how to’ guide but a ‘which best’ and ‘how best to’ summary.6ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

More on toolsThis book is the start of an ongoing project on managementaccounting tools and we will be developing further content andevaluation of the tools. A dedicated section at cgma.org/essentialtoolssupports these summaries and provides you with greater breadthand depth of information on these and other tools. It also providesfurther resources and case studies and allows you to rate theeffectiveness of these essential tools.Have your sayIf you have come across better tools; have suggestions on how a tool canbe developed and improved; or simply have a question or a comment toshare, visit cgma.org/essentialtools. You can also use this forum to ratethe effectiveness of the tools and discuss them with your peers.7

Governance and Risk ManagementTHE CIMA STRATEGICSCORECARD What is it? SCORECARDThe CIMA Strategic Scorecard was developed in 2004. It was the resultof research by CIMA, in collaboration with the Professional Accountantsin Business Committee (PAIB) of the International Federation ofAccountants (IFAC), into major corporate failures at the time such asEnron and WorldCom. An important finding was that company boardshad failed to oversee strategy and risk effectively. The global financialcrisis of 2008–09 reinforced these conclusions.The scorecard therefore aims to help boards of any organisation toengage effectively in the strategic process. It recognises that boardsstruggle to engage in strategy because of: lack of time and crowdedagendas; information overload; lack of robust, board level processesfor dealing with strategy; and greater complexity of business.8ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

The CIMA Strategic Scorecard Strategic positionStrategic risks/opportunities mic/globalisationSocial/demographicInvestorsBlack SwansMarket changeMergers and acquisitionsScenario planning/future riskassessments InnovationBusiness model – how do we make money? Value chain Current strategy and business plan clarity/core competencies Culture – values and performance-based Talent Assets/liabilitiesStrategic implementationStrategic options Quality decisions (based oninsight/value) ROI Balance short/long term(sustainable future proofedbusiness)Product developmentCustomer satisfactionQualityCost leadership/pricingProject managementKPIs and aligned incentivesSystems/process/operational risksSource: CIMA Executive CPD Academy9

What benefits does the scorecard provide?The CIMA Strategic Scorecard provides a simple, effective process thathelps the board to focus on strategic issues and ask the right questions.It is structured around four key dimensions of strategy: strategicposition, strategic risks and opportunities, strategic options and strategicimplementation. This means that the board can work constructivelywith management to promote the future success of the organisation.It can help to ensure a high-level perspective on strategy, thus avoidingthe ‘comfort zone of detail’.The discipline of preparing and updating the scorecard also helpsmanagement to keep its focus on strategic issues, and facilitatesdiscussion within the executive team so that it can refine proposalsprior to exposure to the board. The scorecard can also help toidentify gaps in knowledge and analysis, so improving the qualityof information presented.The scorecard framework helps boards, and the businesses they control,to: summarise key aspects of the operating environment; highlight risksand opportunities; identify major strategic options; and chart and trackprogress against significant milestones.The implementation of the scorecard is based on the assumption that theorganisation has already determined its broad strategic direction and hasa strategic plan in place. The scorecard provides a process for developingand moving this strategy forward in a dynamic way. For boards thatneed to do more foundational thinking about what the company standsfor, a good starting point is to develop a ‘board mandate’. See the linkin ‘Further resources’ for more information on this, which also links to auseful checklist.10ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

The format of the scorecard is very flexible and can be adapted tomeet the needs of the organisation. For each of the four dimensions,high-level information is provided in a format that provokes high-quality,constructive and effective strategic discussion. Achieving this in practiceis a challenge.The format of the scorecard has evolved since its initial creation,and CIMA is continuing to undertake further development work tostrengthen the ability of the scorecard to support the level of strategicand risk discussion necessary to help boards and their organisations toavoid major problems.Implementing the CIMA Strategic Scorecard ?Questions to consider: How are we going to achieve buy-in from both executive managementand the board to introduce the scorecard? Do we have a strategic plan in place? If not, this will have to becompleted first before attempting a scorecard. How are we going to present the information for each of the fourscorecard dimensions? What information do we have already to support a scorecard? When are we going to introduce the scorecard? And would it helpto have a facilitator?11

ACTIONS TO TAKE/Dos Decide on a target meeting to introduce the scorecard. Introducingit at a strategy planning session can work well. Keep it simple – it is better to produce a first draft scorecardreasonably quickly to kick start discussion. At the start focus on the headline issues rather than trying topopulate with detail. For the purposes of the scorecard, it maybe better to flag an issue at board level and then indicate whenfurther information will be provided. Appoint a scorecard champion. Assess the effectiveness of the scorecard in terms of the quality ofthe strategic discussion generated at board level. Ensure that updates to the scorecard reflect material changes eitherwithin the organisation or externally.ACTIONS TO AVOID/Don’ts Avoid including too much detail. ‘Less is more’ is the best principlefor the scorecard. Don’t stop modifying the scorecard if it is not engaging the boardeffectively. Do not turn the process of updating the scorecard into an onerous,tiresome chore. Highlight material changes only. Avoid holding back information from the board just because it is notyet complete or exact. Avoid taking an ad-hoc reporting approach. Agree a schedule withthe board as to when you will present the scorecard to them.12ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

Using the scorecard in practiceBringing focus to strategic thinkingCIMA uses the scorecard for council and executive committeemeetings. We have found that it has helped to ensure that thekey issues we face remain prominent. It has helped the seniormanagement team to ‘force itself’ to include only the reallyhigh-level issues.We trialled the scorecard in collaboration with a housing trust.The trial introduced the scorecard as part of an ongoing processto restore confidence after the housing trust had recovered frommajor difficulties requiring sweeping change in the executiveteam and trustee board. Participants used the four dimensionsof the scorecard as the agenda items for a strategy awaydaywhich ran over two days.The discussion about strategic options was held just before theend of the first day. This meant that they could continue theconversation informally over dinner. The impetus for introducingthe scorecard came from the new chief executive in consultationwith the chairman. After the initial awayday, the scorecard waspresented at board meetings on a quarterly basis.Other CIMA members have used the scorecard on their owninitiative, often modifying the framework and using it in innovativeways to suit their needs. An internal auditor, for example, usedit as the basis for auditing the strategic review process in hisorganisation.13

Feedback from the executives involved in its implementationincluded:“We have discussed more strategy than ever before at a boardmeeting and we have made decisions.”Board member“We have had a great discussion with the board and I feelthat they are totally supportive of our strategy. This process hasbrought us closer together.”Member of the executive team“The process has brought focus to our strategic thinking andenabled our executive team to discuss the strategic options andengage the board.”Chief executive“It has helped us to focus on the issues that really matter and toavoid the comfort zone of detail.”Finance director14ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

Related and similar practices to consider Balanced Scorecard Board mandate Boardroom conversationsFurther resourcescgma.org/essentialtools15

Governance and Risk ManagementENTERPRISE RISK MANAGEMENT(ERM)What is it? PROCESSEnterprise risk management (ERM) is the process of identifying andaddressing methodically the potential events that represent risks tothe achievement of strategic objectives, or to opportunities to gaincompetitive advantage. Risk management is an essential element of thestrategic management of any organisation and should be embedded inthe ongoing activities of the business. Two widely referenced frameworksinclude the US-based Committee of Sponsoring Organizations (COSO)‘ERM – Integrated Framework’; and guidance developed by theUK-based Airmic and The Institute of Risk Management (IRM) –‘A structured approach to ERM and the requirements of ISO 31000’.The fundamental elements of ERM are the assessment of significantrisks and the implementation of suitable risk responses. Risk responsesinclude: acceptance or tolerance of a risk; avoidance or terminationof a risk; risk transfer or sharing via insurance, a joint venture or otherarrangement; and reduction or mitigation of risk via internal controlprocedures or other risk prevention activities.Other important ERM concepts include the risk philosophy or riskstrategy, risk culture and risk appetite. These are expressions of theattitude to risk in the organisation, and of the amount of risk thatthe organisation is willing to take. These are important elementsof governance responsibility.Management responsibilities include the risk architecture orinfrastructure, documentation of procedures or risk managementprotocols, training, monitoring and reporting on risks and riskmanagement activities.16ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

ERM processSelf-assessmentInternal auditPlanRisk ommitteePlanresponsestrategyAssessriskPotential impactLikelihoodSource: How to Communicate Risks Using Heat Maps, CGMA“If a business has its doors open, then it is managing risk in some way.However, that does not mean the organisation has an enterprise-wide,holistic and strategic approach to risk management.”–M ark S Beasley PhD, Director, ERM Initiative at North CarolinaState University, January 201217

What benefits does ERM provide?ERM provides greater awareness about the risks facing the organisationand the ability to respond effectively. It can give enhanced confidenceabout the achievement of strategic objectives and improve compliancewith legal, regulatory and reporting requirements. ERM also providesincreased efficiency and effectiveness of operations.Implementing ERM? Questions to consider: What are the main components or drivers of our business strategy? What internal factors or events could impede or derail each of thesecomponents? What external events could impede or derail each of the components? Do we have the right systems and processes in place to address theseinternal and external risks?18ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

ACTIONS TO TAKE/Dos Gain support of top management and the board. Engage a broad base of managers and employees in the process. Start with a few key risks and build ERM incrementally. Use existing knowledge, skills and resources in management,internal audit, compliance etc. Embed ERM into the fabric of the organisation. Take a holistic, portfolio view of risks across the enterprise.ACTIONS TO AVOID/Don’ts Never treat ERM as a project – ERM is a process. Don’t get bogged down in details and history – ERM should bestrategic and forward-looking. Avoid relying only on a few key staff – make ERM everyone’s job. Don’t take a silo or stove-pipe approach to risks. Don’t ignore howrisks might impact on other parts of the business. Avoid obsessing too much about categorising risks – rather thanensuring that the key risks have been identified and mitigationplans developed. Never assume that the risk register is complete – there will alwaysbe ‘unknown unknowns’ and the biggest enemy of effective ERMis complacency.19

ENTERPRISE RISK MANAGEMENTIN PRACTICEGemini Motor Sports, a hypotheticalillustration from a CGMA case study: how toevaluate enterprise risk management maturityGemini Motor Sports (GMS), a public company headquarteredin Brazil, manufactures on-road and off-road recreational vehiclesfor sale through a dealer network in Brazil and Canada. GMSChief Financial Officer (CFO) David Cruz was charged withoverseeing the development of the initial ERM framework forthe company.In the first year of implementation, the ERM team met with seniormanagement, and identified and prioritised a number of crucialrisks that had been disruptive to GMS. Their initial presentationto the audit committee was criticised for being a rehash of pastproblems, and not useful to the board as they discussed thestrategic direction of GMS.In the second year of the programme, after seeking ERM trainingfor the team, Cruz focused more attention on potential events thatmanagers thought might affect the business. He asked them toassess the likelihood and potential impact of the identified risks.The resulting report was well received. However, the auditcommittee chair suggested that the next step be an evaluationof the risk management process and the degree of its integrationwith the strategic management process of the organisation,leading to the use of the CGMA Risk Management Maturity tool.20ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

Lessons learned: Broad involvement on the part of board members andemployees is essential in determining the risk appetite ofa company, and in identifying and prioritising risks. Speed of onset and persistence of risks, in addition toimpact and likelihood, are important considerations in theprioritisation of risks. Ongoing monitoring and concise reporting on key riskexposures are essential for effective risk management.Further resourcescgma.org/essentialtools21

Governance and Risk ManagementRISK HEAT MAPSWhat are they? FRAMEWORKA risk heat map is a tool used to present the results of a risk assessmentprocess visually and in a meaningful and concise way.Whether conducted as part of a broad-based enterprise risk managementprocess or more narrowly focused internal control process, riskassessment is a critical step in risk management. It involves evaluatingthe likelihood and potential impact of identified risks. Heat maps are away of representing the resulting qualitative and quantitative evaluationsof the probability of risk occurrence and the impact on the organisationin the event that a particular risk is experienced.The development of an effective heat map has several critical elements –a common understanding of the risk appetite of the company, the level ofimpact that would be material to the company, and a common languagefor assigning probabilities and potential impacts.The 5x5 heat map diagram on the right provides an illustration ofhow organisations can map probability ranges to common qualitativecharacterisations of risk event likelihood, and a ranking scheme forpotential impacts. They can also rank impacts on the basis of whatis material in financial terms, or in relation to the achievement ofstrategic objectives. In this example, risks are prioritised using a simplemultiplication formula.Organisations generally map risks on a heat map using a ‘residual risk’basis that considers the extent to which risks are mitigated or reduced byinternal controls or other risk response strategies.22ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

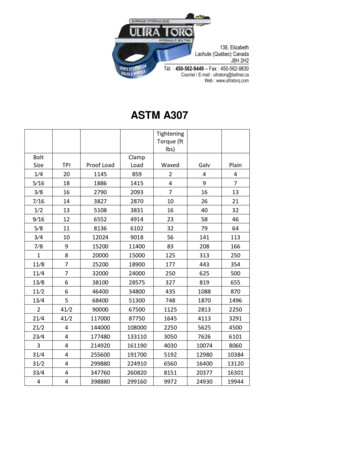

Potential ImpactHeat risk able 50-90% 90-100%Likelihood% ranges0-10% 10-25% 25-50%Source: Scott McKay, Risk assessment for mid-sized companies: toolsfor developing a tailored approach to risk management. AICPA, 2011“Helping managers quantify the potential impact of risk events isone of the most important exercises in the risk management process.Operational managers often struggle with the concept of materialityand how to define it in both qualitative and quantitative terms.”– Scott McKay. Risk assessment for mid-sized companies, 201123

What benefits do Risk Heat Maps provide?Risk heat maps provide a visual, big picture, holistic view to share whilemaking strategic decisions. They can improve the management of risks andgovernance of the risk management process with increased focus on riskappetite and risk tolerance of the company. Risk heat maps can allow formore precision in the risk assessment process with the identification of gapsin the risk management and control process. They can also support greaterintegration of risk management across the enterprise and embedding ofrisk management in operations.Implementing a Risk Heat Map? Questions to consider: How much risk are we willing to accept? What constitutes a material risk to our company? What is the range of acceptable variance from our key performanceand operating metrics? How will we define our terms to evaluate the likelihood of risk eventsand the impact that they might have on our business, so that we canmap our potential risk events to our heat map?24ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

ACTIONS TO TAKE/Dos Use risk self-assessment workshops to take advantage of theinsights of managers. Prepare an initial ‘straw-man’ risk library to use as a starting point. Get consensus on risk tolerances – acceptable levels of missingtargets. Clarify terms used to establish probability estimates. Establish participants’ understanding of the effectiveness of controlsand other risk responses used in the organisation.ACTIONS TO AVOID/Don’ts Don’t rely on surveys to capture initial thoughts about risks. Avoid getting stuck in root cause analysis. Don’t forget to quantify risks in terms of potential financial impacton the organisation in terms of cash, earnings etc. Don’t forget to consider the state of controls and other riskmanagement practices in place in the organisation.25

RISK HEAT MAPS IN PRACTICEHow to communicate risks using a heat mapIn the CGMA tool How to communicate risks using a heat map,Figure 5 shows a sample heat map for a select set of risks for ahypothetical company. The sample groups these risks togetheraccording to their interrelated nature and effect on operations.See the link in ‘Further resources’ to access the full case study.The company used its earnings per share sensitivity to establisha range of impacts from trivial ( 25k in earnings) to verymaterial ( 75m in earnings). Risks that were evaluated andgrouped for presentation in the example include the following: Obsolescence risk Customer concentration or distribution risk Manufacturing risk New product introduction risk Supply chain risk Safety risk Physical asset riskBy mapping these risks, it was clear that the likelihood and theimpact of physical asset risk were relatively low in relation tothe risks associated with new product introduction, customerconcentration and supply chain. Each of those was consideredto be both more likely and to have greater impact.26ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

Lessons learned: A more accurate sales forecasting function was a recurringtheme thought to be a key risk indicator associated with severalof these interrelated risks. The perception of supply chain risk increased with the verticalsupply chain as viewed by downstream business units. The likelihood and the potential impact of risk events appearedhighest with the new product introduction (NPI) process,indicating that opportunities may exist in how the companyis structured and manages NPI.Further resourcescgma.org/essentialtools27

Governance and Risk ManagementCGMA Ethical ManagementReflection ChecklisTWhat is it? CHECKLIST/BEST PRACTICEThis is a checklist of reflective questions relating to the management ofethics. It is designed to provide organisations and individuals with anoverview of how well ethical management practices are embedded intheir organisations.The questions cover areas such as: ethical statements and codes ofconduct; training; collection of ethical data; reporting of ethical issues;and support when faced with ethical dilemmas.The checklist can be downloaded from cgma.org/essentialtoolsWhat benefits does the Ethical ManagementReflection Checklist provide?With the importance of ethics and non-financial reporting rising onthe global agenda, organisations need to be managing their businessresponsibly. Increasingly, they are also being required to demonstrateand verify what they are doing to ensure this.The ethical management reflection checklist helps to reinforce yourprofessional code of ethics in the workplace by highlighting strengthsand weaknesses within your organisation.Using the checklist? Questions to consider: Where will you get the information from? Who will you involve? Is this part of a larger assessment? Who will you share the information with afterwards and how willit best be used?28ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

ACTIONS TO TAKE/Dos Reflect on your professional obligations from your code andhow your company’s policies reflect this, for example, on theissue of integrity. Try to engage others in the process over answers you aren’t sureabout. There is often valuable information elsewhere in the business. Once you have your findings, use market information to compareyour position with others to understand strengths and weaknesses.ACTIONS TO AVOID/Don’ts Don’t compromise your professional obligations in undertakingyour work. Never assume answers without involving others (for example, HR,risk and procurement). Processes may not be communicated well,which is also a critical gap. Don’t ignore red flags. For example, if you find your organisationhas no anti-bribery policy, or if it states commitments that it doesn’tundertake, take action and escalate.29

CGMA ETHICAL managementREFLECTION CHECKLIST IN PRACTICECGMA designation holders are dedicated to upholding thehighest standards of ethics and integrity. They are governed bythe professional code of conduct of their issuing body, which isthe AICPA or CIMA.The principles underlying both professional codes are similarand are built on the following core principles: Integrity and objectivity Professional competence and due care Confidentiality Professional behaviour and conduct.A case study has been developed using the fictitious MegatronCorporation, a large public company, to illustrate the navigationof ethical dilemmas, highlighting issues relating to non-disclosureat the corporate level that come to the attention of non-executivefinancial managers and controllers.Taking the viewpoint of the corporate controller, the case focuseson the discovery, reporting and resolution of disclosure issuescreated by the actions of other employees, executive officersor directors.The facts of the case cover issues of integrity, objectivity,confidentiality, internal accounting controls, and the proceduresfor investigating and reporting irregularities. As the corporatecontroller, you must consider these facts and formulate anappropriate response.See the link in ‘Further resources’ to access the full case study.30ESSENTIAL TOOLS FOR MANAGEMENT ACCOUNTANTS

Further resourcescgma.org/essentialtoolscgma.org/ethics31

Strategic Planning and ExecutionStrategic Planning ToolsWhat are they? FRAMEWORKSStrategic planning is the process of developing the strategy or directionand action plan to achieve the goals of an organisation. Key elements ofany strategic planning process are: 1. developing

This book helps management accountants and business managers to identify the right tools from a crowded field and to obtain the full value from such tools. It does this by: supporting business in evaluating the value of the top management accounting tools helping management account